Key Insights

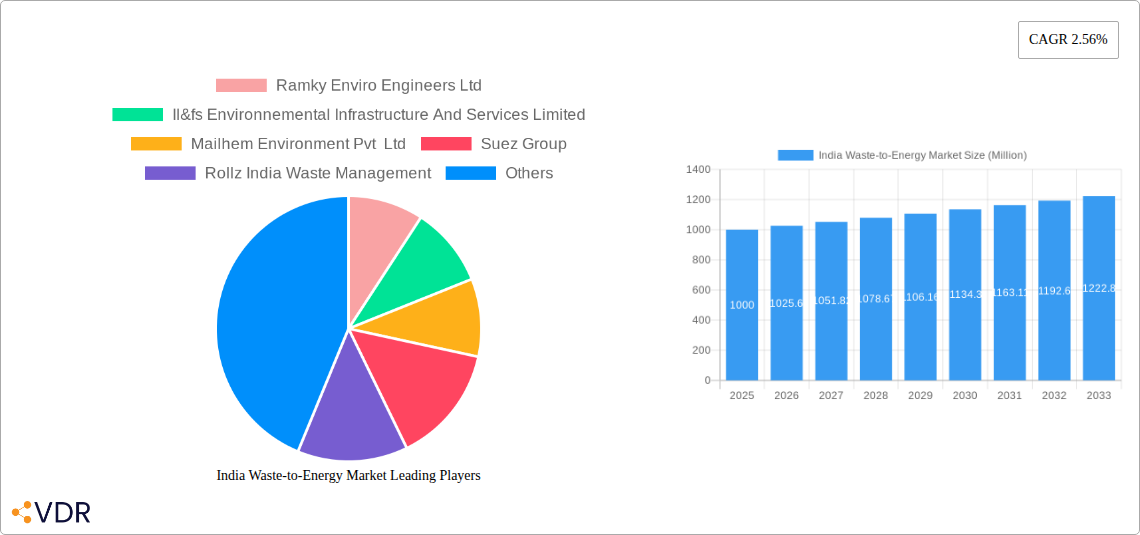

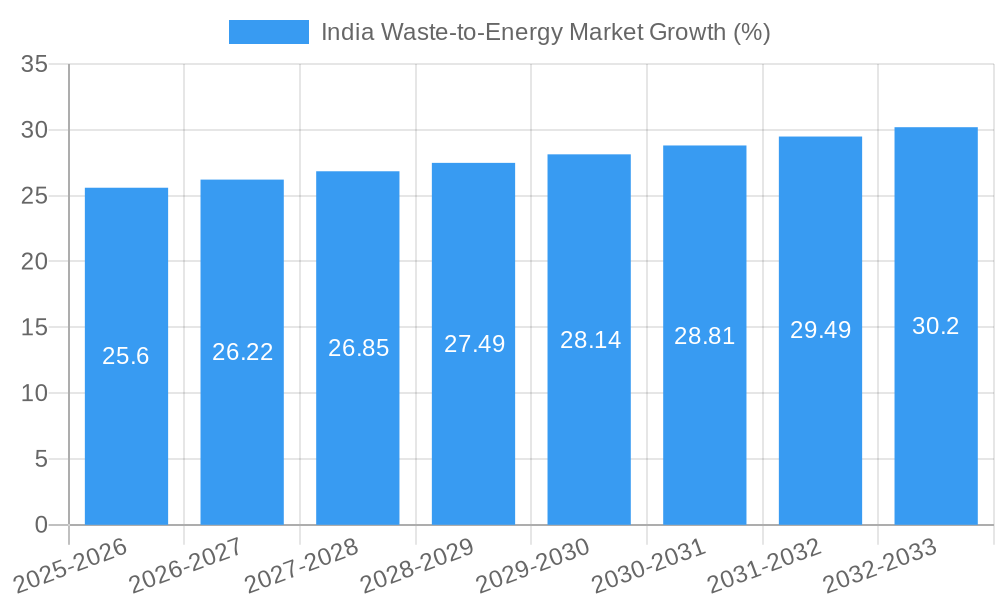

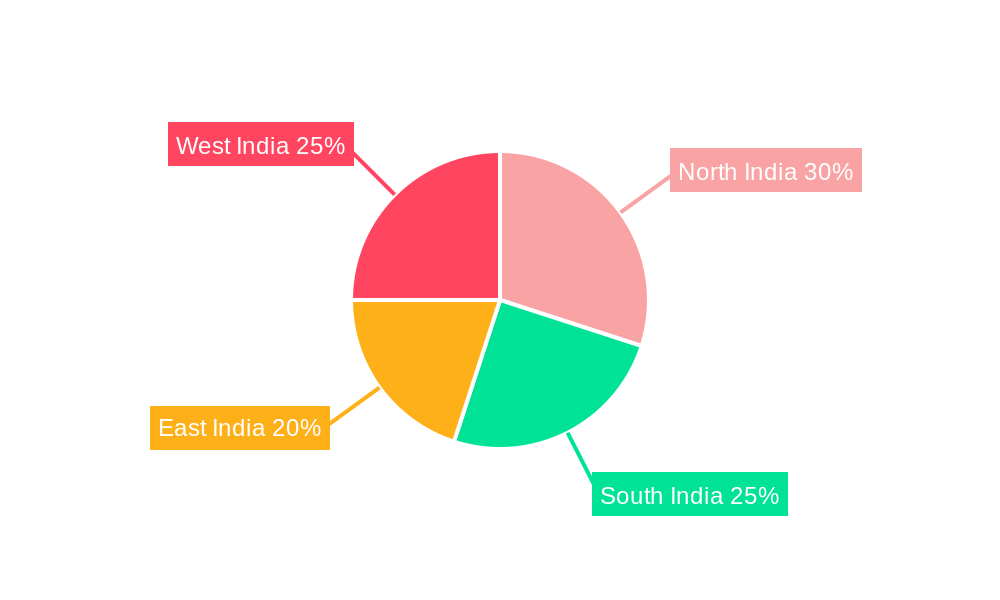

The India waste-to-energy market, valued at approximately ₹1000 million (estimated) in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.56% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and industrialization are generating substantial quantities of waste, creating an urgent need for sustainable waste management solutions. Government initiatives promoting renewable energy and stricter regulations on landfill disposal are further accelerating market adoption. Technological advancements in waste gasification, particularly bio-chemical processes and thermal technologies, are improving efficiency and reducing operational costs. The market is segmented by gasification technology (bio-chemical, other technologies), disposal method (landfill, waste processing, recycling), and technology type (thermal). The thermal technology segment is currently dominant due to its established infrastructure and relatively lower initial investment compared to newer technologies. However, the bio-chemical gasification segment is expected to witness faster growth driven by its environmentally friendly nature and potential for higher energy recovery. Key players like Ramky Enviro Engineers Ltd, Suez Group, and Veolia Environnement SA are actively shaping the market landscape through technological innovation and strategic partnerships. Regional variations exist, with a potentially higher growth rate anticipated in rapidly urbanizing areas like North and West India.

The market's growth is not without challenges. High capital investment costs for waste-to-energy plants, particularly for newer technologies, remain a major constraint. Land acquisition and regulatory hurdles can also delay project implementation. Furthermore, inconsistent waste collection and processing infrastructure in certain regions can impact the reliability of waste feedstock supply, hindering the overall development of the sector. However, with continued government support, technological improvements, and a growing awareness of sustainable waste management practices, the India waste-to-energy market is expected to overcome these barriers and experience substantial growth in the coming years. Further research into optimizing the bio-chemical gasification process and reducing initial investment costs will be crucial in unlocking the full potential of this market segment.

India Waste-to-Energy Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Waste-to-Energy market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The parent market is the broader waste management industry in India, while the child markets include gasification, thermal technologies, and various waste disposal methods. The total market size in 2025 is estimated at XX Million.

India Waste-to-Energy Market Dynamics & Structure

The Indian Waste-to-Energy market is characterized by increasing market concentration, driven by mergers and acquisitions (M&A) activity. Technological innovation, particularly in gasification and thermal technologies, is a key growth driver. Stringent regulatory frameworks aimed at waste management are shaping market dynamics, while the presence of competitive product substitutes (e.g., landfills) poses a challenge. End-user demographics, primarily municipalities and industrial sectors, influence demand.

- Market Concentration: The market is moderately concentrated, with a few large players holding significant market share (estimated at xx%).

- Technological Innovation: Continuous advancements in gasification (bio-chemical and other technologies) and thermal technologies are improving efficiency and reducing costs.

- Regulatory Framework: Government regulations promoting waste-to-energy solutions are creating favorable conditions for market expansion.

- Competitive Substitutes: Landfills remain a significant competitor, though their environmental impact is increasingly scrutinized.

- M&A Activity: The number of M&A deals in the sector has increased in recent years, leading to consolidation and increased market share for larger players. (xx deals in the last 5 years).

- End-User Demographics: Municipalities and industrial waste generators are the primary end users.

India Waste-to-Energy Market Growth Trends & Insights

The Indian Waste-to-Energy market is experiencing robust growth, driven by rising urbanization, increasing waste generation, and government initiatives. The market size has exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching an estimated XX Million by 2033. This growth is fueled by technological disruptions, particularly in advanced gasification and thermal technologies, improving efficiency and reducing costs. Consumer behavior shifts, reflecting growing environmental awareness, further support the adoption of sustainable waste management solutions. Market penetration of waste-to-energy solutions is still relatively low, indicating significant untapped potential.

Dominant Regions, Countries, or Segments in India Waste-to-Energy Market

The growth of the India Waste-to-Energy market is not uniform across all regions and segments. Urban centers with high waste generation and supportive government policies witness the highest adoption rates. Thermal technologies currently dominate the market, while the gasification segment (both bio-chemical and other technologies) is poised for significant growth. Waste processing and recycling are emerging as key disposal methods.

- Leading Region: Maharashtra and Gujarat are currently leading in terms of project installations and market share, driven by favorable government policies and high waste generation.

- Key Drivers: Government policies incentivizing renewable energy, increasing urbanization leading to higher waste generation, improving infrastructure for waste collection, and growing environmental awareness are major growth drivers.

- Dominant Segment: Thermal technologies currently hold the largest market share due to established infrastructure and lower initial investment costs. However, the gasification segment is expected to experience faster growth due to higher efficiency and potential for advanced applications.

- Market Share & Growth Potential: The thermal segment holds an estimated xx% market share in 2025, projected to grow to xx% by 2033. The gasification segment is projected to show significant growth, increasing its market share from xx% to xx% over the same period.

India Waste-to-Energy Market Product Landscape

The Indian Waste-to-Energy market presents a diverse range of technologies, including thermal incineration, gasification, anaerobic digestion, and pyrolysis. Recent product innovations focus on improving energy efficiency, reducing emissions, and enhancing resource recovery. Advanced gasification technologies offer higher energy recovery and reduced greenhouse gas emissions compared to traditional thermal methods. Key performance indicators include energy conversion efficiency, greenhouse gas emissions, and the volume of waste processed. The unique selling proposition for many systems centers around optimized waste processing, reduced environmental impact, and efficient energy generation.

Key Drivers, Barriers & Challenges in India Waste-to-Energy Market

Key Drivers:

- Government policies promoting renewable energy and waste management.

- Growing urbanization and increasing waste generation.

- Technological advancements improving efficiency and reducing costs.

- Rising environmental awareness and concerns over landfill saturation.

Challenges & Restraints:

- High upfront capital costs for establishing waste-to-energy plants.

- Complex regulatory approvals and permitting processes.

- Concerns regarding the quality of waste feedstock.

- Challenges related to land acquisition and community acceptance. In some cases, community resistance to plant location can create significant project delays. This is estimated to impact project timelines by an average of xx months.

Emerging Opportunities in India Waste-to-Energy Market

- Expansion into smaller cities and towns with limited waste management infrastructure.

- Integration of waste-to-energy technologies with other waste management solutions (e.g., recycling).

- Development of innovative waste pre-processing technologies to improve feedstock quality.

- Exploration of niche applications for recovered energy and byproducts.

Growth Accelerators in the India Waste-to-Energy Market Industry

The long-term growth of the Indian Waste-to-Energy market will be driven by continued technological innovation, focusing on efficiency improvements and cost reductions. Strategic partnerships between private companies and government agencies will play a crucial role in project development and financing. Expansion into untapped markets, particularly in smaller cities and rural areas, will unlock significant growth potential. Government support through favorable policies and financial incentives will remain critical for market expansion.

Key Players Shaping the India Waste-to-Energy Market Market

- Ramky Enviro Engineers Ltd

- Il&fs Environmental Infrastructure And Services Limited

- Mailhem Environment Pvt Ltd

- Suez Group

- Rollz India Waste Management

- Veolia Environnement SA

- Abellon Clean Energy Ltd

- Hitachi Zosen Inova

- A2z Group

- Ecogreen Energy Pvt Ltd

- Hydroair Techtonics (pcd) Limited

- Gj Eco Power Pvt Ltd

- Jitf Urban Infrastructure Limited

Notable Milestones in India Waste-to-Energy Market Sector

- March 2022: The WASTE-TO-ENERGY Recycling Plant in Visakhapatnam commenced operations, generating 9.90 MW (and projected 15 MW) of power daily. This highlights the increasing capacity of waste-to-energy plants and the potential for large-scale energy generation from waste.

- January 2022: The Brihanmumbai Municipal Corporation proposed a 600 metric tonne per day waste-to-energy plant in Mumbai, showcasing investment in large-scale waste management infrastructure.

In-Depth India Waste-to-Energy Market Market Outlook

The future of the India Waste-to-Energy market is exceptionally bright. Continued government support, coupled with technological advancements and a growing awareness of the environmental and economic benefits of sustainable waste management, will propel market expansion. Strategic investments in waste-to-energy infrastructure, alongside the development of innovative technologies, will create significant opportunities for market participants. The market's potential for job creation and economic growth is substantial, positioning it as a key contributor to India's sustainable development goals.

India Waste-to-Energy Market Segmentation

-

1. Technology

-

1.1. Thermal

- 1.1.1. Incineration

- 1.1.2. Pyrolysis

- 1.1.3. Gasification

- 1.2. Bio-Chemical

- 1.3. Other Technologies

-

1.1. Thermal

-

2. Disposal Method

- 2.1. Landfill

- 2.2. Waste Processing

- 2.3. Recycling

India Waste-to-Energy Market Segmentation By Geography

- 1. India

India Waste-to-Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Energy Demand4.; Increasing Export Opportunities

- 3.3. Market Restrains

- 3.3.1 Establishing WTE facilities requires substantial initial investment

- 3.3.2 which can be a barrier for many stakeholders. The high upfront costs may deter potential investors and slow market expansion

- 3.4. Market Trends

- 3.4.1 The adoption of advanced technologies

- 3.4.2 such as gasification and pyrolysis

- 3.4.3 is enhancing the efficiency and environmental performance of WTE plants. These technologies offer cleaner and more efficient energy recovery from waste

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waste-to-Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal

- 5.1.1.1. Incineration

- 5.1.1.2. Pyrolysis

- 5.1.1.3. Gasification

- 5.1.2. Bio-Chemical

- 5.1.3. Other Technologies

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Disposal Method

- 5.2.1. Landfill

- 5.2.2. Waste Processing

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North India India Waste-to-Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Waste-to-Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Waste-to-Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Waste-to-Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Ramky Enviro Engineers Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Il&fs Environnemental Infrastructure And Services Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mailhem Environment Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Suez Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rollz India Waste Management

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Veolia Environnement SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Abellon Clean Energy Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hitachi Zosen Inova

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 A2z Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ecogreen Energy Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hydroair Techtonics (pcd) Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Gj Eco Power Pvt Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Jitf Urban Infrastructure Limited

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Ramky Enviro Engineers Ltd

List of Figures

- Figure 1: India Waste-to-Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Waste-to-Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Waste-to-Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Waste-to-Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: India Waste-to-Energy Market Revenue Million Forecast, by Disposal Method 2019 & 2032

- Table 4: India Waste-to-Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Waste-to-Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Waste-to-Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Waste-to-Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Waste-to-Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Waste-to-Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Waste-to-Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 11: India Waste-to-Energy Market Revenue Million Forecast, by Disposal Method 2019 & 2032

- Table 12: India Waste-to-Energy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waste-to-Energy Market?

The projected CAGR is approximately 2.56%.

2. Which companies are prominent players in the India Waste-to-Energy Market?

Key companies in the market include Ramky Enviro Engineers Ltd, Il&fs Environnemental Infrastructure And Services Limited, Mailhem Environment Pvt Ltd, Suez Group, Rollz India Waste Management, Veolia Environnement SA, Abellon Clean Energy Ltd, Hitachi Zosen Inova, A2z Group, Ecogreen Energy Pvt Ltd, Hydroair Techtonics (pcd) Limited, Gj Eco Power Pvt Ltd, Jitf Urban Infrastructure Limited.

3. What are the main segments of the India Waste-to-Energy Market?

The market segments include Technology, Disposal Method.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Energy Demand4.; Increasing Export Opportunities.

6. What are the notable trends driving market growth?

The adoption of advanced technologies. such as gasification and pyrolysis. is enhancing the efficiency and environmental performance of WTE plants. These technologies offer cleaner and more efficient energy recovery from waste.

7. Are there any restraints impacting market growth?

Establishing WTE facilities requires substantial initial investment. which can be a barrier for many stakeholders. The high upfront costs may deter potential investors and slow market expansion.

8. Can you provide examples of recent developments in the market?

March 2022: The WASTE-TO-ENERGY Recycling Plant, a flagship project of the Greater Visakhapatnam Municipal Corporation (GVMC), commenced operating at Kapuluppada in Visakhapatnam. The plant generates about 9.90 MW of power per day using one boiler. According to the agreement between Jindal Group and the GVMC, the recycling plant will generate about 15 MW of electricity daily. To generate 15 MW of power, GVMC focused on providing about 1,200 tones of waste per day. The corporation is mulling to transport 260 tones of garbage from Srikakulam, Vizianagaram, and Nellimarla municipalities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waste-to-Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waste-to-Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waste-to-Energy Market?

To stay informed about further developments, trends, and reports in the India Waste-to-Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence