Key Insights

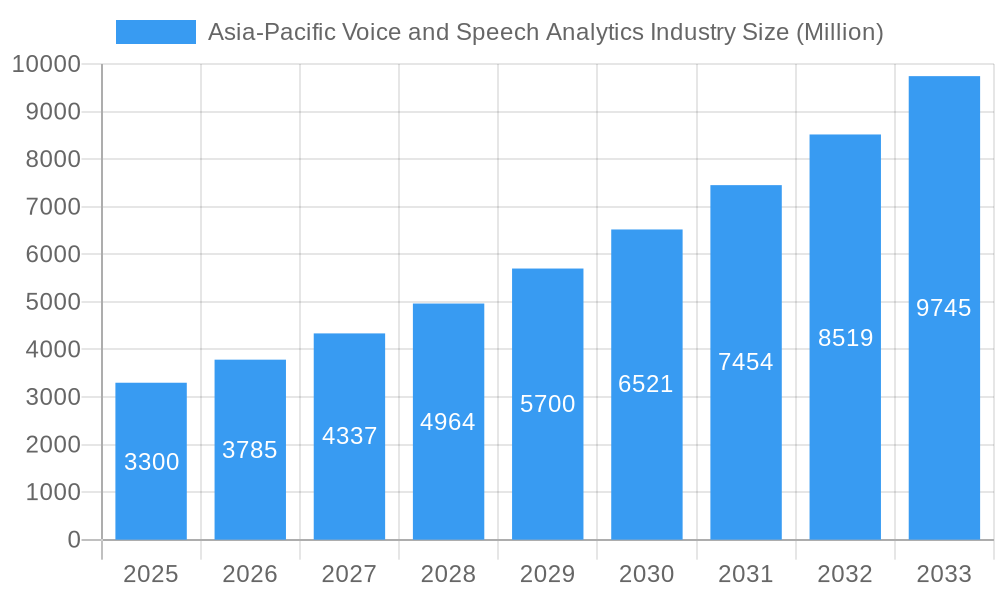

The Asia-Pacific Voice and Speech Analytics market is poised for significant expansion, projected to reach USD 3.3 billion in 2025 and grow at an impressive compound annual growth rate (CAGR) of 14.7% during the forecast period of 2025-2033. This robust growth is fueled by an increasing adoption of advanced analytics technologies across various industries to enhance customer experience, optimize operational efficiency, and gain competitive intelligence. Key drivers include the rising volume of unstructured voice data from customer interactions, the growing demand for real-time insights, and the increasing sophistication of AI and machine learning algorithms that power these solutions. Furthermore, the burgeoning digital transformation initiatives across the region, coupled with a strong emphasis on data-driven decision-making, are creating a fertile ground for the voice and speech analytics market to flourish. The market is also benefiting from the expanding reach of cloud-based solutions, which offer scalability and cost-effectiveness, making advanced analytics accessible to a wider range of organizations.

Asia-Pacific Voice and Speech Analytics Industry Market Size (In Billion)

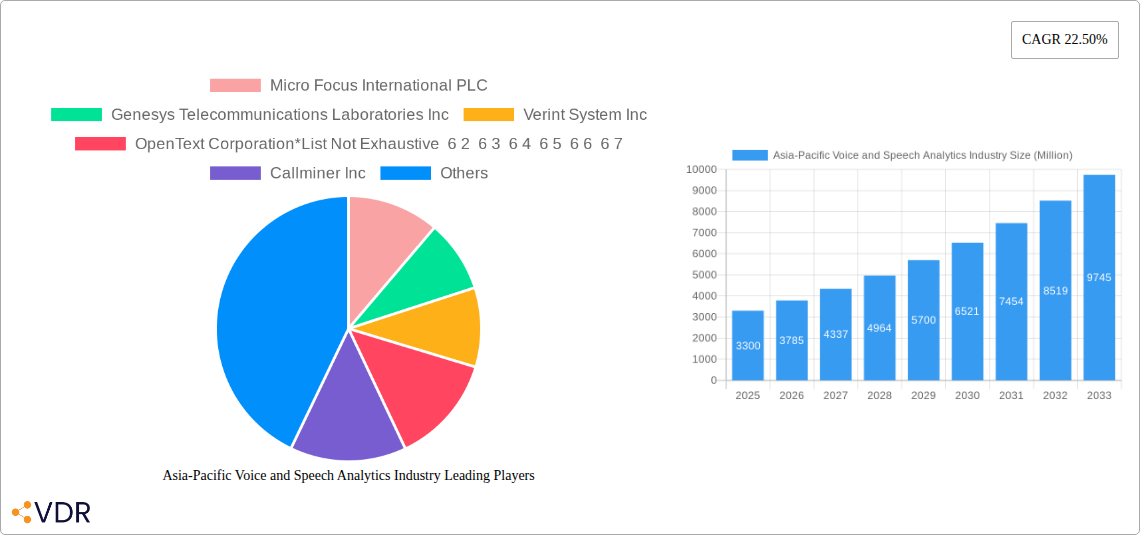

The market segmentation reveals a diverse adoption landscape, with both on-premise and on-demand deployment models catering to different organizational needs. Small and medium enterprises (SMEs) are increasingly leveraging speech analytics to compete with larger players, while large enterprises are integrating these solutions for comprehensive business intelligence. The BFSI, Healthcare, and Retail sectors are leading the charge in adopting voice and speech analytics due to their high volume of customer interactions and stringent compliance requirements. Government agencies are also recognizing the value of these technologies for enhancing public services and security. While the market is dominated by established players like Micro Focus International PLC, Genesys Telecommunications Laboratories Inc, and Verint System Inc, emerging companies like Callminer Inc and VoiceBase Inc are also carving out significant market share, indicating a dynamic and competitive environment. The Asia-Pacific region, with its rapidly growing economies and increasing digital penetration, represents a prime growth opportunity for voice and speech analytics providers.

Asia-Pacific Voice and Speech Analytics Industry Company Market Share

Asia-Pacific Voice and Speech Analytics Industry Market Dynamics & Structure

The Asia-Pacific voice and speech analytics industry is characterized by a dynamic and evolving market structure, driven by increasing demand for enhanced customer experience, operational efficiency, and regulatory compliance. Market concentration is moderate, with a few dominant players holding significant market share, while a growing number of emerging companies contribute to innovation and competition. Technological innovation is a primary driver, fueled by advancements in Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP), enabling more accurate and sophisticated analysis of voice data. Regulatory frameworks, particularly concerning data privacy and security in countries like Japan and Australia, are shaping market development, pushing for robust compliance solutions.

- Market Concentration: A blend of established global leaders and agile regional players.

- Technological Innovation Drivers: AI, ML, NLP advancements for deeper insights.

- Regulatory Frameworks: Data privacy (e.g., PDPA in Singapore, APPI in Japan) and compliance mandates influencing solution design.

- Competitive Product Substitutes: Traditional analytics tools and manual analysis are being increasingly replaced.

- End-User Demographics: Growing adoption across BFSI, Healthcare, and Retail sectors due to the need for personalized customer interactions and risk mitigation.

- M&A Trends: Strategic acquisitions are observed as larger players seek to expand their technology portfolios and market reach. The M&A deal volume is projected to be XX in the forecast period, indicating consolidation and strategic integration.

Asia-Pacific Voice and Speech Analytics Industry Growth Trends & Insights

The Asia-Pacific voice and speech analytics market is poised for substantial expansion, fueled by a confluence of technological advancements and increasing enterprise adoption. The projected market size for the Asia-Pacific Voice and Speech Analytics industry is estimated to reach $6.5 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 26.3% from 2025 to 2033, reaching an impressive $26.9 billion by the end of the forecast period. This remarkable growth is underpinned by the escalating demand for sophisticated tools that can extract actionable insights from the vast amounts of unstructured voice data generated daily in contact centers and other customer interaction channels.

The adoption rates of voice and speech analytics solutions are accelerating across various industry verticals within the region. Initially driven by the BFSI and telecommunications sectors, the adoption is now rapidly expanding into healthcare, retail, and government segments, as organizations recognize the immense potential for improving customer engagement, agent performance, and operational efficiency. Technological disruptions, including the refinement of AI-powered sentiment analysis, predictive analytics, and real-time transcription, are continuously enhancing the capabilities of these solutions, making them more accessible and valuable to a wider range of businesses.

Consumer behavior shifts are also playing a pivotal role. Customers increasingly expect personalized and seamless interactions across all touchpoints. Voice and speech analytics enable businesses to understand customer needs, preferences, and pain points at a granular level, allowing for tailored service delivery and proactive issue resolution. This heightened focus on customer experience is a significant catalyst for the adoption of advanced analytics technologies. Furthermore, the growing emphasis on compliance and risk management within industries like BFSI is driving the demand for solutions that can monitor agent conduct, detect fraudulent activities, and ensure adherence to regulatory guidelines. The migration of on-premise solutions to cloud-based, on-demand models is also contributing to wider accessibility and scalability, further accelerating market penetration across Small and Medium Enterprises (SMEs) and large enterprises alike. The intricate interplay of these factors is creating a robust growth trajectory for the Asia-Pacific voice and speech analytics market.

Dominant Regions, Countries, or Segments in Asia-Pacific Voice and Speech Analytics Industry

The Asia-Pacific voice and speech analytics market exhibits strong growth, with specific regions, countries, and segments emerging as key drivers of this expansion. Among the deployment models, On-Demand (Cloud-based) solutions are experiencing the most rapid adoption, projected to capture a significant share of the market due to their scalability, cost-effectiveness, and ease of implementation, especially for Small and Medium Enterprises (SMEs).

Country-level Dominance:

- China is emerging as a powerhouse, driven by its massive digital economy, high adoption of cloud services, and a rapidly growing customer service industry seeking to leverage AI for efficiency and personalization. Government initiatives supporting digital transformation further bolster this growth.

- Japan remains a mature market with a strong emphasis on technological innovation and data security. Its sophisticated BFSI and healthcare sectors are early adopters of advanced analytics for compliance and customer insights.

- South Korea showcases high technological readiness and a consumer base that expects cutting-edge digital experiences, fueling demand for sophisticated voice and speech analytics solutions to enhance customer interactions in its vibrant retail and technology sectors.

- India presents a massive growth opportunity, particularly in its burgeoning IT and BPO sectors. The sheer volume of customer interactions and the increasing focus on digital transformation and cost optimization are driving adoption, especially for cloud-based solutions.

Segment-level Dominance:

- End-user - BFSI: This sector is a dominant force, driven by stringent regulatory requirements, the need for enhanced fraud detection, personalized customer service, and agent performance management. The sheer volume of transactions and customer calls makes it a prime target for speech analytics.

- Size of Organization - Large Enterprises: While SMEs are increasingly adopting these solutions, large enterprises, with their substantial budgets and complex operational needs, currently lead in overall market share. They leverage voice and speech analytics for broad-scale process optimization and strategic insights. However, the growth potential within the SME segment is exceptionally high due to the increasing availability of affordable, cloud-based solutions.

- Deployment - On-Demand: This model's dominance is fueled by its agility, reduced upfront investment, and ability to scale rapidly, aligning perfectly with the dynamic business needs of the Asia-Pacific region.

The growth in these dominant segments is further propelled by supportive economic policies, burgeoning digital infrastructure, and a growing understanding of the strategic advantages offered by voice and speech analytics in improving customer satisfaction, operational efficiency, and compliance. The market share within these dominant segments is estimated to be over 60% of the total Asia-Pacific market by 2025.

Asia-Pacific Voice and Speech Analytics Industry Product Landscape

The product landscape in the Asia-Pacific voice and speech analytics industry is characterized by continuous innovation, focusing on enhanced accuracy, broader application, and seamless integration. Cutting-edge solutions now offer real-time transcription with industry-leading accuracy rates of over 95%, powered by advanced AI and ML algorithms trained on diverse regional accents and languages. Unique selling propositions often revolve around specialized features such as sentiment analysis that can discern nuanced emotions, topic modeling for identifying trending customer concerns, and agent performance scoring with actionable feedback loops. Technological advancements are also enabling deeper integration with CRM systems, business intelligence platforms, and existing contact center infrastructure, providing a holistic view of customer interactions. Innovations in areas like emotion detection and predictive customer churn analysis are emerging as key differentiators, pushing the boundaries of what is possible with voice data.

Key Drivers, Barriers & Challenges in Asia-Pacific Voice and Speech Analytics Industry

Key Drivers: The Asia-Pacific voice and speech analytics market is propelled by several significant drivers. The escalating demand for superior customer experience is paramount, with businesses striving to understand and meet evolving customer expectations. Technological advancements in AI, ML, and NLP are making solutions more powerful and accessible. Increasing regulatory compliance requirements, especially in sectors like BFSI, necessitate robust monitoring and auditing capabilities. Furthermore, the drive for operational efficiency and cost reduction in contact centers, coupled with the growing adoption of cloud-based solutions, are significant growth catalysts.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several challenges. Data privacy and security concerns, particularly in countries with evolving data protection laws, can be a significant barrier. The high cost of initial implementation and integration for some advanced solutions can deter SMEs. A shortage of skilled professionals capable of implementing and managing these sophisticated analytics platforms also poses a challenge. Moreover, the diversity of languages and dialects across the Asia-Pacific region presents ongoing challenges for achieving universal transcription and analysis accuracy. Supply chain issues are minimal for software-based solutions, but the competitive pressure from emerging players and established technology giants is intense, requiring continuous innovation.

Emerging Opportunities in Asia-Pacific Voice and Speech Analytics Industry

Emerging opportunities in the Asia-Pacific voice and speech analytics industry lie in untapped markets and innovative applications. The burgeoning SME segment presents a vast opportunity as cloud-based solutions become more affordable and accessible, democratizing access to powerful analytics. The application of speech analytics in emerging sectors like education for personalized learning insights and in the gaming industry for player behavior analysis offers new avenues for growth. Furthermore, the development of specialized solutions for niche industries, such as healthcare for patient interaction analysis and diagnostics support, and for government services to improve citizen engagement, represents significant untapped potential. Evolving consumer preferences for hyper-personalized experiences will continue to drive demand for advanced sentiment and intent analysis capabilities.

Growth Accelerators in the Asia-Pacific Voice and Speech Analytics Industry Industry

Several catalysts are accelerating the long-term growth of the Asia-Pacific voice and speech analytics industry. Technological breakthroughs in areas like real-time AI-powered voice biometrics for enhanced security and authentication are opening new use cases. Strategic partnerships between technology providers and cloud service providers are expanding market reach and simplifying deployment for end-users. Market expansion strategies targeting developing economies within the region, where the adoption of digital customer service is rapidly increasing, are proving effective. The continuous evolution of NLP to better understand complex human language, sarcasm, and cultural nuances will also act as a significant growth accelerator, making these solutions even more powerful and indispensable for businesses.

Key Players Shaping the Asia-Pacific Voice and Speech Analytics Industry Market

- Micro Focus International PLC

- Genesys Telecommunications Laboratories Inc

- Verint System Inc

- OpenText Corporation

- Callminer Inc

- Nice Ltd

- Avaya Inc

- VoiceBase Inc

- Calabrio Inc

- Raytheon BBN Technologies

Notable Milestones in Asia-Pacific Voice and Speech Analytics Industry Sector

- 2019: Increased investment in AI-driven speech analytics by major cloud providers in the region.

- 2020: Rise in demand for remote work solutions, boosting the adoption of cloud-based speech analytics for contact center agent monitoring.

- 2021: Major advancements in multi-language processing capabilities for speech analytics platforms catering to diverse APAC markets.

- 2022: Several key players launch enhanced sentiment analysis and emotion detection features, increasing solution sophistication.

- 2023: Growing focus on data privacy and compliance leads to the development of region-specific, GDPR-compliant solutions.

- 2024: Emergence of specialized voice analytics solutions for the healthcare and BFSI sectors gaining significant traction.

In-Depth Asia-Pacific Voice and Speech Analytics Industry Market Outlook

The Asia-Pacific voice and speech analytics industry is projected for robust future growth, driven by a powerful combination of technological innovation and increasing enterprise adoption. The market's trajectory is significantly influenced by the ongoing advancements in AI and ML, which are continuously enhancing the accuracy and capabilities of speech analytics tools. Key strategic opportunities lie in the expansion of cloud-based solutions to cater to the vast SME market, which is currently underserved but holds immense potential. Furthermore, the development of highly specialized analytics for burgeoning sectors like healthcare and gaming, alongside the continuous refinement of multi-language processing to address the region's linguistic diversity, will be crucial growth accelerators. The market's future potential is immense, offering businesses unprecedented insights into customer behavior and operational performance, thus solidifying its strategic importance in the digital transformation landscape of the Asia-Pacific region.

Asia-Pacific Voice and Speech Analytics Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. On-Demand

-

2. Size of Organization

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End-user

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. Government

- 3.5. Other En

Asia-Pacific Voice and Speech Analytics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Voice and Speech Analytics Industry Regional Market Share

Geographic Coverage of Asia-Pacific Voice and Speech Analytics Industry

Asia-Pacific Voice and Speech Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand of Speech Analytics in Various Industry Verticals; Growing focus on improving and enhancing overall customer experience

- 3.3. Market Restrains

- 3.3.1. High Implementation Costs

- 3.4. Market Trends

- 3.4.1. IT and Telecom Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Voice and Speech Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. On-Demand

- 5.2. Market Analysis, Insights and Forecast - by Size of Organization

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. Government

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Micro Focus International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genesys Telecommunications Laboratories Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Verint System Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OpenText Corporation*List Not Exhaustive 6 2 6 3 6 4 6 5 6 6 6 7

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Callminer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nice Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avaya Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VoiceBase Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Calabrio Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Raytheon BBN Technologies

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Micro Focus International PLC

List of Figures

- Figure 1: Asia-Pacific Voice and Speech Analytics Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Voice and Speech Analytics Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 2: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by Size of Organization 2020 & 2033

- Table 3: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 6: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by Size of Organization 2020 & 2033

- Table 7: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by End-user 2020 & 2033

- Table 8: Asia-Pacific Voice and Speech Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Voice and Speech Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Voice and Speech Analytics Industry?

The projected CAGR is approximately 14.7%.

2. Which companies are prominent players in the Asia-Pacific Voice and Speech Analytics Industry?

Key companies in the market include Micro Focus International PLC, Genesys Telecommunications Laboratories Inc, Verint System Inc, OpenText Corporation*List Not Exhaustive 6 2 6 3 6 4 6 5 6 6 6 7, Callminer Inc, Nice Ltd, Avaya Inc, VoiceBase Inc, Calabrio Inc, Raytheon BBN Technologies.

3. What are the main segments of the Asia-Pacific Voice and Speech Analytics Industry?

The market segments include Deployment, Size of Organization, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand of Speech Analytics in Various Industry Verticals; Growing focus on improving and enhancing overall customer experience.

6. What are the notable trends driving market growth?

IT and Telecom Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Implementation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Voice and Speech Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Voice and Speech Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Voice and Speech Analytics Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Voice and Speech Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence