Key Insights

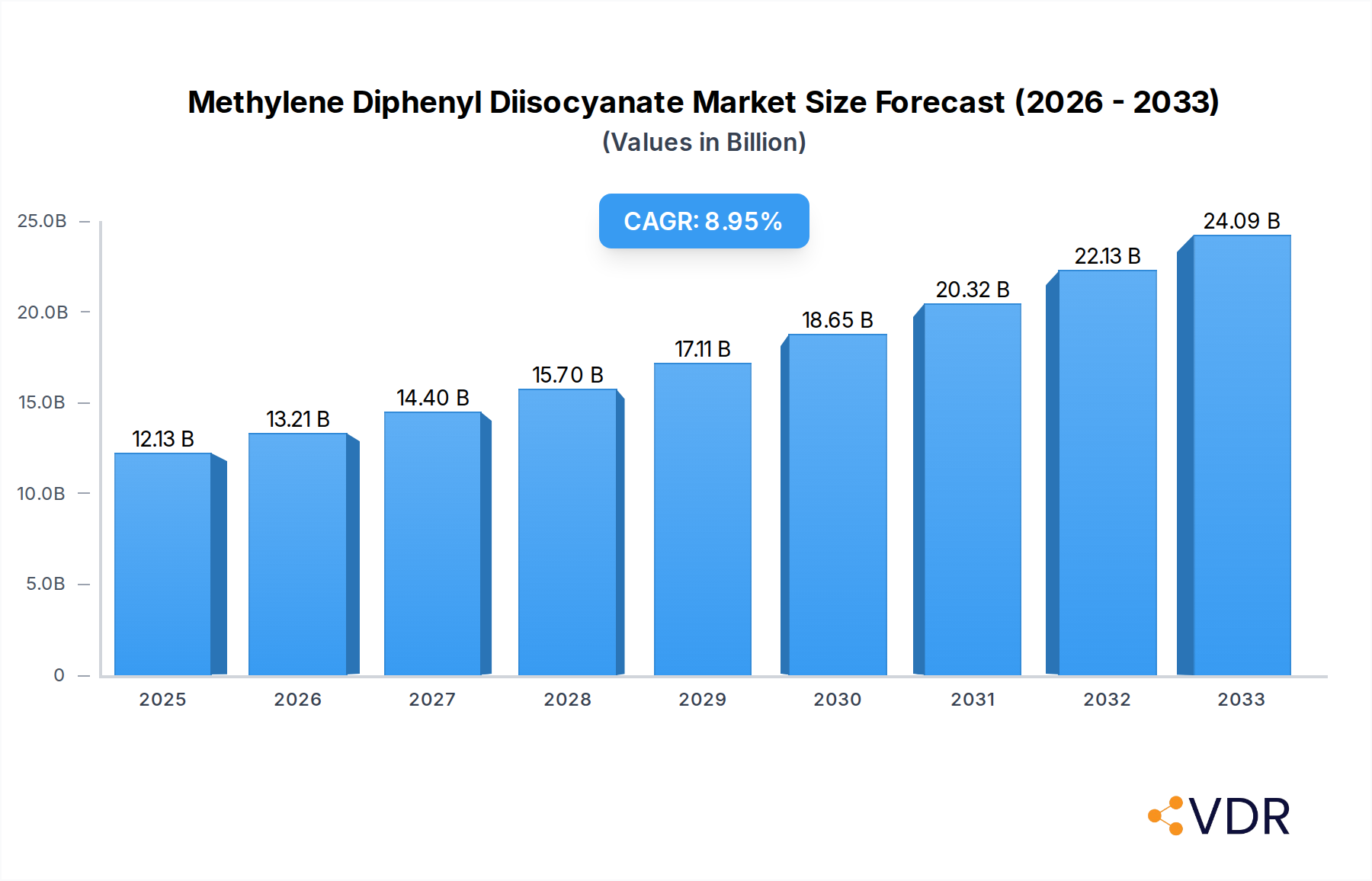

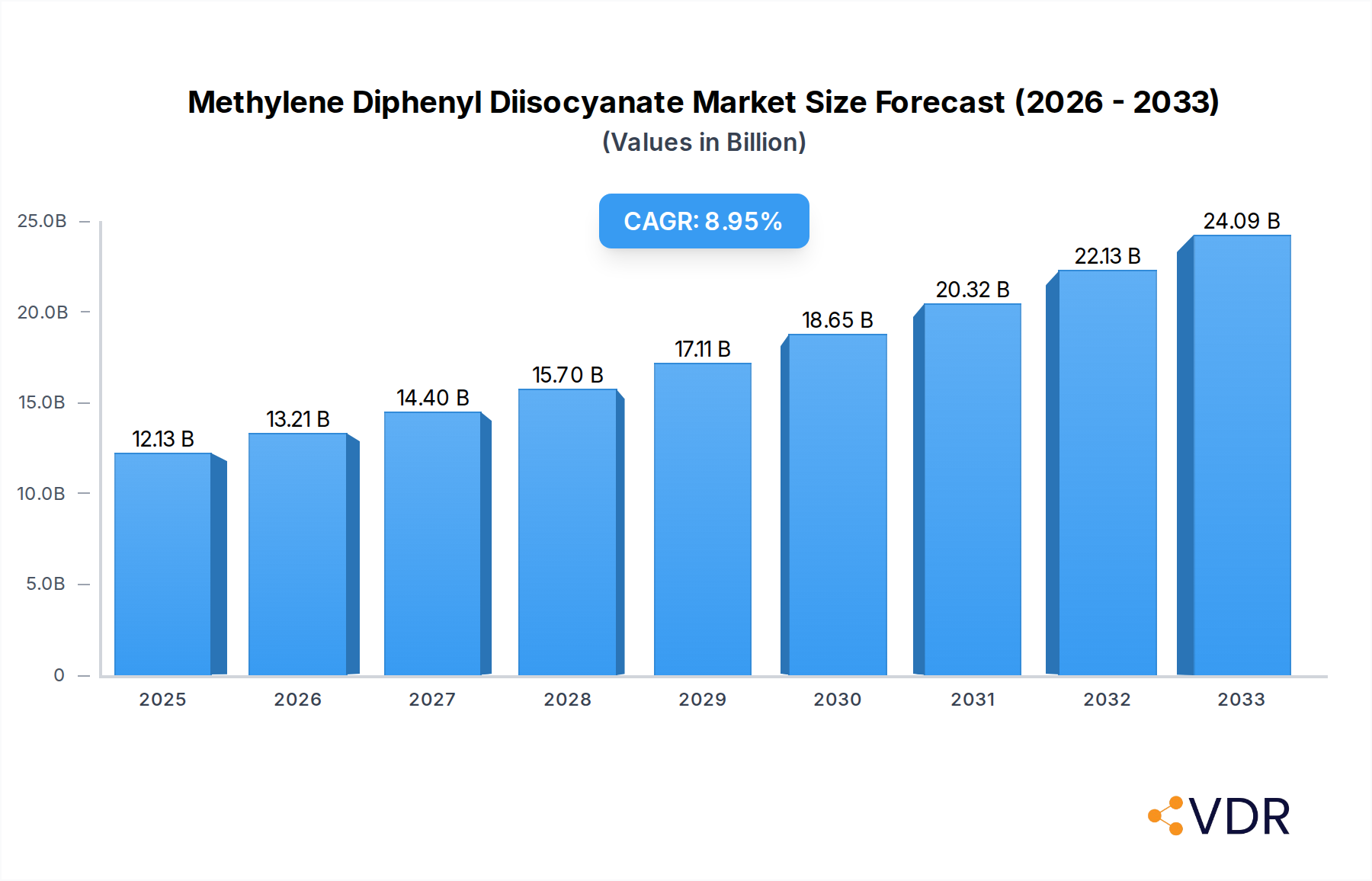

The global Methylene Diphenyl Diisocyanate (MDI) market is poised for substantial growth, projected to reach a significant $12.13 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 9.05% through 2033. This upward trajectory is largely propelled by the escalating demand for rigid and flexible foams, which serve as essential components in a multitude of applications, including insulation in the construction sector, cushioning in furniture and interiors, and structural elements in automotive manufacturing. The increasing emphasis on energy efficiency, particularly in buildings and vehicles, is a key driver for rigid foam consumption, while the burgeoning e-commerce sector fuels demand for protective packaging, further bolstering the MDI market. Furthermore, advancements in MDI-based adhesives, sealants, and coatings, offering enhanced durability and performance, are opening new avenues for market expansion.

Methylene Diphenyl Diisocyanate Market Market Size (In Billion)

The market is characterized by dynamic trends, including a growing preference for advanced polyurethanes with improved properties and a focus on sustainable production methods. While the market exhibits strong growth, it faces certain restraints, such as fluctuating raw material prices, particularly for benzene and aniline, which can impact production costs and profitability. Additionally, stringent environmental regulations concerning the handling and disposal of isocyanates in some regions can pose challenges. Nevertheless, the innovative product development by leading companies like BASF SE, Covestro AG, and Wanhua, alongside strategic expansions in emerging economies, particularly in the Asia Pacific region, are expected to overcome these hurdles and ensure continued market vitality. The diversified end-user industry base, spanning construction, automotive, electronics, furniture, and footwear, provides a resilient foundation for sustained market expansion.

Methylene Diphenyl Diisocyanate Market Company Market Share

Methylene Diphenyl Diisocyanate (MDI) Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock critical insights into the global Methylene Diphenyl Diisocyanate (MDI) market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides a detailed examination of market dynamics, growth trends, key players, and future opportunities. Essential for industry professionals, investors, and stakeholders seeking to navigate the evolving landscape of MDI production and application. Dive deep into parent and child market segments, including Rigid Foam, Flexible Foam, Coatings, Elastomers, Adhesives & Sealants, and applications across Construction, Furniture, Electronics, Automotive, and Footwear.

Methylene Diphenyl Diisocyanate Market Market Dynamics & Structure

The global Methylene Diphenyl Diisocyanate (MDI) market exhibits a moderate to high concentration, with a few dominant players like Wanhua, BASF SE, and Covestro AG holding significant market shares, estimated to be over 60% collectively. Technological innovation remains a primary driver, with companies continuously investing in process optimization for increased efficiency and reduced environmental impact. Regulatory frameworks, particularly concerning emissions and sustainable production, are shaping manufacturing practices and product development. Competitive product substitutes, while present in niche applications, do not pose a significant threat to MDI's core utility due to its unique performance characteristics. End-user demographics are shifting towards sustainability and performance, influencing demand for MDI in energy-efficient construction materials and lightweight automotive components. Mergers and acquisitions (M&A) activity is strategic, focusing on capacity expansion and vertical integration, with an estimated XX M&A deals occurring annually within the broader isocyanates sector. Barriers to innovation include the high capital investment required for MDI production facilities and the complexity of managing hazardous raw materials.

- Market Concentration: Moderate to High, dominated by top 3-5 players.

- Technological Innovation: Focus on process efficiency, sustainability, and new applications.

- Regulatory Frameworks: Increasingly stringent environmental standards influencing production.

- Competitive Substitutes: Limited impact on core MDI applications.

- End-User Demographics: Growing demand for sustainable and high-performance materials.

- M&A Trends: Strategic, focusing on capacity and integration.

Methylene Diphenyl Diisocyanate Market Growth Trends & Insights

The Methylene Diphenyl Diisocyanate (MDI) market is poised for robust growth, driven by escalating demand across its diverse application spectrum. The market size is projected to expand from an estimated USD XXX billion in 2025 to USD XXX billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates for MDI-based products are particularly high in emerging economies, fueled by rapid industrialization and urbanization, which translate to increased construction activities and a greater need for insulation materials. Technological disruptions are primarily focused on enhancing sustainability, such as the development of bio-based MDI, and improving the performance characteristics of MDI-based polymers for specialized applications like advanced composites and high-durability coatings. Consumer behavior shifts towards energy efficiency in buildings and lightweighting in transportation are directly benefiting the MDI market, as rigid polyurethane foams derived from MDI are essential for thermal insulation and structural integrity. The electronics and appliances sector also contributes to growth, with MDI used in insulation and encapsulation for components.

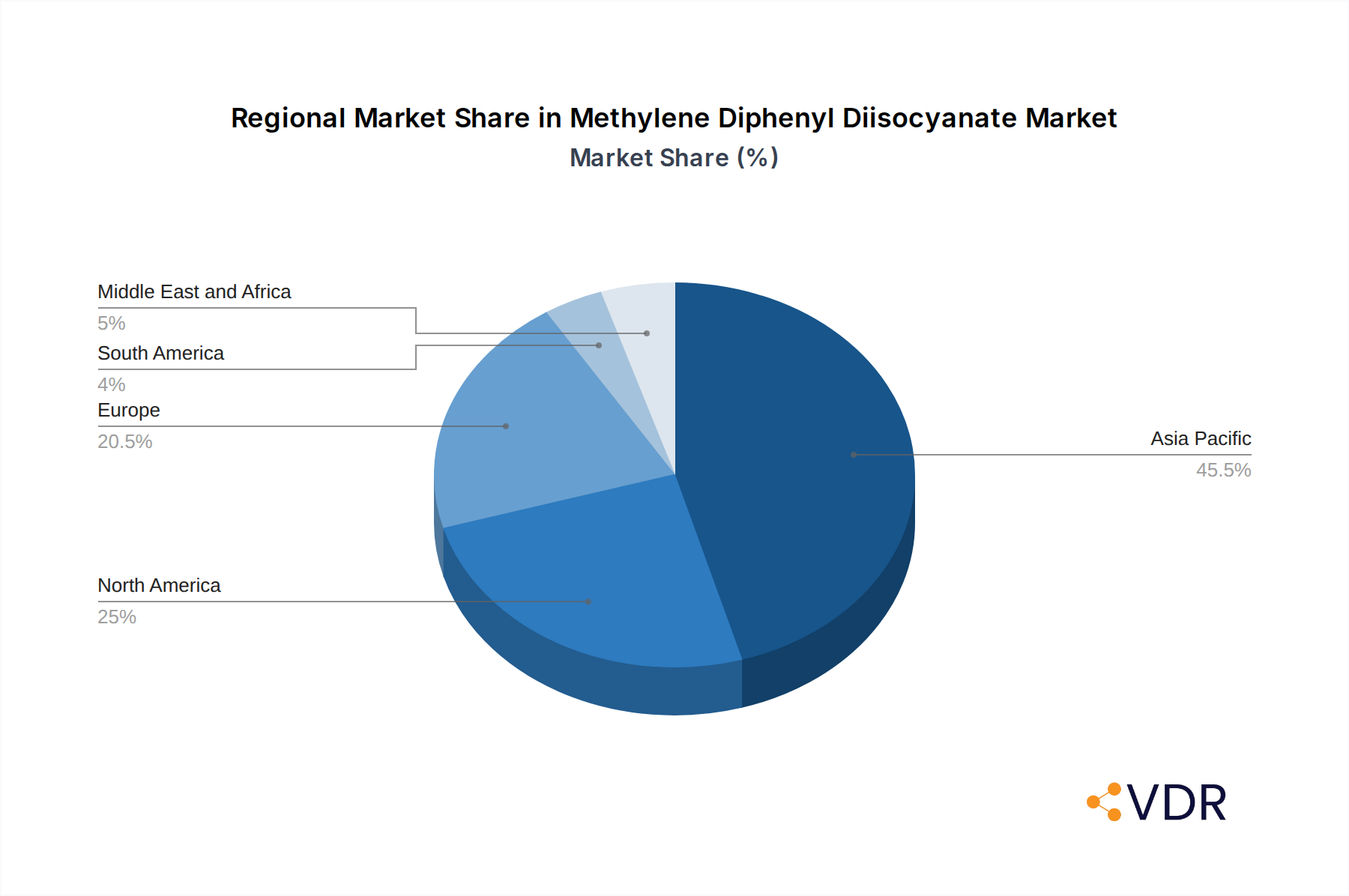

Dominant Regions, Countries, or Segments in Methylene Diphenyl Diisocyanate Market

The Asia Pacific region is unequivocally the dominant force in the global Methylene Diphenyl Diisocyanate (MDI) market, driven by its immense manufacturing capabilities, burgeoning construction sector, and rapidly expanding automotive industry. Within this region, China stands out as the largest consumer and producer of MDI, accounting for an estimated XX% of global demand. The country's aggressive infrastructure development projects, coupled with a vast domestic market for appliances and furniture, create a consistently high demand for MDI-based rigid and flexible foams. Economic policies that encourage manufacturing and a growing middle class with increasing disposable income further propel MDI consumption.

The Construction end-user industry is the primary growth engine for the MDI market, particularly in its application for rigid polyurethane foams. These foams are critical for thermal insulation in buildings, contributing significantly to energy efficiency and reduced carbon footprints. The global push towards green building standards and stricter energy regulations worldwide directly translates to increased demand for MDI in this segment. Market share within the rigid foam application is estimated at over XX% of total MDI consumption.

Furthermore, the Automotive sector is a significant contributor, with MDI utilized in lightweighting initiatives to improve fuel efficiency and reduce emissions. Flexible foams for seating and interior components, as well as elastomers for seals and components, are also key applications. The increasing adoption of electric vehicles, which often require advanced insulation and structural materials, further amplifies MDI demand.

Methylene Diphenyl Diisocyanate Market Product Landscape

The Methylene Diphenyl Diisocyanate (MDI) product landscape is characterized by continuous innovation aimed at enhancing performance and sustainability. Key product variants include polymeric MDI (PMDI) and monomeric MDI (MMDI), each tailored for specific applications. PMDI, the most common form, is extensively used in rigid polyurethane foams for insulation, offering excellent thermal resistance and structural integrity. MMDI finds application in coatings, adhesives, sealants, and elastomers, where its purity and reactivity are crucial for achieving desired material properties. Recent product advancements include the development of bio-based MDI, derived from renewable resources, addressing the growing demand for environmentally friendly solutions. Performance metrics such as thermal conductivity, tensile strength, and chemical resistance are continuously being improved through advanced manufacturing processes and formulation techniques.

Key Drivers, Barriers & Challenges in Methylene Diphenyl Diisocyanate Market

Key Drivers:

- Growing Construction Industry: Demand for insulation in buildings for energy efficiency.

- Automotive Lightweighting: Use in foams and elastomers to reduce vehicle weight.

- Furniture and Appliances: Essential for flexible foams and insulation.

- Technological Advancements: Development of higher-performance and sustainable MDI variants.

- Economic Growth in Emerging Markets: Increased industrialization and urbanization.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in benzene and aniline prices impact production costs.

- Environmental Regulations: Stringent emission standards and handling requirements for isocyanates.

- Supply Chain Disruptions: Geopolitical factors and logistics can affect availability.

- Health and Safety Concerns: MDI is a hazardous substance requiring careful handling.

- High Capital Investment: Significant upfront costs for MDI production facilities.

Emerging Opportunities in Methylene Diphenyl Diisocyanate Market

Emerging opportunities in the Methylene Diphenyl Diisocyanate (MDI) market lie in the development and application of advanced, sustainable MDI-based materials. The increasing global focus on circular economy principles presents opportunities for MDI recyclability and the development of bio-attributed MDI. Untapped markets in developing regions with significant infrastructure needs offer substantial growth potential. Innovative applications in renewable energy sectors, such as composite materials for wind turbine blades, and advanced insulation solutions for data centers, are also promising avenues. Furthermore, the demand for high-performance elastomers and coatings in specialized industries like aerospace and marine presents opportunities for differentiated MDI products.

Growth Accelerators in the Methylene Diphenyl Diisocyanate Market Industry

Growth accelerators in the Methylene Diphenyl Diisocyanate (MDI) market are largely driven by ongoing technological breakthroughs and strategic market expansion initiatives. The continuous development of more energy-efficient and environmentally friendly polyurethane systems, where MDI plays a crucial role, is a significant catalyst. Partnerships between MDI manufacturers and downstream users are fostering innovation in application development, leading to the creation of novel materials with enhanced properties. Furthermore, investments in expanding production capacities, particularly in Asia Pacific and North America, are crucial for meeting projected demand and ensuring market stability. The increasing adoption of stringent building codes and energy efficiency standards globally will further accelerate the demand for MDI-based insulation.

Key Players Shaping the Methylene Diphenyl Diisocyanate Market Market

- Sumitomo Chemical Co Ltd

- Kumho Mitsui Chemicals Corp

- Sadara

- Shanghai Lianheng Isocyanate Co Ltd

- BASF SE

- Wanhua

- Tosoh Corporation

- Dow

- Hexion

- Covestro AG

- Chongqing ChangFeng Chemical Co Ltd

- Huntsman Corporation

- KAROON Petrochemical Company

Notable Milestones in Methylene Diphenyl Diisocyanate Market Sector

- January 2024: BASF SE announced price increases for its Lupranate MDI basic products in ASEAN and South Asia by USD 200 per metric ton, citing higher raw material and energy costs.

- October 2023: BASF SE successfully produced the first biomass-balanced (BMB) methylene diphenyl diisocyanate (MDI) at its Yeosu site in Korea.

- September 2023: Dow inaugurated a new MDI distillation and prepolymers facility in Freeport, Texas, to enhance its North American capacity and supply an additional 30% of product.

- January 2023: BASF SE commenced the third and final phase of its MDI expansion project at its Verbund site in Geismar, Louisiana, aiming to increase production capacity.

- July 2022: BASF invested USD 780 million in expanding its MDI plant at its Geismar, Louisiana site, increasing its production capacity.

In-Depth Methylene Diphenyl Diisocyanate Market Market Outlook

The future outlook for the Methylene Diphenyl Diisocyanate (MDI) market is exceptionally positive, underpinned by persistent global demand for energy-efficient solutions and advanced materials. Growth accelerators, including the development of sustainable MDI production processes and innovative applications in sectors like renewable energy and electric mobility, will continue to fuel market expansion. Strategic investments in capacity by key players, particularly in high-growth regions, will ensure the availability of MDI to meet evolving industry needs. The market is expected to witness significant growth, driven by a confluence of technological advancements, favorable regulatory environments promoting sustainability, and a growing global consciousness towards energy conservation. The long-term potential for MDI remains robust, offering substantial opportunities for stakeholders who can adapt to evolving market demands and embrace sustainable innovations.

Methylene Diphenyl Diisocyanate Market Segmentation

-

1. Application

- 1.1. Rigid Foam

- 1.2. Flexible Foam

- 1.3. Coatings

- 1.4. Elastomers

- 1.5. Adhesive and Sealants

- 1.6. Other Applications

-

2. End-user Industry

- 2.1. Construction

- 2.2. Furniture and Interiors

- 2.3. Electronics and Appliances

- 2.4. Automotive

- 2.5. Footwear

- 2.6. Other End-user Industries

Methylene Diphenyl Diisocyanate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Methylene Diphenyl Diisocyanate Market Regional Market Share

Geographic Coverage of Methylene Diphenyl Diisocyanate Market

Methylene Diphenyl Diisocyanate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for PU in Insulation in the Construction Industry; Expanding Scope of Application

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Associated with MDI; Toxic Effects of MDI

- 3.4. Market Trends

- 3.4.1. The Construction Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Methylene Diphenyl Diisocyanate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Rigid Foam

- 5.1.2. Flexible Foam

- 5.1.3. Coatings

- 5.1.4. Elastomers

- 5.1.5. Adhesive and Sealants

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Furniture and Interiors

- 5.2.3. Electronics and Appliances

- 5.2.4. Automotive

- 5.2.5. Footwear

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Methylene Diphenyl Diisocyanate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Rigid Foam

- 6.1.2. Flexible Foam

- 6.1.3. Coatings

- 6.1.4. Elastomers

- 6.1.5. Adhesive and Sealants

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Furniture and Interiors

- 6.2.3. Electronics and Appliances

- 6.2.4. Automotive

- 6.2.5. Footwear

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Methylene Diphenyl Diisocyanate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Rigid Foam

- 7.1.2. Flexible Foam

- 7.1.3. Coatings

- 7.1.4. Elastomers

- 7.1.5. Adhesive and Sealants

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Furniture and Interiors

- 7.2.3. Electronics and Appliances

- 7.2.4. Automotive

- 7.2.5. Footwear

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Methylene Diphenyl Diisocyanate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Rigid Foam

- 8.1.2. Flexible Foam

- 8.1.3. Coatings

- 8.1.4. Elastomers

- 8.1.5. Adhesive and Sealants

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Furniture and Interiors

- 8.2.3. Electronics and Appliances

- 8.2.4. Automotive

- 8.2.5. Footwear

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Methylene Diphenyl Diisocyanate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Rigid Foam

- 9.1.2. Flexible Foam

- 9.1.3. Coatings

- 9.1.4. Elastomers

- 9.1.5. Adhesive and Sealants

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Furniture and Interiors

- 9.2.3. Electronics and Appliances

- 9.2.4. Automotive

- 9.2.5. Footwear

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Methylene Diphenyl Diisocyanate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Rigid Foam

- 10.1.2. Flexible Foam

- 10.1.3. Coatings

- 10.1.4. Elastomers

- 10.1.5. Adhesive and Sealants

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Furniture and Interiors

- 10.2.3. Electronics and Appliances

- 10.2.4. Automotive

- 10.2.5. Footwear

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sumitomo Chemical Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kumho Mitsui Chemicals Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sadara

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shanghai Lianheng Isocyanate Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wanhua

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tosoh Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hexion

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Covestro AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chongqing ChangFeng Chemical Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huntsman Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KAROON Petrochemical Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Global Methylene Diphenyl Diisocyanate Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Methylene Diphenyl Diisocyanate Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Application 2025 & 2033

- Figure 4: Asia Pacific Methylene Diphenyl Diisocyanate Market Volume (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Methylene Diphenyl Diisocyanate Market Volume Share (%), by Application 2025 & 2033

- Figure 7: Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Methylene Diphenyl Diisocyanate Market Volume (Million), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Methylene Diphenyl Diisocyanate Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: Asia Pacific Methylene Diphenyl Diisocyanate Market Volume (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Methylene Diphenyl Diisocyanate Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Application 2025 & 2033

- Figure 16: North America Methylene Diphenyl Diisocyanate Market Volume (Million), by Application 2025 & 2033

- Figure 17: North America Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Methylene Diphenyl Diisocyanate Market Volume Share (%), by Application 2025 & 2033

- Figure 19: North America Methylene Diphenyl Diisocyanate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: North America Methylene Diphenyl Diisocyanate Market Volume (Million), by End-user Industry 2025 & 2033

- Figure 21: North America Methylene Diphenyl Diisocyanate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Methylene Diphenyl Diisocyanate Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: North America Methylene Diphenyl Diisocyanate Market Volume (Million), by Country 2025 & 2033

- Figure 25: North America Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Methylene Diphenyl Diisocyanate Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Methylene Diphenyl Diisocyanate Market Volume (Million), by Application 2025 & 2033

- Figure 29: Europe Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Methylene Diphenyl Diisocyanate Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Methylene Diphenyl Diisocyanate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 32: Europe Methylene Diphenyl Diisocyanate Market Volume (Million), by End-user Industry 2025 & 2033

- Figure 33: Europe Methylene Diphenyl Diisocyanate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Methylene Diphenyl Diisocyanate Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Methylene Diphenyl Diisocyanate Market Volume (Million), by Country 2025 & 2033

- Figure 37: Europe Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Methylene Diphenyl Diisocyanate Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Application 2025 & 2033

- Figure 40: South America Methylene Diphenyl Diisocyanate Market Volume (Million), by Application 2025 & 2033

- Figure 41: South America Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: South America Methylene Diphenyl Diisocyanate Market Volume Share (%), by Application 2025 & 2033

- Figure 43: South America Methylene Diphenyl Diisocyanate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: South America Methylene Diphenyl Diisocyanate Market Volume (Million), by End-user Industry 2025 & 2033

- Figure 45: South America Methylene Diphenyl Diisocyanate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South America Methylene Diphenyl Diisocyanate Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South America Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Methylene Diphenyl Diisocyanate Market Volume (Million), by Country 2025 & 2033

- Figure 49: South America Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Methylene Diphenyl Diisocyanate Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Application 2025 & 2033

- Figure 52: Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume (Million), by Application 2025 & 2033

- Figure 53: Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 56: Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume (Million), by End-user Industry 2025 & 2033

- Figure 57: Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Application 2020 & 2033

- Table 3: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Application 2020 & 2033

- Table 9: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: China Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: India Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Application 2020 & 2033

- Table 25: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Country 2020 & 2033

- Table 29: United States Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United States Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Canada Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Canada Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Mexico Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Application 2020 & 2033

- Table 37: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Country 2020 & 2033

- Table 41: Germany Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Germany Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: France Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: France Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Italy Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Italy Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Russia Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Russia Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 54: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Application 2020 & 2033

- Table 55: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 56: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 57: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Country 2020 & 2033

- Table 59: Brazil Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Brazil Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Argentina Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Argentina Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of South America Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 65: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 66: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Application 2020 & 2033

- Table 67: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 68: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 69: Global Methylene Diphenyl Diisocyanate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Methylene Diphenyl Diisocyanate Market Volume Million Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: South Africa Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: South Africa Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Methylene Diphenyl Diisocyanate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Methylene Diphenyl Diisocyanate Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Methylene Diphenyl Diisocyanate Market?

The projected CAGR is approximately 9.05%.

2. Which companies are prominent players in the Methylene Diphenyl Diisocyanate Market?

Key companies in the market include Sumitomo Chemical Co Ltd, Kumho Mitsui Chemicals Corp, Sadara, Shanghai Lianheng Isocyanate Co Ltd, BASF SE, Wanhua, Tosoh Corporation, Dow, Hexion, Covestro AG, Chongqing ChangFeng Chemical Co Ltd, Huntsman Corporation, KAROON Petrochemical Company.

3. What are the main segments of the Methylene Diphenyl Diisocyanate Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for PU in Insulation in the Construction Industry; Expanding Scope of Application.

6. What are the notable trends driving market growth?

The Construction Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Regulations Associated with MDI; Toxic Effects of MDI.

8. Can you provide examples of recent developments in the market?

January 2024: BASF SE announced that either with immediate effect or as contract terms allow, it will increase prices for its Lupranate MDI basic products by USD 200 per metric ton in ASEAN and South Asia due to higher raw material prices and continued pressure in the cost of energy and regulatory efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Methylene Diphenyl Diisocyanate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Methylene Diphenyl Diisocyanate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Methylene Diphenyl Diisocyanate Market?

To stay informed about further developments, trends, and reports in the Methylene Diphenyl Diisocyanate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence