Key Insights

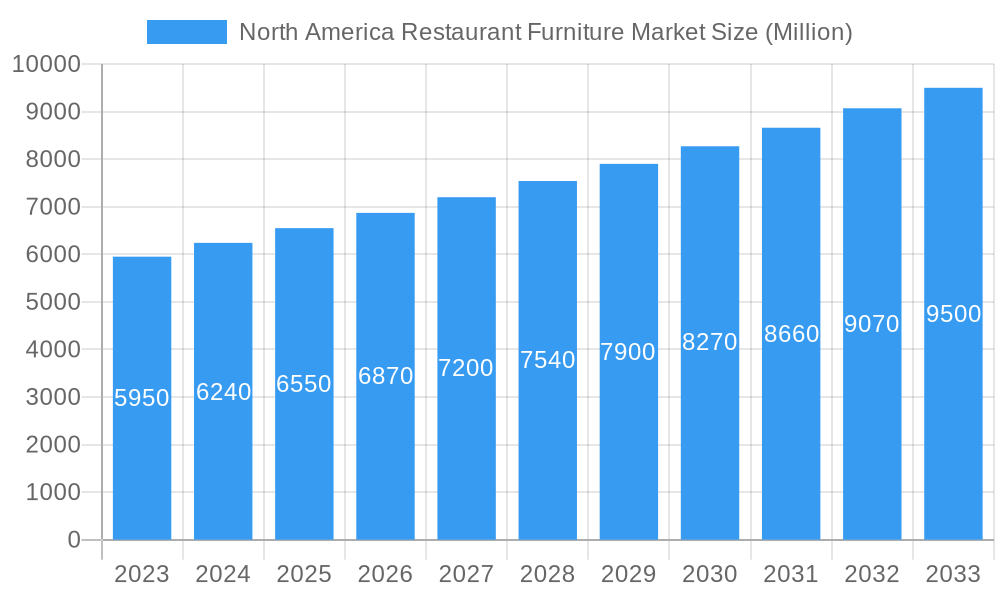

The North American restaurant furniture market is poised for robust growth, driven by a dynamic hospitality sector and evolving consumer preferences for dining experiences. With an estimated market size of [Estimate based on CAGR and unit value, e.g., $6,500 million] in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.10% through 2033. This expansion is fueled by increasing investments in new restaurant openings, renovations of existing establishments, and the growing demand for diverse dining formats such as casual dining, fine dining, and quick-service restaurants. The market's key drivers include a rising disposable income, a strong propensity for out-of-home dining, and the continuous innovation in furniture design to enhance ambiance, comfort, and functionality. Furthermore, the increasing emphasis on creating unique and Instagrammable dining environments significantly influences furniture choices, pushing demand for aesthetically pleasing and comfortable seating solutions and dining sets.

North America Restaurant Furniture Market Market Size (In Billion)

The market's growth trajectory is further supported by emerging trends such as the adoption of sustainable and eco-friendly furniture materials, driven by both consumer and regulatory pressures. This includes a shift towards recycled materials, reclaimed wood, and durable, long-lasting designs that minimize waste. Technology integration, such as smart furniture with charging ports and modular designs that allow for flexible seating arrangements, is also gaining traction, especially in fast-paced snack bars and adaptable restaurant spaces. However, the market faces restraints such as fluctuating raw material costs, which can impact profitability and pricing strategies for manufacturers. Supply chain disruptions and the increasing cost of labor in manufacturing also present challenges. Despite these hurdles, the North American restaurant furniture market, encompassing segments like dining sets and seating furniture for restaurants, snack bars, and hotels, is expected to witness sustained expansion, with companies like Tropitone Furniture Co., Herman Miller, and Steelcase leading the innovation and supply.

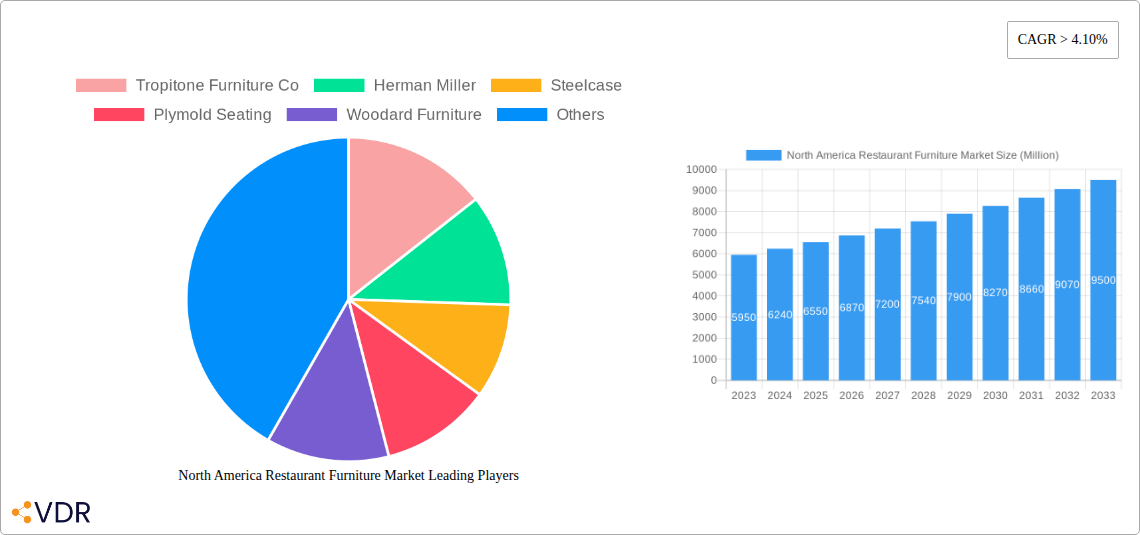

North America Restaurant Furniture Market Company Market Share

North America Restaurant Furniture Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the North America restaurant furniture market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). With a projected market size of over $12,500 Million units in 2025, the market is poised for significant expansion driven by evolving consumer preferences, technological advancements in furniture design, and a robust hospitality sector. The report analyzes key market dynamics, growth trends, dominant segments, product innovations, and the competitive landscape, providing actionable insights for industry stakeholders.

North America Restaurant Furniture Market Market Dynamics & Structure

The North America restaurant furniture market exhibits a moderately concentrated structure, with a blend of large, established players and a growing number of niche manufacturers catering to specific design aesthetics and functional needs. Technological innovation plays a pivotal role, with advancements in sustainable materials, ergonomic designs, and smart furniture solutions influencing product development and consumer adoption. Regulatory frameworks, particularly concerning fire safety, durability standards, and environmental impact, shape manufacturing processes and product offerings. Competitive product substitutes, such as modular furniture systems and the increasing use of durable outdoor furniture for indoor spaces, present ongoing challenges and opportunities. End-user demographics are shifting, with a rising demand for comfortable, aesthetically pleasing, and adaptable furniture that caters to diverse dining experiences, from casual eateries to fine dining establishments. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding market reach, acquiring new technologies, and diversifying product portfolios. For instance, the partnership between KOKUYO Co., Ltd. and Allsteel Inc. in January 2023 signifies a move to broaden service offerings across different regions and sectors.

- Market Concentration: Moderate, with a mix of large manufacturers and specialized providers.

- Technological Drivers: Sustainable materials, ergonomic design, smart furniture integration.

- Regulatory Frameworks: Fire safety, durability standards, environmental compliance.

- Competitive Substitutes: Modular systems, multi-functional furniture.

- End-User Demographics: Growing demand for comfort, style, and versatility.

- M&A Trends: Consolidation for market expansion and technology acquisition.

North America Restaurant Furniture Market Growth Trends & Insights

The North America restaurant furniture market is experiencing robust growth, with an estimated market size of $12,500 Million units in 2025. This expansion is fueled by a dynamic hospitality sector, increased consumer spending on dining experiences, and a continuous drive for aesthetic and functional upgrades in commercial spaces. The adoption rate of contemporary and sustainable furniture solutions is on the rise, reflecting a growing environmental consciousness among businesses and consumers alike. Technological disruptions, including advancements in material science and manufacturing techniques, are enabling the creation of more durable, lightweight, and aesthetically diverse furniture options. Consumer behavior shifts are significant; diners increasingly seek unique and comfortable environments that enhance their overall dining experience, leading to a higher demand for specialized and custom-designed furniture. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.2% during the forecast period (2025-2033). This growth trajectory is further supported by the increasing number of restaurant openings and renovations across the continent. The penetration of smart furniture solutions, such as integrated charging ports and adjustable features, is also expected to climb as establishments aim to offer enhanced convenience and a modern appeal.

Dominant Regions, Countries, or Segments in North America Restaurant Furniture Market

Within the North America restaurant furniture market, Seating Furniture emerges as the dominant segment, consistently driving market growth. This segment's supremacy is attributed to its fundamental role in every dining establishment, encompassing chairs, stools, booths, and banquettes. The United States stands as the leading country, fueled by its vast and diverse hospitality industry, comprising numerous restaurants, bars, and hotels. Key drivers for dominance in this region include favorable economic policies that encourage business investment, continuous infrastructure development in the food service sector, and a highly competitive market demanding constant innovation and aesthetic appeal. The Restaurants application segment also holds significant sway, benefiting from the sheer volume of establishments and the constant need for furniture updates to align with changing trends and operational requirements. The market share for Seating Furniture is estimated to be around 65% of the overall market value.

- Dominant Segment (Type): Seating Furniture, including chairs, stools, booths, and banquettes.

- Key Drivers: Essential for customer comfort and dining experience, wide variety of styles and functionalities.

- Market Share: Approximately 65%.

- Dominant Application: Restaurants.

- Key Drivers: High volume of establishments, frequent renovation cycles, diverse dining concepts.

- Leading Country: United States.

- Key Drivers: Large hospitality sector, strong economic growth, consumer demand for varied dining experiences.

- Growth Potential: Continual expansion and modernization of food service establishments.

- Leading Region (Sub-segmental): Major metropolitan areas across the US and Canada with high population density and vibrant culinary scenes.

North America Restaurant Furniture Market Product Landscape

The North America restaurant furniture market is characterized by a dynamic product landscape focused on enhancing both aesthetics and functionality. Innovations in material science have led to the widespread adoption of durable, eco-friendly materials like recycled plastics, sustainable woods, and high-performance fabrics. Designers are emphasizing ergonomic comfort, modularity for flexible space utilization, and integrated technological features such as wireless charging capabilities. Key product categories include stylish dining sets that create inviting atmospheres, comfortable and robust seating furniture for extended use, and specialized furniture for snack bars and hotel lounges. Unique selling propositions often revolve around customizability, durability under heavy commercial use, and adherence to modern design trends. Technological advancements are continuously pushing the boundaries of what’s possible, offering businesses furniture that is not only visually appealing but also contributes to operational efficiency and a superior customer experience.

Key Drivers, Barriers & Challenges in North America Restaurant Furniture Market

The North America restaurant furniture market is propelled by several key drivers. The robust growth of the hospitality industry, including the opening of new restaurants and the renovation of existing ones, directly translates to increased demand. Evolving consumer preferences for unique and comfortable dining environments also plays a crucial role, pushing establishments to invest in aesthetically pleasing and functional furniture. Furthermore, technological advancements in material science and manufacturing are enabling the creation of more durable, sustainable, and design-forward furniture options.

However, the market faces significant barriers and challenges. Rising raw material costs and supply chain disruptions can impact manufacturing profitability and lead times, as seen with global material shortages. Stringent regulatory standards for durability and safety require compliance, adding to production costs. Intense competition among manufacturers and a price-sensitive market can also exert pressure on profit margins. The need for continuous innovation to keep pace with rapidly changing design trends presents another hurdle.

Emerging Opportunities in North America Restaurant Furniture Market

Emerging opportunities within the North America restaurant furniture market lie in the growing demand for sustainable and eco-friendly furniture solutions. Consumers and businesses are increasingly prioritizing products made from recycled materials, ethically sourced wood, and low-VOC finishes. The rise of ghost kitchens and delivery-focused eateries presents a niche opportunity for specialized, space-efficient furniture that prioritizes durability and ease of cleaning. Furthermore, the integration of smart technology, such as built-in charging stations and adjustable height tables, caters to a tech-savvy consumer base. The expansion of outdoor dining spaces due to evolving consumer habits also creates a demand for weather-resistant and aesthetically pleasing outdoor restaurant furniture.

Growth Accelerators in the North America Restaurant Furniture Market Industry

Several catalysts are accelerating growth in the North America restaurant furniture market. The continuous expansion and modernization of the hospitality sector, driven by increased disposable incomes and a vibrant dining culture, provide a foundational growth engine. Technological breakthroughs in furniture manufacturing, such as advanced robotics and 3D printing, are enabling faster production, greater customization, and the creation of complex designs. Strategic partnerships between furniture manufacturers and interior designers or hospitality consultants are also fostering innovation and expanding market reach. Moreover, market expansion strategies, including penetration into underserved regional markets and the development of e-commerce platforms for easier procurement, are further fueling growth.

Key Players Shaping the North America Restaurant Furniture Market Market

- Tropitone Furniture Co

- Herman Miller

- Steelcase

- Plymold Seating

- Woodard Furniture

- Grosfillex Inc

- California House

- Grand Rapids Chair Co

- Knoll

- MTS Seating

Notable Milestones in North America Restaurant Furniture Market Sector

- January 2023: KOKUYO Co., Ltd. announced a partnership agreement with Allsteel Inc., a leading manufacturer of contract furnishings. This collaboration aims to provide combined service and support for global clients in the Asia Pacific region and for Allsteel in North America, expanding service reach.

- September 2022: Herman Miller, in collaboration with Danish design brand HAY, unveiled the Herman Miller x HAY Collection. This collection reinterprets eight beloved Eames mid-century classics with new color palettes and updated materials, blending timeless design with a contemporary perspective, influencing aesthetic trends in commercial spaces.

In-Depth North America Restaurant Furniture Market Market Outlook

The future outlook for the North America restaurant furniture market is exceptionally positive, with sustained growth projected through 2033. Key growth accelerators include the ongoing innovation in sustainable and smart furniture technologies, which will cater to increasing environmental awareness and the demand for technologically integrated spaces. Strategic partnerships and collaborations will continue to be vital for expanding market access and offering comprehensive solutions. The market is also expected to benefit from the resilience and adaptability of the hospitality sector, which is continuously evolving to meet changing consumer expectations. Emerging opportunities in personalized dining experiences and the integration of furniture into the overall brand narrative will create further avenues for market expansion and product differentiation. The market's capacity for innovation, coupled with strong underlying demand, positions it for continued success.

North America Restaurant Furniture Market Segmentation

-

1. Type

- 1.1. Dining Sets

- 1.2. Seating Furniture

-

2. Application

- 2.1. Restaurants

- 2.2. Snack Bar

- 2.3. Hotels and Bars

North America Restaurant Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Restaurant Furniture Market Regional Market Share

Geographic Coverage of North America Restaurant Furniture Market

North America Restaurant Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tech-Integrated Furniture are Helping to Grow the Market

- 3.3. Market Restrains

- 3.3.1. Raw Material Cost Barrier to Growth

- 3.4. Market Trends

- 3.4.1. Restaurants Drive Demand and Trends in the Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Restaurant Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dining Sets

- 5.1.2. Seating Furniture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Restaurants

- 5.2.2. Snack Bar

- 5.2.3. Hotels and Bars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tropitone Furniture Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Herman Miller

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Steelcase

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plymold Seating

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Woodard Furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grosfillex Inc **List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 California House

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grand Rapids Chair Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Knoll

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MTS Seating

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tropitone Furniture Co

List of Figures

- Figure 1: North America Restaurant Furniture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Restaurant Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: North America Restaurant Furniture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Restaurant Furniture Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Restaurant Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Restaurant Furniture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: North America Restaurant Furniture Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Restaurant Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Restaurant Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Restaurant Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Restaurant Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Restaurant Furniture Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the North America Restaurant Furniture Market?

Key companies in the market include Tropitone Furniture Co, Herman Miller, Steelcase, Plymold Seating, Woodard Furniture, Grosfillex Inc **List Not Exhaustive, California House, Grand Rapids Chair Co, Knoll, MTS Seating.

3. What are the main segments of the North America Restaurant Furniture Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Tech-Integrated Furniture are Helping to Grow the Market.

6. What are the notable trends driving market growth?

Restaurants Drive Demand and Trends in the Furniture Market.

7. Are there any restraints impacting market growth?

Raw Material Cost Barrier to Growth.

8. Can you provide examples of recent developments in the market?

In January 2023, KOKUYO Co., Ltd. announced the partnership agreement with Allsteel Inc., a leading manufacturer of contract furnishings. This partnership will allow Kokuyo to provide combined service and support of office furniture for global clients in the Asia Pacific region and Allsteel in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Restaurant Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Restaurant Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Restaurant Furniture Market?

To stay informed about further developments, trends, and reports in the North America Restaurant Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence