Key Insights

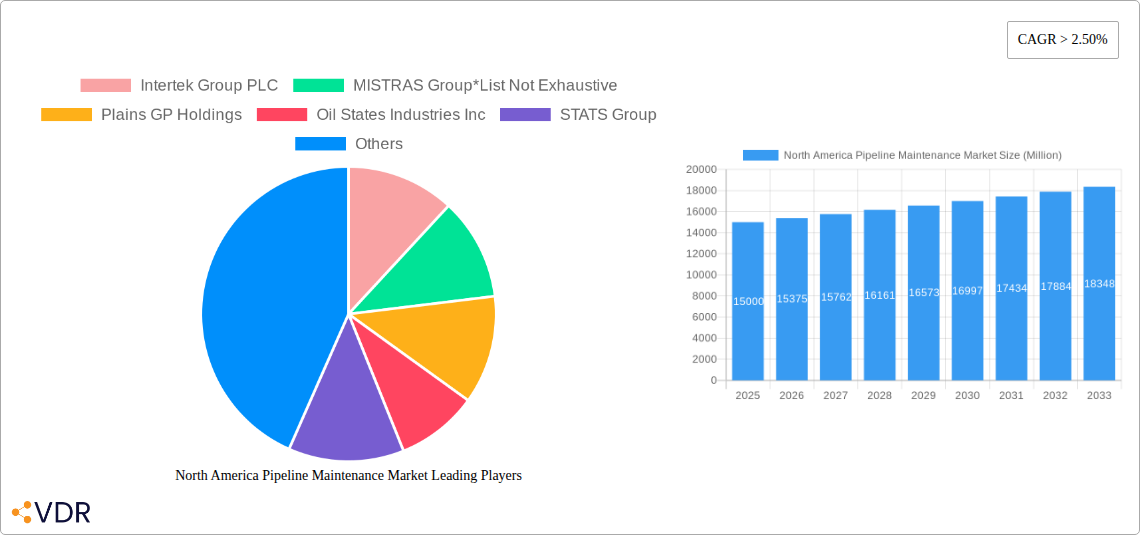

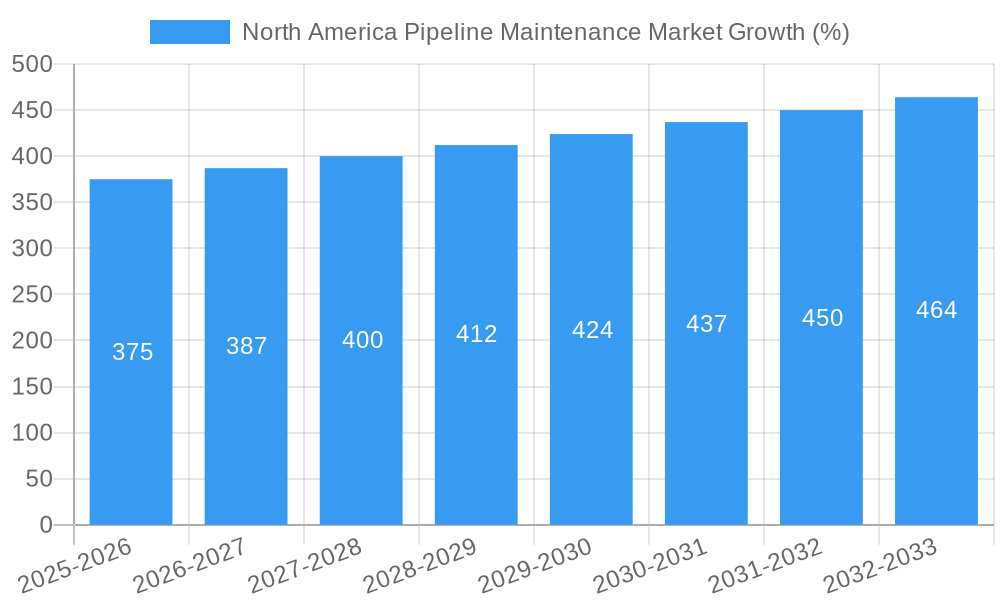

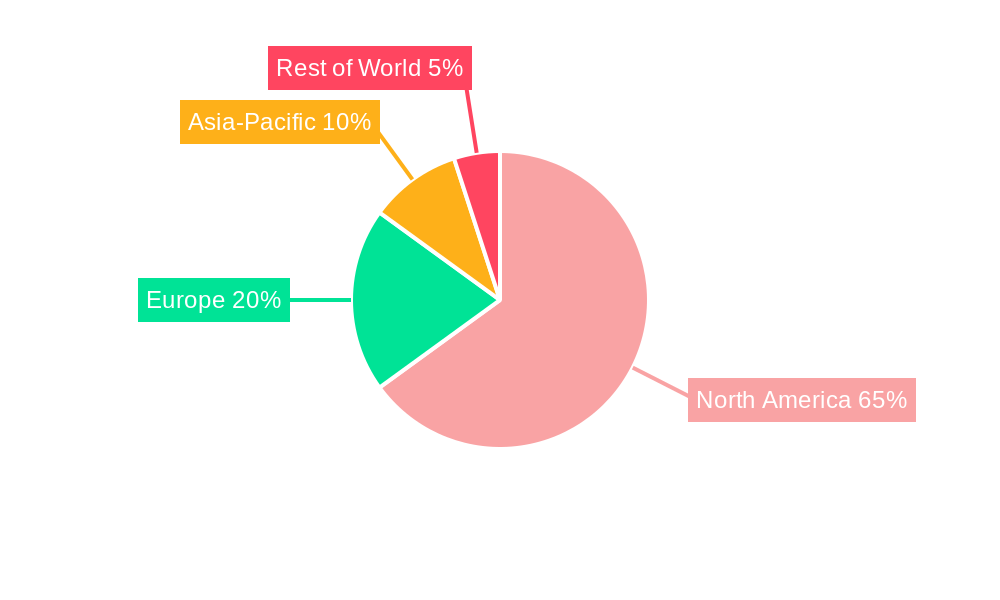

The North American pipeline maintenance market, currently valued at approximately $XX billion (estimated based on global market size and regional distribution), is experiencing robust growth, projected to maintain a CAGR exceeding 2.50% from 2025 to 2033. This expansion is driven by several factors. Aging pipeline infrastructure necessitates increased maintenance and repair activities to ensure safety and operational efficiency. Stringent government regulations regarding pipeline integrity management further fuel demand for specialized services like pigging, flushing, chemical cleaning, and pipeline repair. The rising adoption of advanced technologies, including data analytics and predictive maintenance, enhances operational efficiency and minimizes downtime, contributing to market growth. Moreover, the ongoing investments in the energy sector, particularly in natural gas and crude oil transportation, create a sustained need for reliable pipeline maintenance services.

The market segmentation reveals a diversified landscape. Onshore pipeline maintenance currently holds a larger market share compared to offshore operations, reflecting the greater density of pipelines on land. However, offshore segments are also expected to witness substantial growth due to increased offshore energy exploration and production activities. Service-wise, pipeline repair and maintenance account for a significant portion of the market, followed by pigging, flushing, and chemical cleaning. Key players such as Intertek Group PLC, MISTRAS Group, Plains GP Holdings, and others are actively shaping the market dynamics through technological innovation and strategic acquisitions. While increased competition could present a restraint, the overall market outlook remains positive, fueled by the long-term need for safe and efficient pipeline operations across North America.

North America Pipeline Maintenance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America pipeline maintenance market, encompassing its dynamics, growth trends, dominant segments, and key players. With a focus on the parent market (North American Energy Infrastructure) and child markets (Pipeline Maintenance Services, Pipeline Repair & Replacement), this report offers actionable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025 to 2033.

Market Size: The North America pipeline maintenance market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. (Values in Million Units)

North America Pipeline Maintenance Market Dynamics & Structure

The North American pipeline maintenance market is characterized by moderate concentration, with a few major players dominating alongside numerous smaller, specialized service providers. Technological innovation, driven by the need for enhanced safety, efficiency, and reduced environmental impact, is a key driver. Stringent regulatory frameworks imposed by government agencies, such as the PHMSA (Pipeline and Hazardous Materials Safety Administration), significantly influence market operations. The market faces competition from alternative transportation methods like rail and trucking, but the enduring reliance on pipelines for energy transportation maintains consistent demand.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Advancements in robotic inspection, data analytics, and predictive maintenance are transforming the industry.

- Regulatory Landscape: Compliance with PHMSA regulations is a significant cost factor.

- Competitive Substitutes: Rail and trucking present alternatives for certain applications.

- M&A Activity: The past five years have seen xx M&A deals in the North American pipeline maintenance sector, largely driven by consolidation and expansion strategies. xx% of deals involved companies with revenue exceeding $100 million.

- Innovation Barriers: High upfront investment costs for advanced technologies and lack of skilled labor can hinder innovation.

North America Pipeline Maintenance Market Growth Trends & Insights

The North American pipeline maintenance market has witnessed significant growth fueled by increasing pipeline infrastructure age, stringent safety regulations, and growing demand for efficient and reliable energy transportation. The market's evolution reflects a shift towards proactive maintenance strategies, driven by advancements in predictive analytics and remote monitoring technologies. This trend is accompanied by increasing adoption of specialized services such as pigging and advanced repair techniques. The market is experiencing a gradual shift towards onshore deployments, primarily due to economic factors and accessibility. Consumer behavior is influencing demand for environmentally friendly and sustainable maintenance solutions.

- Market Size Evolution: The market expanded from xx Million in 2019 to xx Million in 2024.

- Adoption Rates: Predictive maintenance technologies show an increasing adoption rate, projected to reach xx% market penetration by 2033.

- Technological Disruptions: AI-powered inspection and robotics are causing significant market disruption.

- Consumer Behavior: Growing environmental awareness is driving demand for eco-friendly maintenance solutions.

Dominant Regions, Countries, or Segments in North America Pipeline Maintenance Market

The onshore segment currently dominates the North American pipeline maintenance market, driven by the extensive network of onshore pipelines transporting oil and gas across the continent. The regions with the most extensive pipeline networks, notably the Gulf Coast, Midcontinent, and Permian Basin, experience the highest demand for maintenance services. Within service types, pipeline repair and maintenance represent the largest segment, followed by pigging, flushing & chemical cleaning.

- Leading Region: The Gulf Coast region exhibits the highest growth potential, driven by extensive pipeline infrastructure and substantial energy production.

- Key Drivers: Economic growth in energy-producing states, stringent pipeline safety regulations, and aging infrastructure are key growth drivers.

- Onshore Dominance: xx% of the market is attributed to onshore deployments in 2025.

- Service Type: Pipeline Repair & Maintenance holds the largest market share (xx%), followed by Pigging, Flushing & Chemical Cleaning (xx%).

North America Pipeline Maintenance Market Product Landscape

Pipeline maintenance products are constantly evolving, driven by the need for improved efficiency, safety, and environmental compliance. Recent innovations include advanced inspection technologies, robotic systems, and specialized cleaning solutions designed to minimize downtime and environmental impact. These advancements are focused on enhancing the accuracy of inspections, enabling quicker repairs, and promoting more sustainable maintenance practices. Key selling propositions center around reduced downtime, improved safety, and cost-effectiveness.

Key Drivers, Barriers & Challenges in North America Pipeline Maintenance Market

Key Drivers:

- Increasing age of existing pipeline infrastructure.

- Stringent government regulations focused on safety and environmental protection.

- Technological advancements in inspection and repair techniques.

- Growth in oil and gas production and transportation.

Key Barriers and Challenges:

- High capital expenditure for implementing advanced technologies.

- Supply chain disruptions affecting access to necessary materials and equipment.

- Shortage of skilled labor, specifically trained technicians and engineers.

- Fluctuations in oil and gas prices impacting investment decisions.

Emerging Opportunities in North America Pipeline Maintenance Market

The market presents significant opportunities in several areas, including the adoption of advanced robotics, the implementation of predictive analytics for proactive maintenance, and the development of sustainable solutions that minimize environmental impact. Untapped markets exist in the inspection and maintenance of smaller-diameter pipelines and the increasing demand for specialized services in the renewable energy sector. Opportunities are also emerging in data analytics and remote monitoring, enhancing efficiency and reducing costs.

Growth Accelerators in the North America Pipeline Maintenance Market Industry

Long-term growth in the North American pipeline maintenance market is driven by ongoing investment in pipeline infrastructure modernization, coupled with technological innovations that improve efficiency and safety. Strategic partnerships between maintenance providers and pipeline operators are vital for optimizing service delivery. The industry is poised for substantial expansion as technological advancements enable the implementation of predictive maintenance and automation across pipeline networks.

Key Players Shaping the North America Pipeline Maintenance Market Market

- Intertek Group PLC

- MISTRAS Group

- Plains GP Holdings

- Oil States Industries Inc

- STATS Group

- M&M Pipeline Services LLC

- NiGen International L L C

- T D Williamson Inc

- Chevron Corporation

- Pipeline Operators

- Energy Transfer LP

- EnerMech Ltd

- Kinder Morgan

- Enterprise Products Partners L P

- Baker Hughes A GE Co

- American Pipeline Solutions

- ExxonMobil Corporation

- Pipeline Maintenance Services Providers

Notable Milestones in North America Pipeline Maintenance Market Sector

- 2020: Increased focus on digitalization and remote monitoring due to the pandemic.

- 2021: Several significant M&A transactions consolidate market players.

- 2022: Launch of several innovative robotic inspection technologies.

- 2023: Increased regulatory scrutiny on pipeline safety and environmental impact.

- 2024: Several key players invest heavily in predictive maintenance solutions.

In-Depth North America Pipeline Maintenance Market Outlook

The future of the North American pipeline maintenance market is bright, driven by the continual need for safe and efficient energy transportation. The market will experience sustained growth through technological advancements, strategic partnerships, and increased regulatory pressures. Opportunities exist for players specializing in predictive maintenance, data analytics, and sustainable solutions. The market is poised to experience significant expansion, driven by technological innovation and continued growth in the energy sector.

North America Pipeline Maintenance Market Segmentation

-

1. Service Type

- 1.1. Pigging

- 1.2. Flushing & Chemical Cleaning

- 1.3. Pipeline Repair & Maintenance

- 1.4. Drying

- 1.5. Others

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Pipeline Maintenance Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Pipeline Maintenance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Pipeline Repair & Maintenance Segment to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pigging

- 5.1.2. Flushing & Chemical Cleaning

- 5.1.3. Pipeline Repair & Maintenance

- 5.1.4. Drying

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pigging

- 6.1.2. Flushing & Chemical Cleaning

- 6.1.3. Pipeline Repair & Maintenance

- 6.1.4. Drying

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pigging

- 7.1.2. Flushing & Chemical Cleaning

- 7.1.3. Pipeline Repair & Maintenance

- 7.1.4. Drying

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Rest of North America North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Pigging

- 8.1.2. Flushing & Chemical Cleaning

- 8.1.3. Pipeline Repair & Maintenance

- 8.1.4. Drying

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. United States North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Intertek Group PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MISTRAS Group*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Plains GP Holdings

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Oil States Industries Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 STATS Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 M&M Pipeline Services LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 NiGen International L L C

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 T D Williamson Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Chevron Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pipeline Operators

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Energy Transfer LP

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 EnerMech Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Kinder Morgan

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Enterprise Products Partners L P

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Baker Hughes A GE Co

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 American Pipeline Solutions

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 ExxonMobil Corporation

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Pipeline Maintenance Services Providers

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 Intertek Group PLC

List of Figures

- Figure 1: North America Pipeline Maintenance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Pipeline Maintenance Market Share (%) by Company 2024

List of Tables

- Table 1: North America Pipeline Maintenance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: North America Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: North America Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Pipeline Maintenance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Pipeline Maintenance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Pipeline Maintenance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Pipeline Maintenance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Pipeline Maintenance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 12: North America Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 13: North America Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 16: North America Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 17: North America Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: North America Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 21: North America Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pipeline Maintenance Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the North America Pipeline Maintenance Market?

Key companies in the market include Intertek Group PLC, MISTRAS Group*List Not Exhaustive, Plains GP Holdings, Oil States Industries Inc, STATS Group, M&M Pipeline Services LLC, NiGen International L L C, T D Williamson Inc, Chevron Corporation, Pipeline Operators, Energy Transfer LP, EnerMech Ltd, Kinder Morgan, Enterprise Products Partners L P, Baker Hughes A GE Co, American Pipeline Solutions, ExxonMobil Corporation, Pipeline Maintenance Services Providers.

3. What are the main segments of the North America Pipeline Maintenance Market?

The market segments include Service Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Pipeline Repair & Maintenance Segment to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pipeline Maintenance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pipeline Maintenance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pipeline Maintenance Market?

To stay informed about further developments, trends, and reports in the North America Pipeline Maintenance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence