Key Insights

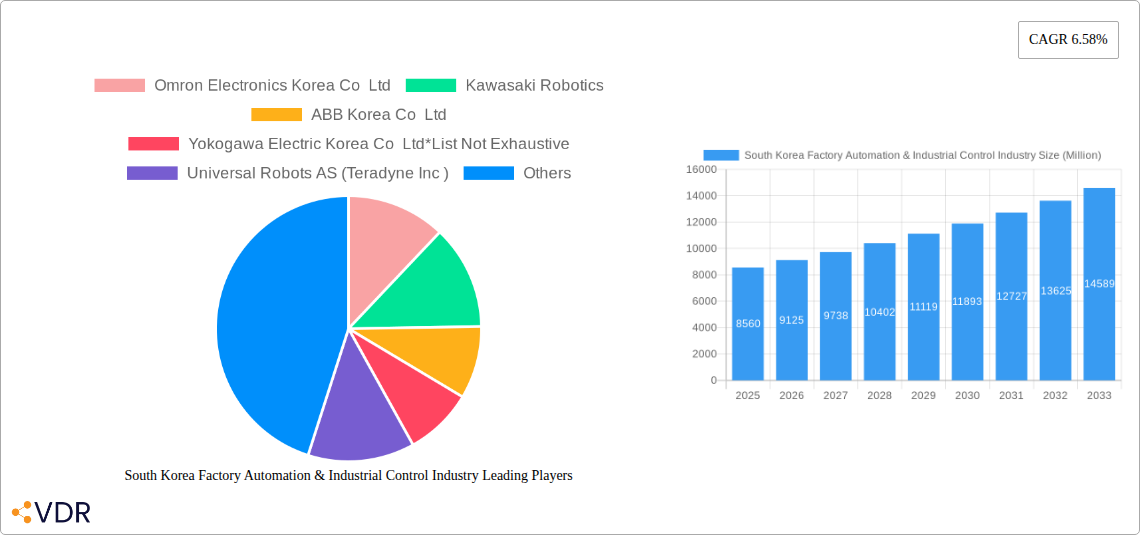

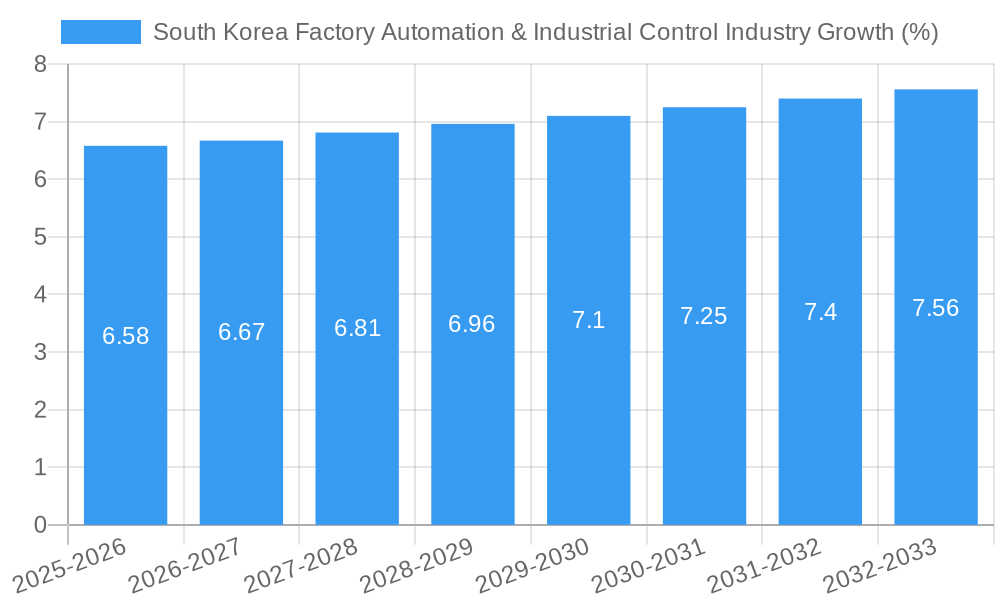

The South Korean factory automation and industrial control market, valued at $8.56 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.58% from 2025 to 2033. This expansion is fueled by several key factors. The country's strong manufacturing base, particularly in sectors like automotive, semiconductors, and electronics, creates a high demand for advanced automation solutions. Government initiatives promoting Industry 4.0 adoption and smart manufacturing further stimulate market growth. Increasing adoption of robotics, particularly in tasks requiring precision and high-speed operation, contributes significantly to this growth. Furthermore, the rising need for enhanced production efficiency, improved product quality, and reduced operational costs pushes businesses to invest heavily in automation technologies. The market is segmented across various product types, including safety sensors, programmable logic controllers (PLCs), human-machine interfaces (HMIs), and industrial robotics, each experiencing growth driven by specific application needs. Leading players like Omron, ABB, and Fanuc dominate the market, leveraging their strong technological expertise and established distribution networks. However, challenges remain, including high initial investment costs for automation technologies, the need for skilled labor to implement and maintain these systems, and potential disruptions caused by global economic fluctuations.

The forecast for the South Korean factory automation and industrial control market shows continued upward momentum. The CAGR of 6.58% suggests a significant market expansion over the next decade. While specific challenges exist, the sustained investment in technological upgrades by major industries and the ongoing government support for digital transformation initiatives indicate that this sector will continue its trajectory of steady growth. The increasing complexity of manufacturing processes, the demand for greater flexibility and customization, and the need for enhanced data analytics capabilities further underpin the market’s potential. This positive outlook is strengthened by the emergence of new technologies, such as AI-powered automation and collaborative robots, which are expected to enhance productivity and efficiency across various industrial applications. The market's diversity, spanning various end-user sectors, ensures resilience even amidst potential economic headwinds.

South Korea Factory Automation & Industrial Control Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of South Korea's thriving factory automation and industrial control market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and future opportunities within this dynamic sector. The report leverages extensive primary and secondary research, delivering robust quantitative and qualitative data to inform strategic planning and investment decisions.

South Korea Factory Automation & Industrial Control Industry Market Dynamics & Structure

The South Korean factory automation and industrial control market is characterized by a moderately concentrated landscape, with both global giants and domestic players vying for market share. Technological innovation, driven by the increasing adoption of Industry 4.0 technologies, is a key driver. Stringent government regulations promoting automation and safety standards shape industry practices. Competition from substitute technologies, such as collaborative robots (cobots), is intensifying. The end-user demographics are diverse, with significant contributions from the automotive, semiconductor, and manufacturing sectors. M&A activity remains moderate, with xx deals recorded in the past five years, primarily focused on expanding technological capabilities and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Strong focus on AI, IoT, and robotics integration, driving efficiency and productivity improvements.

- Regulatory Framework: Supportive policies promoting automation and smart factory initiatives.

- Competitive Substitutes: Increased competition from cobots and other advanced automation solutions.

- End-User Demographics: Automotive, semiconductor, and manufacturing sectors are major consumers.

- M&A Trends: Moderate activity, driven by technology acquisition and market expansion strategies.

South Korea Factory Automation & Industrial Control Industry Growth Trends & Insights

The South Korean factory automation and industrial control market experienced robust growth during the historical period (2019-2024), primarily driven by increased investments in manufacturing automation and government support for Industry 4.0 initiatives. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. The forecast period (2025-2033) anticipates sustained growth, fueled by rising labor costs, increasing demand for enhanced productivity, and ongoing technological advancements. Adoption rates of advanced automation technologies, like AI-powered vision systems and collaborative robots, are accelerating. Shifting consumer preferences toward higher quality and customized products further fuel demand. The market is expected to reach xx million units by 2033, with a projected CAGR of xx%.

Dominant Regions, Countries, or Segments in South Korea Factory Automation & Industrial Control Industry

The South Korean factory automation and industrial control market demonstrates strong growth across various segments. The semiconductor and automotive sectors are the dominant end-users, accounting for approximately xx% and xx% of the market, respectively, driven by the high level of automation in these industries. Within product types, Programmable Logic Controllers (PLCs) and Industrial Robotics represent the largest segments, reflecting the increasing demand for process automation and flexible manufacturing solutions. The Gyeonggi-do region, home to major manufacturing hubs, is the leading geographical area.

- Key Drivers: Government incentives for automation, robust manufacturing sector, high labor costs.

- Dominant Segments: Semiconductors (xx million units), Automotive (xx million units), PLCs (xx million units), Industrial Robotics (xx million units).

- Leading Region: Gyeonggi-do, benefiting from established industrial infrastructure and skilled workforce.

South Korea Factory Automation & Industrial Control Industry Product Landscape

The South Korean factory automation and industrial control market showcases a diverse range of products, from basic sensors and switches to sophisticated robotics systems and AI-powered machine vision solutions. Continuous innovation focuses on improving efficiency, safety, and integration capabilities. The latest advancements include miniaturization, increased connectivity, and the integration of advanced analytics for predictive maintenance. Unique selling propositions center around enhanced reliability, reduced downtime, and improved overall equipment effectiveness (OEE).

Key Drivers, Barriers & Challenges in South Korea Factory Automation & Industrial Control Industry

Key Drivers:

- Rising labor costs are pushing companies to automate processes for enhanced efficiency and reduced operational expenditures.

- Government initiatives supporting Industry 4.0 and smart factory adoption are driving market growth.

- Increasing demand for high-quality products and shorter production cycles fuels the need for advanced automation solutions.

Key Challenges:

- High initial investment costs for automation technologies can be a barrier for smaller companies.

- Skilled labor shortages hinder the seamless implementation and maintenance of automated systems.

- Supply chain disruptions can impact the availability of essential components and increase costs. These disruptions resulted in a xx% increase in component costs in 2022.

Emerging Opportunities in South Korea Factory Automation & Industrial Control Industry

Emerging opportunities lie in the increasing adoption of collaborative robots (cobots) for safer and more flexible manufacturing processes. The integration of artificial intelligence (AI) and machine learning (ML) for predictive maintenance and process optimization represents another significant growth area. Furthermore, the expansion of the smart factory concept, encompassing connectivity and data analytics, provides vast opportunities for system integrators and solution providers. Untapped markets exist within smaller and medium-sized enterprises (SMEs) which are gradually embracing automation solutions.

Growth Accelerators in the South Korea Factory Automation & Industrial Control Industry Industry

Long-term growth will be accelerated by continued technological advancements, particularly in areas such as AI, IoT, and robotics. Strategic partnerships between technology providers and system integrators will be critical for successful market penetration. Government policies encouraging automation and digitalization will play a vital role in fostering market expansion. The expansion into new industries and applications, such as logistics and healthcare, will also contribute significantly to the market's sustained growth.

Key Players Shaping the South Korea Factory Automation & Industrial Control Market

- Omron Electronics Korea Co Ltd

- Kawasaki Robotics

- ABB Korea Co Ltd

- Yokogawa Electric Korea Co Ltd

- Universal Robots AS (Teradyne Inc )

- Honeywell Korea Ltd

- Fuji Electric FA Korea Co Ltd

- Staubli International AG

- Kuka Robotics Korea Co Ltd

- Panasonic Industrial Devices Sales Korea Co Ltd

- Denso Korea Corporation

- Schneider Electric

- Rockwell Automation Inc

- Emerson Electric Korea Ltd

- Mitsubishi Electric Automation Korea Co Ltd

- Korea Fanuc Corporation

- Nidec Corporation

- Epson Korea Co Ltd

- Siemens Korea

- Yaskawa Electric Corporation

Notable Milestones in South Korea Factory Automation & Industrial Control Industry Sector

- 2020: Government announces increased funding for Industry 4.0 initiatives.

- 2021: Several major manufacturers launch large-scale automation projects.

- 2022: Significant investments in AI-powered machine vision systems are made.

- 2023: Several mergers and acquisitions occur within the automation sector.

- 2024: New safety standards related to industrial robotics are introduced.

In-Depth South Korea Factory Automation & Industrial Control Industry Market Outlook

The South Korean factory automation and industrial control market exhibits significant long-term growth potential, fueled by ongoing technological innovation, government support, and a robust manufacturing sector. Strategic opportunities exist for companies focusing on advanced automation solutions, such as AI-powered systems, collaborative robots, and predictive maintenance technologies. Growth will be driven by companies offering integrated solutions and addressing the specific needs of diverse industry sectors, from automotive and semiconductors to food and beverage processing. The market's future success will hinge on adaptability, responsiveness to technological advances, and proactive engagement with evolving industry regulations.

South Korea Factory Automation & Industrial Control Industry Segmentation

-

1. Product Type

- 1.1. Presence Sensing Safety Sensors

- 1.2. Emergency Stop Devices

- 1.3. Safety Controllers/Modules

- 1.4. Safety Mats

- 1.5. Programmable Logic Controllers (PLC)

- 1.6. Human Machine Interface (HMI)

- 1.7. Machine Vision Systems

- 1.8. Industrial Robotics

- 1.9. Sensors and Transmitters

-

1.10. Switches

- 1.10.1. Safety Switches

- 1.10.2. Limit Switches

- 1.10.3. Pushbutton Switches

- 1.10.4. DIP Switches

- 1.11. Relays

- 1.12. Industrial Power Supplies

-

2. End-user

- 2.1. Automotive

- 2.2. Semiconductor

- 2.3. Manufacturing

- 2.4. Oil and Gas

- 2.5. Chemical and Petrochemical

- 2.6. Food and Beverage

- 2.7. Power and Utilities

- 2.8. Other End-users

South Korea Factory Automation & Industrial Control Industry Segmentation By Geography

- 1. South Korea

South Korea Factory Automation & Industrial Control Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Internet of Things (IoT) and Machine-to-Machine Technologies; Increasing Emphasis on Energy Efficiency and Cost Reduction; Exponential Growth of the E-commerce Industry and Customer Expectations

- 3.3. Market Restrains

- 3.3.1. High Up-front Installation Costs and Interoperability Issues; Unavailability for Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Internet of Things (IoT) and Machine-to-Machine Technologies to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Factory Automation & Industrial Control Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Presence Sensing Safety Sensors

- 5.1.2. Emergency Stop Devices

- 5.1.3. Safety Controllers/Modules

- 5.1.4. Safety Mats

- 5.1.5. Programmable Logic Controllers (PLC)

- 5.1.6. Human Machine Interface (HMI)

- 5.1.7. Machine Vision Systems

- 5.1.8. Industrial Robotics

- 5.1.9. Sensors and Transmitters

- 5.1.10. Switches

- 5.1.10.1. Safety Switches

- 5.1.10.2. Limit Switches

- 5.1.10.3. Pushbutton Switches

- 5.1.10.4. DIP Switches

- 5.1.11. Relays

- 5.1.12. Industrial Power Supplies

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Semiconductor

- 5.2.3. Manufacturing

- 5.2.4. Oil and Gas

- 5.2.5. Chemical and Petrochemical

- 5.2.6. Food and Beverage

- 5.2.7. Power and Utilities

- 5.2.8. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Omron Electronics Korea Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kawasaki Robotics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Korea Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yokogawa Electric Korea Co Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Robots AS (Teradyne Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Korea Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuji Electric FA Korea Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Staubli International AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kuka Robotics Korea Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Industrial Devices Sales Korea Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Denso Korea Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Schneider Electric

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Rockwell Automation Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Emerson Electric Korea Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mitsubishi Electric Automation Korea Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Korea Fanuc Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Nidec Corporation

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Epson Korea Co Ltd

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Siemens Korea

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Yaskawa Electric Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Omron Electronics Korea Co Ltd

List of Figures

- Figure 1: South Korea Factory Automation & Industrial Control Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Factory Automation & Industrial Control Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 8: South Korea Factory Automation & Industrial Control Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Factory Automation & Industrial Control Industry?

The projected CAGR is approximately 6.58%.

2. Which companies are prominent players in the South Korea Factory Automation & Industrial Control Industry?

Key companies in the market include Omron Electronics Korea Co Ltd, Kawasaki Robotics, ABB Korea Co Ltd, Yokogawa Electric Korea Co Ltd*List Not Exhaustive, Universal Robots AS (Teradyne Inc ), Honeywell Korea Ltd, Fuji Electric FA Korea Co Ltd, Staubli International AG, Kuka Robotics Korea Co Ltd, Panasonic Industrial Devices Sales Korea Co Ltd, Denso Korea Corporation, Schneider Electric, Rockwell Automation Inc, Emerson Electric Korea Ltd, Mitsubishi Electric Automation Korea Co Ltd, Korea Fanuc Corporation, Nidec Corporation, Epson Korea Co Ltd, Siemens Korea, Yaskawa Electric Corporation.

3. What are the main segments of the South Korea Factory Automation & Industrial Control Industry?

The market segments include Product Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Internet of Things (IoT) and Machine-to-Machine Technologies; Increasing Emphasis on Energy Efficiency and Cost Reduction; Exponential Growth of the E-commerce Industry and Customer Expectations.

6. What are the notable trends driving market growth?

Increasing Adoption of Internet of Things (IoT) and Machine-to-Machine Technologies to Drive the Market.

7. Are there any restraints impacting market growth?

High Up-front Installation Costs and Interoperability Issues; Unavailability for Skilled Workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Factory Automation & Industrial Control Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Factory Automation & Industrial Control Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Factory Automation & Industrial Control Industry?

To stay informed about further developments, trends, and reports in the South Korea Factory Automation & Industrial Control Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence