Key Insights

The European portable gas detector market is experiencing robust growth, driven by increasing awareness of workplace safety regulations and the rising prevalence of hazardous gas exposure in various industries. The period from 2019 to 2024 saw significant expansion, and this momentum is projected to continue throughout the forecast period (2025-2033). Key factors contributing to this growth include stringent government regulations mandating the use of gas detection equipment in sectors like oil and gas, mining, and manufacturing. Furthermore, technological advancements leading to the development of more compact, reliable, and user-friendly portable gas detectors are fueling market adoption. The increasing demand for multi-gas detectors capable of detecting a wider range of hazardous gases simultaneously is another significant trend. Growth is also being spurred by the rising adoption of advanced features such as wireless connectivity, data logging, and remote monitoring capabilities, which enhance safety and operational efficiency. Competitive landscape analysis reveals a mix of established players and emerging companies vying for market share, often through innovation in sensor technology and integration with cloud-based platforms for real-time data analysis.

The market's growth trajectory is expected to remain positive, although the pace might see some fluctuation depending on economic conditions and evolving safety standards across different European nations. Significant opportunities exist for manufacturers who can offer innovative solutions addressing specific industry needs. The demand for cost-effective, easy-to-maintain, and durable devices will continue to be a key consideration for buyers. Expansion into emerging markets within Europe and the integration of advanced analytical tools capable of predicting potential gas leaks are likely to shape the future of this market. This continued expansion underlines the growing importance placed on worker safety and environmental protection across the European Union. Focus on improving worker training and awareness programs also contributes significantly to the market's positive outlook.

Europe Portable Gas Detector Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Portable Gas Detector Market, covering market dynamics, growth trends, regional performance, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by type (single-gas, multi-gas) and end-user industry (oil & gas, chemicals & petrochemicals, water & wastewater, power generation & transmission, metal & mining, other end-user industries), providing granular insights for informed decision-making. The market is valued at xx Million units in 2025 and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Portable Gas Detector Market Dynamics & Structure

The European portable gas detector market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, driven by the need for enhanced safety and efficiency, plays a pivotal role. Stringent safety regulations across various industries mandate the use of these detectors, further fueling market growth. Competitive substitutes, such as fixed gas detection systems, exist but portable detectors maintain their dominance due to flexibility and portability requirements. The end-user demographics are diverse, encompassing large multinational corporations to smaller enterprises across various sectors. Mergers and acquisitions (M&A) activity is moderate, with strategic alliances shaping the competitive landscape.

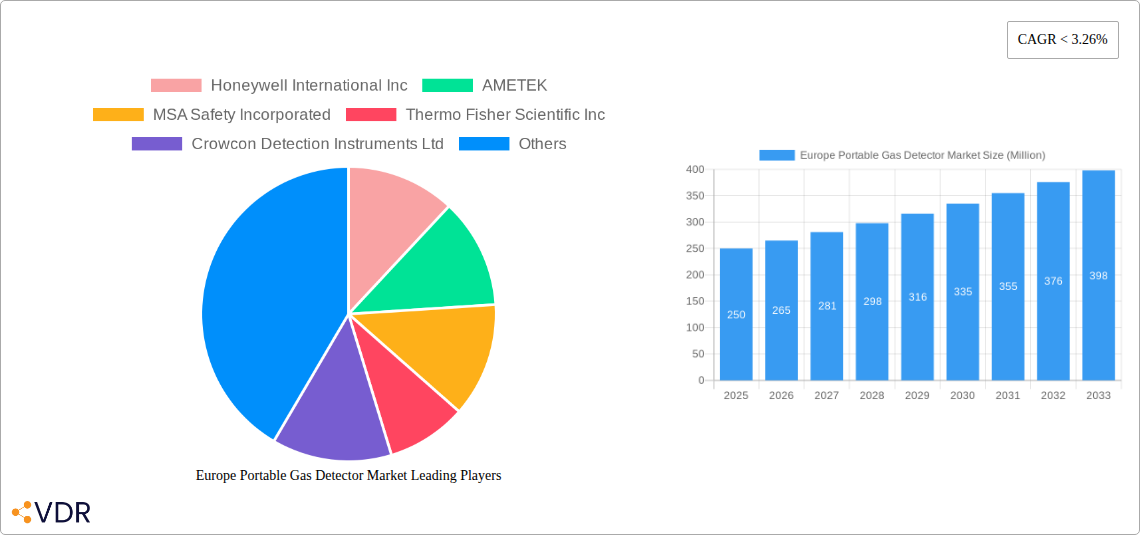

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on improved sensor technology, wireless connectivity, data logging capabilities, and miniaturization.

- Regulatory Framework: Stringent safety regulations across industries, particularly in oil & gas and chemicals, are key drivers.

- Competitive Substitutes: Fixed gas detection systems, but portability advantage favors portable detectors.

- End-User Demographics: Diverse, ranging from large corporations to smaller businesses across various sectors.

- M&A Trends: Moderate M&A activity, with strategic partnerships influencing market dynamics. xx M&A deals recorded between 2019 and 2024.

Europe Portable Gas Detector Market Growth Trends & Insights

The Europe portable gas detector market experienced steady growth during the historical period (2019-2024), driven by increasing industrial activity and heightened safety concerns. Adoption rates are particularly high in sectors with inherent risks, such as oil & gas and chemicals. Technological advancements, including the introduction of more accurate and feature-rich detectors, have further stimulated market expansion. Consumer behavior shifts towards prioritizing safety and compliance have significantly influenced market growth. The market is expected to continue its upward trajectory, fueled by ongoing industrialization and stringent regulatory environments.

- Market Size Evolution: The market size increased from xx Million units in 2019 to xx Million units in 2024.

- Adoption Rates: High adoption rates in high-risk industries, with increasing penetration in other sectors.

- Technological Disruptions: Introduction of advanced sensors, wireless communication, and data analytics capabilities.

- Consumer Behavior Shifts: Increasing emphasis on safety and compliance drives demand for advanced detectors.

Dominant Regions, Countries, or Segments in Europe Portable Gas Detector Market

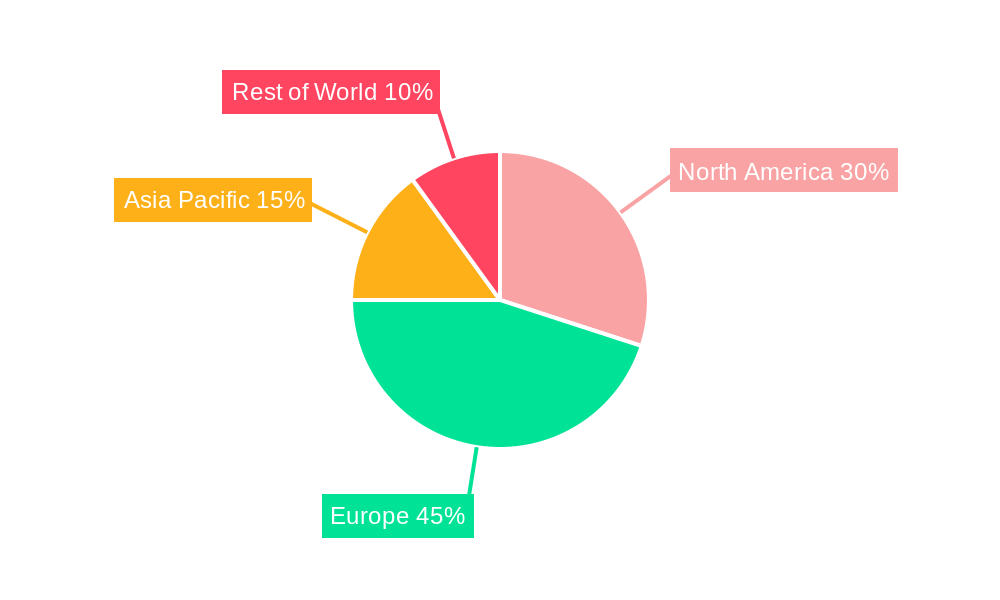

The German and UK markets are currently the largest within Europe, driven by robust industrial sectors and strong regulatory frameworks. The Oil & Gas and Chemicals & Petrochemical sectors are the leading end-user industries. Within the product type segment, multi-gas detectors hold a larger market share due to their ability to detect multiple hazards simultaneously. Growth is further fueled by supportive government policies promoting industrial safety and infrastructure development.

- Leading Region: Germany and the UK are the dominant regions.

- Leading End-user Industry: Oil & Gas and Chemicals & Petrochemicals dominate the market.

- Leading Product Type: Multi-gas detectors hold a larger market share.

- Key Drivers: Stringent safety regulations, robust industrial sectors, and supportive government policies.

Europe Portable Gas Detector Market Product Landscape

The market offers a diverse range of portable gas detectors, varying in functionality, sensor technology, and design. Single-gas detectors offer specialized detection for specific hazards, while multi-gas detectors provide comprehensive monitoring. Key features include advanced sensor technologies for improved accuracy, wireless connectivity for remote monitoring and data management, and rugged designs for demanding industrial environments. Unique selling propositions include long battery life, ease of use, and sophisticated data logging features.

Key Drivers, Barriers & Challenges in Europe Portable Gas Detector Market

Key Drivers:

- Stringent safety regulations across various industries.

- Increasing industrial activity and infrastructure development.

- Growing awareness of workplace safety among businesses and employees.

- Technological advancements leading to more accurate, reliable, and user-friendly devices.

Key Challenges & Restraints:

- High initial investment costs for sophisticated detectors.

- Potential supply chain disruptions affecting component availability.

- Competitive pressures from established and emerging players.

- Regulatory hurdles and compliance requirements varying across regions. (Estimated impact on market growth: xx%)

Emerging Opportunities in Europe Portable Gas Detector Market

- Expansion into new and untapped markets: Increased focus on safety in smaller businesses and developing sectors.

- Innovative applications: Integration with IoT and smart safety systems for enhanced monitoring and analytics.

- Evolving consumer preferences: Demand for user-friendly, durable, and feature-rich detectors with advanced functionalities.

Growth Accelerators in the Europe Portable Gas Detector Market Industry

Technological breakthroughs such as improved sensor technology, wireless connectivity, and advanced data analytics are major catalysts. Strategic partnerships between detector manufacturers and end-user industries foster innovation and market expansion. Increased investment in R&D and aggressive marketing strategies further fuel market growth.

Key Players Shaping the Europe Portable Gas Detector Market Market

- Honeywell International Inc

- AMETEK

- MSA Safety Incorporated

- Thermo Fisher Scientific Inc

- Crowcon Detection Instruments Ltd

- Teledyne Technologies Incorporated

- GfG Gas Detection

- Industrial Scientific

- RIKEN KEIKI Co Ltd

- Drägerwerk AG & Co KGaA

Notable Milestones in Europe Portable Gas Detector Market Sector

- September 2022: Blackline Safety Corp. launched the G6 single-gas detector, a linked employee wearable, impacting the petrochemical, oil & gas, and other industrial sectors by improving incident response time.

- August 2022: Riken Keiki Co., Ltd. released the GX-Force portable four-gas detector with built-in pumping aspiration, enhancing detection of combustible gases, oxygen, carbon monoxide, and hydrogen sulfide.

In-Depth Europe Portable Gas Detector Market Market Outlook

The European portable gas detector market is poised for robust growth over the forecast period, driven by continuous technological advancements, stringent safety regulations, and expanding industrial activity. Strategic partnerships and investments in R&D will further enhance market competitiveness and drive innovation. Untapped markets and emerging applications present significant opportunities for market expansion and growth. The market is expected to witness increased adoption of advanced features like wireless connectivity, data logging, and cloud-based analytics, leading to a more sophisticated and connected safety ecosystem.

Europe Portable Gas Detector Market Segmentation

-

1. Type

- 1.1. Single-gas

- 1.2. Multi-gas

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemicals & Petrochemical

- 2.3. Water & Wastewater

- 2.4. Power Generation & Transmission

- 2.5. Metal & Mining

- 2.6. Other End User Industries

Europe Portable Gas Detector Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Western Europe

- 5. Central

Europe Portable Gas Detector Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

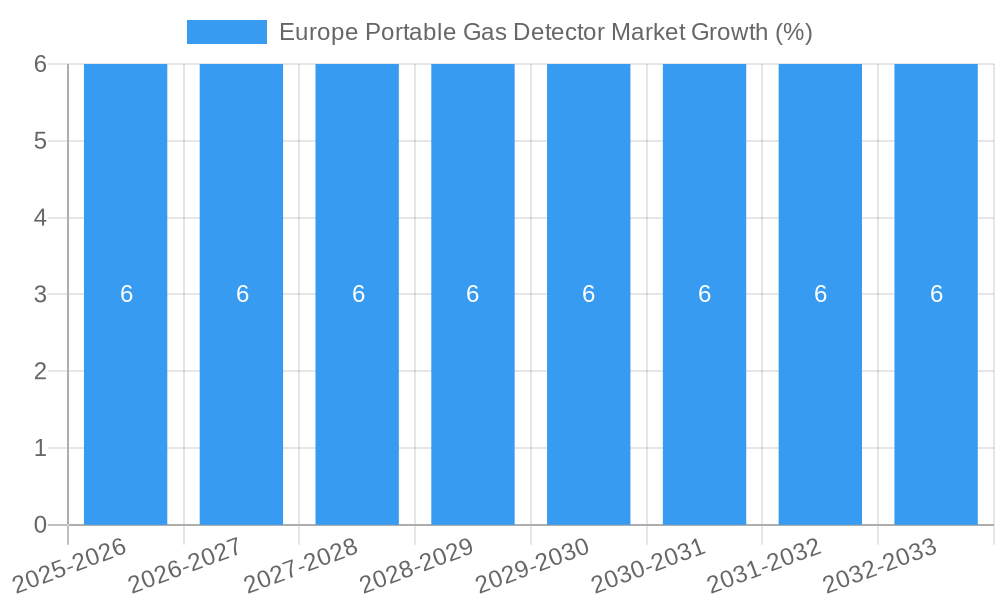

| Growth Rate | CAGR of < 3.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness on Worker Safety and Stringent Regulations

- 3.3. Market Restrains

- 3.3.1. Increasing Frequency of False Detection

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Offer Market Growth Opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-gas

- 5.1.2. Multi-gas

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemicals & Petrochemical

- 5.2.3. Water & Wastewater

- 5.2.4. Power Generation & Transmission

- 5.2.5. Metal & Mining

- 5.2.6. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Rest of Western Europe

- 5.3.5. Central

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-gas

- 6.1.2. Multi-gas

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil & Gas

- 6.2.2. Chemicals & Petrochemical

- 6.2.3. Water & Wastewater

- 6.2.4. Power Generation & Transmission

- 6.2.5. Metal & Mining

- 6.2.6. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-gas

- 7.1.2. Multi-gas

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil & Gas

- 7.2.2. Chemicals & Petrochemical

- 7.2.3. Water & Wastewater

- 7.2.4. Power Generation & Transmission

- 7.2.5. Metal & Mining

- 7.2.6. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-gas

- 8.1.2. Multi-gas

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil & Gas

- 8.2.2. Chemicals & Petrochemical

- 8.2.3. Water & Wastewater

- 8.2.4. Power Generation & Transmission

- 8.2.5. Metal & Mining

- 8.2.6. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Western Europe Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-gas

- 9.1.2. Multi-gas

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil & Gas

- 9.2.2. Chemicals & Petrochemical

- 9.2.3. Water & Wastewater

- 9.2.4. Power Generation & Transmission

- 9.2.5. Metal & Mining

- 9.2.6. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Central Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-gas

- 10.1.2. Multi-gas

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil & Gas

- 10.2.2. Chemicals & Petrochemical

- 10.2.3. Water & Wastewater

- 10.2.4. Power Generation & Transmission

- 10.2.5. Metal & Mining

- 10.2.6. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Germany Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Portable Gas Detector Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Honeywell International Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 AMETEK

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 MSA Safety Incorporated

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Thermo Fisher Scientific Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Crowcon Detection Instruments Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Teledyne Technologies Incorporated

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 GfG Gas Detection

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Industrial Scientific

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 RIKEN KEIKI Co Ltd *List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Drgerwerk AG & Co KGaA

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Portable Gas Detector Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Portable Gas Detector Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Portable Gas Detector Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Portable Gas Detector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Portable Gas Detector Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Europe Portable Gas Detector Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Portable Gas Detector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Portable Gas Detector Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Portable Gas Detector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Portable Gas Detector Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Europe Portable Gas Detector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Portable Gas Detector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Portable Gas Detector Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Europe Portable Gas Detector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Portable Gas Detector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Portable Gas Detector Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Europe Portable Gas Detector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Portable Gas Detector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Portable Gas Detector Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Europe Portable Gas Detector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Portable Gas Detector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Portable Gas Detector Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Europe Portable Gas Detector Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Portable Gas Detector Market?

The projected CAGR is approximately < 3.26%.

2. Which companies are prominent players in the Europe Portable Gas Detector Market?

Key companies in the market include Honeywell International Inc, AMETEK, MSA Safety Incorporated, Thermo Fisher Scientific Inc, Crowcon Detection Instruments Ltd, Teledyne Technologies Incorporated, GfG Gas Detection, Industrial Scientific, RIKEN KEIKI Co Ltd *List Not Exhaustive, Drgerwerk AG & Co KGaA.

3. What are the main segments of the Europe Portable Gas Detector Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness on Worker Safety and Stringent Regulations.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Offer Market Growth Opportunities.

7. Are there any restraints impacting market growth?

Increasing Frequency of False Detection.

8. Can you provide examples of recent developments in the market?

September 2022 : Blackline Safety Corp. announced the release of the G6 single-gas detector, establishing a new trend in linked employee wearables. Blackline's latest product, the G6 single-gas sensor, is designed for petrochemical, oil and gas, and other industrial sectors, allowing for faster incident reaction time, excellent safety and compliance, long-term connection, and increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Portable Gas Detector Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Portable Gas Detector Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Portable Gas Detector Market?

To stay informed about further developments, trends, and reports in the Europe Portable Gas Detector Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence