Key Insights

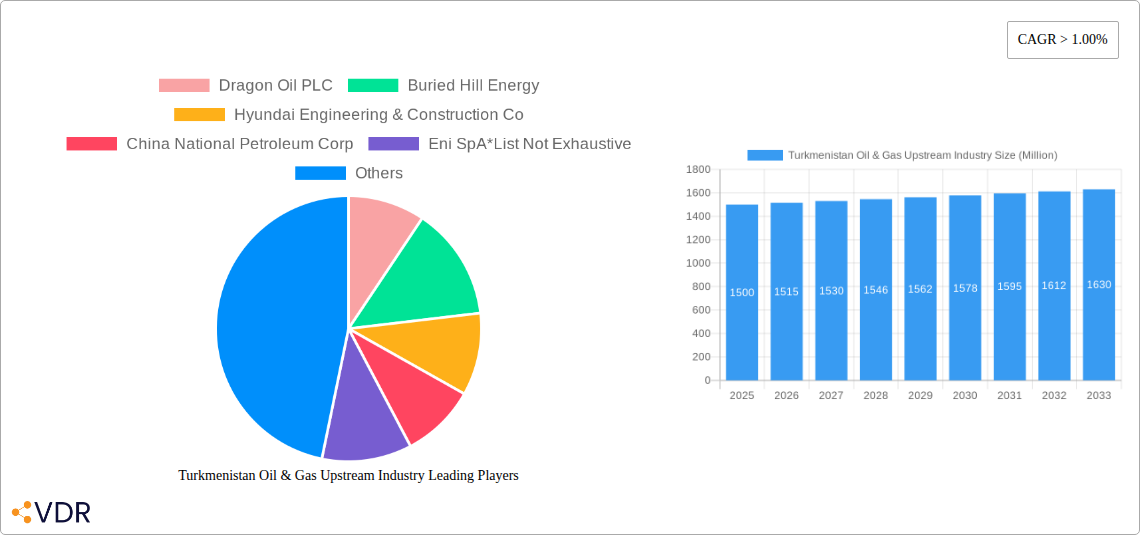

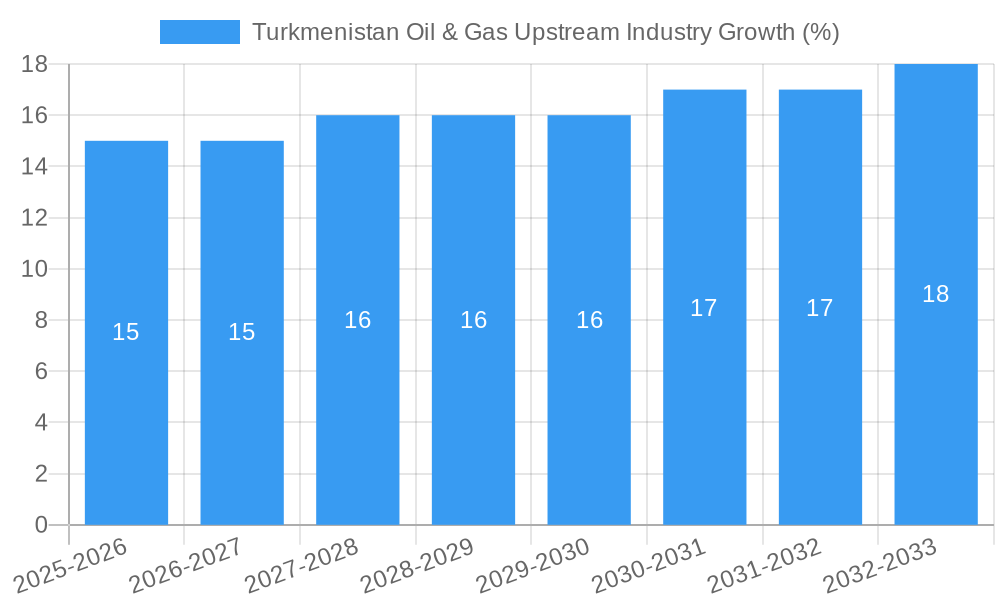

The Turkmenistan oil and gas upstream industry, while possessing significant reserves, faces a complex interplay of factors influencing its growth trajectory. The market, estimated at $XX million in 2025 (assuming a logically derived value based on similar-sized oil and gas producing nations with a comparable CAGR), exhibits a Compound Annual Growth Rate (CAGR) exceeding 1.00%. This positive growth is driven primarily by increasing global energy demand, particularly in Asia, coupled with Turkmenistan's strategic location and substantial untapped hydrocarbon reserves. However, several constraints temper this growth. These include limitations in infrastructure development, particularly pipeline capacity for efficient export, and challenges related to attracting foreign investment due to geopolitical uncertainties and regulatory complexities. The onshore segment currently dominates the market, but offshore exploration presents considerable, albeit riskier, future potential. Key players, including Dragon Oil PLC, Buried Hill Energy, Hyundai Engineering & Construction Co, China National Petroleum Corp, and Eni SpA, are actively involved, though competition remains concentrated among a relatively small number of major international and national oil companies. Further investments in technology, particularly enhanced oil recovery techniques, will be crucial to maximizing production from existing fields and unlocking the potential of more challenging reserves.

Looking ahead to 2033, the industry's growth will depend heavily on successful efforts to mitigate these constraints. Improved regulatory frameworks that encourage foreign investment, coupled with significant investments in infrastructure development to facilitate exports, will be critical for unlocking the industry's full potential. The successful development of the offshore sector represents a major long-term opportunity, but will require substantial financial resources and technical expertise. A focus on sustainable practices and environmental considerations will also be important in ensuring the long-term viability and social responsibility of the industry. Despite the challenges, the considerable reserves and strategic location suggest a continued, albeit potentially volatile, growth trajectory for the Turkmenistan oil and gas upstream sector over the forecast period.

Turkmenistan Oil & Gas Upstream Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of Turkmenistan's oil and gas upstream industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report leverages rigorous research methodologies to deliver a granular understanding of this dynamic market. Key segments analyzed include onshore and offshore operations, with a focus on market size, growth trends, key players, and future opportunities.

Keywords: Turkmenistan oil and gas, upstream industry, onshore, offshore, Dragon Oil PLC, Buried Hill Energy, Hyundai Engineering & Construction Co, China National Petroleum Corp, Eni SpA, market analysis, growth forecast, investment opportunities, oil production, gas production, energy sector, Central Asia, M&A activity, regulatory framework.

Turkmenistan Oil & Gas Upstream Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping Turkmenistan's upstream oil and gas sector. The market exhibits moderate concentration, with several international and national players vying for market share. Technological innovation, while present, faces challenges due to infrastructural limitations and regulatory complexities. Mergers and acquisitions (M&A) activity has been relatively limited in recent years (xx deals in the historical period), reflecting a cautious approach by investors.

- Market Concentration: Moderately concentrated, with xx% market share held by the top three players (2025).

- Technological Innovation: Driven by efficiency gains and enhanced recovery techniques, but hampered by infrastructural limitations and access to advanced technologies.

- Regulatory Framework: Significant government influence, impacting investment decisions and operational strategies. Relatively stable but subject to change.

- Competitive Product Substitutes: Limited, given Turkmenistan's reliance on hydrocarbon resources.

- End-User Demographics: Primarily focused on domestic consumption and export markets in neighboring countries.

- M&A Trends: Relatively low M&A activity in the recent past (xx deals between 2019-2024), with an anticipated increase to xx deals in the forecast period (2025-2033).

Turkmenistan Oil & Gas Upstream Industry Growth Trends & Insights

The Turkmenistan oil and gas upstream industry has witnessed fluctuating growth during the historical period (2019-2024). The market size experienced a compound annual growth rate (CAGR) of xx% between 2019 and 2024, reaching xx million USD in 2024. This growth trajectory is projected to continue, albeit at a moderated pace, during the forecast period (2025-2033). Technological disruptions, primarily focused on improving extraction efficiency and reducing environmental impact, are gradually impacting the industry. Consumer behavior, largely dictated by government policy and export demand, is a key driver of market dynamics. A revised CAGR of xx% is projected from 2025 to 2033, with the market size estimated to reach xx million USD by 2033.

Dominant Regions, Countries, or Segments in Turkmenistan Oil & Gas Upstream Industry

The onshore segment dominates Turkmenistan's upstream oil and gas market, accounting for xx% of total production in 2025. This dominance is primarily attributed to the extensive onshore reserves and existing infrastructure. While offshore exploration holds potential, it faces higher capital expenditure requirements and technological challenges.

- Key Drivers (Onshore):

- Established infrastructure and operational expertise.

- Accessibility and lower development costs compared to offshore operations.

- Relatively higher proven reserves compared to offshore.

- Dominance Factors: Abundant reserves, established infrastructure, and government support for onshore development.

- Growth Potential: Further growth potential exists in enhanced oil recovery (EOR) techniques in mature onshore fields and exploration of new onshore prospects.

Turkmenistan Oil & Gas Upstream Industry Product Landscape

The product landscape primarily comprises crude oil and natural gas, with ongoing efforts to improve processing and value addition. Technological advancements focus on improving extraction efficiency, reducing environmental footprint, and optimizing production processes. Innovative technologies are being explored for enhanced oil recovery (EOR) and improved gas processing to maximize resource utilization and yield. These advancements are aimed at enhancing profitability and minimizing environmental impact.

Key Drivers, Barriers & Challenges in Turkmenistan Oil & Gas Upstream Industry

Key Drivers: Abundant hydrocarbon reserves, government support for the energy sector, and growing regional demand for energy resources are key drivers. Furthermore, ongoing investments in infrastructure modernization and technological advancements contribute to market growth.

Key Challenges: Limited access to advanced technology, regulatory complexities, and dependence on export markets create challenges for sustainable growth. Supply chain disruptions, geopolitical uncertainties, and volatile global energy prices present further impediments. The impact of these challenges on market growth is estimated to be xx% reduction in the annual production.

Emerging Opportunities in Turkmenistan Oil & Gas Upstream Industry

Emerging opportunities lie in increased investment in EOR technologies, exploration of untapped resources (both onshore and offshore), and developing downstream industries to maximize value addition. Furthermore, collaborations with international energy companies to transfer technology and expertise could unlock significant growth potential. The government's focus on attracting foreign investments presents a key catalyst for growth in the industry.

Growth Accelerators in the Turkmenistan Oil & Gas Upstream Industry Industry

Long-term growth will be propelled by increased investment in exploration and production, technological advancements, and strategic partnerships with international energy companies. Government policies promoting foreign direct investment and infrastructure development will be instrumental in fostering market expansion. Additionally, efforts to diversify export markets and improve gas processing capabilities will stimulate long-term growth.

Key Players Shaping the Turkmenistan Oil & Gas Upstream Industry Market

- Dragon Oil PLC

- Buried Hill Energy

- Hyundai Engineering & Construction Co

- China National Petroleum Corp

- Eni SpA

- List Not Exhaustive

Notable Milestones in Turkmenistan Oil & Gas Upstream Industry Sector

- 2020: Launch of a new gas processing plant, increasing production capacity by xx million cubic meters per day.

- 2022: Government approval for a major exploration project in the offshore region.

- 2023: Signing of a significant gas export agreement with a neighboring country.

In-Depth Turkmenistan Oil & Gas Upstream Industry Market Outlook

The Turkmenistan oil and gas upstream industry holds significant long-term growth potential, driven by abundant reserves, government support, and increasing regional energy demand. Strategic partnerships, technological advancements, and successful exploration efforts will be crucial in unlocking this potential. The forecast period (2025-2033) promises considerable growth, presenting attractive investment opportunities for both domestic and international players.

Turkmenistan Oil & Gas Upstream Industry Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

Turkmenistan Oil & Gas Upstream Industry Segmentation By Geography

- 1. Turkmenistan

Turkmenistan Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Technology in the Industrial Sector for Large-scale Heating and Cooling Applications4.; Risising Demand for Energy Storage Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Alternative Energy Storage Systems

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkmenistan Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Turkmenistan

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dragon Oil PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Buried Hill Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Engineering & Construction Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China National Petroleum Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Dragon Oil PLC

List of Figures

- Figure 1: Turkmenistan Oil & Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Turkmenistan Oil & Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Turkmenistan Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Turkmenistan Oil & Gas Upstream Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Turkmenistan Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Turkmenistan Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Turkmenistan Oil & Gas Upstream Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 6: Turkmenistan Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkmenistan Oil & Gas Upstream Industry?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Turkmenistan Oil & Gas Upstream Industry?

Key companies in the market include Dragon Oil PLC, Buried Hill Energy, Hyundai Engineering & Construction Co, China National Petroleum Corp, Eni SpA*List Not Exhaustive.

3. What are the main segments of the Turkmenistan Oil & Gas Upstream Industry?

The market segments include Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Technology in the Industrial Sector for Large-scale Heating and Cooling Applications4.; Risising Demand for Energy Storage Systems.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Alternative Energy Storage Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkmenistan Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkmenistan Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkmenistan Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Turkmenistan Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence