Key Insights

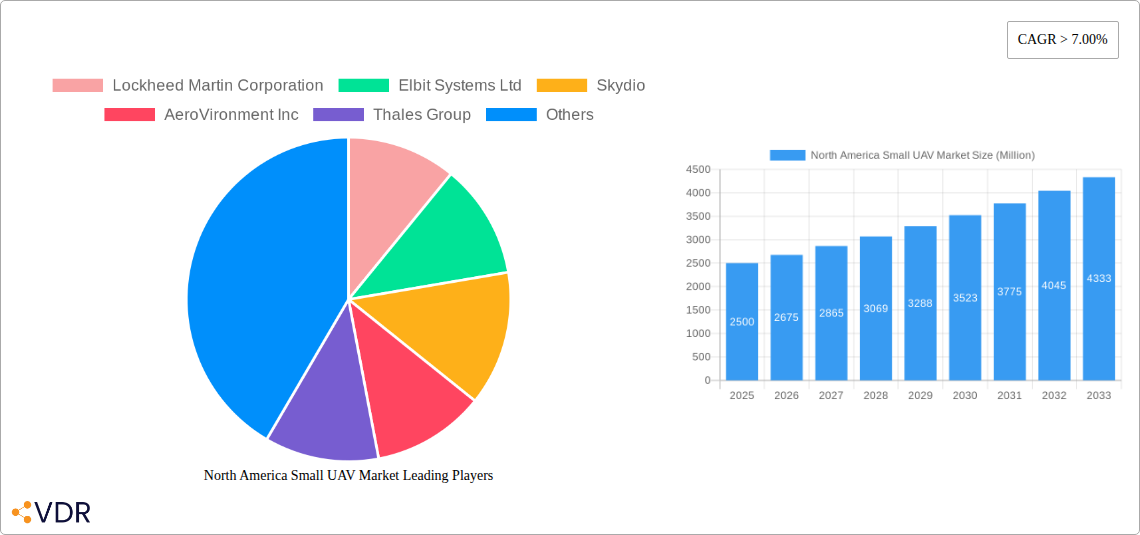

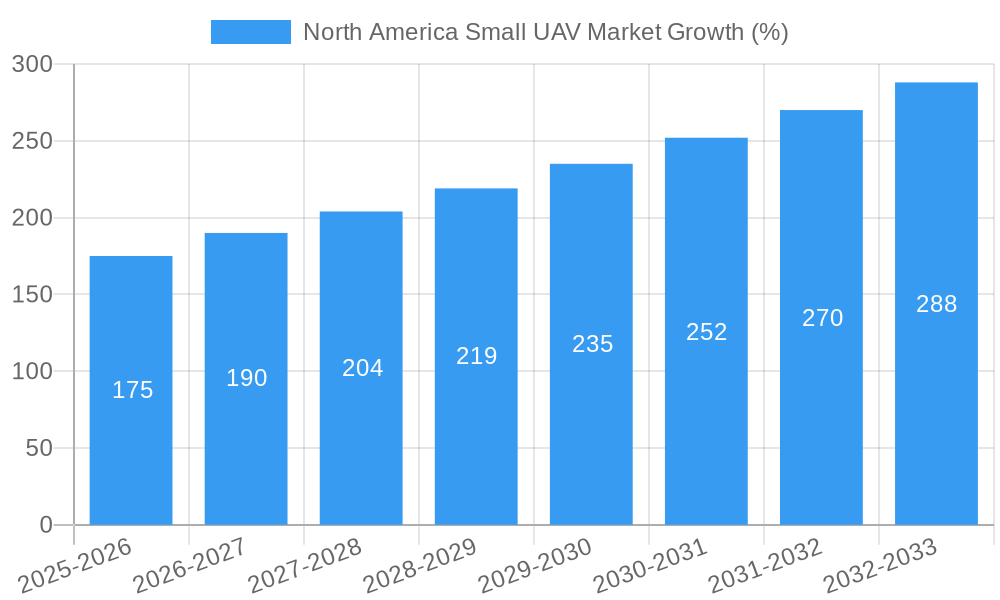

The North American small unmanned aerial vehicle (UAV) market is experiencing robust growth, driven by increasing adoption across diverse sectors. The market, valued at approximately $2.5 billion in 2025 (estimated based on a global market size and regional distribution), is projected to maintain a compound annual growth rate (CAGR) exceeding 7% through 2033. This expansion is fueled by several key factors. Firstly, advancements in propulsion technology, particularly the development of more efficient and longer-lasting hybrid and lithium-ion batteries, are extending flight times and operational capabilities. Secondly, the decreasing cost of UAVs is making them increasingly accessible to a wider range of end-users, from individual hobbyists to large-scale commercial operators. Finally, regulatory frameworks are evolving to better accommodate the integration of UAVs into various airspace environments, stimulating market growth. The construction, agriculture, and energy sectors are particularly significant drivers, utilizing small UAVs for surveying, inspection, and monitoring applications. The defense and law enforcement segments also represent substantial markets for small UAVs, leveraging their capabilities for surveillance and reconnaissance.

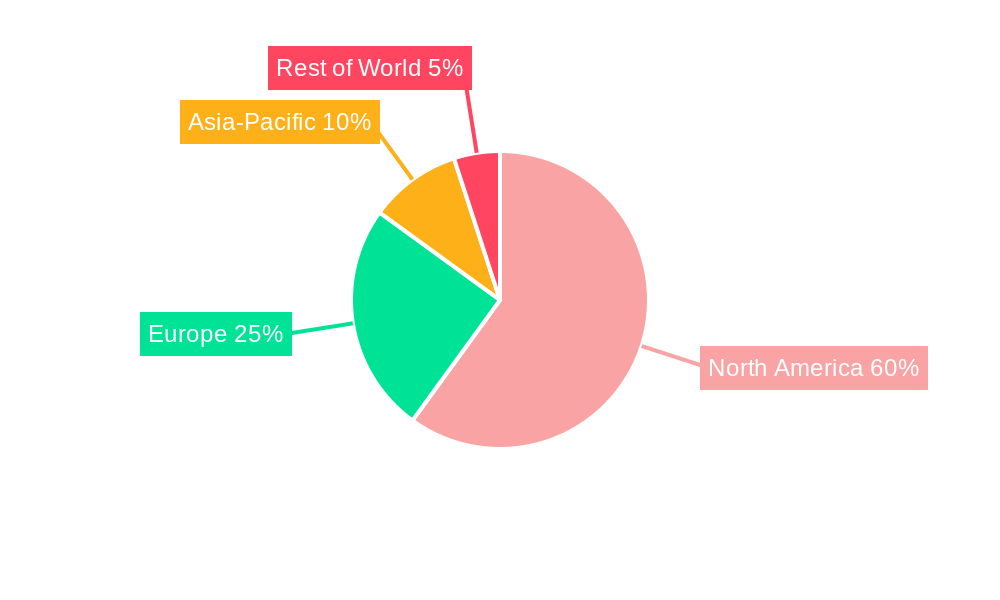

The market segmentation reveals a strong preference for fixed-wing and rotary-wing UAVs, each holding significant market share. While lithium-ion batteries currently dominate the propulsion technology segment, the growing interest in sustainable and environmentally friendly options is likely to increase the adoption of hydrogen cell and solar-powered UAVs over the forecast period. Geographic distribution shows the United States and Canada as the primary markets within North America, although Mexico presents a growing opportunity. Key players, including Lockheed Martin, Elbit Systems, Skydio, and DJI, are actively shaping the market through innovation, strategic partnerships, and competitive pricing. However, challenges remain, including concerns about data security and privacy, regulatory hurdles in certain jurisdictions, and the potential for negative public perception. Despite these, the overall outlook for the North American small UAV market remains strongly positive, projecting considerable growth and market expansion throughout the forecast period.

North America Small UAV Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America small unmanned aerial vehicle (UAV) market, encompassing the parent market (North American UAV market) and its child segments (fixed-wing, rotary-wing UAVs; various propulsion technologies; diverse end-user industries). The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report reveals key market dynamics, growth trends, dominant segments, and the competitive landscape, empowering businesses to make data-driven decisions.

North America Small UAV Market Dynamics & Structure

This section analyzes the North America small UAV market's structure, including market concentration, technological advancements, regulatory landscapes, and competitive dynamics. We examine the impact of mergers and acquisitions (M&A) activities and delve into end-user demographic shifts. The analysis reveals the market share distribution among key players and identifies innovation barriers, providing a comprehensive understanding of the market's competitive dynamics.

- Market Concentration: The North American small UAV market exhibits a [xx]% market concentration level in 2025, with the top 5 players holding a combined [xx]% share. This indicates [describe market concentration: highly concentrated, moderately concentrated, fragmented etc.].

- Technological Innovation: Continuous advancements in battery technology (Lithium-ion, Hybrid, Solar) and the exploration of Hydrogen Cell propulsion are driving innovation. [xx]% of new UAV models launched in 2024 incorporated improved battery technology.

- Regulatory Framework: Stringent regulations concerning airspace management and data privacy are shaping market growth and adoption. The impact of FAA regulations on market expansion is analyzed in detail.

- Competitive Landscape: Intense competition among established players like Lockheed Martin Corporation, Elbit Systems Ltd, Skydio, AeroVironment Inc, Thales Group, BAE Systems PLC, Parrot Drone SA, Israel Aerospace Industries Ltd, SZ DJI Technology Co Ltd, and Aeronautics Ltd is driving innovation and price competition.

- M&A Activity: The period 2019-2024 witnessed [xx] M&A deals in the North American small UAV sector, primarily focused on [mention specific areas like technology acquisition or market expansion].

North America Small UAV Market Growth Trends & Insights

This section provides a detailed analysis of the market's historical and projected growth trajectory. It leverages proprietary data and industry insights to present a comprehensive picture of market size evolution, adoption rates across various end-user segments, technological disruptions and consumer behavior shifts. The analysis will showcase compound annual growth rates (CAGR) and market penetration rates, providing quantifiable insights into market dynamics.

[Insert 600-word analysis here, covering market size (in Million units) for each year from 2019-2033, CAGR, penetration rates by industry, and a discussion on technological trends shaping the market.]

Dominant Regions, Countries, or Segments in North America Small UAV Market

This section identifies the leading regions, countries, and segments driving market growth. We examine the performance of fixed-wing versus rotary-wing UAVs, the adoption of different propulsion technologies (Lithium-ion, Hydrogen Cell, Hybrid, Solar), and end-user industry contributions (Construction, Agriculture, Energy, Entertainment, Defense and Law Enforcement, Other). The United States and Canada are analyzed individually to understand their unique market characteristics.

- Leading Segment: The [Specify leading segment: e.g., Defense and Law Enforcement] segment dominates the market, accounting for [xx]% of total revenue in 2025.

- Dominant Country: The United States holds the largest market share ([xx]%) due to [reasons, e.g., high defense spending, robust technological infrastructure].

- Key Growth Drivers:

- Strong government support for UAV technology development and deployment in [mention specific programs].

- Increasing adoption of UAVs across various industries for enhanced efficiency and productivity.

- Growing investment in research and development to improve UAV capabilities and reduce costs.

[Insert further analysis (approx 400 words) detailing market share and growth potential for each major segment and country.]

North America Small UAV Market Product Landscape

The North America small UAV market showcases a diverse range of products tailored to specific applications. Innovations focus on improving flight time, payload capacity, sensor integration, and autonomous flight capabilities. Manufacturers are increasingly emphasizing user-friendly interfaces and advanced data analytics features to enhance user experience and operational efficiency. The market sees a rise in specialized UAVs designed for specific tasks within various sectors.

Key Drivers, Barriers & Challenges in North America Small UAV Market

Key Drivers:

- Increasing demand from various end-user industries for improved efficiency and cost reduction.

- Technological advancements leading to enhanced UAV capabilities and affordability.

- Government initiatives and funding to promote the adoption of UAV technology.

Key Challenges & Restraints:

- Stringent regulations and licensing requirements hindering widespread adoption.

- Concerns about data security and privacy related to UAV operations.

- Potential for misuse of UAV technology, raising safety and security issues.

- Supply chain disruptions impacting component availability and production costs. [Estimate quantitative impact, e.g., a 15% increase in production costs].

Emerging Opportunities in North America Small UAV Market

Emerging opportunities lie in the expansion of UAV applications in new sectors (e.g., precision agriculture, infrastructure inspection, environmental monitoring) and the development of advanced features such as swarm technology, AI-powered navigation, and improved sensor integration. The increasing demand for autonomous delivery systems and the development of robust counter-drone technologies also presents significant opportunities.

Growth Accelerators in the North America Small UAV Market Industry

Long-term growth will be fueled by technological breakthroughs like improved battery technology and AI-driven autonomy, strategic partnerships between UAV manufacturers and end-user industries, and expansion into new geographical markets and applications. Government support for research and development will also play a crucial role in accelerating market expansion.

Key Players Shaping the North America Small UAV Market Market

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Skydio

- AeroVironment Inc

- Thales Group

- BAE Systems PLC

- Parrot Drone SA

- Israel Aerospace Industries Ltd

- SZ DJI Technology Co Ltd

- Aeronautics Ltd

Notable Milestones in North America Small UAV Market Sector

- May 2022: Teledyne FLIR Defense secures a $14 million contract to supply Black Hornet 3 drones to the US Army.

- February 2022: Skydio wins a $99.8 million contract from the US Army for X2D UAVs.

In-Depth North America Small UAV Market Market Outlook

The North America small UAV market is poised for significant growth over the forecast period. Continued technological innovation, increasing demand from diverse sectors, and supportive government policies will drive market expansion. Strategic partnerships and market consolidation through M&A activities will further shape the industry's landscape, presenting attractive opportunities for both established players and new entrants. The development and adoption of advanced technologies such as AI and swarm technology will unlock new applications and drive sustained growth.

North America Small UAV Market Segmentation

-

1. UAV Type

- 1.1. Fixed-wing

- 1.2. Rotary-wing

-

2. Propulsion Technology

- 2.1. Hydrogen Cell

- 2.2. Hybrid

- 2.3. Solar

- 2.4. Lithium-ion

-

3. End-user Industry

- 3.1. Construction

- 3.2. Agriculture

- 3.3. Energy

- 3.4. Entertainment

- 3.5. Defense and Law Enforcement

- 3.6. Other End-user Industries

North America Small UAV Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Small UAV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Agriculture Industry to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by UAV Type

- 5.1.1. Fixed-wing

- 5.1.2. Rotary-wing

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Technology

- 5.2.1. Hydrogen Cell

- 5.2.2. Hybrid

- 5.2.3. Solar

- 5.2.4. Lithium-ion

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Construction

- 5.3.2. Agriculture

- 5.3.3. Energy

- 5.3.4. Entertainment

- 5.3.5. Defense and Law Enforcement

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by UAV Type

- 6. United States North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lockheed Martin Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Elbit Systems Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Skydio

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AeroVironment Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thales Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BAE Systems PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Parrot Drone SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Israel Aerospace Industries Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SZ DJI Technology Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aeronautics Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: North America Small UAV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Small UAV Market Share (%) by Company 2024

List of Tables

- Table 1: North America Small UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Small UAV Market Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 3: North America Small UAV Market Revenue Million Forecast, by Propulsion Technology 2019 & 2032

- Table 4: North America Small UAV Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Small UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Small UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Small UAV Market Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 12: North America Small UAV Market Revenue Million Forecast, by Propulsion Technology 2019 & 2032

- Table 13: North America Small UAV Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Small UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small UAV Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the North America Small UAV Market?

Key companies in the market include Lockheed Martin Corporation, Elbit Systems Ltd, Skydio, AeroVironment Inc, Thales Group, BAE Systems PLC, Parrot Drone SA, Israel Aerospace Industries Ltd, SZ DJI Technology Co Ltd, Aeronautics Ltd.

3. What are the main segments of the North America Small UAV Market?

The market segments include UAV Type, Propulsion Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Agriculture Industry to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, Teledyne FLIR Defense signed a contract worth 14 million to deliver Black Hornet 3 drones to the US Army. The advanced nano UAVs augment squad and small unit surveillance and reconnaissance capabilities as part of the Army's Soldier Borne Sensor program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small UAV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small UAV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small UAV Market?

To stay informed about further developments, trends, and reports in the North America Small UAV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence