Key Insights

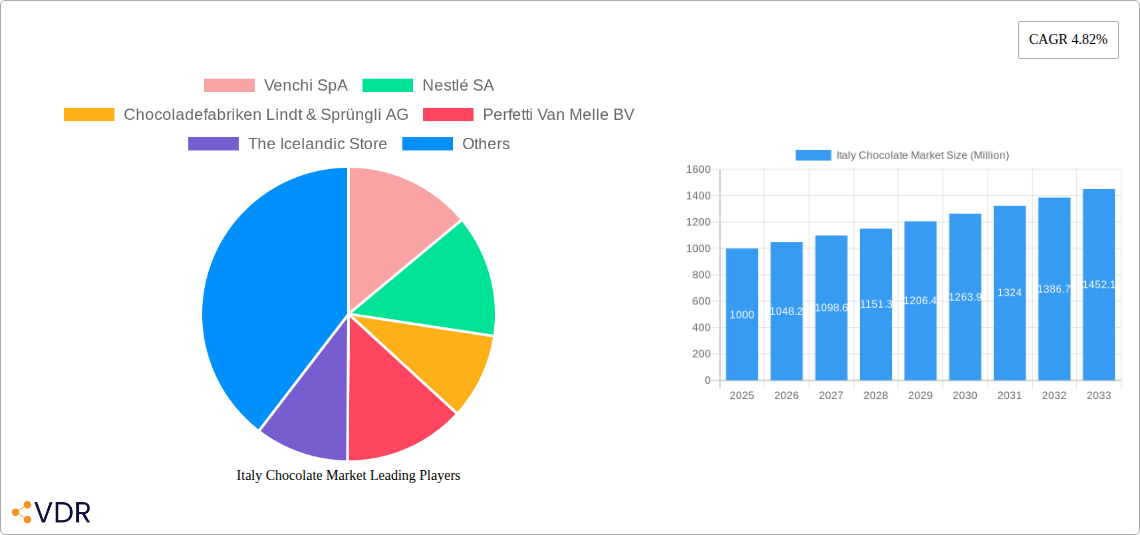

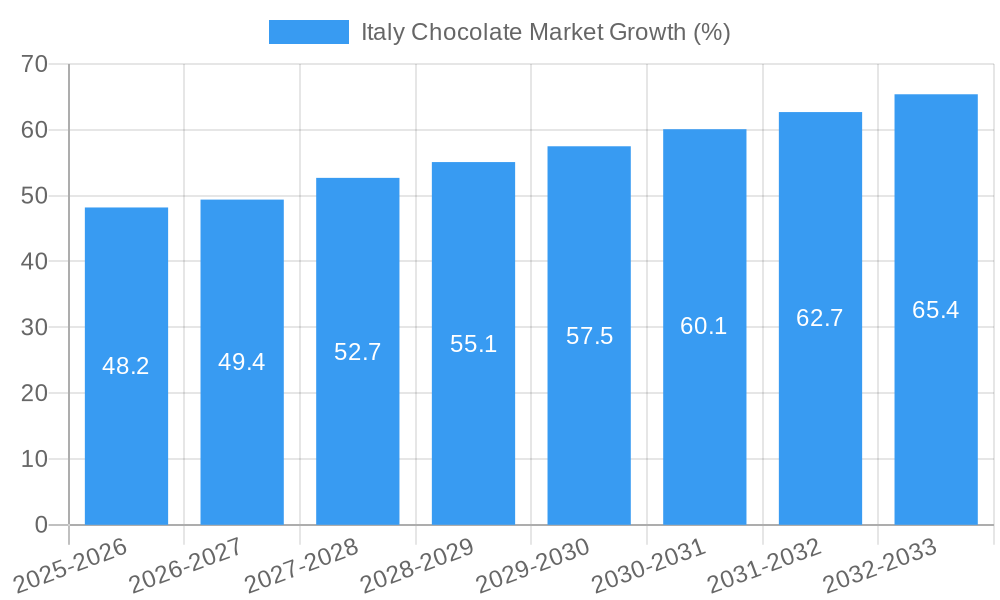

The Italian chocolate market, valued at approximately €[Estimate based on available data and market size for similar markets. Let's assume €1 Billion in 2025 for illustrative purposes. Adjust this based on your actual market size data "XX"] million in 2025, exhibits robust growth potential, projected to expand at a CAGR of 4.82% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the increasing popularity of premium and artisanal chocolates, driven by a growing consumer preference for high-quality ingredients and unique flavor profiles, is significantly impacting market dynamics. Secondly, the thriving tourism sector in Italy contributes to increased demand, particularly for chocolates as souvenirs and gifts. Online retail channels are experiencing rapid expansion, offering consumers increased convenience and access to a wider variety of chocolate products, from established brands like Ferrero and Lindt to smaller, specialized producers. Finally, innovative product development, including the introduction of new flavors, healthier options (e.g., dark chocolate with higher cocoa content), and sustainable sourcing initiatives, are attracting discerning consumers.

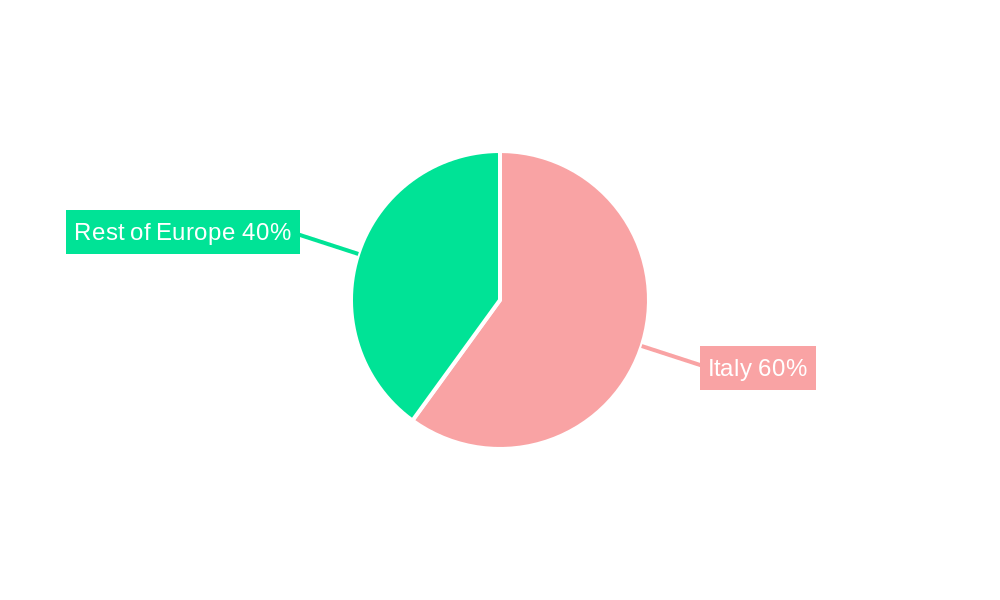

However, certain challenges exist. Fluctuations in cocoa bean prices and supply chain disruptions represent potential headwinds. Furthermore, increasing competition from international brands necessitates continuous innovation and brand differentiation for domestic players. The market segmentation reveals a diverse landscape, with significant contributions from convenience stores, online retailers, and supermarkets/hypermarkets. Within confectionery variants, dark chocolate enjoys high demand, mirroring a broader global trend towards healthier indulgence. Leading players like Ferrero, Lindt, and Nestlé maintain strong market positions, yet smaller artisanal producers are also gaining traction, capitalizing on the demand for unique and high-quality products. The strong regional presence across Europe, particularly in key markets like Germany, France, and the UK, demonstrates the appeal of Italian chocolates beyond national borders, presenting significant export opportunities for Italian manufacturers.

Italy Chocolate Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy chocolate market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this lucrative market. The report analyzes the parent market of confectionery and the child market of chocolate in Italy, providing a granular view of market segmentation and competitive dynamics. Market values are presented in million units.

Italy Chocolate Market Dynamics & Structure

This section delves into the intricate structure of the Italian chocolate market, examining market concentration, innovation drivers, regulatory landscapes, competitive substitutes, end-user demographics, and merger & acquisition (M&A) trends. The Italian chocolate market is characterized by a mix of large multinational corporations and smaller, artisanal producers. Market concentration is moderate, with a few dominant players controlling a significant share.

- Market Concentration: xx% of the market is controlled by the top 5 players.

- Technological Innovation: Focus on sustainable sourcing, innovative flavors, and packaging improvements are key drivers. Barriers include high R&D costs and maintaining traditional production methods.

- Regulatory Framework: EU regulations on food safety and labeling significantly influence the market. Compliance costs and labeling requirements impact smaller producers disproportionately.

- Competitive Substitutes: Other confectionery items, healthy snacks, and desserts compete for consumer spending. The market witnesses growing competition from artisanal and organic chocolate brands.

- End-User Demographics: The target market encompasses a wide age range, with distinct preferences across age groups. Younger consumers are driving demand for innovative flavors and sustainable products.

- M&A Trends: The past five years have witnessed xx M&A deals in the Italian chocolate market, primarily focused on consolidating market share and expanding product portfolios.

Italy Chocolate Market Growth Trends & Insights

This section presents a detailed analysis of the Italy chocolate market's growth trajectory, utilizing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The market has witnessed steady growth, driven by increasing consumer spending, changing lifestyles, and the rising popularity of premium chocolate.

The market size was valued at xx million units in 2024 and is projected to reach xx million units by 2033, registering a CAGR of xx% during the forecast period. Technological advancements, such as improved processing techniques and sustainable packaging solutions, are influencing growth. Consumer behavior shifts, including increased preference for healthier options and premium chocolate, are also impacting the market. Market penetration continues to increase, particularly in the online retail channel.

Dominant Regions, Countries, or Segments in Italy Chocolate Market

This section identifies the leading regions, countries, or segments within the Italian chocolate market, focusing on distribution channels (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others) and confectionery variants (Dark Chocolate, Milk and White Chocolate).

- Distribution Channels: Supermarket/Hypermarkets currently hold the largest market share, followed by convenience stores. Online retail is experiencing rapid growth. Key drivers for supermarket dominance include wide product availability and established distribution networks. The growth of online retail is fueled by increasing internet penetration and consumer preference for convenience.

- Confectionery Variants: Milk chocolate remains the dominant segment due to its broad appeal, followed by dark chocolate, which is experiencing strong growth fueled by health and wellness trends. The white chocolate segment holds a smaller share.

Italy Chocolate Market Product Landscape

The Italian chocolate market offers a diverse product landscape, characterized by both traditional and innovative offerings. Products range from classic milk and dark chocolate bars to artisan chocolates with unique flavor combinations and premium ingredients. Technological advancements have led to improved processing techniques, resulting in enhanced texture, flavor, and shelf life. Unique selling propositions (USPs) include using locally sourced cocoa beans, unique flavor profiles, and sustainable packaging.

Key Drivers, Barriers & Challenges in Italy Chocolate Market

Key Drivers: Rising disposable incomes, changing consumer preferences towards premium and artisanal chocolates, and the growth of online retail are key drivers of market growth. The increasing demand for vegan and organic chocolate also contributes significantly.

Challenges & Restraints: Fluctuations in cocoa prices, stringent regulations, and increasing competition from international brands pose challenges to market growth. Supply chain disruptions due to geopolitical factors and sustainability concerns further complicate the landscape. The estimated impact on market growth due to these challenges is approximately xx%.

Emerging Opportunities in Italy Chocolate Market

Emerging opportunities include the growth of niche segments, such as vegan, organic, and fair-trade chocolate. The increasing popularity of personalized chocolate experiences and the expansion into experiential retail are driving growth. Untapped market segments include high-end chocolates catering to niche preferences and innovative product formats catering to a wider array of consumer choices.

Growth Accelerators in the Italy Chocolate Market Industry

The long-term growth of the Italian chocolate market will be accelerated by strategic partnerships between producers and retailers, the adoption of advanced technologies for production and packaging, and the expansion of market reach through innovative distribution strategies and targeted marketing campaigns. Sustainable sourcing initiatives will also contribute significantly to the industry's future.

Key Players Shaping the Italy Chocolate Market Market

- Venchi SpA

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- The Icelandic Store

- Bauli SpA

- ICAM SpA

- Chocolates Valor SA

- Ferrero International SA

- Mars Incorporated

- Gruppo Elah Dufour SpA

- Witors Sp

- Mondelēz International Inc

- Alfred Ritter GmbH & Co KG

- A Loacker Spa/AG

Notable Milestones in Italy Chocolate Market Sector

- October 2022: Ritter Sport UK & IRE launched two new 100g flavored chocolate bars, bolstering the market with new product offerings and a focused marketing campaign.

- January 2023: Ritter Sport's global launch of a vegan travel retail edition expanded the market's vegan chocolate offerings.

- February 2023: Venchi's release of new Easter chocolate treats indicates a strong seasonal demand and continuous innovation within the premium chocolate segment.

In-Depth Italy Chocolate Market Market Outlook

The future of the Italian chocolate market is promising, with continued growth driven by increasing consumer demand, innovation in product offerings, and the expansion of e-commerce. Strategic partnerships and investments in sustainable practices will play a key role in shaping the industry's trajectory. The market's potential for growth is significant, particularly in the premium and specialized chocolate segments. Opportunities exist for both established players and new entrants to capitalize on emerging trends and evolving consumer preferences.

Italy Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Italy Chocolate Market Segmentation By Geography

- 1. Italy

Italy Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Preference for Plant-Based Protein; Prevalence of Consumers Intolerant to Soy

- 3.2.2 Peanut and Other Legumes is Increasing

- 3.3. Market Restrains

- 3.3.1. Strict Regulation and Policies Pertaining to Hemp Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Germany Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7. France Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Italy Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Venchi SpA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestlé SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Perfetti Van Melle BV

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 The Icelandic Store

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bauli SpA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ICAM SpA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Chocolates Valor SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ferrero International SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mars Incorporated

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Gruppo Elah Dufour SpA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Witors Sp

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Mondelēz International Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Alfred Ritter GmbH & Co KG

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 A Loacker Spa/AG

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Venchi SpA

List of Figures

- Figure 1: Italy Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 3: Italy Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Italy Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Italy Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 14: Italy Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Italy Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Chocolate Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the Italy Chocolate Market?

Key companies in the market include Venchi SpA, Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, The Icelandic Store, Bauli SpA, ICAM SpA, Chocolates Valor SA, Ferrero International SA, Mars Incorporated, Gruppo Elah Dufour SpA, Witors Sp, Mondelēz International Inc, Alfred Ritter GmbH & Co KG, A Loacker Spa/AG.

3. What are the main segments of the Italy Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Preference for Plant-Based Protein; Prevalence of Consumers Intolerant to Soy. Peanut and Other Legumes is Increasing.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Strict Regulation and Policies Pertaining to Hemp Protein.

8. Can you provide examples of recent developments in the market?

February 2023: Italian premium chocolate brand Venchi released the latest Easter chocolate treats.January 2023: Ritter Sport launched a Travel Retail Edition Vegan Tower 5x 100g set globally, offering three varieties of non-dairy chocolate in a five-pack. The travel edition assortment flavors are Smooth Chocolate and new Roasted Peanut and Salted Caramel, which were introduced in domestic markets in January 2023.October 2022: Ritter Sport UK & IRE launched two new 100 g flavored chocolate bars in salted caramel and orange flavors. To promote the product, the company also launched a ‘Start your love affair with the square’ campaign that aims to migrate more middle-aged women to the brand and runs in September and October in print, digital, and social, involving PR, marketing, and sampling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Chocolate Market?

To stay informed about further developments, trends, and reports in the Italy Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence