Key Insights

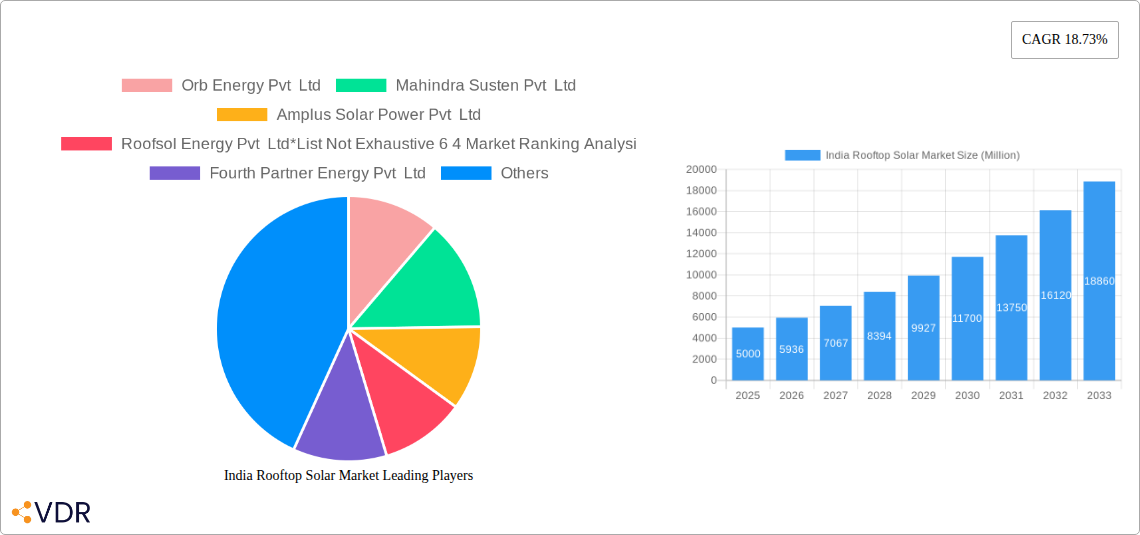

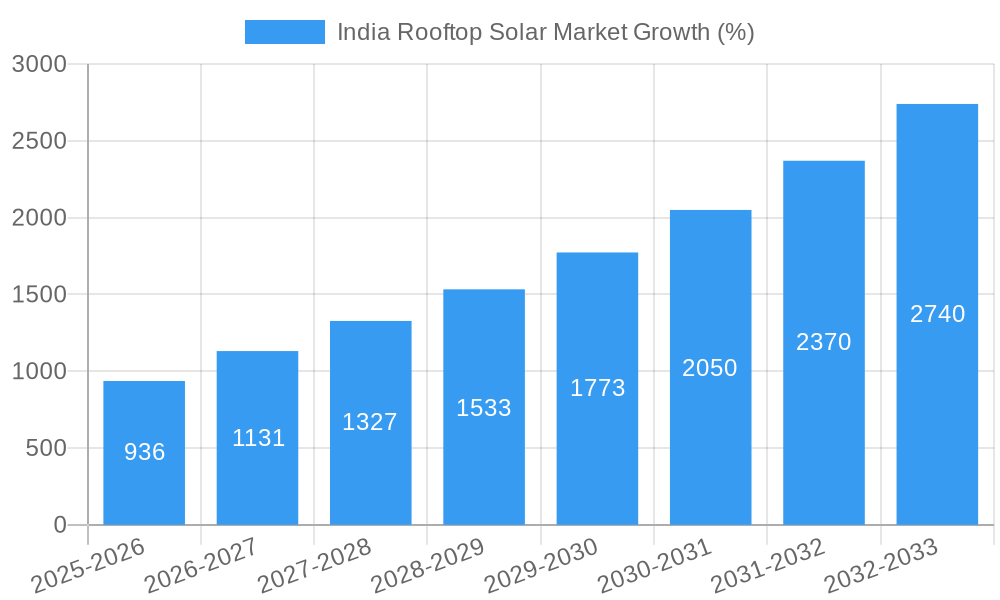

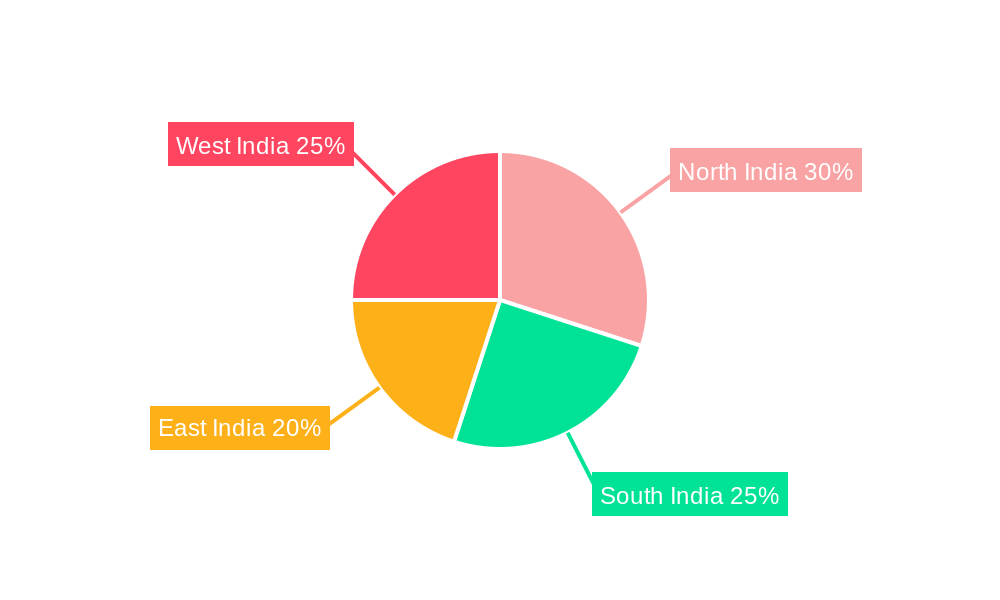

The India rooftop solar market is experiencing robust growth, driven by increasing electricity demand, rising energy costs, supportive government policies promoting renewable energy adoption (like the National Solar Mission), and decreasing solar panel prices. The market's Compound Annual Growth Rate (CAGR) of 18.73% from 2019 to 2024 indicates significant expansion, and this trajectory is expected to continue through 2033. While precise market size figures for 2019-2024 are unavailable, extrapolating from the available data, we can reasonably assume a substantial increase in market value over this period. The residential segment is projected to show strong growth fuelled by decreasing installation costs and increasing awareness of environmental sustainability amongst homeowners. The industrial and commercial sectors also present significant opportunities, with larger-scale installations driven by cost savings and corporate sustainability goals. However, challenges remain. These include regulatory hurdles in some regions, inconsistent grid infrastructure impacting off-grid adoption, and financing limitations for some potential customers. The presence of established players like Tata Power Solar, Mahindra Susten, and Orb Energy, along with emerging companies, indicates a competitive market, fostering innovation and driving down costs further. The geographic distribution shows significant potential across all regions of India, but North and West India may lead in terms of faster growth due to higher industrial and commercial activity and potentially higher consumer awareness.

The key to unlocking the full potential of the India rooftop solar market lies in addressing the existing restraints. This includes streamlining regulatory processes, improving grid infrastructure, particularly in rural areas to support both on-grid and off-grid systems, and promoting financial incentives or innovative financing models to make rooftop solar more accessible to a wider range of consumers. Further investment in research and development, particularly to improve energy storage solutions, will help overcome intermittency issues inherent in solar power, further enhancing its appeal and fostering market expansion. The continued involvement and investment of major players, along with the entrance of new players, will contribute significantly to the market's anticipated growth over the coming years.

India Rooftop Solar Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India rooftop solar market, encompassing market dynamics, growth trends, key players, and future outlook. It leverages extensive data from 2019-2024 (historical period), utilizes 2025 as the base year and estimated year, and projects market trends until 2033 (forecast period). This report is an essential resource for investors, industry professionals, and policymakers seeking to understand and capitalize on the burgeoning opportunities within this dynamic sector. The report breaks down the market into parent and child markets for a granular understanding.

India Rooftop Solar Market Dynamics & Structure

The Indian rooftop solar market is characterized by increasing market concentration, driven by technological advancements, supportive government regulations, and the rising adoption of renewable energy solutions. The market is witnessing a surge in mergers and acquisitions (M&A) activity, with larger players consolidating their market share. Technological innovation, while accelerating, faces challenges including high initial investment costs and grid integration complexities.

- Market Concentration: xx% market share held by top 5 players in 2024. Expect further consolidation by 2033.

- Technological Innovation: Focus on higher efficiency panels, improved energy storage solutions, and smart grid integration.

- Regulatory Framework: Government initiatives like the National Solar Mission and state-level policies are driving adoption.

- Competitive Product Substitutes: Limited direct substitutes, but competition exists from other renewable sources like wind power.

- End-User Demographics: Significant growth across industrial, commercial, and residential sectors, with industrial leading the way.

- M&A Trends: xx M&A deals recorded in 2024, indicating strong consolidation and investment activity. Projected increase to xx deals by 2033.

India Rooftop Solar Market Growth Trends & Insights

The Indian rooftop solar market has witnessed substantial growth in recent years, fueled by rising energy demand, government incentives, and decreasing solar panel costs. The market size has expanded from xx million units in 2019 to xx million units in 2024, with a Compound Annual Growth Rate (CAGR) of xx%. Market penetration is expected to increase significantly, driven by factors such as increasing awareness of environmental benefits and declining installation costs. Technological disruptions, such as the introduction of more efficient solar panels and advanced energy storage systems, will further accelerate market growth.

Dominant Regions, Countries, or Segments in India Rooftop Solar Market

The industrial and commercial sectors dominate the Indian rooftop solar market, driven by high energy consumption and significant cost-saving opportunities. States with favorable solar irradiance and supportive policies are witnessing faster adoption rates. The on-grid segment currently holds a larger market share compared to off-grid, although the off-grid segment is expected to witness accelerated growth in remote areas.

- Key Drivers:

- Favorable government policies and incentives.

- Declining solar panel prices.

- Increasing energy demand from industries and businesses.

- Growing awareness about environmental sustainability.

- Dominance Factors:

- High energy consumption in industrial and commercial sectors.

- Availability of suitable rooftops in urban and industrial areas.

- Relatively higher ROI compared to other renewable energy sources.

India Rooftop Solar Market Product Landscape

The Indian rooftop solar market features a diverse range of products, including monocrystalline and polycrystalline solar panels, inverters, mounting systems, and energy storage solutions. Product innovation is focused on enhancing efficiency, durability, and aesthetics to meet diverse end-user needs. Unique selling propositions include customized solutions, performance guarantees, and advanced monitoring systems.

Key Drivers, Barriers & Challenges in India Rooftop Solar Market

Key Drivers:

- Declining solar panel prices

- Government incentives and policies (e.g., tax benefits, net metering)

- Increasing energy demand

- Growing awareness of environmental concerns

Key Challenges & Restraints:

- High initial investment costs

- Complex grid integration processes

- Lack of awareness among residential consumers

- Supply chain constraints (xx% increase in raw material prices in 2024)

Emerging Opportunities in India Rooftop Solar Market

- Untapped potential in rural areas

- Growing demand for hybrid solar solutions

- Increased focus on energy storage systems

- Expansion of the residential segment

Growth Accelerators in the India Rooftop Solar Market Industry

Technological advancements, particularly in battery storage and panel efficiency, are major growth catalysts. Strategic partnerships between solar developers and energy consumers are accelerating market penetration. Government initiatives aimed at simplifying regulatory processes and reducing financing barriers are crucial for long-term growth.

Key Players Shaping the India Rooftop Solar Market Market

- Orb Energy Pvt Ltd

- Mahindra Susten Pvt Ltd

- Amplus Solar Power Pvt Ltd

- Roofsol Energy Pvt Ltd

- Fourth Partner Energy Pvt Ltd

- Cleantech Energy Corporation Pte Ltd

- Tata Power Solar Systems Limited

- Sunsource Energy Pvt Ltd

- Clean Max Enviro Energy Solutions Pvt Ltd

- Growatt New Energy Technology Co Ltd

Notable Milestones in India Rooftop Solar Market Sector

- April 2024: Apple's joint venture with CleanMax for six rooftop solar projects (14.4 MW total capacity) in Mumbai and New Delhi.

- March 2024: GAIL (India) invites bids for a grid-tied rooftop solar PV system with a 5-year AMC in the Krishna Godavari Basin.

In-Depth India Rooftop Solar Market Market Outlook

The Indian rooftop solar market is poised for significant growth over the next decade. Continued technological innovation, supportive government policies, and increasing private sector investments will drive market expansion. Strategic partnerships and the development of innovative financing models will play a critical role in unlocking the substantial untapped potential of this market. The market is projected to reach xx million units by 2033.

India Rooftop Solar Market Segmentation

-

1. End-user

- 1.1. Industrial

- 1.2. Commercial (Including Public Sector)

- 1.3. Residential

-

2. Grid Type (Qualitative Analysis Only)

- 2.1. On-grid

- 2.2. Off-grid

India Rooftop Solar Market Segmentation By Geography

- 1. India

India Rooftop Solar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Emphasis Towards Renewable Energy Integration4.; Increasing Demand in the Commercial and Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Slow-Paced Installation of Rooftop Projects

- 3.4. Market Trends

- 3.4.1. The On-grid Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Rooftop Solar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Industrial

- 5.1.2. Commercial (Including Public Sector)

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Grid Type (Qualitative Analysis Only)

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. North India India Rooftop Solar Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Rooftop Solar Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Rooftop Solar Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Rooftop Solar Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Orb Energy Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mahindra Susten Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amplus Solar Power Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Roofsol Energy Pvt Ltd*List Not Exhaustive 6 4 Market Ranking Analysi

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fourth Partner Energy Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cleantech Energy Corporation Pte Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Tata Power Solar Systems Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sunsource Energy Pvt Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Clean Max Enviro Energy Solutions Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Growatt New Energy Technology Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Orb Energy Pvt Ltd

List of Figures

- Figure 1: India Rooftop Solar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Rooftop Solar Market Share (%) by Company 2024

List of Tables

- Table 1: India Rooftop Solar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Rooftop Solar Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: India Rooftop Solar Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: India Rooftop Solar Market Volume Gigawatt Forecast, by End-user 2019 & 2032

- Table 5: India Rooftop Solar Market Revenue Million Forecast, by Grid Type (Qualitative Analysis Only) 2019 & 2032

- Table 6: India Rooftop Solar Market Volume Gigawatt Forecast, by Grid Type (Qualitative Analysis Only) 2019 & 2032

- Table 7: India Rooftop Solar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Rooftop Solar Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: India Rooftop Solar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Rooftop Solar Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: North India India Rooftop Solar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Rooftop Solar Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: South India India Rooftop Solar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Rooftop Solar Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: East India India Rooftop Solar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Rooftop Solar Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: West India India Rooftop Solar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Rooftop Solar Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: India Rooftop Solar Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 20: India Rooftop Solar Market Volume Gigawatt Forecast, by End-user 2019 & 2032

- Table 21: India Rooftop Solar Market Revenue Million Forecast, by Grid Type (Qualitative Analysis Only) 2019 & 2032

- Table 22: India Rooftop Solar Market Volume Gigawatt Forecast, by Grid Type (Qualitative Analysis Only) 2019 & 2032

- Table 23: India Rooftop Solar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Rooftop Solar Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Rooftop Solar Market?

The projected CAGR is approximately 18.73%.

2. Which companies are prominent players in the India Rooftop Solar Market?

Key companies in the market include Orb Energy Pvt Ltd, Mahindra Susten Pvt Ltd, Amplus Solar Power Pvt Ltd, Roofsol Energy Pvt Ltd*List Not Exhaustive 6 4 Market Ranking Analysi, Fourth Partner Energy Pvt Ltd, Cleantech Energy Corporation Pte Ltd, Tata Power Solar Systems Limited, Sunsource Energy Pvt Ltd, Clean Max Enviro Energy Solutions Pvt Ltd, Growatt New Energy Technology Co Ltd.

3. What are the main segments of the India Rooftop Solar Market?

The market segments include End-user , Grid Type (Qualitative Analysis Only) .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Emphasis Towards Renewable Energy Integration4.; Increasing Demand in the Commercial and Industrial Sector.

6. What are the notable trends driving market growth?

The On-grid Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Slow-Paced Installation of Rooftop Projects.

8. Can you provide examples of recent developments in the market?

April 2024: Apple announced forming a joint venture with renewable energy developer CleanMax to invest in six rooftop solar projects to power its operations in India. The solar project is expected to have a total capacity of 14.4 MW and, when operational, will provide a local solution to power the company’s offices and two retail stores in Mumbai and New Delhi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Rooftop Solar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Rooftop Solar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Rooftop Solar Market?

To stay informed about further developments, trends, and reports in the India Rooftop Solar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence