Key Insights

The United Kingdom handheld vacuum cleaner market, valued at approximately 550.01 million in the base year 2024, is projected to experience robust growth. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.1% from 2024 to 2033, reaching an estimated value exceeding 550.01 million by the end of the forecast period. This expansion is primarily driven by the increasing consumer demand for convenient, efficient, and portable cleaning solutions. The growing popularity of cordless models, offering enhanced maneuverability and ease of use, appeals particularly to consumers in smaller living spaces and apartments. Furthermore, a significant increase in pet ownership directly contributes to demand, as handheld vacuums are highly effective for managing pet hair and dander. Continuous technological advancements, including improvements in suction power, lightweight designs, extended battery life, and smart features, are enhancing product appeal and stimulating market growth. The market is segmented by product type (corded, cordless), application (household, automotive, commercial), and distribution channel (online, offline), presenting diverse opportunities for market participants to innovate and differentiate their offerings. While established brands like Dyson, Hoover, and Vax hold significant market share, the landscape is also marked by intense competition from emerging brands introducing innovative features and competitive pricing strategies. Despite challenges such as price sensitivity and the availability of alternative cleaning methods, the overall outlook for the UK handheld vacuum cleaner market remains positive, supported by a growing consumer base and ongoing product innovation.

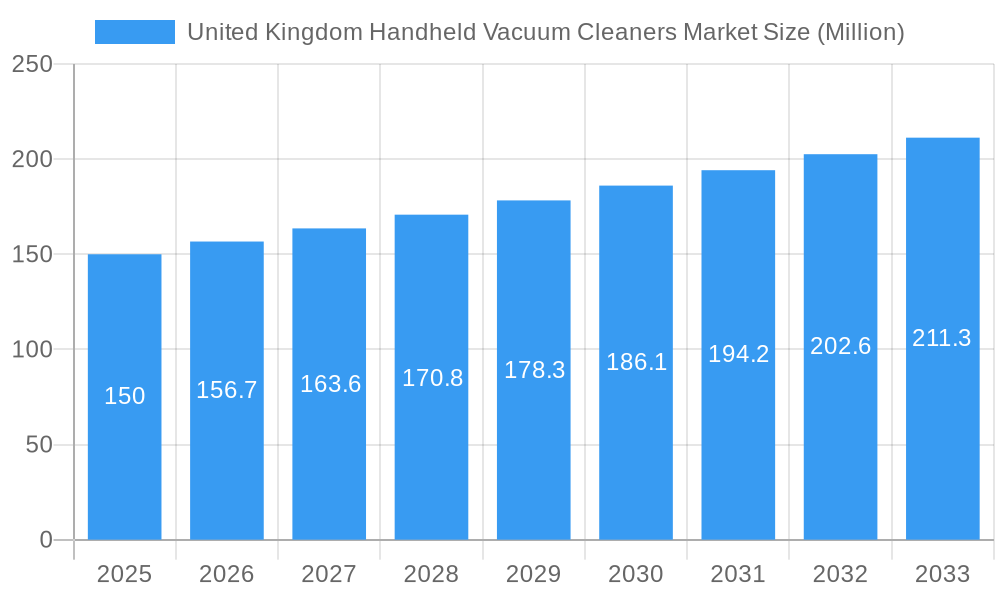

United Kingdom Handheld Vacuum Cleaners Market Market Size (In Million)

Geographically, the market demonstrates a concentration in urban centers and affluent regions, reflecting higher disposable incomes and a preference for premium cleaning appliances. The online sales channel is rapidly gaining traction, driven by widespread e-commerce adoption and the convenience of online purchasing. However, offline retail channels continue to play a vital role, offering consumers opportunities for product demonstrations and immediate customer assistance. The competitive environment is characterized by substantial investments in marketing and innovation by established players, alongside strategic efforts by emerging brands to secure market share. Future growth will be contingent upon sustained technological advancements, effective marketing campaigns, and the ability to adapt to evolving consumer preferences, particularly concerning sustainability and product lifecycle management. The market will continue to benefit from steady urban population growth in the UK and evolving lifestyle trends influencing consumer demand for cleaning products.

United Kingdom Handheld Vacuum Cleaners Market Company Market Share

United Kingdom Handheld Vacuum Cleaners Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom handheld vacuum cleaner market, encompassing market dynamics, growth trends, dominant segments, and key players. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. Market values are presented in million units.

United Kingdom Handheld Vacuum Cleaners Market Dynamics & Structure

This section analyzes the UK handheld vacuum cleaner market's structure, identifying key trends impacting growth and competition. We examine market concentration, technological advancements, regulatory landscape, competitive substitutes, end-user demographics, and mergers and acquisitions (M&A) activity.

- Market Concentration: The UK market shows a moderately concentrated landscape, with a few dominant players holding significant market share (e.g., Dyson holding approximately xx%, followed by Hoover at xx%, and Vax at xx%). Smaller players compete through niche offerings or price strategies.

- Technological Innovation: Key drivers of innovation include improved battery technology for cordless models, advanced filtration systems (e.g., HEPA filters), and smarter features like app integration and self-cleaning mechanisms. Innovation barriers include high R&D costs and the need for efficient manufacturing processes.

- Regulatory Framework: UK regulations concerning energy efficiency and waste disposal impact product design and manufacturing processes. Compliance costs influence pricing strategies and market competitiveness.

- Competitive Product Substitutes: Robot vacuum cleaners and other cleaning appliances pose a competitive threat, particularly in the household segment. Market penetration of these alternatives is a key factor analyzed in the report.

- End-User Demographics: The growing popularity of cordless models reflects changing consumer preferences towards convenience and ease of use. Demographic analysis considers age, income level, and household size to understand segment-specific demands.

- M&A Trends: The report analyzes recent M&A activity, such as the July 2022 acquisition of Allegion by Stanley Black & Decker (though not directly related to handheld vacuum cleaners, it signifies broader industry consolidation trends), offering insights into potential future mergers and market consolidation. The total volume of M&A deals in the period 2019-2024 is estimated at xx deals.

United Kingdom Handheld Vacuum Cleaners Market Growth Trends & Insights

This section details the market's growth trajectory, analyzing factors like market size evolution, adoption rates, technological disruptions, and consumer behavior changes. Using robust data analysis, we project future market size and growth based on historical trends and current market dynamics. Key metrics such as CAGR (Compound Annual Growth Rate) and market penetration rates are provided, giving a granular understanding of market progress.

(This section would contain a 600-word detailed analysis using the provided XXX data source and would incorporate the specific metrics mentioned above).

Dominant Regions, Countries, or Segments in United Kingdom Handheld Vacuum Cleaners Market

This section pinpoints the leading regions, countries, or segments within the UK handheld vacuum cleaner market, driving overall growth. We identify the most successful segments by Type (Corded, Cordless), Application (Household, Automotive, Commercial), and Distribution Channel (Online, Offline), examining their respective market shares and growth potential.

- Type: The cordless segment dominates the market, driven by consumer preference for convenience and portability, currently holding approximately xx% of the market. The corded segment continues to retain a smaller, but still significant, market share due to its affordability and longer runtime.

- Application: The household segment constitutes the largest share of the market, as handheld vacuums are extensively used for spot cleaning in homes. The commercial segment is experiencing moderate growth due to increasing demand from hotels, offices, and other commercial spaces. The automotive segment remains a niche market.

- Distribution Channel: Online sales are growing rapidly, contributing approximately xx% of total sales, driven by the increased popularity of e-commerce and convenient online shopping experiences. Offline sales through retailers and specialty stores are still prominent. This shift reflects changing consumer behavior and purchasing habits. (This section would be expanded to include a 600-word detailed analysis including specific market share data for each segment).

United Kingdom Handheld Vacuum Cleaners Market Product Landscape

The UK handheld vacuum cleaner market offers a diverse range of products, differing in power, features, and price points. Recent product innovations include improved battery technology offering longer runtimes, lightweight designs for increased maneuverability, and advanced filtration systems enhancing cleaning efficiency. Unique selling propositions include features like cyclonic technology, specialized attachments for different surfaces, and hygienic dust disposal mechanisms. Technological advancements such as improved motor technology and sensor integration are pushing performance standards and consumer expectations.

Key Drivers, Barriers & Challenges in United Kingdom Handheld Vacuum Cleaners Market

Key Drivers: The market is propelled by rising consumer awareness of hygiene, increasing disposable incomes enabling premium product purchases, and a shift towards convenience and ease-of-use cleaning solutions. Technological innovations, like improved battery life and enhanced suction power, also significantly drive market growth.

Key Challenges & Restraints: Supply chain disruptions from global events, increasing raw material costs, and intense competition from established and emerging brands pose significant challenges. Stringent environmental regulations relating to material usage and waste disposal also impact the cost and complexity of product development and manufacturing. Additionally, consumer concerns about the environmental impact of plastic components may restrain market growth if not properly addressed by sustainable solutions.

Emerging Opportunities in United Kingdom Handheld Vacuum Cleaners Market

Emerging opportunities lie in the expansion into niche applications, such as pet-specific cleaning tools, specialized cleaning solutions for different materials, and integration of smart technology features like app connectivity for remote control and maintenance scheduling. Untapped markets include targeting smaller households or focusing on specific customer segments with unique cleaning needs. Evolving consumer preferences towards environmentally friendly products present an opportunity for manufacturers to leverage sustainable materials and designs.

Growth Accelerators in the United Kingdom Handheld Vacuum Cleaners Market Industry

Long-term growth will be driven by continued technological innovations in battery technology, motor efficiency, and filtration systems. Strategic partnerships between manufacturers and retailers can accelerate market penetration. Expanding product lines to cater to diverse consumer needs and expanding into underserved markets will further enhance market growth and profitability.

Notable Milestones in United Kingdom Handheld Vacuum Cleaners Market Sector

- May 2023: Dyson launched the Dyson Gen5detect, a cordless vacuum featuring a fifth-generation Hyperdymium motor and advanced dust detection technology. This significantly impacts the high-end cordless segment, driving innovation and potentially influencing competitor strategies.

- July 2022: Stanley Black & Decker's acquisition of Allegion indirectly impacts the market by potentially influencing future supply chain strategies and industry consolidation.

In-Depth United Kingdom Handheld Vacuum Cleaners Market Market Outlook

The UK handheld vacuum cleaner market exhibits strong growth potential, driven by technological advancements, changing consumer preferences, and increasing demand for convenient and efficient cleaning solutions. Strategic partnerships, expansion into untapped market segments, and focus on sustainability will be key to capturing future market share. The market is poised for significant growth over the forecast period, with the cordless segment expected to remain the dominant force, propelled by continuous innovation and evolving consumer expectations.

United Kingdom Handheld Vacuum Cleaners Market Segmentation

-

1. Type

- 1.1. Corded

- 1.2. Cordless

-

2. ByApplication

- 2.1. Household

- 2.2. Automotive

- 2.3. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

United Kingdom Handheld Vacuum Cleaners Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Handheld Vacuum Cleaners Market Regional Market Share

Geographic Coverage of United Kingdom Handheld Vacuum Cleaners Market

United Kingdom Handheld Vacuum Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Works without any physical efforts

- 3.3. Market Restrains

- 3.3.1. High maintenance cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Cordless Vacuum cleaners

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corded

- 5.1.2. Cordless

- 5.2. Market Analysis, Insights and Forecast - by ByApplication

- 5.2.1. Household

- 5.2.2. Automotive

- 5.2.3. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoover

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kenwood

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vax

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dyson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miele

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Electrolux

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bissell

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dirt Devil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shark

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siemens

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoover

List of Figures

- Figure 1: United Kingdom Handheld Vacuum Cleaners Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Handheld Vacuum Cleaners Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by ByApplication 2020 & 2033

- Table 4: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by ByApplication 2020 & 2033

- Table 5: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by ByApplication 2020 & 2033

- Table 12: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by ByApplication 2020 & 2033

- Table 13: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Handheld Vacuum Cleaners Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the United Kingdom Handheld Vacuum Cleaners Market?

Key companies in the market include Hoover, Kenwood, Vax, Dyson, Miele, Electrolux, Bissell, Dirt Devil, Shark, Siemens.

3. What are the main segments of the United Kingdom Handheld Vacuum Cleaners Market?

The market segments include Type, ByApplication, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 550.01 million as of 2022.

5. What are some drivers contributing to market growth?

Works without any physical efforts.

6. What are the notable trends driving market growth?

Increasing Demand for Cordless Vacuum cleaners.

7. Are there any restraints impacting market growth?

High maintenance cost.

8. Can you provide examples of recent developments in the market?

May 2023: Dyson introduced the groundbreaking Dyson Gen5detect vacuum cleaner. This cordless marvel boasts the latest fifth-generation Hyperdymium motor, delivering unparalleled suction power. Its cutting-edge technology is capable of capturing even the smallest viruses lurking in your home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Handheld Vacuum Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Handheld Vacuum Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Handheld Vacuum Cleaners Market?

To stay informed about further developments, trends, and reports in the United Kingdom Handheld Vacuum Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence