Key Insights

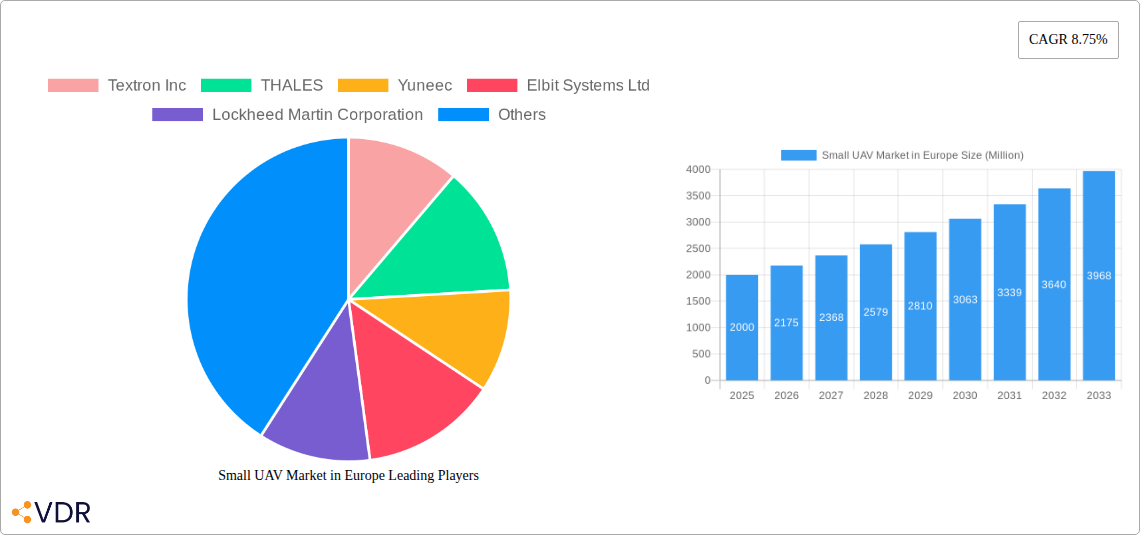

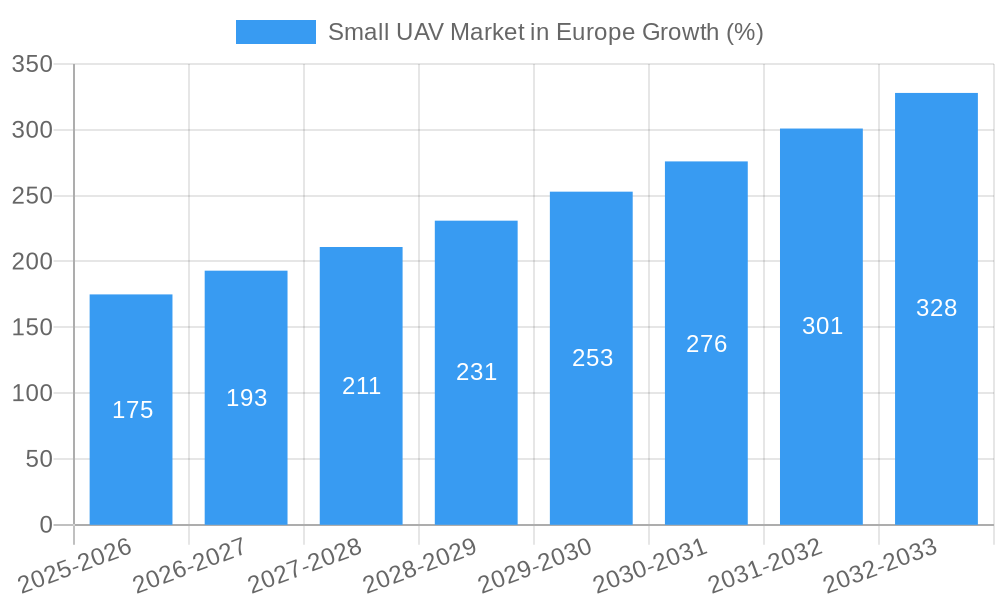

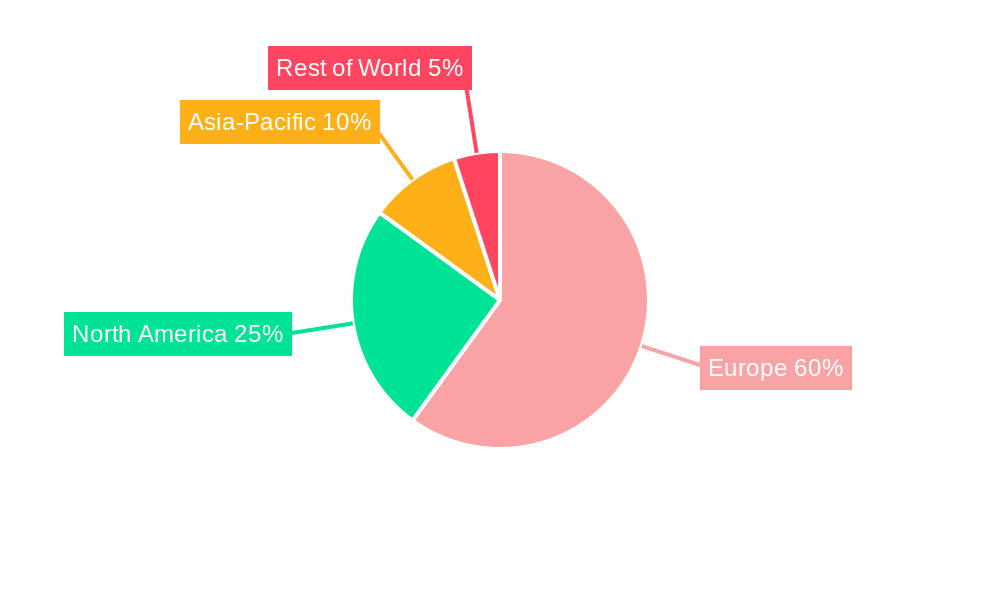

The European small unmanned aerial vehicle (UAV) market is experiencing robust growth, driven by increasing demand across military, law enforcement, and civil applications. The market, currently estimated at €2 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 8.75% from 2025 to 2033. This growth is fueled by several key factors. Technological advancements leading to smaller, more efficient, and affordable UAVs are making them accessible to a wider range of users. Furthermore, the rising adoption of UAVs for surveillance, mapping, delivery, and inspection tasks across various sectors is significantly boosting market expansion. Stringent regulations regarding UAV operation are gradually easing in several European countries, further facilitating market growth. The segment breakdown shows a strong preference for fixed-wing UAVs due to their longer endurance and greater range compared to rotary-wing models. Within size categories, the mini-UAV segment holds the largest share due to its versatility and cost-effectiveness. Germany, France, and the United Kingdom are the leading markets in Europe, benefiting from strong technological infrastructure and high adoption rates across various sectors.

Competition in the European small UAV market is intense, with both established defense contractors like Textron, Thales, and Lockheed Martin, and innovative startups such as Shield AI and Parrot Drones vying for market share. The presence of several strong regional players, such as UAS Europe and Microdrones, indicates a thriving ecosystem. However, challenges remain. Concerns about data privacy and security, along with the need for robust counter-drone technologies to mitigate potential risks, represent significant restraints. Moreover, the market faces challenges related to regulatory compliance and standardization across different European nations. Despite these challenges, the long-term outlook for the European small UAV market remains positive, fueled by ongoing technological innovation, expanding applications, and increasing governmental support for the sector.

Small UAV Market in Europe: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Small Unmanned Aerial Vehicle (UAV) market in Europe, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market is segmented by wing type (fixed-wing, rotary-wing), size (micro, mini, nano), and application (military & law enforcement, civil & commercial). The European Small UAV market is projected to reach xx Million units by 2033.

Small UAV Market in Europe Market Dynamics & Structure

The European small UAV market is characterized by a moderately concentrated landscape with several key players competing fiercely. Market concentration is estimated at xx% in 2025, with the top 5 players holding a significant share. Technological innovation, particularly in areas like AI-powered autonomy, extended flight times, and enhanced sensor capabilities, is a key driver. Regulatory frameworks, varying significantly across European countries, present both opportunities and challenges. Competitive substitutes, such as satellite imagery and traditional aerial surveillance methods, exert some pressure. End-user demographics are expanding, driven by increasing adoption across various sectors. M&A activity has been moderate, with xx deals recorded between 2019 and 2024, primarily focusing on technology integration and market expansion.

- Market Concentration: xx% in 2025 (Top 5 players)

- Key Drivers: Technological innovation (AI, extended flight times), increasing adoption across sectors.

- Challenges: Varying regulatory frameworks, competition from substitute technologies.

- M&A Activity: xx deals (2019-2024)

Small UAV Market in Europe Growth Trends & Insights

The European small UAV market has witnessed significant growth during the historical period (2019-2024), expanding at a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is expected to continue during the forecast period (2025-2033), driven by factors such as increasing demand from military and civilian applications, advancements in drone technology, and supportive government policies. Market penetration is currently at xx% and is projected to reach xx% by 2033. Technological disruptions, such as the development of advanced sensor technologies and improved battery life, are fueling market expansion. Consumer behavior is shifting towards more sophisticated and user-friendly drones, driving demand for high-performance and specialized models.

Dominant Regions, Countries, or Segments in Small UAV Market in Europe

The military and law enforcement application segment dominates the market, currently holding a xx% market share, followed by the civil and commercial sector at xx%. This is largely driven by increased government spending on defense and security and the growing need for efficient surveillance and reconnaissance capabilities. Among wing types, rotary-wing drones currently hold a larger market share (xx%) compared to fixed-wing drones (xx%), primarily due to their maneuverability and versatility. Within size categories, mini and micro drones are the most prevalent, accounting for xx% and xx% of the market respectively. Germany and France emerge as leading countries, fueled by strong domestic industries and government initiatives.

- Leading Segment: Military and Law Enforcement (xx% market share)

- Key Drivers: Increased government spending, need for surveillance and reconnaissance

- Leading Wing Type: Rotary-wing (xx% market share)

- Leading Size Category: Mini and Micro (xx% and xx% market share respectively)

- Leading Countries: Germany, France

Small UAV Market in Europe Product Landscape

The small UAV market showcases a diverse range of products, from basic consumer drones to highly sophisticated military-grade systems. Recent innovations focus on enhancing payload capacity, flight endurance, and autonomous capabilities. Integration of advanced sensors, including thermal cameras, LiDAR, and high-resolution cameras, is expanding applications. Unique selling propositions include advanced flight control systems, obstacle avoidance technology, and data analytics platforms. These technological advancements are enabling drones to perform complex tasks across various industries.

Key Drivers, Barriers & Challenges in Small UAV Market in Europe

Key Drivers:

- Increasing demand across various sectors (e.g., agriculture, infrastructure inspection)

- Technological advancements (improved battery life, autonomous flight)

- Government initiatives and supportive regulations (in certain regions)

Key Barriers & Challenges:

- Stringent regulatory hurdles and varying standards across different European countries

- Supply chain disruptions and component shortages

- Concerns around data privacy and security

- Competition from established players and new entrants

- High initial investment costs for advanced systems. The impact of these challenges is estimated to reduce overall market growth by xx% by 2033.

Emerging Opportunities in Small UAV Market in Europe

Significant opportunities exist in areas like beyond-visual-line-of-sight (BVLOS) operations, drone delivery services, and advanced data analytics. Untapped markets include precision agriculture, environmental monitoring, and infrastructure inspection in remote or difficult-to-access areas. The growing demand for autonomous drone solutions and specialized applications presents further growth potential. Evolving consumer preferences towards user-friendly and feature-rich drones create opportunities for innovative product development and service offerings.

Growth Accelerators in the Small UAV Market in Europe Industry

Technological breakthroughs in battery technology, AI-powered autonomy, and sensor integration are set to accelerate market growth. Strategic partnerships between drone manufacturers, software developers, and data analytics companies are fostering innovation. Expansion into new applications and markets, coupled with supportive government policies promoting drone adoption, will further drive long-term growth.

Key Players Shaping the Small UAV Market in Europe Market

- Textron Inc

- THALES

- Yuneec

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Shield AI

- AeroVironment Inc

- Parrot Drones SAS

- SZ DJI Technology Co Ltd

- UAS Europe AB

- DELAIR SAS

- Microdrones GmbH

- Northrop Grumman Corporation

- Teledyne FLIR LLC

Notable Milestones in Small UAV Market in Europe Sector

- January 2023: Elbit Systems Ltd. secures a contract with the UK to supply Magni-X drones to the British Army, boosting the adoption of micro-UAS in military operations.

- May 2022: The French defense innovation agency (AID) launches the Larinae and Colibri projects, focusing on the development of low-cost small attack drones, signifying a shift towards more affordable and accessible military UAV technologies.

In-Depth Small UAV Market in Europe Market Outlook

The European small UAV market is poised for substantial growth over the coming years, driven by ongoing technological advancements, expanding applications, and supportive regulatory frameworks in key regions. Strategic partnerships, increased investment in R&D, and the emergence of innovative business models will further unlock the market's vast potential. Opportunities abound for companies focusing on specialized applications, advanced autonomy features, and robust data analytics capabilities. The continued expansion of the civil and commercial sectors, coupled with the ongoing modernization of military and law enforcement capabilities, ensures a bright outlook for the future.

Small UAV Market in Europe Segmentation

-

1. Wing Type

- 1.1. Fixed-wing

- 1.2. Rotary-wing

-

2. Size

- 2.1. Micro

- 2.2. Mini

- 2.3. Nano

-

3. Application

- 3.1. Military and Law Enforcement

- 3.2. Civil and Commercial

Small UAV Market in Europe Segmentation By Geography

-

1. Country

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Rest of Europe

Small UAV Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. The Rotary-wing Segment is Projected to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Wing Type

- 5.1.1. Fixed-wing

- 5.1.2. Rotary-wing

- 5.2. Market Analysis, Insights and Forecast - by Size

- 5.2.1. Micro

- 5.2.2. Mini

- 5.2.3. Nano

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Military and Law Enforcement

- 5.3.2. Civil and Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Country

- 5.1. Market Analysis, Insights and Forecast - by Wing Type

- 6. Germany Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7. France Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8. Italy Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Textron Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 THALES

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Yuneec

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Elbit Systems Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lockheed Martin Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Shield AI

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AeroVironment Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Parrot Drones SAS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SZ DJI Technology Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 UAS Europe AB

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 DELAIR SAS

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Microdrones GmbH

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Northrop Grumman Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Teledyne FLIR LLC

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Textron Inc

List of Figures

- Figure 1: Small UAV Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Small UAV Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Small UAV Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Small UAV Market in Europe Revenue Million Forecast, by Wing Type 2019 & 2032

- Table 3: Small UAV Market in Europe Revenue Million Forecast, by Size 2019 & 2032

- Table 4: Small UAV Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Small UAV Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Small UAV Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Small UAV Market in Europe Revenue Million Forecast, by Wing Type 2019 & 2032

- Table 15: Small UAV Market in Europe Revenue Million Forecast, by Size 2019 & 2032

- Table 16: Small UAV Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Small UAV Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Small UAV Market in Europe?

The projected CAGR is approximately 8.75%.

2. Which companies are prominent players in the Small UAV Market in Europe?

Key companies in the market include Textron Inc, THALES, Yuneec, Elbit Systems Ltd, Lockheed Martin Corporation, Shield AI, AeroVironment Inc, Parrot Drones SAS, SZ DJI Technology Co Ltd, UAS Europe AB, DELAIR SAS, Microdrones GmbH, Northrop Grumman Corporation, Teledyne FLIR LLC.

3. What are the main segments of the Small UAV Market in Europe?

The market segments include Wing Type, Size, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

The Rotary-wing Segment is Projected to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

In January 2023, Elbit Systems Ltd. announced a contract with the UK to equip the British Army with Magni-X drones. The Defence Ministry will receive the micro-unmanned aerial system as part of a transaction with the subordinate Defence Equipment and Support agency's Future Capability Group. The deal is part of the United Kingdom's efforts to expand the use of drones in the Army's Human Machine Teaming initiative.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Small UAV Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Small UAV Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Small UAV Market in Europe?

To stay informed about further developments, trends, and reports in the Small UAV Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence