Key Insights

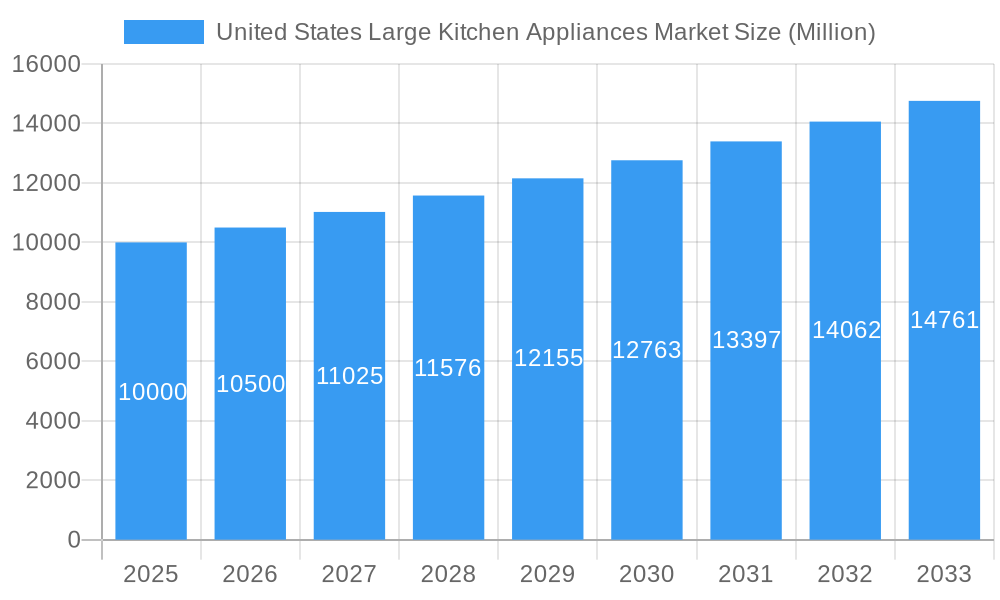

The United States large kitchen appliance market, encompassing refrigerators, freezers, dishwashers, cookers, ovens, and ranges, exhibits robust growth potential. Driven by factors such as rising disposable incomes, increasing urbanization leading to smaller kitchen spaces (fueling demand for efficient, space-saving appliances), and a growing preference for technologically advanced features like smart appliances and energy-efficient models, the market is expected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. The market is segmented by product type, distribution channel, and application (residential and commercial). While specialist retailers and online channels are key distribution avenues, supermarkets and hypermarkets also contribute significantly. The residential segment dominates, reflecting the high penetration of large kitchen appliances in US households. Leading brands like Whirlpool, GE, Samsung, LG, and Bosch compete fiercely, constantly innovating to meet evolving consumer preferences and technological advancements. Factors like economic fluctuations and supply chain disruptions could pose challenges to consistent growth. However, the long-term outlook remains positive, fueled by continuous improvements in appliance technology and a sustained demand for enhanced kitchen functionality and convenience.

United States Large Kitchen Appliances Market Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging brands vying for market share. Key players invest heavily in research and development to introduce innovative features and enhance product durability and energy efficiency. Furthermore, strategic partnerships, mergers, and acquisitions contribute to market consolidation and expansion. The online retail channel is rapidly growing, providing consumers with increased convenience and a wider selection of products. Future growth will depend heavily on maintaining a balance between technological advancements, affordability, and addressing sustainability concerns through energy-efficient designs and environmentally friendly manufacturing practices. Understanding consumer preferences and adapting product offerings accordingly will remain crucial for success in this dynamic market.

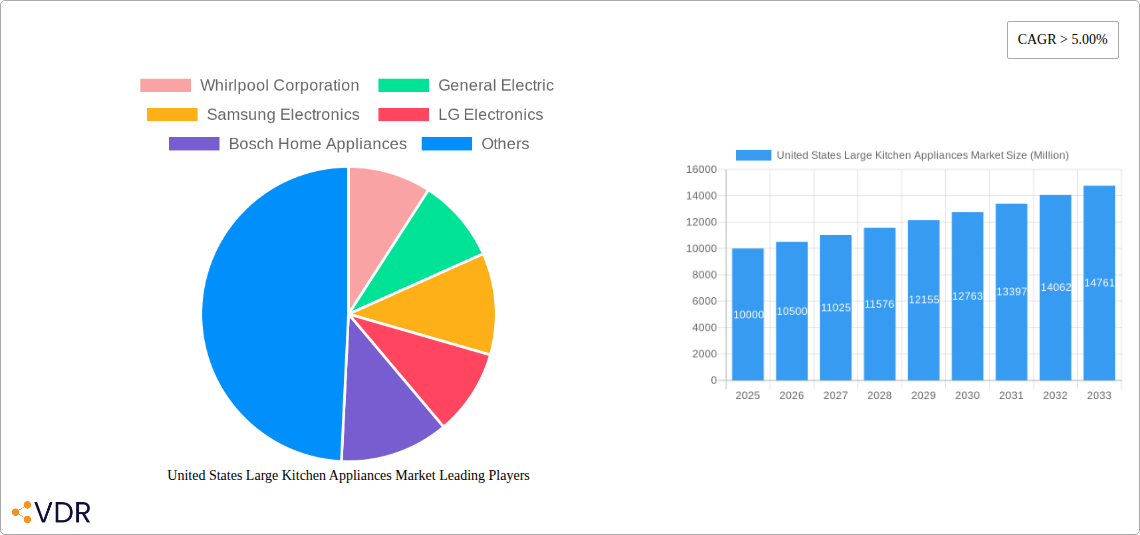

United States Large Kitchen Appliances Market Company Market Share

United States Large Kitchen Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States large kitchen appliances market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report segments the market by product (Refrigerators, Freezers, Dishwashing Machines, Cookers & Ovens, Ranges), distribution channel (Specialist Retailers, Online Retailers, Supermarkets and Hypermarkets, Manufacturer Retailers, Other Distribution Channels), and application (Residential, Commercial).

United States Large Kitchen Appliances Market Dynamics & Structure

The US large kitchen appliances market is characterized by a moderately concentrated landscape, with key players like Whirlpool Corporation, General Electric, Samsung Electronics, LG Electronics, and Bosch Home Appliances holding significant market share. Technological innovation, particularly in smart appliances and energy efficiency, is a major driver. Stringent energy efficiency regulations and safety standards imposed by government bodies shape product development and manufacturing practices. The market also witnesses competitive pressures from substitute products like built-in appliances and smaller, space-saving alternatives. Consumer demographics, particularly the rise of millennial and Gen Z homeowners with a preference for smart home technology, significantly influence market trends. The historical period (2019-2024) saw several mergers and acquisitions (M&A) deals, totaling approximately xx million units, primarily driven by strategic expansion and technology integration.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Smart appliances, energy-efficient models, and connected kitchen ecosystems are key drivers.

- Regulatory Framework: Stringent energy efficiency standards and safety regulations influence product design and manufacturing.

- Competitive Substitutes: Built-in appliances and compact kitchen solutions pose competitive challenges.

- End-User Demographics: Millennials and Gen Z homeowners are driving demand for smart and energy-efficient appliances.

- M&A Trends: xx million units worth of M&A activity during 2019-2024, indicative of consolidation and technological integration.

United States Large Kitchen Appliances Market Growth Trends & Insights

The US large kitchen appliances market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth was fueled by increasing disposable incomes, rising urbanization, and a growing preference for modern, technologically advanced kitchens. The adoption rate of smart appliances is steadily increasing, with xx% penetration in 2025, further driven by improved connectivity and user-friendly interfaces. Technological disruptions, such as the integration of AI and IoT, are reshaping the market landscape, offering consumers enhanced convenience and control. Shifting consumer preferences towards energy efficiency and sustainability are also influencing demand. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by continuous technological advancements, growing demand for premium appliances, and the expanding adoption of smart kitchen solutions. Market penetration of smart appliances is projected to reach xx% by 2033.

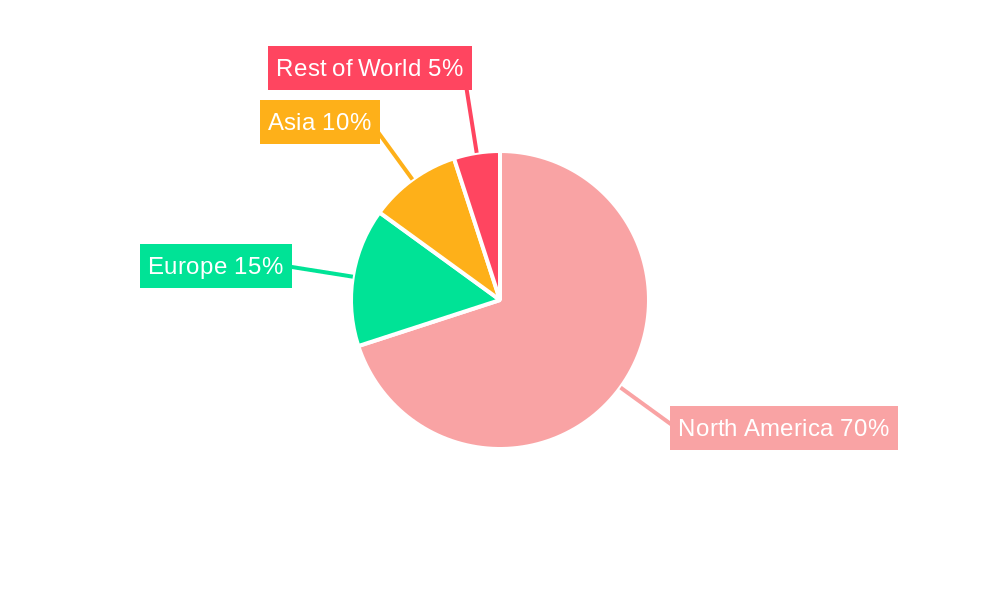

Dominant Regions, Countries, or Segments in United States Large Kitchen Appliances Market

The Northeast and West Coast regions of the US demonstrate strong growth, driven by higher disposable incomes and a preference for premium appliances. Within product segments, refrigerators and dishwashers represent the largest market share, while online retailers are witnessing rapid growth in distribution channels. The residential application segment dominates the market with a share of xx%, driven by new home construction and renovations.

- Leading Region: Northeast and West Coast regions drive market growth due to higher disposable income.

- Dominant Product: Refrigerators and Dishwashers account for the largest market share.

- Fastest-Growing Distribution Channel: Online retailers experience significant growth.

- Key Application: Residential applications dominate the market.

- Growth Drivers: Increasing disposable income, new home construction, and preference for modern kitchens.

United States Large Kitchen Appliances Market Product Landscape

The US market showcases a wide range of large kitchen appliances with varying features and functionalities. Innovation focuses on energy efficiency, smart capabilities, and improved user interfaces. Refrigerators with advanced cooling systems and smart features, such as inventory management and temperature control via mobile apps, are popular. Dishwashers with quiet operation and enhanced cleaning technologies are also in high demand. Cookers and ovens feature smart functionalities such as pre-programmed cooking options and remote monitoring. Unique selling propositions include sleek designs, advanced features, and intuitive interfaces.

Key Drivers, Barriers & Challenges in United States Large Kitchen Appliances Market

Key Drivers: Rising disposable incomes, increasing urbanization, preference for modern and technologically advanced kitchens, and government initiatives promoting energy efficiency are driving market growth.

Challenges & Restraints: Supply chain disruptions, particularly concerning component availability, coupled with increasing raw material costs and intense competition, pose significant challenges. Furthermore, stringent regulatory compliance and evolving consumer preferences demand continuous innovation and adaptation. These factors could negatively impact market growth by xx% if not addressed effectively.

Emerging Opportunities in United States Large Kitchen Appliances Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly appliances, smart kitchen integration, and customization options. Untapped markets in rural areas and the increasing adoption of subscription-based appliance services present further potential. The rise of "smart kitchens" and connected appliances offers significant growth avenues.

Growth Accelerators in the United States Large Kitchen Appliances Market Industry

Technological advancements in energy efficiency, smart features, and AI integration, combined with strategic partnerships between appliance manufacturers and technology companies, will significantly accelerate market growth. Market expansion strategies focusing on underserved customer segments and international collaborations will also propel growth.

Key Players Shaping the United States Large Kitchen Appliances Market Market

Notable Milestones in United States Large Kitchen Appliances Market Sector

- 2021-Q4: Whirlpool Corporation launched a new line of energy-efficient refrigerators.

- 2022-Q2: Samsung Electronics announced a partnership with a smart home technology provider.

- 2023-Q1: LG Electronics introduced a new range of smart ovens with AI-powered cooking assistance.

In-Depth United States Large Kitchen Appliances Market Market Outlook

The US large kitchen appliances market exhibits strong growth potential, driven by continuous innovation, increasing disposable incomes, and the expansion of smart home technology. Strategic partnerships, product diversification, and targeted marketing initiatives will be crucial for companies to capitalize on the opportunities presented by this dynamic market. The market is poised for sustained expansion over the forecast period (2025-2033).

United States Large Kitchen Appliances Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Large Kitchen Appliances Market Segmentation By Geography

- 1. United States

United States Large Kitchen Appliances Market Regional Market Share

Geographic Coverage of United States Large Kitchen Appliances Market

United States Large Kitchen Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 There is an increasing focus on health and wellness

- 3.2.2 which is driving demand for appliances that support healthier cooking methods. Features such as air fryers

- 3.2.3 steam cooking

- 3.2.4 and advanced temperature controls are becoming more popular.

- 3.3. Market Restrains

- 3.3.1 The cost of high-end

- 3.3.2 technologically advanced large kitchen appliances can be significant. This high initial investment may be a barrier for some consumers

- 3.3.3 particularly in economically uncertain times or for those with budget constraints.

- 3.4. Market Trends

- 3.4.1. There is a growing demand for energy-efficient and environmentally friendly appliances. Consumers are interested in products that reduce energy consumption and have a lower environmental impact. Manufacturers are responding with Energy Star-certified appliances and those made from sustainable materials.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Large Kitchen Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Electric

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Home Appliances

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: United States Large Kitchen Appliances Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Large Kitchen Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Large Kitchen Appliances Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Large Kitchen Appliances Market?

The projected CAGR is approximately 4.27%.

2. Which companies are prominent players in the United States Large Kitchen Appliances Market?

Key companies in the market include Whirlpool Corporation , General Electric , Samsung Electronics , LG Electronics , Bosch Home Appliances.

3. What are the main segments of the United States Large Kitchen Appliances Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

There is an increasing focus on health and wellness. which is driving demand for appliances that support healthier cooking methods. Features such as air fryers. steam cooking. and advanced temperature controls are becoming more popular..

6. What are the notable trends driving market growth?

There is a growing demand for energy-efficient and environmentally friendly appliances. Consumers are interested in products that reduce energy consumption and have a lower environmental impact. Manufacturers are responding with Energy Star-certified appliances and those made from sustainable materials..

7. Are there any restraints impacting market growth?

The cost of high-end. technologically advanced large kitchen appliances can be significant. This high initial investment may be a barrier for some consumers. particularly in economically uncertain times or for those with budget constraints..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Large Kitchen Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Large Kitchen Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Large Kitchen Appliances Market?

To stay informed about further developments, trends, and reports in the United States Large Kitchen Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence