Key Insights

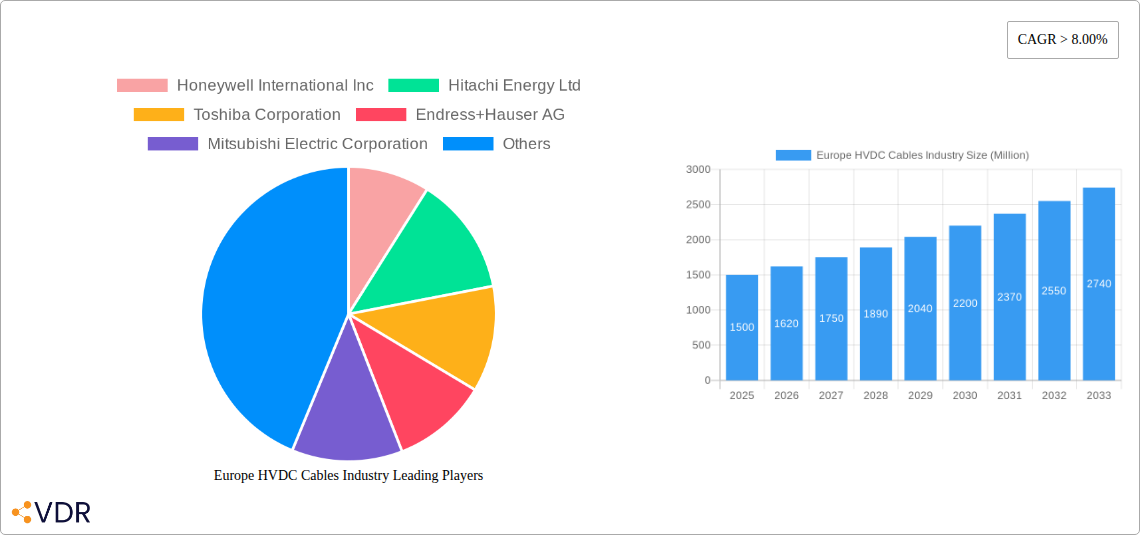

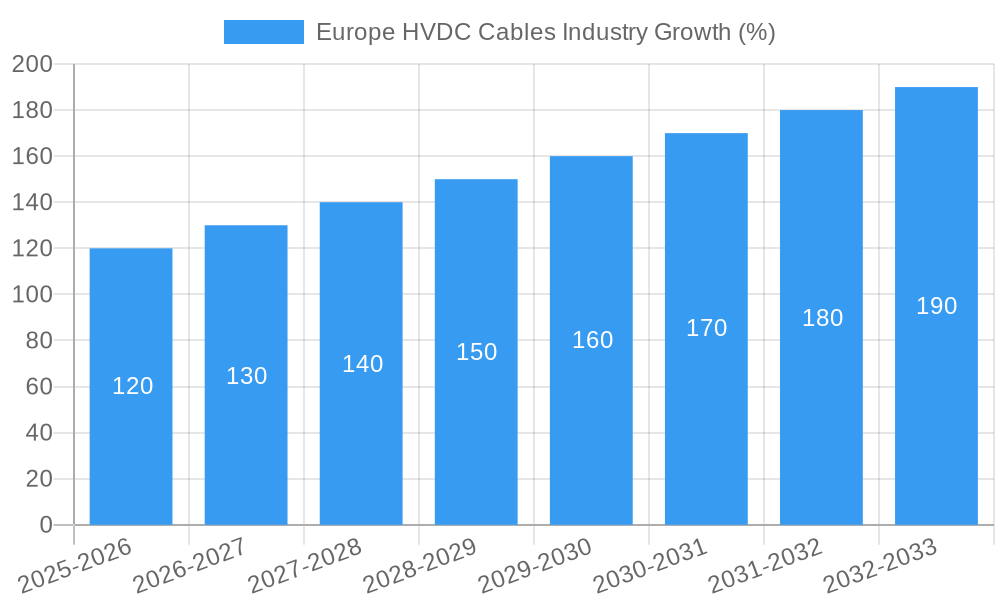

The European HVDC Cables market, valued at approximately €1.5 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is driven by the increasing demand for efficient and reliable long-distance power transmission, particularly in supporting the integration of renewable energy sources like offshore wind farms. Government initiatives promoting sustainable energy infrastructure across Europe, coupled with the need to upgrade aging grid systems, are further bolstering market growth. The submarine HVDC transmission system segment currently dominates, reflecting the significant investments in offshore wind energy projects. However, growth in the underground HVDC transmission system segment is expected to be substantial driven by increasing urbanization and the need for efficient power distribution in densely populated areas. Key players like ABB (although not explicitly listed, it's a major player in this space), Hitachi Energy, Siemens Energy, and Nexans are actively investing in R&D and capacity expansion to capitalize on this burgeoning market.

The market's growth trajectory is not without challenges. High initial investment costs associated with HVDC cable installations and the complex technical expertise required for project execution are significant restraints. Furthermore, stringent environmental regulations and permitting processes can delay project timelines and increase overall costs. Nevertheless, the long-term benefits of enhanced grid stability, reduced transmission losses, and increased capacity for renewable energy integration outweigh these obstacles, ensuring the continued expansion of the European HVDC Cables market over the forecast period. The competitive landscape is characterized by intense rivalry among established players and emerging technology providers, leading to ongoing innovation and price competition. Focus on improving cable efficiency, reducing installation time and cost, and developing more environmentally friendly materials will be key differentiators in this dynamic market.

Europe HVDC Cables Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Europe HVDC Cables industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report delves into both parent (HVDC Transmission Systems) and child markets (Submarine, Overhead, Underground HVDC Transmission Systems and Components like Converter Stations and Cables) offering granular insights.

Europe HVDC Cables Industry Market Dynamics & Structure

The European HVDC Cables market is characterized by moderate concentration, with key players like Siemens Energy AG, Hitachi Energy Ltd, and ABB (not explicitly listed but a major player) holding significant market share (estimated at xx% combined in 2025). Technological innovation, driven by the need for higher capacity and more efficient transmission, is a primary growth driver. Stringent regulatory frameworks focused on renewable energy integration and grid modernization are shaping market dynamics. Competition from AC transmission systems is present, but the advantages of HVDC, particularly for long-distance and offshore wind power integration, are solidifying its dominance. End-user demographics primarily comprise electricity grid operators and renewable energy developers. M&A activity has been moderate in recent years (xx deals in the past 5 years), with strategic acquisitions aiming to expand geographical reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2025).

- Technological Innovation: Focus on higher voltage levels, improved cable materials, and smarter grid integration.

- Regulatory Framework: Strong focus on renewable energy integration and grid modernization.

- Competitive Substitutes: AC transmission systems, facing increasing competition from HVDC's advantages in long-distance transmission.

- End-User Demographics: Electricity grid operators and renewable energy developers.

- M&A Trends: Moderate activity focused on geographical expansion and technological enhancement.

Europe HVDC Cables Industry Growth Trends & Insights

The European HVDC Cables market is experiencing robust growth, driven by the increasing demand for renewable energy integration and the expansion of offshore wind farms. The market size witnessed significant expansion during the historical period (2019-2024), growing from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This positive trend is expected to continue through the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx Million by 2033. Market penetration is increasing steadily as more countries adopt HVDC technology for their national grids. Technological disruptions, such as the development of next-generation cable materials and advanced converter stations, are further accelerating growth. Consumer behavior shifts toward greater environmental awareness and the adoption of sustainable energy solutions are underpinning the market's expansion.

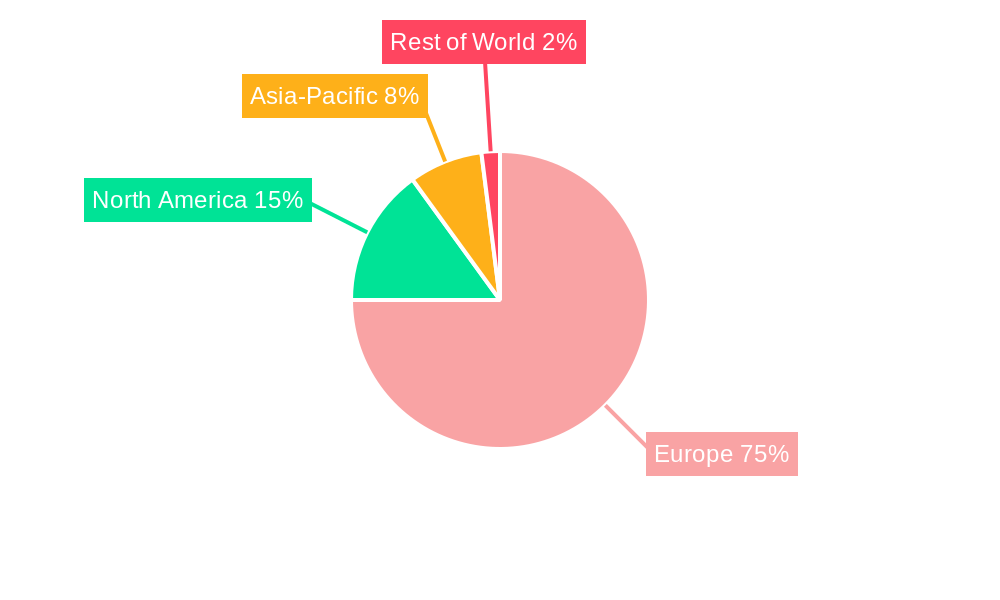

Dominant Regions, Countries, or Segments in Europe HVDC Cables Industry

The Submarine HVDC Transmission System segment dominates the market due to the rapid growth of offshore wind energy projects across the North Sea. Germany, the UK, and the Netherlands are leading countries in this segment. The Transmission Medium (Cables) component holds a significant market share, as cable technology constantly improves, increasing efficiency and reducing losses.

- Key Drivers for Submarine HVDC: Increased offshore wind capacity, supportive government policies, and substantial investments in grid infrastructure.

- Dominance Factors: Higher capacity needs for offshore wind integration, and the limitations of AC transmission in long submarine distances.

- Growth Potential: Significant, driven by the continued expansion of offshore wind capacity and interconnections between countries.

Europe HVDC Cables Industry Product Landscape

The HVDC cable market offers a range of products tailored to various applications, including high-voltage cables with enhanced insulation materials, optimized for high-capacity transmission, and advanced monitoring systems for real-time condition assessment. Product innovations focus on improved reliability, increased power transfer capacity, and reduced environmental impact. Key selling propositions include superior insulation technology, optimized design for specific application requirements, and enhanced monitoring systems for improved operational efficiency.

Key Drivers, Barriers & Challenges in Europe HVDC Cables Industry

Key Drivers: The increasing demand for renewable energy integration, particularly offshore wind power, is the primary driver. Supportive government policies and investments in grid modernization are also significant factors. The need for efficient long-distance power transmission further boosts the market.

Challenges: High initial investment costs associated with HVDC projects present a significant barrier. Supply chain complexities and potential material shortages can cause delays and increase costs. Regulatory approvals and permitting processes can be lengthy and complex. Intense competition among established players and the emergence of new entrants further challenge market participants. Estimated impact of these challenges on market growth in 2025 is approximately xx%.

Emerging Opportunities in Europe HVDC Cables Industry

Untapped markets in Eastern Europe and the expansion of offshore wind energy into deeper waters represent significant opportunities. The development of innovative cable materials with enhanced performance characteristics and the integration of digital technologies for smarter grid management offer further potential. Growing demand for interconnections between countries further fuels market growth.

Growth Accelerators in the Europe HVDC Cables Industry Industry

Technological advancements, such as the development of higher-voltage and higher-capacity cables, are pivotal growth accelerators. Strategic partnerships between cable manufacturers, grid operators, and renewable energy developers are fostering market expansion. Government initiatives aimed at supporting grid modernization and the integration of renewable energy are further driving growth.

Key Players Shaping the Europe HVDC Cables Industry Market

- Honeywell International Inc

- Hitachi Energy Ltd

- Toshiba Corporation

- Endress+Hauser AG

- Mitsubishi Electric Corporation

- Eaton Corporation PLC

- Siemens Energy AG

- General Electric Company

Notable Milestones in Europe HVDC Cables Industry Sector

- February 2022: McDermott International awarded a contract for the BorWin6 980 MW HVDC project.

- June 2021: PSE SA and Litgrid approved investments in the 700-MW Harmony Link interconnector project.

In-Depth Europe HVDC Cables Industry Market Outlook

The future of the European HVDC Cables market is promising, driven by the increasing demand for renewable energy and the need for efficient long-distance power transmission. Continued technological advancements, strategic collaborations, and supportive government policies will fuel long-term market growth. Strategic investments in R&D and expansion into new markets will be key to success for industry players. The market presents significant opportunities for companies that can deliver innovative, reliable, and cost-effective HVDC cable solutions.

Europe HVDC Cables Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Ovehead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

Europe HVDC Cables Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Netherlands

- 6. Rest of Europe

Europe HVDC Cables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Of Power Quality Equipment

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission System Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Ovehead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Netherlands

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. United Kingdom Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Ovehead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Germany Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Ovehead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Italy Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Ovehead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. France Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9.1.1. Submarine HVDC Transmission System

- 9.1.2. HVDC Ovehead Transmission System

- 9.1.3. HVDC Underground Transmission System

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Converter Stations

- 9.2.2. Transmission Medium (Cables)

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10. Netherlands Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10.1.1. Submarine HVDC Transmission System

- 10.1.2. HVDC Ovehead Transmission System

- 10.1.3. HVDC Underground Transmission System

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Converter Stations

- 10.2.2. Transmission Medium (Cables)

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11. Rest of Europe Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11.1.1. Submarine HVDC Transmission System

- 11.1.2. HVDC Ovehead Transmission System

- 11.1.3. HVDC Underground Transmission System

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Converter Stations

- 11.2.2. Transmission Medium (Cables)

- 11.1. Market Analysis, Insights and Forecast - by Transmission Type

- 12. Germany Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe HVDC Cables Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Honeywell International Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Hitachi Energy Ltd

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Toshiba Corporation

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Endress+Hauser AG

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Mitsubishi Electric Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Eaton Corporation PLC

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Siemens Energy AG

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 General Electric Company

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe HVDC Cables Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe HVDC Cables Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe HVDC Cables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 3: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Europe HVDC Cables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe HVDC Cables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 14: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 15: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 17: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 20: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 23: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 26: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe HVDC Cables Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 29: Europe HVDC Cables Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Europe HVDC Cables Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HVDC Cables Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Europe HVDC Cables Industry?

Key companies in the market include Honeywell International Inc, Hitachi Energy Ltd, Toshiba Corporation, Endress+Hauser AG, Mitsubishi Electric Corporation, Eaton Corporation PLC, Siemens Energy AG, General Electric Company.

3. What are the main segments of the Europe HVDC Cables Industry?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission System Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Costs Of Power Quality Equipment.

8. Can you provide examples of recent developments in the market?

In February 2022, McDermott International was awarded its largest-ever renewable energy contract from TenneT for the BorWin6 980 MW high-voltage direct current project. The project is for the design, manufacture, installation, and commissioning of an HVDC offshore converter platform located 118 miles offshore Germany on the North Sea Cluster 7 platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HVDC Cables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HVDC Cables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HVDC Cables Industry?

To stay informed about further developments, trends, and reports in the Europe HVDC Cables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence