Key Insights

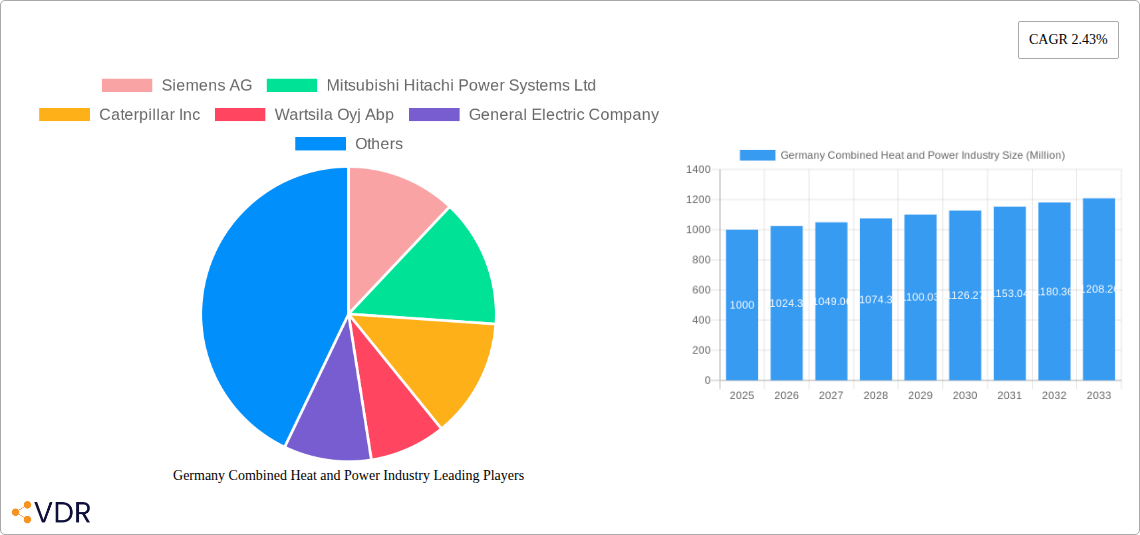

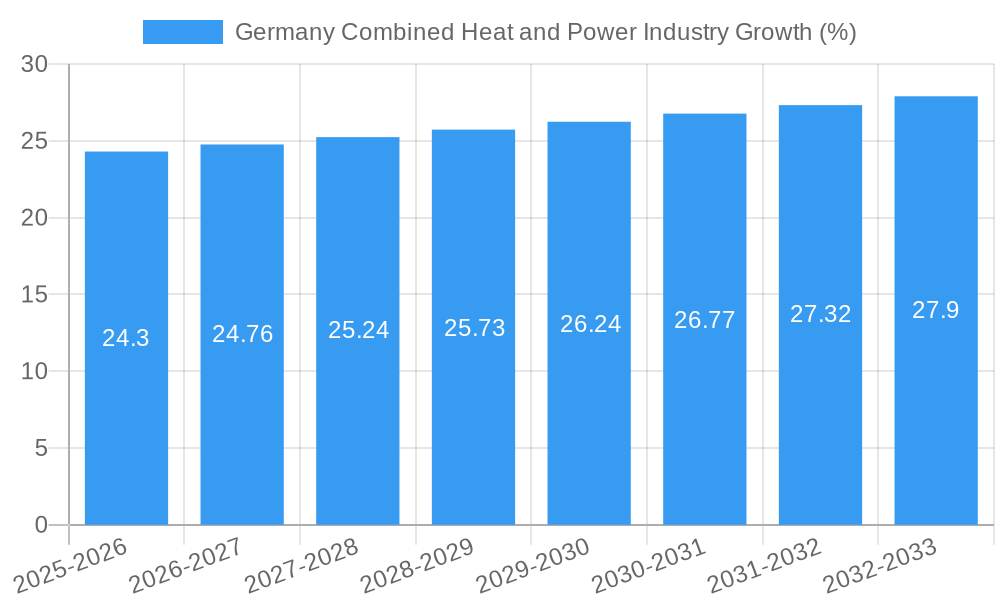

The German combined heat and power (CHP) market, valued at approximately €[Estimate based on market size XX and value unit million. Let's assume XX = 1000 for example purposes, resulting in €1000 million in 2025] million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 2.43% from 2025 to 2033. This growth is fueled by increasing energy efficiency regulations, the rising demand for reliable energy sources in residential, commercial, and industrial sectors, and Germany's commitment to decarbonizing its energy mix. The residential segment is expected to remain a significant contributor to market growth, driven by increasing awareness of CHP's economic and environmental benefits. Natural gas continues to be the dominant fuel type, though a gradual shift towards more sustainable options, such as biomass and biogas, is anticipated, aligning with Germany's renewable energy targets. Key players like Siemens AG, Mitsubishi Hitachi Power Systems, and others are driving innovation through technological advancements in CHP systems, focusing on higher efficiency and reduced emissions.

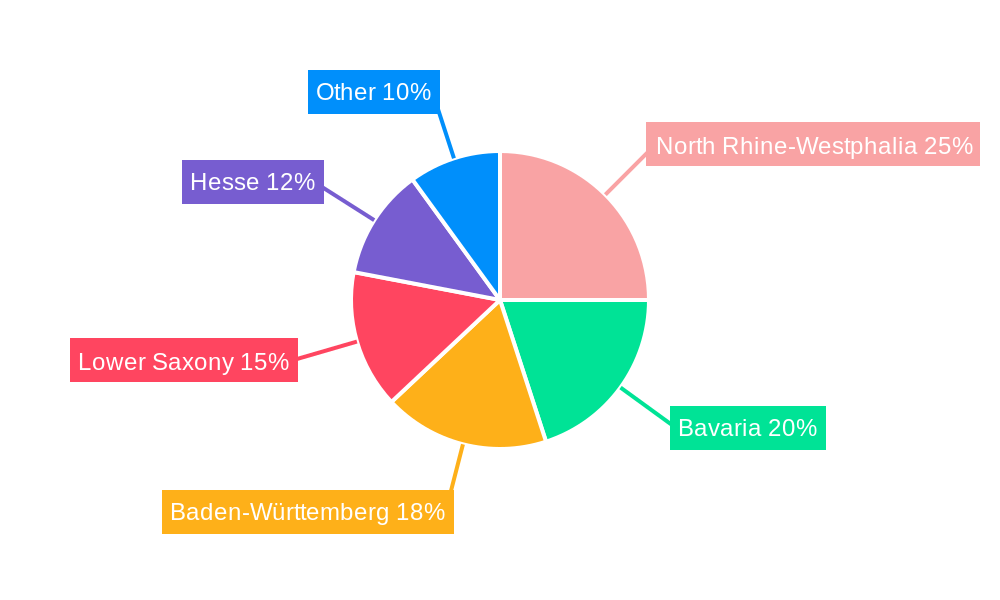

However, market growth faces certain restraints. Fluctuations in fuel prices, particularly natural gas, can impact the economic viability of CHP systems. Furthermore, the high initial investment cost associated with installing CHP units can pose a barrier to entry for smaller businesses and residential consumers. The regulatory landscape and grid infrastructure also play a crucial role, with supportive policies being essential for fostering sustained market expansion. Strong regional variations exist, with states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, exhibiting higher CHP adoption rates due to their industrial concentration and favorable policy environments. The market’s future hinges on successfully addressing these challenges through a combination of technological advancements, supportive government policies, and public awareness campaigns highlighting the long-term benefits of CHP technology. The forecast period suggests a continued, albeit moderate, expansion of the market, influenced by evolving energy policies and consumer preferences.

Germany Combined Heat and Power (CHP) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the German Combined Heat and Power (CHP) industry, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. It segments the market by application (residential, commercial, industrial, utility), fuel type (natural gas, coal, oil, other fuel types), and key players, offering a granular understanding of this vital energy sector.

Germany Combined Heat and Power Industry Market Dynamics & Structure

The German CHP market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape with key players like Siemens AG, Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, Caterpillar Inc, Wärtsilä Oyj Abp, Wärtsilä Oyj Abp, and General Electric Company holding significant market share. Technological innovation, driven by increasing efficiency demands and renewable energy integration, is a major driver. Stringent environmental regulations, including emissions standards, heavily influence market dynamics, pushing adoption of cleaner fuel sources and technologies. Competition from alternative energy solutions and decentralized power generation poses a significant challenge.

Market Structure Highlights:

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on high-efficiency CHP systems, cogeneration with renewables, and digitalization.

- Regulatory Framework: Stringent emission norms and renewable energy targets shape market development.

- Competitive Substitutes: Solar PV, wind power, and grid electricity.

- M&A Activity: xx major M&A deals in the historical period (2019-2024), indicating consolidation trends, with a total deal value of approximately xx Million. The recent acquisition of Quadra Energy by TotalEnergies exemplifies this trend.

- End-User Demographics: Industrial sector dominates, followed by commercial and utility sectors. Residential sector showing steady growth.

Germany Combined Heat and Power Industry Growth Trends & Insights

The German CHP market has witnessed consistent growth during the historical period (2019-2024), driven by industrial sector expansion and government policies promoting energy efficiency. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This growth is expected to continue, albeit at a moderated pace, during the forecast period (2025-2033), reaching an estimated xx Million by 2033, with a projected CAGR of xx%. Technological advancements, particularly in fuel cell technology and the integration of renewable energy sources, are major growth catalysts. The increasing adoption of smart grids and digitalization in CHP systems is further enhancing efficiency and operational optimization. Consumer behavior is shifting towards environmentally friendly solutions, increasing demand for CHP systems with reduced carbon footprint.

Dominant Regions, Countries, or Segments in Germany Combined Heat and Power Industry

The industrial sector is the dominant segment in the German CHP market, accounting for approximately xx% of the total market value in 2024. This is driven by high energy demands in manufacturing, particularly in chemical and automotive industries. Natural gas remains the dominant fuel type, holding a market share of approximately xx%, fueled by its relatively low cost and availability. However, the “Other Fuel Types” segment, encompassing biomass and renewable biogas, is witnessing the fastest growth rate, driven by stringent environmental regulations and government incentives for renewable energy adoption. Bavaria and North Rhine-Westphalia are leading regions due to concentrated industrial activity and supportive policies.

Key Drivers for Dominant Segments:

- Industrial Sector: High energy demand, cost optimization drives in manufacturing.

- Natural Gas: Abundant supply, relatively low cost compared to other fuels.

- Other Fuel Types (Renewable): Government incentives, environmental regulations, and sustainability concerns.

- Bavaria & North Rhine-Westphalia: High industrial concentration, favorable policy environment.

Germany Combined Heat and Power Industry Product Landscape

The German CHP market offers a diverse range of products, from small-scale residential units to large-scale industrial systems. Recent innovations focus on enhancing energy efficiency, reducing emissions, and improving system control through digitalization. High-efficiency gas turbines, combined cycle systems, and fuel cell technologies are gaining prominence. Manufacturers are increasingly incorporating smart features for remote monitoring, predictive maintenance, and optimized energy management. Unique selling propositions often involve superior efficiency, reduced environmental impact, and streamlined operations.

Key Drivers, Barriers & Challenges in Germany Combined Heat and Power Industry

Key Drivers:

- Government policies promoting energy efficiency and renewable energy integration.

- Rising energy prices and the need for cost-effective energy solutions.

- Technological advancements leading to increased efficiency and reduced emissions.

Key Barriers and Challenges:

- High upfront investment costs for CHP systems can be a barrier to entry for small businesses.

- Competition from alternative energy solutions.

- Regulatory hurdles and complex permitting processes can delay project implementation.

- Supply chain disruptions impacting the availability of certain components.

Emerging Opportunities in Germany Combined Heat and Power Industry

Emerging opportunities lie in the integration of renewable energy sources (solar, wind) with CHP systems, creating hybrid solutions that reduce reliance on fossil fuels. The growing demand for district heating networks presents a significant opportunity for large-scale CHP installations. The development and adoption of fuel cell technologies with improved efficiency and lower emissions offer substantial growth potential. Furthermore, the digitalization of CHP systems, enabling optimized operations and remote monitoring, is driving innovation and expansion in the market.

Growth Accelerators in the Germany Combined Heat and Power Industry Industry

Technological breakthroughs, especially in fuel cell technology and renewable energy integration, are crucial growth accelerators. Strategic partnerships between CHP manufacturers and energy providers are facilitating market expansion. Government support through incentives and supportive policies continues to drive investment in CHP projects. Market expansion strategies focusing on niche segments, such as district heating and decentralized energy generation, will further fuel market growth.

Key Players Shaping the Germany Combined Heat and Power Industry Market

- Siemens AG

- Mitsubishi Hitachi Power Systems Ltd

- Caterpillar Inc

- Wärtsilä Oyj Abp

- General Electric Company

- MAN Energy Solutions

- 2G Energy AG

- Viessmann Group

- BHKW-Infozentrum

- Bosch Thermotechnology

Notable Milestones in Germany Combined Heat and Power Industry Sector

- [Date]: TotalEnergies acquires Quadra Energy, expanding its presence in the German renewable energy market and integrating a 9 GW virtual power plant into its portfolio. This significantly boosts the company's capacity in the German CHP market.

In-Depth Germany Combined Heat and Power Industry Market Outlook

The German CHP market is poised for continued growth, fueled by ongoing technological advancements, supportive government policies, and increasing demand for efficient and sustainable energy solutions. Strategic partnerships, expansion into new segments (e.g., district heating), and the integration of renewable energy sources will shape the future market landscape. The focus on digitalization and smart grid integration will further enhance the efficiency and sustainability of CHP systems, creating lucrative opportunities for market players.

Germany Combined Heat and Power Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Coal

- 2.3. Oil

- 2.4. Other Fuel Types

Germany Combined Heat and Power Industry Segmentation By Geography

- 1. Germany

Germany Combined Heat and Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as sugar

- 3.2.2 chemicals

- 3.2.3 and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat

- 3.2.4 enhancing operational efficiency and reducing energy costs.

- 3.3. Market Restrains

- 3.3.1 The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems

- 3.3.2 potentially deterring investment and adoption.

- 3.4. Market Trends

- 3.4.1 There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready

- 3.4.2 aligning with its broader energy transition goals.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Coal

- 5.2.3. Oil

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North Rhine-Westphalia Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Siemens AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Hitachi Power Systems Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Caterpillar Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wartsila Oyj Abp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MAN Energy Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 2G Energy AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Viessmann Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BHKW-Infozentrum

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bosch Thermotechnology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Siemens AG

List of Figures

- Figure 1: Germany Combined Heat and Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Combined Heat and Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Combined Heat and Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Combined Heat and Power Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Germany Combined Heat and Power Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Germany Combined Heat and Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Combined Heat and Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Rhine-Westphalia Germany Combined Heat and Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Bavaria Germany Combined Heat and Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Baden-Württemberg Germany Combined Heat and Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Lower Saxony Germany Combined Heat and Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Hesse Germany Combined Heat and Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Combined Heat and Power Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Germany Combined Heat and Power Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: Germany Combined Heat and Power Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Combined Heat and Power Industry?

The projected CAGR is approximately 2.43%.

2. Which companies are prominent players in the Germany Combined Heat and Power Industry?

Key companies in the market include Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, Wartsila Oyj Abp, General Electric Company, MAN Energy Solutions, 2G Energy AG, Viessmann Group, BHKW-Infozentrum, Bosch Thermotechnology.

3. What are the main segments of the Germany Combined Heat and Power Industry?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Industries such as sugar. chemicals. and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat. enhancing operational efficiency and reducing energy costs..

6. What are the notable trends driving market growth?

There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready. aligning with its broader energy transition goals..

7. Are there any restraints impacting market growth?

The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems. potentially deterring investment and adoption..

8. Can you provide examples of recent developments in the market?

TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This move aligns with TotalEnergies' strategy to expand its footprint in Germany's renewable energy market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Combined Heat and Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Combined Heat and Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Combined Heat and Power Industry?

To stay informed about further developments, trends, and reports in the Germany Combined Heat and Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence