Key Insights

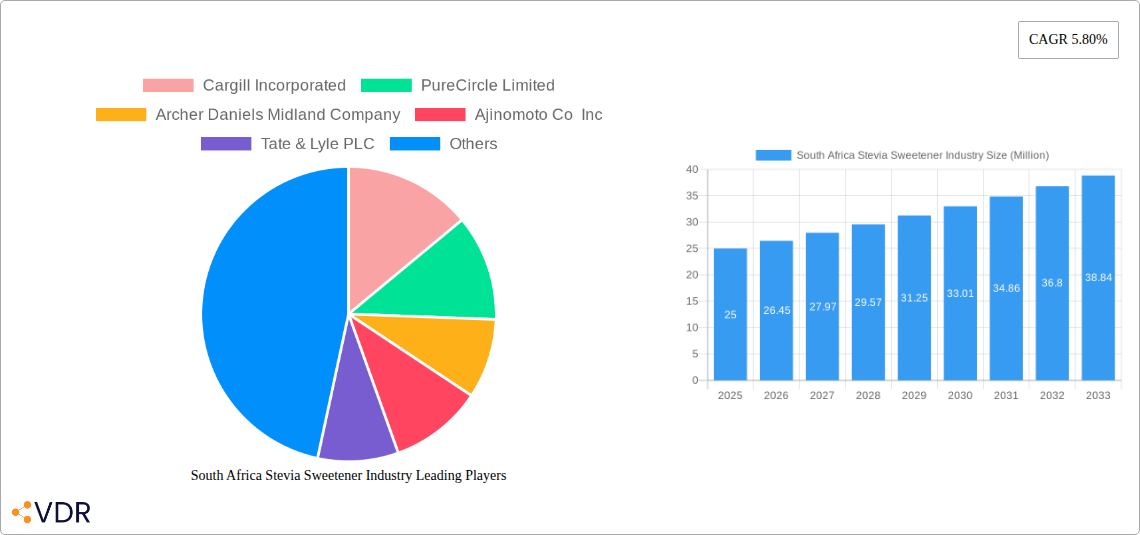

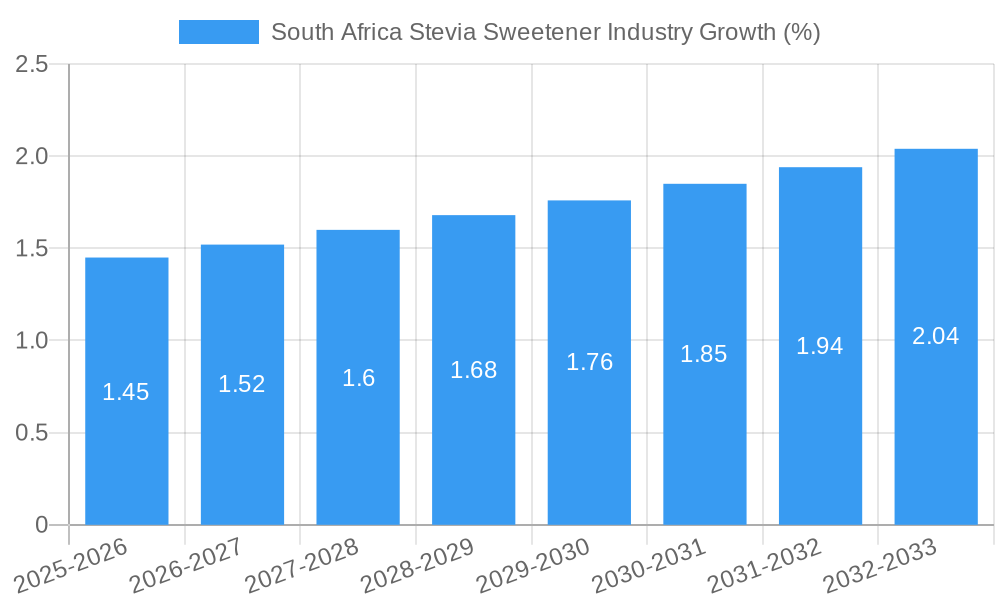

The South African stevia sweetener market, a segment within the broader global stevia market exhibiting a 5.80% CAGR, presents a compelling investment opportunity. While precise market size figures for South Africa are unavailable, we can extrapolate from the global context. Considering the global market's growth and the increasing health consciousness in South Africa, coupled with rising demand for natural sweeteners, we can reasonably project a substantial market size for South Africa, potentially in the tens of millions of dollars by 2025. Key drivers include the growing awareness of the health risks associated with sugar consumption, a surge in demand for healthier food and beverage options, and the increasing preference for natural and low-calorie sweeteners. Furthermore, the expanding food and beverage industry in South Africa, particularly in sectors like confectionery and beverages, fuels the demand for stevia.

However, challenges remain. The relatively high cost of stevia compared to traditional sweeteners could hinder broader adoption, particularly among price-sensitive consumers. Furthermore, consumer education regarding the taste and functionality of stevia is crucial for expanding its market penetration. Successful market penetration hinges on overcoming taste perceptions and effective marketing campaigns highlighting stevia's health benefits. The market is segmented by product type (primarily focusing on high-intensity sweeteners in South Africa given the focus on health) and application (with beverages and confectionery likely representing the largest segments). Major global players like Cargill, PureCircle, and Tate & Lyle are likely present, though their exact market share in South Africa requires further investigation. The forecast period of 2025-2033 suggests a promising trajectory, provided that challenges related to cost and consumer perception are effectively addressed.

South Africa Stevia Sweetener Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa stevia sweetener industry, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends through 2033. It segments the market by product type (Sucrose, Starch Sweeteners and Sugar Alcohols, High Intensity Sweeteners (HIS), Others) and application (Dairy, Bakery, Soups, Sauces and Dressings, Confectionery, Beverages, Others), offering granular insights for industry professionals and investors.

South Africa Stevia Sweetener Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the South African stevia sweetener industry. The market is characterized by a moderate level of concentration, with key players such as Cargill Incorporated, PureCircle Limited, Archer Daniels Midland Company, Ajinomoto Co Inc, Tate & Lyle PLC, Ingredion Incorporated, and GLG Life Tech Corporation holding significant market share. However, the presence of smaller, specialized players also contributes to a dynamic market.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Innovation focuses on improving stevia's taste profile and cost-effectiveness, driving the adoption of advanced extraction and processing technologies. However, challenges remain in achieving consistent sweetness and reducing production costs.

- Regulatory Framework: South African regulations concerning food additives and labeling influence market dynamics. Compliance requirements affect production and marketing strategies.

- Competitive Substitutes: Stevia competes with other sweeteners, including sucrose, high-fructose corn syrup, and artificial sweeteners. The market is influenced by consumer preferences, health concerns, and price sensitivities.

- End-User Demographics: Growing health consciousness and increasing demand for natural sweeteners drive the market's growth, particularly among health-conscious consumers.

- M&A Trends: The number of M&A deals in the South African stevia sweetener industry during 2019-2024 was approximately xx, reflecting consolidation and expansion strategies among key players.

South Africa Stevia Sweetener Industry Growth Trends & Insights

The South African stevia sweetener market experienced robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by increasing consumer demand for natural and healthier food and beverage options. The market is projected to continue its growth trajectory during the forecast period (2025-2033), with an estimated CAGR of xx%. Market penetration for stevia-based sweeteners remains relatively low compared to traditional sweeteners, presenting significant growth potential. Technological advancements, including improved extraction methods and formulation techniques, are further fueling market expansion. Changing consumer behavior, particularly the rising preference for sugar-reduced products, is another critical factor boosting market growth. The market size is projected to reach xx Million units by 2033.

Dominant Regions, Countries, or Segments in South Africa Stevia Sweetener Industry

The South African stevia sweetener market shows significant regional variations in growth and consumption patterns. While data on precise regional breakdowns is limited, the urban centers are likely to exhibit higher consumption rates due to increased purchasing power and higher awareness of health-conscious food choices.

- By Product Type: The High Intensity Sweeteners (HIS) segment is expected to dominate the market due to its intense sweetness and ability to replace larger quantities of sugar. However, the Sucrose segment will retain a significant share owing to its established market presence and affordability.

- By Application: The beverage sector currently represents a large portion of stevia usage, followed by the confectionery and dairy industries. Future growth is anticipated in the bakery and food segments as more stevia-based products are launched.

- Key Drivers: Growing health awareness, increasing demand for natural food additives, and supportive government policies promoting healthy lifestyles are key drivers. Furthermore, investments in research and development are contributing to the development of improved stevia products.

South Africa Stevia Sweetener Industry Product Landscape

The South African stevia sweetener market features a range of products, including stevia extracts, stevia blends, and stevia-based sweeteners. Technological advancements have resulted in improved stevia products with enhanced taste profiles and improved solubility. Key players are focusing on developing innovative formulations that address consumer preferences for natural sweetness and reduced calorie intake. The unique selling propositions (USPs) often focus on the natural origin, low-calorie attributes, and improved taste compared to previous generations of stevia.

Key Drivers, Barriers & Challenges in South Africa Stevia Sweetener Industry

Key Drivers: The rising prevalence of diabetes and obesity is a major driver, alongside increased consumer awareness of sugar's health implications. Government regulations favoring healthy food options and the growing demand for natural and clean-label products further fuel market growth.

Key Challenges: The relatively high price of stevia compared to traditional sweeteners, inconsistent taste profiles in some stevia products, and limited awareness among some consumers represent significant barriers. Supply chain inefficiencies and potential regulatory hurdles also pose challenges.

Emerging Opportunities in South Africa Stevia Sweetener Industry

Untapped opportunities exist in expanding stevia's application beyond established sectors, such as the growing functional food and beverage market. Innovations focusing on improved taste and cost-effectiveness of stevia products also present growth avenues. Education and awareness campaigns can further boost market penetration and increase consumer adoption.

Growth Accelerators in the South Africa Stevia Sweetener Industry Industry

Continued technological advancements in stevia extraction and processing will accelerate growth. Strategic partnerships and collaborations between stevia producers, food and beverage manufacturers, and retailers can broaden market reach and drive adoption. Increased consumer education about stevia's benefits will create further market expansion.

Key Players Shaping the South Africa Stevia Sweetener Industry Market

- Cargill Incorporated

- PureCircle Limited

- Archer Daniels Midland Company

- Ajinomoto Co Inc

- Tate & Lyle PLC

- Ingredion Incorporated

- GLG Life Tech Corporation

*List Not Exhaustive

Notable Milestones in South Africa Stevia Sweetener Industry Sector

- 2020: Launch of a new stevia-based sweetener with enhanced taste profile by a major player.

- 2022: Introduction of stricter labeling regulations for food additives, including stevia-based sweeteners.

- 2023: Successful completion of a significant merger between two key players in the industry. (Specific details to be added based on available data)

In-Depth South Africa Stevia Sweetener Industry Market Outlook

The South African stevia sweetener market exhibits strong growth potential, driven by increasing consumer demand for natural sweeteners and continued technological innovation. Strategic partnerships, product diversification, and focused marketing efforts will play crucial roles in shaping the future of the market. The market is poised for significant expansion during the forecast period, presenting attractive opportunities for investors and industry players alike.

South Africa Stevia Sweetener Industry Segmentation

-

1. Product Type

- 1.1. Sucrose

-

1.2. Starch Sweeteners and Sugar Alcohols

- 1.2.1. Dextrose

- 1.2.2. High Fructose Corn Syrup (HFCS)

- 1.2.3. Maltodextrin

- 1.2.4. Sorbitol

- 1.2.5. Xylitol

- 1.2.6. Others

-

1.3. High Intensity Sweeteners (HIS)

- 1.3.1. Sucralose

- 1.3.2. Aspartame

- 1.3.3. Saccharin

- 1.3.4. Cyclamate

- 1.3.5. Ace-K

- 1.3.6. Neotame

- 1.3.7. Stevia

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Others

South Africa Stevia Sweetener Industry Segmentation By Geography

- 1. South Africa

South Africa Stevia Sweetener Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift towards Natural Sweeteners

- 3.3. Market Restrains

- 3.3.1. Health Concerns Related to Sweetener Consumption

- 3.4. Market Trends

- 3.4.1. Stevia Is The Growing Sweetener Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.2.1. Dextrose

- 5.1.2.2. High Fructose Corn Syrup (HFCS)

- 5.1.2.3. Maltodextrin

- 5.1.2.4. Sorbitol

- 5.1.2.5. Xylitol

- 5.1.2.6. Others

- 5.1.3. High Intensity Sweeteners (HIS)

- 5.1.3.1. Sucralose

- 5.1.3.2. Aspartame

- 5.1.3.3. Saccharin

- 5.1.3.4. Cyclamate

- 5.1.3.5. Ace-K

- 5.1.3.6. Neotame

- 5.1.3.7. Stevia

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Stevia Sweetener Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cargill Incorporated

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PureCircle Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Archer Daniels Midland Company

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ajinomoto Co Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tate & Lyle PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ingredion Incorporated

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GLG Life Tech Corporation*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Cargill Incorporated

List of Figures

- Figure 1: South Africa Stevia Sweetener Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Stevia Sweetener Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: South Africa South Africa Stevia Sweetener Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa South Africa Stevia Sweetener Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Sudan South Africa Stevia Sweetener Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan South Africa Stevia Sweetener Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Uganda South Africa Stevia Sweetener Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda South Africa Stevia Sweetener Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Tanzania South Africa Stevia Sweetener Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania South Africa Stevia Sweetener Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Kenya South Africa Stevia Sweetener Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya South Africa Stevia Sweetener Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa South Africa Stevia Sweetener Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa South Africa Stevia Sweetener Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 25: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 27: South Africa Stevia Sweetener Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Stevia Sweetener Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Stevia Sweetener Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the South Africa Stevia Sweetener Industry?

Key companies in the market include Cargill Incorporated, PureCircle Limited, Archer Daniels Midland Company, Ajinomoto Co Inc, Tate & Lyle PLC, Ingredion Incorporated, GLG Life Tech Corporation*List Not Exhaustive.

3. What are the main segments of the South Africa Stevia Sweetener Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift towards Natural Sweeteners.

6. What are the notable trends driving market growth?

Stevia Is The Growing Sweetener Type.

7. Are there any restraints impacting market growth?

Health Concerns Related to Sweetener Consumption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Stevia Sweetener Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Stevia Sweetener Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Stevia Sweetener Industry?

To stay informed about further developments, trends, and reports in the South Africa Stevia Sweetener Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence