Key Insights

The North American edible meat industry, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. Rising consumer demand for protein-rich diets, coupled with increasing disposable incomes and changing dietary preferences, fuels market expansion. The industry's segmentation, encompassing beef, mutton, pork, poultry, and other meats, offers diverse product offerings catering to varying consumer tastes and preferences. Growth is further propelled by innovative product development, including ready-to-eat meals and value-added processed meat products, enhancing convenience and appeal. However, challenges such as fluctuating raw material prices, stringent regulations concerning food safety and animal welfare, and growing concerns about the environmental impact of meat production pose potential restraints. The distribution channels, encompassing both on-trade (restaurants, hotels) and off-trade (retail stores, supermarkets), demonstrate the industry's broad reach and adaptability to evolving consumer purchasing behaviors. Specific segments like poultry and processed meats are expected to witness faster growth compared to others due to their affordability and convenience.

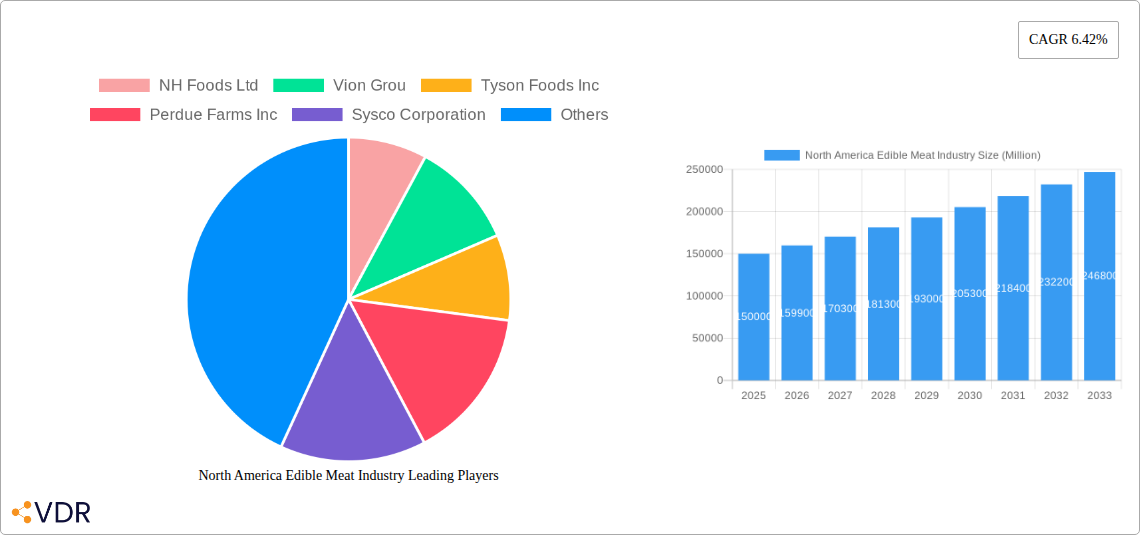

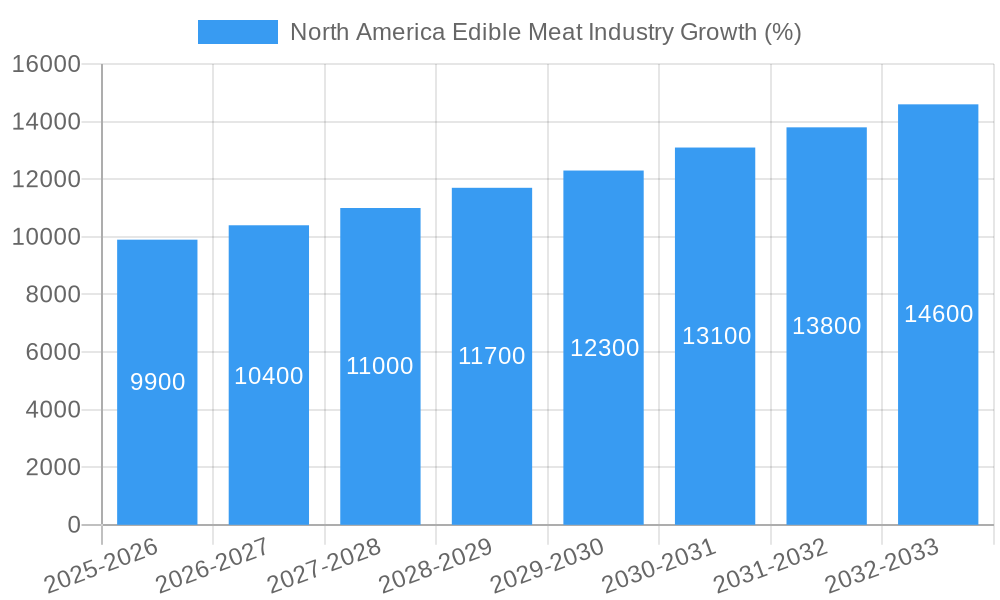

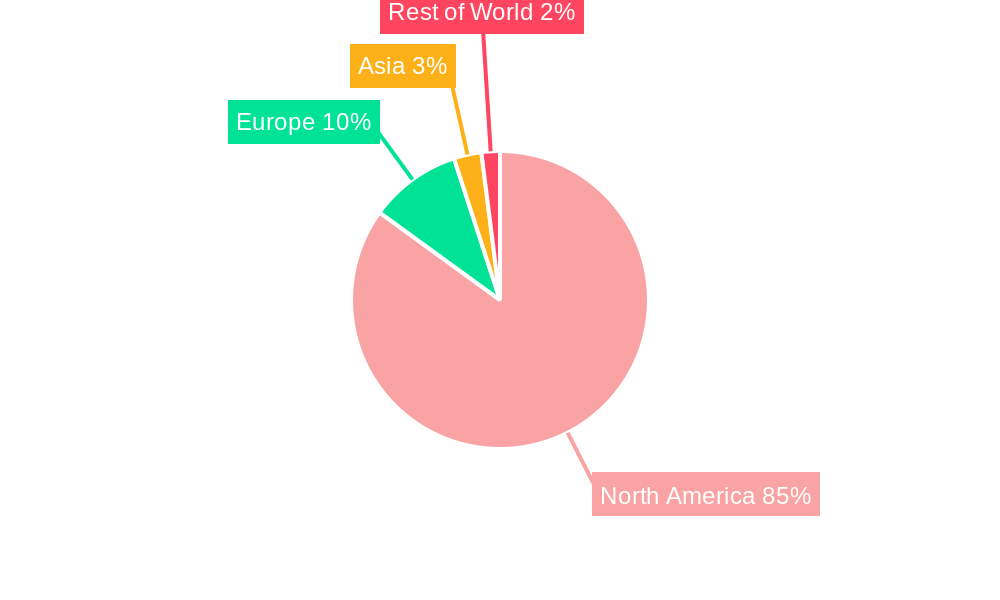

Within the North American market, the United States dominates, followed by Canada and Mexico. The forecast period (2025-2033) anticipates a continuation of the positive growth trajectory, with a Compound Annual Growth Rate (CAGR) of 6.42%. This sustained growth is expected to be supported by continued product innovation, strategic partnerships between producers and distributors, and increasing focus on sustainable and ethical meat production practices. Key players such as Tyson Foods, JBS SA, and Cargill, leveraging their established distribution networks and brand recognition, will play a crucial role in shaping the market landscape. The industry is expected to witness increased mergers and acquisitions as companies strive to expand their market share and enhance their product portfolios to cater to the ever-evolving demands of the consumer.

North America Edible Meat Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America edible meat industry, encompassing market size, growth trends, competitive landscape, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by type (beef, mutton, pork, poultry, other meat), form (canned, fresh/chilled, frozen, processed), and distribution channel (off-trade, on-trade). Key players such as Tyson Foods Inc, JBS SA, and Cargill Inc are analyzed in detail. This report is essential for understanding the dynamics and future potential of this vital sector.

North America Edible Meat Industry Market Dynamics & Structure

The North American edible meat industry is a highly consolidated market, with a few large players holding significant market share. The market is characterized by intense competition, driven by factors such as fluctuating commodity prices, evolving consumer preferences, and stringent regulatory requirements. Technological innovations, particularly in areas like automation and food safety, are transforming production processes and impacting the overall market structure.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This high level of concentration indicates the influence of large-scale producers.

- Technological Innovation: Automation in processing, improved packaging technologies, and traceability systems are key drivers of efficiency and consumer trust. However, high initial investment costs pose a barrier to entry for smaller players.

- Regulatory Framework: Stringent food safety regulations and labeling requirements impact production costs and influence market dynamics. Compliance with these rules significantly affects both large and small meat processing firms.

- Competitive Product Substitutes: Plant-based meat alternatives are gaining traction, representing a growing challenge to traditional meat products, projected to capture xx Million units by 2033.

- End-User Demographics: Growing health consciousness among consumers is influencing demand for leaner meats and alternative protein sources. This shift in preference will likely require adaptation within the industry.

- M&A Trends: The industry has seen significant merger and acquisition (M&A) activity in recent years (e.g., JBS SA's acquisition of TriOak Foods assets and the Cargill/Continental Grain acquisition of Sanderson Farms). The volume of M&A deals in the period 2019-2024 totaled xx, indicating a consolidated market.

North America Edible Meat Industry Growth Trends & Insights

The North American edible meat industry experienced a xx% CAGR during the historical period (2019-2024), reaching a market size of xx Million units in 2024. This growth was fueled by several factors including a growing population, increasing per capita meat consumption (though projected to plateau around xx Million units per year), and rising disposable incomes. However, consumer preference shifts towards healthier and more sustainable food options are creating new challenges. The market is expected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Technological disruptions, including precision farming techniques and automation in processing plants, contribute significantly to improved efficiency and output. Consumer behavior trends, such as a growing preference for convenience foods and premium meat products, also directly impact market growth. The increasing adoption of online grocery shopping and food delivery services are changing the distribution landscape, impacting market segmentations such as off-trade vs on-trade.

Dominant Regions, Countries, or Segments in North America Edible Meat Industry

The United States dominates the North American edible meat market, accounting for xx% of the total market value in 2025. Within the US market, the poultry segment holds the largest market share, driven by relatively lower prices and high demand.

- Key Drivers:

- Strong economic growth and stable per capita income in the US and Canada are primary drivers for meat consumption.

- Well-established distribution networks facilitate efficient delivery of meat products to consumers across various channels.

- Favorable government policies supporting the agricultural sector and meat processing industry are also pivotal factors.

- Dominance Factors: The US holds significant dominance due to its large livestock population, extensive processing infrastructure, and high consumer demand. Further analysis into specific state-level data reveals that those with higher concentrations of farming and livestock also exhibit higher meat consumption, reflecting regional variations in market trends. The poultry segment's dominance within the US is attributed to its affordability and widespread acceptance. The off-trade channel (supermarkets, grocery stores) holds the larger share of distribution for all meat types.

North America Edible Meat Industry Product Landscape

The North American edible meat industry showcases a diverse range of products, from fresh and chilled meats to processed and value-added options. Innovation focuses on extending shelf life, improving food safety, and catering to evolving consumer preferences for convenience and health-conscious options. This includes organic and grass-fed meats, along with value-added products like ready-to-cook meals and meat-based snacks. Technological advancements like advanced packaging solutions enhance product quality and reduce food waste, creating improved efficiency across the value chain.

Key Drivers, Barriers & Challenges in North America Edible Meat Industry

Key Drivers: Growing population, rising disposable incomes, changing dietary habits (though partially offset by plant-based alternatives), and technological advancements in production and processing are driving market growth. Government support for the agricultural sector also plays a significant role.

Key Challenges: Fluctuating commodity prices, stringent food safety regulations, increasing competition from plant-based meat alternatives, and labor shortages pose significant challenges to market expansion. Supply chain disruptions caused by factors such as disease outbreaks, extreme weather events, and geopolitical instability further impact stability and profitability. These factors can lead to significant price increases and reduced availability.

Emerging Opportunities in North America Edible Meat Industry

Growing demand for convenient, ready-to-eat meals and healthier meat options presents significant opportunities. The rise of plant-based meat alternatives necessitates innovation in meat processing, creating potential in blending plant-based and traditional meats for hybrid products. Expansion into emerging markets, including those with growing middle classes, also offers potential growth avenues. Focus on sustainable farming practices, addressing environmental concerns, will enhance brand image and potentially attract consumers.

Growth Accelerators in the North America Edible Meat Industry

Technological innovation in areas such as automation, precision livestock farming, and traceability systems will play a key role in enhancing efficiency and sustainability. Strategic partnerships and collaborations within the industry and with related sectors, such as technology providers, will accelerate market growth. Expansion into international markets, particularly those with rising consumption of meat products, will contribute to market expansion. Emphasis on sustainability and ethical sourcing will become increasingly important for brand image and consumer preference.

Key Players Shaping the North America Edible Meat Industry Market

- NH Foods Ltd

- Vion Grou

- Tyson Foods Inc

- Perdue Farms Inc

- Sysco Corporation

- The Kraft Heinz Company

- Foster Farms Inc

- Continental Grain Company

- Hormel Foods Corporation

- Cargill Inc

- Marfrig Global Foods S A

- The Clemens Family Corporation

- JBS SA

- OSI Group

Notable Milestones in North America Edible Meat Industry Sector

- July 2022: Cargill Incorporated and Continental Grain Company acquired Sanderson Farms, creating a leading US poultry business. This significantly altered the market landscape, increasing consolidation.

- December 2022: JBS USA acquired assets from TriOak Foods, expanding its presence in pork production and related areas. This move strengthened JBS's vertical integration within the meat production chain.

- February 2023: Sysco Corporation launched its ‘Recipe for Sustainability’ program, highlighting a growing focus on environmental sustainability within the industry. This initiative positions Sysco as a leader in corporate social responsibility.

In-Depth North America Edible Meat Industry Market Outlook

The North American edible meat industry is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic partnerships. The focus on sustainable practices, product diversification, and value-added products will shape future market dynamics. Opportunities exist in expanding into new markets, developing innovative meat alternatives, and enhancing supply chain efficiency to address potential disruptions. The increasing emphasis on traceability and transparency in meat production is expected to drive future market growth and consumer trust.

North America Edible Meat Industry Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Pork

- 1.4. Poultry

- 1.5. Other Meat

-

2. Form

- 2.1. Canned

- 2.2. Fresh / Chilled

- 2.3. Frozen

- 2.4. Processed

-

3. Distribution Channel

-

3.1. Off-Trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Channel

- 3.1.3. Supermarkets and Hypermarkets

- 3.1.4. Others

- 3.2. On-Trade

-

3.1. Off-Trade

North America Edible Meat Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Edible Meat Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Edible Meat Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Pork

- 5.1.4. Poultry

- 5.1.5. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Canned

- 5.2.2. Fresh / Chilled

- 5.2.3. Frozen

- 5.2.4. Processed

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-Trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Channel

- 5.3.1.3. Supermarkets and Hypermarkets

- 5.3.1.4. Others

- 5.3.2. On-Trade

- 5.3.1. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Edible Meat Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Edible Meat Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Edible Meat Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Edible Meat Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 NH Foods Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vion Grou

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tyson Foods Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Perdue Farms Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sysco Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Kraft Heinz Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Foster Farms Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Continental Grain Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hormel Foods Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cargill Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Marfrig Global Foods S A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Clemens Family Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 JBS SA

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 OSI Group

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 NH Foods Ltd

List of Figures

- Figure 1: North America Edible Meat Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Edible Meat Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Edible Meat Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Edible Meat Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Edible Meat Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 4: North America Edible Meat Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: North America Edible Meat Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Edible Meat Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Edible Meat Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Edible Meat Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 13: North America Edible Meat Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: North America Edible Meat Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Edible Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Edible Meat Industry?

The projected CAGR is approximately 6.42%.

2. Which companies are prominent players in the North America Edible Meat Industry?

Key companies in the market include NH Foods Ltd, Vion Grou, Tyson Foods Inc, Perdue Farms Inc, Sysco Corporation, The Kraft Heinz Company, Foster Farms Inc, Continental Grain Company, Hormel Foods Corporation, Cargill Inc, Marfrig Global Foods S A, The Clemens Family Corporation, JBS SA, OSI Group.

3. What are the main segments of the North America Edible Meat Industry?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

February 2023: Sysco Corporation has launched its new ‘Recipe for Sustainability’ program. Through this program, Sysco will collaborate with top Students at Arizona State University and Pennsylvania State University to explore innovations that will accelerate climate action and lead the industry towards a more sustainable future.December 2022: JBS USA, a subsidiary of JBS SA, announced it reached an agreement to acquire certain assets from TriOak Foods for an undisclosed amount. Operations of TriOak Foods include live pork production, grain merchandising, and fertilizer marketing.July 2022: Cargill Incorporated partnered with Continental Grain Company to acquire Sanderson Farms. Upon completion of the acquisition, Cargill and Continental Grain will combine Sanderson Farms with Wayne Farms, a subsidiary of Continental Grain, to form a new, privately held poultry business. The combination of Sanderson Farms and Wayne Farms will create a best-in-class US poultry company with a high-quality asset base, complementary operating cultures, and an industry-leading management team and workforce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Edible Meat Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Edible Meat Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Edible Meat Industry?

To stay informed about further developments, trends, and reports in the North America Edible Meat Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence