Key Insights

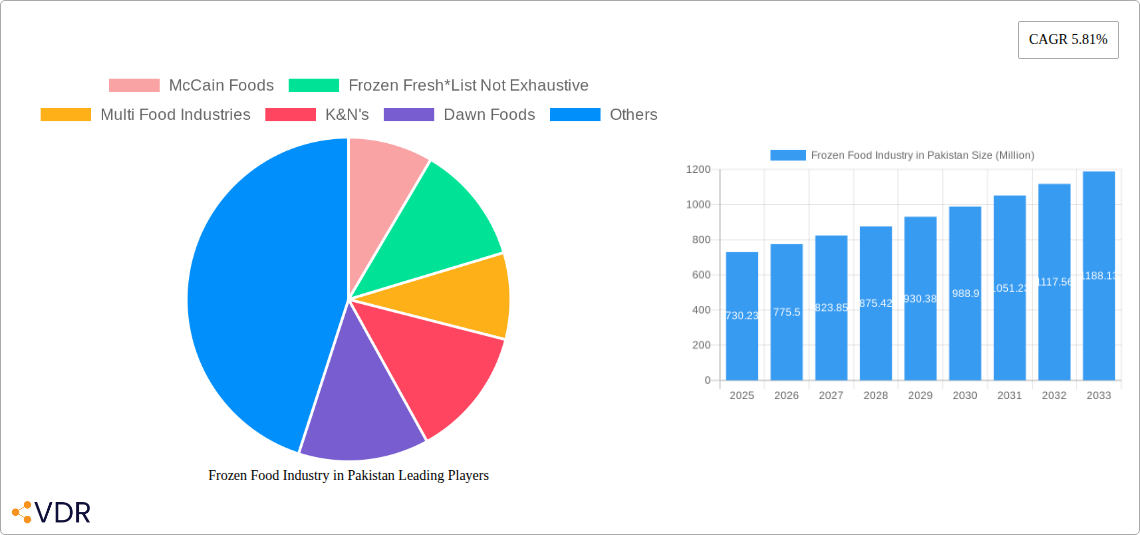

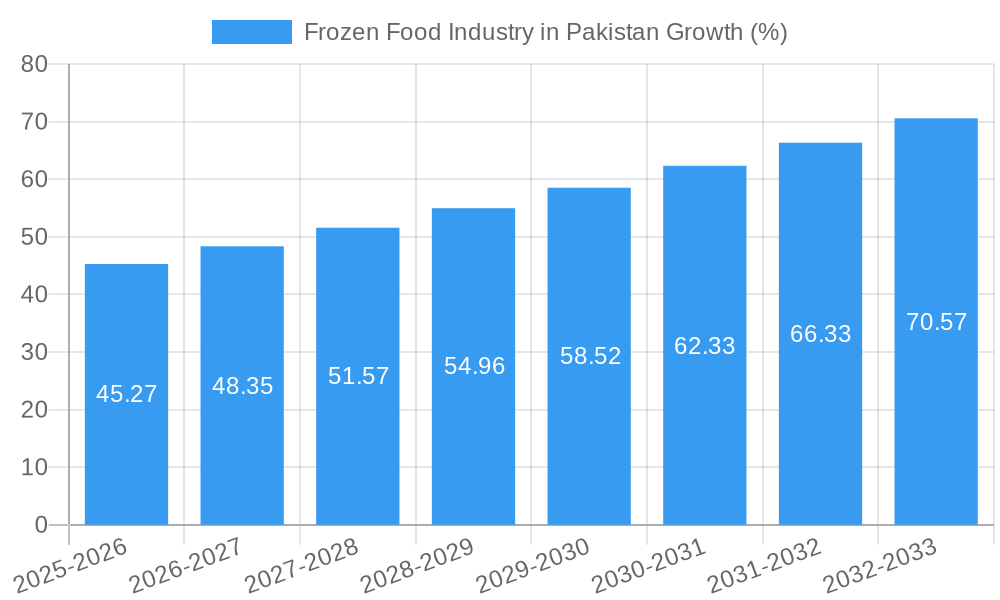

The Pakistani frozen food market, valued at $730.23 million in 2025, is projected to experience robust growth, driven by increasing urbanization, changing lifestyles, and a rising demand for convenience foods. The market's Compound Annual Growth Rate (CAGR) of 5.81% from 2019 to 2024 indicates a steady upward trajectory, expected to continue through 2033. Key growth drivers include the expanding middle class with greater disposable income, increased awareness of food safety and preservation, and the rising popularity of ready-to-eat and ready-to-cook meals, particularly among younger demographics. The diverse product segments, encompassing frozen fruits and vegetables, meat and fish, ready meals, desserts, and snacks, contribute to market diversification and cater to a wide range of consumer preferences. While specific market restraints are not explicitly detailed, potential challenges could include maintaining cold chain integrity across the supply chain, especially in a developing economy like Pakistan’s, and ensuring affordability for a significant portion of the population. The dominance of supermarkets/hypermarkets as a distribution channel highlights opportunities for strategic partnerships and expansion in this area. Leading players like McCain Foods and local brands like Al-Shaheer are well-positioned to capitalize on this growing market, although competition is likely to intensify as more players enter the sector. The continuous innovation in freezing techniques, like Individual Quick Freezing (IQF), further enhances the quality and shelf life of frozen products, bolstering consumer confidence and market growth.

The sustained growth of the Pakistani frozen food industry is fueled by several interconnected factors. The rising disposable income among the expanding middle class allows for greater spending on convenience foods, thus bolstering demand. Simultaneously, the increased adoption of western lifestyles and busy schedules accelerates the preference for quick and easy meal options, further driving the sector's expansion. Government initiatives promoting food safety and infrastructure development for cold chain logistics are crucial for long-term industry sustainability. However, consistent improvements in cold chain infrastructure are vital to mitigate spoilage and maintain product quality. Moreover, addressing pricing concerns to ensure accessibility to a broader consumer base will be crucial for realizing the full market potential and fostering inclusive growth. The market's segmentation offers opportunities for targeted marketing and product development, allowing companies to tailor their offerings to specific consumer needs and preferences.

Frozen Food Industry in Pakistan: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Frozen Food Industry in Pakistan, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this burgeoning market.

Frozen Food Industry in Pakistan Market Dynamics & Structure

The Pakistani frozen food market is characterized by a moderately fragmented structure, with key players like McCain Foods, Multi Food Industries, K&N's, Dawn Foods, Icepac Limited, Big Bird, PK Meat & Food Company, Al-Shaheer, and Seasons Foods competing alongside numerous smaller regional brands. Market concentration is moderate, with the top 5 players holding an estimated xx% market share in 2025. Technological innovation, primarily in freezing techniques (IQF, blast freezing) and packaging, plays a significant role. Regulatory frameworks concerning food safety and hygiene are evolving, impacting production standards. Competitive substitutes include fresh and processed foods, influencing consumer choices. The end-user demographic is diverse, encompassing all socioeconomic strata, with increasing demand from urban, middle-class households. M&A activity has been relatively low in recent years, with only xx deals recorded between 2019 and 2024, largely driven by expansion into new product categories or geographical areas.

- Market Concentration: Moderate (Top 5 players holding approximately xx% market share in 2025)

- Technological Drivers: IQF, blast freezing, innovative packaging solutions

- Regulatory Framework: Evolving food safety and hygiene standards

- Competitive Substitutes: Fresh produce, processed foods

- End-User Demographics: Diverse, increasing demand from urban middle class

- M&A Activity: Low (xx deals between 2019-2024), focused on expansion

Frozen Food Industry in Pakistan Growth Trends & Insights

The Pakistani frozen food market exhibited a CAGR of xx% during the historical period (2019-2024), driven by factors including rising disposable incomes, urbanization, changing lifestyles, and increasing demand for convenience foods. Market size reached approximately xx Million units in 2024. The adoption rate of frozen foods is accelerating, particularly in urban centers, as consumers become more aware of the benefits of convenience and preservation. Technological disruptions in freezing technology and cold chain logistics have enhanced product quality and shelf life. Consumer behavior is shifting towards healthier options and a wider variety of ready-to-eat and ready-to-cook meals. We project a CAGR of xx% from 2025 to 2033, reaching an estimated market size of xx Million units by 2033. This growth will be fueled by continued urbanization, increased consumer spending, and the expansion of retail channels.

Dominant Regions, Countries, or Segments in Frozen Food Industry in Pakistan

The dominant segments in the Pakistani frozen food market are diverse, reflecting both consumption preferences and market penetration:

By Product Category: Ready-to-eat meals lead, followed by ready-to-cook products. The ready-to-eat segment demonstrates substantial growth potential due to evolving lifestyles and increased female participation in the workforce.

By Product Type: Frozen meat and fish, and frozen vegetables and fruits dominate, followed by frozen ready meals. The growth of frozen ready meals is driven by the convenience factor.

By Freezing Technique: Individual Quick Freezing (IQF) is the most prevalent technique owing to superior product quality and shelf life.

By Distribution Channel: Supermarkets/hypermarkets dominate distribution, with convenience stores and online channels exhibiting high growth potential. The expansion of organized retail is crucial for market growth.

- Key Drivers: Rising disposable income, increased urbanization, expanding retail infrastructure, evolving lifestyles.

- Dominant Segments: Ready-to-eat meals, frozen meat and fish, frozen vegetables and fruits, IQF freezing, supermarkets/hypermarkets.

Frozen Food Industry in Pakistan Product Landscape

Product innovation centers around convenience, health, and variety. Ready-to-eat meals are incorporating more diverse flavors and cuisines. Manufacturers are focusing on natural and minimally processed ingredients to cater to health-conscious consumers. Advances in freezing technology are improving product quality and shelf life, minimizing nutrient loss. Unique selling propositions include convenient packaging, ethnic flavors, and health benefits. Technological advancements in packaging, such as retort pouches, are improving product shelf-life and appeal.

Key Drivers, Barriers & Challenges in Frozen Food Industry in Pakistan

Key Drivers: Rising disposable incomes, increased urbanization, changing lifestyles, the growth of organized retail, and government initiatives supporting the food processing industry.

Challenges & Restraints: Inadequate cold chain infrastructure leading to losses in the supply chain (estimated xx% loss in 2024), limited awareness of frozen food benefits in some regions, high energy costs impacting production, and intense competition within the market.

Emerging Opportunities in Frozen Food Industry in Pakistan

Significant opportunities exist in expanding into less-penetrated regions, introducing innovative products catering to specific dietary needs (vegetarian, halal), focusing on value-added products with higher margins, strengthening the cold chain infrastructure, and leveraging digital marketing to increase brand awareness. Growing popularity of online grocery shopping presents another substantial opportunity for market expansion.

Growth Accelerators in the Frozen Food Industry in Pakistan Industry

Continued investments in cold chain logistics are pivotal. Strategic partnerships between producers and retailers to improve distribution efficiency can drive growth. The expansion of organized retail networks will broaden market access. Technological advancements in packaging and freezing techniques will enhance product quality and appeal. Government support in developing cold storage facilities and promoting food safety standards is crucial.

Key Players Shaping the Frozen Food Industry in Pakistan Market

- McCain Foods

- Frozen Fresh

- Multi Food Industries

- K&N's

- Dawn Foods

- Icepac Limited

- Big Bird

- PK Meat & Food Company

- Al-Shaheer

- Seasons Foods

Notable Milestones in Frozen Food Industry in Pakistan Sector

- December 2021: PK Meat launched 'The PK Meat Shop,' expanding its delivery service and offering a diverse range of products online and in retail outlets.

- July 2021: Al-Shaheer Corporation (ASC) entered the frozen meat segment with its 'Chef One' brand, launching ready-to-cook and ready-to-eat options.

- February 2020: Dawn Foods launched Doughstory, introducing frozen parathas, naans, and samosas, targeting both domestic and international markets.

In-Depth Frozen Food Industry in Pakistan Market Outlook

The Pakistani frozen food market is poised for significant growth over the forecast period (2025-2033). Continued urbanization, rising disposable incomes, and the expansion of modern retail will fuel market expansion. Strategic investments in cold chain infrastructure, product innovation, and effective marketing will be key to capturing this growth potential. Opportunities exist in developing value-added, healthier products, and expanding e-commerce channels. The market is expected to reach xx Million units by 2033, representing a robust growth trajectory.

Frozen Food Industry in Pakistan Segmentation

-

1. Product Category

- 1.1. Ready-to-Eat

- 1.2. Ready-to-Cook

- 1.3. Ready-to-Drink

- 1.4. Other Product Categories

-

2. Product Type

- 2.1. Frozen Fruits and Vegetables

- 2.2. Frozen Meat and Fish

- 2.3. Frozen-cooked Ready Meals

- 2.4. Frozen Desserts

- 2.5. Frozen Snacks

- 2.6. Other Product Types

-

3. Freezing Technique

- 3.1. Individual Quick Freezing (IQF)

- 3.2. Blast freezing

- 3.3. Belt freezing

- 3.4. Other Freezing Techniques

-

4. Distribution Channel

- 4.1. Supermarkets/Hypermarkets

- 4.2. Convenience Stores

- 4.3. Specialty Stores

- 4.4. Online Stores

- 4.5. Other Distribution Channels

Frozen Food Industry in Pakistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Frozen Food Industry in Pakistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Rising Demand for Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 5.1.1. Ready-to-Eat

- 5.1.2. Ready-to-Cook

- 5.1.3. Ready-to-Drink

- 5.1.4. Other Product Categories

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Frozen Fruits and Vegetables

- 5.2.2. Frozen Meat and Fish

- 5.2.3. Frozen-cooked Ready Meals

- 5.2.4. Frozen Desserts

- 5.2.5. Frozen Snacks

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 5.3.1. Individual Quick Freezing (IQF)

- 5.3.2. Blast freezing

- 5.3.3. Belt freezing

- 5.3.4. Other Freezing Techniques

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Supermarkets/Hypermarkets

- 5.4.2. Convenience Stores

- 5.4.3. Specialty Stores

- 5.4.4. Online Stores

- 5.4.5. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 6. North America Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Category

- 6.1.1. Ready-to-Eat

- 6.1.2. Ready-to-Cook

- 6.1.3. Ready-to-Drink

- 6.1.4. Other Product Categories

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Frozen Fruits and Vegetables

- 6.2.2. Frozen Meat and Fish

- 6.2.3. Frozen-cooked Ready Meals

- 6.2.4. Frozen Desserts

- 6.2.5. Frozen Snacks

- 6.2.6. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 6.3.1. Individual Quick Freezing (IQF)

- 6.3.2. Blast freezing

- 6.3.3. Belt freezing

- 6.3.4. Other Freezing Techniques

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Supermarkets/Hypermarkets

- 6.4.2. Convenience Stores

- 6.4.3. Specialty Stores

- 6.4.4. Online Stores

- 6.4.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Category

- 7. South America Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Category

- 7.1.1. Ready-to-Eat

- 7.1.2. Ready-to-Cook

- 7.1.3. Ready-to-Drink

- 7.1.4. Other Product Categories

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Frozen Fruits and Vegetables

- 7.2.2. Frozen Meat and Fish

- 7.2.3. Frozen-cooked Ready Meals

- 7.2.4. Frozen Desserts

- 7.2.5. Frozen Snacks

- 7.2.6. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 7.3.1. Individual Quick Freezing (IQF)

- 7.3.2. Blast freezing

- 7.3.3. Belt freezing

- 7.3.4. Other Freezing Techniques

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Supermarkets/Hypermarkets

- 7.4.2. Convenience Stores

- 7.4.3. Specialty Stores

- 7.4.4. Online Stores

- 7.4.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Category

- 8. Europe Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Category

- 8.1.1. Ready-to-Eat

- 8.1.2. Ready-to-Cook

- 8.1.3. Ready-to-Drink

- 8.1.4. Other Product Categories

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Frozen Fruits and Vegetables

- 8.2.2. Frozen Meat and Fish

- 8.2.3. Frozen-cooked Ready Meals

- 8.2.4. Frozen Desserts

- 8.2.5. Frozen Snacks

- 8.2.6. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 8.3.1. Individual Quick Freezing (IQF)

- 8.3.2. Blast freezing

- 8.3.3. Belt freezing

- 8.3.4. Other Freezing Techniques

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Supermarkets/Hypermarkets

- 8.4.2. Convenience Stores

- 8.4.3. Specialty Stores

- 8.4.4. Online Stores

- 8.4.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Category

- 9. Middle East & Africa Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Category

- 9.1.1. Ready-to-Eat

- 9.1.2. Ready-to-Cook

- 9.1.3. Ready-to-Drink

- 9.1.4. Other Product Categories

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Frozen Fruits and Vegetables

- 9.2.2. Frozen Meat and Fish

- 9.2.3. Frozen-cooked Ready Meals

- 9.2.4. Frozen Desserts

- 9.2.5. Frozen Snacks

- 9.2.6. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 9.3.1. Individual Quick Freezing (IQF)

- 9.3.2. Blast freezing

- 9.3.3. Belt freezing

- 9.3.4. Other Freezing Techniques

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Supermarkets/Hypermarkets

- 9.4.2. Convenience Stores

- 9.4.3. Specialty Stores

- 9.4.4. Online Stores

- 9.4.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Category

- 10. Asia Pacific Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Category

- 10.1.1. Ready-to-Eat

- 10.1.2. Ready-to-Cook

- 10.1.3. Ready-to-Drink

- 10.1.4. Other Product Categories

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Frozen Fruits and Vegetables

- 10.2.2. Frozen Meat and Fish

- 10.2.3. Frozen-cooked Ready Meals

- 10.2.4. Frozen Desserts

- 10.2.5. Frozen Snacks

- 10.2.6. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 10.3.1. Individual Quick Freezing (IQF)

- 10.3.2. Blast freezing

- 10.3.3. Belt freezing

- 10.3.4. Other Freezing Techniques

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Supermarkets/Hypermarkets

- 10.4.2. Convenience Stores

- 10.4.3. Specialty Stores

- 10.4.4. Online Stores

- 10.4.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 McCain Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Frozen Fresh*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Multi Food Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 K&N's

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dawn Foods

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Icepac Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Big Bird

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PK Meat & Food Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al-Shaheer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seasons Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 McCain Foods

List of Figures

- Figure 1: Global Frozen Food Industry in Pakistan Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Pakistan Frozen Food Industry in Pakistan Revenue (Million), by Country 2024 & 2032

- Figure 3: Pakistan Frozen Food Industry in Pakistan Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2024 & 2032

- Figure 5: North America Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2024 & 2032

- Figure 6: North America Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2024 & 2032

- Figure 7: North America Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2024 & 2032

- Figure 8: North America Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2024 & 2032

- Figure 9: North America Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2024 & 2032

- Figure 10: North America Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: North America Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: North America Frozen Food Industry in Pakistan Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Frozen Food Industry in Pakistan Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2024 & 2032

- Figure 15: South America Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2024 & 2032

- Figure 16: South America Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2024 & 2032

- Figure 17: South America Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: South America Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2024 & 2032

- Figure 19: South America Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2024 & 2032

- Figure 20: South America Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: South America Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: South America Frozen Food Industry in Pakistan Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Frozen Food Industry in Pakistan Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2024 & 2032

- Figure 25: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2024 & 2032

- Figure 26: Europe Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Europe Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2024 & 2032

- Figure 29: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2024 & 2032

- Figure 30: Europe Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Europe Frozen Food Industry in Pakistan Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2024 & 2032

- Figure 35: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2024 & 2032

- Figure 36: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2024 & 2032

- Figure 39: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2024 & 2032

- Figure 40: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2024 & 2032

- Figure 45: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2024 & 2032

- Figure 46: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2024 & 2032

- Figure 47: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2024 & 2032

- Figure 48: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2024 & 2032

- Figure 49: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2024 & 2032

- Figure 50: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 51: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 52: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2019 & 2032

- Table 3: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2019 & 2032

- Table 5: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2019 & 2032

- Table 9: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2019 & 2032

- Table 11: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2019 & 2032

- Table 17: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2019 & 2032

- Table 19: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2019 & 2032

- Table 25: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2019 & 2032

- Table 27: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2019 & 2032

- Table 39: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2019 & 2032

- Table 41: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2019 & 2032

- Table 50: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2019 & 2032

- Table 51: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2019 & 2032

- Table 52: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 53: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Food Industry in Pakistan?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the Frozen Food Industry in Pakistan?

Key companies in the market include McCain Foods, Frozen Fresh*List Not Exhaustive, Multi Food Industries, K&N's, Dawn Foods, Icepac Limited, Big Bird, PK Meat & Food Company, Al-Shaheer, Seasons Foods.

3. What are the main segments of the Frozen Food Industry in Pakistan?

The market segments include Product Category, Product Type, Freezing Technique, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 730.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Rising Demand for Convenience Food.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

December 2021: PK Meat launched 'The PK Meat Shop' to extend theirits delivery service to more regions across Pakistan. PK Meat Shop currently offers dissimilar types of meat products to suit the taste of all categories of consumers, with the products available in all major retail outlets. The eCommerce site features ready-to-cook, ready-to-eat, crispy-coated, and vegetarian and flour products, offering an all-inclusive experience to shoppers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frozen Food Industry in Pakistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frozen Food Industry in Pakistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frozen Food Industry in Pakistan?

To stay informed about further developments, trends, and reports in the Frozen Food Industry in Pakistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence