Key Insights

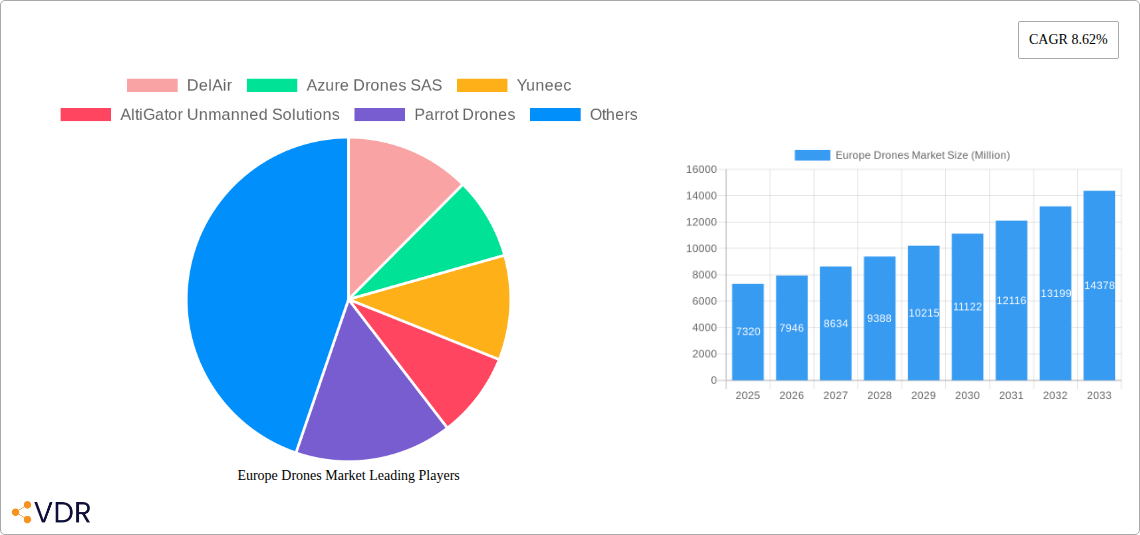

The European drone market, valued at €7.32 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.62% from 2025 to 2033. This robust expansion is driven by several key factors. Increasing adoption across diverse sectors like construction (for site surveying and progress monitoring), agriculture (precision farming and crop monitoring), and energy (infrastructure inspection and maintenance) is fueling demand. Furthermore, advancements in drone technology, including enhanced autonomy, longer flight times, and improved sensor capabilities, are expanding application possibilities and lowering barriers to entry for businesses of all sizes. The rise of drone-based services, offering specialized solutions tailored to various industries, further contributes to market growth. Strong regulatory frameworks in several European nations, coupled with increasing investments in research and development, create a supportive environment for market expansion. Competition among leading drone manufacturers, such as DJI, Parrot, and Yuneec, fosters innovation and drives down prices, making drone technology more accessible.

However, certain challenges restrain market growth. Concerns regarding data privacy and security, coupled with stringent regulations concerning drone operations in airspace, remain obstacles. The need for skilled pilots and technicians to operate and maintain drones represents a significant hurdle, especially in smaller companies and developing regions. Furthermore, the initial investment costs for purchasing and maintaining drone equipment can be substantial, potentially limiting adoption among smaller businesses. Despite these challenges, the long-term outlook for the European drone market remains positive, with continued technological advancements and expanding applications expected to drive growth through 2033. The strong presence of established manufacturers, coupled with a growing ecosystem of service providers, indicates a robust future for the sector. Germany, France, and the UK are leading the market within Europe, benefitting from strong technological infrastructure and supportive regulations.

Europe Drones Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European drones market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by application (Construction, Agriculture, Energy, Law Enforcement, Medical & Parcel Delivery, Other Applications) offering granular insights into this rapidly evolving industry. The market size is presented in million units.

Europe Drones Market Dynamics & Structure

The European drones market is characterized by a moderately concentrated landscape with key players like DJI, Parrot Drones, and Yuneec holding significant market share (estimated at xx% collectively in 2025). However, the market is witnessing increasing competition from smaller, specialized drone manufacturers focusing on niche applications. Technological innovation is a primary driver, with advancements in battery technology, sensor integration (LiDAR, thermal imaging), and autonomous flight capabilities constantly expanding market potential. Regulatory frameworks, particularly regarding Beyond Visual Line of Sight (BVLOS) operations, are evolving, impacting market growth. The market also sees competitive pressure from traditional surveying and aerial photography methods. Mergers and acquisitions (M&A) activity is moderate, with approximately xx deals recorded between 2019 and 2024, primarily focused on consolidating technological expertise and expanding market reach.

- Market Concentration: Moderately concentrated, with top 3 players holding an estimated xx% market share in 2025.

- Technological Innovation: Key drivers include improved battery life, advanced sensors, and autonomous flight capabilities.

- Regulatory Frameworks: Evolving BVLOS regulations significantly impact market expansion.

- Competitive Substitutes: Traditional aerial photography and surveying methods pose competitive pressure.

- M&A Activity: Moderate activity (xx deals 2019-2024) driven by technology consolidation and market expansion.

- Innovation Barriers: High R&D costs and regulatory complexities hinder innovation.

Europe Drones Market Growth Trends & Insights

The European drones market has demonstrated robust growth during the historical period (2019-2024), propelled by widespread adoption across a multitude of industries. The market size is projected to reach approximately **[Insert Market Size in 2025] million units by 2025**, with an anticipated expansion to **[Insert Market Size in 2033] million units by 2033**, signifying a Compound Annual Growth Rate (CAGR) of **[Insert CAGR]%** during the forecast period (2025-2033). This upward trajectory is primarily attributed to rapid technological advancements, a notable decrease in drone pricing, and the continuous expansion of their application spectrum. Currently, market penetration is particularly high within the agricultural and construction sectors. Consumer preferences are evolving towards autonomous, user-friendly drones equipped with enhanced safety features. Technological disruptions, especially in AI-driven autonomous flight capabilities and sophisticated sensor integration, are acting as significant catalysts for market transformation.

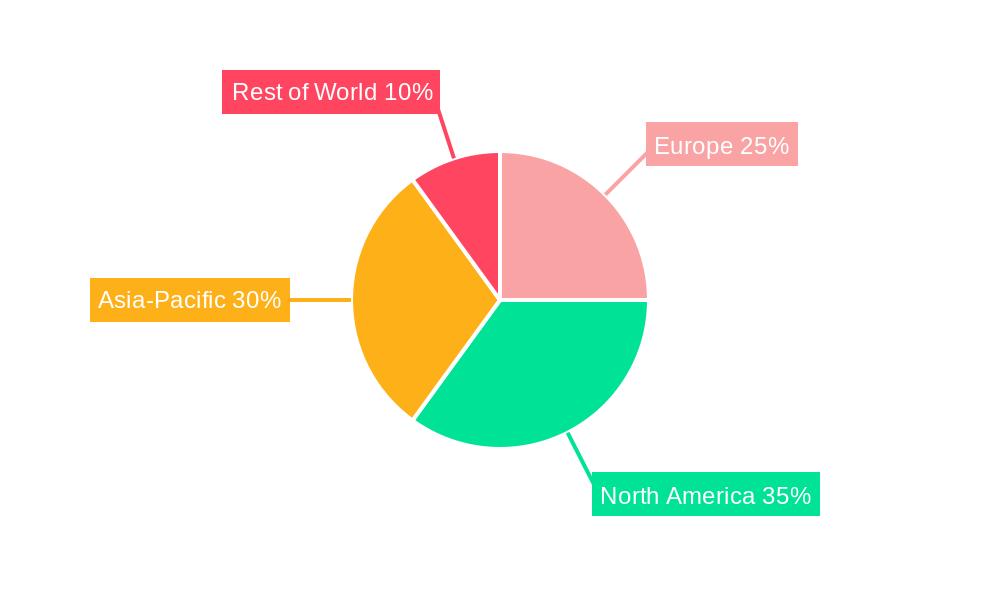

Dominant Regions, Countries, or Segments in Europe Drones Market

Western European nations, notably Germany, France, and the United Kingdom, currently lead the European drones market. This dominance is underpinned by their strong economic foundations, well-developed infrastructure, and an established history of early drone technology adoption. The construction sector stands out as the largest market segment, driven by the substantial demand for efficient site surveying, inspection, and monitoring solutions. The agricultural sector is also experiencing significant upward momentum, largely propelled by the increasing adoption of precision farming techniques aimed at optimizing crop yields and resource management.

- Germany: Spearheads the market owing to its powerful industrial base and a regulatory environment that fosters innovation and deployment.

- France: Exhibits considerable growth, significantly influenced by substantial investments in drone technology research and development.

- UK: Boasts a large market size, supported by a diverse range of applications across numerous industries, from logistics to public safety.

- Construction: Remains the dominant segment, driven by the persistent need for enhanced efficiency and accuracy in site surveying, infrastructure inspection, and progress monitoring.

- Agriculture: Witnesses rapid expansion fueled by the growing adoption of precision agriculture for improved crop management, yield optimization, and sustainable farming practices.

- Energy: Represents an increasingly important segment, driven by the critical demand for thorough inspection and maintenance of energy infrastructure, including pipelines, wind turbines, and power grids.

Europe Drones Market Product Landscape

The European drones market offers a diverse range of products, from small consumer drones to large, heavy-lift industrial drones equipped with advanced sensors and payload capabilities. Key product innovations include improved battery life, enhanced flight control systems, obstacle avoidance technologies, and integration of advanced sensors like LiDAR and hyperspectral cameras. These advancements enhance the efficiency, safety, and application versatility of drones across various industries. Unique selling propositions often center on payload capacity, flight time, ease of use, and data analytics capabilities.

Key Drivers, Barriers & Challenges in Europe Drones Market

Key Drivers:

- Escalating demand for more efficient, cost-effective, and automated solutions across a wide array of industries.

- Continuous technological advancements leading to enhanced drone performance, expanded capabilities, and greater operational efficiency.

- Proactive government initiatives, strategic investments, and supportive policies aimed at fostering the growth and integration of drone technology.

- The growing need for advanced data collection and analysis capabilities in sectors like agriculture, construction, and surveillance.

Key Barriers & Challenges:

- Complex and evolving regulatory frameworks, coupled with persistent concerns regarding airspace safety and operational limitations.

- Heightened concerns surrounding data privacy, cybersecurity threats, and the ethical implications of widespread drone surveillance.

- Significant initial investment costs and ongoing maintenance expenses associated with advanced drone systems and their payloads, which can sometimes limit widespread adoption. This may result in an estimated reduction in market potential by approximately [Insert Percentage]% annually.

- Intense competition from both established industry giants and agile new market entrants, necessitating continuous innovation and strategic differentiation.

- The need for skilled personnel to operate and maintain advanced drone systems, requiring investment in training and development programs.

Emerging Opportunities in Europe Drones Market

- Growth in Beyond Visual Line of Sight (BVLOS) operations.

- Expanding applications in sectors such as delivery, emergency response, and environmental monitoring.

- Increased adoption of AI and machine learning for autonomous drone operations.

- Development of drone-based services and solutions.

Growth Accelerators in the Europe Drones Market Industry

The sustained long-term growth of the European drones market is powerfully propelled by relentless technological innovation, strategic collaborations and partnerships between drone manufacturers, software developers, and end-users, and the proactive exploration and expansion into novel application areas. The seamless integration of cutting-edge sensor technologies, sophisticated AI-powered autonomy for enhanced decision-making, and significant improvements in battery technology for extended flight times will be pivotal in driving substantial market expansion. Furthermore, robust government support, particularly in the crucial area of streamlining regulatory processes and providing clear operational guidelines, will act as a significant accelerator for overall market growth.

Key Players Shaping the Europe Drones Market Market

- DelAir

- Azure Drones SAS

- Yuneec

- AltiGator Unmanned Solutions

- Parrot Drones

- DJI

- CATUAV S L

- UAS Europe AB

- Onyx Scan Advanced LiDAR Systems

- Terra Drone Corporation

- Aerialtronic

- Flyability SA

Notable Milestones in Europe Drones Market Sector

- January 2022: Azur Drones receives operational authorization for its Skeyetech drone system in Germany, enabling BVLOS operations.

- December 2021: Successful urban cargo delivery demonstration in Torino, Italy, paving the way for BVLOS flights in AAM.

In-Depth Europe Drones Market Market Outlook

The European drones market is poised for substantial growth over the next decade, driven by ongoing technological advancements, expanding applications across multiple sectors, and supportive regulatory environments. Strategic opportunities lie in developing innovative drone-based services, focusing on BVLOS operations, and expanding into new geographic markets. The market is expected to witness continued consolidation through mergers and acquisitions as companies seek to expand their product portfolios and market reach. The long-term outlook remains optimistic, anticipating robust growth and significant market expansion.

Europe Drones Market Segmentation

-

1. Application

- 1.1. Construction

- 1.2. Agriculture

- 1.3. Energy

- 1.4. Law Enforcement

- 1.5. Medical and Parcel Delivery

- 1.6. Other Applications

Europe Drones Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Russia

- 5. Spain

- 6. Rest of Europe

Europe Drones Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Construction Segment Held the Highest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction

- 5.1.2. Agriculture

- 5.1.3. Energy

- 5.1.4. Law Enforcement

- 5.1.5. Medical and Parcel Delivery

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. France

- 5.2.3. Germany

- 5.2.4. Russia

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Kingdom Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Construction

- 6.1.2. Agriculture

- 6.1.3. Energy

- 6.1.4. Law Enforcement

- 6.1.5. Medical and Parcel Delivery

- 6.1.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Construction

- 7.1.2. Agriculture

- 7.1.3. Energy

- 7.1.4. Law Enforcement

- 7.1.5. Medical and Parcel Delivery

- 7.1.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Construction

- 8.1.2. Agriculture

- 8.1.3. Energy

- 8.1.4. Law Enforcement

- 8.1.5. Medical and Parcel Delivery

- 8.1.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Russia Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Construction

- 9.1.2. Agriculture

- 9.1.3. Energy

- 9.1.4. Law Enforcement

- 9.1.5. Medical and Parcel Delivery

- 9.1.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Spain Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Construction

- 10.1.2. Agriculture

- 10.1.3. Energy

- 10.1.4. Law Enforcement

- 10.1.5. Medical and Parcel Delivery

- 10.1.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Europe Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Construction

- 11.1.2. Agriculture

- 11.1.3. Energy

- 11.1.4. Law Enforcement

- 11.1.5. Medical and Parcel Delivery

- 11.1.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Germany Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 DelAir

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Azure Drones SAS

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Yuneec

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 AltiGator Unmanned Solutions

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Parrot Drones

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 DJI

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 CATUAV S L

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 UAS Europe AB

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Onyx Scan Advanced LiDAR Systems

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Terra Drone Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Aerialtronic

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Flyability SA

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.1 DelAir

List of Figures

- Figure 1: Europe Drones Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Drones Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Drones Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Drones Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Drones Market?

The projected CAGR is approximately 8.62%.

2. Which companies are prominent players in the Europe Drones Market?

Key companies in the market include DelAir, Azure Drones SAS, Yuneec, AltiGator Unmanned Solutions, Parrot Drones, DJI, CATUAV S L, UAS Europe AB, Onyx Scan Advanced LiDAR Systems, Terra Drone Corporation, Aerialtronic, Flyability SA.

3. What are the main segments of the Europe Drones Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.32 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Construction Segment Held the Highest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2022, Azur Drones announced that German National Airworthiness Authorities granted operational authorization for its Skeyetech drone system. This will allow Skeyetech to conduct BVLOS drone operations, day and night, over private areas, under the supervision of an operator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Drones Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Drones Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Drones Market?

To stay informed about further developments, trends, and reports in the Europe Drones Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence