Key Insights

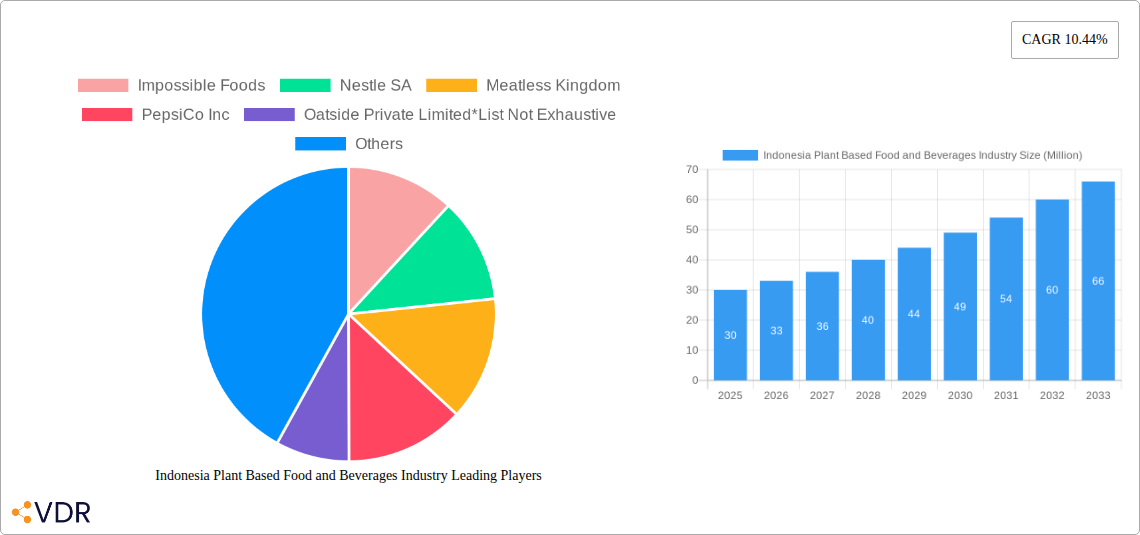

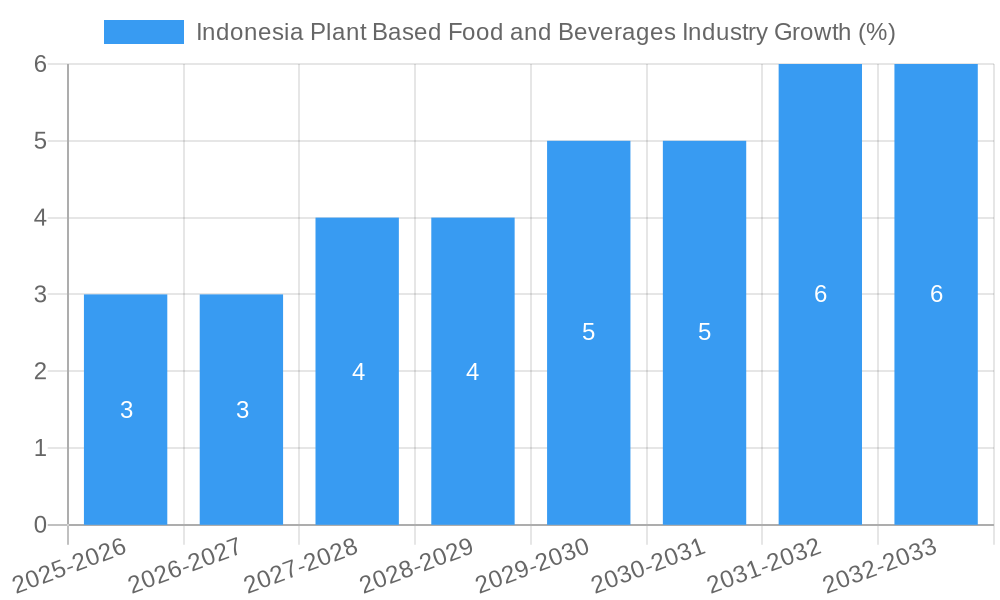

The Indonesian plant-based food and beverage market presents a compelling investment opportunity, driven by increasing health consciousness, environmental concerns, and a growing vegan and vegetarian population. The market, currently estimated at $377.97 million in 2025 (assuming this figure represents the global market and Indonesia holds a reasonable share based on its population and economic growth), is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 10.44% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes, particularly amongst the young and increasingly affluent middle class, are driving demand for premium and convenient plant-based options. Furthermore, the rising awareness of the environmental impact of animal agriculture is boosting consumer interest in sustainable and ethically sourced products. The market segmentation shows strong potential across diverse categories, including meat substitutes (e.g., tempeh, tofu, and emerging plant-based meat alternatives), dairy alternative beverages (soy milk, oat milk, almond milk), and other plant-based products such as snacks and ready meals. Strong distribution channels such as supermarkets and hypermarkets, complemented by the rapid expansion of online retail, provide ample access for consumers. Key players, both international and domestic, are competing to capture market share, leading to product innovation and competitive pricing.

The Indonesian market’s unique characteristics offer specific opportunities. The country’s rich culinary heritage, with its existing use of plant-based ingredients like soy and coconut, provides a fertile ground for the integration of new plant-based products. However, challenges remain, including overcoming consumer perceptions around taste and cost, and ensuring a stable supply chain to meet growing demand. Successful players will need to focus on developing locally relevant products that cater to Indonesian taste preferences and address affordability concerns. Educational initiatives to highlight the health and environmental benefits of plant-based options will also play a vital role in accelerating market growth. Government support through policies promoting sustainable agriculture and food security can further facilitate market expansion.

Indonesia Plant Based Food and Beverages Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Indonesia plant-based food and beverages market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and future opportunities within this rapidly expanding sector. The report segments the market by product type (Meat Substitutes, Dairy Alternative Beverages, Other Plant-based Products) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other Distribution Channels), providing a granular understanding of the Indonesian landscape.

Indonesia Plant Based Food and Beverages Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the Indonesian plant-based food and beverage industry. The report examines market concentration, identifying key players and their market shares. It explores the impact of technological innovation on product development and manufacturing, including the role of alternative protein sources and processing technologies. Further, it delves into the regulatory framework governing food safety and labeling, as well as the influence of consumer preferences and demographics. Finally, it assesses the prevalence of mergers and acquisitions (M&A) within the industry, providing quantitative insights into deal volumes and qualitative observations on M&A trends.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on sustainable sourcing, improved taste and texture, and cost reduction.

- Regulatory Framework: Stringent food safety regulations and labeling requirements.

- Competitive Substitutes: Traditional meat and dairy products pose significant competition.

- End-User Demographics: Growing middle class and increasing health consciousness drive demand.

- M&A Trends: xx M&A deals recorded between 2019-2024, primarily focused on expansion and technology acquisition.

Indonesia Plant Based Food and Beverages Industry Growth Trends & Insights

This section presents a detailed analysis of the market's growth trajectory, driven by factors such as increasing consumer awareness of health and environmental benefits, changing dietary habits, and technological advancements. The analysis incorporates historical data (2019-2024), estimates for 2025, and forecasts for 2025-2033. Key metrics such as Compound Annual Growth Rate (CAGR), market penetration rates, and adoption rates across various segments are presented to provide a complete picture of market evolution. The report explores technological disruptions influencing production methods, product innovation, and market access, along with shifts in consumer behavior impacting demand patterns. Specific examples of consumer behavior changes and their implications for the industry are included, along with projected market size figures in million units for each year within the forecast period.

- Market Size (Million Units): 2019 (xx), 2020 (xx), 2021 (xx), 2022 (xx), 2023 (xx), 2024 (xx), 2025 (xx Million), 2033 (xx Million)

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2025, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Indonesia Plant Based Food and Beverages Industry

This section identifies the leading regions, countries, or segments within the Indonesian plant-based food and beverage market that are driving growth. It examines the performance of each segment (Meat Substitutes, Dairy Alternative Beverages, Other Plant-based Products) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other Distribution Channels), identifying the most dominant areas and their contributing factors. Key drivers such as economic policies, infrastructure development, and consumer preferences are explored in detail. The analysis includes market share data and growth potential projections for each segment, providing a clear understanding of the market's regional and segment-specific dynamics.

- Dominant Segment (by type): Dairy Alternative Beverages, driven by high consumer adoption and product diversification.

- Dominant Segment (by distribution channel): Supermarkets/Hypermarkets, due to established distribution networks and wider product availability.

- Key Regional Drivers: Growing urban population, rising disposable incomes, and increasing awareness of health and environmental concerns.

Indonesia Plant Based Food and Beverages Industry Product Landscape

This section provides a concise overview of the plant-based food and beverage products available in Indonesia, highlighting key innovations and technological advancements driving product development. It details the applications of these products, along with their performance metrics, focusing on factors such as taste, texture, and nutritional value. The unique selling propositions (USPs) of various products are also discussed, emphasizing their competitive advantages in the market.

Key Drivers, Barriers & Challenges in Indonesia Plant Based Food and Beverages Industry

This section identifies the key factors driving growth in the Indonesian plant-based food and beverage market, including technological advancements, economic factors, and supportive government policies. It also analyzes the challenges and restraints that hinder market expansion, such as supply chain issues, regulatory hurdles, and intense competition from traditional food products. Specific examples and quantifiable impacts are provided to illustrate these factors.

- Key Drivers: Increasing consumer awareness of health benefits, rising disposable incomes, and growing adoption of sustainable lifestyles.

- Key Challenges: Limited awareness in certain regions, high production costs, and competition from established food brands.

Emerging Opportunities in Indonesia Plant Based Food and Beverages Industry

This section explores promising opportunities for growth within the Indonesian plant-based food and beverage market. It focuses on emerging trends, untapped market segments, innovative product applications, and shifts in consumer preferences.

Growth Accelerators in the Indonesia Plant Based Food and Beverages Industry Industry

This section discusses the key catalysts expected to fuel long-term growth in the Indonesian plant-based food and beverage market. These include technological breakthroughs in alternative protein production, strategic partnerships between food companies and technology providers, and market expansion strategies targeting previously underserved consumer segments.

Key Players Shaping the Indonesia Plant Based Food and Beverages Industry Market

- Impossible Foods

- Nestle SA

- Meatless Kingdom

- PepsiCo Inc

- Oatside Private Limited

- The Kraft Heinz Company

- Danone S A

- Amy's Kitchen Inc

- Green Rebel Foods

- Rude Health

Notable Milestones in Indonesia Plant Based Food and Beverages Industry Sector

- September 2021: Nutrifood launches a new plant-based powdered almond drink.

- September 2020: IKEA Indonesia launches vegan Vanilla Ice Cream.

- September 2020: Float Foods launches Indonesia's first joint cross-border food incubator.

In-Depth Indonesia Plant Based Food and Beverages Industry Market Outlook

The Indonesian plant-based food and beverage market exhibits substantial growth potential, driven by increasing health consciousness, environmental concerns, and expanding consumer base. Strategic opportunities abound for companies focused on product innovation, sustainable sourcing, and effective marketing strategies catering to the diverse Indonesian palate and distribution channels. The market is poised for continued expansion, making it an attractive space for both established players and emerging startups.

Indonesia Plant Based Food and Beverages Industry Segmentation

-

1. Product Type

-

1.1. Meat Substitutes

- 1.1.1. Tofu

- 1.1.2. Tempeh

- 1.1.3. Others

-

1.2. Dairy Alternative Beverages

- 1.2.1. Soy Milk

- 1.2.2. Almond Milk

- 1.2.3. Other Dairy Alternative Beverages

- 1.3. Non-dairy Ice Cream

- 1.4. Non-dairy Cheese

- 1.5. Non-dairy Yogurt

- 1.6. Non-dairy Spreads

- 1.7. Other Plant-based Products

-

1.1. Meat Substitutes

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Indonesia Plant Based Food and Beverages Industry Segmentation By Geography

- 1. Indonesia

Indonesia Plant Based Food and Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rise in Vegan Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Meat Substitutes

- 5.1.1.1. Tofu

- 5.1.1.2. Tempeh

- 5.1.1.3. Others

- 5.1.2. Dairy Alternative Beverages

- 5.1.2.1. Soy Milk

- 5.1.2.2. Almond Milk

- 5.1.2.3. Other Dairy Alternative Beverages

- 5.1.3. Non-dairy Ice Cream

- 5.1.4. Non-dairy Cheese

- 5.1.5. Non-dairy Yogurt

- 5.1.6. Non-dairy Spreads

- 5.1.7. Other Plant-based Products

- 5.1.1. Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Impossible Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestle SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Meatless Kingdom

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PepsiCo Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Oatside Private Limited*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Kraft Heinz Company

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone S A

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Amy's Kitchen Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Green Rebel Foods

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rude Health

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Impossible Foods

List of Figures

- Figure 1: Indonesia Plant Based Food and Beverages Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Plant Based Food and Beverages Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 4: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Indonesia Plant Based Food and Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 15: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Plant Based Food and Beverages Industry?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Indonesia Plant Based Food and Beverages Industry?

Key companies in the market include Impossible Foods, Nestle SA, Meatless Kingdom, PepsiCo Inc, Oatside Private Limited*List Not Exhaustive, The Kraft Heinz Company, Danone S A, Amy's Kitchen Inc, Green Rebel Foods, Rude Health.

3. What are the main segments of the Indonesia Plant Based Food and Beverages Industry?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 377.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Rise in Vegan Population.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Nutrifood launched a new plant-based powdered almond drink featuring coconut flavor. The drink is high in calcium, contains 12 vitamins and 5 minerals, and is free from lactose.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Plant Based Food and Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Plant Based Food and Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Plant Based Food and Beverages Industry?

To stay informed about further developments, trends, and reports in the Indonesia Plant Based Food and Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence