Key Insights

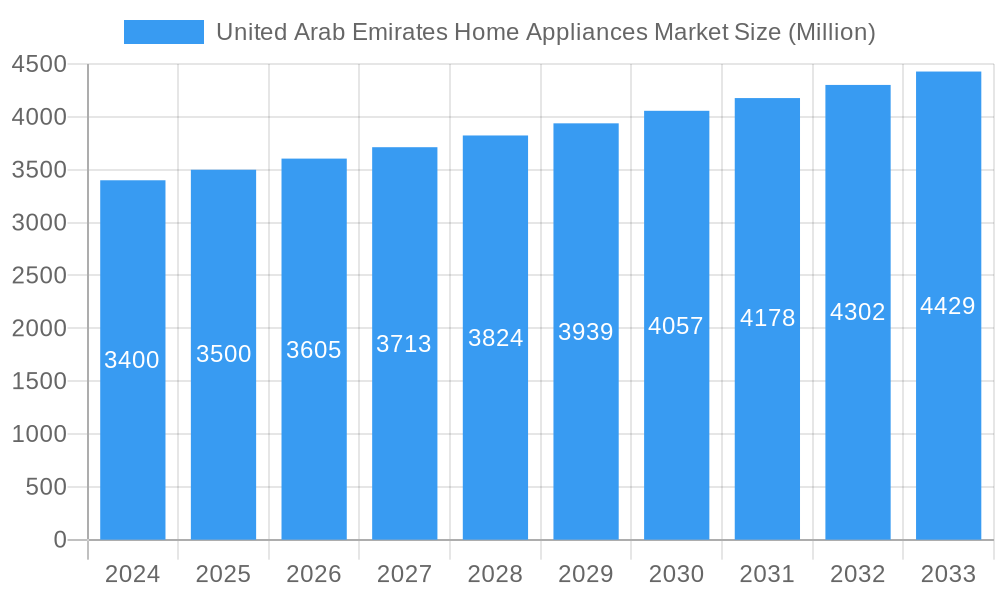

The United Arab Emirates (UAE) Home Appliances Market is projected to reach a market size of $3.48 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.13% from 2025 to 2033. This growth is propelled by robust economic performance, a growing expatriate population, and rising disposable incomes. Government initiatives promoting enhanced living standards and smart city development are also significant drivers, fostering the adoption of advanced and energy-efficient appliances. The market is witnessing a strong demand for innovative, feature-rich products, especially in essential categories like refrigerators, washing machines, and air conditioners, crucial for the region's climate.

United Arab Emirates Home Appliances Market Market Size (In Billion)

Evolving consumer trends, including a significant shift towards online sales channels for convenience and broader product selection, are shaping market dynamics. Specialty stores also remain important for consumers seeking expert advice and premium brands. While growth drivers are substantial, potential fluctuations in import duties and rising raw material costs may present challenges. Nevertheless, the strong demand for technologically advanced, aesthetically appealing, and energy-efficient appliances is expected to sustain market expansion. Key industry players are focusing on product innovation and distribution network enhancement to secure greater market share.

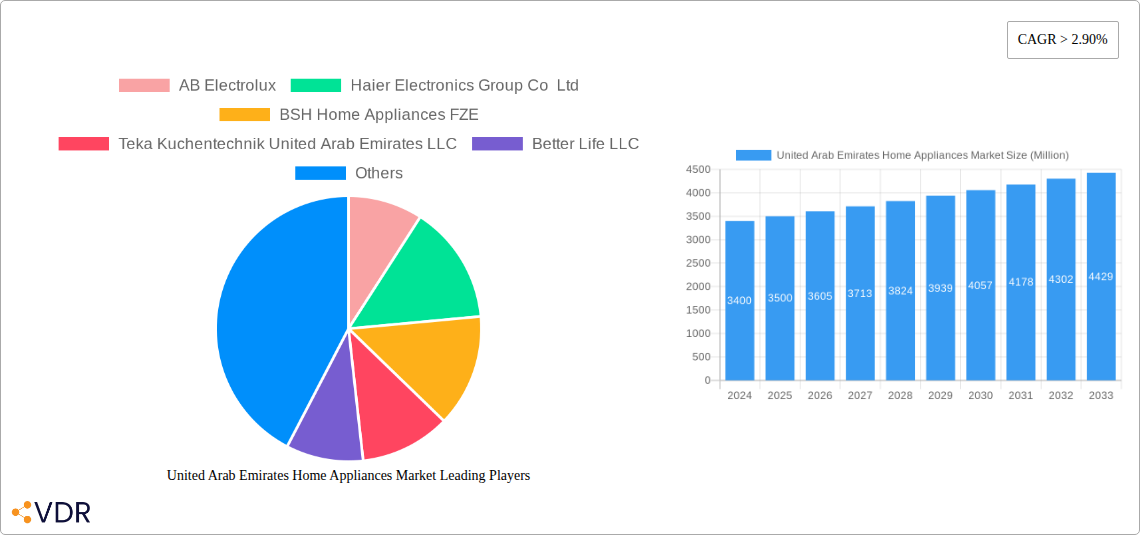

United Arab Emirates Home Appliances Market Company Market Share

United Arab Emirates Home Appliances Market: Comprehensive Outlook & Growth Forecast (2019-2033)

Unlock unparalleled insights into the burgeoning United Arab Emirates (UAE) home appliances market. This in-depth report delivers a critical analysis of market dynamics, growth trends, and future opportunities, providing industry professionals with actionable intelligence. With a focus on high-traffic keywords like "UAE home appliances," "kitchen appliances market," "major appliances UAE," and "smart home devices UAE," this report is optimized for maximum search engine visibility. We meticulously break down the market by product categories including Major Appliances (Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Ovens, Air Conditioners) and Small Appliances (Coffee/Tea Makers, Food Processors, Grills & Roasters, Vacuum Cleaners), alongside crucial distribution channels like Supermarkets and Hypermarkets, Specialty Stores, and Online platforms. Quantified data, presented in Million units, offers a clear understanding of market size and penetration.

United Arab Emirates Home Appliances Market Dynamics & Structure

The United Arab Emirates home appliances market is characterized by a moderately concentrated structure, with key global players like AB Electrolux, Haier Electronics Group Co Ltd, BSH Home Appliances FZE, LG Electronics Gulf FZE, and Samsung Electronics Ltd holding significant market share. Technological innovation is a primary driver, with a strong emphasis on energy efficiency, smart connectivity, and advanced features that appeal to the tech-savvy UAE consumer. Regulatory frameworks, particularly concerning energy consumption and product safety, are evolving to align with global sustainability standards. Competitive product substitutes are abundant, ranging from feature-rich built-in appliances to innovative countertop solutions, intensifying the need for differentiation. End-user demographics are diverse, with a growing expatriate population and a strong preference for premium, modern products. Mergers and acquisitions (M&A) trends, while not historically rampant, are anticipated to increase as companies seek to consolidate market presence and expand product portfolios.

- Market Concentration: Dominated by a mix of global conglomerates and regional distributors.

- Technological Innovation Drivers: Energy efficiency, IoT integration, AI-powered features, and premium design aesthetics.

- Regulatory Frameworks: Focus on energy efficiency standards (e.g., ESMA), product safety, and environmental impact.

- Competitive Product Substitutes: Abundance of brands across all appliance categories, including private labels.

- End-User Demographics: High disposable income, preference for premium and technologically advanced products, growing demand for smart home solutions.

- M&A Trends: Potential for consolidation as key players seek to enhance market reach and product offerings.

United Arab Emirates Home Appliances Market Growth Trends & Insights

The United Arab Emirates home appliances market is projected to experience robust growth over the forecast period of 2025–2033, driven by several key trends and insights. The market size evolution is a testament to the UAE's dynamic economy and high consumer spending power. We anticipate a Compound Annual Growth Rate (CAGR) of approximately 7.5%, reflecting a steady increase in both unit sales and value. Adoption rates for technologically advanced appliances, particularly those offering smart connectivity and enhanced energy efficiency, are soaring. This is fueled by a rising consumer awareness of sustainability and a desire for convenience. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into everyday appliances, are transforming the user experience, offering personalized controls and remote operation capabilities. Consumer behavior shifts are clearly indicating a preference for premium, aesthetically pleasing, and feature-rich products that align with modern living standards. The increasing urbanization and ongoing infrastructure development, including new residential projects and smart city initiatives, further bolster demand.

- Market Size Evolution: Significant expansion driven by population growth and increasing disposable incomes.

- Adoption Rates: High and accelerating adoption of energy-efficient and smart home appliances.

- Technological Disruptions: Pervasive integration of AI, IoT, and connectivity features.

- Consumer Behavior Shifts: Preference for premium designs, energy efficiency, smart functionality, and integrated kitchen solutions.

- Market Penetration: Deepening penetration across all product categories, with a noticeable increase in the adoption of built-in appliances and advanced small appliances.

- Economic Factors: Strong economic growth, government initiatives supporting consumer spending, and a thriving real estate sector.

Dominant Regions, Countries, or Segments in United Arab Emirates Home Appliances Market

Within the United Arab Emirates home appliances market, Major Appliances consistently dominate, accounting for an estimated 65% of the total market value. Among these, Air Conditioners emerge as the leading segment, driven by the region's consistently high temperatures and the continuous development of residential and commercial infrastructure. Refrigerators and Washing Machines also hold substantial market share, reflecting their essential nature in every household. The Online distribution channel is experiencing the most rapid growth, projected to capture over 35% of the market share by 2033, driven by the convenience, competitive pricing, and extensive product availability offered by e-commerce platforms. Supermarkets and Hypermarkets remain significant channels, particularly for impulse purchases of small appliances.

- Dominant Product Segment: Major Appliances

- Air Conditioners: High demand due to climate, essential for residential and commercial comfort.

- Refrigerators: Consistent demand due to population growth and lifestyle upgrades.

- Washing Machines: Essential household item with increasing adoption of advanced features.

- Dominant Distribution Channel: Online

- Convenience and Accessibility: 24/7 shopping, home delivery.

- Competitive Pricing: Price comparisons and online-exclusive deals.

- Wide Product Selection: Access to a broader range of brands and models.

- Key Drivers of Dominance:

- Economic Policies: Government support for retail and e-commerce sectors.

- Infrastructure: Advanced logistics and internet penetration.

- Consumer Preferences: Growing trust and comfort with online purchasing.

- Technological Advancements: Seamless integration of online platforms with product information and customer service.

United Arab Emirates Home Appliances Market Product Landscape

The UAE home appliances product landscape is defined by innovation and a strong consumer demand for sophisticated, energy-efficient, and aesthetically pleasing devices. Major appliances like refrigerators and washing machines are increasingly featuring smart connectivity, allowing for remote control and diagnostics via smartphone applications. Built-in kitchen appliances, including ovens and dishwashers, are gaining popularity for their seamless integration into modern kitchen designs. Small appliances are witnessing a surge in demand for multifunctional devices, such as air fryers and advanced coffee makers, catering to evolving culinary habits. Performance metrics are often benchmarked against global standards for energy consumption and durability. Unique selling propositions often revolve around advanced cooling technologies, quieter operation, and intuitive user interfaces, all designed to enhance the modern living experience in the UAE.

Key Drivers, Barriers & Challenges in United Arab Emirates Home Appliances Market

Key Drivers:

- Rising Disposable Income: A substantial portion of the UAE population has high disposable income, enabling greater spending on premium home appliances.

- Growing Real Estate Sector: Continuous development of new residential and commercial properties creates a consistent demand for new appliance installations.

- Technological Advancements: Integration of smart technology, AI, and energy-efficient features appeals to a tech-savvy consumer base.

- Growing Expatriate Population: The diverse expatriate community brings varying preferences and a demand for a wide range of appliance types.

Barriers & Challenges:

- Intense Competition: A highly competitive market with numerous international and local brands vying for market share.

- Price Sensitivity: While premium products are in demand, a segment of the market remains price-sensitive, creating pressure on profit margins.

- Supply Chain Disruptions: Global supply chain volatility can impact product availability and pricing.

- Counterfeit Products: The presence of counterfeit appliances poses a threat to brand reputation and consumer safety.

Emerging Opportunities in United Arab Emirates Home Appliances Market

Emerging opportunities in the UAE home appliances market are largely centered around the burgeoning smart home ecosystem and the growing demand for sustainable solutions. The integration of appliances with voice-activated assistants and comprehensive home automation systems represents a significant untapped market. Furthermore, the increasing consumer focus on health and wellness is driving demand for appliances with advanced air purification features and germ-killing technologies. The e-commerce channel continues to offer substantial growth potential, particularly for niche and specialized appliance categories. Innovative subscription-based models for appliance maintenance and upgrades could also gain traction among consumers seeking convenience and long-term cost predictability.

Growth Accelerators in the United Arab Emirates Home Appliances Market Industry

Several key factors are accelerating the growth of the UAE home appliances industry. Technological breakthroughs in energy efficiency, such as the widespread adoption of inverter technology in air conditioners and refrigerators, are reducing operating costs for consumers and meeting stringent environmental regulations. Strategic partnerships between appliance manufacturers and smart home technology providers are fostering the development of integrated living solutions. Market expansion strategies by global brands, including localized product offerings and enhanced after-sales service networks, are further stimulating demand. The UAE's vision for a digitally connected society and its focus on smart city development also act as significant growth accelerators, encouraging the adoption of connected home appliances.

Key Players Shaping the United Arab Emirates Home Appliances Market

- AB Electrolux

- Haier Electronics Group Co Ltd

- BSH Home Appliances FZE

- Teka Kuchentechnik United Arab Emirates LLC

- Better Life LLC

- Samsung Electronics Ltd

- LG Electronics Gulf FZE

- Dyson Limited

- Hisense Middle East

- Karcher

Notable Milestones in United Arab Emirates Home Appliances Market Sector

- June 2023: LG Electronics (LG) announced the launch of its new line-up of built-in home appliances in the UAE, featuring premium ovens, hoods, electric and gas cooktops designed for a seamless and modern cooking experience.

- March 2023: BSH Home Appliances announced an investment of approximately €50 million (USD 53362500) in a state-of-the-art stove factory in Cairo, Egypt, signaling strategic expansion in the region.

In-Depth United Arab Emirates Home Appliances Market Market Outlook

The future outlook for the United Arab Emirates home appliances market is exceptionally bright, with growth accelerators positioning it for sustained expansion. The increasing adoption of advanced AI-powered features and the seamless integration of smart home devices will continue to redefine consumer expectations and drive demand for cutting-edge products. Strategic partnerships, particularly those focusing on sustainability and IoT integration, are expected to create new revenue streams and market opportunities. The UAE's ongoing commitment to technological innovation and its status as a hub for premium consumption ensure a fertile ground for appliance manufacturers to introduce and popularize the latest in home convenience and efficiency. The market's trajectory suggests a strong emphasis on value-added products and personalized consumer experiences.

United Arab Emirates Home Appliances Market Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee/Tea Makers

- 1.2.2. Food Processors

- 1.2.3. Grills & Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

United Arab Emirates Home Appliances Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Home Appliances Market Regional Market Share

Geographic Coverage of United Arab Emirates Home Appliances Market

United Arab Emirates Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income; Growing population and urbanization

- 3.3. Market Restrains

- 3.3.1. Price sensitivity; Seasonal demand fluctuations

- 3.4. Market Trends

- 3.4.1. Growing Expatriate Population is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee/Tea Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills & Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Electrolux

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSH Home Appliances FZE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Teka Kuchentechnik United Arab Emirates LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Better Life LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Gulf FZE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dyson Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hisense Middle East

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Karcher**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AB Electrolux

List of Figures

- Figure 1: United Arab Emirates Home Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Home Appliances Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the United Arab Emirates Home Appliances Market?

Key companies in the market include AB Electrolux, Haier Electronics Group Co Ltd, BSH Home Appliances FZE, Teka Kuchentechnik United Arab Emirates LLC, Better Life LLC, Samsung Electronics Ltd, LG Electronics Gulf FZE, Dyson Limited, Hisense Middle East, Karcher**List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income; Growing population and urbanization.

6. What are the notable trends driving market growth?

Growing Expatriate Population is Driving the Market.

7. Are there any restraints impacting market growth?

Price sensitivity; Seasonal demand fluctuations.

8. Can you provide examples of recent developments in the market?

June 2023: LG Electronics (LG) announced the launch of its new line-up of built-in home appliances in the UAE. It includes premium ovens, hoods, electric and gas cooktops with versatile, elegant designs and easy controls, all built to revolutionize the way people cook and provide them with a seamless and modern cooking experience. The new appliances are designed to blend seamlessly into any kitchen interior, creating a sleek and modern look while delivering the latest technology and meeting the highest requirements for ergonomics and equipment in the modern kitchen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Home Appliances Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence