Key Insights

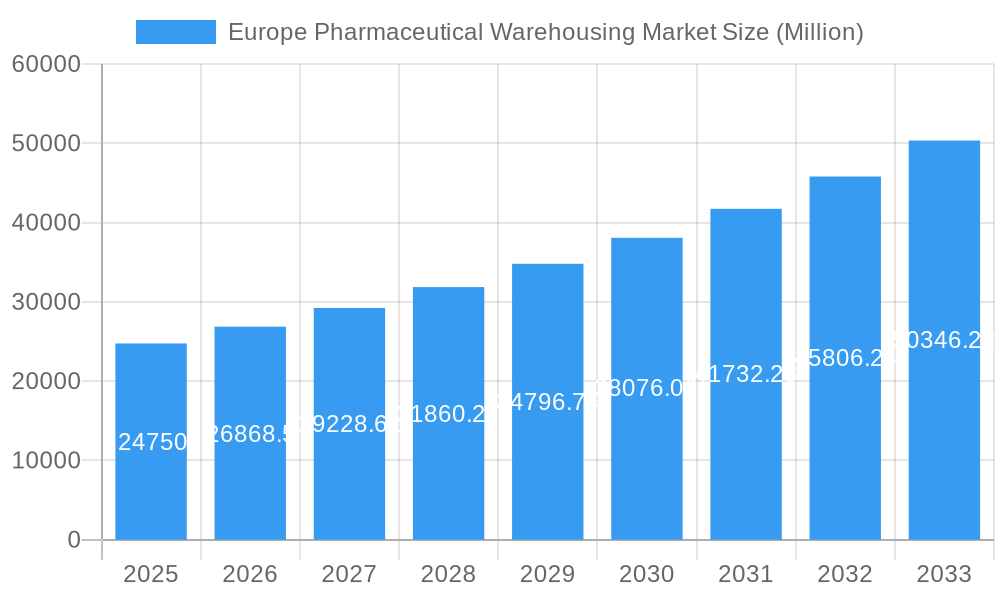

The European pharmaceutical warehousing market is experiencing robust growth, projected to reach €24.75 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 8.26% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for pharmaceutical products, fueled by an aging population and rising prevalence of chronic diseases across Europe, necessitates efficient and secure storage solutions. Stringent regulatory requirements for drug storage and handling are also pushing companies to invest in advanced cold chain and non-cold chain warehousing facilities. Furthermore, the ongoing trend of outsourcing logistics functions to specialized providers is significantly contributing to market growth. Germany, France, the UK, and Italy represent the largest national markets within Europe, benefiting from established pharmaceutical industries and well-developed logistics infrastructure. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others), with cold chain warehousing experiencing particularly high demand due to the temperature-sensitive nature of many pharmaceutical products. Growth is also being spurred by technological advancements, such as automated storage and retrieval systems, and the adoption of sophisticated inventory management software to enhance efficiency and reduce waste.

Europe Pharmaceutical Warehousing Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational logistics providers like DB Schenker, UPS, FedEx, and Kuehne + Nagel, as well as specialized pharmaceutical logistics companies like Alloga and Bio Pharma Logistics. These companies are strategically investing in expanding their warehousing capacity, upgrading their technology, and enhancing their service offerings to meet the growing needs of the pharmaceutical industry. However, challenges remain, including maintaining stringent quality control standards across the supply chain, managing the complexities of regulatory compliance in different European countries, and mitigating risks associated with temperature-sensitive pharmaceuticals. Despite these challenges, the long-term outlook for the European pharmaceutical warehousing market remains positive, driven by sustained growth in pharmaceutical production and consumption, coupled with the continuous adoption of innovative logistics solutions.

Europe Pharmaceutical Warehousing Market Company Market Share

Europe Pharmaceutical Warehousing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Pharmaceutical Warehousing Market, offering invaluable insights for industry professionals, investors, and strategic planners. With a focus on market dynamics, growth trends, key players, and future opportunities, this report serves as an essential resource for navigating this rapidly evolving sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by Type (Cold Chain Warehouse, Non-Cold Chain Warehouse) and Application (Pharmaceutical Factory, Pharmacy, Hospital, Others). The total market size is projected to reach XX million units by 2033.

Europe Pharmaceutical Warehousing Market Market Dynamics & Structure

The European pharmaceutical warehousing market is a moderately concentrated landscape, featuring several large multinational corporations alongside numerous smaller, specialized providers. This dynamic market is significantly shaped by rapid technological innovation, particularly in cold chain logistics and automation, driving efficiency and enhancing security. Stringent regulatory frameworks, most notably GDP (Good Distribution Practice) guidelines, heavily influence operational practices and necessitate substantial investments in compliance. The market faces ongoing competitive pressure from alternative solutions, such as outsourced logistics and third-party providers, each vying for market share. Underlying market demand is robustly driven by demographic trends, including an aging population and the rising prevalence of chronic diseases, increasing the need for efficient and reliable pharmaceutical storage and distribution. A notable characteristic is the frequent occurrence of mergers and acquisitions (M&A) activity, reflecting consolidation and expansion strategies amongst key market players aiming to gain a competitive edge.

- Market Concentration: The top 5 players held an estimated XX% market share in 2025, indicating a moderately concentrated market structure. Further analysis is needed to determine the level of market concentration and potential anti-competitive behavior.

- Technological Innovation: Advanced technologies, including automation (robotics, automated guided vehicles), AI-powered inventory management systems, and real-time temperature monitoring with integrated data analytics are transforming warehouse operations and enhancing supply chain resilience.

- Regulatory Landscape: Compliance with stringent regulations, including GDP guidelines and data privacy regulations (GDPR), is paramount and necessitates significant investment in infrastructure and operational procedures. Non-compliance carries severe penalties and reputational damage.

- Competitive Substitutes: The market faces competitive pressure from various sources, including fully outsourced logistics services, specialized niche players focusing on specific therapeutic areas (e.g., biologics), and the increasing adoption of cloud-based warehouse management systems (WMS).

- M&A Activity: An average of XX M&A deals per year were observed during the historical period (2019-2024), indicating a trend of consolidation and strategic expansion within the industry. This activity suggests an ongoing fight for market share and the potential for further consolidation in the future.

Europe Pharmaceutical Warehousing Market Growth Trends & Insights

The European pharmaceutical warehousing market demonstrates a robust and sustained growth trajectory. This growth is primarily fueled by several interconnected factors, including increasing demand for pharmaceutical products across various therapeutic areas, significant expansion of healthcare infrastructure, and a growing adoption rate of advanced warehousing technologies. The market size experienced a CAGR of XX% during the historical period (2019-2024) and is projected to maintain a CAGR of XX% during the forecast period (2025-2033). This growth is further underpinned by rising investments in state-of-the-art cold chain infrastructure, a notable increase in the outsourcing of warehousing and logistics functions by pharmaceutical companies, and the widespread adoption of automated warehousing systems. The market penetration rate for sophisticated cold chain warehousing is expected to reach XX% by 2033, reflecting a significant improvement in the sector's capabilities. Technological disruptions, such as the implementation of blockchain technology for enhanced traceability and security, are transforming the industry landscape, improving transparency and reducing the risk of counterfeiting. Furthermore, evolving consumer behavior, particularly a growing emphasis on personalized medicine and tailored therapies, is influencing the demand for specialized warehousing solutions capable of handling increasingly complex pharmaceutical products.

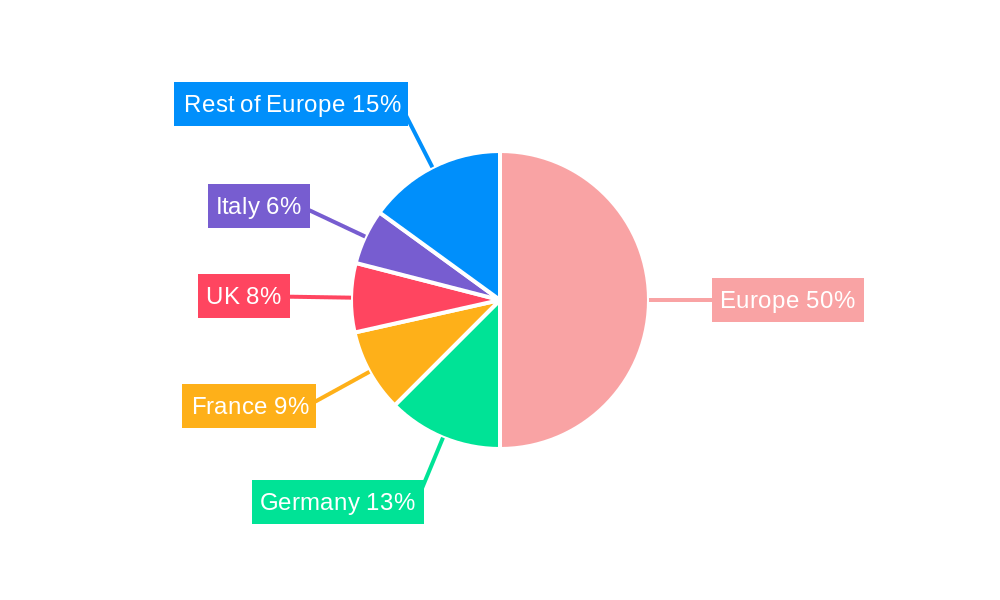

Dominant Regions, Countries, or Segments in Europe Pharmaceutical Warehousing Market

Germany and the UK currently hold the largest market share within the European pharmaceutical warehousing market. The dominance of these regions can be attributed to factors such as a well-established pharmaceutical industry, robust healthcare infrastructure, and strong regulatory frameworks. However, countries like France, Italy, and Spain are experiencing significant growth driven by increasing investments in cold chain logistics and a rising demand for temperature-sensitive pharmaceutical products. The cold chain segment dominates the market, driven by the need for secure storage and transportation of temperature-sensitive pharmaceuticals.

- Key Drivers in Germany & UK: Strong pharmaceutical manufacturing base, developed logistics infrastructure, high regulatory compliance.

- Growth Potential in France, Italy, & Spain: Increasing investment in cold chain facilities, rising demand for specialized pharmaceutical products.

- Market Share: Germany holds approximately XX% and the UK approximately XX% of the European pharmaceutical warehousing market in 2025.

- Cold Chain Dominance: Cold chain warehousing accounts for approximately XX% of the total market value in 2025.

Europe Pharmaceutical Warehousing Market Product Landscape

The pharmaceutical warehousing market features a diverse range of products, from standard non-cold chain warehouses to sophisticated, automated cold chain facilities with integrated technology solutions. These solutions include advanced temperature monitoring systems, humidity controls, and sophisticated inventory management software. Unique selling propositions frequently center on speed, security, reliability, and compliance with stringent regulatory requirements. Recent technological advancements include the use of robotics and AI for efficient inventory management and order fulfillment, enhancing speed and reducing operational costs.

Key Drivers, Barriers & Challenges in Europe Pharmaceutical Warehousing Market

Key Drivers: The expanding demand for pharmaceutical products across various therapeutic categories serves as a primary driver of market growth. This is coupled with substantial investments in modernizing healthcare infrastructure, the rising adoption of sophisticated warehousing technologies, and the presence of stringent regulatory frameworks that encourage investment in advanced infrastructure and compliance procedures. Supportive government initiatives aimed at fostering pharmaceutical innovation and modernizing supply chains also play a crucial role in stimulating market expansion.

Key Barriers & Challenges: The high capital expenditures required for developing and maintaining sophisticated cold chain infrastructure, alongside the stringent regulatory compliance requirements, present significant hurdles for market participants. These challenges are further compounded by persistent skilled labor shortages across the industry and the inherent risk of product spoilage due to temperature fluctuations. Furthermore, supply chain disruptions caused by geopolitical events or unforeseen circumstances pose a significant risk to operational stability. For instance, the impact of such disruptions in 2024 resulted in an estimated XX million units in lost revenue, highlighting the vulnerability of the sector.

Emerging Opportunities in Europe Pharmaceutical Warehousing Market

Several key opportunities are emerging to drive market growth and innovation. The rise of personalized medicine, increasing demand for complex biologics, and the expanding e-pharmacy sector create significant growth avenues. Expansion into untapped markets within Eastern Europe holds considerable potential for companies willing to invest in infrastructure and navigate regional regulatory landscapes. Moreover, innovations in cold chain technologies, particularly sustainable and energy-efficient solutions, are poised to generate new market segments and improve the environmental footprint of the industry. Finally, developing specialized warehousing solutions tailored to the unique needs of advanced therapies, such as cell and gene therapies, presents an opportunity to create lucrative new revenue streams and cater to the increasing demand for these complex treatments.

Growth Accelerators in the Europe Pharmaceutical Warehousing Market Industry

Several key factors are accelerating market expansion. Technological advancements in cold chain technology, encompassing automation and advanced data analytics capabilities, are pivotal in improving efficiency and reducing operational costs. Strategic partnerships between pharmaceutical companies and specialized logistics providers are instrumental in optimizing supply chain efficiency and achieving cost reductions. Government initiatives aimed at modernizing supply chains and simplifying regulatory procedures provide an enabling environment for growth. Expanding into new geographical markets and diversifying service offerings will further amplify growth opportunities and enhance market resilience.

Key Players Shaping the Europe Pharmaceutical Warehousing Market Market

Notable Milestones in Europe Pharmaceutical Warehousing Market Sector

- June 2023: ViaPharma signed a 20-year lease agreement with CTP for two Czech CTParks, adding almost 27,000 sq m of pharmaceutical warehousing space.

- August 2022: UPS acquired BomiGroup, expanding its temperature-controlled facilities across 14 countries.

In-Depth Europe Pharmaceutical Warehousing Market Market Outlook

The future of the European pharmaceutical warehousing market looks promising, driven by continuous technological advancements, strategic partnerships, and increasing demand. The market is poised for significant growth, particularly in cold chain logistics and specialized warehousing solutions. Opportunities abound for companies that can adapt to the evolving regulatory landscape and meet the growing demand for secure, efficient, and compliant pharmaceutical warehousing solutions. The market is projected to witness strong growth, exceeding XX million units by 2033.

Europe Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

Europe Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Warehousing Market

Europe Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency

- 3.2.2 visibility

- 3.2.3 and product safety from pharmaceutical companies

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support in emerging economies

- 3.4. Market Trends

- 3.4.1. Rise in the demand Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics SE and Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alloga

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rhenus SE and Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bio Pharma Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne Nagel Management AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEODIS SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KRC Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: UK Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 8.26%.

2. Which companies are prominent players in the Europe Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp, Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, KRC Logistics.

3. What are the main segments of the Europe Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.75 Million as of 2022.

5. What are some drivers contributing to market growth?

The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency. visibility. and product safety from pharmaceutical companies.

6. What are the notable trends driving market growth?

Rise in the demand Pharmaceutical.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support in emerging economies.

8. Can you provide examples of recent developments in the market?

June 2023: ViaPharma signed a 20-year lease agreement with the developer CTP for two Czech CTParks. CTP will prepare and hand over the premises, with a total area of almost 27,000 sq m and several specific modifications for the pharmaceutical industry, at the end of 2023. CTPark Ostrava Poruba and CTPark Brno Líšeň will be the next locations of cooperation. ViaPharma already leased three warehouses in Romania, including the largest ever pharmaceutical warehouse in the country with an area of 35,000 sq m in CTPark Mogosoaia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence