Key Insights

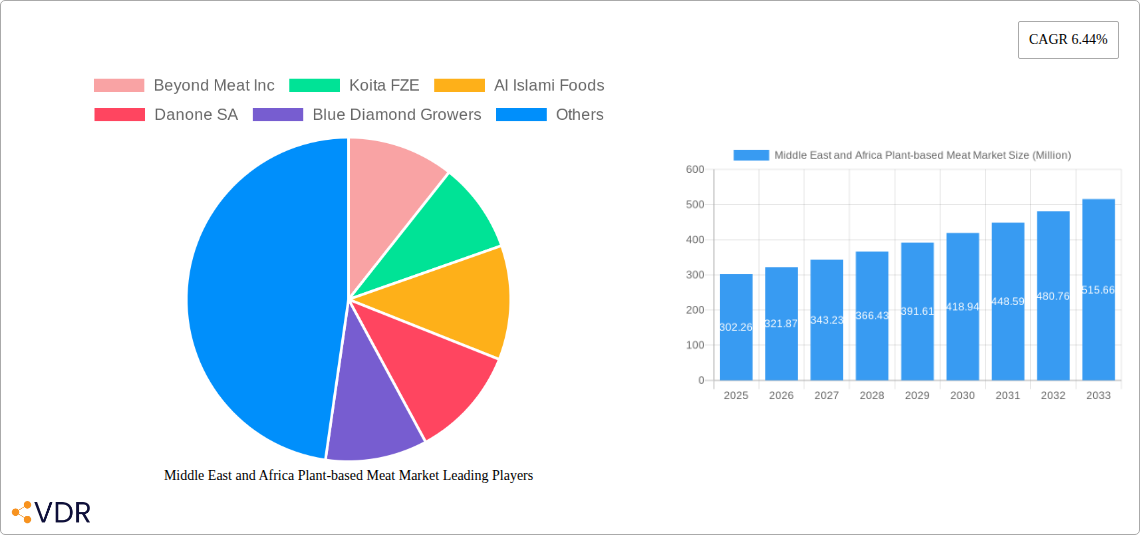

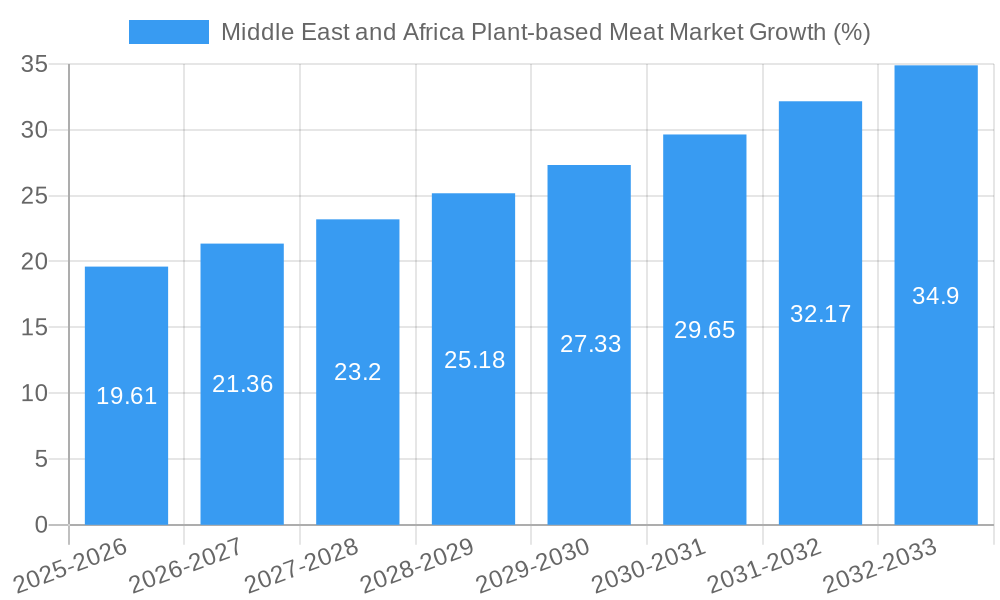

The Middle East and Africa plant-based meat market is experiencing robust growth, projected to reach \$302.26 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.44% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing health consciousness among consumers is a significant factor, with many seeking alternatives to traditional meat products perceived as high in saturated fat and cholesterol. Growing awareness of the environmental impact of animal agriculture, particularly regarding greenhouse gas emissions and land use, is also driving demand for sustainable protein sources. Furthermore, the rise of veganism and vegetarianism, coupled with increasing disposable incomes in certain regions, contributes to the market's upward trajectory. The market segmentation reveals that hypermarkets/supermarkets currently hold a dominant share of the distribution channels, although online retail channels are exhibiting strong growth potential, particularly in urban centers with increasing internet penetration. Plant-based meat alternatives are currently the leading product type, indicating a strong consumer preference for direct meat substitutes. Key players like Beyond Meat, Danone, and Upfield are actively investing in the region, further fueling market growth. Challenges remain, however, including price sensitivity in certain segments of the population, limited awareness about the nutritional benefits of plant-based alternatives, and cultural preferences that favor traditional meat consumption in some regions.

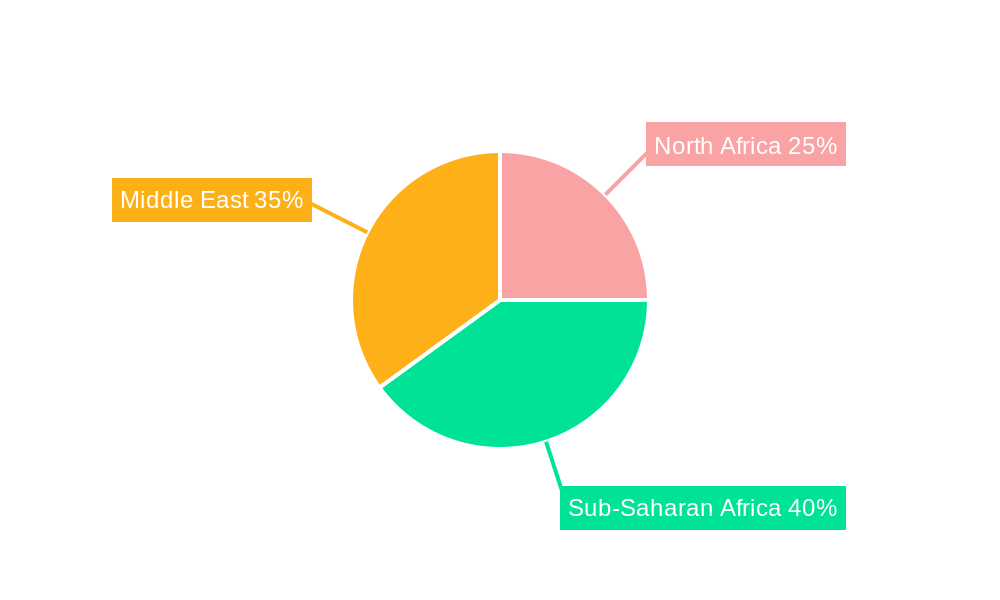

Despite these challenges, the market outlook remains positive. Strategic partnerships between established food companies and plant-based startups are expected to enhance product accessibility and affordability. Government initiatives promoting sustainable agriculture and healthy eating habits will further stimulate market growth. While precise market share data for specific regions within Africa and the Middle East is not available, it is evident from market trends and the activities of major companies that the growth is not uniform across the entire region. Growth is likely to be concentrated in areas with higher urbanization, increased purchasing power, and existing infrastructure to support the distribution of these products. The continued rise of plant-based options in response to environmental concerns and health trends should ensure the sustained expansion of the market across the forecast period. The presence of major players, coupled with increasing consumer awareness, indicates that this market segment will continue to gain significant traction.

Middle East & Africa Plant-Based Meat Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the rapidly expanding Middle East and Africa plant-based meat market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes both the parent market (plant-based foods) and the child market (plant-based meat) offering granular detail on key segments including plant-based dairy. Market values are presented in million units.

Middle East and Africa Plant-based Meat Market Market Dynamics & Structure

The Middle East and Africa plant-based meat market is characterized by increasing market concentration, driven by the entry of international players and the consolidation of regional brands. Technological innovations, such as improved protein extraction methods and novel texturization techniques, are significantly impacting product quality and consumer acceptance. Regulatory frameworks, while still evolving, are gradually supporting the growth of the plant-based sector. Competitive pressures arise from established meat producers and new entrants. Consumer demographics show a growing trend towards health-conscious individuals and flexitarians fueling demand. M&A activity is on the rise, with major players expanding through acquisitions.

- Market Concentration: xx% controlled by top 5 players in 2024, projected to increase to xx% by 2033.

- Technological Innovation: Focus on improving taste, texture, and nutritional profile of plant-based meat alternatives.

- Regulatory Landscape: Gradual easing of regulations related to labeling and food safety.

- Competitive Substitutes: Traditional meat products, other plant-based protein sources (e.g., tofu, tempeh).

- End-User Demographics: Growing middle class, increasing health awareness, rising demand for sustainable food options.

- M&A Activity: xx major M&A deals observed between 2019-2024, with projections of xx deals by 2033.

Middle East and Africa Plant-based Meat Market Growth Trends & Insights

The Middle East and Africa plant-based meat market witnessed significant growth between 2019 and 2024, driven by increasing consumer awareness of the environmental and health benefits of plant-based diets. Market size expanded from xx million units in 2019 to xx million units in 2024, demonstrating a CAGR of xx%. Adoption rates are increasing steadily, especially among younger generations. Technological disruptions, such as the development of more realistic meat alternatives, are accelerating market growth. Consumer behavior shifts towards healthier and more sustainable food choices are further fueling this expansion.

- Market Size Evolution: xx million units in 2019, xx million units in 2024, projected xx million units by 2033.

- CAGR (2019-2024): xx%

- Market Penetration: xx% in 2024, projected to reach xx% by 2033.

- Technological Disruptions: Advancements in protein extraction, texturization, and flavor enhancement.

- Consumer Behavior: Growing preference for plant-based options driven by health, environmental, and ethical considerations.

Dominant Regions, Countries, or Segments in Middle East and Africa Plant-based Meat Market

The UAE and South Africa are currently leading the market in terms of plant-based meat consumption and distribution. Within distribution channels, hypermarkets/supermarkets hold the largest market share, followed by online retail channels, reflecting the growing penetration of e-commerce. Within product types, plant-based burgers and sausages currently dominate, while the plant-based dairy segment shows significant growth potential.

- Leading Regions: UAE, South Africa, Egypt

- Dominant Distribution Channel: Hypermarkets/Supermarkets (xx% market share)

- Leading Product Type: Plant-Based Burgers and Sausages

- High Growth Potential Segment: Plant-based dairy

Middle East and Africa Plant-based Meat Market Product Landscape

The plant-based meat market offers a diverse range of products, including burgers, sausages, mince, and other meat alternatives. These products are designed to mimic the taste, texture, and nutritional profile of traditional meat, utilizing ingredients such as soy, pea, wheat, and mycoprotein. Key innovations focus on improving product texture, reducing cost, and enhancing flavor profiles. Companies are increasingly focusing on delivering products that meet the diverse dietary needs and preferences of consumers.

Key Drivers, Barriers & Challenges in Middle East and Africa Plant-based Meat Market

Key Drivers: Growing health consciousness, environmental concerns, increasing awareness of animal welfare issues, and government support for sustainable food systems.

Key Challenges: High production costs, limited consumer awareness in some regions, limited distribution networks in certain areas, competition from traditional meat products, and regulatory hurdles concerning labeling and food safety.

Emerging Opportunities in Middle East and Africa Plant-based Meat Market

Untapped markets in several African countries present significant growth potential. Innovative product development, such as plant-based meat alternatives tailored to local tastes and dietary preferences, can drive further market expansion. Evolving consumer preferences towards healthier and more sustainable food choices will create opportunities for companies offering value-added products.

Growth Accelerators in the Middle East and Africa Plant-based Meat Market Industry

Technological advancements in plant-based protein production and processing are key growth accelerators. Strategic partnerships between international and local companies will facilitate market expansion. Government initiatives promoting sustainable agriculture and food security will further drive market growth.

Key Players Shaping the Middle East and Africa Plant-based Meat Market Market

- Beyond Meat Inc

- Koita FZE

- Al Islami Foods

- Danone SA

- Blue Diamond Growers

- Upfield Holdings B V

- The Meatless Farm Co

- Saudi Dairy and Food Stuff Company

- Rude Health

- Superbom Alimentos

- Vbites Foods Limited

- List Not Exhaustive

Notable Milestones in Middle East and Africa Plant-based Meat Market Sector

- January 2021: Vbites Food Limited expanded its business in the Middle East.

- February 2021: Danone SA acquired Earth Island, expanding its plant-based offerings.

- May 2022: Saudi Dairy and Food Stuff Company launched Saudia oat milk.

In-Depth Middle East and Africa Plant-based Meat Market Market Outlook

The Middle East and Africa plant-based meat market is poised for substantial growth in the coming years. Continued technological innovations, increased consumer awareness, expanding distribution networks, and supportive government policies will contribute to this expansion. Strategic partnerships and market expansion strategies will play a vital role in shaping the future of this dynamic market. The market is projected to reach xx million units by 2033.

Middle East and Africa Plant-based Meat Market Segmentation

-

1. Product Type

-

1.1. Plant-Based Meat

- 1.1.1. Burger Patties

- 1.1.2. Sausages

- 1.1.3. Strips and Nuggets

- 1.1.4. Meatballs

- 1.1.5. Other Plant-Based Meats

-

1.2. Plant-Based Dairy

- 1.2.1. Milk

- 1.2.2. Yogurt

- 1.2.3. Butter and Cheese

- 1.2.4. Other Plant-based Dairy

-

1.1. Plant-Based Meat

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. United Arab Emirates

- 3.3. Saudi Arabia

- 3.4. Egypt

- 3.5. Rest of Middle East and Africa

Middle East and Africa Plant-based Meat Market Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Saudi Arabia

- 4. Egypt

- 5. Rest of Middle East and Africa

Middle East and Africa Plant-based Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Increasing Health Concerns Are Supporting the Market’s Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Plant-Based Meat

- 5.1.1.1. Burger Patties

- 5.1.1.2. Sausages

- 5.1.1.3. Strips and Nuggets

- 5.1.1.4. Meatballs

- 5.1.1.5. Other Plant-Based Meats

- 5.1.2. Plant-Based Dairy

- 5.1.2.1. Milk

- 5.1.2.2. Yogurt

- 5.1.2.3. Butter and Cheese

- 5.1.2.4. Other Plant-based Dairy

- 5.1.1. Plant-Based Meat

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. United Arab Emirates

- 5.3.3. Saudi Arabia

- 5.3.4. Egypt

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Saudi Arabia

- 5.4.4. Egypt

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Plant-Based Meat

- 6.1.1.1. Burger Patties

- 6.1.1.2. Sausages

- 6.1.1.3. Strips and Nuggets

- 6.1.1.4. Meatballs

- 6.1.1.5. Other Plant-Based Meats

- 6.1.2. Plant-Based Dairy

- 6.1.2.1. Milk

- 6.1.2.2. Yogurt

- 6.1.2.3. Butter and Cheese

- 6.1.2.4. Other Plant-based Dairy

- 6.1.1. Plant-Based Meat

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. United Arab Emirates

- 6.3.3. Saudi Arabia

- 6.3.4. Egypt

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Plant-Based Meat

- 7.1.1.1. Burger Patties

- 7.1.1.2. Sausages

- 7.1.1.3. Strips and Nuggets

- 7.1.1.4. Meatballs

- 7.1.1.5. Other Plant-Based Meats

- 7.1.2. Plant-Based Dairy

- 7.1.2.1. Milk

- 7.1.2.2. Yogurt

- 7.1.2.3. Butter and Cheese

- 7.1.2.4. Other Plant-based Dairy

- 7.1.1. Plant-Based Meat

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. United Arab Emirates

- 7.3.3. Saudi Arabia

- 7.3.4. Egypt

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Saudi Arabia Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Plant-Based Meat

- 8.1.1.1. Burger Patties

- 8.1.1.2. Sausages

- 8.1.1.3. Strips and Nuggets

- 8.1.1.4. Meatballs

- 8.1.1.5. Other Plant-Based Meats

- 8.1.2. Plant-Based Dairy

- 8.1.2.1. Milk

- 8.1.2.2. Yogurt

- 8.1.2.3. Butter and Cheese

- 8.1.2.4. Other Plant-based Dairy

- 8.1.1. Plant-Based Meat

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. United Arab Emirates

- 8.3.3. Saudi Arabia

- 8.3.4. Egypt

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Egypt Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Plant-Based Meat

- 9.1.1.1. Burger Patties

- 9.1.1.2. Sausages

- 9.1.1.3. Strips and Nuggets

- 9.1.1.4. Meatballs

- 9.1.1.5. Other Plant-Based Meats

- 9.1.2. Plant-Based Dairy

- 9.1.2.1. Milk

- 9.1.2.2. Yogurt

- 9.1.2.3. Butter and Cheese

- 9.1.2.4. Other Plant-based Dairy

- 9.1.1. Plant-Based Meat

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. United Arab Emirates

- 9.3.3. Saudi Arabia

- 9.3.4. Egypt

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Plant-Based Meat

- 10.1.1.1. Burger Patties

- 10.1.1.2. Sausages

- 10.1.1.3. Strips and Nuggets

- 10.1.1.4. Meatballs

- 10.1.1.5. Other Plant-Based Meats

- 10.1.2. Plant-Based Dairy

- 10.1.2.1. Milk

- 10.1.2.2. Yogurt

- 10.1.2.3. Butter and Cheese

- 10.1.2.4. Other Plant-based Dairy

- 10.1.1. Plant-Based Meat

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Channels

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. South Africa

- 10.3.2. United Arab Emirates

- 10.3.3. Saudi Arabia

- 10.3.4. Egypt

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. South Africa Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Beyond Meat Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Koita FZE

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Al Islami Foods

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Danone SA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Blue Diamond Growers

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Upfield Holdings B V

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 The Meatless Farm Co

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Saudi Dairy and Food Stuff Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Rude Health

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Superbom Alimentos

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Vbites Foods Limited *List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Beyond Meat Inc

List of Figures

- Figure 1: Middle East and Africa Plant-based Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Plant-based Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa Plant-based Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa Plant-based Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa Plant-based Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa Plant-based Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa Plant-based Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa Plant-based Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 23: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Plant-based Meat Market?

The projected CAGR is approximately 6.44%.

2. Which companies are prominent players in the Middle East and Africa Plant-based Meat Market?

Key companies in the market include Beyond Meat Inc, Koita FZE, Al Islami Foods, Danone SA, Blue Diamond Growers, Upfield Holdings B V, The Meatless Farm Co, Saudi Dairy and Food Stuff Company, Rude Health, Superbom Alimentos, Vbites Foods Limited *List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Plant-based Meat Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 302.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Increasing Health Concerns Are Supporting the Market’s Growth.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Dairy and Food Stuff Company launched Saudia oat milk, claiming it is the Kingdom's first locally produced oat-based milk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Plant-based Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Plant-based Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Plant-based Meat Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Plant-based Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence