Key Insights

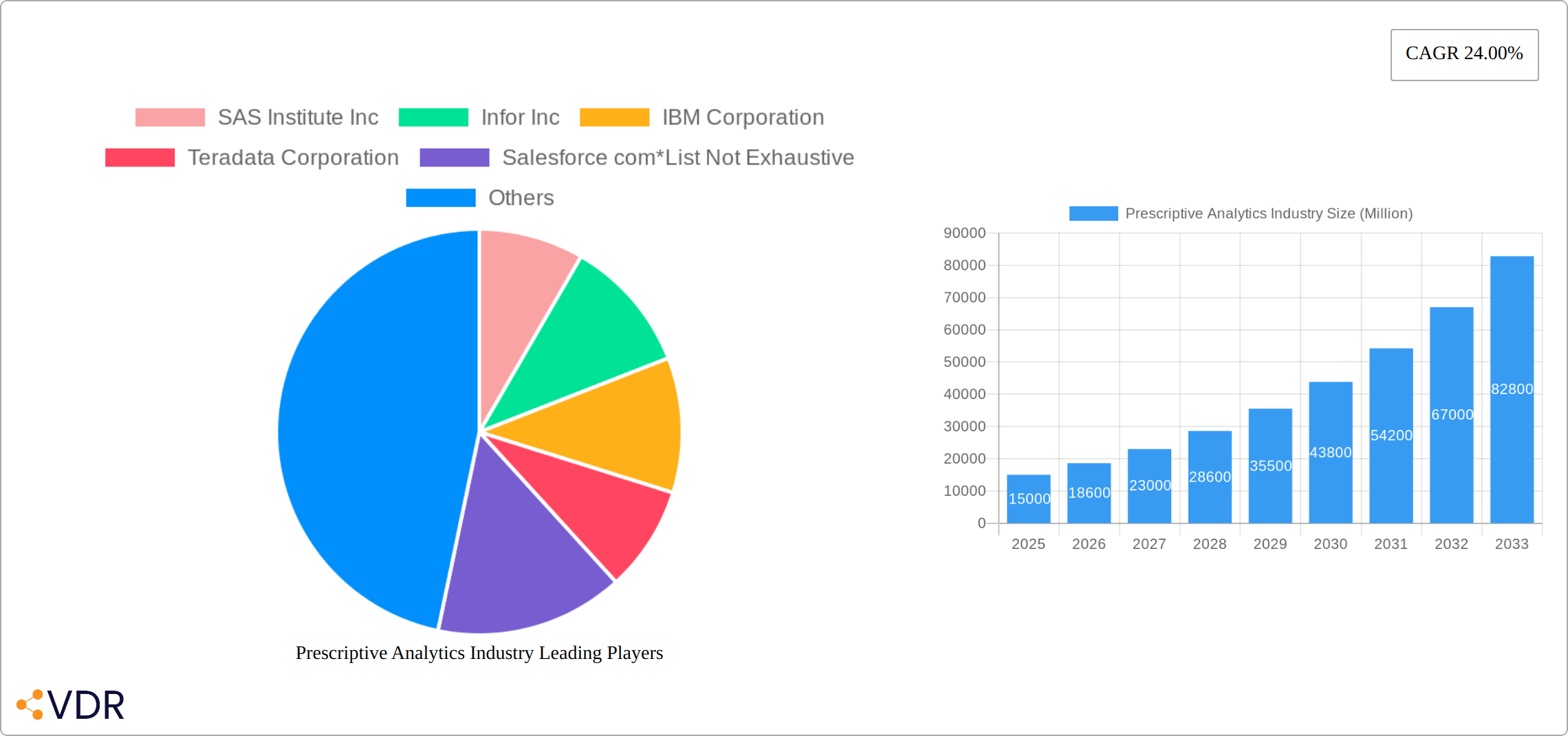

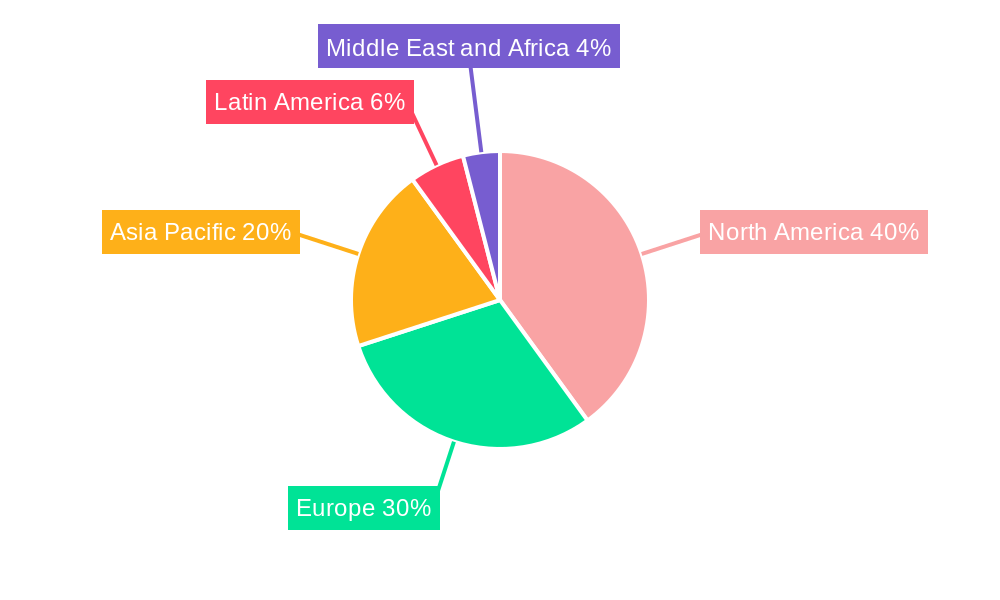

The prescriptive analytics market is experiencing robust growth, fueled by the increasing need for businesses to make proactive, data-driven decisions. A compound annual growth rate (CAGR) of 24% from 2019 to 2024 suggests a significant expansion, and this momentum is expected to continue throughout the forecast period (2025-2033). Key drivers include the rising volume and variety of data available, advancements in artificial intelligence (AI) and machine learning (ML) algorithms, and a growing demand for improved operational efficiency and optimized resource allocation across diverse industries. The BFSI (Banking, Financial Services, and Insurance), healthcare, and retail sectors are significant adopters, leveraging prescriptive analytics for risk management, personalized medicine, and supply chain optimization, respectively. While data security concerns and the need for skilled professionals represent potential restraints, the overall market outlook remains exceptionally positive. The competitive landscape is dynamic, with established players like SAS, IBM, and Oracle competing alongside emerging specialized vendors. Geographic distribution shows a strong presence in North America and Europe, with the Asia-Pacific region poised for significant growth driven by technological advancements and increasing digitalization efforts.

The continued expansion of the prescriptive analytics market is anticipated to be driven by several factors. The increasing adoption of cloud-based solutions will reduce infrastructure costs and improve accessibility for businesses of all sizes. Furthermore, the integration of prescriptive analytics with other advanced technologies such as IoT (Internet of Things) and blockchain will unlock new possibilities for data-driven decision making in various industries. Government initiatives promoting digital transformation and data-driven governance will also contribute to market growth. However, challenges remain, including the need for robust data governance frameworks to address data privacy and security concerns, and the ongoing need to develop skilled professionals capable of building and deploying prescriptive analytics models effectively. Despite these challenges, the long-term outlook for the prescriptive analytics market remains strong, with significant opportunities for growth and innovation across diverse sectors and geographical regions.

Prescriptive Analytics Industry Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the Prescriptive Analytics market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The report segments the market by end-user industry (BFSI, Healthcare, Retail, IT & Telecom, Industrial, Government & Defense, and Others), providing granular insights into market size and growth potential across various sectors.

Parent Market: Business Analytics Software Market (estimated at xx Million in 2025) Child Market: Prescriptive Analytics Market (a segment of the Business Analytics Software Market)

Prescriptive Analytics Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market evolution of the Prescriptive Analytics industry from 2019 to 2024. The market exhibits moderate concentration, with key players holding significant shares but facing challenges from emerging competitors and technological disruption.

- Market Concentration: The market is characterized by a mix of established players like SAS Institute Inc, IBM Corporation, and SAP SE, and emerging niche players, resulting in a moderately concentrated landscape. Market share held by top 5 players in 2024: xx%.

- Technological Innovation Drivers: Advancements in AI, machine learning, and big data analytics are driving innovation, leading to more sophisticated and predictive analytical solutions.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR, CCPA) are significantly impacting data handling practices and influencing product development within the prescriptive analytics space. Compliance costs are estimated to be xx Million annually for the industry.

- Competitive Product Substitutes: Traditional business intelligence (BI) tools and other decision-support systems pose some competitive pressure, however, the unique capabilities of prescriptive analytics continue to drive demand.

- End-User Demographics: Adoption is driven by large enterprises across diverse sectors, with a growing interest from mid-sized businesses as costs decrease and accessibility improves.

- M&A Trends: The number of M&A deals in the prescriptive analytics sector increased significantly between 2019 and 2024, indicating consolidation and strategic expansion efforts by major players. Approximate number of M&A deals between 2019-2024: xx.

Prescriptive Analytics Industry Growth Trends & Insights

The Prescriptive Analytics market experienced robust growth from 2019 to 2024, fueled by escalating data volumes, the imperative for optimized decision-making, and widespread adoption of advanced analytics across diverse sectors. While precise figures are omitted here for brevity, the market demonstrated significant expansion during this period, exhibiting a notable Compound Annual Growth Rate (CAGR). This upward trajectory is projected to continue throughout the forecast period (2025-2033), driven by several key factors:

- Rising Cloud Adoption: The increasing preference for cloud-based prescriptive analytics solutions offers scalability, cost-effectiveness, and accessibility, accelerating market growth.

- Demand for Real-time Insights: Businesses are increasingly demanding real-time analytics and decision-making capabilities to respond swiftly to dynamic market conditions and gain a competitive edge.

- AI and Machine Learning Integration: The seamless integration of AI and machine learning algorithms enhances the accuracy and sophistication of prescriptive models, leading to more effective decision support.

- Continued R&D Investment: Ongoing investments in research and development are crucial for refining existing predictive models and developing innovative solutions that address evolving business needs.

- Operational Efficiency and Cost Reduction: Prescriptive analytics empowers organizations to streamline operations, reduce costs, and improve resource allocation, making it a highly attractive investment.

While sectors like BFSI and Healthcare show high market penetration, substantial growth potential remains untapped in areas such as Retail and Government, which are experiencing accelerated digital transformation. The market is projected to reach significant expansion by 2033, maintaining a strong CAGR throughout the forecast period.

Dominant Regions, Countries, or Segments in Prescriptive Analytics Industry

North America currently holds a leading position in the Prescriptive Analytics market, driven by its advanced technological infrastructure, a robust presence of key players, and substantial investments in R&D. However, the Asia-Pacific region is poised for the most rapid growth during the forecast period, fueled by rapid digitalization, robust economic expansion, and supportive government policies promoting technological advancements. Europe also contributes significantly, with a strong focus on data privacy regulations driving demand for secure and compliant solutions.

- North America: Strong IT infrastructure, high digital literacy, and early adoption of advanced analytics provide a fertile ground for market expansion.

- Asia-Pacific: Rapid economic growth, substantial investments in digital transformation, and government support for technology are key growth drivers.

- Europe: Stringent data privacy regulations are driving the demand for robust, compliant prescriptive analytics solutions.

- Segmental Leadership: The BFSI sector currently dominates the market share, leveraging data-driven insights for risk management, fraud detection, and CRM. However, the Healthcare sector demonstrates significant growth potential due to the increasing need for personalized medicine and improved patient outcomes.

Prescriptive Analytics Industry Product Landscape

The Prescriptive Analytics market offers a diverse range of products and services, including sophisticated software platforms, expert consulting services, and comprehensive implementation support. These solutions integrate advanced algorithms, machine learning models, and intuitive data visualization tools. Recent innovations prioritize enhanced user experience, seamless integration with existing business systems, and the incorporation of cutting-edge analytics techniques such as reinforcement learning. Key differentiators often include specialized industry-specific solutions, real-time data processing capabilities, and automated decision-making functionalities.

Key Drivers, Barriers & Challenges in Prescriptive Analytics Industry

Key Drivers:

- The rising volume and variety of data available to businesses fuels the need for sophisticated analytics solutions.

- The increasing focus on data-driven decision-making across industries drives demand for prescriptive analytics tools.

- Technological advancements such as AI and machine learning enhance the capabilities and accuracy of prescriptive analytics.

Challenges & Restraints:

- The high cost of implementation and integration of prescriptive analytics solutions can be a barrier for smaller businesses.

- Data security and privacy concerns remain significant challenges, influencing adoption and regulatory compliance.

- The complexity of prescriptive analytics tools can pose implementation hurdles and require specialized expertise.

Emerging Opportunities in Prescriptive Analytics Industry

The market presents exciting opportunities in untapped sectors like education and agriculture. The growing adoption of IoT devices and the increasing availability of real-time data are creating new avenues for innovative applications. Additionally, the development of more user-friendly and accessible prescriptive analytics tools will drive wider market penetration.

Growth Accelerators in the Prescriptive Analytics Industry

Several factors are poised to accelerate growth within the Prescriptive Analytics industry. The continuous advancement of AI and machine learning, coupled with increased cloud adoption and strategic collaborations between technology providers and industry-specific verticals, will be instrumental in driving sustained expansion. Furthermore, significant opportunities exist through market penetration in developing economies with a high demand for efficient decision-making tools and processes.

Key Players Shaping the Prescriptive Analytics Industry Market

- SAS Institute Inc

- Infor Inc

- IBM Corporation

- Teradata Corporation

- Salesforce com

- River Logic Inc

- Microsoft Corporation

- Altair Engineering Inc

- Oracle Corporation

- SAP SE

Notable Milestones in Prescriptive Analytics Industry Sector

- August 2022: SAP SE announced its vision for the future of analytics, highlighting the use of new databases, machine learning algorithms, and self-service analytics.

- July 2022: IBM Corporation acquired Databand, enhancing its data observability capabilities.

In-Depth Prescriptive Analytics Industry Market Outlook

The future of the Prescriptive Analytics market is bright, with continued growth driven by technological advancements, increased adoption across diverse sectors, and expansion into new markets. Strategic partnerships and the development of industry-specific solutions will be key to realizing the full potential of this transformative technology. The market is poised for significant expansion, driven by both organic growth and strategic acquisitions.

Prescriptive Analytics Industry Segmentation

-

1. End-user Industry

- 1.1. BFSI

- 1.2. Healthcare

- 1.3. Retail

- 1.4. IT and Telecom

- 1.5. Industri

- 1.6. Government and Defense

- 1.7. Other End-user Industries

Prescriptive Analytics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Prescriptive Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Importance of Big Data with Large Volumes of Data Generated

- 3.2.2 both in Structured and Unstructured Form; Increasing Adoption of Business Analytics and Business Intelligence

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. BFSI is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. BFSI

- 5.1.2. Healthcare

- 5.1.3. Retail

- 5.1.4. IT and Telecom

- 5.1.5. Industri

- 5.1.6. Government and Defense

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. BFSI

- 6.1.2. Healthcare

- 6.1.3. Retail

- 6.1.4. IT and Telecom

- 6.1.5. Industri

- 6.1.6. Government and Defense

- 6.1.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. BFSI

- 7.1.2. Healthcare

- 7.1.3. Retail

- 7.1.4. IT and Telecom

- 7.1.5. Industri

- 7.1.6. Government and Defense

- 7.1.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. BFSI

- 8.1.2. Healthcare

- 8.1.3. Retail

- 8.1.4. IT and Telecom

- 8.1.5. Industri

- 8.1.6. Government and Defense

- 8.1.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. BFSI

- 9.1.2. Healthcare

- 9.1.3. Retail

- 9.1.4. IT and Telecom

- 9.1.5. Industri

- 9.1.6. Government and Defense

- 9.1.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. BFSI

- 10.1.2. Healthcare

- 10.1.3. Retail

- 10.1.4. IT and Telecom

- 10.1.5. Industri

- 10.1.6. Government and Defense

- 10.1.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. North America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SAS Institute Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Infor Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 IBM Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Teradata Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Salesforce com*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 River Logic Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Microsoft Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Altair Engineering Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Oracle Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Prescriptive Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: Europe Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: Europe Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Asia Pacific Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Asia Pacific Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Latin America Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Latin America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Middle East and Africa Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Middle East and Africa Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Prescriptive Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Global Prescriptive Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prescriptive Analytics Industry?

The projected CAGR is approximately 24.00%.

2. Which companies are prominent players in the Prescriptive Analytics Industry?

Key companies in the market include SAS Institute Inc, Infor Inc, IBM Corporation, Teradata Corporation, Salesforce com*List Not Exhaustive, River Logic Inc, Microsoft Corporation, Altair Engineering Inc, Oracle Corporation, SAP SE.

3. What are the main segments of the Prescriptive Analytics Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Importance of Big Data with Large Volumes of Data Generated. both in Structured and Unstructured Form; Increasing Adoption of Business Analytics and Business Intelligence.

6. What are the notable trends driving market growth?

BFSI is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

August 2022 - SAP SE announced it by utilizing new types of databases, machine learning algorithms, real-time data processing capabilities, the development of self-service analytics and data marketplaces, and the company shift from the current state of analytics to the future. We can help customers base decisions on intelligent data-driven insights. As a result, we see the end of analytics as autonomous.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prescriptive Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prescriptive Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prescriptive Analytics Industry?

To stay informed about further developments, trends, and reports in the Prescriptive Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence