Key Insights

The North America luxury vinyl tile (LVT) flooring market is experiencing robust growth, projected to reach a market size of $14.72 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.89% from 2019 to 2033. This expansion is driven by several key factors. The increasing popularity of LVT as a durable, water-resistant, and aesthetically versatile alternative to traditional flooring materials like hardwood and ceramic tile fuels significant demand, particularly within the residential sector. Furthermore, the commercial sector is adopting LVT for its ease of maintenance, cost-effectiveness, and ability to mimic the look of more expensive materials, contributing significantly to market growth. The diverse product offerings, including rigid and flexible LVT options, cater to varied design preferences and installation needs, further enhancing market appeal. Growth is also facilitated by the expanding distribution channels, with home centers, online stores, and specialty retailers offering convenient access to a wide range of LVT products. While the United States dominates the North American market, Canada and Mexico also contribute to substantial revenue generation, indicating a strong regional presence. Competitive intensity within the market, characterized by established players such as LG Hausys, Shaw Industries Group, and Mohawk Industries alongside emerging brands, is driving innovation and product diversification, continuously enhancing product quality and design to meet evolving consumer demands.

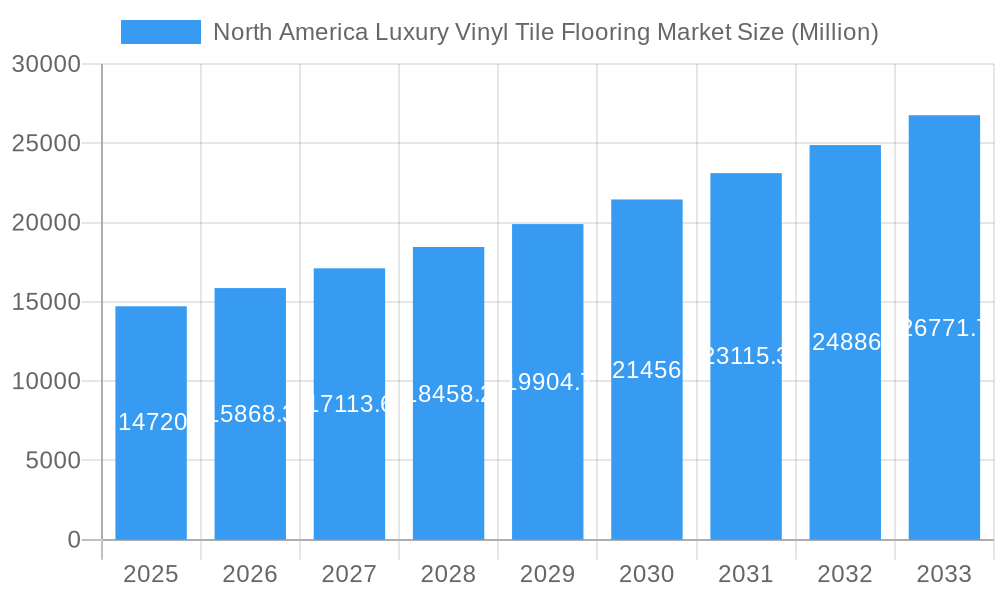

North America Luxury Vinyl Tile Flooring Market Market Size (In Billion)

The market’s sustained growth trajectory is expected to continue throughout the forecast period (2025-2033), underpinned by ongoing advancements in LVT technology, such as enhanced durability, improved realistic wood and stone visuals, and the development of eco-friendly materials. These innovations cater to the growing consumer preference for sustainable and high-performance flooring solutions. While potential restraints, such as fluctuating raw material prices and economic uncertainties, might temporarily influence growth, the overall market outlook remains positive, driven by the enduring appeal of LVT and its position as a leading flooring choice in both residential and commercial applications. Continued diversification of product lines and strategic expansion into new markets are anticipated to further propel the market’s growth in the coming years.

North America Luxury Vinyl Tile Flooring Market Company Market Share

North America Luxury Vinyl Tile Flooring Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Luxury Vinyl Tile (LVT) flooring market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. The report segments the market by product type (rigid, flexible), end-user (residential, commercial), distribution channel (home centers, flagship stores, specialty stores, online stores, other), and country (United States, Canada, Rest of North America). The market size is presented in Million units.

North America Luxury Vinyl Tile Flooring Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the North American LVT flooring market. The report examines market concentration, revealing the market share held by major players such as LG Hausys, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, American Biltrite, Armstrong Flooring, Gerflor, Mohawk Industries, Adore Floors Inc, Interface, and others. It explores the impact of technological innovations, including advancements in material science and manufacturing processes, leading to improved durability, aesthetics, and performance. Regulatory frameworks related to environmental sustainability and product safety are also considered. The analysis includes an evaluation of competitive substitutes, like hardwood and ceramic tile, and an assessment of mergers and acquisitions (M&A) activity within the industry.

- Market Concentration: xx% of the market is controlled by the top 5 players in 2025.

- M&A Activity: xx deals were recorded between 2019 and 2024, with an average deal value of xx Million units.

- Technological Innovation: Focus on water-resistant, waterproof, and sound-dampening technologies is driving growth.

- Regulatory Landscape: Increasingly stringent environmental regulations are influencing material choices and manufacturing processes.

North America Luxury Vinyl Tile Flooring Market Growth Trends & Insights

This section details the evolution of the North American LVT flooring market size, adoption rates, and key influencing factors. It analyzes technological disruptions, such as the emergence of rigid core LVT, and their impact on market dynamics. Consumer behavior shifts, driven by factors such as increasing disposable income and a preference for low-maintenance flooring solutions, are also explored. The report presents key metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates to illustrate market performance and future projections. The analysis incorporates data and insights from various sources to provide a comprehensive understanding of market growth trends. The section also considers economic cycles and their influence on consumer spending and industry investment.

- Market Size: The market size is projected to reach xx Million units by 2033.

- CAGR (2025-2033): xx%

- Market Penetration: xx% penetration in residential segment in 2025.

Dominant Regions, Countries, or Segments in North America Luxury Vinyl Tile Flooring Market

This section identifies the leading regions, countries, and segments driving market growth. It examines the performance of different segments – by product type (rigid vs. flexible), end-user (residential vs. commercial), and distribution channel (home centers, etc.) – and pinpoints the most dominant areas. The analysis incorporates factors such as economic policies, infrastructure development, and consumer preferences to explain the dominance of specific regions or segments. The report presents market share data and growth potential projections for each segment and country to illustrate market performance and future trends.

- Dominant Segment: Rigid Core LVT is projected to be the dominant segment by 2033, with xx Million units in sales.

- Dominant Country: The United States represents the largest market share, with xx Million units sold in 2025.

- Key Drivers for Growth: Increased preference for durable and waterproof flooring in both residential and commercial sectors is driving market growth.

North America Luxury Vinyl Tile Flooring Market Product Landscape

This section provides a concise overview of product innovations, applications, and performance metrics in the North American LVT flooring market. It highlights the unique selling propositions (USPs) of different LVT products, emphasizing advancements in technology that improve durability, aesthetics, and overall performance. The description also touches on new applications of LVT flooring in various settings, showcasing its versatility and suitability for diverse environments.

Key Drivers, Barriers & Challenges in North America Luxury Vinyl Tile Flooring Market

This section outlines the key drivers and challenges shaping the North American LVT flooring market. Driving forces include technological advancements, increased consumer demand for stylish and durable flooring, and favorable economic conditions. Challenges encompass supply chain disruptions, rising raw material costs, and intense competition from alternative flooring solutions. Quantifiable impacts of these factors are discussed, providing a clearer understanding of their influence on market growth.

- Key Drivers: Growing consumer preference for luxury vinyl tiles and technological advancements in product design and manufacturing.

- Key Challenges: Fluctuations in raw material prices and potential supply chain disruptions.

Emerging Opportunities in North America Luxury Vinyl Tile Flooring Market

This section highlights emerging trends and opportunities within the North American LVT market. It identifies untapped markets, innovative applications, and evolving consumer preferences that present promising avenues for growth. Examples might include new product categories like large-format tiles or sustainable LVT options catering to environmentally conscious consumers.

- Untapped Markets: Growth potential in the commercial sector beyond traditional office spaces.

Growth Accelerators in the North America Luxury Vinyl Tile Flooring Market Industry

This section pinpoints catalysts driving long-term growth in the North American LVT flooring market. It emphasizes the role of technological breakthroughs, strategic partnerships, and market expansion strategies in accelerating market development. The discussion highlights innovative collaborations and investments that are expected to bolster market growth significantly in the years to come.

Key Players Shaping the North America Luxury Vinyl Tile Flooring Market Market

This section profiles key players in the North American LVT flooring market, including LG Hausys, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, American Biltrite, Armstrong Flooring, Gerflor, Mohawk Industries, Adore Floors Inc, and Interface. The report may also include links to the companies' websites where available.

Notable Milestones in North America Luxury Vinyl Tile Flooring Market Sector

This section summarizes important events impacting the North American LVT flooring market.

- December 2023: Galleher's acquisition by Transom Capital expands premium flooring distribution.

- September 2023: AHF Products and Spartan Surfaces' distribution agreement for Parterre flooring broadens market reach.

In-Depth North America Luxury Vinyl Tile Flooring Market Market Outlook

This concluding section summarizes the key growth accelerators and provides a concise outlook on the future potential of the North American LVT flooring market. It emphasizes strategic opportunities and potential market expansion areas, offering a final perspective on the industry's trajectory and growth prospects.

North America Luxury Vinyl Tile Flooring Market Segmentation

-

1. Product Type

- 1.1. Rigid

- 1.2. Flexible

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online Stores

- 3.5. Other Distribution Channels

North America Luxury Vinyl Tile Flooring Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Luxury Vinyl Tile Flooring Market Regional Market Share

Geographic Coverage of North America Luxury Vinyl Tile Flooring Market

North America Luxury Vinyl Tile Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real Estate Market is Driving the Market; Increasing Construction Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Competition from Other Flooring Options; Rise in Raw Material Costs

- 3.4. Market Trends

- 3.4.1. The Residential Segment Leads the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Luxury Vinyl Tile Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid

- 5.1.2. Flexible

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG Hausys

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shaw Industries Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tarkett

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mannington Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Biltrite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Armstrong Flooring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerflor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawk Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adore Floors Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Interface

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LG Hausys

List of Figures

- Figure 1: North America Luxury Vinyl Tile Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Luxury Vinyl Tile Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Luxury Vinyl Tile Flooring Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the North America Luxury Vinyl Tile Flooring Market?

Key companies in the market include LG Hausys, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, American Biltrite, Armstrong Flooring, Gerflor, Mohawk Industries, Adore Floors Inc **List Not Exhaustive, Interface.

3. What are the main segments of the North America Luxury Vinyl Tile Flooring Market?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real Estate Market is Driving the Market; Increasing Construction Industry is Driving the Market.

6. What are the notable trends driving market growth?

The Residential Segment Leads the Market.

7. Are there any restraints impacting market growth?

Competition from Other Flooring Options; Rise in Raw Material Costs.

8. Can you provide examples of recent developments in the market?

In December 2023, Galleher, the third-biggest flooring distributor and the largest in the western United States was acquired by operations-focused middle market private equity company transom capital, allowing it to enter the premium flooring industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Luxury Vinyl Tile Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Luxury Vinyl Tile Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Luxury Vinyl Tile Flooring Market?

To stay informed about further developments, trends, and reports in the North America Luxury Vinyl Tile Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence