Key Insights

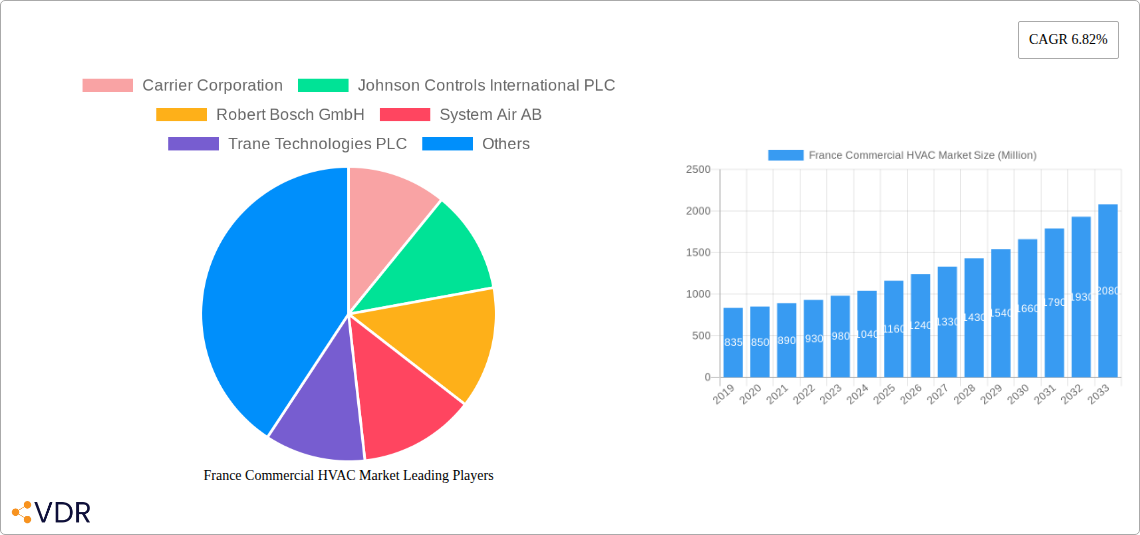

The France Commercial HVAC Market is poised for robust expansion, projected to reach 1,160 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 6.82% through 2033. This significant growth is primarily fueled by an increasing demand for energy-efficient and sustainable HVAC solutions across various commercial sectors. Key drivers include stringent government regulations promoting energy conservation, a growing focus on improving indoor air quality for occupant comfort and productivity, and the ongoing modernization of existing commercial infrastructure. The hospitality sector, with its emphasis on guest experience and operational efficiency, along with the continuous development of commercial and public buildings, are significant contributors to this market expansion. Furthermore, technological advancements in HVAC equipment, such as smart thermostats, variable refrigerant flow (VRF) systems, and integrated building management systems, are enhancing performance and driving adoption.

France Commercial HVAC Market Market Size (In Million)

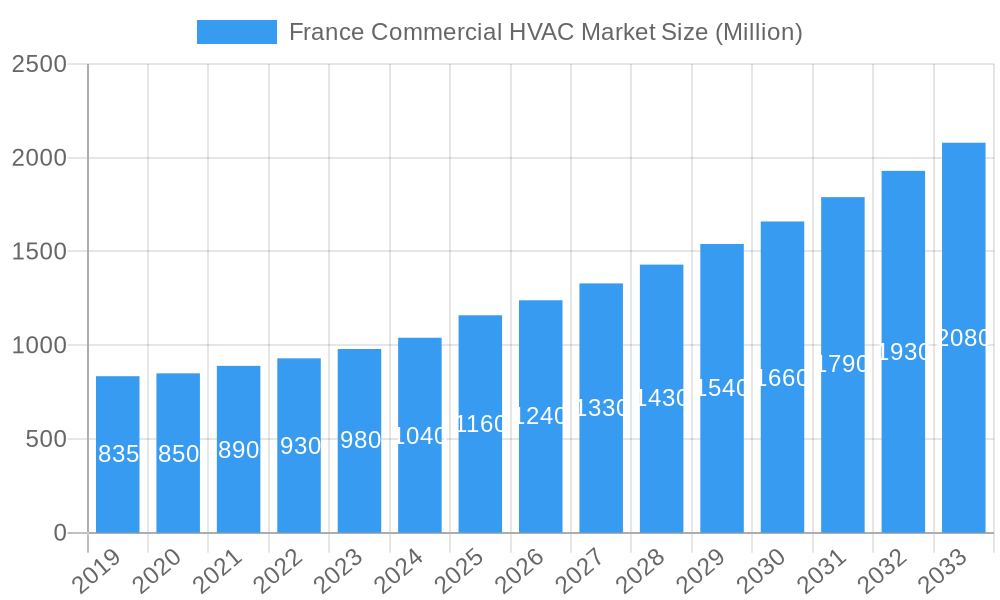

The market is segmented into HVAC Equipment, comprising Heating Equipment and Air Conditioning/Ventilation Equipment, and HVAC Services. The end-user industry segmentation includes the Hospitality, Commercial Buildings, and Public Buildings sectors, each presenting unique opportunities for HVAC providers. While growth is strong, the market faces certain restraints, including the high initial investment cost of advanced HVAC systems and the need for skilled labor for installation and maintenance. However, the increasing awareness of the long-term cost savings associated with energy-efficient systems and the availability of government incentives are expected to mitigate these challenges. Leading companies such as Carrier Corporation, Johnson Controls International PLC, and Trane Technologies PLC are actively investing in research and development to offer innovative and sustainable HVAC solutions, further shaping the competitive landscape in France.

France Commercial HVAC Market Company Market Share

France Commercial HVAC Market: Comprehensive Forecast and Growth Analysis (2019–2033)

Gain unparalleled insights into the dynamic France Commercial HVAC Market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this research provides a granular analysis of market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, and emerging opportunities. Essential for industry professionals, manufacturers, suppliers, and investors, this report offers a strategic roadmap for navigating the evolving landscape of commercial heating, ventilation, and air conditioning solutions in France. The report delves into key segments, including HVAC Equipment (Heating Equipment, Air Conditioning/Ventilation Equipment) and HVAC Services, and analyzes end-user industries such as Hospitality, Commercial Buildings, and Public Buildings. All values are presented in Million units.

France Commercial HVAC Market Market Dynamics & Structure

The France Commercial HVAC Market is characterized by a moderately concentrated structure, with major global players vying for market share alongside emerging local manufacturers. Technological innovation is a primary driver, fueled by increasing demand for energy-efficient and sustainable HVAC solutions, driven by stringent regulatory frameworks aimed at reducing carbon emissions and improving indoor air quality. Competitive product substitutes are evolving, with advancements in heat pump technology and smart building integration offering alternatives to traditional systems. End-user demographics are shifting, with a growing emphasis on occupant comfort, health, and operational cost savings influencing purchasing decisions across hospitality, commercial, and public building sectors. Mergers and acquisitions (M&A) are a significant trend, as larger companies consolidate their market position and acquire innovative technologies. For instance, the expansion of Johnson Controls' Nantes plant signifies a strategic move to bolster production capacity for energy-efficient chillers and heat pumps, a trend echoed by Groupe Atlantic's investment in a new heat pump facility.

- Market Concentration: Moderate, with key global players and strong regional presence.

- Technological Innovation: Driven by energy efficiency, smart controls, and sustainability mandates.

- Regulatory Frameworks: EU directives on energy performance and emissions are paramount.

- Competitive Substitutes: Heat pumps, variable refrigerant flow (VRF) systems, and advanced ventilation solutions.

- End-User Demographics: Focus on comfort, health, and operational cost reduction.

- M&A Trends: Consolidation for market share and technological acquisition.

France Commercial HVAC Market Growth Trends & Insights

The France Commercial HVAC Market is poised for robust growth, projected to expand significantly from 2019 through 2033, with the base year of 2025 serving as a pivotal point for current market assessment. The market size evolution is directly influenced by France's commitment to sustainability and its ambitious climate targets, which are accelerating the adoption of energy-efficient HVAC technologies. Adoption rates for heat pumps, in particular, are seeing a substantial surge, driven by government incentives and increasing awareness of their environmental benefits and lower operational costs compared to fossil fuel-based heating systems. Technological disruptions, such as the integration of IoT and AI in HVAC systems for predictive maintenance and optimized performance, are transforming the market. Consumer behavior shifts are evident, with a growing preference for smart, connected, and environmentally friendly HVAC solutions that offer enhanced comfort and contribute to a reduced carbon footprint. The increasing focus on retrofitting existing buildings to meet modern energy standards is a significant growth accelerator. The market penetration of high-efficiency systems is expected to climb steadily throughout the forecast period, supported by supportive policies and rising demand for improved indoor environmental quality in all commercial spaces. The projected Compound Annual Growth Rate (CAGR) indicates a consistent upward trajectory, reflecting the strong underlying demand and favorable market conditions.

Dominant Regions, Countries, or Segments in France Commercial HVAC Market

Within the France Commercial HVAC Market, Commercial Buildings emerge as the dominant end-user industry segment, driving significant market growth and adoption of advanced HVAC solutions. This dominance is fueled by a confluence of economic policies, infrastructure development, and evolving business needs across the nation. The burgeoning construction and renovation of office spaces, retail establishments, and mixed-use developments necessitate sophisticated climate control systems to ensure occupant comfort, productivity, and energy efficiency. France's strong emphasis on sustainable building practices, reinforced by regulations like the RE2020 (Environmental Regulation 2020), is a key driver for the adoption of high-performance HVAC equipment and services in commercial properties.

- Commercial Buildings Dominance Factors:

- Economic Policies: Government incentives and tax credits for energy-efficient building upgrades.

- Infrastructure Development: Continued investment in new commercial real estate projects and refurbishment of existing ones.

- Occupant Well-being: Increasing recognition of the link between indoor air quality, comfort, and employee productivity.

- Operational Cost Savings: Demand for HVAC systems that minimize energy consumption and maintenance expenses.

- Market Share: Commercial Buildings represent a substantial portion of the overall HVAC market share, projected to hold approximately 45% by 2025.

- Growth Potential: High demand for smart HVAC solutions, VRF systems, and energy-efficient chillers in new and existing commercial spaces.

Beyond Commercial Buildings, HVAC Equipment is a significant segment, with Air Conditioning/Ventilation Equipment showing particularly strong growth. This sub-segment benefits from increasing awareness of indoor air quality and the need for effective climate control in all seasons. The Hospitality sector also presents substantial growth potential, with a rising demand for guest comfort and energy-efficient operations influencing HVAC choices. The HVAC Services segment, encompassing installation, maintenance, and repair, is intrinsically linked to the growth of equipment sales and is expected to witness a parallel expansion.

France Commercial HVAC Market Product Landscape

The France Commercial HVAC Market product landscape is defined by continuous innovation aimed at enhancing energy efficiency, sustainability, and intelligent control. Key product developments include advanced heat pump technologies that offer higher coefficients of performance (COP), even in colder climates, and integrated ventilation systems with heat recovery capabilities to minimize energy loss. Smart HVAC equipment, featuring IoT connectivity, AI-powered optimization, and remote monitoring, is gaining traction, enabling predictive maintenance and personalized climate control. The market also sees a rise in modular and scalable HVAC solutions designed to adapt to the evolving needs of commercial spaces.

Key Drivers, Barriers & Challenges in France Commercial HVAC Market

The France Commercial HVAC Market is propelled by several key drivers, including stringent government regulations promoting energy efficiency and decarbonization, growing environmental consciousness among businesses, and the increasing demand for comfortable and healthy indoor environments. Technological advancements in heat pumps and smart building integration further accelerate adoption.

- Key Drivers:

- RE2020 Regulations: Mandating higher energy performance and lower carbon emissions.

- Sustainability Mandates: Corporate and governmental commitments to reduce environmental impact.

- Energy Cost Volatility: Driving demand for more efficient and cost-effective HVAC solutions.

- Technological Advancements: Development of high-efficiency heat pumps and smart HVAC systems.

However, the market faces several barriers and challenges. The initial high upfront cost of advanced HVAC systems can be a deterrent for some businesses. The availability of skilled labor for installation and maintenance of complex systems is another concern. Supply chain disruptions and fluctuating raw material prices can also impact pricing and availability.

- Key Barriers & Challenges:

- High Initial Investment Costs: For advanced and sustainable HVAC solutions.

- Skilled Labor Shortage: For installation and maintenance of complex systems.

- Supply Chain Vulnerabilities: Leading to potential delays and price fluctuations.

- Regulatory Complexity: Navigating evolving and multifaceted compliance requirements.

Emerging Opportunities in France Commercial HVAC Market

Emerging opportunities in the France Commercial HVAC Market lie in the retrofitting of existing commercial buildings to meet new energy efficiency standards, the growing demand for integrated building management systems that optimize HVAC performance, and the development of district heating and cooling networks powered by renewable energy sources. The increasing adoption of heat pumps for both heating and cooling, particularly in regions with favorable incentives, presents a significant untapped market.

Growth Accelerators in the France Commercial HVAC Market Industry

Growth accelerators in the France Commercial HVAC Market industry are primarily technological breakthroughs and strategic market expansion. The continuous innovation in heat pump technology, making them more efficient and cost-effective, is a major catalyst. Strategic partnerships between HVAC manufacturers and smart building technology providers are creating integrated solutions that appeal to the modern commercial sector. Furthermore, government initiatives and subsidies aimed at encouraging the adoption of low-carbon HVAC systems are playing a crucial role in driving market expansion.

Key Players Shaping the France Commercial HVAC Market Market

- Carrier Corporation

- Johnson Controls International PLC

- Robert Bosch GmbH

- System Air AB

- Trane Technologies PLC

- Flaktgroup Inc

- LG Electronics Inc

- BDR Thermea Group

- Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- Danfoss Inc

- Panasonic Corporation

Notable Milestones in France Commercial HVAC Market Sector

- March 2024: Johnson Controls significantly expanded its chiller and heat pump plant in Nantes, France. This expansion solidified Nantes as Johnson Controls' European primary manufacturing center for York-branded chillers and heat pumps. The upgraded facility is now operational, signifying a crucial milestone for the company. Johnson Controls is strategically positioned to meet the rising market demand for new technologies by bolstering its production capacity and emphasizing its dedication to a sustainable, energy-efficient future.

- November 2023: Groupe Atlantic, a French HVAC firm, announced plans to construct a new EUR 150 million heat pump production facility in France in 2024. Spanning 35,000 m2, this new plant would be situated on a sprawling 19-ha parcel in the SaoneOr joint development zone, approximately 125 km north of Lyon in Grand Chalon. Notably, this would mark Groupe Atlantic's third heat pump manufacturing site in France, complementing its existing plants in Billy-Berclau and Merville in northern France.

In-Depth France Commercial HVAC Market Market Outlook

The in-depth France Commercial HVAC Market outlook is exceptionally positive, driven by a robust commitment to sustainability and technological innovation. Growth accelerators such as advanced heat pump technology, smart building integration, and favorable government policies will continue to propel market expansion. Strategic partnerships and ongoing R&D investments by key players will introduce more energy-efficient and cost-effective solutions, catering to the evolving demands of commercial buildings, hospitality, and public sectors. The market is set to witness a significant increase in the deployment of HVAC services, supporting the growing installed base of advanced equipment. Future strategic opportunities lie in capitalizing on the retrofitting market and the development of decentralized energy solutions, solidifying France's position as a leader in sustainable HVAC practices.

France Commercial HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning/Ventilation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-user Industry

- 2.1. Hospitality

- 2.2. Commercial Buildings

- 2.3. Public Buildings

- 2.4. Other End-user Industries

France Commercial HVAC Market Segmentation By Geography

- 1. France

France Commercial HVAC Market Regional Market Share

Geographic Coverage of France Commercial HVAC Market

France Commercial HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Supportive Government Regulations

- 3.2.2 Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy-efficient Devices

- 3.3. Market Restrains

- 3.3.1 Supportive Government Regulations

- 3.3.2 Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy-efficient Devices

- 3.4. Market Trends

- 3.4.1. Commercial Buildings is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Commercial HVAC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning/Ventilation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Hospitality

- 5.2.2. Commercial Buildings

- 5.2.3. Public Buildings

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carrier Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Controls International PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 System Air AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trane Technologies PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flaktgroup Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDR Thermea Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Carrier Corporation

List of Figures

- Figure 1: France Commercial HVAC Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Commercial HVAC Market Share (%) by Company 2025

List of Tables

- Table 1: France Commercial HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 2: France Commercial HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 3: France Commercial HVAC Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: France Commercial HVAC Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: France Commercial HVAC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: France Commercial HVAC Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: France Commercial HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 8: France Commercial HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 9: France Commercial HVAC Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: France Commercial HVAC Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: France Commercial HVAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: France Commercial HVAC Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Commercial HVAC Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the France Commercial HVAC Market?

Key companies in the market include Carrier Corporation, Johnson Controls International PLC, Robert Bosch GmbH, System Air AB, Trane Technologies PLC, Flaktgroup Inc, LG Electronics Inc, BDR Thermea Group, Mitsubishi Electric Hydronics & IT Cooling Systems S p A, Danfoss Inc, Panasonic Corporatio.

3. What are the main segments of the France Commercial HVAC Market?

The market segments include Type of Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations. Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy-efficient Devices.

6. What are the notable trends driving market growth?

Commercial Buildings is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Supportive Government Regulations. Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy-efficient Devices.

8. Can you provide examples of recent developments in the market?

March 2024: Johnson Controls significantly expanded its chiller and heat pump plant in Nantes, France. This expansion solidified Nantes as Johnson Controls' European primary manufacturing center for York-branded chillers and heat pumps. The upgraded facility is now operational, signifying a crucial milestone for the company. Johnson Controls is strategically positioned to meet the rising market demand for new technologies by bolstering its production capacity and emphasizing its dedication to a sustainable, energy-efficient future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Commercial HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Commercial HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Commercial HVAC Market?

To stay informed about further developments, trends, and reports in the France Commercial HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence