Key Insights

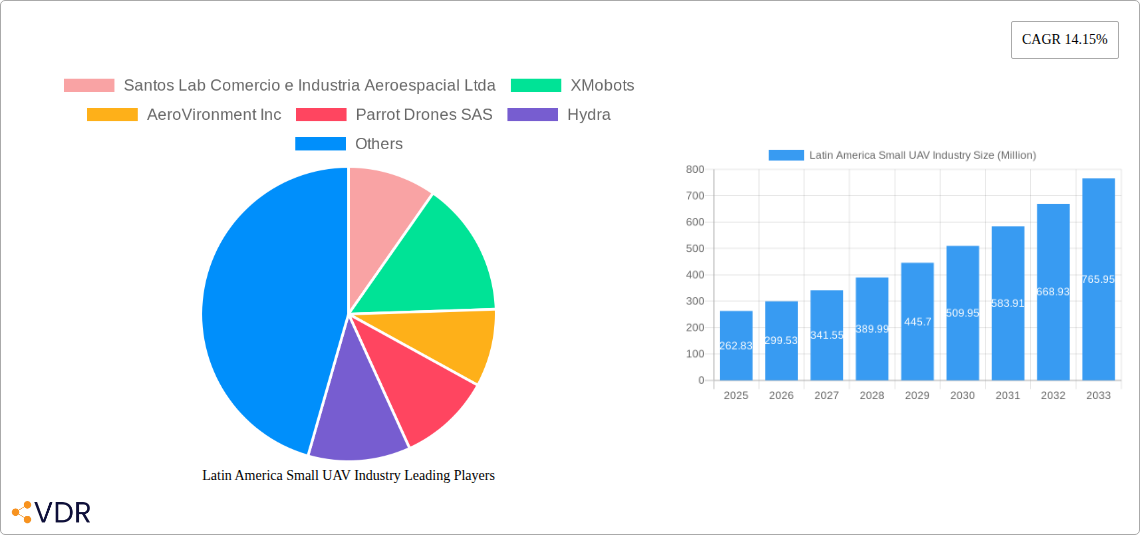

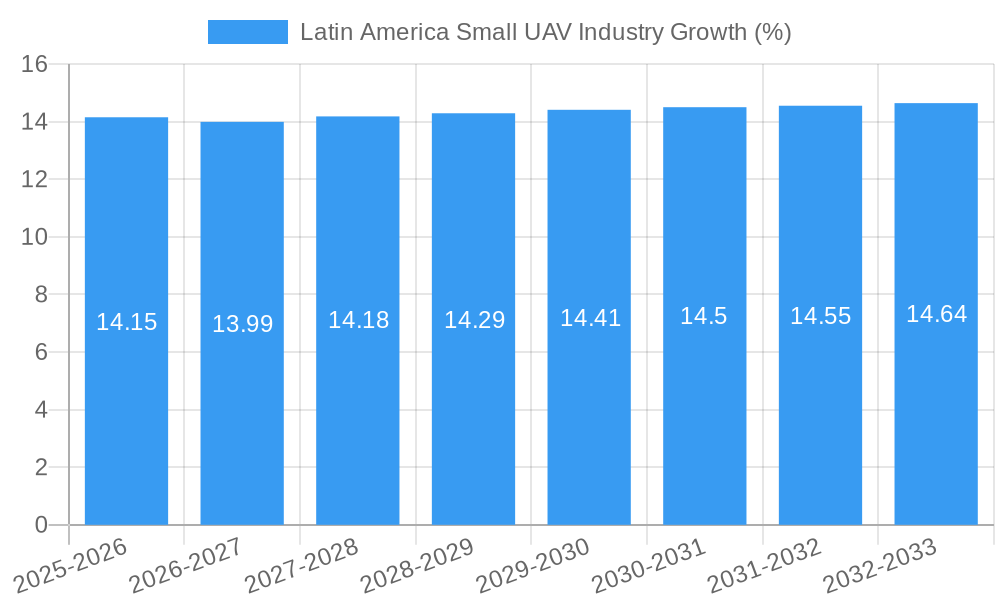

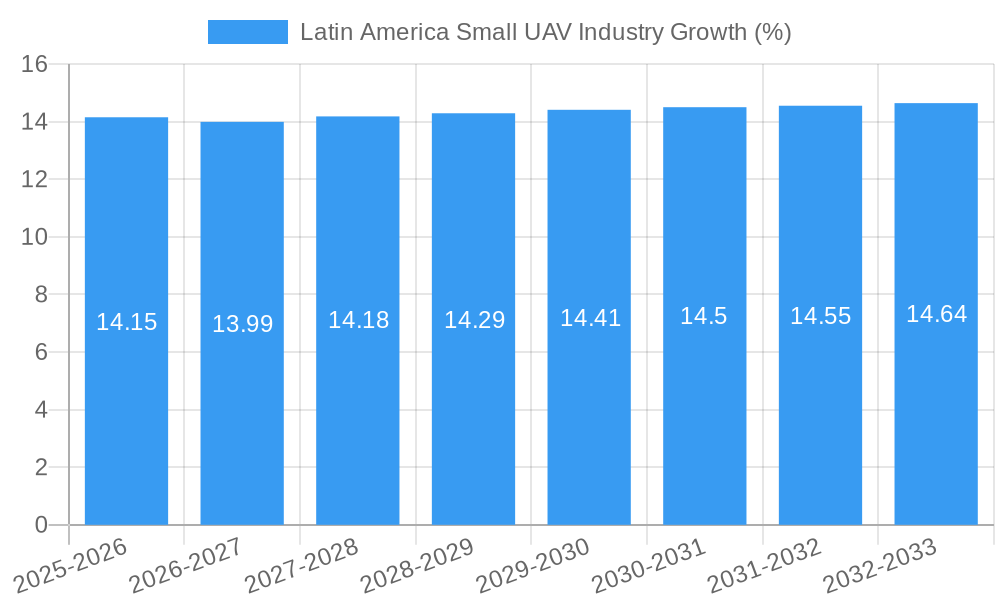

The Latin America Small Unmanned Aerial Vehicle (UAV) market is poised for substantial growth, projected to reach a market size of $262.83 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 14.15% anticipated between 2019 and 2033. This robust expansion is fueled by a confluence of factors, including increasing adoption across defense and commercial sectors for surveillance, mapping, inspection, and delivery applications. The demand for advanced imaging and sensor technologies integrated into small UAVs is a significant driver, enabling enhanced data collection capabilities for diverse industries such as agriculture, mining, and infrastructure development. Furthermore, the evolving regulatory landscape in many Latin American countries is gradually becoming more conducive to UAV operations, albeit with ongoing developments to ensure safe and secure airspace integration. The region's vast geographical diversity, coupled with the need for efficient and cost-effective solutions in challenging terrains, further bolsters the market's upward trajectory. Key players like SZ DJI Technology Co Ltd, Teledyne FLIR LLC, and AeroVironment Inc. are actively expanding their presence and product offerings to cater to the burgeoning demand.

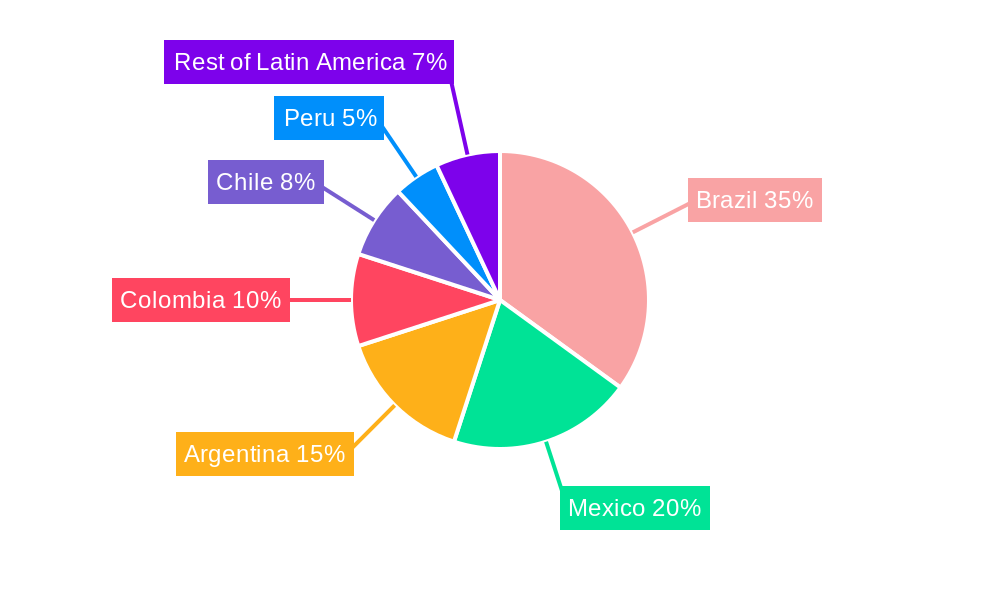

The market's growth is further propelled by emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) for autonomous flight and data analysis, enhancing the capabilities of small UAVs beyond basic aerial photography. The increasing focus on drone-as-a-service (DaaS) models is also democratizing access to UAV technology, making it more accessible for small and medium-sized enterprises. While the market is experiencing significant upward momentum, certain restraints, such as the initial high cost of advanced drone systems and the need for skilled operators, may pose challenges. However, ongoing technological advancements are driving down costs, and the growing availability of training programs is mitigating the skills gap. Brazil, with its large economy and diverse industrial base, is expected to be a dominant force in the Latin American small UAV market, followed by other key nations like Mexico and Argentina. The collective efforts of established aerospace giants and innovative drone startups are set to shape a dynamic and rapidly evolving market in the coming years.

Latin America Small UAV Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Latin America Small Unmanned Aerial Vehicle (UAV) industry, providing critical insights into market dynamics, growth trajectories, and future potential. Covering a study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry stakeholders seeking to understand the evolving landscape of drone technology in the region. We delve into production and consumption analysis, import and export markets, price trends, and key industry developments, offering a holistic view of the market. Explore crucial segments like Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis, and Industry Developments.

Latin America Small UAV Industry Market Dynamics & Structure

The Latin America Small UAV market is characterized by a dynamic interplay of evolving technological advancements, diverse regulatory landscapes, and a growing adoption across various end-use sectors. Market concentration remains moderate, with a few dominant players establishing a strong presence while a growing number of smaller enterprises contribute to innovation and niche market penetration. Technological innovation is primarily driven by advancements in battery life, sensor integration, AI-powered analytics, and autonomous flight capabilities, addressing the increasing demand for precision agriculture, infrastructure inspection, and security surveillance. Regulatory frameworks across Latin America are gradually maturing, with countries implementing specific guidelines for drone operations, safety, and data privacy, which, while sometimes creating initial barriers, are essential for sustainable growth. Competitive product substitutes, primarily traditional methods of data collection and manual inspections, are being increasingly displaced by the efficiency, cost-effectiveness, and safety offered by small UAVs. End-user demographics are expanding beyond traditional military and law enforcement applications to include agriculture, construction, mining, media, and emergency services, reflecting a broader acceptance and understanding of drone utility. Mergers and acquisitions (M&A) trends are emerging as larger companies seek to consolidate market share, acquire innovative technologies, and expand their geographic reach. For instance, the acquisition of specialized drone service providers by established aerospace companies aims to integrate advanced drone solutions into their broader offerings. The market anticipates further consolidation as companies strive for economies of scale and comprehensive solution portfolios.

- Market Concentration: Moderate, with key players holding significant share while innovation thrives among emerging companies.

- Technological Innovation Drivers: Enhanced battery endurance, sophisticated sensor payloads (e.g., thermal, LiDAR), AI for data processing, and improved autonomous navigation.

- Regulatory Frameworks: Developing, with ongoing efforts to standardize rules for commercial and recreational drone use, impacting operational feasibility and market entry.

- Competitive Product Substitutes: Traditional inspection methods, manned aerial surveillance, and ground-based data collection are increasingly being challenged by UAV efficiency.

- End-User Demographics: Expanding from defense to include agriculture, mining, construction, utilities, media, and emergency response.

- M&A Trends: Increasing consolidation as larger entities acquire specialized technology firms and service providers to expand capabilities and market reach.

Latin America Small UAV Industry Growth Trends & Insights

The Latin America Small UAV industry is experiencing a robust growth trajectory, fueled by increasing technological sophistication, expanding application areas, and favorable economic conditions in several key nations. Market size evolution is projected to witness a significant upward trend, driven by a combination of factors that are making drones more accessible and indispensable for businesses and governments across the region. Adoption rates are accelerating, particularly within the agriculture sector, where small UAVs are revolutionizing crop monitoring, yield prediction, and precision spraying, leading to enhanced efficiency and reduced environmental impact. Similarly, the infrastructure and energy sectors are leveraging drones for detailed inspections of pipelines, power lines, and bridges, thereby improving safety and reducing operational costs.

Technological disruptions are playing a pivotal role in this growth. Advancements in sensor technology, such as high-resolution cameras, thermal imaging, and LiDAR, are enabling drones to collect more comprehensive and actionable data than ever before. Artificial intelligence and machine learning are further enhancing the utility of this data, allowing for automated analysis and faster decision-making. The development of longer-lasting batteries and more efficient propulsion systems is also extending flight times and operational ranges, making drones suitable for larger-scale operations.

Consumer behavior shifts are evident as businesses become more aware of the tangible benefits offered by drone technology. The perception of drones is moving from novelty to necessity, with a growing demand for integrated solutions that encompass hardware, software, and data analytics services. This shift is encouraging increased investment in research and development, leading to a virtuous cycle of innovation and market expansion. The increasing availability of specialized drone platforms tailored for specific industries, such as agriculture-focused drones with advanced multispectral sensors or construction drones equipped with photogrammetry capabilities, is further driving adoption. Furthermore, the cost-effectiveness of drone-based solutions compared to traditional methods is becoming a significant driver for small and medium-sized enterprises (SMEs) to invest in this technology. The regulatory environment, while still developing, is gradually becoming more conducive to commercial drone operations, with many countries establishing clear frameworks for registration, pilot licensing, and operational zones. This regulatory clarity is crucial for building confidence among potential adopters and facilitating widespread market penetration. The market penetration of small UAVs is expected to reach new heights as these enabling factors continue to converge, creating a fertile ground for sustained growth and innovation in the Latin American small UAV sector.

Dominant Regions, Countries, or Segments in Latin America Small UAV Industry

The Latin America Small UAV industry's dominance is currently shifting, with Brazil emerging as a key growth engine. This ascendancy is attributed to a confluence of factors spanning economic policies, infrastructure development, and a burgeoning technology adoption rate across critical sectors.

Production Analysis: Brazil leads in small UAV production, driven by significant investments from domestic and international players. The country benefits from a robust industrial base and government incentives aimed at fostering advanced manufacturing and technological innovation. The presence of companies like Santos Lab Comercio e Industria Aeroespacial Ltda and XMobots underscores Brazil's growing capacity in designing and manufacturing sophisticated drone systems.

Consumption Analysis: Brazil also demonstrates the highest consumption of small UAVs, largely propelled by its vast agricultural sector. Drones are extensively used for precision farming, crop monitoring, and aerial spraying, leading to substantial demand for specialized agricultural UAVs. The mining and infrastructure sectors in Brazil are also significant consumers, utilizing drones for exploration, inspection, and surveying. Projected consumption figures for Brazil in 2025 stand at approximately 150 million units, a substantial portion of the regional market.

Import Market Analysis (Value & Volume): While Brazil is a significant producer, it also imports specialized components and high-end UAV models to supplement its domestic capabilities. Other countries like Mexico and Colombia are major importers, particularly for commercial and industrial applications, reflecting their growing need for drone technology in sectors such as logistics, security, and resource management. The import market volume for Latin America is estimated to be around 80 million units in 2025, with a notable value driven by advanced technology imports.

Export Market Analysis (Value & Volume): Brazil is increasingly becoming an exporter of small UAVs and related services, particularly to neighboring South American countries. Its competitive manufacturing costs and the quality of its domestically produced drones are contributing factors. Exports are expected to reach approximately 30 million units by 2025, generating significant foreign exchange. Argentina and Chile are also showing potential in niche export markets.

Price Trend Analysis: The price trend for small UAVs in Latin America is generally declining due to increased competition and technological advancements, making them more accessible. However, specialized, high-performance drones with advanced sensors and longer flight capabilities command premium prices. The average price for a commercial-grade small UAV is projected to be around $1,500 to $5,000 in 2025, with industrial-grade systems potentially exceeding $10,000.

Industry Developments: Significant investments in R&D, strategic partnerships between local and international firms, and a growing number of pilot projects demonstrating the effectiveness of UAVs in various applications are key developments. The establishment of drone pilot training centers and the streamlining of regulatory processes are further facilitating market growth. The overall market value in Latin America is anticipated to reach over $5 billion by 2025.

Latin America Small UAV Industry Product Landscape

The Latin America Small UAV product landscape is characterized by increasing diversification and sophistication, catering to a widening array of applications. Innovations focus on enhancing operational efficiency, data acquisition capabilities, and user-friendliness. Key product categories include multirotor drones for aerial photography, mapping, and surveillance, fixed-wing UAVs for extended range surveying and delivery, and hybrid VTOL (Vertical Take-Off and Landing) systems that combine the benefits of both. Technological advancements are evident in the integration of advanced sensors like LiDAR for detailed 3D mapping, multispectral and hyperspectral cameras for precision agriculture, and thermal cameras for infrastructure inspection and search and rescue operations. Enhanced battery technology is pushing flight times beyond 30-40 minutes for many commercial drones, while AI-powered features for obstacle avoidance, automated flight planning, and intelligent data processing are becoming standard. Unique selling propositions often revolve around ruggedized designs for harsh environmental conditions prevalent in Latin America, extended operational ranges, and specialized payloads tailored for specific industry needs, such as crop disease detection or pipeline integrity monitoring.

Key Drivers, Barriers & Challenges in Latin America Small UAV Industry

The growth of the Latin America Small UAV industry is propelled by several key drivers. Technological Advancements in sensor technology, battery life, and AI capabilities are making drones more versatile and efficient. Expanding Application Areas, particularly in agriculture, mining, infrastructure inspection, and logistics, are creating significant market demand. Cost-Effectiveness compared to traditional methods is a major incentive for businesses to adopt drone solutions. Government Initiatives and supportive regulations in some countries are fostering market growth.

However, the industry faces significant barriers and challenges. Regulatory Hurdles and the lack of harmonized regulations across the region can impede widespread adoption and create operational complexities. Limited Infrastructure for charging, maintenance, and data processing in remote areas can be a constraint. Public Perception and Privacy Concerns surrounding drone usage need to be addressed through education and transparent data handling practices. Cybersecurity Risks associated with drone operations and data transmission require robust security measures. Skilled Workforce Shortage for operating and maintaining advanced UAV systems is another critical challenge. The high initial investment cost for advanced drone systems can also be a barrier for smaller businesses. Supply chain disruptions for critical components can impact production and availability.

Emerging Opportunities in Latin America Small UAV Industry

Emerging opportunities in the Latin America Small UAV industry lie in several promising areas. The last-mile delivery segment is poised for significant growth, especially in urban and remote areas where traditional logistics are challenging and costly. Innovative applications in environmental monitoring, such as tracking deforestation, wildlife conservation, and pollution control, are gaining traction. The disaster response and emergency services sector presents a crucial opportunity for rapid deployment of UAVs for reconnaissance, damage assessment, and delivering essential supplies. Furthermore, the increasing adoption of drones in education and training programs signifies a growing demand for skilled drone pilots and operators. Untapped markets within smaller economies and specialized industrial niches, such as subsea inspection using tethered or autonomous underwater vehicles (AUVs) integrated with drone capabilities, offer significant potential for early movers. Evolving consumer preferences for integrated, end-to-end drone solutions, including data analytics and cloud platforms, also present a fertile ground for service providers.

Growth Accelerators in the Latin America Small UAV Industry Industry

Several catalysts are accelerating the long-term growth of the Latin America Small UAV industry. Technological breakthroughs in areas like AI-powered autonomous flight, swarm intelligence, and advanced payload miniaturization are continuously expanding the capabilities and applications of small UAVs. Strategic partnerships between drone manufacturers, software developers, and end-users are crucial for developing tailored solutions and expanding market reach. For example, collaborations between agricultural technology companies and drone manufacturers are accelerating the adoption of precision farming practices. Market expansion strategies, including entering new geographical regions within Latin America and targeting underserved industries, are driving demand. The increasing investment in drone-as-a-service (DaaS) models is lowering the barrier to entry for many businesses, enabling wider adoption. Furthermore, the development of robust testing and validation infrastructure, alongside pilot training programs, is building confidence and promoting safe and effective drone operations.

Key Players Shaping the Latin America Small UAV Industry Market

- SZ DJI Technology Co Ltd

- AeroVironment Inc

- Teledyne FLIR LL

- Parrot Drones SAS

- Northrop Grumman Corporation

- The Boeing Company

- XMobots

- Santos Lab Comercio e Industria Aeroespacial Ltda

- FT Sistemas SA

- Nostromo LLC

- Hydra

- JETWIND BRAZIL

Notable Milestones in Latin America Small UAV Industry Sector

- 2019/2020: Increased regulatory clarity in countries like Brazil and Mexico, leading to the formalization of commercial drone operations.

- 2020: Significant surge in drone adoption for aerial surveillance and delivery during the COVID-19 pandemic.

- 2021: Launch of advanced AI-powered analytics platforms for drone data in agriculture by key regional players.

- 2022: Major infrastructure inspection projects in key Latin American countries increasingly relying on drone technology.

- 2023: Growing number of mergers and acquisitions as larger defense and aerospace companies acquire specialized drone startups.

- 2024: Expansion of drone delivery services beyond pilot programs into commercial operations in select urban centers.

In-Depth Latin America Small UAV Industry Market Outlook

The Latin America Small UAV industry is set for sustained and accelerated growth, driven by a confluence of technological innovation, expanding market applications, and increasing industry acceptance. Growth accelerators such as advancements in AI for autonomous operations and sophisticated data analytics will further enhance the value proposition of UAVs across sectors like agriculture, mining, and infrastructure. Strategic partnerships and the increasing prevalence of drone-as-a-service models will democratize access to this technology, empowering a wider range of businesses. Market expansion into new geographical regions and untapped industrial niches will continue to fuel demand. The future outlook indicates a robust market potential, with a strong emphasis on integrated solutions that encompass hardware, software, and data services. Stakeholders can capitalize on these opportunities by focusing on innovation, regulatory engagement, and building robust ecosystems to support the burgeoning drone economy in Latin America.

Latin America Small UAV Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Small UAV Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Small UAV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Civil and Commercial Segment is Projected to Register the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Santos Lab Comercio e Industria Aeroespacial Ltda

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 XMobots

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 AeroVironment Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Parrot Drones SAS

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hydra

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SZ DJI Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Teledyne FLIR LL

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 JETWIND BRAZIL

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 FT Sistemas SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Nostromo LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Northrop Grumman Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 The Boeing Company

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Santos Lab Comercio e Industria Aeroespacial Ltda

List of Figures

- Figure 1: Latin America Small UAV Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Small UAV Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Small UAV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Small UAV Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Latin America Small UAV Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Latin America Small UAV Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Latin America Small UAV Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Latin America Small UAV Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Latin America Small UAV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Latin America Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Peru Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Chile Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Latin America Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Latin America Small UAV Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Latin America Small UAV Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Latin America Small UAV Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Latin America Small UAV Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Latin America Small UAV Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Latin America Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Colombia Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Peru Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Venezuela Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Ecuador Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Bolivia Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Paraguay Latin America Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Small UAV Industry?

The projected CAGR is approximately 14.15%.

2. Which companies are prominent players in the Latin America Small UAV Industry?

Key companies in the market include Santos Lab Comercio e Industria Aeroespacial Ltda, XMobots, AeroVironment Inc, Parrot Drones SAS, Hydra, SZ DJI Technology Co Ltd, Teledyne FLIR LL, JETWIND BRAZIL, FT Sistemas SA, Nostromo LLC, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Latin America Small UAV Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 262.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Civil and Commercial Segment is Projected to Register the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Small UAV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Small UAV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Small UAV Industry?

To stay informed about further developments, trends, and reports in the Latin America Small UAV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence