Key Insights

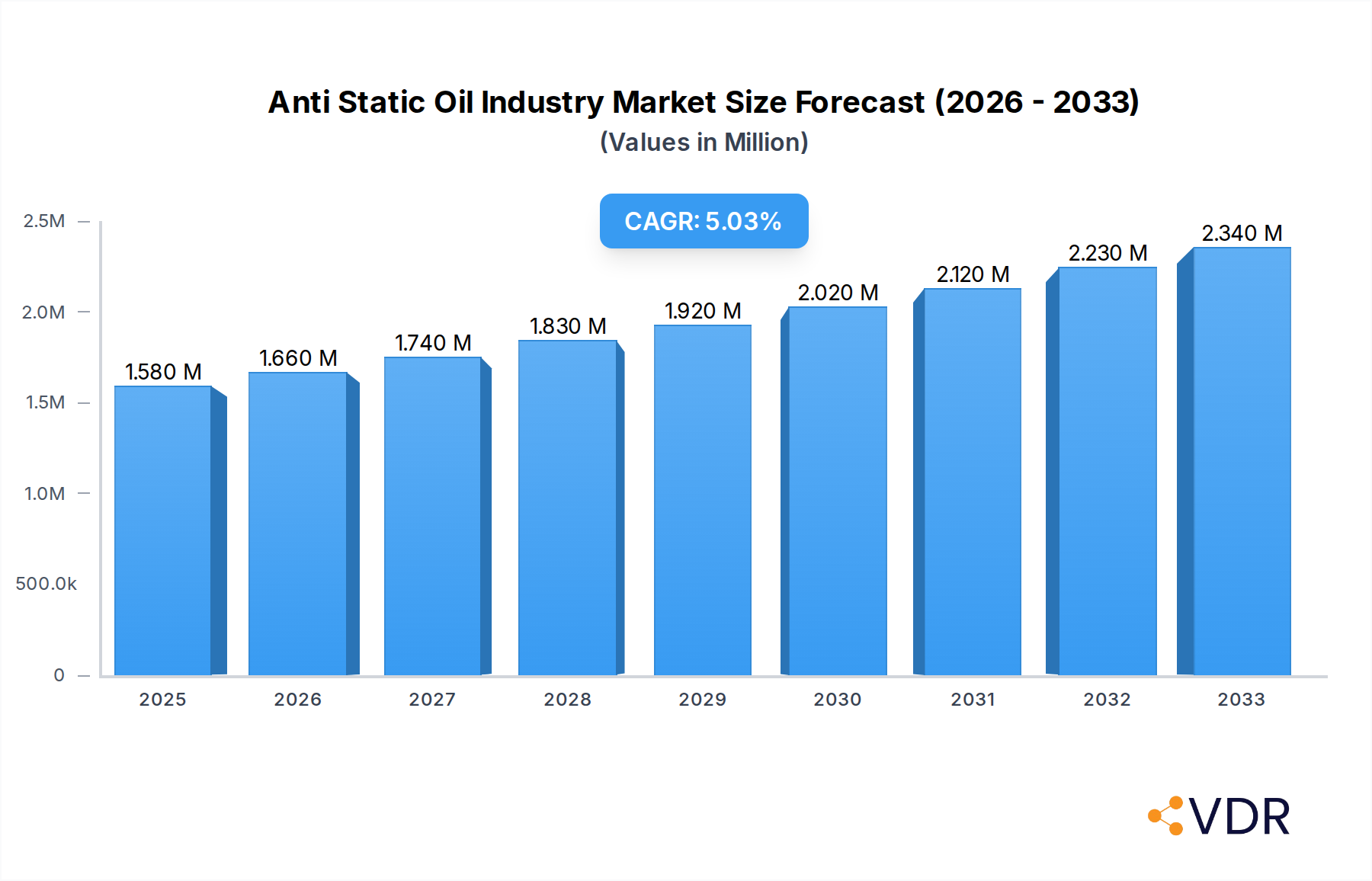

The global Anti-Static Oil market is poised for significant expansion, projected to reach USD 1.58 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 5.16% through 2033. This growth is primarily propelled by the increasing demand for effective static control solutions across a diverse range of industries. The textile industry, facing challenges from static electricity during processing and in finished goods, is a major consumer, alongside the burgeoning electronics sector where static discharge can lead to component damage. Furthermore, the automotive and aviation industries are increasingly integrating advanced materials and sophisticated electronic systems that necessitate stringent anti-static measures to ensure safety and performance. Emerging applications in other sectors are also contributing to market momentum, driven by a heightened awareness of the risks associated with electrostatic discharge.

Anti Static Oil Industry Market Size (In Million)

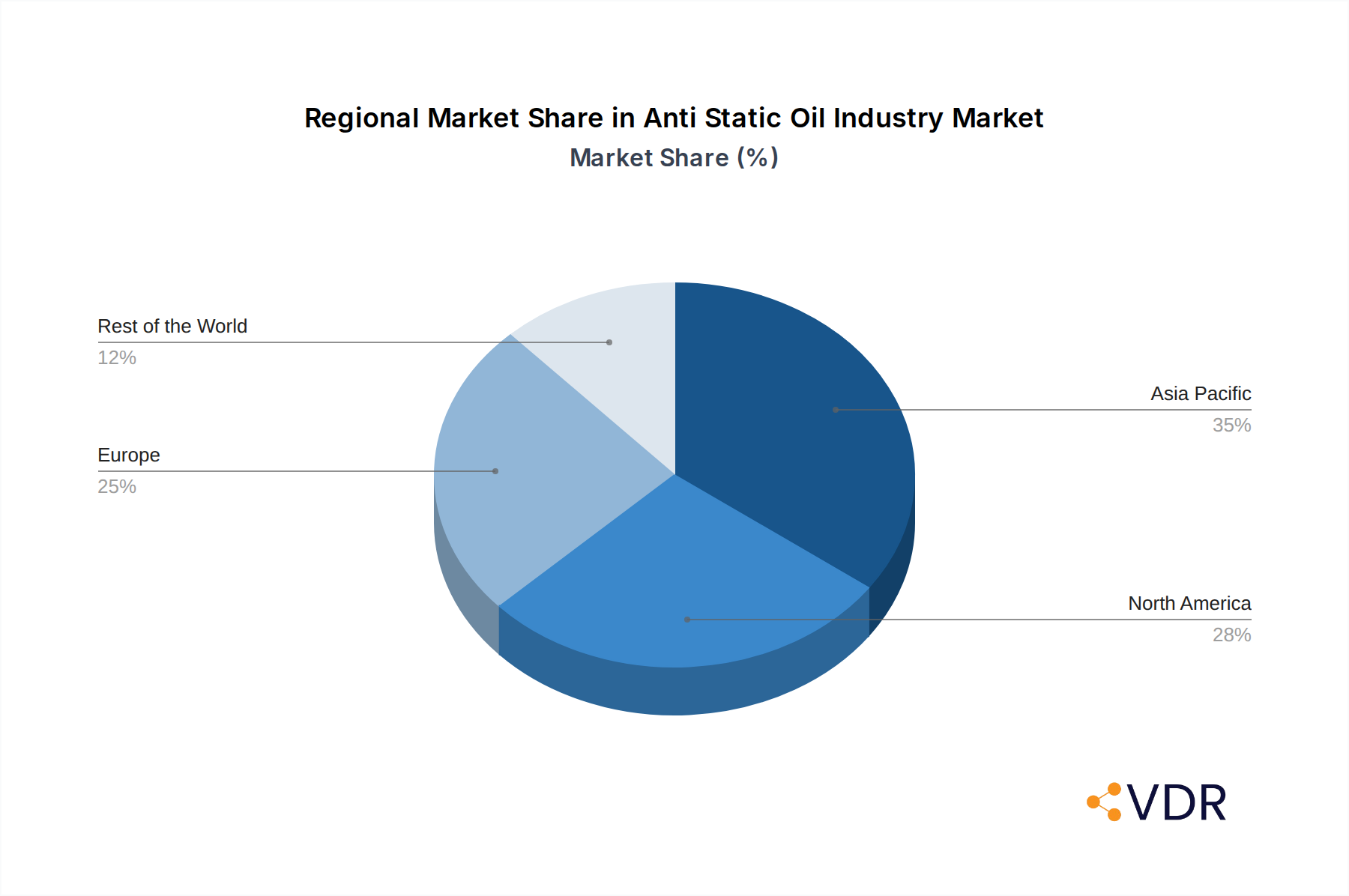

The market landscape is characterized by a clear segmentation between temporary and permanent anti-static oils, catering to different application needs and longevity requirements. Key market drivers include the growing emphasis on product quality and reliability, regulatory mandates for safety in manufacturing environments, and technological advancements leading to more efficient and durable anti-static formulations. However, the market also faces restraints such as the high cost of certain advanced anti-static agents and the availability of alternative static control methods. Geographically, the Asia Pacific region, led by China and India, is expected to witness the fastest growth due to its expanding manufacturing base and significant investments in industrial modernization. North America and Europe remain substantial markets, driven by mature industries and stringent quality standards.

Anti Static Oil Industry Company Market Share

This in-depth report provides a definitive analysis of the global Anti Static Oil industry, a critical sector catering to the demand for electrostatic discharge (ESD) prevention across diverse industrial applications. The study encompasses a comprehensive historical analysis from 2019 to 2024, a detailed base year assessment for 2025, and an extensive forecast period from 2025 to 2033. We leverage advanced analytical frameworks, including XXX, to deliver granular insights into market dynamics, growth trajectories, regional dominance, product innovations, key drivers, emerging opportunities, and the strategic landscape of major industry players. The Anti Static Oil market is projected to witness significant expansion, driven by the increasing sensitivity of electronic components, stringent safety regulations in industries like aviation and automotive, and the growing demand for ESD protection in textiles and other sensitive manufacturing processes. Our analysis quantifies market evolution, adoption rates, technological disruptions, and shifts in consumer behavior, offering a strategic roadmap for stakeholders.

Anti Static Oil Industry Market Dynamics & Structure

The Anti Static Oil industry exhibits a moderately consolidated market structure, with a mix of large multinational corporations and specialized regional manufacturers. Technological innovation is a primary driver, focusing on developing more effective, long-lasting, and environmentally friendly anti-static formulations. Regulatory frameworks, particularly concerning material safety and environmental impact, are increasingly influencing product development and market access. Competitive product substitutes, such as anti-static coatings, films, and ionizing equipment, present a constant challenge, pushing anti-static oil manufacturers to emphasize performance, cost-effectiveness, and ease of application. End-user demographics are shifting towards industries with higher ESD sensitivity, including advanced electronics manufacturing, aerospace, and specialized textile production for critical environments. Mergers and acquisitions (M&A) activity, though not at an explosive pace, is observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. The market for anti-static oils is influenced by macro-economic factors, including industrial output, global trade patterns, and investment in manufacturing infrastructure.

- Market Concentration: A blend of key global players and numerous smaller, specialized companies.

- Technological Innovation Drivers: Enhanced ESD dissipation efficiency, reduced environmental impact, improved material compatibility, and extended longevity of anti-static properties.

- Regulatory Frameworks: Increasing emphasis on REACH compliance, RoHS directives, and sector-specific safety standards.

- Competitive Product Substitutes: Anti-static coatings, films, sprays, and ionizing bars.

- End-User Demographics: Growing demand from the electronics, automotive, aviation, and advanced textile sectors.

- M&A Trends: Strategic acquisitions aimed at market expansion and technology integration.

Anti Static Oil Industry Growth Trends & Insights

The Anti Static Oil market is poised for robust growth, projected to expand from an estimated $X,XXX million in 2025 to $XX,XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period. This expansion is fundamentally driven by the escalating integration of sophisticated electronic components across virtually every industry, from consumer electronics and telecommunications to automotive and aerospace. The inherent vulnerability of these components to electrostatic discharge necessitates the widespread adoption of effective anti-static solutions like specialized oils.

The textile industry continues to be a significant consumer, particularly in sectors requiring cleanroom environments or the production of sensitive technical fabrics. The increasing demand for ESD-safe packaging materials for sensitive electronic goods further fuels this growth. In the electronics industry, the shrinking size and increasing complexity of semiconductor devices render them more susceptible to ESD damage, leading to a higher demand for anti-static oils in manufacturing processes, handling, and packaging.

The automotive industry is witnessing a surge in electronic content within vehicles, from advanced driver-assistance systems (ADAS) to sophisticated infotainment units, all of which require stringent ESD protection during assembly and operation. Similarly, the aviation industry, with its reliance on sensitive avionic systems and strict safety protocols, represents a high-value segment for anti-static oil applications.

Technological disruptions are also playing a crucial role. Innovations in anti-static oil formulations are leading to products with enhanced efficacy, longer-lasting protection, and improved environmental profiles, such as reduced volatile organic compounds (VOCs). The development of temporary and permanent anti-static oil solutions caters to a broader spectrum of application needs and cost considerations.

Consumer behavior shifts are also indirectly influencing the market. The growing awareness of product reliability and the increasing cost associated with electronic component failures are prompting manufacturers to invest more in preventative measures like anti-static oils. Furthermore, the trend towards miniaturization and higher performance in electronic devices continues to amplify the need for superior ESD control. The adoption rates are expected to rise significantly as industries recognize the economic benefits of preventing ESD-related losses.

Dominant Regions, Countries, or Segments in Anti Static Oil Industry

The Electronics industry, within the Applications segment, is currently the most dominant force driving growth in the global Anti Static Oil market. This dominance is underpinned by the relentless pace of technological advancement in semiconductors, consumer electronics, and telecommunications, all of which are critically dependent on effective electrostatic discharge (ESD) prevention. The ever-increasing density and complexity of electronic components make them exceptionally vulnerable to static electricity, leading to a consistent and escalating demand for specialized anti-static oils. The market share for this segment is estimated to be in the range of XX.XX% in 2025, with projections indicating continued leadership throughout the forecast period.

Key drivers for the electronics industry's dominance include:

- Rapid Product Innovation Cycles: The constant introduction of new and more sensitive electronic devices necessitates upgraded ESD protection strategies.

- Stringent Quality Control and Reliability Standards: Manufacturers face immense pressure to deliver defect-free products, making ESD prevention a non-negotiable aspect of the production process.

- Growth of Semiconductor Manufacturing: The expansion of foundries and assembly plants globally, particularly in Asia, directly translates to increased consumption of anti-static oils.

- Global Supply Chain Integration: The interconnectedness of the electronics supply chain, with numerous handling and assembly stages, amplifies the need for ESD control across the entire value chain.

From a geographical perspective, Asia Pacific is anticipated to be the leading region, driven by its status as a global manufacturing hub for electronics. Countries like China, South Korea, Taiwan, and Japan are major centers for semiconductor fabrication, assembly, and consumer electronics production. Government initiatives supporting the manufacturing sector, coupled with significant investments in advanced technology, further bolster the demand for anti-static oils in this region. The market share for the Asia Pacific region is estimated to be around XX.XX% of the global market in 2025.

In terms of Product Type, Permanent anti-static oil is expected to garner a larger market share due to its long-lasting protection and reduced need for reapplication. However, Temporary anti-static oil will continue to hold a significant position, especially for applications where cost-effectiveness and ease of temporary protection are paramount.

Anti Static Oil Industry Product Landscape

The Anti Static Oil industry is characterized by continuous innovation in product formulations designed to offer superior electrostatic discharge (ESD) protection. Manufacturers are actively developing advanced temporary anti-static oils that provide immediate and effective dissipation for sensitive materials and components, crucial for handling and packaging operations. Simultaneously, there is a growing emphasis on permanent anti-static oils, engineered for long-term efficacy and embedded protection in various substrates, particularly plastics and textiles. These products offer enhanced performance metrics such as lower surface resistivity, improved humidity independence, and greater material compatibility, minimizing risks of static buildup in critical applications like electronics manufacturing, automotive interiors, and aviation components. Unique selling propositions include eco-friendly formulations with reduced VOCs and specialized grades tailored for specific industry needs, ensuring optimal performance and safety.

Key Drivers, Barriers & Challenges in Anti Static Oil Industry

Key Drivers: The anti-static oil market is propelled by several critical factors. The escalating demand for ESD-protected electronic components, driven by miniaturization and increased electronic content in devices across automotive, aerospace, and consumer electronics sectors, is a primary driver. Stringent regulatory requirements for safety and product reliability in sensitive industries further mandate the use of anti-static solutions. Technological advancements in developing more effective and sustainable anti-static oil formulations, alongside the expanding manufacturing base in emerging economies, are also significant growth accelerators. The growth of industries like specialized textiles for cleanrooms and protective gear also contributes to market expansion.

Key Barriers & Challenges: Despite the growth potential, the industry faces several challenges. The availability of effective substitutes, such as anti-static coatings and films, presents a competitive restraint. Fluctuations in raw material prices, particularly those derived from petrochemicals, can impact manufacturing costs and profitability. Stringent environmental regulations regarding chemical usage and disposal can pose compliance challenges and necessitate investment in R&D for greener alternatives. Furthermore, the perceived high cost of certain specialized anti-static oils can be a barrier to adoption in price-sensitive applications. Supply chain disruptions and geopolitical instability can also affect the availability and cost of essential raw materials.

Emerging Opportunities in Anti Static Oil Industry

Emerging opportunities in the Anti Static Oil industry are predominantly centered around the development of eco-friendly and sustainable formulations. With growing global environmental consciousness and stricter regulations, there is a significant demand for bio-based or low-VOC anti-static oils. Furthermore, the expansion of the electric vehicle (EV) market presents a substantial opportunity, as EVs contain a complex array of sensitive electronic components that require robust ESD protection. The increasing use of advanced composite materials in aerospace and automotive industries also opens avenues for specialized anti-static oils that are compatible with these materials. Untapped markets in developing economies with burgeoning manufacturing sectors also offer significant growth potential.

Growth Accelerators in the Anti Static Oil Industry Industry

Several key catalysts are accelerating the growth trajectory of the Anti Static Oil industry. Continuous technological breakthroughs in formulating oils with superior and long-lasting ESD dissipation properties are a major contributor. Strategic partnerships and collaborations between anti-static oil manufacturers and end-users, particularly in the electronics and automotive sectors, foster innovation and tailor-made solutions. The increasing adoption of Industry 4.0 principles, which emphasize automation and precision manufacturing, elevates the importance of ESD control to prevent production line stoppages and product defects. Market expansion strategies, including penetration into new geographic regions and diversification into niche applications, are also crucial growth accelerators.

Key Players Shaping the Anti Static Oil Industry Market

- Hansen & Rosenthal Group

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Limited

- Lube Oil Company

- Panama Petrochem Ltd

- Ricci S p A

- Shidimo Interaux Private Limited

- SMK PETROCHEMICALS INDIA PVT LTD

- Takemoto Oil & Fat Co Ltd

- Total SA

- Unicon Fibro Chemicals Pvt Ltd

- Witmans Group

Notable Milestones in Anti Static Oil Industry Sector

- 2023: Launch of new bio-based temporary anti-static oil formulations by [Company Name], addressing growing environmental concerns.

- 2022: Significant investment in R&D by [Company Name] to develop permanent anti-static oils for advanced composite materials in aviation.

- 2021: Acquisition of a specialized anti-static chemical producer by [Company Name], enhancing its product portfolio and market reach.

- 2020: Introduction of enhanced humidity-independent anti-static oil by [Company Name], crucial for electronics manufacturing in varied climatic conditions.

- 2019: Development of a novel, non-flammable anti-static oil solution by [Company Name] for high-risk industrial environments.

In-Depth Anti Static Oil Industry Market Outlook

The future outlook for the Anti Static Oil industry is exceptionally promising, driven by persistent innovation and the expanding scope of its essential applications. Growth accelerators such as the relentless pursuit of miniaturization and enhanced functionality in electronics, coupled with the increasing electrification of the automotive sector, will continue to fuel demand. Strategic alliances between raw material suppliers and end-users will drive the development of bespoke solutions, while the focus on sustainability will propel the adoption of eco-friendly formulations. The industry is well-positioned to capitalize on global trends towards higher quality, greater reliability, and increased safety across a multitude of manufacturing sectors.

The total market value of the Anti Static Oil Industry in 2025 is estimated to be $X,XXX million.

Anti Static Oil Industry Segmentation

-

1. Applications

- 1.1. Textile industry

- 1.2. Electronics industry

- 1.3. Automotive industry

- 1.4. Aviation industry

- 1.5. Others (

-

2. Product Type

- 2.1. Temporary anti-static oil

- 2.2. Permanent anti-static oil

Anti Static Oil Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. ASEAN Countries

- 1.4. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Spain

- 3.4. Italy

- 3.5. France

- 3.6. Turkey

- 3.7. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Egypt

- 5.2. Rest of Middle East and Africa

Anti Static Oil Industry Regional Market Share

Geographic Coverage of Anti Static Oil Industry

Anti Static Oil Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand From Key Industries Like Textile

- 3.2.2 Aviation

- 3.2.3 and Others; Other Drivers

- 3.3. Market Restrains

- 3.3.1 Growing Demand From Key Industries Like Textile

- 3.3.2 Aviation

- 3.3.3 and Others; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Use of Electronic Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Static Oil Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 5.1.1. Textile industry

- 5.1.2. Electronics industry

- 5.1.3. Automotive industry

- 5.1.4. Aviation industry

- 5.1.5. Others (

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Temporary anti-static oil

- 5.2.2. Permanent anti-static oil

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 6. Asia Pacific Anti Static Oil Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 6.1.1. Textile industry

- 6.1.2. Electronics industry

- 6.1.3. Automotive industry

- 6.1.4. Aviation industry

- 6.1.5. Others (

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Temporary anti-static oil

- 6.2.2. Permanent anti-static oil

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 7. North America Anti Static Oil Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 7.1.1. Textile industry

- 7.1.2. Electronics industry

- 7.1.3. Automotive industry

- 7.1.4. Aviation industry

- 7.1.5. Others (

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Temporary anti-static oil

- 7.2.2. Permanent anti-static oil

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 8. Europe Anti Static Oil Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 8.1.1. Textile industry

- 8.1.2. Electronics industry

- 8.1.3. Automotive industry

- 8.1.4. Aviation industry

- 8.1.5. Others (

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Temporary anti-static oil

- 8.2.2. Permanent anti-static oil

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 9. South America Anti Static Oil Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 9.1.1. Textile industry

- 9.1.2. Electronics industry

- 9.1.3. Automotive industry

- 9.1.4. Aviation industry

- 9.1.5. Others (

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Temporary anti-static oil

- 9.2.2. Permanent anti-static oil

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 10. Middle East and Africa Anti Static Oil Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Applications

- 10.1.1. Textile industry

- 10.1.2. Electronics industry

- 10.1.3. Automotive industry

- 10.1.4. Aviation industry

- 10.1.5. Others (

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Temporary anti-static oil

- 10.2.2. Permanent anti-static oil

- 10.1. Market Analysis, Insights and Forecast - by Applications

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hansen & Rosenthal Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hindustan Petroleum Corporation Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Indian Oil Corporation Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lube Oil Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Panama Petrochem Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ricci S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shidimo Interaux Private Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SMK PETROCHEMICALS INDIA PVT LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Takemoto Oil & Fat Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Total SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Unicon Fibro Chemicals Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Witmans Group*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hansen & Rosenthal Group

List of Figures

- Figure 1: Global Anti Static Oil Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Anti Static Oil Industry Revenue (million), by Applications 2025 & 2033

- Figure 3: Asia Pacific Anti Static Oil Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 4: Asia Pacific Anti Static Oil Industry Revenue (million), by Product Type 2025 & 2033

- Figure 5: Asia Pacific Anti Static Oil Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Asia Pacific Anti Static Oil Industry Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Anti Static Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Anti Static Oil Industry Revenue (million), by Applications 2025 & 2033

- Figure 9: North America Anti Static Oil Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 10: North America Anti Static Oil Industry Revenue (million), by Product Type 2025 & 2033

- Figure 11: North America Anti Static Oil Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: North America Anti Static Oil Industry Revenue (million), by Country 2025 & 2033

- Figure 13: North America Anti Static Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Anti Static Oil Industry Revenue (million), by Applications 2025 & 2033

- Figure 15: Europe Anti Static Oil Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 16: Europe Anti Static Oil Industry Revenue (million), by Product Type 2025 & 2033

- Figure 17: Europe Anti Static Oil Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Anti Static Oil Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Anti Static Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Anti Static Oil Industry Revenue (million), by Applications 2025 & 2033

- Figure 21: South America Anti Static Oil Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 22: South America Anti Static Oil Industry Revenue (million), by Product Type 2025 & 2033

- Figure 23: South America Anti Static Oil Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: South America Anti Static Oil Industry Revenue (million), by Country 2025 & 2033

- Figure 25: South America Anti Static Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Anti Static Oil Industry Revenue (million), by Applications 2025 & 2033

- Figure 27: Middle East and Africa Anti Static Oil Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 28: Middle East and Africa Anti Static Oil Industry Revenue (million), by Product Type 2025 & 2033

- Figure 29: Middle East and Africa Anti Static Oil Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East and Africa Anti Static Oil Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Anti Static Oil Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anti Static Oil Industry Revenue million Forecast, by Applications 2020 & 2033

- Table 2: Global Anti Static Oil Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Global Anti Static Oil Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Anti Static Oil Industry Revenue million Forecast, by Applications 2020 & 2033

- Table 5: Global Anti Static Oil Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Anti Static Oil Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: ASEAN Countries Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Rest of Asia Pacific Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Anti Static Oil Industry Revenue million Forecast, by Applications 2020 & 2033

- Table 12: Global Anti Static Oil Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 13: Global Anti Static Oil Industry Revenue million Forecast, by Country 2020 & 2033

- Table 14: United States Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Canada Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Mexico Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Global Anti Static Oil Industry Revenue million Forecast, by Applications 2020 & 2033

- Table 18: Global Anti Static Oil Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 19: Global Anti Static Oil Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Germany Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Spain Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: France Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Turkey Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of the Europe Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Anti Static Oil Industry Revenue million Forecast, by Applications 2020 & 2033

- Table 28: Global Anti Static Oil Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 29: Global Anti Static Oil Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Brazil Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Global Anti Static Oil Industry Revenue million Forecast, by Applications 2020 & 2033

- Table 34: Global Anti Static Oil Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 35: Global Anti Static Oil Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Egypt Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Anti Static Oil Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Static Oil Industry?

The projected CAGR is approximately 5.16%.

2. Which companies are prominent players in the Anti Static Oil Industry?

Key companies in the market include Hansen & Rosenthal Group, Hindustan Petroleum Corporation Limited, Indian Oil Corporation Limited, Lube Oil Company, Panama Petrochem Ltd, Ricci S p A, Shidimo Interaux Private Limited, SMK PETROCHEMICALS INDIA PVT LTD, Takemoto Oil & Fat Co Ltd, Total SA, Unicon Fibro Chemicals Pvt Ltd, Witmans Group*List Not Exhaustive.

3. What are the main segments of the Anti Static Oil Industry?

The market segments include Applications, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand From Key Industries Like Textile. Aviation. and Others; Other Drivers.

6. What are the notable trends driving market growth?

Growing Use of Electronic Industry.

7. Are there any restraints impacting market growth?

Growing Demand From Key Industries Like Textile. Aviation. and Others; Other Drivers.

8. Can you provide examples of recent developments in the market?

Recent developments pertinent to the market studied will be covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Static Oil Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Static Oil Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Static Oil Industry?

To stay informed about further developments, trends, and reports in the Anti Static Oil Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence