Key Insights

The United States cafes and bars market exhibits robust growth potential, driven by evolving consumer preferences and lifestyle trends. The market's expansion is fueled by the increasing demand for convenient and experience-driven dining options, particularly among millennials and Gen Z. The rise of specialty coffee shops, craft breweries, and unique bar concepts catering to diverse tastes and dietary needs contributes significantly to this growth. The integration of technology, such as mobile ordering and loyalty programs, further enhances customer engagement and streamlines operations. While the COVID-19 pandemic initially impacted the industry, a resurgence in social gatherings and a renewed focus on supporting local businesses has led to a significant recovery. The market segmentation reveals a diverse landscape, with chained outlets maintaining a significant presence alongside independent establishments. Location-wise, leisure and retail settings demonstrate strong performance, indicating a clear correlation between high foot traffic areas and market success. The competitive landscape is characterized by both established players like Starbucks and McDonald's, as well as emerging brands focusing on niche offerings. Future growth will likely be shaped by factors such as inflation, economic conditions, and evolving consumer health consciousness, requiring businesses to adapt their offerings and strategies accordingly.

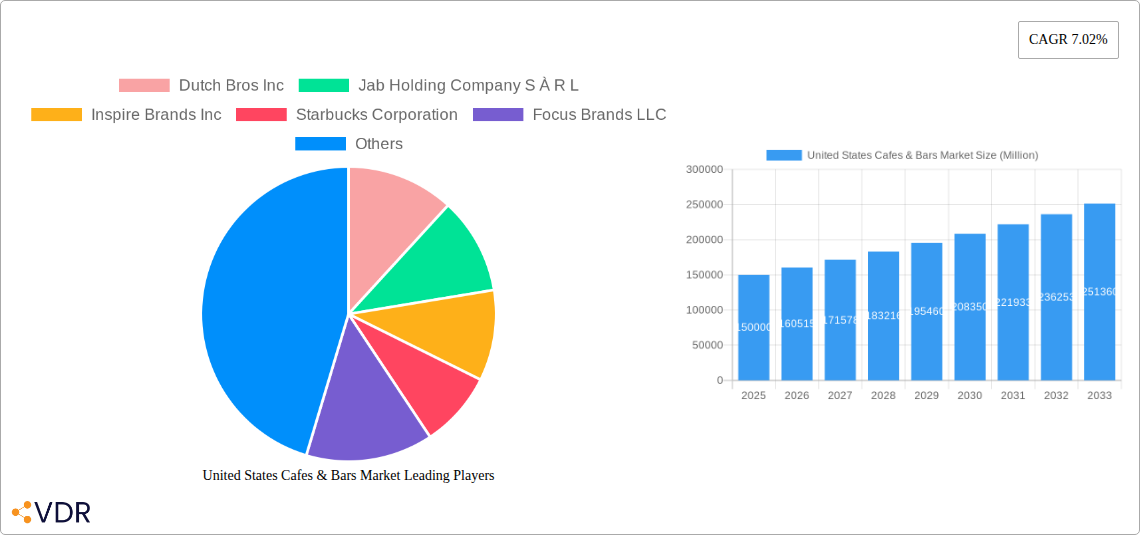

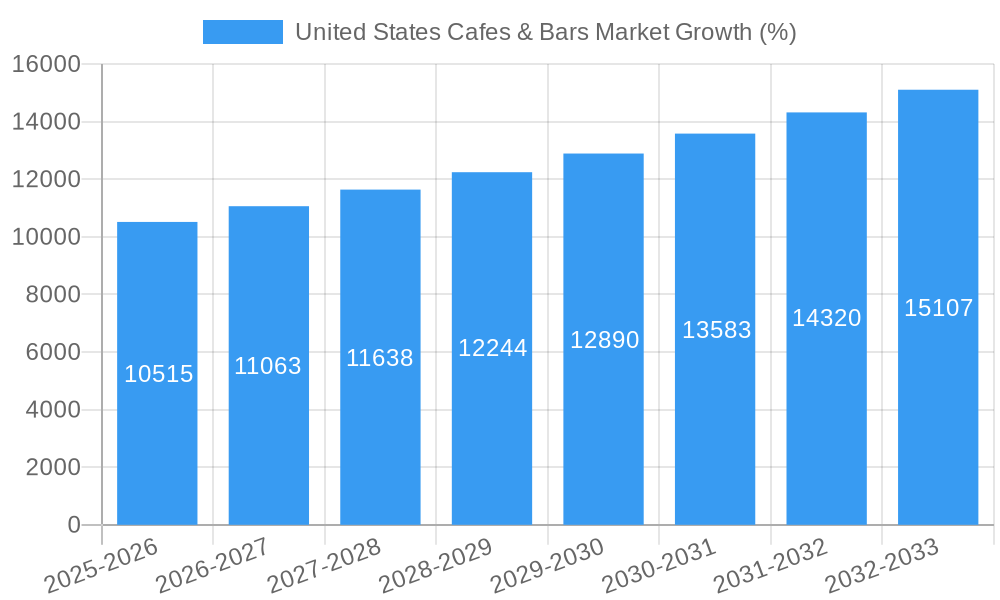

The projected Compound Annual Growth Rate (CAGR) of 7.02% suggests consistent market expansion through 2033. However, challenges remain. Rising labor costs and ingredient prices pose operational pressures, necessitating efficient cost management strategies. Maintaining brand loyalty and adapting to shifting consumer trends are also crucial for long-term success. Further market segmentation analysis could focus on specific sub-categories within cuisines (e.g., the growth of vegan cafes or craft cocktail bars) to identify high-growth niches. Geographic variations within the US market, considering factors like population density and regional economic disparities, will also impact overall market performance. Continuous innovation in menu offerings, ambiance, and customer service will be key differentiators in this competitive market.

United States Cafes & Bars Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States cafes & bars market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic sector. The report delves into parent markets (food service industry, hospitality) and child markets (specific cafe & bar types, locations) for a granular understanding of market segmentation. The market size is projected to reach xx Million by 2033.

United States Cafes & Bars Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the U.S. cafes & bars sector. We examine market concentration, identifying the leading players and their respective market shares. The influence of technological innovation, such as mobile ordering and loyalty programs, is explored, along with the impact of regulatory frameworks on operations and expansion. Furthermore, we delve into the role of competitive substitutes (e.g., home coffee brewing, meal delivery services) and analyze M&A activity within the industry.

- Market Concentration: The U.S. cafes & bars market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, while a large number of smaller independent businesses also contribute significantly. xx% of the market is controlled by the top 5 players.

- Technological Innovation: Technological advancements, including mobile ordering apps, loyalty programs, and automated brewing systems, are driving efficiency and enhancing customer experience. However, the high initial investment cost and ongoing maintenance can pose barriers to entry for smaller businesses.

- Regulatory Frameworks: Federal, state, and local regulations related to food safety, alcohol licensing, and labor laws significantly impact market operations. Compliance costs and varying regulations across states create complexities for businesses, especially chains.

- Competitive Product Substitutes: The rising popularity of home-brewed coffee and tea, as well as meal delivery services, presents a competitive challenge to cafes and bars.

- End-User Demographics: Millennials and Gen Z represent a significant portion of the target demographic, valuing unique experiences and ethically sourced products.

- M&A Trends: The market has witnessed a notable increase in mergers and acquisitions in recent years, with xx deals recorded in the past five years, indicating consolidation and expansion efforts among key players.

United States Cafes & Bars Market Growth Trends & Insights

This section offers a detailed analysis of the U.S. cafes & bars market's growth trajectory, drawing upon extensive market research and data analysis. We examine market size evolution, adoption rates of new technologies, and shifting consumer preferences. Key metrics, including Compound Annual Growth Rate (CAGR) and market penetration, provide valuable insights into the market's dynamics.

(Note: This section would contain a 600-word analysis based on XXX – the specified data source is missing and needs to be provided to complete this section. The analysis will incorporate CAGR, market penetration, adoption rates of new technologies, and analysis of consumer behavior shifts.)

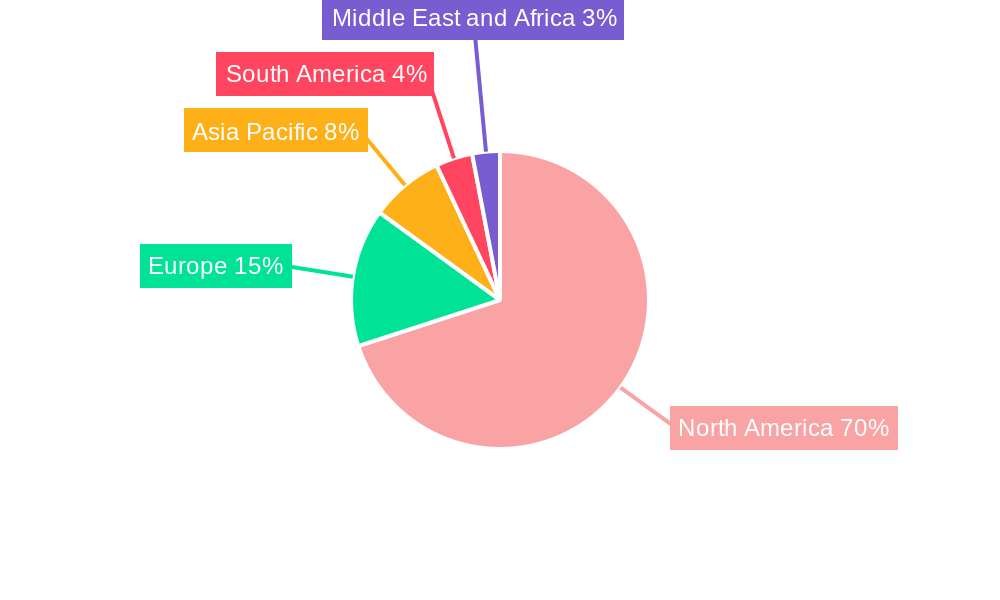

Dominant Regions, Countries, or Segments in United States Cafes & Bars Market

This section identifies the leading regions, countries, and market segments within the U.S. cafes & bars industry that are driving market growth. We analyze dominance factors, including market share, growth potential, economic policies, infrastructure, and consumer preferences.

- Cuisine: The Cafe segment currently holds the largest market share, driven by high consumer demand and diverse offerings. The Juice/Smoothie/Desserts Bars segment shows strong growth potential due to health-conscious consumer trends.

- Outlet: Chained outlets dominate the market in terms of revenue, leveraging brand recognition and operational efficiency. However, independent outlets are experiencing growth fueled by localized experiences and unique offerings.

- Location: Retail locations maintain the largest market share due to high foot traffic and accessibility. Standalone locations are attractive due to offering flexibility in design and branding. The growth of cafes in travel hubs suggests an increase in demand for convenient options for travelers.

(Note: This section would contain a 600-word analysis with detailed market share data and growth projections for each segment and location.)

United States Cafes & Bars Market Product Landscape

The U.S. cafes & bars market showcases diverse product offerings, from traditional coffee and tea to innovative beverages and food items. Key product innovations involve the use of high-quality ingredients, unique flavor combinations, and specialized brewing techniques. Performance metrics like customer satisfaction and repeat purchases are closely monitored to drive product improvement and development. The focus is on providing unique selling propositions (USPs) that appeal to specific customer preferences. Technological advancements such as automated espresso machines and contactless payment systems improve efficiency and customer experience.

Key Drivers, Barriers & Challenges in United States Cafes & Bars Market

Key Drivers:

- Growing consumer demand for convenient and high-quality food and beverage options.

- Increasing disposable incomes, fueling higher spending on dining experiences.

- Technological advancements improving operational efficiency and enhancing customer experience.

- Expansion of cafe and bar chains into new markets.

Challenges & Restraints:

- Intense competition, including from established chains and independent businesses.

- Rising labor costs and difficulties in attracting and retaining skilled staff.

- Fluctuating commodity prices impacting operational profitability.

- Increasing regulatory scrutiny and compliance costs.

Emerging Opportunities in United States Cafes & Bars Market

- Expansion into underserved markets and regions with limited cafe & bar options.

- Development of niche concepts focusing on specialized beverages, organic ingredients, or unique dining experiences.

- Leveraging technology to enhance the customer experience through mobile ordering, loyalty programs, and personalized recommendations.

Growth Accelerators in the United States Cafes & Bars Market Industry

The long-term growth of the U.S. cafes & bars market will be driven by strategic partnerships, technological advancements such as AI-powered menu planning and personalized recommendations, and the expansion into untapped markets including rural areas and smaller towns. Innovative approaches to supply chain management and sustainable sourcing will further support market expansion.

Key Players Shaping the United States Cafes & Bars Market Market

- Dutch Bros Inc

- Jab Holding Company S À R L

- Inspire Brands Inc

- Starbucks Corporation

- Focus Brands LLC

- Restaurant Brands International Inc

- McDonald's Corporation

- Smoothie King Franchises Inc

- Tropical Smoothie Cafe LL

- International Dairy Queen Inc

Notable Milestones in United States Cafes & Bars Market Sector

- December 2022: Dutch Bros launched eight classic drinks with sugar-free options.

- January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations.

- December 2022: Pret A Manger announced U.S. expansion plans through a franchise partnership.

In-Depth United States Cafes & Bars Market Market Outlook

The future of the U.S. cafes & bars market appears robust. Continued innovation in product offerings, coupled with strategic expansions and technological advancements, will fuel market growth. Companies that effectively adapt to changing consumer preferences and capitalize on emerging trends will be well-positioned for long-term success. The market's potential for expansion into new segments and geographic areas presents significant strategic opportunities.

United States Cafes & Bars Market Segmentation

-

1. Cuisine

- 1.1. Bars & Pubs

- 1.2. Cafes

- 1.3. Juice/Smoothie/Desserts Bars

- 1.4. Specialist Coffee & Tea Shops

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United States Cafes & Bars Market Segmentation By Geography

- 1. United States

United States Cafes & Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Rapid expansion of coffee chains and the increased popularity of gourmet coffee is boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bars & Pubs

- 5.1.2. Cafes

- 5.1.3. Juice/Smoothie/Desserts Bars

- 5.1.4. Specialist Coffee & Tea Shops

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 United Kingdom

- 7.1.3 Germany

- 7.1.4 France

- 7.1.5 Italy

- 7.1.6 Russia

- 7.1.7 Rest of Europe

- 8. Asia Pacific United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dutch Bros Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jab Holding Company S À R L

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inspire Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Starbucks Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Focus Brands LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Restaurant Brands International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McDonald's Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Smoothie King Franchises Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tropical Smoothie Cafe LL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Dairy Queen Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dutch Bros Inc

List of Figures

- Figure 1: United States Cafes & Bars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Cafes & Bars Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United States Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United States Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United States Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Spain United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Africa United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: United States Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 34: United States Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: United States Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 36: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cafes & Bars Market?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the United States Cafes & Bars Market?

Key companies in the market include Dutch Bros Inc, Jab Holding Company S À R L, Inspire Brands Inc, Starbucks Corporation, Focus Brands LLC, Restaurant Brands International Inc, McDonald's Corporation, Smoothie King Franchises Inc, Tropical Smoothie Cafe LL, International Dairy Queen Inc.

3. What are the main segments of the United States Cafes & Bars Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Rapid expansion of coffee chains and the increased popularity of gourmet coffee is boosting the market.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations, which can be ordered as a cold brew, breve, or Dutch Freeze.December 2022: Dutch Bros launched eight classic drinks with sugar-free options as well.December 2022: Pret A Manger announced its expansion plans in the United States through a franchise partnership with restaurant ownership and operations firm Dallas Holdings. The partnership will bring a network of new Pret locations to Southern California, as well as a location in New York City's Hudson Yards neighborhood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cafes & Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cafes & Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cafes & Bars Market?

To stay informed about further developments, trends, and reports in the United States Cafes & Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence