Key Insights

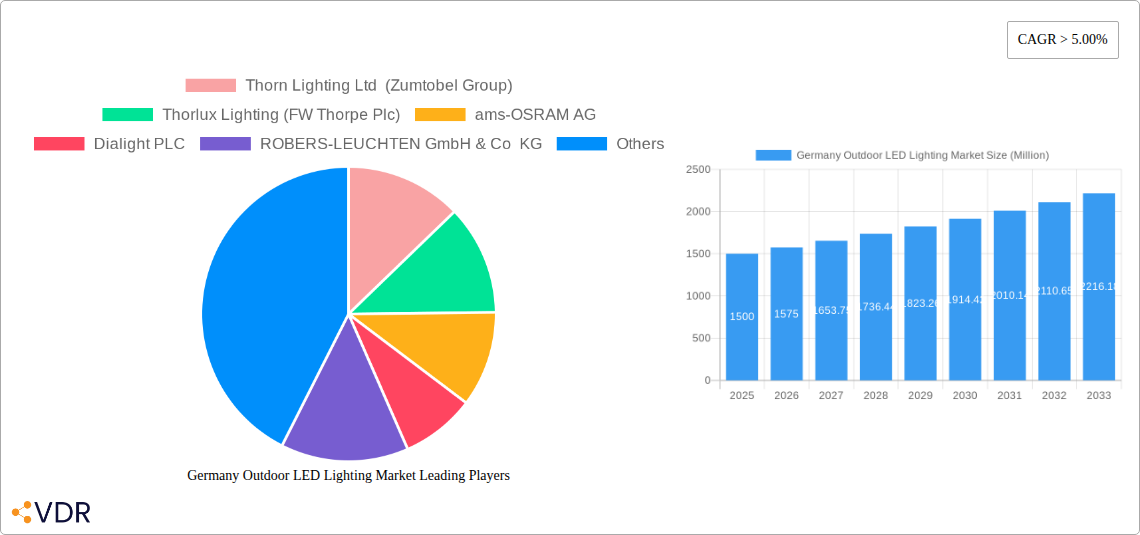

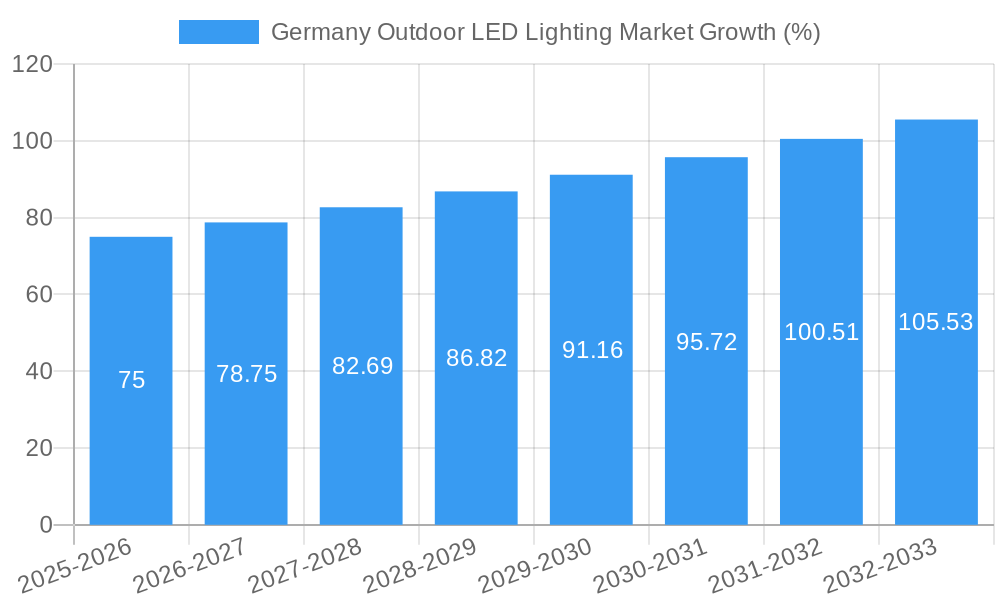

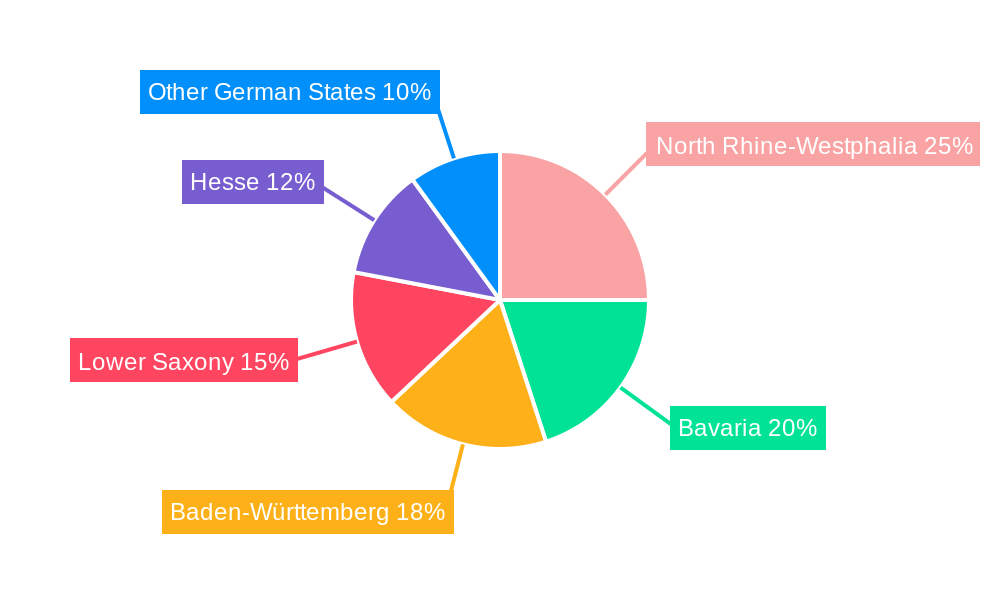

The German outdoor LED lighting market, currently experiencing robust growth, presents significant opportunities for industry players. Driven by increasing government initiatives promoting energy efficiency, a growing focus on smart city infrastructure, and the rising adoption of sustainable lighting solutions, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. Key market segments include public place lighting (streets, roadways), and other outdoor applications such as parks, pedestrian areas, and building exteriors. The strong presence of established lighting manufacturers like Signify (Philips), Osram, and TRILUX, alongside a number of specialized regional players, contributes to a competitive yet dynamic market landscape. Germany's robust economy and commitment to technological advancement further fuel market expansion. The concentration of market activity in regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse reflects the higher population density and infrastructure development in these areas. However, potential restraints include initial high investment costs for LED installations and the need for ongoing maintenance. Despite these challenges, the long-term cost savings associated with LED lighting, coupled with growing environmental awareness, are expected to drive sustained market growth throughout the forecast period.

The regional distribution of the market within Germany highlights the importance of targeting specific areas for optimal market penetration. While precise market segmentation data for each German state is not readily available, analyzing population density, existing infrastructure, and regional government environmental policies allows for a reasoned assessment of market potential within each region. Further growth is likely to be influenced by technological advancements, including the integration of smart sensors and IoT capabilities within outdoor LED lighting systems, enabling remote monitoring, energy optimization, and improved safety features. This ongoing innovation is crucial for attracting investment and maintaining the market's competitive edge. This innovative approach towards smart cities and improved energy solutions promises continued growth of the German outdoor LED lighting sector.

Germany Outdoor LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany outdoor LED lighting market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of LED lighting and the child market of outdoor LED lighting, specifically focusing on public places, streets and roadways, and other applications. The study period spans 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. Market values are presented in million units.

Germany Outdoor LED Lighting Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the German outdoor LED lighting market. The market exhibits a moderately concentrated structure, with several major players and a number of smaller, specialized firms. Technological innovation, driven by energy efficiency improvements and smart lighting solutions, is a key driver. Stringent German environmental regulations and EU energy efficiency directives significantly impact market dynamics, fostering adoption of advanced LED technologies. The market also witnesses increasing competition from alternative lighting solutions, primarily traditional lighting systems. However, the long-term cost advantages and environmental benefits of LED are expected to maintain its dominance. Mergers and acquisitions (M&A) activity is moderate, reflecting consolidation efforts within the industry.

- Market Concentration: Moderately concentrated, with xx% market share held by the top 5 players.

- Technological Innovation: Strong focus on energy efficiency, smart lighting, and IoT integration.

- Regulatory Framework: Stringent environmental regulations and EU directives promoting energy efficiency.

- Competitive Substitutes: Traditional lighting systems pose some competition.

- M&A Activity: Moderate level, reflecting industry consolidation. Recent examples include the acquisition of xx% of SchahlLED Lighting by FW Thorpe in September 2022.

- End-User Demographics: Primarily municipalities, private businesses, and infrastructure developers.

Germany Outdoor LED Lighting Market Growth Trends & Insights

The German outdoor LED lighting market has experienced robust growth during the historical period (2019-2024), driven by increasing government initiatives focused on energy efficiency and smart city development. This growth is expected to continue throughout the forecast period (2025-2033), with a CAGR of xx%. Market penetration of LED lighting in outdoor applications is currently at xx%, and is projected to reach xx% by 2033. Technological disruptions, particularly the emergence of smart lighting systems with integrated sensors and remote management capabilities, are accelerating market expansion. Shifting consumer preferences towards energy-efficient and sustainable solutions are also contributing to growth.

- Market Size (2024): xx Million Units

- Market Size (2033): xx Million Units

- CAGR (2025-2033): xx%

- Market Penetration (2024): xx%

- Market Penetration (2033): xx%

Dominant Regions, Countries, or Segments in Germany Outdoor LED Lighting Market

Within Germany, the "Streets and Roadways" segment dominates the outdoor LED lighting market, driven by significant government investments in infrastructure upgrades and smart city initiatives. Urban areas show higher adoption rates due to denser populations and greater visibility of lighting projects. Public Places (parks, squares, etc.) and "Others" (industrial, commercial etc.) segments are also demonstrating healthy growth.

- Key Drivers for Streets and Roadways Segment:

- Government investments in infrastructure development and smart city projects.

- Stringent regulations promoting energy-efficient lighting in public spaces.

- Increased focus on improving road safety and visibility.

- Market Share (2024): Streets and Roadways: xx%; Public Places: xx%; Others: xx%

- Growth Potential: High growth potential for all segments, with particular focus on smart city applications and sustainable infrastructure.

Germany Outdoor LED Lighting Market Product Landscape

The German outdoor LED lighting market offers a wide range of products, including high-intensity discharge lamps, low-power energy-efficient LEDs, and smart lighting systems with integrated sensors and remote monitoring capabilities. These solutions cater to diverse applications, with a focus on improved energy efficiency, enhanced lighting quality, and reduced maintenance costs. Technological advancements are characterized by the integration of smart technology, enabling remote control, energy optimization, and real-time monitoring of lighting systems. Unique selling propositions include features such as adaptive lighting control, long lifespans, and reduced light pollution.

Key Drivers, Barriers & Challenges in Germany Outdoor LED Lighting Market

Key Drivers:

- Increasing government support for energy efficiency initiatives.

- Growing adoption of smart city technologies.

- Rising demand for sustainable lighting solutions.

- Enhanced safety and security in public spaces.

Key Barriers and Challenges:

- High initial investment costs for advanced LED lighting systems.

- Potential for supply chain disruptions impacting component availability.

- Complexity of integrating smart lighting systems into existing infrastructure.

- Competition from traditional lighting technologies and other lighting technologies.

Emerging Opportunities in Germany Outdoor LED Lighting Market

Emerging opportunities lie in the adoption of smart lighting systems with IoT integration, the expansion into untapped markets such as rural areas and private estates, and the development of sustainable and eco-friendly lighting solutions. Consumer preferences are shifting towards solutions that offer both energy efficiency and enhanced aesthetics.

Growth Accelerators in the Germany Outdoor LED Lighting Market Industry

Long-term growth will be fueled by technological innovation, strategic partnerships between lighting manufacturers and smart city developers, and the expansion of the market into new applications and regions. Government incentives and supportive policies will further accelerate growth.

Key Players Shaping the Germany Outdoor LED Lighting Market Market

- Thorn Lighting Ltd (Zumtobel Group)

- Thorlux Lighting (FW Thorpe Plc)

- ams-OSRAM AG

- Dialight PLC

- ROBERS-LEUCHTEN GmbH & Co KG

- Liper Elektro GmbH

- TRILUX GmbH & Co K

- LEDVANCE GmbH (MLS Co Ltd)

- ALS Architektonische Lichtsysteme GmbH

- Signify Holding (Philips)

Notable Milestones in Germany Outdoor LED Lighting Market Sector

- September 2022: FW Thorpe Plc acquires 80% of SchahlLED Lighting, expanding its presence in intelligent LED services for industrial and logistics sectors.

- September 2022: Signify launches new app features and products for its WiZ smart lighting system, enhancing user convenience with SpaceSense motion detection technology.

- August 2022: Signify introduces an A-class LED tube, offering 60% energy savings compared to standard Philips LEDs, aligning with the new EU energy labeling framework.

In-Depth Germany Outdoor LED Lighting Market Market Outlook

The German outdoor LED lighting market is poised for significant growth in the coming years, driven by technological advancements, increased government support for energy efficiency, and growing adoption of smart city technologies. Strategic partnerships and market expansion will play a crucial role in shaping the future landscape, creating opportunities for innovative players and established companies alike. The focus on sustainability, smart features, and energy savings will continue to drive market demand.

Germany Outdoor LED Lighting Market Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

Germany Outdoor LED Lighting Market Segmentation By Geography

- 1. Germany

Germany Outdoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Industrialization in Various Countries; Growing Demand for ProcessSafety

- 3.3. Market Restrains

- 3.3.1. Trade-offs between privacy/security and regulatory constraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. North Rhine-Westphalia Germany Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thorn Lighting Ltd (Zumtobel Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thorlux Lighting (FW Thorpe Plc)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ams-OSRAM AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dialight PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ROBERS-LEUCHTEN GmbH & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Liper Elektro GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TRILUX GmbH & Co K

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ALS Architektonische Lichtsysteme GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Signify Holding (Philips)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Thorn Lighting Ltd (Zumtobel Group)

List of Figures

- Figure 1: Germany Outdoor LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Outdoor LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Outdoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Outdoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Germany Outdoor LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: Germany Outdoor LED Lighting Market Volume K Unit Forecast, by Outdoor Lighting 2019 & 2032

- Table 5: Germany Outdoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Outdoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Germany Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North Rhine-Westphalia Germany Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North Rhine-Westphalia Germany Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Bavaria Germany Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Bavaria Germany Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Baden-Württemberg Germany Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Baden-Württemberg Germany Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Lower Saxony Germany Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Lower Saxony Germany Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Hesse Germany Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Hesse Germany Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Germany Outdoor LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 20: Germany Outdoor LED Lighting Market Volume K Unit Forecast, by Outdoor Lighting 2019 & 2032

- Table 21: Germany Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Germany Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Outdoor LED Lighting Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Germany Outdoor LED Lighting Market?

Key companies in the market include Thorn Lighting Ltd (Zumtobel Group), Thorlux Lighting (FW Thorpe Plc), ams-OSRAM AG, Dialight PLC, ROBERS-LEUCHTEN GmbH & Co KG, Liper Elektro GmbH, TRILUX GmbH & Co K, LEDVANCE GmbH (MLS Co Ltd), ALS Architektonische Lichtsysteme GmbH, Signify Holding (Philips).

3. What are the main segments of the Germany Outdoor LED Lighting Market?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Industrialization in Various Countries; Growing Demand for ProcessSafety.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trade-offs between privacy/security and regulatory constraints.

8. Can you provide examples of recent developments in the market?

September 2022: FW Thorpe buys 80% shares of SchahlLED Lighting in Germany, an intelligent LED services for the industrial and logistics sectors company. FW Thorpe has purchased 80% of the share capital in the business, with the initial £12.8m consideration funded from its existing cash reserves.September 2022: Signify introduced a new app, features, and products for its WiZ smart lighting system to enhance users’ daily convenience. The new offerings include SpaceSense, a motion detection technology for lighting systems that don’t require any sensor to be installed.August 2022: Signify introduced an A-class LED tube, which consumes 60% less energy than a standard Philips LED. The MASTER LEDtube UE expands the energy-efficient products that meet the A-grade criteria of the new EU energy labeling and eco-design framework through technological innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Outdoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Outdoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Outdoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the Germany Outdoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence