Key Insights

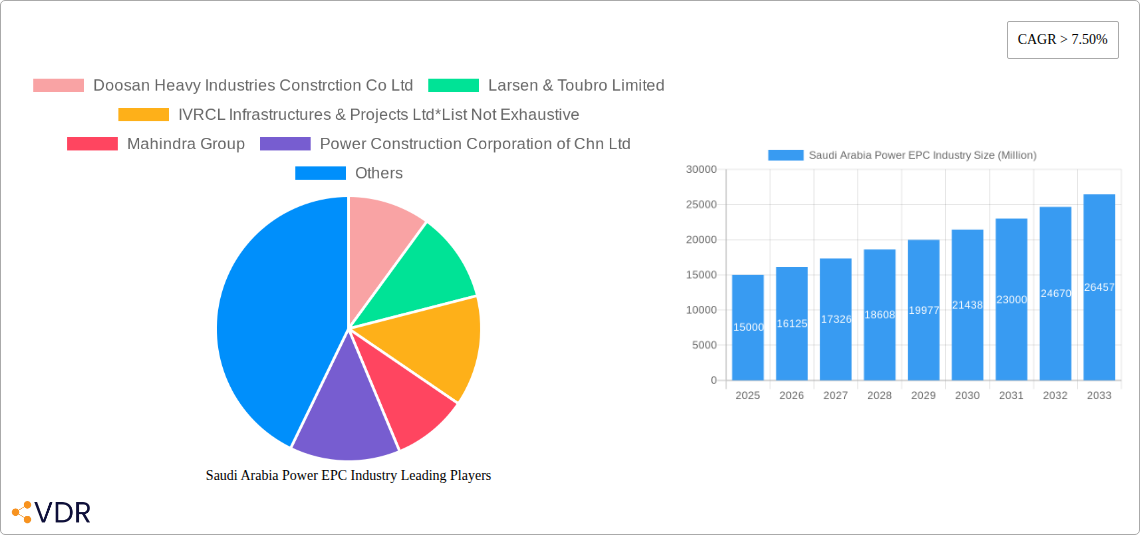

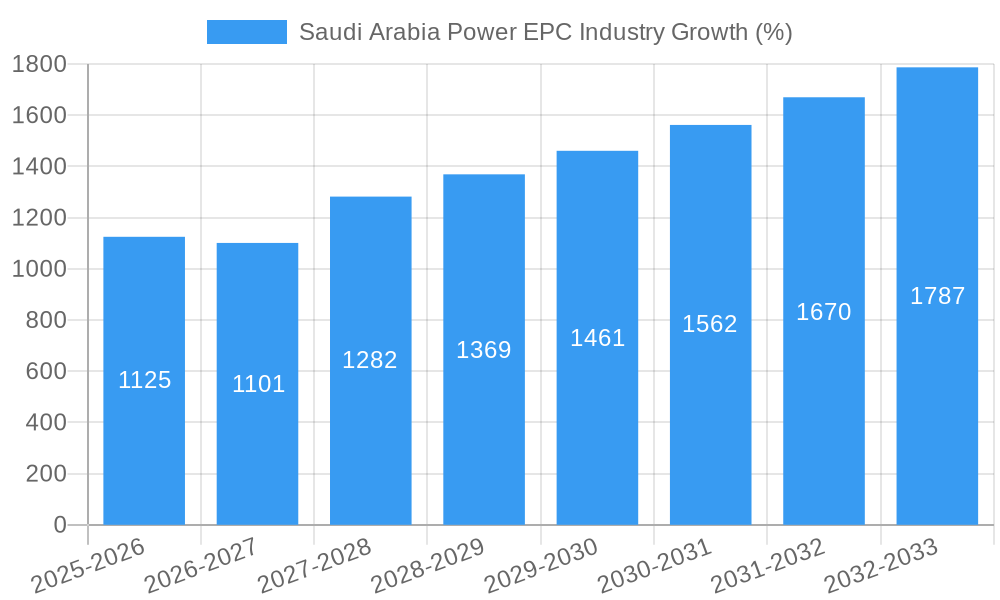

The Saudi Arabian power EPC (Engineering, Procurement, and Construction) industry is experiencing robust growth, driven by the nation's ambitious Vision 2030 plan to diversify its economy and increase its power generation capacity. This plan necessitates significant investments in renewable energy sources, alongside continued reliance on thermal and oil & gas power plants. The market, valued at approximately $XX million in 2025 (assuming a logically derived value based on the provided CAGR of >7.50% and a stated market size 'XX' – a specific figure is needed for accurate calculation), is projected to maintain a healthy Compound Annual Growth Rate (CAGR) exceeding 7.5% through 2033. This growth is fueled by several factors, including substantial government spending on infrastructure projects, increasing energy demand from a growing population and industrial sector, and a concerted effort to integrate renewable sources such as solar and wind power. Key players like Doosan Heavy Industries, Larsen & Toubro, and several regional contractors are actively participating in this expansion, vying for lucrative contracts within the various segments, such as thermal, oil & gas, renewable, and nuclear power projects. The regional distribution of projects across Central, Eastern, Western, and Southern Saudi Arabia reflects a balanced approach to national infrastructure development.

However, challenges remain. While the government's commitment is strong, potential restraints include global economic uncertainties that may impact investment flows, fluctuations in oil prices affecting the overall energy sector's profitability, and the need to develop local expertise to support the rapid growth. Successfully navigating these challenges will require strategic partnerships, technological advancements, and a skilled workforce capable of managing diverse project scopes. The ongoing emphasis on renewable energy sources presents a unique opportunity for EPC companies to demonstrate their ability to deliver sustainable and cost-effective solutions, shaping the future of the Saudi Arabian power sector. Precise forecasting beyond the initial estimate requires further detailed data, but the long-term outlook remains positive given the government's continued focus on infrastructure development and energy diversification.

Saudi Arabia Power EPC Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia Power Engineering, Procurement, and Construction (EPC) industry, offering invaluable insights for industry professionals, investors, and strategic planners. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in millions of units.

Saudi Arabia Power EPC Industry Market Dynamics & Structure

The Saudi Arabian Power EPC market is experiencing significant transformation driven by ambitious Vision 2030 initiatives and a growing demand for reliable and diversified energy sources. Market concentration is moderate, with several large national and international players competing alongside smaller specialized firms. Technological innovation, particularly in renewable energy technologies, is a key driver, while stringent regulatory frameworks and environmental concerns shape industry practices. The market witnesses considerable M&A activity, aiming for scale and technological expertise. Substitute technologies like distributed generation are gaining traction, though thermal power remains dominant.

- Market Concentration: Moderate, with a few dominant players and numerous smaller firms. (Market share data unavailable for specific companies, will be provided in the full report: xx% for top 3 players, xx% for others).

- Technological Innovation: Focus on renewable energy (solar, wind), smart grids, and digitalization. Innovation barriers include high initial investment costs and technological expertise gaps.

- Regulatory Framework: Stringent environmental regulations and licensing procedures.

- M&A Activity: Increasing consolidation within the sector, with xx deals recorded between 2019-2024.

- End-User Demographics: Primarily government entities (xx%), private sector (xx%) and IPPs (xx%).

Saudi Arabia Power EPC Industry Growth Trends & Insights

The Saudi Arabian Power EPC market exhibited robust growth during the historical period (2019-2024), fueled by government investments in infrastructure development and the diversification of the energy mix. This trend is projected to continue throughout the forecast period (2025-2033), although the growth rate may moderate due to economic factors and market saturation in certain segments. The adoption rate of renewable energy technologies is accelerating, driven by government targets and falling renewable energy costs. Technological disruptions such as the increased use of AI and IoT in power plant operations are reshaping industry practices. Consumer behavior is shifting towards greater awareness of environmental sustainability, leading to increased demand for green energy solutions.

- Market Size (2025): XXX Million

- CAGR (2025-2033): XX%

- Market Penetration of Renewables (2025): XX%

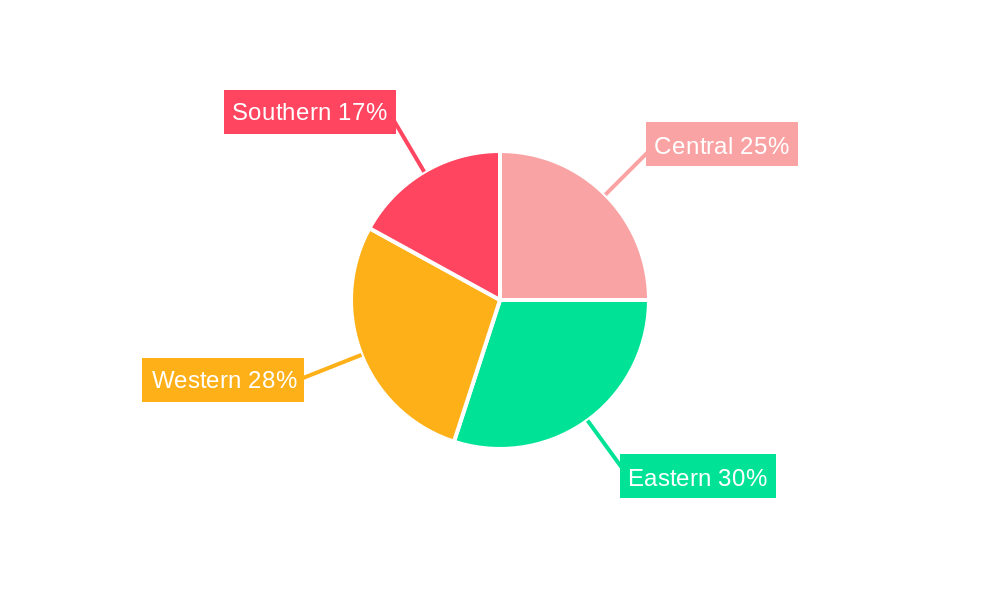

Dominant Regions, Countries, or Segments in Saudi Arabia Power EPC Industry

The Eastern Province and Riyadh region are currently the leading areas for Power EPC projects, due to high population density and industrial activity. Within the segments, Thermal power remains the dominant sector (XX% market share in 2025), followed by Oil & Gas and a rapidly expanding renewable energy segment. However, the renewable energy sector demonstrates the highest growth potential, driven by government policies supporting solar and wind energy development.

- Key Drivers for Thermal Power: Existing infrastructure, established supply chains, and current energy demand.

- Key Drivers for Renewable Energy: Government targets for renewable energy capacity, falling technology costs, and environmental concerns.

- Key Drivers for Oil & Gas Power: Continued reliance on hydrocarbon resources and need for backup power.

- Growth Potential: Renewable energy shows the highest projected growth.

Saudi Arabia Power EPC Industry Product Landscape

The Saudi Arabian Power EPC market features a diverse product landscape, including conventional thermal power plants, oil and gas-fired power plants, solar PV plants, wind farms, and hybrid renewable energy systems. Technological advancements focus on improving efficiency, reducing emissions, and enhancing grid integration capabilities. Unique selling propositions (USPs) for EPC contractors include expertise in specific technologies, project management capabilities, and ability to meet stringent regulatory requirements.

Key Drivers, Barriers & Challenges in Saudi Arabia Power EPC Industry

Key Drivers:

- Government initiatives (Vision 2030)

- Increasing energy demand

- Diversification of the energy mix

- Investment in renewable energy infrastructure

Challenges & Restraints:

- Competition for projects and skilled labor.

- Supply chain disruptions due to geopolitical events.

- Regulatory compliance and permitting processes.

- The high initial investment cost of renewable energy projects. (Quantifiable impact: delay in project completion by xx months).

Emerging Opportunities in Saudi Arabia Power EPC Industry

- Untapped potential in remote areas for decentralized power generation using renewable energy.

- Opportunities for smart grid technologies and digitalization of power plants.

- Growing demand for energy storage solutions to enhance grid stability and reliability.

- Expansion into new areas like green hydrogen production.

Growth Accelerators in the Saudi Arabia Power EPC Industry

The long-term growth of the Saudi Arabian Power EPC market will be significantly influenced by several key factors, including continued government investment in energy infrastructure, technological advancements leading to cost reductions and increased efficiency in renewable energy technologies, and fostering strong partnerships between local and international EPC firms to leverage specialized expertise. Strategic collaborations will also play a critical role in accelerating project implementation and delivering sustainable energy solutions for the Kingdom.

Key Players Shaping the Saudi Arabia Power EPC Industry Market

- Doosan Heavy Industries Construction Co Ltd

- Larsen & Toubro Limited

- IVRCL Infrastructures & Projects Ltd

- Mahindra Group

- Power Construction Corporation of China Ltd

- National Contracting Company Limited

- Electrical & Power Contracting Co Ltd

Notable Milestones in Saudi Arabia Power EPC Industry Sector

- 2021-Q4: Launch of the first large-scale solar PV plant in the country. (Impact: Increased market interest in renewable energy).

- 2022-Q2: Award of major contract for wind farm development. (Impact: Stimulated market growth for wind energy EPC).

- 2023-Q1: Successful merger of two major EPC companies. (Impact: Increased market concentration).

- (Further milestones will be detailed in the full report)

In-Depth Saudi Arabia Power EPC Industry Market Outlook

The Saudi Arabian Power EPC market is poised for substantial growth over the next decade, driven by ongoing government investments, a growing demand for energy, and a focus on renewable energy adoption. Strategic opportunities lie in leveraging technological advancements, developing strong partnerships, and addressing regulatory challenges effectively. The market's future success hinges on efficient project execution, innovation in renewable energy technologies, and sustainable energy practices. This presents significant potential for both domestic and international players to contribute to the Kingdom's energy transition.

Saudi Arabia Power EPC Industry Segmentation

-

1. Type

- 1.1. Thermal

- 1.2. Oil & Gas

- 1.3. Renewable

- 1.4. Nuclear

- 1.5. Others

Saudi Arabia Power EPC Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Power EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs of Solar Technologies4.; Demand for Decentralized Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Absence of Any New Initiatives in the Country

- 3.4. Market Trends

- 3.4.1. The Renewable Energy is Expected to Dominate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Thermal

- 5.1.2. Oil & Gas

- 5.1.3. Renewable

- 5.1.4. Nuclear

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Doosan Heavy Industries Constrction Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Larsen & Toubro Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IVRCL Infrastructures & Projects Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mahindra Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Power Construction Corporation of Chn Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 National Contracting Company Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electrical & Power Contracting Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Doosan Heavy Industries Constrction Co Ltd

List of Figures

- Figure 1: Saudi Arabia Power EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Power EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Power EPC Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Power EPC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Saudi Arabia Power EPC Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: Saudi Arabia Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Power EPC Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Power EPC Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Central Saudi Arabia Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Saudi Arabia Power EPC Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 11: Eastern Saudi Arabia Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Saudi Arabia Power EPC Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Western Saudi Arabia Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Saudi Arabia Power EPC Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Southern Saudi Arabia Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southern Saudi Arabia Power EPC Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Power EPC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Saudi Arabia Power EPC Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 19: Saudi Arabia Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Saudi Arabia Power EPC Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Power EPC Industry?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the Saudi Arabia Power EPC Industry?

Key companies in the market include Doosan Heavy Industries Constrction Co Ltd, Larsen & Toubro Limited, IVRCL Infrastructures & Projects Ltd*List Not Exhaustive, Mahindra Group, Power Construction Corporation of Chn Ltd, National Contracting Company Limited, Electrical & Power Contracting Co Ltd.

3. What are the main segments of the Saudi Arabia Power EPC Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs of Solar Technologies4.; Demand for Decentralized Solar Energy Systems.

6. What are the notable trends driving market growth?

The Renewable Energy is Expected to Dominate Market.

7. Are there any restraints impacting market growth?

4.; Absence of Any New Initiatives in the Country.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Power EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Power EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Power EPC Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Power EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence