Key Insights

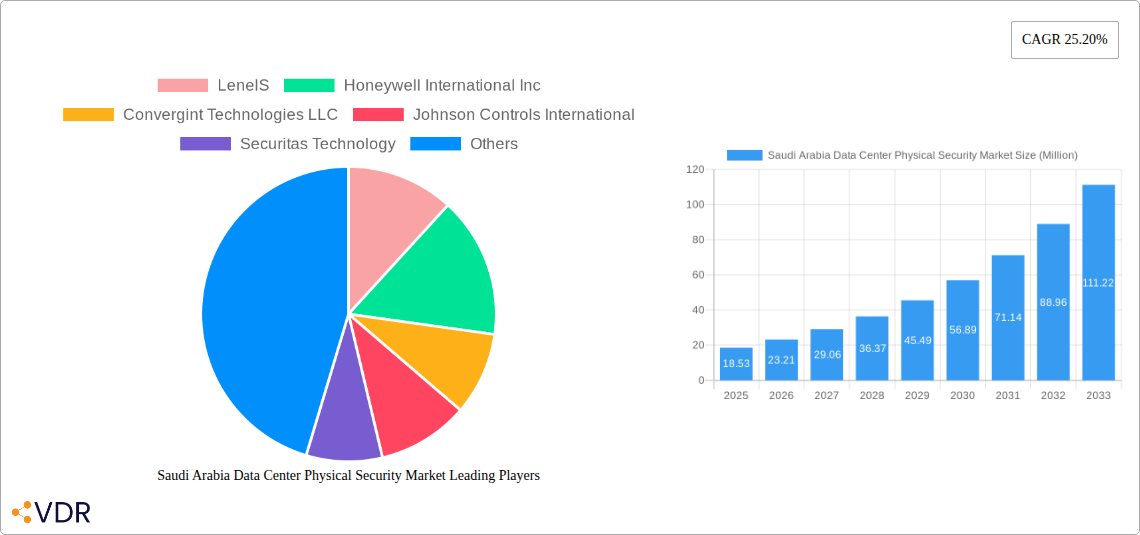

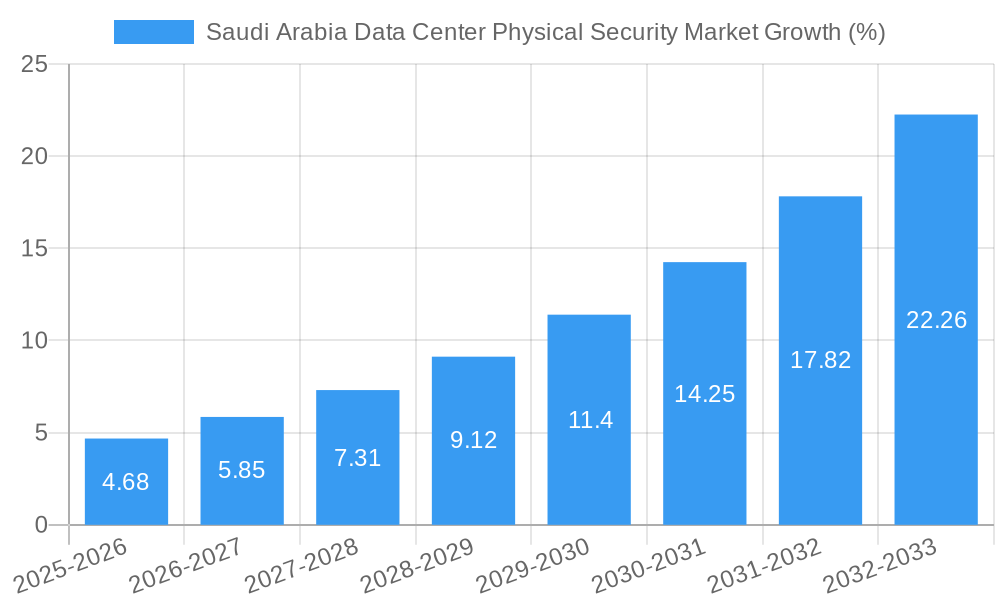

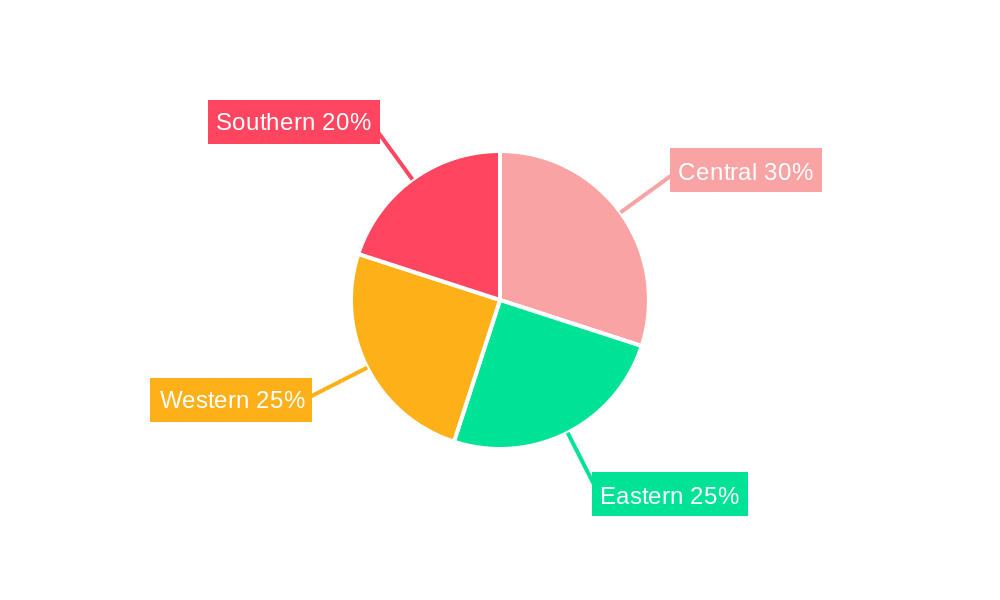

The Saudi Arabian data center physical security market is experiencing robust growth, projected to reach \$18.53 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 25.20% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the Kingdom's ongoing Vision 2030 initiative is fueling significant investments in digital infrastructure, leading to a surge in data center construction and an increased need for robust security solutions. Secondly, the growing adoption of cloud computing and the rise of big data are creating a heightened awareness of data center vulnerabilities and the critical need for comprehensive physical security measures. This demand is further amplified by stringent government regulations regarding data protection and cybersecurity, pushing organizations to prioritize advanced security technologies. The market is segmented by service type (consulting, professional, and system integration), end-user (IT & Telecom, BFSI, Government, Healthcare, and others), and solution type (video surveillance, access control, and other solutions like mantraps and fences). Key players like LenelS, Honeywell, and Johnson Controls are actively competing in this expanding market, offering a range of sophisticated solutions to meet diverse security needs. The regional distribution across Saudi Arabia (Central, Eastern, Western, and Southern regions) suggests a geographically diverse market with opportunities for expansion in all areas. The robust growth trajectory is expected to continue throughout the forecast period, driven by sustained investment in digital infrastructure and heightened awareness of security risks.

The competitive landscape is characterized by both international and local players, indicating a mix of established expertise and emerging local businesses. The market's segmentation reflects the diverse requirements of different industry sectors. For example, the BFSI sector typically demands highly secure solutions, while the healthcare sector focuses on solutions ensuring patient data privacy. The ongoing digital transformation within Saudi Arabia provides a fertile ground for continued expansion, with a significant demand for advanced technologies such as AI-powered video analytics and integrated security systems. The government's role as a major end-user, coupled with its proactive investment in cybersecurity infrastructure, further strengthens the growth outlook for the Saudi Arabian data center physical security market. Future market expansion will likely be driven by the adoption of more sophisticated technologies like biometric authentication, advanced threat detection, and proactive security monitoring.

Saudi Arabia Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia data center physical security market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by service type (Consulting Services, Professional Services, System Integration Services), end-user (IT & Telecommunication, BFSI, Government, Healthcare, Other End Users), and solution type (Video Surveillance, Access Control Solutions, Mantraps, Fences, and Monitoring Solutions). The market is expected to reach xx Million by 2033.

Saudi Arabia Data Center Physical Security Market Dynamics & Structure

The Saudi Arabian data center physical security market is experiencing significant growth driven by increasing digitalization, stringent government regulations, and rising investments in data center infrastructure. Market concentration is moderately high, with a few major international players dominating alongside regional companies. Technological innovation, particularly in AI-powered surveillance and biometrics, is a key driver, while regulatory frameworks focusing on data protection and cybersecurity are shaping market practices. Competitive product substitutes are limited, although cost-effective solutions are emerging. The end-user demographic is diverse, with strong demand from the IT & Telecommunication, BFSI, and Government sectors. M&A activity is moderate, with strategic partnerships becoming increasingly prevalent.

- Market Concentration: Moderately high, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AI-powered video analytics, biometric access control, and advanced perimeter security solutions are key innovation drivers.

- Regulatory Framework: Stringent data protection laws and cybersecurity regulations are influencing security investments.

- Competitive Substitutes: Limited substitutes, but cost-effective solutions pose a potential threat.

- End-User Demographics: IT & Telecommunication, BFSI, and Government sectors are major drivers of market demand.

- M&A Trends: Moderate M&A activity, with a focus on strategic partnerships for technology integration. xx M&A deals recorded between 2019-2024.

Saudi Arabia Data Center Physical Security Market Growth Trends & Insights

The Saudi Arabia data center physical security market has witnessed consistent growth over the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to the Vision 2030 initiative, which promotes digital transformation and infrastructure development. The increasing adoption of cloud computing and the rise of data-intensive applications are further fueling market expansion. Technological disruptions, such as the adoption of AI and IoT-enabled security systems, are accelerating market transformation, while consumer behavior is shifting towards more sophisticated and integrated security solutions. Market penetration of advanced security solutions remains relatively low, presenting significant opportunities for growth. The market is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in Saudi Arabia Data Center Physical Security Market

The Riyadh region dominates the Saudi Arabia data center physical security market, driven by high concentration of data centers and government infrastructure. Within the segments, the IT and Telecommunication sector holds the largest market share, followed by the BFSI and Government sectors. Among service types, system integration services are witnessing high demand. Access control solutions are the leading segment in terms of solution type, followed closely by video surveillance. These segments are driven by the increasing need for robust security systems to safeguard sensitive data and protect critical infrastructure.

- Key Drivers (Riyadh Region): High concentration of data centers, robust government initiatives, and strong private sector investment.

- Key Drivers (IT & Telecommunication): Growing data center deployments, increasing cyber threats, and stringent data protection regulations.

- Key Drivers (BFSI): Strict compliance requirements, increasing fraud attempts, and the need to protect sensitive financial information.

- Key Drivers (System Integration Services): Demand for integrated security solutions and the need for specialized expertise.

- Key Drivers (Access Control Solutions): Growing concerns regarding unauthorized access and the need for robust identity verification.

Saudi Arabia Data Center Physical Security Market Product Landscape

The market offers a diverse range of products including video surveillance systems with advanced analytics, biometric access control systems, and sophisticated perimeter security solutions. Recent innovations include AI-powered threat detection, automated incident response systems, and cloud-based security management platforms. These advancements are enhancing the efficiency and effectiveness of data center security, improving overall security posture, and reducing operational costs. Unique selling propositions often center around ease of integration, scalability, and advanced analytical capabilities.

Key Drivers, Barriers & Challenges in Saudi Arabia Data Center Physical Security Market

Key Drivers:

- Government initiatives supporting digital transformation and cybersecurity.

- Increasing adoption of cloud computing and data center expansion.

- Growing concerns regarding cyber threats and data breaches.

Challenges & Restraints:

- High initial investment costs associated with implementing advanced security systems.

- Skill gap in managing and maintaining advanced security technologies.

- Regulatory complexities and compliance requirements.

Emerging Opportunities in Saudi Arabia Data Center Physical Security Market

Emerging opportunities exist in leveraging AI and IoT for predictive security, integrating advanced analytics for threat intelligence, and deploying cybersecurity solutions for cloud-based data centers. The untapped potential of smart city initiatives and increasing adoption of edge computing also present significant opportunities for expansion.

Growth Accelerators in the Saudi Arabia Data Center Physical Security Market Industry

Strategic partnerships between technology providers and system integrators are driving market expansion. Technological advancements in AI, IoT, and cloud computing are further accelerating market growth. Furthermore, government initiatives promoting digital transformation and cybersecurity are creating a favorable environment for investment and growth.

Key Players Shaping the Saudi Arabia Data Center Physical Security Market Market

- LenelS

- Honeywell International Inc

- Convergint Technologies LLC

- Johnson Controls International

- Securitas Technology

- Siemens AG

- Schneider Electric SE

- Ctelecoms

- Bosch Sicherheitssysteme GmbH

- 3S System Security Solutions Co

- List Not Exhaustive

Notable Milestones in Saudi Arabia Data Center Physical Security Market Sector

- September 2023: Johnson Controls announced its new OpenBlue Service, enhancing building safety and optimizing security investments.

- August 2023: Metrasens partnered with Convergint, expanding access to advanced detection systems.

In-Depth Saudi Arabia Data Center Physical Security Market Outlook

The Saudi Arabia data center physical security market is poised for sustained growth, driven by the ongoing digital transformation and increasing focus on cybersecurity. Strategic investments in advanced technologies and proactive security measures will be crucial for long-term success. Opportunities exist for companies to capitalize on the growing demand for integrated solutions and to leverage innovative technologies to address emerging security challenges.

Saudi Arabia Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others (

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT and Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Saudi Arabia Data Center Physical Security Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. Operational and Return On Investment Concerns

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others (

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT and Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Central Saudi Arabia Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 LenelS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Convergint Technologies LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Johnson Controls International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Securitas Technology

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ctelecoms

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bosch Sicherheitssysteme GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3S System Security Solutions Co *List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LenelS

List of Figures

- Figure 1: Saudi Arabia Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 12: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 13: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Data Center Physical Security Market?

The projected CAGR is approximately 25.20%.

2. Which companies are prominent players in the Saudi Arabia Data Center Physical Security Market?

Key companies in the market include LenelS, Honeywell International Inc, Convergint Technologies LLC, Johnson Controls International, Securitas Technology, Siemens AG, Schneider Electric SE, Ctelecoms, Bosch Sicherheitssysteme GmbH, 3S System Security Solutions Co *List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Operational and Return On Investment Concerns.

8. Can you provide examples of recent developments in the market?

September 2023: Johnson Controls announced its new OpenBlue Service, ensuring security device performance. It is designed to help customers improve building safety, manage risk, and maximize the value of investments made in security technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence