Key Insights

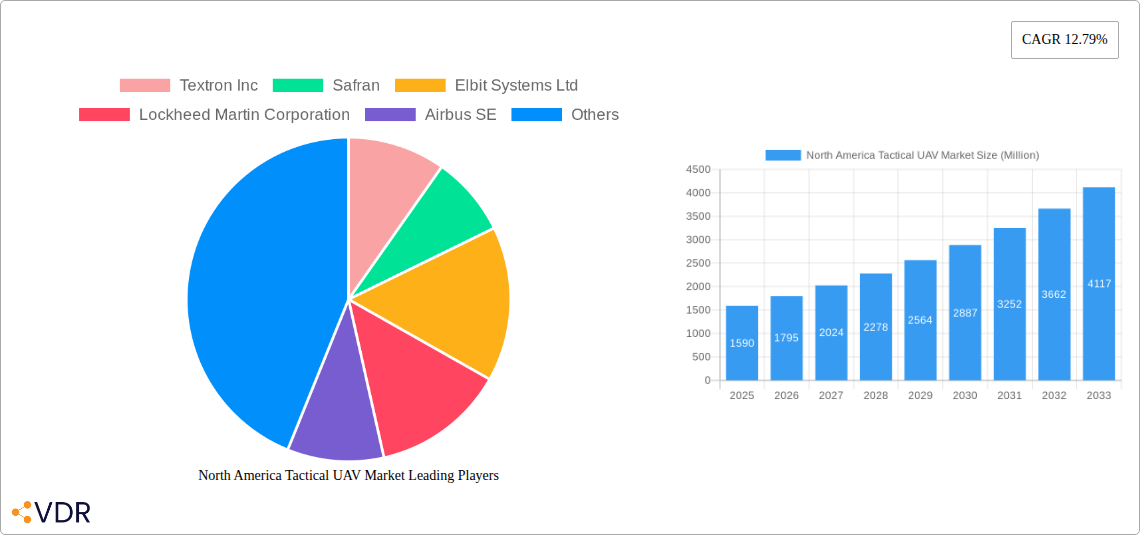

The North American Tactical Unmanned Aerial Vehicle (UAV) market is poised for significant expansion, projected to reach an estimated $1.59 billion in 2025. This robust growth is driven by a confluence of factors, including escalating geopolitical tensions, increasing demand for advanced surveillance and reconnaissance capabilities by defense forces, and the continuous technological advancements in UAV performance and payload integration. Emerging trends such as the development of autonomous swarm capabilities, enhanced AI integration for data analysis, and the miniaturization of UAV systems are further fueling market momentum. These advancements enable tactical UAVs to perform a wider range of missions, from intelligence gathering and target acquisition to electronic warfare and logistics support, solidifying their indispensable role in modern military operations. The market's trajectory is further bolstered by substantial investments in research and development by leading defense contractors, aimed at creating more sophisticated and versatile unmanned platforms.

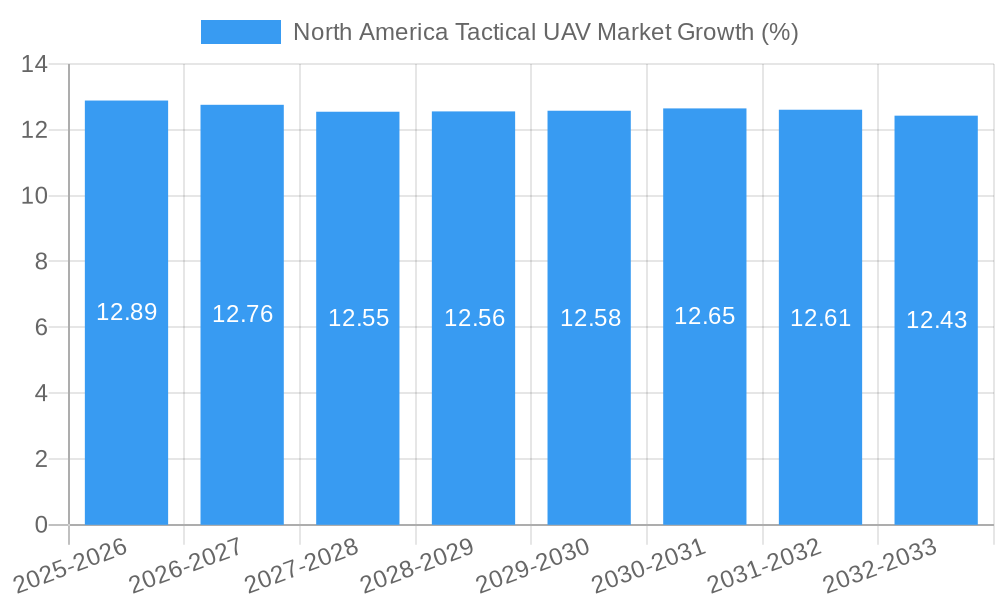

The market's impressive CAGR of 12.79% over the forecast period of 2025-2033 indicates sustained and dynamic growth. While the market is characterized by strong growth drivers, potential restraints include stringent regulatory frameworks, the high cost of advanced technology acquisition and maintenance, and concerns surrounding cybersecurity and data security. However, the inherent advantages of tactical UAVs, such as reduced risk to human personnel, enhanced operational efficiency, and cost-effectiveness compared to manned aircraft for certain missions, are expected to outweigh these challenges. Key players like Textron Inc., Safran, Elbit Systems Ltd., Lockheed Martin Corporation, and Northrop Grumman Corporation are actively engaged in innovating and expanding their product portfolios to cater to the evolving needs of North American defense agencies. The strategic importance of North America, particularly the United States, as a primary consumer of tactical UAVs will continue to shape regional market dynamics and investment patterns.

Here's a compelling, SEO-optimized report description for the North America Tactical UAV Market, designed for maximum visibility and industry engagement, with no placeholders:

North America Tactical UAV Market: Market Dynamics & Structure

The North America Tactical UAV market is characterized by a dynamic interplay of technological advancements, evolving defense needs, and robust regulatory frameworks. Market concentration is moderate, with key players like Textron Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, and The Boeing Company holding significant shares in both the parent market (Tactical UAVs) and child markets (e.g., ISR UAVs, Strike UAVs). Technological innovation is a primary driver, fueled by advancements in artificial intelligence, sensor technology, and miniaturization, leading to increasingly sophisticated capabilities. Regulatory bodies in the US and Canada are continuously refining airspace management and operational guidelines, impacting market entry and expansion. Competitive product substitutes, while less prevalent in the tactical domain due to specialized requirements, include manned intelligence, surveillance, and reconnaissance (ISR) platforms and other unmanned systems. End-user demographics are primarily governmental and defense agencies, with growing interest from homeland security. Mergers and acquisitions (M&A) trends indicate consolidation and strategic partnerships aimed at expanding capabilities and market reach.

- Market Concentration: Moderate, with a mix of large defense contractors and specialized UAV manufacturers.

- Technological Innovation Drivers: AI integration for autonomous operations, advanced sensor payloads (EO/IR, SIGINT), enhanced communication systems, and improved endurance.

- Regulatory Frameworks: Evolving FAA and Transport Canada regulations for Beyond Visual Line of Sight (BVLOS) operations and classified airspace access.

- Competitive Product Substitutes: Manned ISR aircraft, semi-autonomous drones, and specialized airborne sensors.

- End-User Demographics: Primarily US Department of Defense, Canadian Armed Forces, and homeland security agencies.

- M&A Trends: Acquisitions focused on acquiring specialized technologies (e.g., AI, counter-UAS) and expanding product portfolios.

North America Tactical UAV Market Growth Trends & Insights

The North America Tactical UAV market is poised for substantial growth, projected to expand from an estimated market size of \$XX billion in 2025 to \$XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. This expansion is driven by increasing defense budgets, a growing emphasis on persistent intelligence, surveillance, and reconnaissance (ISR) capabilities, and the demand for precision strike missions. Adoption rates for tactical UAVs are accelerating across various military branches, with the US Army and Air Force leading in procurement. Technological disruptions are transforming the landscape, with the integration of artificial intelligence (AI) enabling autonomous navigation, target recognition, and swarm capabilities. Consumer behavior shifts, though primarily within government procurement cycles, are leaning towards modular, cost-effective, and rapidly deployable UAV solutions that offer enhanced situational awareness and reduced risk to personnel. The market penetration of tactical UAVs continues to deepen, as their operational effectiveness and cost-efficiency become increasingly evident compared to traditional manned platforms. The integration of advanced datalinks and secure communication protocols further enhances their utility in complex operational environments. Future growth will be significantly influenced by the development of counter-UAS technologies and the increasing reliance on unmanned systems for border patrol, disaster response, and special operations. The evolution of payload technologies, including multi-spectral sensors and electronic warfare capabilities, will also play a crucial role in driving market expansion.

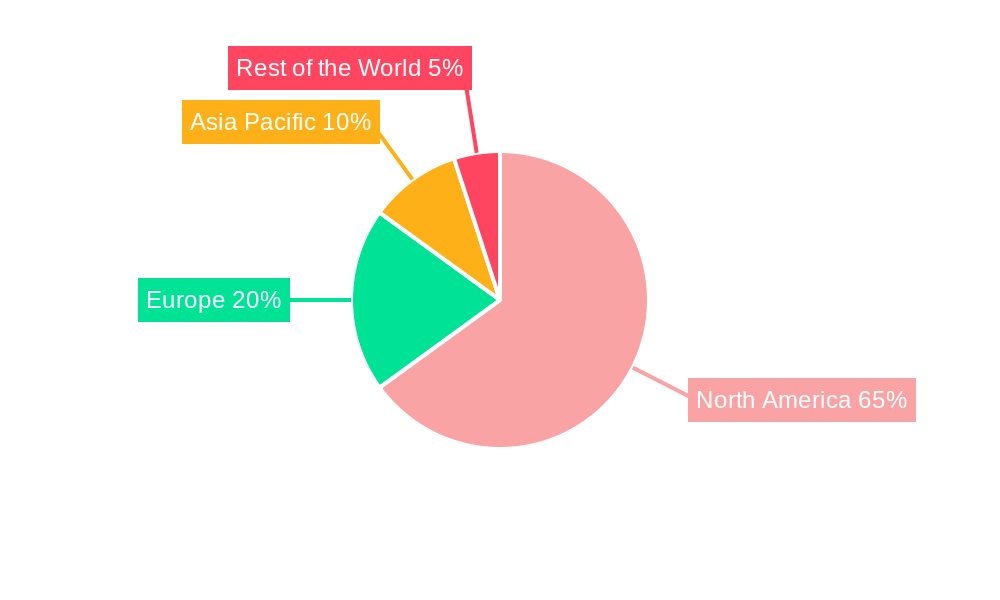

Dominant Regions, Countries, or Segments in North America Tactical UAV Market

The United States unequivocally dominates the North America Tactical UAV market, serving as both the largest producer and consumer. This dominance is underpinned by significant government investment in defense modernization, a robust industrial base for aerospace and defense manufacturing, and a proactive approach to adopting advanced military technologies. Within the US, key regions for tactical UAV development and deployment include California, Texas, and Virginia, leveraging established defense industry hubs and research institutions. The Production Analysis for tactical UAVs in North America is heavily skewed towards the US, with major manufacturers operating extensive production facilities.

The Consumption Analysis further reinforces US leadership, as its military branches are the primary operators of tactical UAV systems for a wide array of missions. The Import Market Analysis (Value & Volume) for the US is characterized by a strong emphasis on domestically produced systems, with limited reliance on foreign imports for tactical UAVs, except for specialized components or niche capabilities. Conversely, Canada, while a significant consumer, has a considerably smaller domestic production capacity, leading to a higher reliance on imports from its southern neighbor.

The Export Market Analysis (Value & Volume) highlights the US as a major global supplier of tactical UAVs, exporting to allied nations. Canada’s export market for tactical UAVs is minimal in comparison. The Price Trend Analysis within the US is influenced by economies of scale in production and competitive bidding processes for large defense contracts. The competitive landscape drives innovation and can lead to price fluctuations based on technological advancements and production volumes. Key drivers of US dominance include substantial R&D funding, a consistent demand for advanced ISR and strike capabilities, and strategic alliances that facilitate technology transfer and joint development initiatives.

- Dominant Country: United States

- Key US Regions: California, Texas, Virginia

- Production Drivers: Robust defense budget, advanced manufacturing capabilities, extensive R&D.

- Consumption Drivers: Active military operations, need for persistent ISR, precision strike requirements.

- Import/Export Dynamics: US leads in production and export; Canada is a net importer.

- Price Trend Influences: Economies of scale, competitive bidding, technological evolution.

North America Tactical UAV Market Product Landscape

The tactical UAV product landscape in North America is characterized by a diverse array of systems designed for specific operational needs. Innovations are heavily focused on enhancing endurance, payload capacity, and autonomous operational capabilities. Advanced sensor integration, including electro-optical/infrared (EO/IR) imaging, synthetic aperture radar (SAR), and electronic intelligence (ELINT) payloads, allows for sophisticated reconnaissance and surveillance. Miniaturization of components and the development of more efficient propulsion systems are enabling smaller, more agile UAVs with extended flight times. Unique selling propositions often lie in the modularity of these systems, allowing for rapid reconfiguration with different payloads to meet evolving mission requirements. Technological advancements in artificial intelligence are facilitating autonomous navigation, swarming behavior, and improved threat detection and identification, significantly increasing operational effectiveness.

Key Drivers, Barriers & Challenges in North America Tactical UAV Market

Key Drivers:

- Technological Advancements: Continued innovation in AI, sensor technology, and propulsion systems fuels demand for more capable UAVs.

- Increasing Defense Budgets: Growing geopolitical tensions and the need for enhanced national security are leading to increased defense spending on advanced capabilities like tactical UAVs.

- Demand for Persistent ISR: The requirement for continuous intelligence gathering and situational awareness in complex environments drives the adoption of long-endurance UAVs.

- Reduced Risk to Personnel: UAVs offer a safer alternative for dangerous missions, such as reconnaissance in hostile territories and strike operations.

- Cost-Effectiveness: Compared to manned aircraft, tactical UAVs often present a more economical solution for specific mission profiles.

Barriers & Challenges:

- Regulatory Hurdles: Evolving airspace regulations, particularly for Beyond Visual Line of Sight (BVLOS) operations, can slow down deployment and widespread adoption.

- Counter-UAS Technologies: The proliferation of sophisticated counter-UAS systems poses a threat and necessitates continuous innovation in electronic warfare and survivability.

- Cybersecurity Vulnerabilities: The increasing reliance on networked systems makes tactical UAVs susceptible to cyber-attacks, requiring robust security measures.

- Supply Chain Disruptions: Dependence on global supply chains for critical components can lead to production delays and increased costs.

- Integration Complexity: Integrating new UAV systems with existing command and control structures and legacy platforms can be a significant challenge.

- Public Perception and Privacy Concerns: While less pronounced in military applications, broader civilian use can face scrutiny regarding privacy and public safety.

Emerging Opportunities in North America Tactical UAV Market

Emerging opportunities in the North America Tactical UAV market are centered around the development of Group 2 and Group 3 tactical UAVs for enhanced close-air support and ISR missions, as well as the expansion of capabilities for counter-UAS operations. The increasing demand for swarming technologies, enabling coordinated operations of multiple UAVs, presents a significant growth area. Furthermore, the integration of AI-powered analytics for real-time data processing and decision-making will unlock new applications. Opportunities also lie in developing specialized UAVs for maritime surveillance and long-endurance border patrol. The evolving threat landscape is also creating a demand for modular and adaptable UAV systems that can be rapidly reconfigured for diverse mission profiles.

Growth Accelerators in the North America Tactical UAV Market Industry

The North America Tactical UAV market is propelled by significant growth accelerators, including continuous technological breakthroughs in artificial intelligence for autonomous flight and data analysis, leading to more sophisticated and efficient operations. Strategic partnerships between defense contractors and technology firms are fostering innovation and accelerating the development of cutting-edge capabilities. Furthermore, market expansion strategies by leading players, including acquisitions and collaborations to broaden their product portfolios and geographical reach, are significant growth catalysts. The increasing focus on network-centric warfare and the demand for interconnected battlefield awareness systems are also driving the adoption of advanced tactical UAVs that can seamlessly integrate into broader defense architectures.

Key Players Shaping the North America Tactical UAV Market Market

- Textron Inc.

- Safran

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Airbus SE

- Aeronautical Systems Inc (General Atomics)

- AeroVironment Inc

- IAI

- Northrop Grumman Corporation

- The Boeing Company

Notable Milestones in North America Tactical UAV Market Sector

- 2019: Introduction of advanced AI algorithms for autonomous navigation in new tactical UAV models.

- 2020: Significant increase in drone procurement by the US military for reconnaissance missions.

- 2021: Development and testing of novel swarming drone capabilities for coordinated surveillance.

- 2022: Major defense contractors invest heavily in counter-UAS technology integration for tactical UAVs.

- 2023: Enhanced sensor payloads (e.g., multi-spectral imaging) become standard on leading tactical UAV platforms.

- 2024: Focus on increasing the operational range and endurance of Group 2 and Group 3 tactical UAVs intensifies.

In-Depth North America Tactical UAV Market Market Outlook

The North America Tactical UAV market outlook is exceptionally strong, driven by an unwavering commitment to technological superiority in defense. Growth accelerators, including advancements in AI, robust R&D investments, and strategic industry collaborations, are set to redefine operational capabilities. The increasing demand for persistent ISR and precision strike, coupled with the imperative to reduce risk to human personnel, will continue to fuel market expansion. Strategic opportunities lie in the development of highly autonomous systems, advanced electronic warfare payloads, and integrated counter-UAS solutions. The market is poised for sustained growth as national security priorities remain paramount, ensuring continuous demand for these critical unmanned aerial systems.

North America Tactical UAV Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Tactical UAV Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Tactical UAV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Military Segment To Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Textron Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Safran

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Elbit Systems Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lockheed Martin Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aeronautical Systems Inc (General Atomics)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AeroVironment Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IAI

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Northrop Grumman Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Boeing Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Textron Inc

List of Figures

- Figure 1: North America Tactical UAV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Tactical UAV Market Share (%) by Company 2024

List of Tables

- Table 1: North America Tactical UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Tactical UAV Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Tactical UAV Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Tactical UAV Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Tactical UAV Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Tactical UAV Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Tactical UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Tactical UAV Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Tactical UAV Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Tactical UAV Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Tactical UAV Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Tactical UAV Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Tactical UAV Market?

The projected CAGR is approximately 12.79%.

2. Which companies are prominent players in the North America Tactical UAV Market?

Key companies in the market include Textron Inc, Safran, Elbit Systems Ltd, Lockheed Martin Corporation, Airbus SE, Aeronautical Systems Inc (General Atomics), AeroVironment Inc, IAI, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the North America Tactical UAV Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.59 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Military Segment To Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Tactical UAV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Tactical UAV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Tactical UAV Market?

To stay informed about further developments, trends, and reports in the North America Tactical UAV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence