Key Insights

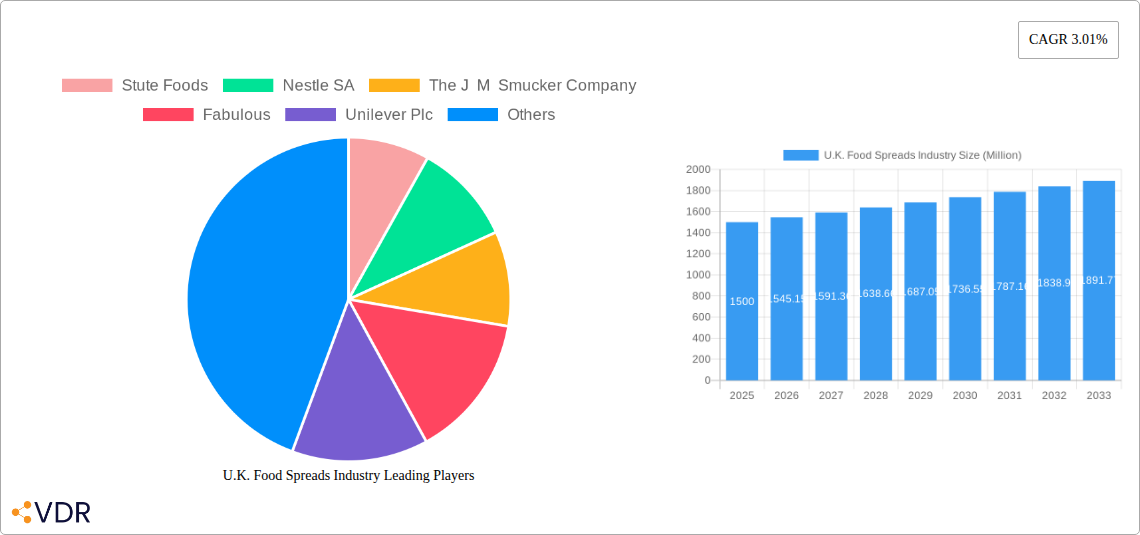

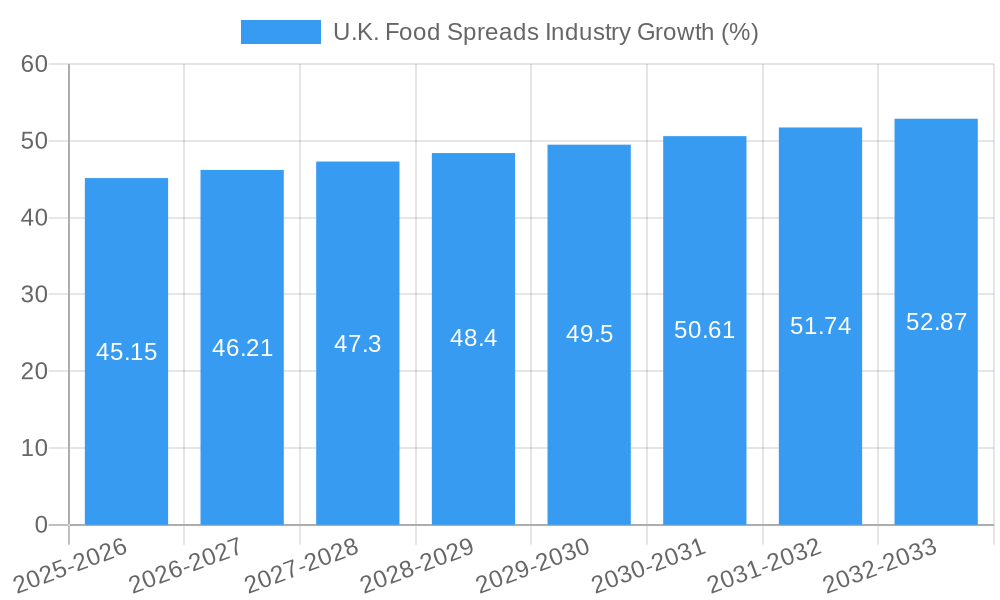

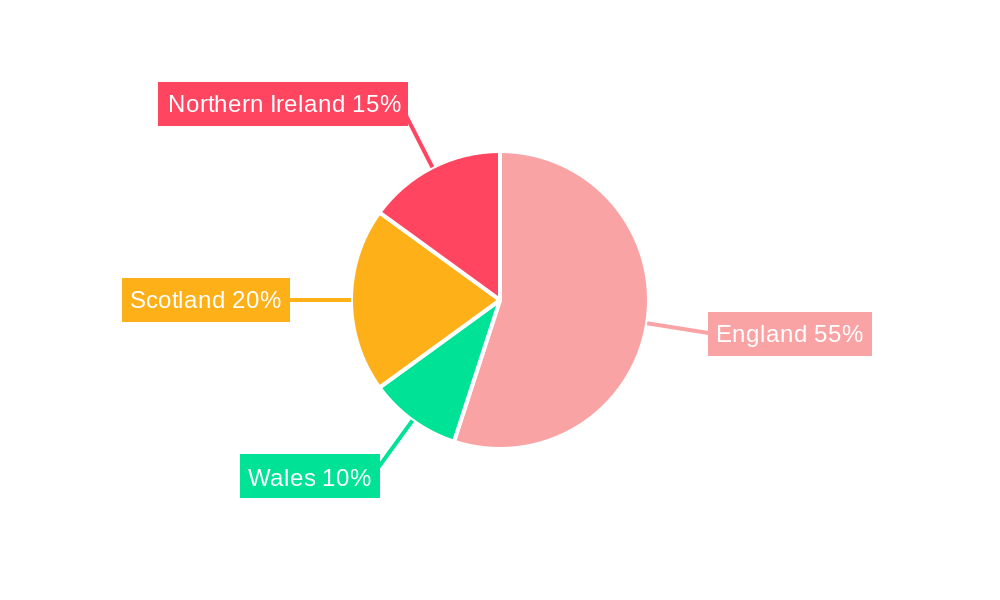

The UK food spreads market, valued at approximately £X million in 2025 (estimated based on provided CAGR and market size), is projected to experience steady growth at a Compound Annual Growth Rate (CAGR) of 3.01% from 2025 to 2033. This growth is fueled by several key drivers. The rising popularity of health-conscious consumers is boosting demand for nut and seed-based spreads, while the enduring appeal of traditional options like honey and fruit preserves maintains a significant market share. Convenience continues to be a major factor, with supermarkets and hypermarkets dominating distribution channels. However, the increasing prominence of online retailers reflects shifting consumer shopping habits and presents opportunities for growth in this sector. Competition is fierce, with established players like Unilever, Nestle, and J.M. Smucker competing against smaller, niche brands focusing on organic and specialized products. Potential restraints include fluctuating raw material prices, particularly for imported ingredients, and consumer concerns about sugar content and overall health implications of certain spreads. Market segmentation by product type (nut-based, fruit-based, honey, chocolate-based, etc.) and distribution channel allows for a granular understanding of market dynamics and potential for targeted marketing strategies. The regional breakdown across England, Wales, Scotland, and Northern Ireland shows variations in consumption patterns based on local preferences and demographics, offering opportunities for regional-specific product offerings and marketing campaigns. Future market trends will likely be shaped by increased innovation in healthier alternatives, sustainable sourcing practices, and the integration of technology to enhance the consumer experience across online and brick-and-mortar retail channels.

The UK food spreads industry is characterized by a dynamic interplay between established brands and emerging players. The continued growth is underpinned by the increasing demand for convenient and flavorful food options, although this demand is being increasingly shaped by the rise in health and wellness awareness. This necessitates innovation in healthier spreads, while also addressing the challenges related to price volatility of raw materials. Companies are adapting by embracing sustainability and ethical sourcing to appeal to ethically conscious consumers. The growing preference for online shopping presents both challenges and opportunities for brands to enhance their e-commerce presence. Strategic partnerships and mergers & acquisitions may play a significant role in shaping the competitive landscape in the coming years. A deep understanding of consumer preferences across different regions within the UK and across product types is crucial for success in this competitive and evolving market.

U.K. Food Spreads Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the U.K. food spreads market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, growth trends, dominant segments, and key players shaping this evolving landscape. The report uses Million units as the unit of measure for all values.

U.K. Food Spreads Industry Market Dynamics & Structure

The U.K. food spreads market is a dynamic sector characterized by intense competition, continuous innovation, and evolving consumer preferences. Market concentration is relatively high, with a few major players holding significant market share. However, smaller, specialized brands, particularly those focusing on niche segments like vegan or organic spreads, are also gaining traction. Technological advancements, such as improved packaging and processing techniques, are driving efficiency and product differentiation. Stringent regulatory frameworks related to food safety and labeling influence product development and marketing strategies. The market also faces competition from substitute products like dips and condiments. Consumer demographics, particularly the growing demand for healthier and more sustainable options, are significantly impacting market trends. The historical period (2019-2024) witnessed a moderate level of M&A activity (xx deals), with larger companies strategically acquiring smaller players to expand their product portfolios and market reach. The forecast period (2025-2033) is expected to see an increase in consolidation, driven by the pursuit of scale and efficiency.

- Market Concentration: High, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on natural ingredients, sustainable packaging, and extended shelf life.

- Regulatory Framework: Strict food safety and labeling regulations impact product development.

- Competitive Substitutes: Dips, condiments, and other snacking options.

- End-User Demographics: Growing demand for healthy, convenient, and ethically sourced spreads.

- M&A Trends: Moderate activity in the past, expected increase in consolidation during the forecast period.

U.K. Food Spreads Industry Growth Trends & Insights

The U.K. food spreads market exhibited steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to the increasing demand for convenient and versatile food products. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, with a forecasted CAGR of xx% during 2025-2033. Technological disruptions, such as the rise of plant-based alternatives and innovative flavor profiles, have played a significant role in shaping market trends. Consumer behavior shifts, characterized by a growing preference for healthier and more sustainable options, are also driving market expansion. The adoption rate of vegan and organic spreads is increasing, indicating a shift towards healthier and ethical consumption.

Dominant Regions, Countries, or Segments in U.K. Food Spreads Industry

The U.K. food spreads market is broadly segmented by product type and distribution channel. Within product types, the Nut- and Seed-based spread segment dominates, driven by the increasing popularity of nut butters and seed-based spreads as healthy snacks and ingredients. The Fruit-based spreads segment holds a significant share, primarily attributed to the widespread consumption of jams and marmalades. The Supermarket/Hypermarket channel is the leading distribution channel, representing the largest share of sales due to its wide reach and accessibility.

- Leading Product Type: Nut- and Seed-based spreads (xx% market share in 2024)

- Leading Distribution Channel: Supermarket/Hypermarket (xx% market share in 2024)

- Key Growth Drivers: Rising disposable incomes, changing lifestyles, and increasing demand for convenience foods.

U.K. Food Spreads Industry Product Landscape

The U.K. food spreads market is witnessing an influx of innovative products, reflecting evolving consumer preferences. Plant-based alternatives are gaining popularity, with brands launching vegan versions of traditional spreads. Focus on clean labels, organic ingredients, and unique flavour profiles are key trends. Products are increasingly emphasizing health benefits, using natural sweeteners and incorporating superfoods. The development of convenient packaging formats, such as single-serve pouches and squeezable tubes, caters to the on-the-go lifestyle of consumers. Technological advancements are improving the texture, taste, and shelf life of spreads. Unique selling propositions (USPs) often centre around health claims, organic certification, and ethical sourcing.

Key Drivers, Barriers & Challenges in U.K. Food Spreads Industry

Key Drivers: Increasing demand for convenient breakfast options, growing health consciousness (vegan & organic options), and rising disposable incomes.

Challenges: Fluctuations in raw material prices, increasing competition, and changing consumer preferences demanding high-quality and sustainable products. Supply chain disruptions can lead to production delays and increased costs, impacting profitability (estimated xx% impact in 2024). Stringent regulations on food labeling and packaging can create compliance challenges. Intense competition from established and emerging brands presents a constant challenge for maintaining market share.

Emerging Opportunities in U.K. Food Spreads Industry

The market presents significant opportunities for specialized spreads, particularly those targeting niche segments like health-conscious consumers, vegans, and individuals seeking unique flavor profiles. Expansion into online retail channels offers opportunities to reach wider audiences. The increasing adoption of smart packaging technologies presents opportunities for enhancing product freshness and providing consumers with additional information.

Growth Accelerators in the U.K. Food Spreads Industry Industry

The long-term growth of the U.K. food spreads market will be significantly influenced by the launch of innovative products catering to specific dietary needs, like gluten-free and low-sugar spreads. Strategic partnerships with retailers and food service companies will enhance distribution and market reach. Expansion into international markets offers potential for growth. Technological advancements, such as personalized nutrition and smart packaging, will further enhance consumer experience and drive demand.

Key Players Shaping the U.K. Food Spreads Industry Market

- Stute Foods

- Nestle SA

- The J M Smucker Company

- Fabulous

- Unilever Plc

- Ferrero International SA

- Bonne Maman

- Upfield Holdings B V

- British Corner Shop

- Hain Celestial Group

- Sioux Honey Association Co-op

Notable Milestones in U.K. Food Spreads Industry Sector

- July 2021: Fabulous launches its first vegan chocolate spread.

- September 2021: Violife expands its vegan spreads range with Viospread.

- November 2022: MeliBio partners with Narayan Foods to launch plant-based honey in the U.K.

In-Depth U.K. Food Spreads Industry Market Outlook

The U.K. food spreads market is poised for continued growth, driven by evolving consumer preferences and technological advancements. Opportunities lie in tapping into the growing demand for healthier, sustainable, and convenient options. Strategic partnerships, expansion into new segments, and adoption of innovative technologies will be crucial for long-term success in this dynamic market. The focus on personalized nutrition and ethical sourcing will shape future product development.

U.K. Food Spreads Industry Segmentation

-

1. Product Type

- 1.1. Nut- and Seed-based Spread

- 1.2. Fruit-based Spread

- 1.3. Honey

- 1.4. Chocolate-based Spread

- 1.5. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Online Retailers

- 2.4. Others

U.K. Food Spreads Industry Segmentation By Geography

- 1. U.K.

U.K. Food Spreads Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Consumers are increasingly looking for spreads that offer health benefits

- 3.2.2 such as reduced fat

- 3.2.3 low sugar

- 3.2.4 or added nutrients. This includes the growing popularity of plant-based and natural options.

- 3.3. Market Restrains

- 3.3.1 Some spreads

- 3.3.2 particularly those high in sugar or fat

- 3.3.3 face criticism from health-conscious consumers. This can impact sales of traditional spreads like sugary jams or high-fat butters.

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Natural/Organic Spreads

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. Food Spreads Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Nut- and Seed-based Spread

- 5.1.2. Fruit-based Spread

- 5.1.3. Honey

- 5.1.4. Chocolate-based Spread

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online Retailers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. England U.K. Food Spreads Industry Analysis, Insights and Forecast, 2019-2031

- 7. Wales U.K. Food Spreads Industry Analysis, Insights and Forecast, 2019-2031

- 8. Scotland U.K. Food Spreads Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern U.K. Food Spreads Industry Analysis, Insights and Forecast, 2019-2031

- 10. Ireland U.K. Food Spreads Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stute Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The J M Smucker Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fabulous

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever Plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ferrero International SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bonne Maman

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Upfield Holdings B V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 British Corner Shop

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hain Celestial Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sioux Honey Association Co-op

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Stute Foods

List of Figures

- Figure 1: U.K. Food Spreads Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: U.K. Food Spreads Industry Share (%) by Company 2024

List of Tables

- Table 1: U.K. Food Spreads Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: U.K. Food Spreads Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: U.K. Food Spreads Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: U.K. Food Spreads Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: U.K. Food Spreads Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England U.K. Food Spreads Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales U.K. Food Spreads Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland U.K. Food Spreads Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern U.K. Food Spreads Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland U.K. Food Spreads Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: U.K. Food Spreads Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: U.K. Food Spreads Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: U.K. Food Spreads Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. Food Spreads Industry?

The projected CAGR is approximately 3.01%.

2. Which companies are prominent players in the U.K. Food Spreads Industry?

Key companies in the market include Stute Foods, Nestle SA, The J M Smucker Company, Fabulous, Unilever Plc, Ferrero International SA, Bonne Maman, Upfield Holdings B V, British Corner Shop, Hain Celestial Group, Sioux Honey Association Co-op.

3. What are the main segments of the U.K. Food Spreads Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumers are increasingly looking for spreads that offer health benefits. such as reduced fat. low sugar. or added nutrients. This includes the growing popularity of plant-based and natural options..

6. What are the notable trends driving market growth?

Increasing Demand for Natural/Organic Spreads.

7. Are there any restraints impacting market growth?

Some spreads. particularly those high in sugar or fat. face criticism from health-conscious consumers. This can impact sales of traditional spreads like sugary jams or high-fat butters..

8. Can you provide examples of recent developments in the market?

In November 2022, MeliBio, the first plant-based honey company partnered with Narayan Foods to launch its products across 75,000 European stores including the United Kingdom. The products of MeliBio are sold under Narayan Foods' Better Foodie brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. Food Spreads Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. Food Spreads Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. Food Spreads Industry?

To stay informed about further developments, trends, and reports in the U.K. Food Spreads Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence