Key Insights

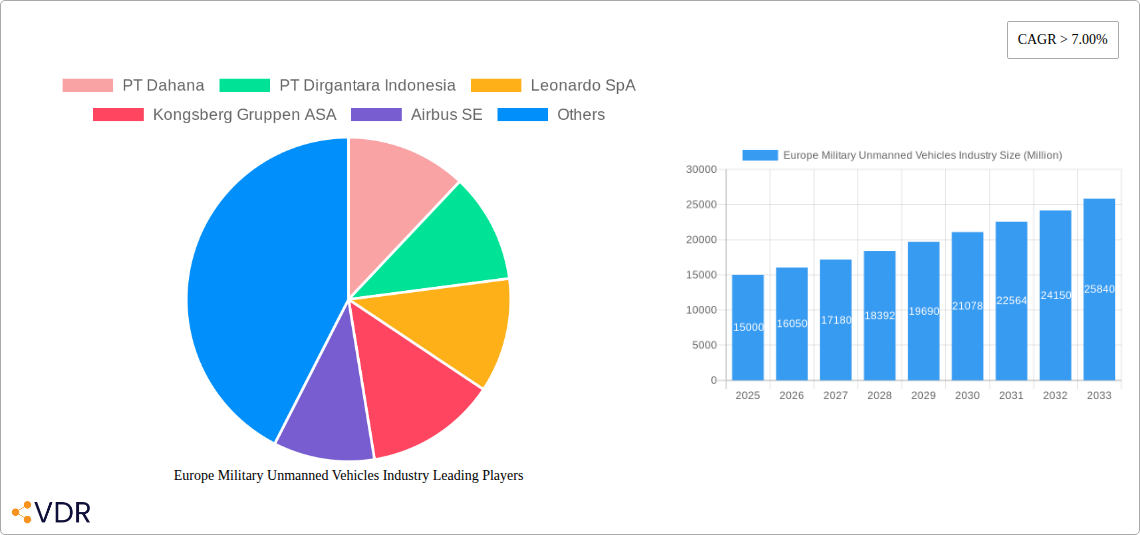

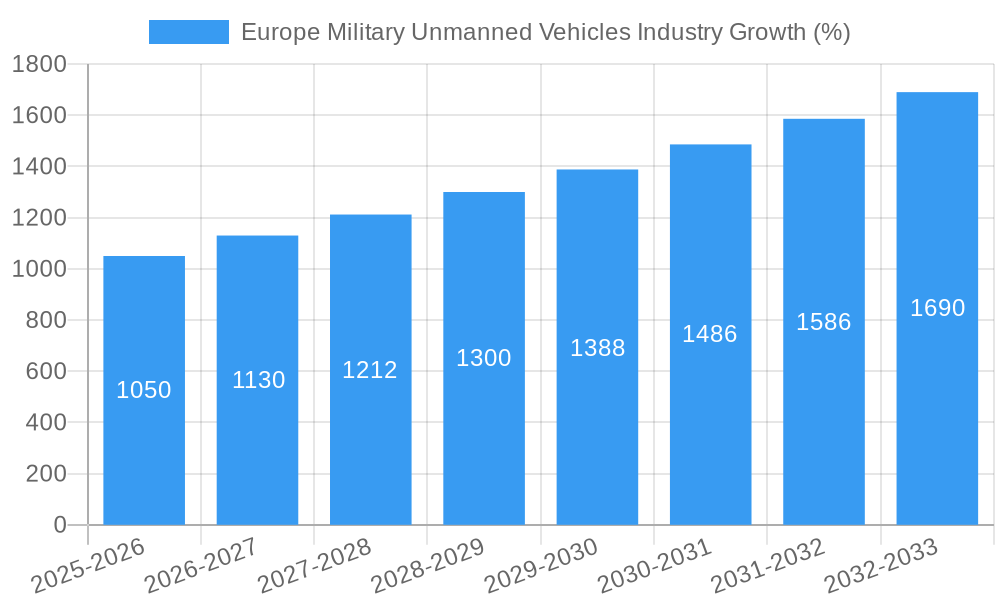

The European military unmanned vehicles (UAV) market, encompassing unmanned aerial, ground, surface, and underwater vehicles, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing defense budgets across European nations, particularly in response to geopolitical instability and evolving warfare tactics, are significantly boosting investment in advanced military technologies, including unmanned systems. Secondly, the inherent advantages of UAVs—reduced risk to human personnel, enhanced operational flexibility, and cost-effectiveness in certain missions—are driving their adoption across various military applications, from surveillance and reconnaissance to precision strikes and mine countermeasures. Furthermore, technological advancements in areas such as artificial intelligence, autonomous navigation, and payload capacity are continuously improving the capabilities and operational effectiveness of these systems, further fueling market growth. Competitive pressures among major European defense contractors are also spurring innovation and driving down costs, making these systems more accessible to various military branches.

Despite the positive outlook, the market faces certain challenges. Stringent regulatory frameworks governing the development, deployment, and operation of UAVs can create hurdles for market expansion. Concerns around cybersecurity vulnerabilities and the potential for misuse of autonomous weapons systems also pose significant restraints. Furthermore, the high initial investment costs associated with procuring and maintaining advanced UAV technology can limit adoption by smaller nations or military branches with constrained budgets. However, the long-term strategic benefits and operational advantages are expected to outweigh these challenges, maintaining a steady trajectory of growth within the forecast period. The market segmentation by vehicle type (UAVs, UGVs, USVs, and UUVs) reflects the diverse applications and evolving nature of military unmanned systems, with UAVs likely maintaining a dominant share due to their versatility and widespread adoption across various military applications. Key players such as Leonardo SpA, Kongsberg Gruppen ASA, Airbus SE, and BAE Systems PLC are leading the innovation and market share in this rapidly evolving sector.

Europe Military Unmanned Vehicles Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European military unmanned vehicles (UMV) industry, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities within the parent market of military defense and the child markets of Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), and Unmanned Surface and Underwater Vehicles (USUVs). The report leverages extensive data analysis to provide actionable insights for industry professionals, investors, and strategic decision-makers. The base year is 2025, with the forecast period extending to 2033, providing a long-term perspective on market evolution. Market values are presented in million units.

Europe Military Unmanned Vehicles Industry Market Dynamics & Structure

This section provides a comprehensive analysis of the competitive landscape, technological advancements, regulatory environment, and evolving market trends within the dynamic European military unmanned vehicle (UMV) industry. We meticulously examine market concentration, identifying key industry players and their respective market share percentages to understand the competitive intensity. The analysis further explores the significant impact of Mergers & Acquisitions (M&A) activities, quantifying deal volumes and assessing their profound influence on shaping the overall market structure.

Technological innovation serves as a primary driver for market growth, with a particular focus on advancements in Artificial Intelligence (AI) integration and the development of sophisticated autonomous capabilities. These advancements are scrutinized alongside the intricate regulatory frameworks governing UMV deployment and operation, and their subsequent effects on market expansion. The presence of competitive product substitutes, such as advanced manned systems, and their potential to disrupt specific UMV segments are also thoroughly assessed. Finally, the report delves into the end-user demographics within the European military, analyzing their evolving operational needs and strategic preferences that are increasingly driving the adoption and development of advanced UMV solutions.

- Market Concentration: The European military UMV market is characterized by a moderately concentrated structure, with a select group of major players dominating specific market segments. In 2025, the top 5 players collectively controlled approximately [Insert %] of the market share, indicating a consolidated yet competitive environment.

- Technological Innovation: Remarkable advancements in AI algorithms, cutting-edge sensor technologies, and sophisticated autonomous navigation systems are collectively propelling significant market growth. However, challenges related to seamless system integration and the substantial research and development (R&D) costs associated with these innovations continue to present barriers to widespread adoption and rapid innovation.

- Regulatory Landscape: The implementation of stringent regulations pertaining to UMV deployment, operational protocols, and data security significantly influences market dynamics. A crucial factor for fostering sustained market growth and facilitating broader adoption across European nations is the ongoing harmonization of these diverse regulatory frameworks.

- M&A Activity: The period between 2019 and 2024 witnessed a notable increase of approximately [Insert %] in M&A deals within the European military UMV sector. This surge was primarily fueled by a strategic drive towards technological consolidation and an ambition to expand market reach and capabilities. During this timeframe, [Insert Number] major acquisition and merger deals were successfully completed.

- Competitive Substitutes: The emergence and refinement of alternative technologies, particularly advanced manned systems equipped with sophisticated capabilities, pose a discernible competitive threat to certain UMV segments, necessitating continuous innovation and differentiation.

- End-User Demographics: The European military's escalating demand for enhanced capabilities in surveillance, reconnaissance, intelligence gathering, and precision combat operations is a primary catalyst for the accelerated adoption of unmanned vehicle systems across various branches.

Europe Military Unmanned Vehicles Industry Growth Trends & Insights

This section details the evolution of the European military UMV market size, analyzing historical data (2019-2024) and forecasting future growth (2025-2033). We examine adoption rates across different UMV types (UAVs, UGVs, USUVs) and analyze the influence of technological disruptions on market dynamics. Consumer behavior shifts within the European military, in terms of procurement preferences and operational strategies, are incorporated into the analysis. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates are provided to quantify the growth trajectory. The analysis utilizes a combination of quantitative data and qualitative insights.

[Insert 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, including specific metrics like CAGR and market penetration rates. Include relevant data points and projections]

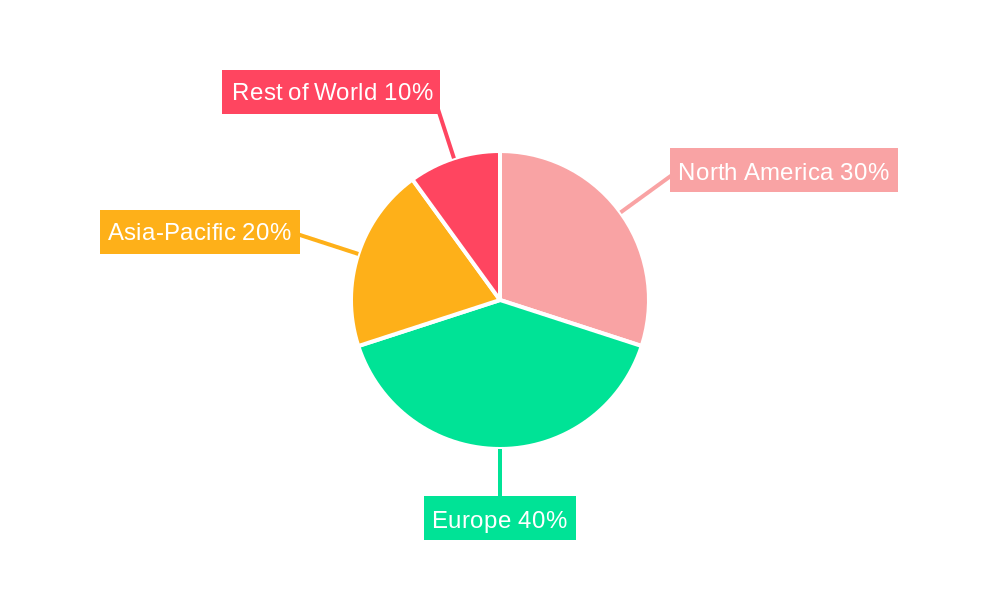

Dominant Regions, Countries, or Segments in Europe Military Unmanned Vehicles Industry

This section meticulously identifies and analyzes the leading regions, countries, and specific UMV segments (including Unmanned Aerial Vehicles - UAVs, Unmanned Ground Vehicles - UGVs, and Unmanned Surface/Subsurface Vehicles - USUVs) that are currently spearheading market growth within the European continent. The analysis considers a confluence of factors contributing to this dominance, including progressive economic policies that actively support defense expenditure, the availability of robust infrastructure that facilitates the efficient development and deployment of UMVs, and the presence of a highly skilled and specialized workforce concentrated in particular regions. Crucial aspects of this analysis also encompass a detailed evaluation of market share distribution and the projected growth potential within these dominant areas.

- Dominant Segment: Unmanned Aerial Vehicles (UAVs) currently represent the largest and most influential segment within the European military UMV market, commanding an estimated [Insert %] market share in 2025. This dominance is primarily driven by the persistent and increasing demand for advanced aerial surveillance, reconnaissance, and persistent monitoring capabilities.

- Leading Countries: Key nations such as the United Kingdom, France, and Germany stand out as major consumers and developers of military UMVs. This leadership position is attributed to their substantial defense budgets, ongoing involvement in international security operations, and proactive governmental support for advanced defense technologies. Other significant players include [Insert Other Key Countries].

- Regional Drivers: The presence of well-established and globally recognized aerospace and defense industrial clusters in regions like [Mention Specific Regions, e.g., Nouvelle-Aquitaine in France, Bavaria in Germany, South East England in the UK], coupled with targeted governmental initiatives designed to foster the research, development, and widespread adoption of UMVs, contribute significantly to the overall market growth and innovation landscape.

[Insert 600-word detailed analysis of regional and segment dominance factors including market share and growth potential. Use detailed examples and insights. This section should delve deeper into specific government procurement programs, key technological hubs, leading research institutions, and the strategic military doctrines influencing UMV adoption in each dominant region and segment. For instance, discuss the UK's focus on drone swarms, France's investments in multi-role UAVs, and Germany's emphasis on secure communication for UGVs. Analyze the market share breakdown within UAVs (e.g., tactical, strategic, micro-UAVs) and the growth drivers for UGVs in areas like logistics and route clearance. Highlight specific examples of successful UMV deployments and their impact on operational effectiveness.]

Europe Military Unmanned Vehicles Industry Product Landscape

The European military UMV market showcases a diverse range of products, each characterized by unique features and capabilities. Technological advancements, such as enhanced autonomy, improved sensor integration, and increased payload capacity, are constantly shaping the product landscape. Manufacturers are continuously striving to improve the performance metrics of their UMVs, including range, endurance, and operational reliability. Key selling propositions emphasize enhanced situational awareness, reduced risk to human personnel, and cost-effectiveness compared to traditional manned systems.

Key Drivers, Barriers & Challenges in Europe Military Unmanned Vehicles Industry

Key Drivers:

- Increasing defense budgets across several European nations.

- Growing demand for advanced surveillance and reconnaissance capabilities.

- The need for reducing human casualties in military operations.

- Technological advancements enhancing UMV performance and autonomy.

Challenges and Restraints:

- High initial investment costs associated with UMV development and acquisition.

- Concerns regarding cybersecurity vulnerabilities and data security.

- Regulatory hurdles and the need for standardized operational procedures.

- Supply chain disruptions impacting component availability and production timelines. This resulted in a xx% delay in project timelines in 2024.

Emerging Opportunities in Europe Military Unmanned Vehicles Industry

- Significant expansion into novel applications, including enhanced border security operations, sophisticated disaster relief and humanitarian aid missions, and critical infrastructure monitoring.

- Accelerated development and integration of highly autonomous UMVs empowered by advanced AI, enabling complex decision-making and mission execution with reduced human oversight.

- Seamless integration of UMVs with existing and future military platforms and networked systems to create multi-domain operational capabilities and enhance situational awareness.

- Fostering increased and more strategic collaborations between government defense agencies, military research institutions, and private sector technology developers to accelerate innovation and ensure timely delivery of cutting-edge solutions.

- Development of resilient and secure communication and control systems, crucial for operating UMVs in contested electromagnetic environments.

- Exploration of UMV roles in electronic warfare, cyber operations, and intelligence, surveillance, and reconnaissance (ISR) missions requiring persistent and adaptable platforms.

Growth Accelerators in the Europe Military Unmanned Vehicles Industry Industry

Technological breakthroughs, including advances in AI, sensor fusion, and swarm technology, will significantly accelerate long-term growth. Strategic partnerships between defense contractors and technology companies foster innovation and streamline product development. Furthermore, expanding UMV applications beyond traditional military roles into civilian sectors, such as search and rescue operations, presents a major catalyst for market expansion.

Key Players Shaping the Europe Military Unmanned Vehicles Industry Market

- Leonardo SpA

- Kongsberg Gruppen ASA

- Airbus SE

- BAE Systems PLC

- SCYTALYS SA

- Thales Group

- SAAB AB

- MBDA

- General Atomics Aeronautical Systems (while US-based, a significant player in the European market through partnerships and sales)

- Elbit Systems Ltd. (similarly, a key international player with a strong European presence)

Notable Milestones in Europe Military Unmanned Vehicles Industry Sector

- November 2021: The UK received a new General Atomics Aeronautical Systems Inc. (GA-ASI) MQ-9A Reaper UAV, signifying a significant step towards enhancing its surveillance and strike capabilities.

- June 2021: France announced plans to procure additional MQ-9 Reaper Block 5 UAVs, reinforcing its commitment to expanding its unmanned aerial capabilities. This purchase signaled a focus on expanding its armed UAV fleet.

In-Depth Europe Military Unmanned Vehicles Industry Market Outlook

The European military UMV market is on a trajectory for robust and sustained growth, propelled by a confluence of factors including relentless technological advancements, steadily increasing defense budgets across key European nations, and the ever-expanding range of applications for unmanned systems in modern warfare and security operations. Strategic partnerships between industry leaders and defense ministries, coupled with focused R&D investments aimed at developing next-generation autonomous capabilities and advanced sensor technologies, will be pivotal in driving continued market expansion.

Companies that proactively invest in and demonstrate expertise in developing sophisticated autonomous systems, artificial intelligence integration, and advanced sensor payloads are best positioned to capture a significant share of this burgeoning market. The long-term outlook for the European military UMV sector is overwhelmingly positive, presenting substantial opportunities for innovation, market leadership, and strategic expansion within the continent's evolving defense landscape. Emerging trends such as the increasing demand for unmanned systems in multi-domain operations, counter-drone technologies, and AI-driven tactical decision support will further shape the market's future trajectory.

Europe Military Unmanned Vehicles Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Military Unmanned Vehicles Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Military Unmanned Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Increasing Autonomy in Land Defense Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Military Unmanned Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PT Dahana

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PT Dirgantara Indonesia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Leonardo SpA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Kongsberg Gruppen ASA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Airbus SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Daewoo Shipbuilding & Marine Engineering Co Lt

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BAE Systems PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PT Pindad

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SCYTALYS SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PT Len Industri

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 FINCANTIERI SpA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 PT PAL Indonesia

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 PT Dahana

List of Figures

- Figure 1: Europe Military Unmanned Vehicles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Military Unmanned Vehicles Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Military Unmanned Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Military Unmanned Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Military Unmanned Vehicles Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Europe Military Unmanned Vehicles Industry?

Key companies in the market include PT Dahana, PT Dirgantara Indonesia, Leonardo SpA, Kongsberg Gruppen ASA, Airbus SE, Daewoo Shipbuilding & Marine Engineering Co Lt, BAE Systems PLC, PT Pindad, SCYTALYS SA, PT Len Industri, FINCANTIERI SpA, PT PAL Indonesia.

3. What are the main segments of the Europe Military Unmanned Vehicles Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Increasing Autonomy in Land Defense Vehicles.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

In November 2021, the UK received a new General Atomics Aeronautical Systems Inc. (GA-ASI) MQ-9A Reaper unmanned aerial vehicle (UAV).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Military Unmanned Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Military Unmanned Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Military Unmanned Vehicles Industry?

To stay informed about further developments, trends, and reports in the Europe Military Unmanned Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence