Key Insights

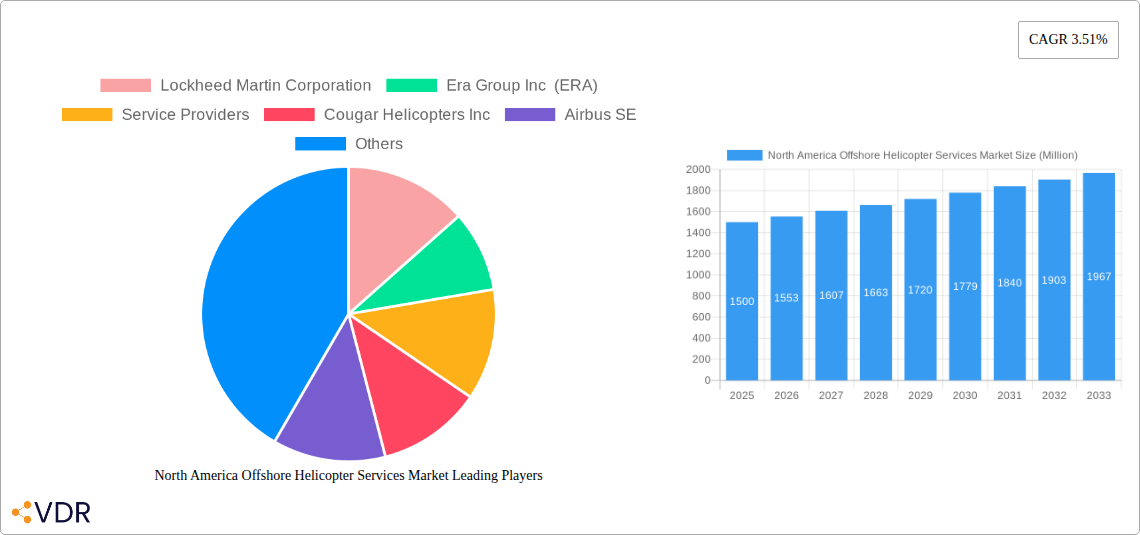

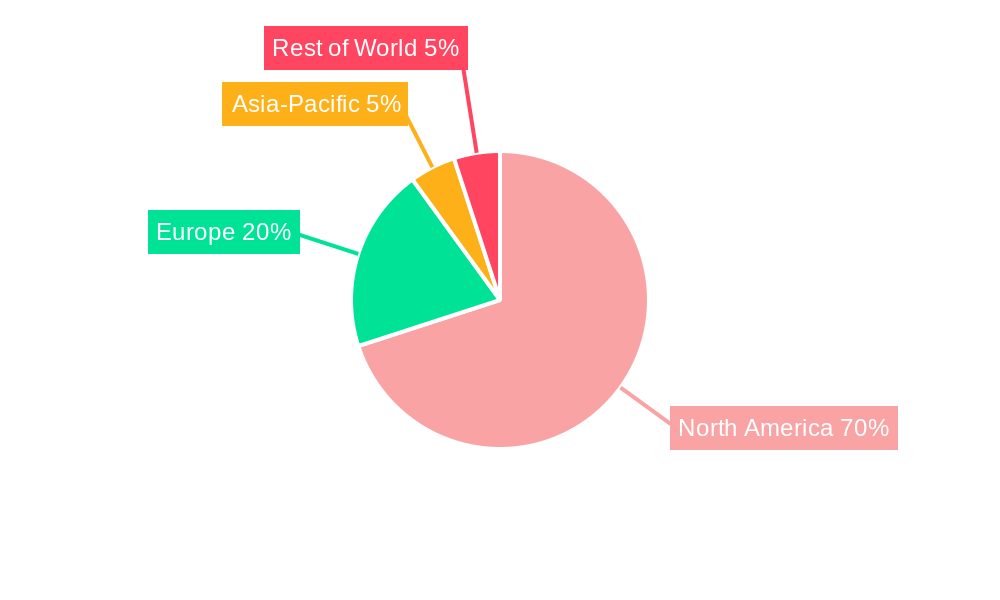

The North America offshore helicopter services market, encompassing light, medium, and heavy helicopters serving the oil and gas, offshore wind, and other industries, is experiencing steady growth. Driven by increasing offshore energy exploration and production activities, particularly in the oil and gas sector and the burgeoning offshore wind power generation, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of approximately 3.51% from 2025 to 2033. Key applications include drilling support, personnel transportation for relocation and decommissioning projects, and ongoing production operations. While the market faces constraints such as fluctuating oil prices and stringent safety regulations, the transition to renewable energy sources, represented by the significant growth in offshore wind farms, is a considerable market driver. This trend suggests a diversification of the end-user base beyond traditional oil and gas, mitigating some of the inherent volatility associated with the energy sector. Major players like Lockheed Martin, Airbus, Textron, and Leonardo are strategically positioned to capitalize on this growth, offering a range of services and advanced helicopter technologies. The market's future trajectory hinges on continued investment in offshore energy infrastructure, technological advancements improving helicopter safety and efficiency, and the overall economic climate influencing energy sector investments.

The United States, as the largest economy in North America, dominates the regional market, followed by Canada and Mexico. The growth within the US market is primarily fueled by its significant offshore oil and gas production, along with the expanding development of offshore wind farms along the East Coast. Canada's offshore activity, while smaller than the US, also contributes to the regional market. Mexico's market share is comparatively smaller, but it possesses potential for growth given ongoing investments in its offshore energy sector. The competitive landscape is characterized by established helicopter manufacturers and service providers, with ongoing consolidation and mergers shaping the industry. The future outlook anticipates a robust demand for specialized helicopters equipped with advanced safety and operational capabilities to meet the increasingly demanding needs of offshore operations. Strategic partnerships between helicopter manufacturers and service providers will likely play a crucial role in shaping the future of this market.

North America Offshore Helicopter Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America offshore helicopter services market, encompassing market dynamics, growth trends, regional performance, and key players. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The market is segmented by helicopter type (light and medium/heavy), end-user industry (oil and gas, offshore wind, others), and application (drilling, relocation/decommissioning, production, others). The report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market size is projected to reach xx Million by 2033.

North America Offshore Helicopter Services Market Market Dynamics & Structure

The North American offshore helicopter services market is characterized by moderate concentration, with key players like Lockheed Martin Corporation, Era Group Inc (ERA), Airbus SE, CHC Group Ltd, Textron Inc, Leonardo SpA, and Bristow Group Inc. holding significant market share. However, the presence of numerous smaller service providers and helicopter manufacturers contributes to a dynamic competitive landscape. Technological innovation, primarily focused on enhancing safety, efficiency, and reducing emissions, is a crucial driver. Stringent regulatory frameworks, particularly concerning safety and environmental compliance, significantly impact market operations. The rise of offshore wind energy presents a significant growth opportunity, while the oil and gas industry remains a major end-user. Furthermore, the market experiences ongoing M&A activity, with recent examples illustrating consolidation trends.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2024.

- Technological Innovation: Focus on autonomous flight systems, advanced flight control, and reduced emissions technologies.

- Regulatory Framework: Stringent safety and environmental regulations impacting operational costs and efficiency.

- Competitive Substitutes: Limited direct substitutes, but alternative transportation methods for crew changes (e.g., specialized vessels) exert competitive pressure.

- End-User Demographics: Primarily driven by large multinational oil and gas companies and increasingly, offshore wind farm operators.

- M&A Trends: Moderate level of M&A activity, driven by consolidation and expansion strategies, with xx deals recorded between 2019 and 2024.

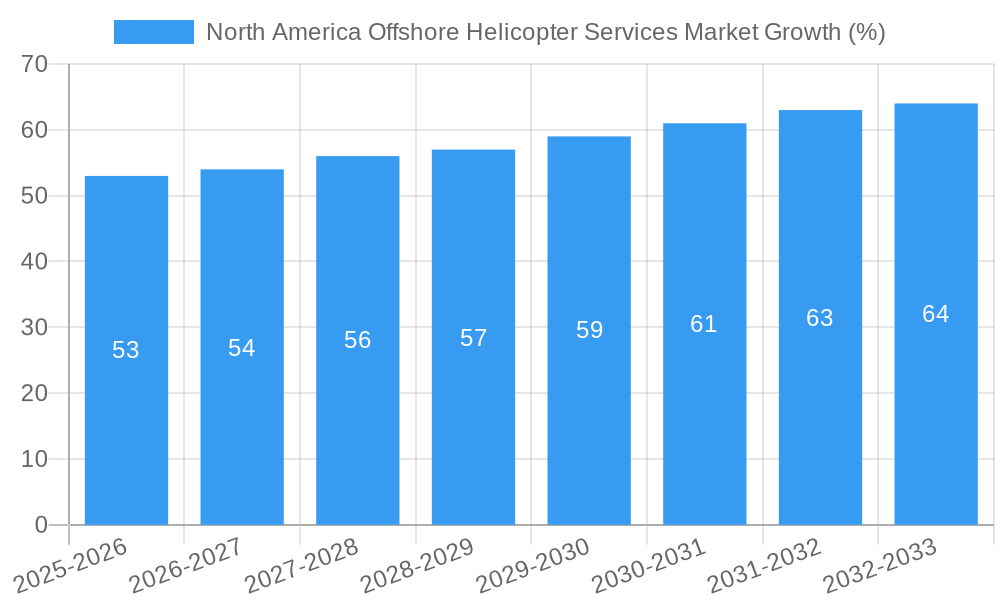

North America Offshore Helicopter Services Market Growth Trends & Insights

The North America offshore helicopter services market experienced a period of relative stability followed by growth during the historical period (2019-2024), influenced by fluctuating oil prices and the initial stages of offshore wind development. The market is projected to witness significant growth during the forecast period (2025-2033), driven by the expansion of offshore wind farms, increasing offshore oil and gas exploration in certain regions, and technological advancements enhancing operational efficiency and safety. The adoption rate of new technologies, particularly those improving safety and reducing environmental impact, is expected to accelerate. Consumer behavior, specifically among end-users, is shifting towards demanding higher safety standards, sustainable practices, and cost-effective solutions.

- Market Size Evolution: Grew from xx Million in 2019 to xx Million in 2024, projected to reach xx Million by 2033.

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, projected to increase to xx% by 2033.

- Technological Disruptions: Adoption of autonomous and remotely piloted helicopters presents significant long-term growth opportunities.

- Consumer Behavior Shifts: Increased emphasis on safety, sustainability, and cost optimization by end-users.

Dominant Regions, Countries, or Segments in North America Offshore Helicopter Services Market

The Gulf of Mexico region in the United States is currently the dominant market segment, fueled by the continued activity in the oil and gas sector and the emerging offshore wind industry. Canada’s offshore operations, predominantly focused on oil and gas, also contribute significantly to market growth. The medium and heavy helicopter segment holds the largest market share due to their greater payload capacity needed for offshore operations. The oil and gas industry remains the largest end-user, while the offshore wind industry displays the highest growth potential. The drilling application dominates the market, followed by production and relocation/decommissioning activities.

- Key Drivers:

- Gulf of Mexico: High concentration of oil and gas platforms and growing offshore wind projects.

- Canada: Significant offshore oil and gas exploration and production activities.

- Medium/Heavy Helicopters: Higher payload capacity for transporting personnel and equipment.

- Oil and Gas Industry: Established market with continued offshore operations.

- Offshore Wind Industry: Rapid expansion and substantial future growth potential.

- Dominance Factors: Proximity to offshore energy resources, government policies supporting renewable energy development, and established infrastructure.

North America Offshore Helicopter Services Market Product Landscape

The North American offshore helicopter services market offers a range of helicopters, from light utility models for smaller tasks to heavy-lift aircraft for larger operations. Manufacturers continually introduce advancements in safety features, avionics, and fuel efficiency. These improvements aim to enhance operational reliability, reduce maintenance costs, and minimize the environmental footprint. Unique selling propositions often center on enhanced safety features, customized maintenance packages, and efficient crew change capabilities. Technological advancements focus on increasing autonomy, utilizing advanced flight control systems, and incorporating predictive maintenance capabilities.

Key Drivers, Barriers & Challenges in North America Offshore Helicopter Services Market

Key Drivers: The expansion of offshore wind farms is a primary driver, coupled with the ongoing need for crew changes and cargo transportation in the oil and gas sector. Government regulations promoting renewable energy also fuel market growth. Technological advancements in helicopter design, maintenance, and safety are further stimulating expansion.

Key Barriers and Challenges: High operational costs, particularly fuel prices, are a significant challenge. Regulatory complexities and strict safety standards add to operational burdens. Competition among service providers, including the entry of new players, can also impact profitability. Supply chain disruptions can impact the availability of parts and maintenance services. These challenges can lead to unpredictable costs and delays affecting project timelines and profitability. The impact of these challenges is estimated to account for a xx% reduction in market growth in 2025.

Emerging Opportunities in North America Offshore Helicopter Services Market

The growing offshore wind energy sector presents significant opportunities. Further expansion into providing specialized services such as search and rescue and emergency medical services to offshore platforms and wind farms are untapped market opportunities. The integration of advanced technologies like autonomous flight and predictive maintenance offers potential for efficiency gains and cost reductions. Developing sustainable aviation fuel (SAF) solutions can help address environmental concerns and attract environmentally conscious clients.

Growth Accelerators in the North America Offshore Helicopter Services Market Industry

Long-term growth will be fueled by continued expansion of offshore renewable energy projects and the ongoing demand from the oil and gas industry. Technological advancements, particularly in autonomous flight systems and improved safety features, will drive efficiency gains and reduce operational risks. Strategic partnerships between helicopter service providers and energy companies will promote market expansion. Government initiatives supporting green energy transitions and improving offshore infrastructure are also expected to boost market growth.

Key Players Shaping the North America Offshore Helicopter Services Market Market

- Lockheed Martin Corporation

- Era Group Inc (ERA)

- Service Providers

- Cougar Helicopters Inc

- Airbus SE

- CHC Group Ltd

- Textron Inc

- Leonardo SpA

- Bristow Group Inc

- Helicopter Manufacturers

Notable Milestones in North America Offshore Helicopter Services Market Sector

- November 2022: Pratt & Whitney Canada's acquisition of CITIC Offshore Helicopter Co., Ltd. expands maintenance services for PW engines used in various helicopter models, enhancing the maintenance and support ecosystem within the industry.

- April 2022: Orsted and Eversource's contract with HeliService International showcases the increasing demand for helicopter services in the burgeoning offshore wind sector.

In-Depth North America Offshore Helicopter Services Market Market Outlook

The North America offshore helicopter services market is poised for substantial growth driven by offshore wind energy expansion, ongoing activity in the oil and gas sector, and technological progress. Strategic partnerships, investments in advanced technologies, and government support for renewable energy will shape the future market landscape. Companies that embrace innovation, enhance safety protocols, and offer cost-effective solutions will be best positioned to capitalize on emerging opportunities. The long-term outlook is positive, with considerable potential for market expansion and increased profitability.

North America Offshore Helicopter Services Market Segmentation

-

1. Type

- 1.1. Light Helicopters

- 1.2. Medium and Heavy Helicopters

-

2. End-user Industry

- 2.1. Oil and Gas Industry

- 2.2. Offshore Wind Industry

- 2.3. Other End-user Industries

-

3. Application

- 3.1. Drilling

- 3.2. Relocation and Decommissioning

- 3.3. Production

- 3.4. OtherApplications

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Offshore Helicopter Services Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Offshore Helicopter Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Crew Transfer Ships

- 3.4. Market Trends

- 3.4.1. Offshore wind to be the fastest-growing segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Light Helicopters

- 5.1.2. Medium and Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas Industry

- 5.2.2. Offshore Wind Industry

- 5.2.3. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Drilling

- 5.3.2. Relocation and Decommissioning

- 5.3.3. Production

- 5.3.4. OtherApplications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Light Helicopters

- 6.1.2. Medium and Heavy Helicopters

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas Industry

- 6.2.2. Offshore Wind Industry

- 6.2.3. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Drilling

- 6.3.2. Relocation and Decommissioning

- 6.3.3. Production

- 6.3.4. OtherApplications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Light Helicopters

- 7.1.2. Medium and Heavy Helicopters

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas Industry

- 7.2.2. Offshore Wind Industry

- 7.2.3. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Drilling

- 7.3.2. Relocation and Decommissioning

- 7.3.3. Production

- 7.3.4. OtherApplications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Light Helicopters

- 8.1.2. Medium and Heavy Helicopters

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas Industry

- 8.2.2. Offshore Wind Industry

- 8.2.3. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Drilling

- 8.3.2. Relocation and Decommissioning

- 8.3.3. Production

- 8.3.4. OtherApplications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lockheed Martin Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Era Group Inc (ERA)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Service Providers

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cougar Helicopters Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Airbus SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 CHC Group Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Textron Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Leonardo SpA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bristow Group Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Helicopter Manufacturers

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: North America Offshore Helicopter Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Offshore Helicopter Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Offshore Helicopter Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Offshore Helicopter Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: North America Offshore Helicopter Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Offshore Helicopter Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Offshore Helicopter Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Offshore Helicopter Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Offshore Helicopter Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: North America Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Offshore Helicopter Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: North America Offshore Helicopter Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Offshore Helicopter Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Offshore Helicopter Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: North America Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: North America Offshore Helicopter Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: North America Offshore Helicopter Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Offshore Helicopter Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Offshore Helicopter Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: North America Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: North America Offshore Helicopter Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: North America Offshore Helicopter Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Offshore Helicopter Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Offshore Helicopter Services Market?

The projected CAGR is approximately 3.51%.

2. Which companies are prominent players in the North America Offshore Helicopter Services Market?

Key companies in the market include Lockheed Martin Corporation, Era Group Inc (ERA), Service Providers, Cougar Helicopters Inc, Airbus SE, CHC Group Ltd, Textron Inc, Leonardo SpA, Bristow Group Inc, Helicopter Manufacturers.

3. What are the main segments of the North America Offshore Helicopter Services Market?

The market segments include Type, End-user Industry, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Offshore wind to be the fastest-growing segment.

7. Are there any restraints impacting market growth?

4.; Competition from Crew Transfer Ships.

8. Can you provide examples of recent developments in the market?

November 2022: A business unit of Pratt & Whitney, Pratt & Whitney Canada, announced the acquisition of Shenzhen-based CITIC Offshore Helicopter Co., Ltd. The COHC has expanded the scope of its designated maintenance services to include line maintenance services and mobile repair team support for the PW206B2 and PW206B3 engines used in the H135B2/B3 helicopters, as well as the PW206C engines used in the Leonardo AW109 helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Offshore Helicopter Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Offshore Helicopter Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Offshore Helicopter Services Market?

To stay informed about further developments, trends, and reports in the North America Offshore Helicopter Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence