Key Insights

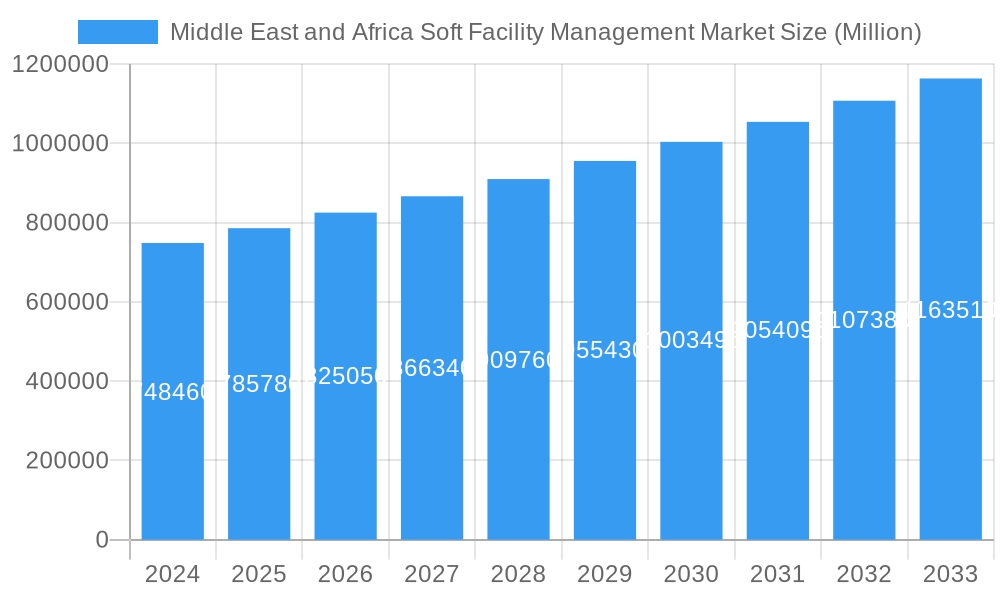

The Middle East and Africa (MEA) Soft Facility Management market is poised for robust growth, projected to reach an estimated $748.46 billion in 2024, expanding at a compound annual growth rate (CAGR) of 5.12% through 2033. This impressive trajectory is fueled by a confluence of factors, including escalating demand for specialized services such as cleaning, catering, and security across burgeoning commercial, institutional, and industrial sectors. The region's rapid urbanization, significant infrastructure development initiatives, and increasing adoption of outsourcing strategies by businesses to focus on core competencies are key drivers. Furthermore, the growing emphasis on maintaining pristine and secure operational environments, particularly in the wake of heightened health and safety awareness, underpins the sustained demand for soft FM solutions.

Middle East and Africa Soft Facility Management Market Market Size (In Billion)

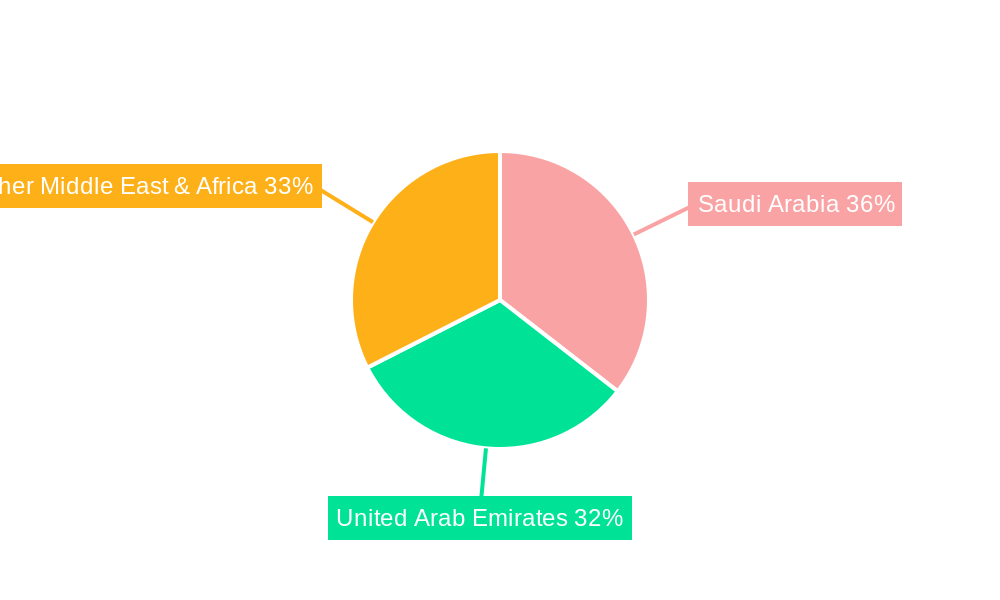

The market's segmentation reveals a dynamic landscape, with office support and landscaping services, alongside cleaning services, representing significant segments. The commercial and industrial end-users are anticipated to contribute substantially to market revenue, driven by the expansion of business parks, retail centers, and manufacturing facilities. Countries like Saudi Arabia and the United Arab Emirates are at the forefront of this expansion, characterized by substantial investments in large-scale projects and a burgeoning expat population demanding high-quality facility management. While opportunities abound, challenges such as the availability of skilled labor and fluctuations in operational costs present areas that market players must strategically address to capitalize on the full potential of this growing market. The integration of technology and sustainable practices will also play a crucial role in shaping the future of soft facility management in the MEA region.

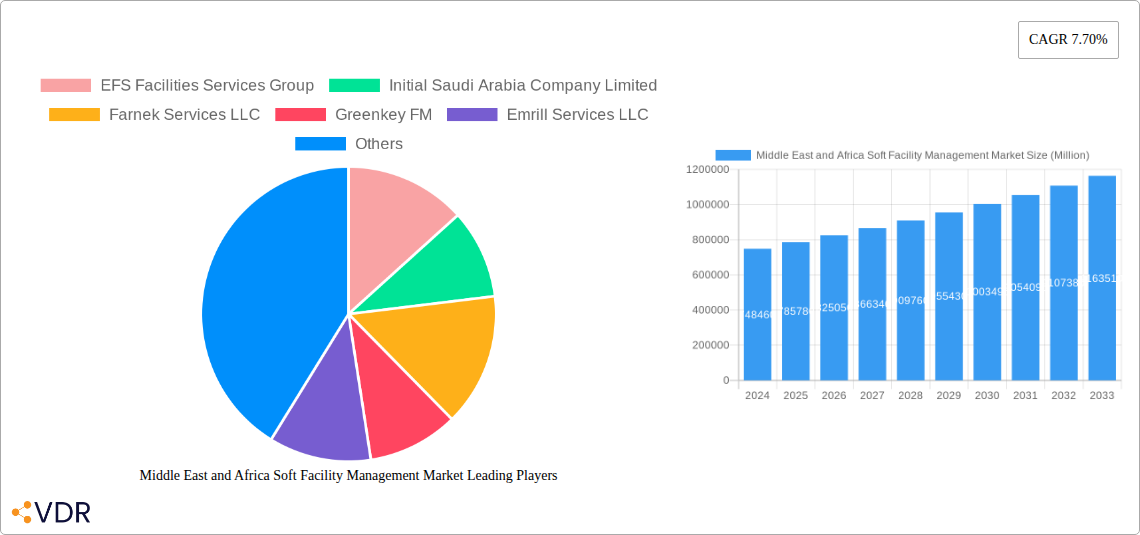

Middle East and Africa Soft Facility Management Market Company Market Share

This report provides an in-depth analysis of the Middle East and Africa (MEA) Soft Facility Management market, offering crucial insights into its dynamics, growth trends, competitive landscape, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this study is essential for stakeholders seeking to understand and capitalize on the evolving demands for outsourced facility services across the region. The MEA soft facility management market is projected to reach $XX billion by 2025 and is expected to grow at a CAGR of XX% during the forecast period (2025-2033), reaching an estimated value of $XX billion by 2033.

Middle East and Africa Soft Facility Management Market Dynamics & Structure

The MEA Soft Facility Management market is characterized by a dynamic interplay of increasing outsourcing trends, rapid urbanization, and a growing focus on operational efficiency by businesses and institutions. Market concentration is moderate, with a mix of established global players and strong regional contenders vying for market share. Technological innovation is a key driver, with advancements in AI-powered cleaning, smart building management systems, and integrated security solutions enhancing service delivery and customer satisfaction. Regulatory frameworks are becoming more robust, particularly concerning labor standards and environmental sustainability, influencing service provider operations. Competitive product substitutes are emerging, such as in-house facility management teams and specialized service providers for niche requirements. End-user demographics are diverse, ranging from large commercial enterprises and governmental institutions to educational bodies and industrial complexes, each with distinct service demands. Mergers and Acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring smaller, specialized firms to expand their service portfolios and geographic reach. For instance, the last two years have seen X significant M&A deals within the MEA soft FM sector, valued at approximately $XX billion. The barriers to innovation include high initial investment costs for advanced technologies and the need for skilled workforce training.

Middle East and Africa Soft Facility Management Market Growth Trends & Insights

The MEA Soft Facility Management market is experiencing robust growth, driven by a confluence of economic development, infrastructure expansion, and a burgeoning demand for specialized outsourced services. The market size has witnessed a steady evolution, projected to reach $XX billion in 2025, reflecting a significant uptick from its $XX billion valuation in 2019. This growth trajectory is underpinned by increasing adoption rates of comprehensive facility management solutions across various sectors, particularly in the commercial and institutional segments. Technological disruptions are actively reshaping the landscape; the integration of IoT devices for building monitoring and maintenance, the deployment of robotic cleaning solutions, and the adoption of digital platforms for service request management are becoming standard practices. These innovations not only enhance operational efficiency but also contribute to cost savings for clients. Consumer behavior shifts are evident, with a growing preference for integrated service providers capable of offering a holistic FM solution, rather than fragmented single-service contracts. This trend is particularly pronounced in burgeoning economies within the MEA region, where businesses are increasingly prioritizing core competencies and outsourcing non-core functions. The market penetration of professional soft facility management services is expanding, currently estimated at XX%, with significant room for growth in emerging markets within the region. The CAGR for the forecast period is projected at XX%, underscoring the sustained upward momentum.

Dominant Regions, Countries, or Segments in Middle East and Africa Soft Facility Management Market

The Commercial end-user segment is currently the dominant force driving growth within the Middle East and Africa Soft Facility Management market. This dominance is fueled by the region's rapidly expanding commercial real estate sector, encompassing office buildings, retail complexes, and hospitality establishments, all of which require extensive and sophisticated facility management services. The increasing influx of foreign investment and the hosting of major international events have spurred the development of world-class commercial infrastructure, creating a sustained demand for professional soft FM. Within this segment, Cleaning Services and Security Services represent the most significant sub-segments, accounting for an estimated XX% and XX% market share respectively. These services are fundamental to maintaining the operational integrity and appeal of commercial properties.

- Key Drivers for Commercial Segment Dominance:

- Economic Policies and Investment: Favorable government policies encouraging foreign direct investment and business establishment directly correlate with the construction and expansion of commercial spaces.

- Infrastructure Development: Major urban centers like Dubai, Riyadh, and Cairo are witnessing unprecedented infrastructure development, including the creation of smart cities and business districts, requiring sophisticated FM solutions.

- Rise of the Gig Economy and Flexible Workspaces: The proliferation of co-working spaces and flexible office arrangements necessitates agile and adaptable FM services.

- Focus on Brand Image and Tenant Experience: Commercial property owners and managers are increasingly investing in high-quality FM to enhance tenant satisfaction and attract premium clients.

Beyond the commercial sector, the Institutional end-user segment, including educational institutions and healthcare facilities, also plays a crucial role. These entities require specialized cleaning, hygiene, and maintenance services to ensure a safe and conducive environment for their users. The Public/Infrastructure segment, encompassing transportation hubs, government buildings, and public spaces, is also a significant contributor, driven by government initiatives to enhance urban living standards and maintain public assets.

The United Arab Emirates (UAE) continues to be a leading country, commanding a substantial market share due to its well-established FM industry, advanced infrastructure, and proactive government support for outsourcing. However, Saudi Arabia is rapidly emerging as a key growth market, driven by its Vision 2030 initiative, which involves massive investments in infrastructure, tourism, and commercial projects, creating a burgeoning demand for soft FM services. The Type: Cleaning Services consistently ranks as a top-performing segment due to its essential nature across all end-user categories.

Middle East and Africa Soft Facility Management Market Product Landscape

The product landscape within the MEA Soft Facility Management market is increasingly defined by the integration of advanced technologies and sustainable practices. Innovations focus on enhancing efficiency, safety, and environmental responsibility. Automated cleaning equipment, such as robotic scrubbers and sanitizers, is gaining traction in large commercial and industrial settings, improving service quality and reducing labor dependency. Smart building management systems that monitor energy consumption, waste generation, and internal environmental conditions are becoming integral to comprehensive FM offerings. Furthermore, eco-friendly cleaning agents and waste management solutions are gaining prominence, driven by growing environmental consciousness and regulatory pressures. Performance metrics emphasize service level agreements (SLAs) that guarantee response times, quality standards, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Middle East and Africa Soft Facility Management Market

Key Drivers:

- Economic Diversification and Business Growth: Governments across MEA are actively diversifying their economies, leading to increased business activity and demand for professional FM services to support new commercial and industrial ventures.

- Urbanization and Infrastructure Development: Rapid urbanization and massive infrastructure projects across the region necessitate comprehensive facility management for new and existing buildings, public spaces, and transportation networks.

- Focus on Core Competencies: Businesses are increasingly outsourcing non-core functions like facility management to concentrate on their primary operations, driving demand for specialized FM providers.

- Technological Advancements: The adoption of smart technologies, automation, and digital platforms is enhancing service delivery, efficiency, and cost-effectiveness, making FM services more attractive.

Key Barriers & Challenges:

- Skilled Workforce Shortage: A significant challenge is the availability of a skilled and trained workforce capable of operating advanced equipment and delivering high-quality services across diverse FM domains.

- Price Sensitivity and Competition: Intense competition among service providers often leads to price wars, putting pressure on profit margins and potentially impacting service quality.

- Regulatory Complexities and Compliance: Navigating diverse and evolving regulatory frameworks across different countries in the region can be challenging, requiring continuous adaptation and investment in compliance.

- Economic Volatility and Geopolitical Instability: Fluctuations in oil prices and geopolitical uncertainties in certain parts of the region can impact investment in new projects and the overall demand for FM services.

Emerging Opportunities in Middle East and Africa Soft Facility Management Market

Emerging opportunities lie in the growing demand for integrated facility management solutions that offer a single point of contact for multiple services. The "smart city" initiatives across the MEA region present significant opportunities for FM providers to integrate technology-driven services into building management and public space upkeep. Furthermore, the increasing focus on sustainability and green building practices is creating a demand for eco-friendly FM solutions, including energy management, waste reduction, and water conservation services. The healthcare and education sectors, experiencing significant investment in expansion and modernization, offer substantial untapped potential for specialized FM services tailored to their unique requirements. The rise of the logistics and e-commerce sectors also presents opportunities for FM providers to manage large warehousing and distribution facilities.

Growth Accelerators in the Middle East and Africa Soft Facility Management Market Industry

Long-term growth in the MEA Soft Facility Management market is being accelerated by strategic government initiatives focused on economic diversification and infrastructure development, such as Saudi Arabia's Vision 2030 and various smart city projects across the UAE and other nations. Technological breakthroughs, particularly in the realm of AI-powered building management systems, IoT integration for predictive maintenance, and automation in cleaning and security, are fundamentally transforming service delivery and creating new value propositions. Strategic partnerships between global FM giants and local players are crucial for knowledge transfer, market access, and scaling operations across the diverse MEA landscape. Market expansion strategies, including diversification into niche sectors like healthcare and education, alongside a focus on delivering sustainable and technologically advanced FM solutions, are key catalysts for sustained growth.

Key Players Shaping the Middle East and Africa Soft Facility Management Market Market

- EFS Facilities Services Group

- Initial Saudi Arabia Company Limited

- Farnek Services LLC

- Greenkey FM

- Emrill Services LLC

- Ecolab Inc

- Sodexo Inc

- Serco Group PLC

- Kharafi National for Infrastructure Projects Developments Construction and Services SAE

- Concordia

- Ejadah Asset Management Group

Notable Milestones in Middle East and Africa Soft Facility Management Market Sector

- November 2022: Isnaad won the top cleaning company award from the Dubai Construction Innovation in FM Awards event. This recognition highlights Isnaad's commitment to excellence and innovation in the cleaning services segment.

- November 2022: Emrill partnered with the Dubai Festival City Mall to launch its first sustainable cleaning robot for a retail environment in Dubai. Automatic robots enable more advanced cleaning services in commercial properties, showcasing a commitment to technological advancement and sustainable operations.

- October 2022: Farnek won 16 new contracts in the UAE capital this year, worth USD 13.61 million. These contracts include cleaning, maintenance, security, hospitality, and total facilities management, covering a variety of vertical sectors such as education, prestige properties, food processing, residential towers, and a sports complex. This significant contract win demonstrates Farnek's broad service capabilities and strong market presence.

In-Depth Middle East and Africa Soft Facility Management Market Market Outlook

The future outlook for the MEA Soft Facility Management market is exceptionally bright, underpinned by persistent economic diversification efforts and ambitious infrastructure development agendas across the region. Growth accelerators like the widespread adoption of IoT and AI in building management, alongside increasing demand for sustainable and eco-friendly FM solutions, will continue to shape the market. Strategic alliances and expansions into underserved sectors, such as healthcare and education, are expected to fuel further growth. The market is poised for a transformation driven by a demand for digitally integrated, client-centric FM services, promising enhanced operational efficiencies and superior user experiences. Stakeholders can anticipate significant opportunities arising from smart city projects and the ongoing modernization of commercial and public infrastructure.

Middle East and Africa Soft Facility Management Market Segmentation

-

1. Type

- 1.1. Office Support and Landscaping Services

- 1.2. Cleaning Services

- 1.3. Catering Services

- 1.4. Security Services

- 1.5. Other Soft FM Services

-

2. End User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End-users

Middle East and Africa Soft Facility Management Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Soft Facility Management Market Regional Market Share

Geographic Coverage of Middle East and Africa Soft Facility Management Market

Middle East and Africa Soft Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities drives the need for soft facility managment services; Steady Growth in Commercial Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Increasing Instances of Data Breaches and Security Threats

- 3.4. Market Trends

- 3.4.1. Infrastructural Development Activities Continue to Create New Opportunities for Soft Facility Managment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Support and Landscaping Services

- 5.1.2. Cleaning Services

- 5.1.3. Catering Services

- 5.1.4. Security Services

- 5.1.5. Other Soft FM Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EFS Facilities Services Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Initial Saudi Arabia Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Farnek Services LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greenkey FM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emrill Services LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ecolab Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sodexo Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Serco Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kharafi National for Infrastructure Projects Developments Construction and Services SAE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Concordia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ejadah Asset Management Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 EFS Facilities Services Group

List of Figures

- Figure 1: Middle East and Africa Soft Facility Management Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Soft Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Soft Facility Management Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Soft Facility Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa Soft Facility Management Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Soft Facility Management Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Middle East and Africa Soft Facility Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Middle East and Africa Soft Facility Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Soft Facility Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Soft Facility Management Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Middle East and Africa Soft Facility Management Market?

Key companies in the market include EFS Facilities Services Group, Initial Saudi Arabia Company Limited, Farnek Services LLC, Greenkey FM, Emrill Services LLC, Ecolab Inc, Sodexo Inc, Serco Group PLC, Kharafi National for Infrastructure Projects Developments Construction and Services SAE, Concordia, Ejadah Asset Management Group.

3. What are the main segments of the Middle East and Africa Soft Facility Management Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities drives the need for soft facility managment services; Steady Growth in Commercial Real Estate Sector.

6. What are the notable trends driving market growth?

Infrastructural Development Activities Continue to Create New Opportunities for Soft Facility Managment Market.

7. Are there any restraints impacting market growth?

Increasing Instances of Data Breaches and Security Threats.

8. Can you provide examples of recent developments in the market?

November 2022: Isnaad won the top cleaning company award from the Dubai Construction Innovation in FM Awards event.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Soft Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Soft Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Soft Facility Management Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Soft Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence