Key Insights

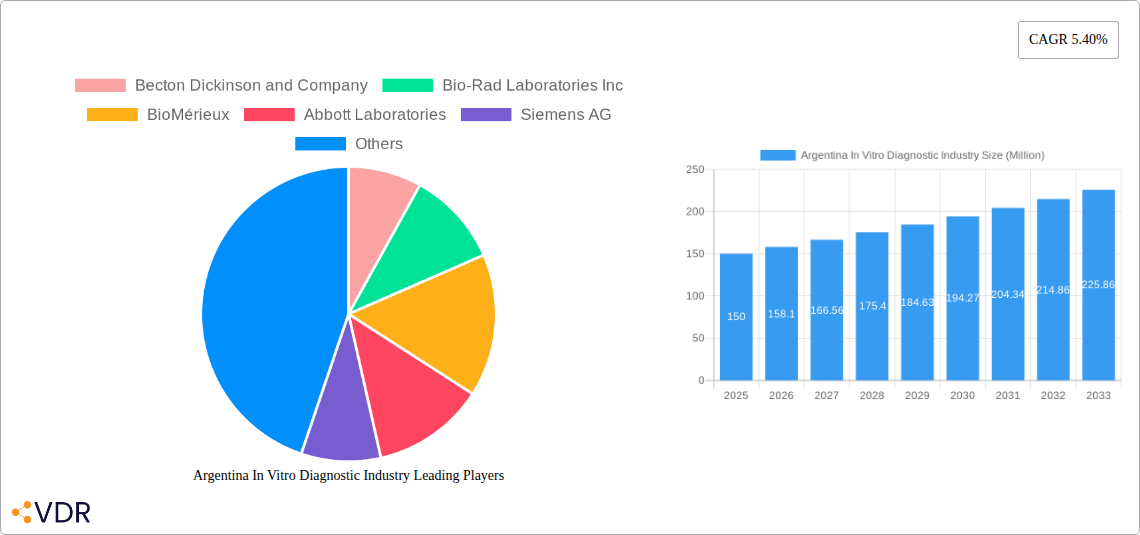

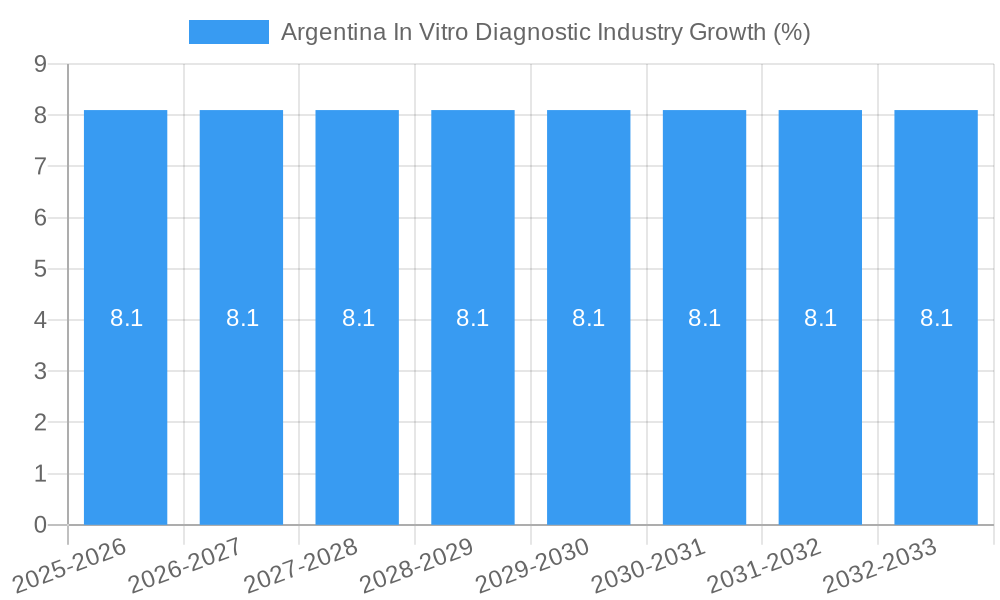

The Argentina In Vitro Diagnostic (IVD) market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular ailments, coupled with an expanding healthcare infrastructure. The market's 5.40% Compound Annual Growth Rate (CAGR) from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include increased government initiatives to improve healthcare access, rising disposable incomes leading to greater healthcare spending, and a growing awareness among the population regarding preventive healthcare and early diagnosis. The market is segmented by various factors, including usability (disposable vs. reusable devices), application (infectious diseases, oncology, etc.), end-users (hospitals, diagnostic labs), test type (clinical chemistry, molecular diagnostics), and product type (instruments, reagents). While a lack of skilled professionals in certain regions might present a challenge, the overall positive outlook is driven by increasing demand for accurate and timely diagnostic testing, technological advancements in IVD technologies (such as point-of-care diagnostics), and the entry of major international players like Becton Dickinson, Abbott Laboratories, and Roche Diagnostics into the Argentinian market, fostering competition and innovation.

The dominance of certain segments, such as clinical chemistry and infectious disease testing, is expected to continue, although the molecular diagnostics segment is poised for substantial growth due to its increasing application in personalized medicine and advanced diagnostics. The increasing adoption of advanced technologies and automation in diagnostic laboratories will also contribute significantly to market growth. Competition is expected to intensify among both local and international players, leading to innovative product development, competitive pricing strategies, and a focus on improving service offerings to maintain market share. The market's future trajectory indicates considerable potential for expansion, spurred by continuous improvements in healthcare infrastructure, technological advancements, and a greater emphasis on early diagnosis and preventative healthcare in Argentina.

Argentina In Vitro Diagnostic (IVD) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Argentina In Vitro Diagnostic (IVD) industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and emerging opportunities within the Argentinan IVD landscape. The report leverages rigorous data analysis and expert insights to provide a clear picture of this evolving market.

Argentina In Vitro Diagnostic Industry Market Dynamics & Structure

The Argentinan IVD market is characterized by a moderate level of concentration, with several multinational corporations and local players vying for market share. Technological innovation, particularly in molecular diagnostics and point-of-care testing, is a significant driver of growth. The regulatory landscape, governed by the ANMAT (Administración Nacional de Medicamentos, Alimentos y Tecnología Médica), plays a crucial role in shaping market access and product approvals. The market also sees competition from substitute products and services, particularly in areas like telehealth and home-based diagnostics. The demographic profile of Argentina, with a growing elderly population and increasing prevalence of chronic diseases, contributes to the demand for IVD services. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with a focus on strategic partnerships and expansion rather than large-scale consolidation. The total value of M&A deals between 2019-2024 is estimated at XX million.

- Market Concentration: Moderately concentrated, with xx% market share held by top 5 players in 2024.

- Technological Innovation: Significant growth driven by advancements in molecular diagnostics and point-of-care testing.

- Regulatory Framework: ANMAT regulations influence market access and product approvals.

- Competitive Substitutes: Telehealth and home-based diagnostics pose competitive pressure.

- End-User Demographics: Growing elderly population fuels demand for IVD services.

- M&A Activity: Moderate activity focused on strategic partnerships and expansion, with a total deal value of XX million between 2019-2024.

Argentina In Vitro Diagnostic Industry Growth Trends & Insights

The Argentinan IVD market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of XX million in 2024. This growth is attributed to factors such as increased healthcare spending, rising prevalence of chronic diseases, and technological advancements. Adoption rates for advanced diagnostic technologies, such as molecular diagnostics, have been increasing steadily. Technological disruptions, particularly the introduction of rapid diagnostic tests during the COVID-19 pandemic, have significantly impacted market dynamics. Consumer behavior has shifted towards a preference for faster, more accurate, and convenient diagnostic tests. The projected CAGR for the forecast period (2025-2033) is xx%, with the market expected to reach XX million by 2033. Market penetration of key technologies continues to grow, with molecular diagnostics expected to witness significant expansion.

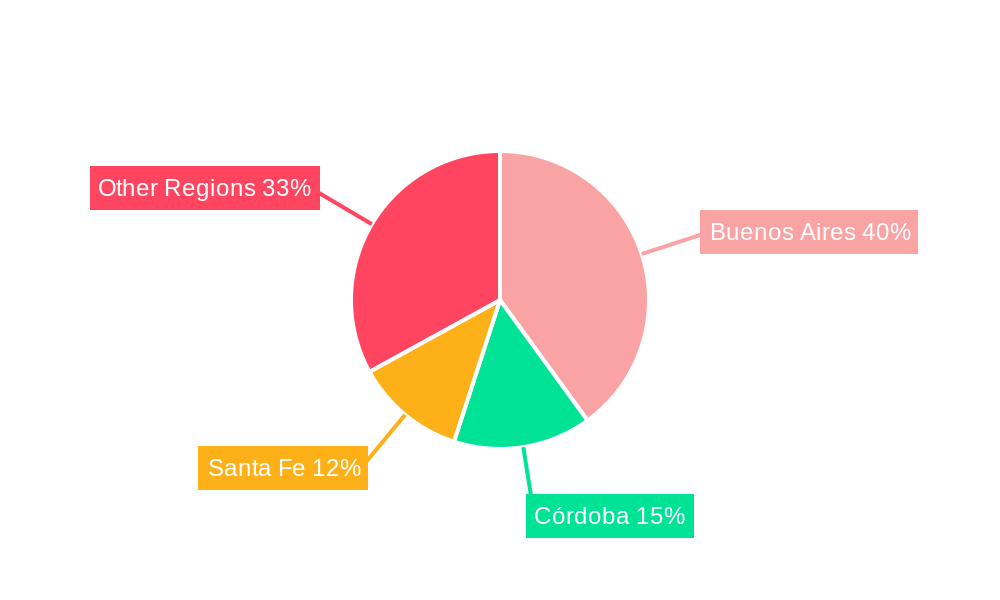

Dominant Regions, Countries, or Segments in Argentina In Vitro Diagnostic Industry

The Buenos Aires metropolitan area dominates the Argentinan IVD market, accounting for approximately xx% of total revenue in 2024. This dominance stems from factors such as higher healthcare infrastructure density and concentration of major hospitals and diagnostic laboratories. Within the segment breakdown, the Disposable IVD Devices segment leads by market share (xx%) owing to cost-effectiveness and convenience. The Infectious Disease application segment showed the strongest growth during the historical period, driven largely by the COVID-19 pandemic. Diagnostic Laboratories constitute the largest end-user segment, reflecting the centralized nature of diagnostic testing in Argentina. Clinical Chemistry remains the leading test type due to its widespread application in routine diagnostics. The Reagent segment holds the largest market share in the product category due to the high volume of tests performed.

- Key Drivers: Higher healthcare infrastructure concentration in Buenos Aires, cost-effectiveness of disposable devices, rising prevalence of infectious diseases.

- Dominant Segments: Disposable IVD Devices, Infectious Disease applications, Diagnostic Laboratories as end-users, Clinical Chemistry test type, Reagent products.

Argentina In Vitro Diagnostic Industry Product Landscape

The Argentinan IVD market showcases a diverse range of products, from traditional instruments and reagents to advanced molecular diagnostic systems and rapid diagnostic tests. Recent product innovations focus on improving accuracy, speed, and ease of use, with an emphasis on point-of-care diagnostics to facilitate faster patient care. Key performance indicators (KPIs) include sensitivity, specificity, turnaround time, and cost-effectiveness. Unique selling propositions often involve improved analytical performance, integrated data management systems, and simplified workflows. Technological advancements center on automation, miniaturization, and the integration of artificial intelligence (AI) for improved diagnostic accuracy and efficiency.

Key Drivers, Barriers & Challenges in Argentina In Vitro Diagnostic Industry

Key Drivers: The increasing prevalence of chronic diseases, growing healthcare expenditure, government initiatives to improve healthcare access, and technological advancements in diagnostics are driving market growth. The rise of personalized medicine and the need for faster diagnostics are also pushing demand.

Challenges and Restraints: Economic instability in Argentina can lead to fluctuations in healthcare spending, impacting market growth. Strict regulatory requirements and high import tariffs can hinder market entry for international players. Limited reimbursement policies for certain diagnostic tests also constrain market growth. Furthermore, supply chain disruptions and the availability of skilled professionals pose operational challenges. The estimated impact of these restraints on market growth is approximately xx% in 2024.

Emerging Opportunities in Argentina In Vitro Diagnostic Industry

Significant opportunities exist in expanding point-of-care diagnostics, particularly in underserved rural areas. There is growing potential for telehealth integration with IVD services to improve access to testing in remote locations. The increasing prevalence of chronic conditions creates opportunities for specialized diagnostics, such as early cancer detection and personalized medicine approaches. Furthermore, the increasing adoption of digital health technologies and data analytics offers significant scope for innovative business models.

Growth Accelerators in the Argentina In Vitro Diagnostic Industry

Technological advancements, especially in areas like molecular diagnostics and automation, will continue to fuel market growth. Strategic partnerships between international IVD companies and local distributors will enhance market penetration. Government initiatives focused on improving healthcare infrastructure and access to diagnostics will create a favorable environment for market expansion. The focus on improving diagnostic efficiency and patient outcomes will drive demand for high-quality IVD products and services.

Key Players Shaping the Argentina In Vitro Diagnostic Market

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- BioMérieux

- Abbott Laboratories

- Siemens AG

- ARKRAY Inc

- Danaher Corporation

- Thermo Fisher Scientific

- QIAGEN

- Roche Diagnostics

Notable Milestones in Argentina In Vitro Diagnostic Industry Sector

- August 2020: The Schep SARS-CoV-2 RT-PCR Duo, a novel kit for the identification of the SARS-CoV-2 virus, was approved by the ANMAT.

- October 2020: Siemens Healthineers AG launched a rapid antigen test for the detection of SARS-CoV-2 virus infection.

In-Depth Argentina In Vitro Diagnostic Industry Market Outlook

The Argentinan IVD market is poised for sustained growth, driven by technological innovation, increasing healthcare spending, and a growing focus on improving diagnostic capabilities. Strategic partnerships, investments in infrastructure, and the adoption of advanced diagnostic technologies will play a pivotal role in shaping the market's future. The continued focus on personalized medicine and early disease detection presents significant opportunities for players in the IVD sector. The market is expected to witness further consolidation, with larger players potentially acquiring smaller companies to expand their product portfolios and market presence.

Argentina In Vitro Diagnostic Industry Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Hematology

- 1.5. Other Test Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End Users

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End Users

Argentina In Vitro Diagnostic Industry Segmentation By Geography

- 1. Argentina

Argentina In Vitro Diagnostic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Advanced Technologies; Increasing Awareness and Acceptance of Personalized Medicine and Companion Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations; Cumbersome Reimbursement Procedures

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina In Vitro Diagnostic Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Hematology

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End Users

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bio-Rad Laboratories Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BioMérieux

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARKRAY Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danaher Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 QIAGEN

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Roche Diagnostics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Argentina In Vitro Diagnostic Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina In Vitro Diagnostic Industry Share (%) by Company 2024

List of Tables

- Table 1: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Usability 2019 & 2032

- Table 5: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 7: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 9: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 10: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Usability 2019 & 2032

- Table 11: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 13: Argentina In Vitro Diagnostic Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina In Vitro Diagnostic Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Argentina In Vitro Diagnostic Industry?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, BioMérieux, Abbott Laboratories, Siemens AG, ARKRAY Inc, Danaher Corporation, Thermo Fisher Scientific*List Not Exhaustive, QIAGEN, Roche Diagnostics.

3. What are the main segments of the Argentina In Vitro Diagnostic Industry?

The market segments include Test Type, Product, Usability, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Advanced Technologies; Increasing Awareness and Acceptance of Personalized Medicine and Companion Diagnostics.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations; Cumbersome Reimbursement Procedures.

8. Can you provide examples of recent developments in the market?

In October 2020, Siemens Healthineers AG launched a rapid antigen test for the detection of SARS-CoV-2 virus infection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina In Vitro Diagnostic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina In Vitro Diagnostic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina In Vitro Diagnostic Industry?

To stay informed about further developments, trends, and reports in the Argentina In Vitro Diagnostic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence