Key Insights

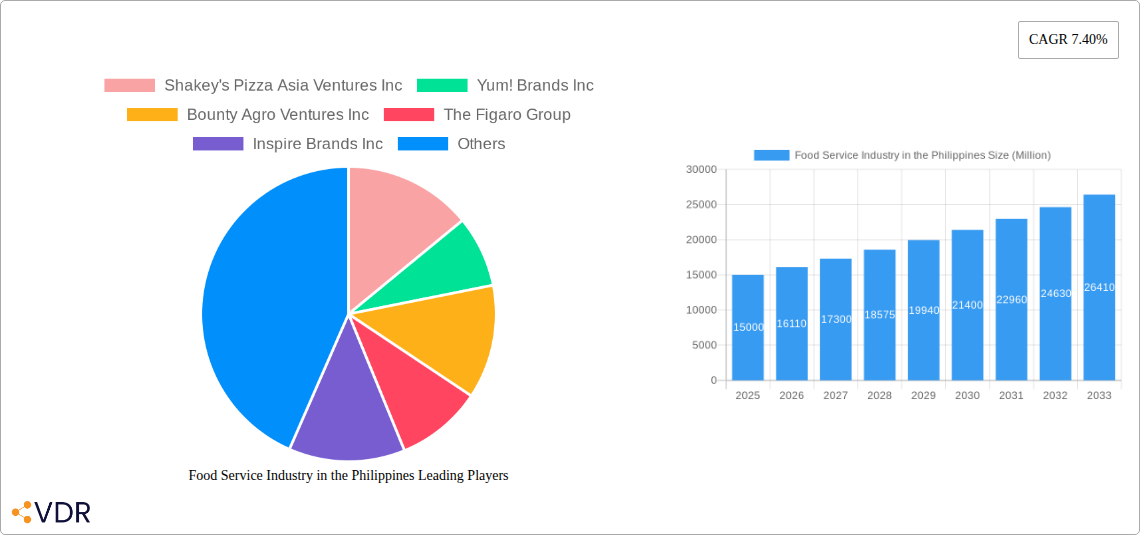

The Philippine food service industry, valued at approximately ₱XX million in 2025 (assuming a logical extrapolation from the provided 2019-2024 data and 7.40% CAGR), is experiencing robust growth. This expansion is fueled by several key drivers, including a rising middle class with increased disposable income, a burgeoning tourism sector, and evolving consumer preferences towards diverse culinary experiences. The increasing popularity of quick-service restaurants (QSRs), cafes, and bars, alongside the expansion of international food chains, contributes significantly to market growth. Significant market segmentation exists, with the leisure, lodging, and retail sectors showing particularly strong performance, alongside a mix of chained and independent outlets. Competition is fierce, with major players like Jollibee Foods Corporation, Golden Arches Development Corporation (McDonald's), and international brands like Starbucks and Yum! Brands vying for market share. However, challenges remain, including rising inflation affecting food costs, increasing labor expenses, and the potential impact of economic downturns on consumer spending. Furthermore, the industry faces pressure to adapt to evolving consumer demands for healthier options and sustainable practices.

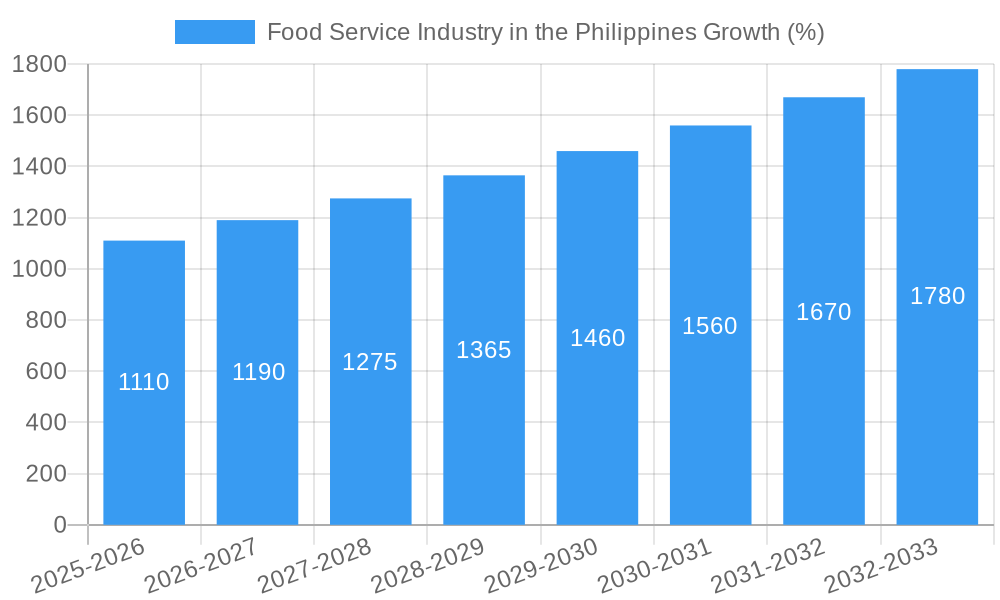

The forecast period (2025-2033) anticipates continued expansion at a compound annual growth rate (CAGR) of 7.40%. This growth trajectory is expected to be influenced by increasing urbanization, the rise of online food delivery platforms, and innovations in restaurant technology. The industry will likely see further consolidation through mergers and acquisitions, as established players seek to enhance their market positions and expand their reach. Strategic partnerships and investments in technology will play a crucial role in optimizing operations, improving customer experience, and responding to evolving consumer expectations. The specific growth rates within different segments (leisure, lodging, etc.) will vary based on their respective responsiveness to these market dynamics. The success of individual companies will depend on their ability to adapt to shifting consumer preferences, leverage technology effectively, and manage operational costs in a dynamic and competitive landscape.

Food Service Industry in the Philippines: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the dynamic Philippine food service industry, encompassing market size, growth trends, competitive landscape, and future outlook from 2019 to 2033. Leveraging robust data and expert insights, this report is an essential resource for industry professionals, investors, and strategic planners seeking a clear understanding of this rapidly evolving sector. The report segments the market by location (Leisure, Lodging, Retail, Standalone, Travel), foodservice type (Cafes & Bars, Other QSR Cuisines), and outlet type (Chained Outlets, Independent Outlets). The base year for this report is 2025, with a forecast period spanning 2025-2033 and historical data covering 2019-2024. Market values are presented in millions of units.

Food Service Industry in the Philippines Market Dynamics & Structure

The Philippine food service industry exhibits a complex interplay of factors shaping its market structure and dynamics. Market concentration is moderate, with a few dominant players like Jollibee Foods Corporation and Golden Arches Development Corporation alongside numerous smaller chains and independent outlets. Technological innovation, particularly in online ordering and delivery platforms, is a major driver, although challenges remain in terms of infrastructure and digital literacy across all population segments. Regulatory frameworks, including food safety standards and labor laws, significantly influence operational costs and practices. The industry faces competition from home-cooked meals and informal street food vendors, representing a constant challenge for formal establishments. Demographics play a crucial role, with a young and growing population driving demand, particularly in quick-service restaurants (QSRs). Mergers and acquisitions (M&A) activity is frequent, with larger players strategically expanding their portfolios and market share. Recent years have seen a surge in M&A activity, estimated at xx Million deals between 2019-2024, though precise data remains unavailable.

- Market Concentration: Moderate, with a few major players and many smaller businesses.

- Technological Innovation: Significant influence from online ordering and delivery, but challenges with infrastructure remain.

- Regulatory Framework: Food safety and labor laws create operational complexities.

- Competitive Substitutes: Home-cooked meals and informal street food exert competitive pressure.

- End-User Demographics: Young and growing population fuels demand for QSRs.

- M&A Trends: Increased activity in recent years, valued at xx Million in deals (2019-2024).

Food Service Industry in the Philippines Growth Trends & Insights

The Philippine food service industry experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors including rising disposable incomes, a burgeoning middle class, increasing urbanization, and the growing popularity of convenience foods. The adoption of digital technologies such as online ordering and delivery systems has accelerated market expansion. However, economic fluctuations and changing consumer preferences, such as a shift towards healthier options, present both opportunities and challenges for businesses. Market penetration remains relatively high in urban areas, but significant untapped potential exists in rural communities. Technological disruptions, such as the rise of ghost kitchens and cloud kitchens, are further shaping the industry's structure and competitive dynamics. Consumer behavior is becoming increasingly influenced by digital marketing and social media trends, driving demand for unique and experiential dining options. We project a CAGR of xx% for the forecast period (2025-2033), reaching a market size of xx Million units by 2033.

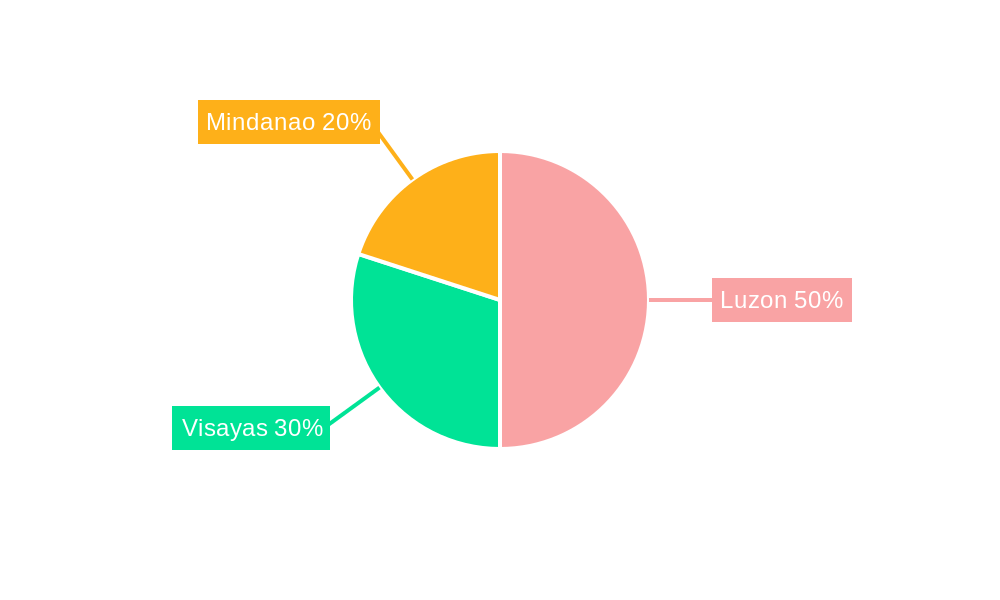

Dominant Regions, Countries, or Segments in Food Service Industry in the Philippines

The National Capital Region (NCR) and other major urban centers dominate the Philippine food service market, driven by higher population density, higher disposable incomes, and greater concentration of businesses. Within the segments, Chained Outlets hold the largest market share, benefiting from brand recognition, economies of scale, and established distribution networks. The “Other QSR Cuisines” category exhibits robust growth due to diverse consumer preferences and the introduction of innovative food offerings.

- Key Drivers for NCR dominance: High population density, higher disposable incomes, and concentration of businesses.

- Key Drivers for Chained Outlets dominance: Brand recognition, economies of scale, established distribution networks.

- Growth potential of Other QSR Cuisines: Diverse consumer preferences and innovation in food offerings.

- Regional Disparities: Significant growth opportunities exist in less developed regions with improving infrastructure and connectivity.

Food Service Industry in the Philippines Product Landscape

The product landscape is characterized by a wide array of offerings, ranging from traditional Filipino cuisine to international fast food and fine dining experiences. Innovation focuses on convenience, health, and customization. Recent trends include the introduction of plant-based options, healthier menu choices, and personalized meal plans. Technological advancements such as automated ordering kiosks and customized mobile applications enhance customer experience and operational efficiency. Unique selling propositions often revolve around specific cultural elements, unique flavor profiles, and commitment to high-quality ingredients.

Key Drivers, Barriers & Challenges in Food Service Industry in the Philippines

Key Drivers: Rising disposable incomes, expanding middle class, increasing urbanization, and technological advancements (online ordering, delivery platforms). Government initiatives promoting tourism and infrastructure development also stimulate growth.

Challenges: Intense competition, fluctuating food prices, labor shortages, and maintaining consistent food quality across multiple outlets. Supply chain disruptions, particularly concerning ingredient sourcing, can significantly impact operational costs and profitability. Regulatory hurdles related to permits, licenses, and food safety standards pose challenges for businesses.

Emerging Opportunities in Food Service Industry in the Philippines

Untapped potential exists in rural areas with rising disposable incomes and expanding access to technology. Opportunities also exist in specialized niche markets, such as healthy food options, vegan/vegetarian cuisine, and personalized meal delivery services. The growing popularity of food delivery apps presents further opportunities for expansion and market reach. Leveraging digital marketing and social media to reach targeted consumers is crucial for success in this competitive landscape.

Growth Accelerators in the Food Service Industry in the Philippines Industry

Technological advancements, strategic partnerships (e.g., between restaurants and delivery platforms), and targeted market expansion strategies will continue to propel growth. Investments in employee training and upskilling are essential to address labor shortages and maintain quality. Furthermore, adopting sustainable practices and promoting eco-friendly initiatives will improve brand image and attract environmentally conscious consumers.

Key Players Shaping the Food Service Industry in the Philippines Market

- Jollibee Foods Corporation

- Golden Arches Development Corporation

- Shakey's Pizza Asia Ventures Inc

- Yum! Brands Inc

- Bounty Agro Ventures Inc

- The Figaro Group

- Inspire Brands Inc

- Seven & I Holdings Co Ltd

- Mary Grace Foods Inc

- Maxs Group Inc

- Udenna Group

- Domino's Pizza Inc

- Berjaya Corporation Bhd

- Starbucks Corporation

- Restaurant Brands International Inc

Notable Milestones in Food Service Industry in the Philippines Sector

- October 2023: Starbucks launched two new ice cream-based drinks in the Philippines.

- May 2023: Inspire Brands, Inc. launched new butter variants (Plain, Choco Almond, Ube Cheese, Strawberry, Cheesy, Choco) for its Butternut brand.

- April 2023: The Figaro Coffee Group launched a new café concept brand, Cafe Portofino.

In-Depth Food Service Industry in the Philippines Market Outlook

The Philippine food service industry is poised for sustained growth driven by a young and expanding population, increasing disposable incomes, and ongoing technological advancements. Strategic partnerships, diversification of offerings, and expansion into underserved markets will be key factors in achieving long-term success. The increasing adoption of sustainable practices and health-conscious choices will also shape the industry's future trajectory, creating significant opportunities for innovative and adaptable businesses.

Food Service Industry in the Philippines Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Food Service Industry in the Philippines Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Service Industry in the Philippines REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Quick service restaurants held a dominating share in the market owing expansion of franchise outlets and menu innovations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Shakey's Pizza Asia Ventures Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yum! Brands Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bounty Agro Ventures Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Figaro Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inspire Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seven & I Holdings Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mary Grace Foods Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jollibee Foods Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maxs Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Udenna Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Golden Arches Development Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Domino's Pizza Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Berjaya Corporation Bhd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Starbucks Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Restaurant Brands International Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Shakey's Pizza Asia Ventures Inc

List of Figures

- Figure 1: Global Food Service Industry in the Philippines Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Philippines Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 3: Philippines Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 5: North America Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 6: North America Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 7: North America Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 8: North America Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 9: North America Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 10: North America Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: South America Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: South America Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 15: South America Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: South America Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 17: South America Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 18: South America Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: Europe Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: Europe Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 23: Europe Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: Europe Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 25: Europe Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 26: Europe Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 33: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 34: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 41: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 42: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Service Industry in the Philippines Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Food Service Industry in the Philippines Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 23: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 24: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 35: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 36: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 37: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 45: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 46: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 47: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Service Industry in the Philippines?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Food Service Industry in the Philippines?

Key companies in the market include Shakey's Pizza Asia Ventures Inc, Yum! Brands Inc, Bounty Agro Ventures Inc, The Figaro Group, Inspire Brands Inc, Seven & I Holdings Co Ltd, Mary Grace Foods Inc, Jollibee Foods Corporation, Maxs Group Inc, Udenna Group, Golden Arches Development Corporation, Domino's Pizza Inc, Berjaya Corporation Bhd, Starbucks Corporation, Restaurant Brands International Inc.

3. What are the main segments of the Food Service Industry in the Philippines?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Quick service restaurants held a dominating share in the market owing expansion of franchise outlets and menu innovations.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

October 2023: Starbucks launched two new drinks with the addition of ice cream in the Philippines.May 2023: Inspire Brands, Inc. launched new butter variants to its Butternut portfolio. These variants include the Plain Butternut, Choco Almond Butternut, Ube Cheese Butternut, Strawberry Butternut, Cheesy Butternut, and Choco Butternut.April 2023: The Figaro Coffee Group increased its brand portfolio and launched a new café concept brand called Cafe Portofino.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Service Industry in the Philippines," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Service Industry in the Philippines report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Service Industry in the Philippines?

To stay informed about further developments, trends, and reports in the Food Service Industry in the Philippines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence