Key Insights

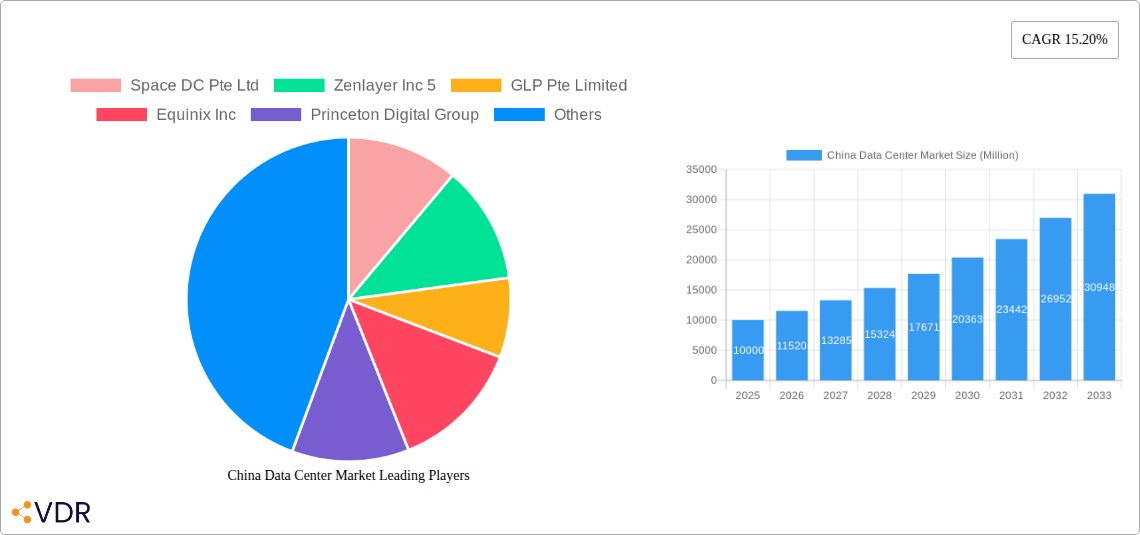

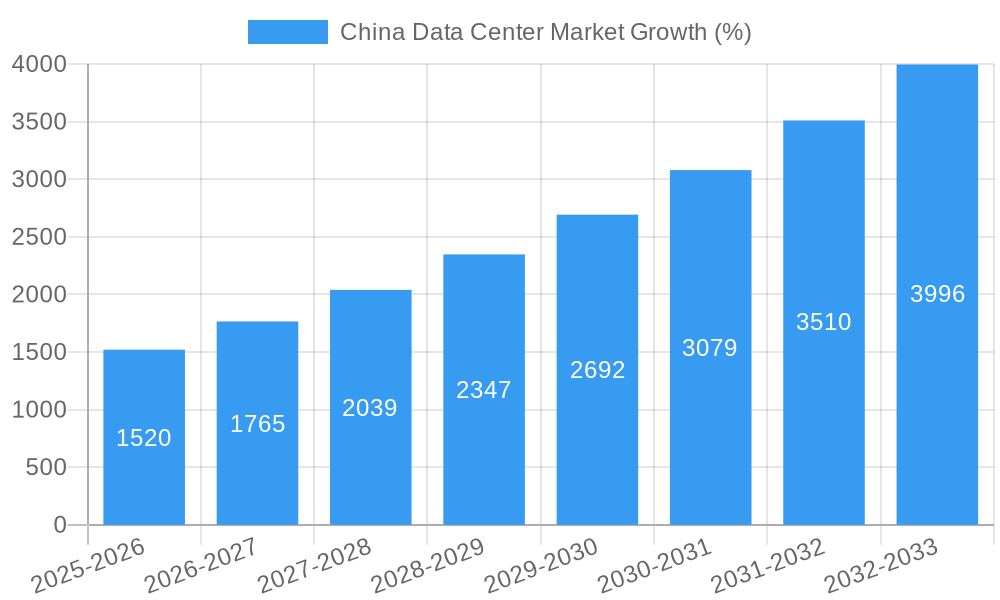

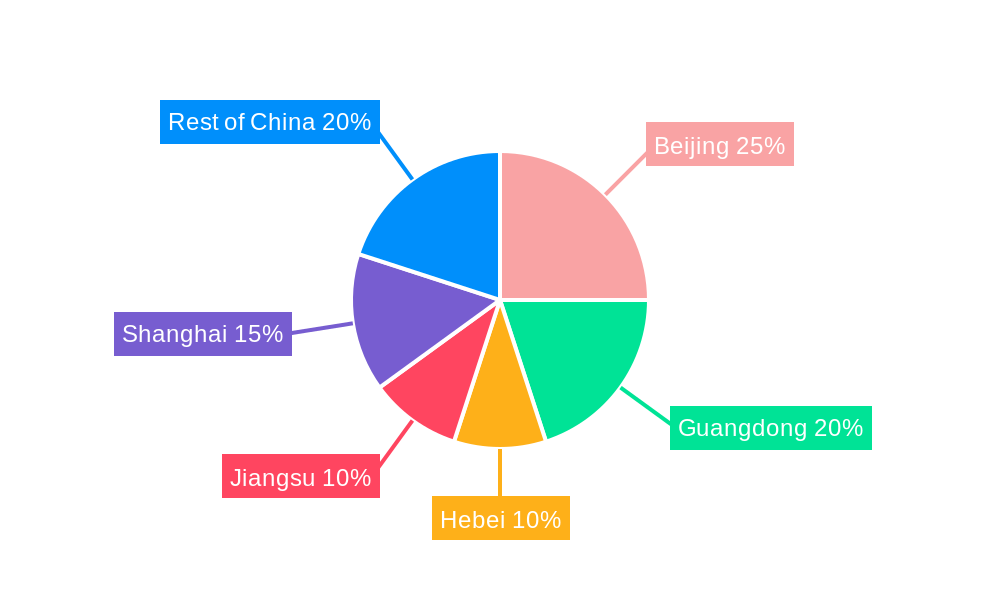

The China data center market is experiencing robust growth, driven by the country's rapid digital transformation, expanding e-commerce sector, increasing cloud adoption, and government initiatives promoting digital infrastructure development. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and study period), is projected to maintain a Compound Annual Growth Rate (CAGR) of 15.20% from 2025 to 2033. This expansion is fueled by significant investments in hyperscale data centers, particularly in key regions like Beijing, Guangdong, Hebei, Jiangsu, and Shanghai, which are strategically located to serve major population centers and business hubs. The demand for larger data center footprints (Mega and Massive) is particularly strong, driven by the needs of major cloud providers and large enterprises. Furthermore, the increasing focus on Tier 1 and Tier III facilities ensures high levels of reliability and redundancy, attracting both domestic and international players. While challenges such as energy consumption and land availability exist, the overall market outlook remains positive, propelled by ongoing government support and the consistently growing demand for digital services.

The market segmentation reveals considerable opportunities across various categories. The concentration of data centers in key regions like Beijing, Guangdong, Hebei, Jiangsu, and Shanghai underscores the importance of strategic geographic location. The preference for larger data center sizes highlights the scale of operations by major players and the increasing reliance on cloud computing. The significant demand for Tier 1 and Tier 3 facilities reflects the emphasis on high reliability and uptime. The considerable presence of both domestic and international companies such as China Telecom, Equinix, and Chindata Group, suggests intense competition and strong foreign investment interest. Future growth will likely be shaped by further government regulations concerning energy efficiency and data sovereignty, the expansion of 5G infrastructure, and the increasing adoption of AI and big data analytics, driving even higher demand for data center capacity. Understanding these dynamics is crucial for businesses seeking to capitalize on this rapidly expanding market.

China Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the booming China data center market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, regional dominance, key players, and future opportunities within this rapidly evolving sector. The report segments the market by data center size (Large, Massive, Mega, Medium, Small), tier type (Tier 1, Tier 2, Tier 3), absorption (Utilized, Non-Utilized), and key hotspots (Beijing, Guangdong, Hebei, Jiangsu, Shanghai, Rest of China). The total market size is projected to reach xx Million USD by 2033.

China Data Center Market Dynamics & Structure

The China data center market exhibits a complex interplay of factors driving its growth and shaping its structure. Market concentration is moderate, with a few large players dominating alongside numerous smaller, regional providers. Technological innovation, particularly in areas like AI, cloud computing, and 5G, is a key growth driver. However, regulatory frameworks, including data sovereignty regulations and licensing requirements, pose significant challenges. Competitive product substitutes, such as edge computing solutions, are emerging, impacting the traditional data center landscape. End-user demographics are shifting towards increased adoption by hyperscalers, enterprises, and government entities. M&A activity is robust, with numerous acquisitions and strategic partnerships shaping market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Driven by AI, cloud computing, and 5G, leading to increased demand for high-capacity and low-latency data centers.

- Regulatory Framework: Stringent data privacy and security regulations influence market strategies and investments.

- M&A Activity: Significant increase in M&A deals over the past five years, with xx deals recorded in 2024.

- Competitive Substitutes: Edge computing is impacting traditional data center deployments.

- End-User Demographics: Increasing demand from hyperscalers and government sector.

China Data Center Market Growth Trends & Insights

The China data center market has experienced significant growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by the rapid expansion of e-commerce, digital services, and the increasing adoption of cloud computing across various sectors. Technological disruptions, such as the rise of AI and IoT, are further accelerating demand. Consumer behavior shifts toward digitalization are creating a sustained need for robust data center infrastructure. The market is expected to maintain strong growth during the forecast period (2025-2033), reaching xx Million USD by 2033, with a projected CAGR of xx%. Market penetration rates are expected to increase from xx% in 2024 to xx% by 2033. Factors like government initiatives promoting digital economy development further contribute to this growth trajectory.

Dominant Regions, Countries, or Segments in China Data Center Market

Guangdong and Beijing lead the China data center market, driven by strong economic activity, well-established infrastructure, and significant government investment. These regions benefit from a large concentration of businesses, particularly in technology and finance. Shanghai and Jiangsu also exhibit robust growth, reflecting the country's broader economic development. The large data center segment is the most dominant, driven by the needs of hyperscalers and large enterprises. Tier III data centers are also seeing significant growth due to their high reliability and scalability.

- Key Drivers in Guangdong & Beijing: Robust economy, developed infrastructure, favorable government policies, high concentration of businesses.

- Market Share: Guangdong holds approximately xx% market share, while Beijing holds approximately xx%.

- Growth Potential: Rest of China presents significant untapped potential due to expanding digital infrastructure and government initiatives.

- Data Center Size: Large and Mega data centers dominate the market share, representing xx% combined.

- Tier Type: Tier III data centers account for the largest market share.

China Data Center Market Product Landscape

The China data center market offers a wide range of products and services, including colocation, hyperscale data centers, cloud services, and managed services. Recent innovations focus on increasing energy efficiency, improving security, and optimizing performance. Key differentiators include specialized solutions for specific industries, advanced cooling technologies, and integrated security features. The market is constantly evolving with the introduction of new technologies, including edge computing solutions and AI-powered data center management systems.

Key Drivers, Barriers & Challenges in China Data Center Market

Key Drivers: Rapid growth of digital economy, increasing adoption of cloud computing and big data analytics, government support for digital infrastructure development, substantial investments by both domestic and international players.

Key Challenges: High energy costs, stringent data security and privacy regulations, land acquisition challenges, competition, and supply chain complexities. These challenges could reduce market growth by approximately xx% if not adequately addressed.

Emerging Opportunities in China Data Center Market

Emerging opportunities include the expansion of data center infrastructure in less developed regions, the growing demand for edge computing solutions, and the increasing adoption of sustainable data center practices. The rise of 5G and IoT is also expected to drive further growth. Untapped markets in smaller cities and rural areas offer significant potential for expansion.

Growth Accelerators in the China Data Center Market Industry

Technological breakthroughs in areas such as AI and blockchain are poised to drive long-term growth. Strategic partnerships between data center providers and technology companies are strengthening market dynamics. Continued government investment in infrastructure and supportive regulatory policies will further accelerate market expansion.

Key Players Shaping the China Data Center Market Market

- Space DC Pte Ltd

- Zenlayer Inc

- GLP Pte Limited

- Equinix Inc

- Princeton Digital Group

- GDS Service Co Ltd

- China Telecom Corporation Ltd

- Chayora Ltd

- Keppel DC REIT Management Pte Ltd

- Telehouse (KDDI Corporation)

- Chindata Group Holdings Ltd

- BDx Data Center Pte Ltd

Notable Milestones in China Data Center Market Sector

- June 2022: Keppel Data centers Pte Ltd acquired two data centers in Jiangmen and Guangdong.

- September 2022: Chindata Group Holdings Ltd acquired 100 million kWh of green energy, reducing carbon emissions by 94,000 tons.

- December 2022: EdgeConnex partnered with Chayora Ltd to expand its services in China.

In-Depth China Data Center Market Market Outlook

The China data center market is poised for continued strong growth, driven by technological advancements, government support, and increasing digitalization across various sectors. Strategic opportunities lie in expanding into underserved regions, adopting sustainable practices, and capitalizing on the growth of emerging technologies such as AI and IoT. The market's future potential is substantial, promising significant returns for investors and market participants who can effectively navigate the challenges and capitalize on the opportunities presented.

China Data Center Market Segmentation

-

1. Hotspot

- 1.1. Beijing

- 1.2. Guangdong

- 1.3. Hebei

- 1.4. Jiangsu

- 1.5. Shanghai

- 1.6. Rest of China

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

China Data Center Market Segmentation By Geography

- 1. China

China Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Securing Confidential Data and Protection Against Data Loss; Growing Demand for Improving Archived Content across Channels; Ongoing efforts to promote Digitization at Workplaces

- 3.3. Market Restrains

- 3.3.1. Transition from Legacy Systems Chips; Customization Challenges Leading to Implementation Issues

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Beijing

- 5.1.2. Guangdong

- 5.1.3. Hebei

- 5.1.4. Jiangsu

- 5.1.5. Shanghai

- 5.1.6. Rest of China

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. China

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Space DC Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zenlayer Inc 5

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GLP Pte Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equinix Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Princeton Digital Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GDS Service Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Telecom Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chayora Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Keppel DC REIT Management Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Telehouse (KDDI Corporation)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Chindata Group Holdings Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BDx Data Center Pte Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Space DC Pte Ltd

List of Figures

- Figure 1: China Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: China Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: China Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: China Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: China Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: China Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: China Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: China Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: China Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 11: China Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 12: China Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: China Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 14: China Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 15: China Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: China Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Data Center Market?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the China Data Center Market?

Key companies in the market include Space DC Pte Ltd, Zenlayer Inc 5, GLP Pte Limited, Equinix Inc, Princeton Digital Group, GDS Service Co Ltd, China Telecom Corporation Ltd, Chayora Ltd, Keppel DC REIT Management Pte Ltd, Telehouse (KDDI Corporation), Chindata Group Holdings Ltd, BDx Data Center Pte Ltd.

3. What are the main segments of the China Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type , End User .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Securing Confidential Data and Protection Against Data Loss; Growing Demand for Improving Archived Content across Channels; Ongoing efforts to promote Digitization at Workplaces.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Transition from Legacy Systems Chips; Customization Challenges Leading to Implementation Issues.

8. Can you provide examples of recent developments in the market?

December 2022: Edgeconnex has entered into strategic partnership with Chayora Ltd for providing its services in China.September 2022: Chindata Group Holdings Ltd has recently acquired green energy of 100 million Kwh by participating in China nationwide green energy transcation. This would help the company reduce carbon emissions by 94000 tons.June 2022: Keppel Data centers Pte Ltd has acquired two data centres in Jiangmen, and Guangdong from Guangdong Bluesea development Co. Ltd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Data Center Market?

To stay informed about further developments, trends, and reports in the China Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence