Key Insights

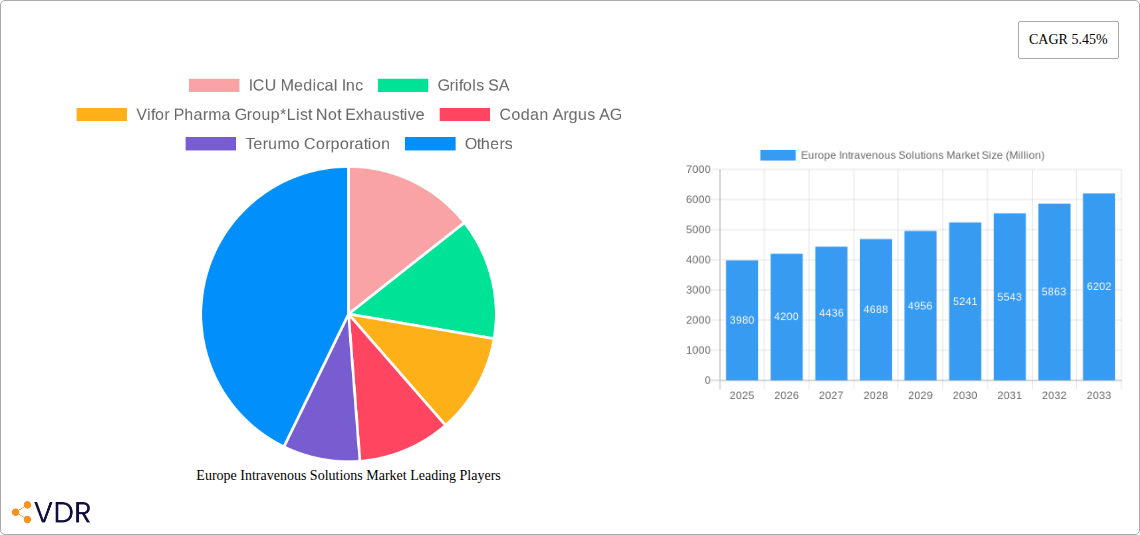

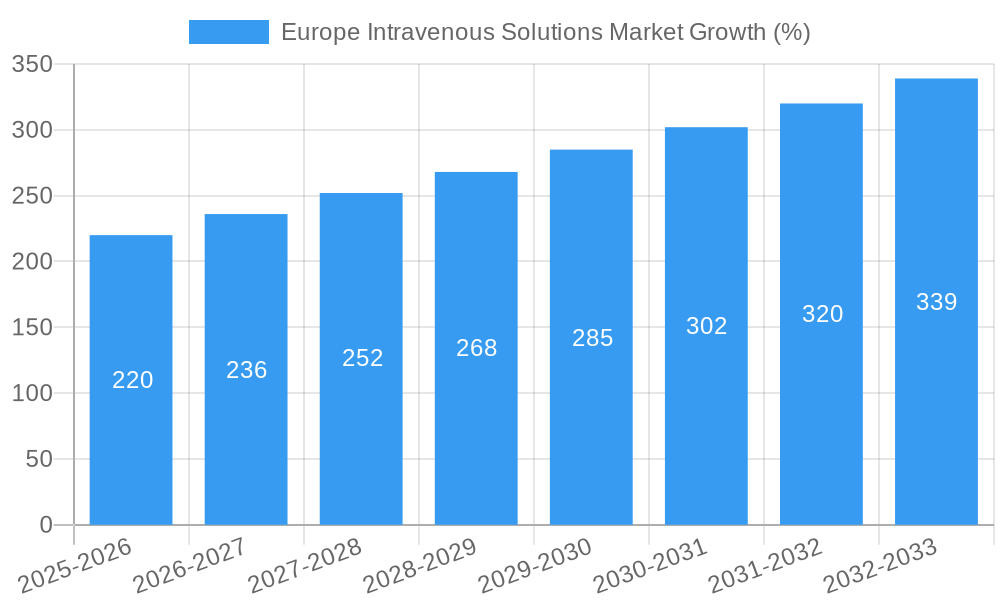

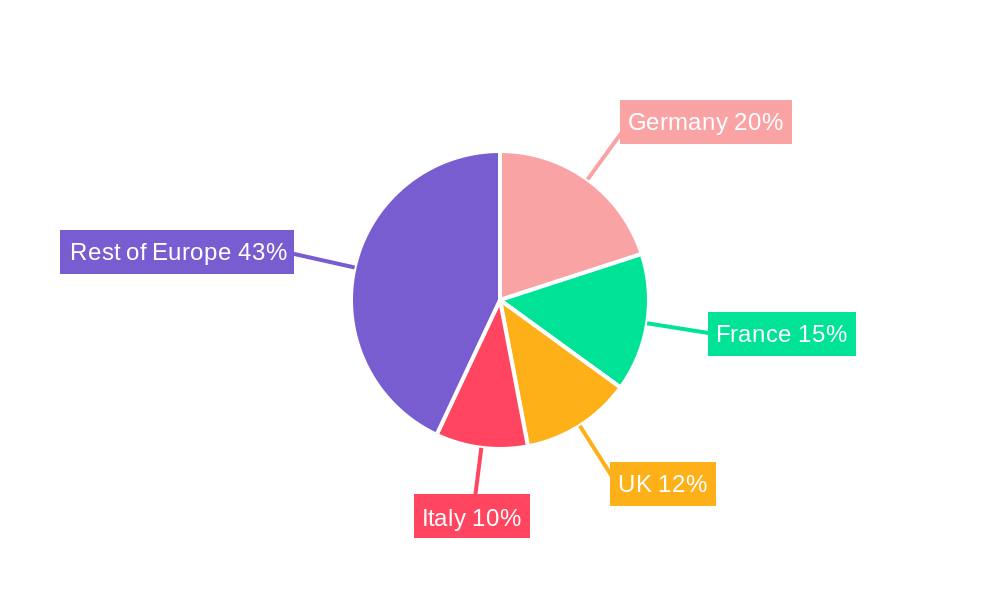

The European intravenous (IV) solutions market, valued at €3.98 billion in 2025, is projected to experience robust growth, driven by a rising elderly population necessitating increased hospitalizations and a surge in chronic diseases like diabetes and cancer requiring intravenous therapies. The market's Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033 indicates substantial expansion. Key segments driving this growth include total parenteral nutrition (TPN) and peripheral parenteral nutrition (PPN), catering to diverse patient needs. Within solution compositions, saline solutions maintain significant market share due to their widespread use in hydration and medication delivery. However, the increasing prevalence of complex medical conditions fuels demand for nutrient-rich solutions like those containing carbohydrates, vitamins, and minerals. The competitive landscape is characterized by both established multinational corporations like Fresenius Kabi AG, Baxter International Inc., and B. Braun Melsungen AG, and regional players catering to specific market niches. Germany, France, and the UK represent major market segments within Europe, reflecting higher healthcare expenditures and advanced medical infrastructure in these regions. Market restraints include stringent regulatory requirements for IV solutions and potential pricing pressures from generic drug manufacturers. The market's future growth will likely be influenced by technological advancements in IV delivery systems, such as smart infusion pumps enhancing patient safety and reducing medication errors.

The forecast period (2025-2033) promises continued market expansion, fueled by advancements in IV solution formulations, particularly those incorporating specialized nutrients tailored to individual patient needs. Furthermore, increased focus on home healthcare and outpatient settings will drive demand for convenient and safe at-home IV therapy options. This will likely shift the balance somewhat from hospital-centric TPN towards more PPN-focused solutions. Ongoing research and development in biosimilar IV solutions could also influence market dynamics and potentially disrupt pricing structures. Growth is anticipated across all major segments, though the exact pace will depend on factors such as economic conditions within individual European countries, shifts in healthcare policies, and the successful launch of innovative IV solutions.

Europe Intravenous Solutions Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe intravenous solutions market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by type (Total Parenteral Nutrition, Peripheral Parenteral Nutrition) and solution composition (Saline, Carbohydrates, Vitamins and Minerals, Other Solution Compositions). Key players include ICU Medical Inc, Grifols SA, Vifor Pharma Group, Codan Argus AG, Terumo Corporation, Fresenius Kabi AG, B Braun Melsungen AG, Amanta Healthcare Ltd, Baxter International Inc, Sichuan Kelun Pharmaceutical Co Ltd, and Otsuka Pharmaceutical Co Ltd. The report's value is presented in million units.

Europe Intravenous Solutions Market Market Dynamics & Structure

The European intravenous solutions market exhibits a moderately concentrated structure, with several large multinational companies holding significant market share. Technological innovation, driven by advancements in drug delivery systems and improved solution formulations, is a key growth driver. Stringent regulatory frameworks, including those set by the European Medicines Agency (EMA), influence product approvals and market access. Competitive pressures arise from both established players and emerging companies offering innovative solutions. The market also faces competition from alternative hydration methods. Mergers and acquisitions (M&A) activity has been moderate, with larger companies strategically acquiring smaller firms to expand their product portfolios and geographical reach.

- Market Concentration: xx% held by top 5 players in 2024 (estimated).

- Technological Innovation: Focus on improved bioavailability, reduced adverse effects, and smart delivery systems.

- Regulatory Landscape: EMA guidelines heavily influence market access and product development.

- Competitive Substitutes: Oral rehydration solutions and other fluid replacement therapies.

- End-User Demographics: Predominantly hospitals and clinics, with growing demand from home healthcare settings.

- M&A Activity: xx deals recorded between 2019 and 2024 (estimated).

Europe Intravenous Solutions Market Growth Trends & Insights

The European intravenous solutions market experienced steady growth during the historical period (2019-2024), driven by factors such as increasing prevalence of chronic diseases, rising geriatric population, and advancements in healthcare infrastructure. The market size reached xx million units in 2024 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by several factors including increased demand for efficient drug delivery systems, growing preference for home healthcare solutions, and technological innovations in IV solutions. Adoption rates have generally increased across various healthcare settings, although penetration remains comparatively lower in certain regions. Technological disruptions, particularly in areas such as smart IV infusion pumps and improved monitoring systems, will continue to shape market growth. Shifting consumer preferences towards convenient and less invasive delivery methods represent a significant market trend.

Dominant Regions, Countries, or Segments in Europe Intravenous Solutions Market

Germany, France, and the UK are currently the leading markets within Europe, accounting for a significant share of the overall market size. The growth in these regions is primarily driven by robust healthcare infrastructure, high healthcare expenditure, and a large aging population. Within the product segmentation, Total Parenteral Nutrition (TPN) holds a larger market share compared to Peripheral Parenteral Nutrition (PPN), primarily due to its wider applications in critical care settings. Similarly, saline solutions constitute the largest share within the solution composition segment, owing to its widespread use in fluid replacement therapies.

- Key Drivers (Germany, France, UK): Well-developed healthcare infrastructure, high healthcare expenditure per capita, large geriatric population.

- Growth Potential: Eastern European countries present significant growth opportunities due to increasing healthcare investments and rising awareness about intravenous therapies.

- Market Share: Germany and France hold the largest shares within the European market (estimated xx% and xx% respectively).

Europe Intravenous Solutions Market Product Landscape

The intravenous solutions market features a range of products, differentiated by solution composition, delivery systems, and intended applications. Innovation focuses on improving patient comfort, reducing infusion time, and minimizing adverse effects. Products with enhanced bioavailability, reduced irritation potential, and smart delivery features represent significant advancements. Key selling propositions emphasize efficacy, safety, convenience, and improved patient outcomes.

Key Drivers, Barriers & Challenges in Europe Intravenous Solutions Market

Key Drivers: The market is propelled by factors like the growing prevalence of chronic diseases requiring intravenous therapy, an aging population necessitating increased healthcare services, and ongoing technological advancements resulting in safer and more efficient intravenous solutions. Favorable government policies promoting healthcare infrastructure development also contribute positively.

Challenges: The market faces obstacles, including stringent regulatory approvals, potential supply chain disruptions, and intense price competition among various market participants. High production costs also affect profitability, further influenced by varying reimbursement policies across different European nations.

Emerging Opportunities in Europe Intravenous Solutions Market

Emerging opportunities lie in personalized medicine approaches, targeted drug delivery systems, and the expansion into home healthcare settings. The development of innovative solutions for specific patient needs, such as those with rare diseases, presents considerable growth potential. The increasing demand for convenient and user-friendly home infusion systems is expected to fuel further market expansion. Furthermore, focusing on improved patient adherence through technological innovation can unlock significant opportunities.

Growth Accelerators in the Europe Intravenous Solutions Market Industry

Technological breakthroughs in areas such as smart infusion pumps, improved monitoring systems, and personalized formulations are crucial accelerators of market growth. Strategic partnerships between manufacturers, healthcare providers, and technology companies can unlock further innovation and market penetration. Market expansion strategies targeting underserved populations and expanding into emerging European countries present significant growth potential.

Key Players Shaping the Europe Intravenous Solutions Market Market

- ICU Medical Inc

- Grifols SA

- Vifor Pharma Group

- Codan Argus AG

- Terumo Corporation

- Fresenius Kabi AG

- B Braun Melsungen AG

- Amanta Healthcare Ltd

- Baxter International Inc

- Sichuan Kelun Pharmaceutical Co Ltd

- Otsuka Pharmaceutical Co Ltd

Notable Milestones in Europe Intravenous Solutions Market Sector

- September 2023: ivWatch LLC expands its technology offerings in the UK market through a partnership with Healthcare 21 Group, boosting patient safety monitoring.

- March 2024: Unilever Health & Wellbeing launches Liquid I.V. in the UK, introducing an innovative electrolyte powder to the market.

In-Depth Europe Intravenous Solutions Market Market Outlook

The future of the European intravenous solutions market appears bright, driven by sustained technological advancements, an aging population, and increased focus on improving patient care. Strategic opportunities exist for companies that can successfully navigate the regulatory landscape, optimize their supply chains, and develop innovative products meeting evolving patient needs. Focus on personalized solutions and home healthcare applications promises significant returns for forward-thinking companies.

Europe Intravenous Solutions Market Segmentation

-

1. Type

- 1.1. Total Parenteral Nutrition

- 1.2. Peripheral Parenteral Nutrition

-

2. Solution Composition

- 2.1. Saline

- 2.2. Carbohydrates

- 2.3. Vitamins and Minerals

- 2.4. Other Solution Compositions

Europe Intravenous Solutions Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Intravenous Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Diseases

- 3.2.2 such as Gastrointestinal Disorder

- 3.2.3 Neurological Diseases

- 3.2.4 and Cancer; Advancements and New Innovations in the Products for Patient Convenience

- 3.3. Market Restrains

- 3.3.1. Regulatory and Quality Requirements

- 3.4. Market Trends

- 3.4.1. Total Parenteral Nutrition Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Total Parenteral Nutrition

- 5.1.2. Peripheral Parenteral Nutrition

- 5.2. Market Analysis, Insights and Forecast - by Solution Composition

- 5.2.1. Saline

- 5.2.2. Carbohydrates

- 5.2.3. Vitamins and Minerals

- 5.2.4. Other Solution Compositions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Total Parenteral Nutrition

- 6.1.2. Peripheral Parenteral Nutrition

- 6.2. Market Analysis, Insights and Forecast - by Solution Composition

- 6.2.1. Saline

- 6.2.2. Carbohydrates

- 6.2.3. Vitamins and Minerals

- 6.2.4. Other Solution Compositions

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Total Parenteral Nutrition

- 7.1.2. Peripheral Parenteral Nutrition

- 7.2. Market Analysis, Insights and Forecast - by Solution Composition

- 7.2.1. Saline

- 7.2.2. Carbohydrates

- 7.2.3. Vitamins and Minerals

- 7.2.4. Other Solution Compositions

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Total Parenteral Nutrition

- 8.1.2. Peripheral Parenteral Nutrition

- 8.2. Market Analysis, Insights and Forecast - by Solution Composition

- 8.2.1. Saline

- 8.2.2. Carbohydrates

- 8.2.3. Vitamins and Minerals

- 8.2.4. Other Solution Compositions

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Total Parenteral Nutrition

- 9.1.2. Peripheral Parenteral Nutrition

- 9.2. Market Analysis, Insights and Forecast - by Solution Composition

- 9.2.1. Saline

- 9.2.2. Carbohydrates

- 9.2.3. Vitamins and Minerals

- 9.2.4. Other Solution Compositions

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Total Parenteral Nutrition

- 10.1.2. Peripheral Parenteral Nutrition

- 10.2. Market Analysis, Insights and Forecast - by Solution Composition

- 10.2.1. Saline

- 10.2.2. Carbohydrates

- 10.2.3. Vitamins and Minerals

- 10.2.4. Other Solution Compositions

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Total Parenteral Nutrition

- 11.1.2. Peripheral Parenteral Nutrition

- 11.2. Market Analysis, Insights and Forecast - by Solution Composition

- 11.2.1. Saline

- 11.2.2. Carbohydrates

- 11.2.3. Vitamins and Minerals

- 11.2.4. Other Solution Compositions

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Germany Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Intravenous Solutions Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 ICU Medical Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Grifols SA

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Vifor Pharma Group*List Not Exhaustive

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Codan Argus AG

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Terumo Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Fresenius Kabi AG

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 B Braun Melsungen AG

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Amanta Healthcare Ltd

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Baxter International Inc

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Sichuan Kelun Pharmaceutical Co Ltd

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Otsuka Pharmaceutical Co Ltd

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.1 ICU Medical Inc

List of Figures

- Figure 1: Europe Intravenous Solutions Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Intravenous Solutions Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Intravenous Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 4: Europe Intravenous Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Intravenous Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 15: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 18: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 21: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 24: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 27: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Intravenous Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Europe Intravenous Solutions Market Revenue Million Forecast, by Solution Composition 2019 & 2032

- Table 30: Europe Intravenous Solutions Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Intravenous Solutions Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Europe Intravenous Solutions Market?

Key companies in the market include ICU Medical Inc, Grifols SA, Vifor Pharma Group*List Not Exhaustive, Codan Argus AG, Terumo Corporation, Fresenius Kabi AG, B Braun Melsungen AG, Amanta Healthcare Ltd, Baxter International Inc, Sichuan Kelun Pharmaceutical Co Ltd, Otsuka Pharmaceutical Co Ltd.

3. What are the main segments of the Europe Intravenous Solutions Market?

The market segments include Type, Solution Composition.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Diseases. such as Gastrointestinal Disorder. Neurological Diseases. and Cancer; Advancements and New Innovations in the Products for Patient Convenience.

6. What are the notable trends driving market growth?

Total Parenteral Nutrition Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Regulatory and Quality Requirements.

8. Can you provide examples of recent developments in the market?

March 2024: Unilever Health & Wellbeing's expansion into the United Kingdom marked the debut of Liquid I.V. Liquid I.V.'s innovative electrolyte powder formula enhances hydration efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Intravenous Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Intravenous Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Intravenous Solutions Market?

To stay informed about further developments, trends, and reports in the Europe Intravenous Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence