Key Insights

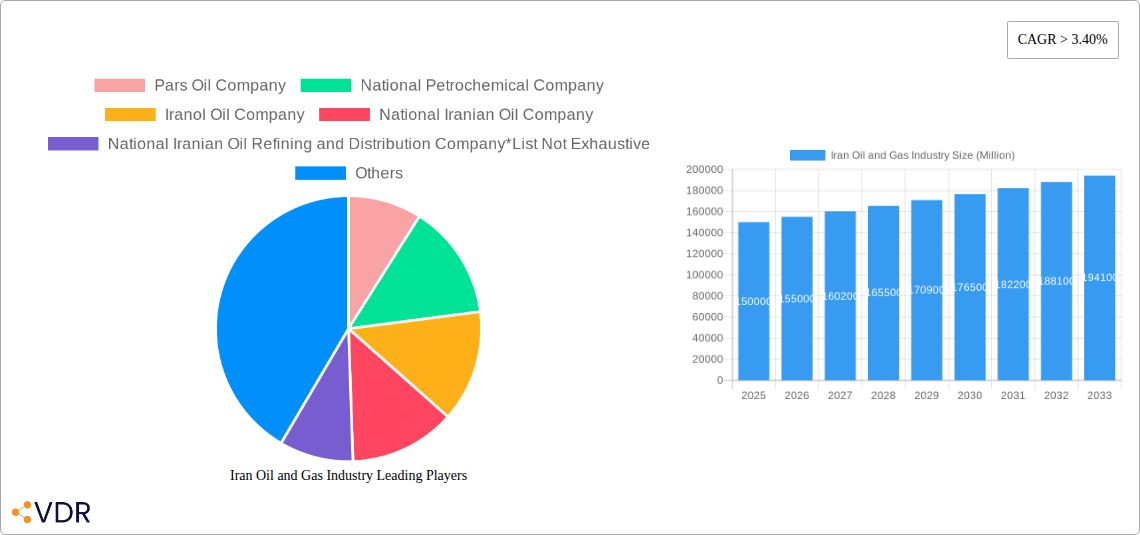

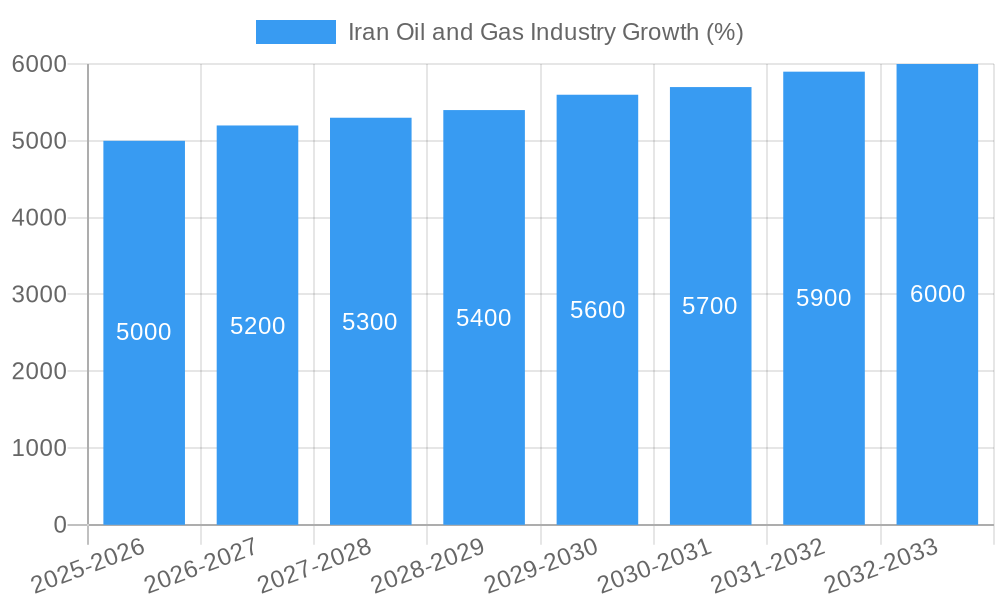

The Iranian oil and gas industry, while facing significant geopolitical challenges, presents a complex market landscape with considerable growth potential. The industry's substantial reserves, coupled with a Compound Annual Growth Rate (CAGR) exceeding 3.40% between 2019 and 2033, indicate a promising outlook. The market, valued at approximately $X million in 2025 (a figure requiring further research to determine accurately given the absence of initial market size), is driven by increasing domestic energy demand and potential export opportunities. Key segments include crude oil, natural gas, and petrochemicals, catering to both domestic and export markets. Significant players like the National Iranian Oil Company (NIOC) and Pars Oil Company dominate the landscape, showcasing the industry’s concentrated nature. However, international sanctions and fluctuating global oil prices remain substantial restraints, creating uncertainty and impacting investment decisions. The future trajectory will depend heavily on the resolution of geopolitical issues and the successful implementation of strategies to attract foreign investment and enhance operational efficiency. While the current market size is unknown, assuming a conservative estimate of the 2025 value (based on world averages and regional comparisons), coupled with a CAGR of 3.4%, a projected growth in the following years can be derived – though always subject to fluctuating market factors.

Further analysis reveals that the petrochemical segment is likely experiencing robust growth, fueled by increasing demand for plastics and other petrochemical-based products both domestically and internationally. The domestic segment benefits from Iran's large population and growing industrial sector, while export markets remain subject to the ongoing geopolitical situation. Future growth will hinge on effective diversification strategies, enhancing operational efficiency across the value chain, and leveraging technological advancements to improve resource extraction and processing. Strategic partnerships, technological upgrades, and consistent regulatory frameworks are crucial for navigating the challenges and capitalizing on the opportunities presented by the Iranian oil and gas sector. The growth in the sector remains contingent on the global energy market's performance and on the ability of the Iranian industry to adapt to ever-changing international relations.

Iran Oil and Gas Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Iranian oil and gas industry, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market dynamics, growth trends, dominant segments, and key players, providing a 360-degree view of this crucial sector. The report leverages extensive data analysis to predict future market trajectories and identify lucrative opportunities within the Iranian oil and gas landscape.

Keywords: Iran oil and gas, Iranian oil industry, Iranian gas market, crude oil Iran, natural gas Iran, petrochemicals Iran, Pars Oil Company, National Petrochemical Company, Iranol Oil Company, National Iranian Oil Company, NIOC, oil refining Iran, gas production Iran, energy market Iran, South Pars gas field, North Pars gas field, energy investment Iran, Persian Gulf energy, Middle East oil and gas.

Iran Oil and Gas Industry Market Dynamics & Structure

This section analyzes the Iranian oil and gas market's structure, assessing market concentration, technological innovation drivers, regulatory frameworks, competitive substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. The historical period (2019-2024) and the forecast period (2025-2033) are considered.

Market Concentration: The Iranian oil and gas industry is characterized by a high degree of state control, with National Iranian Oil Company (NIOC) playing a dominant role. However, several other key players such as Pars Oil Company, National Petrochemical Company, and Iranol Oil Company also contribute significantly to the market. Market share distribution among these players is estimated at xx% for NIOC, xx% for Pars Oil Company, xx% for National Petrochemical Company, and the remaining xx% among other companies.

Technological Innovation: Technological advancements in extraction, refining, and transportation are crucial. However, sanctions and limited international collaboration have hindered the adoption of cutting-edge technologies.

Regulatory Framework: Government regulations and policies significantly impact the industry's operations, investments, and production levels. Stringent environmental regulations are also a growing concern.

Competitive Substitutes: While there are few direct substitutes for oil and gas, the development of renewable energy sources poses a long-term competitive threat.

End-User Demographics: The domestic market and export markets show different consumption patterns and growth rates. Detailed analysis of domestic consumption and export destinations is provided within the report.

M&A Activity: M&A activity within the Iranian oil and gas sector has been relatively limited in recent years due to sanctions. However, an increase in activity is anticipated following sanctions relief (assuming it happens). The total value of M&A deals in the period 2019-2024 is estimated at $xx million.

Iran Oil and Gas Industry Growth Trends & Insights

This section provides a comprehensive analysis of the Iranian oil and gas market's growth trajectory from 2019 to 2033, incorporating historical data and future projections. Key trends such as market size evolution, adoption rates of new technologies, technological disruptions, and shifting consumer behavior will be evaluated. The analysis will leverage a combination of quantitative and qualitative methods to provide insightful conclusions. Specific metrics, including the Compound Annual Growth Rate (CAGR) and market penetration rates, will be provided for each segment.

The market size (in million USD) is projected to grow from $xx million in 2019 to $xx million in 2025 and $xx million by 2033, with a CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in Iran Oil and Gas Industry

This section identifies the leading regions, countries, or segments driving market growth. The analysis will focus on the contributions of different product types (crude oil, natural gas, petrochemicals) and end-users (domestic, export).

- Crude Oil: The South Pars gas field is the major producer of crude oil. Its share in the total Iranian Crude oil market is around xx%.

- Natural Gas: The South Pars Gas Field remains a dominant force in natural gas production, contributing xx% of the total production.

- Petrochemicals: The National Petrochemical Company is a significant player.

- Domestic Consumption: Domestic consumption of oil and gas has been relatively stable, with the highest growth expected from the Petrochemical sector in the coming decade.

- Exports: Iran’s crude oil and gas exports have fluctuated due to international sanctions. Regional analysis of export markets is provided in the report.

Iran Oil and Gas Industry Product Landscape

The Iranian oil and gas industry's product landscape is shaped by both mature and emerging technologies. While traditional crude oil and natural gas remain the core products, the petrochemical sector exhibits a higher degree of innovation. Technological advancements in refining processes and the production of value-added petrochemical products are driving product diversification. The focus is on improving efficiency and product quality, while also addressing environmental concerns.

Key Drivers, Barriers & Challenges in Iran Oil and Gas Industry

Key Drivers:

- Abundant Reserves: Iran possesses vast reserves of oil and natural gas, providing a strong foundation for industry growth.

- Government Support: The government's focus on energy independence and economic development through the oil and gas sector acts as a significant driver.

- Regional Demand: Regional demand for Iranian oil and gas, particularly in the Middle East and Asia, remains high.

Key Barriers and Challenges:

- International Sanctions: Sanctions imposed on Iran have significantly hampered the industry's access to international markets and technologies.

- Investment Constraints: Sanctions have also limited foreign investment needed for modernization and expansion projects.

- Infrastructure Limitations: Aging infrastructure needs significant upgrades to support increased production and distribution. Investment of $xx million is predicted by 2033 to address these issues.

Emerging Opportunities in Iran Oil and Gas Industry

- Gas Export Expansion: Expanding natural gas exports to regional and global markets is a major opportunity.

- Petrochemical Diversification: Developing advanced petrochemical products to cater to growing global demand will add further value.

- Renewable Energy Integration: Investing in renewable energy technologies to enhance energy security and environmental sustainability offers a compelling opportunity.

Growth Accelerators in the Iran Oil and Gas Industry Industry

Several factors could propel long-term growth in the Iranian oil and gas sector. Strategic partnerships with foreign companies (post-sanctions), technological breakthroughs in extraction and refining processes, and investments in infrastructure development will all contribute to this acceleration. Furthermore, diversification into downstream industries, such as petrochemicals, will unlock new growth avenues. The projected growth in demand for natural gas in the region presents a significant opportunity for Iran to expand its export base and secure long-term energy revenue streams.

Key Players Shaping the Iran Oil and Gas Industry Market

- Pars Oil Company

- National Petrochemical Company

- Iranol Oil Company

- National Iranian Oil Company (NIOC)

- National Iranian Oil Refining and Distribution Company

Notable Milestones in Iran Oil and Gas Industry Sector

- November 2021: Iran announced a planned USD 11 billion investment to increase gas production capacity by 240 million cubic meters/day. USD 4 billion will be allocated to the North Pars field development.

- January 2022: The Lavan Refinery announced the construction of a 150,000-barrel petro-refinery and plans to increase its daily production by one million liters.

In-Depth Iran Oil and Gas Industry Market Outlook

The future of the Iranian oil and gas industry hinges on several factors, including the resolution of sanctions and increased investment in modernization and capacity expansion. Strategic partnerships, technological advancements, and government policies will play a critical role in determining the industry's long-term growth trajectory. The substantial reserves and regional demand provide a strong foundation for sustained growth if the challenges associated with sanctions and infrastructure limitations are addressed effectively. The predicted growth in the petrochemical sector indicates strong future market potential.

Iran Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Iran Oil and Gas Industry Segmentation By Geography

- 1. Iran

Iran Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pars Oil Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Petrochemical Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iranol Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Iranian Oil Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 National Iranian Oil Refining and Distribution Company*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Pars Oil Company

List of Figures

- Figure 1: Iran Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Iran Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: Iran Oil and Gas Industry Volume Tonnes Forecast, by Upstream 2019 & 2032

- Table 5: Iran Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: Iran Oil and Gas Industry Volume Tonnes Forecast, by Midstream 2019 & 2032

- Table 7: Iran Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: Iran Oil and Gas Industry Volume Tonnes Forecast, by Downstream 2019 & 2032

- Table 9: Iran Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Iran Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 11: Iran Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Iran Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

- Table 13: Iran Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 14: Iran Oil and Gas Industry Volume Tonnes Forecast, by Upstream 2019 & 2032

- Table 15: Iran Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 16: Iran Oil and Gas Industry Volume Tonnes Forecast, by Midstream 2019 & 2032

- Table 17: Iran Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 18: Iran Oil and Gas Industry Volume Tonnes Forecast, by Downstream 2019 & 2032

- Table 19: Iran Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Iran Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Oil and Gas Industry?

The projected CAGR is approximately > 3.40%.

2. Which companies are prominent players in the Iran Oil and Gas Industry?

Key companies in the market include Pars Oil Company, National Petrochemical Company, Iranol Oil Company, National Iranian Oil Company, National Iranian Oil Refining and Distribution Company*List Not Exhaustive.

3. What are the main segments of the Iran Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

Upstream Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, the Lavan Refinery, in the south of Iran, announced the construction of a 150,000-barrel petro-refinery next to the Lavan Refinery and its efforts to increase the refinery's production by one million liters per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Iran Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence