Key Insights

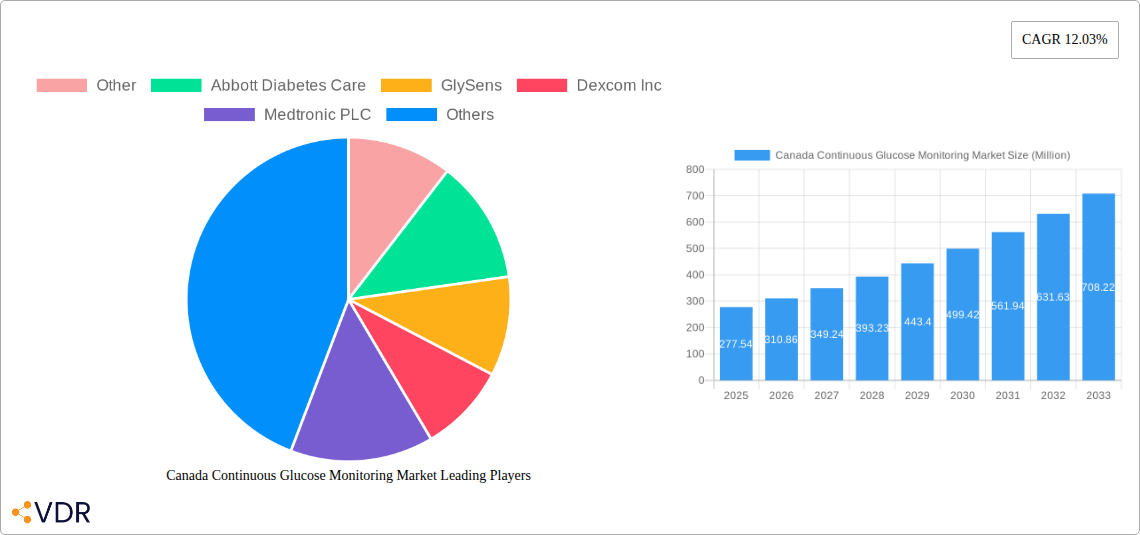

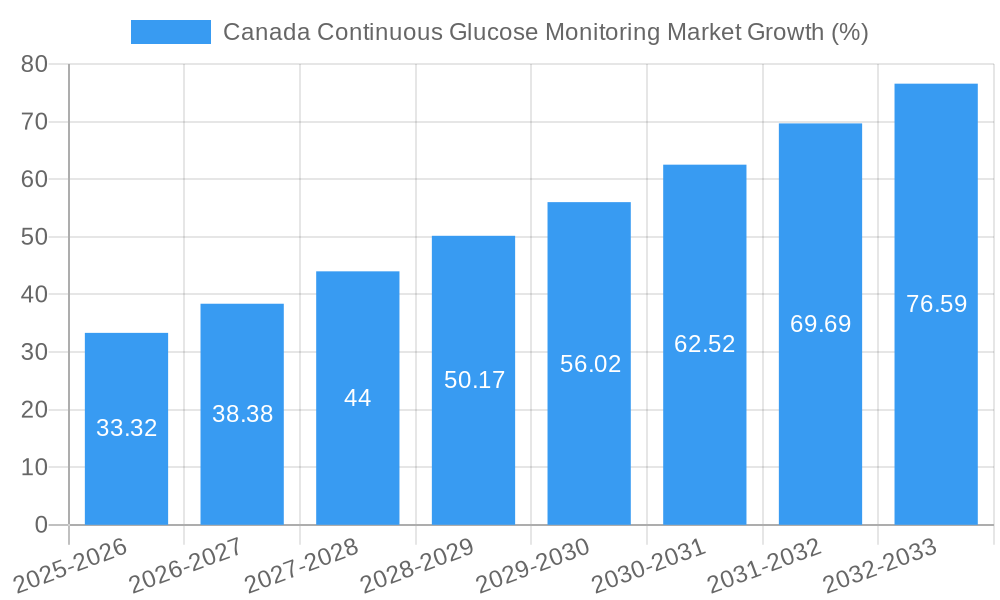

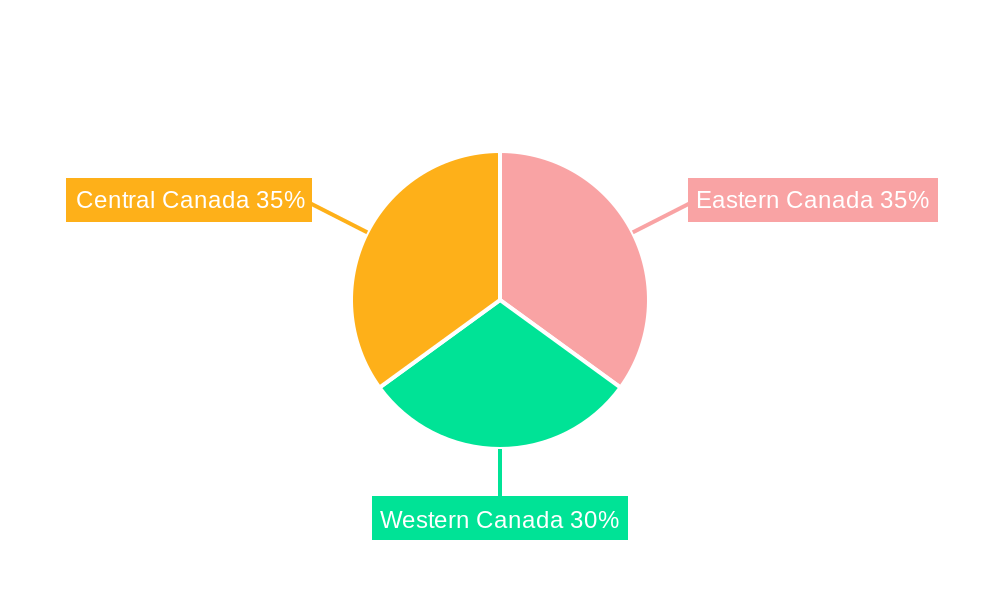

The Canadian Continuous Glucose Monitoring (CGM) market, valued at $277.54 million in 2025, is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 12.03% from 2025 to 2033. This robust expansion is driven by several key factors. The rising prevalence of diabetes, particularly Type 1 and Type 2, within Canada fuels the demand for advanced glucose monitoring solutions. Improved accuracy, ease of use, and the ability to provide real-time data compared to traditional methods are significant advantages driving CGM adoption. Furthermore, increasing government initiatives promoting better diabetes management and the growing awareness among patients about the benefits of proactive glucose control contribute to market growth. Technological advancements, including the development of smaller, more comfortable, and more accurate sensors, are further enhancing the appeal of CGMs. The market is segmented into components (sensors and durables) reflecting the different technological aspects and replacement cycles. Key players like Abbott Diabetes Care, Dexcom Inc., Medtronic PLC, and Ascensia Diabetes Care are actively involved in innovation and market penetration, competing through product differentiation and strategic partnerships. The regional breakdown within Canada (Eastern, Western, and Central) showcases varying adoption rates based on healthcare infrastructure and population demographics.

The competitive landscape is dynamic, with both established players and emerging companies vying for market share. The focus is shifting towards integrating CGMs with insulin pumps and other diabetes management tools, leading to the development of integrated systems that improve patient outcomes. However, factors like the high cost of CGMs and the need for ongoing sensor replacements pose challenges to market penetration, particularly amongst uninsured or underinsured individuals. Future market growth hinges on addressing affordability concerns through insurance coverage expansions and innovative pricing strategies. Furthermore, addressing data security and privacy concerns related to the continuous monitoring of personal health data will be crucial for sustaining growth in the years ahead. The market's future depends on successfully navigating these challenges while continuing to innovate and expand access to this life-improving technology.

Canada Continuous Glucose Monitoring (CGM) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Continuous Glucose Monitoring (CGM) market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033. It segments the market by component (Sensors, Durables) and analyzes key players like Dexcom Inc, Medtronic PLC, Abbott Diabetes Care, Ascensia Diabetes Care, GlySens, and Others. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the growth opportunities within this rapidly evolving market. The market value is presented in Million units throughout the report.

Canada Continuous Glucose Monitoring Market Dynamics & Structure

This section analyzes the structure and dynamics of the Canadian CGM market, considering market concentration, technological advancements, regulatory influences, competitive substitutes, end-user demographics, and merger & acquisition (M&A) activities.

Market Concentration: The Canadian CGM market exhibits a moderately concentrated structure, with a few major players holding significant market share. Dexcom Inc and Medtronic PLC are leading players, collectively accounting for approximately xx% of the market share in 2024. Smaller players like Abbott Diabetes Care and Ascensia Diabetes Care cater to niche segments. The "Other" category comprises smaller domestic and international players.

Technological Innovation: Continuous innovation drives market growth. Advancements in sensor technology, miniaturization, improved accuracy, and integration with mobile apps are key factors. However, challenges remain in achieving seamless integration with insulin pumps and overcoming user-related barriers like sensor placement and calibration.

Regulatory Landscape: Health Canada's regulations significantly influence market access and pricing. Changes in reimbursement policies and approvals for new technologies affect market penetration. Navigating the regulatory landscape is crucial for market entry and expansion.

Competitive Landscape: The market is characterized by intense competition among established players. The competition is primarily based on technological innovation, pricing strategies, distribution networks, and brand recognition. Product differentiation and strategic partnerships are essential for success.

End-User Demographics: The primary end-users are individuals with type 1 and type 2 diabetes. The increasing prevalence of diabetes, coupled with growing awareness of CGM benefits, drives market expansion. The growing elderly population further contributes to market growth.

M&A Activity: The CGM market has witnessed xx M&A deals in the historical period (2019-2024), primarily focusing on enhancing product portfolios and expanding market reach. Future consolidation is anticipated.

- Market Share (2024): Dexcom Inc (xx%), Medtronic PLC (xx%), Abbott Diabetes Care (xx%), Ascensia Diabetes Care (xx%), GlySens (xx%), Others (xx%)

- Number of M&A Deals (2019-2024): xx

- Innovation Barriers: Regulatory hurdles, high R&D costs, and integration complexities.

Canada Continuous Glucose Monitoring Market Growth Trends & Insights

The Canadian CGM market has witnessed significant growth during the historical period (2019-2024), driven by factors such as rising diabetes prevalence, increasing awareness of CGM benefits, technological advancements, and favorable reimbursement policies. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million units by 2033. This growth is attributed to several factors, including:

- Increasing Diabetes Prevalence: The rising incidence of type 1 and type 2 diabetes in Canada directly fuels demand for CGMs as an effective diabetes management tool. The aging population also plays a role in this trend.

- Growing Awareness & Acceptance: Increased awareness and acceptance of CGM technology among healthcare professionals and patients are driving adoption rates. Improved accuracy, ease of use, and data sharing capabilities contribute to this trend.

- Technological Advancements: Continuous innovations in sensor technology, algorithms, data analytics, and integration with mobile devices are enhancing the appeal and effectiveness of CGMs. The introduction of next-generation devices contributes to market expansion.

- Favorable Reimbursement Policies: Increased insurance coverage and government initiatives to support diabetes management have positively impacted market accessibility and affordability. Provincial differences in reimbursement policies continue to influence regional adoption rates.

- Shifting Consumer Behavior: A shift towards proactive diabetes management and patient empowerment is driving increased self-monitoring and the adoption of technologies like CGMs. Patients are increasingly seeking advanced tools for better disease management.

The market penetration rate of CGMs in Canada is currently estimated at xx% and is anticipated to increase to xx% by 2033. The continuous improvement in technology and increase in affordability are expected to drive the adoption rate further.

Dominant Regions, Countries, or Segments in Canada Continuous Glucose Monitoring Market

The Canadian CGM market is geographically dispersed, with varying adoption rates across provinces and territories. However, the most significant market share is concentrated in the most populated provinces, like Ontario and Quebec, due to factors such as higher diabetes prevalence, robust healthcare infrastructure, and greater physician awareness and adoption. This concentration is also affected by reimbursement policies, which vary among provinces. The "Sensors" segment dominates the component market, followed by "Durables," such as transmitters and receivers.

- Key Drivers (Ontario and Quebec):

- Higher diabetes prevalence compared to other provinces.

- Well-developed healthcare infrastructure with established diabetes care centers.

- Greater physician awareness and adoption of CGM technology.

- Relatively favorable reimbursement policies in certain regions.

- Market Share (2024): Ontario (xx%), Quebec (xx%), Other Provinces (xx%).

- Growth Potential: The market in provinces with lower current adoption rates presents considerable growth potential for future expansion through targeted outreach and improved awareness campaigns.

Canada Continuous Glucose Monitoring Market Product Landscape

The Canadian CGM market offers a range of products, including flash glucose monitoring (FGM) systems and continuous glucose monitoring (CGM) systems. These systems vary in their features, accuracy, and data-sharing capabilities. Recent innovations focus on improving accuracy, minimizing calibration frequency, extending sensor lifespan, and providing seamless integration with insulin pumps and mobile health applications. Key selling propositions include ease of use, improved accuracy, and data-driven insights for better diabetes management.

Key Drivers, Barriers & Challenges in Canada Continuous Glucose Monitoring Market

Key Drivers: The increasing prevalence of diabetes, advancements in CGM technology leading to enhanced accuracy and convenience, growing patient awareness, and favorable government policies supporting diabetes management are the major drivers. These factors, along with rising healthcare expenditures and increased focus on patient-centric care are propelling market growth.

Challenges & Restraints: High initial costs associated with CGM devices represent a significant barrier to broader adoption, especially among individuals with lower incomes. Furthermore, challenges exist in integrating CGMs with other diabetes management technologies, and in overcoming sensor calibration issues. Variability in reimbursement policies across different provinces leads to significant adoption rate disparities. Finally, the relatively higher cost of CGM systems when compared with alternative glucose monitoring methods can be a major barrier for patients.

Emerging Opportunities in Canada Continuous Glucose Monitoring Market

Opportunities exist in expanding CGM adoption among younger populations and those with type 2 diabetes. The development of hybrid closed-loop systems offers significant growth prospects, along with greater integration with mobile health applications and telehealth platforms. Furthermore, opportunities lie in personalized diabetes management, using AI-driven analytics to improve treatment outcomes. Finally, expanding to underserved rural and remote areas presents a substantial opportunity for growth.

Growth Accelerators in the Canada Continuous Glucose Monitoring Market Industry

Technological advancements in sensor technology, data analytics, and artificial intelligence will continue to drive market growth. Strategic partnerships between CGM manufacturers and healthcare providers can expand market reach and improve patient access. Expanding government initiatives to increase affordability and accessibility through improved reimbursement policies will also accelerate market growth. Finally, focusing on product innovation and development of more user-friendly devices will stimulate faster adoption.

Key Players Shaping the Canada Continuous Glucose Monitoring Market Market

- Abbott Diabetes Care

- Dexcom Inc

- Medtronic PLC

- Ascensia Diabetes Care

- GlySens

- Other

Notable Milestones in Canada Continuous Glucose Monitoring Market Sector

- October 2023: Dexcom launched its next-generation G7 continuous glucose monitor (CGM) in Canada for people with all types of diabetes aged two and older, including those who are pregnant. This launch significantly broadens the market reach of Dexcom's CGM technology.

- March 2023: Dexcom announced that all people with type 1 and type 2 diabetes in Manitoba, Canada, meet eligibility criteria for its G6 CGM. This decision eliminates the preapproval process in Manitoba, potentially increasing adoption rates in that province.

In-Depth Canada Continuous Glucose Monitoring Market Market Outlook

The Canadian CGM market is poised for sustained growth, driven by technological advancements, increasing diabetes prevalence, and favorable regulatory developments. Strategic partnerships, focused marketing campaigns targeting specific demographics, and expansion into underserved areas will be crucial for capturing the significant market potential. The integration of AI and machine learning capabilities within CGMs will provide enhanced data insights and personalized treatment recommendations, leading to further market expansion. Addressing challenges related to cost and access remains essential for maximizing market penetration.

Canada Continuous Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables

Canada Continuous Glucose Monitoring Market Segmentation By Geography

- 1. Canada

Canada Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Canada is anticipated to boost the market studied.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Eastern Canada Canada Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Other

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Abbott Diabetes Care

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 GlySens

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Dexcom Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Medtronic PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Ascensia Diabetes Care

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Other

List of Figures

- Figure 1: Canada Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Continuous Glucose Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Canada Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Canada Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Canada Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Canada Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Eastern Canada Canada Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Western Canada Canada Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Western Canada Canada Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Central Canada Canada Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Central Canada Canada Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2019 & 2032

- Table 16: Canada Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 17: Canada Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Canada Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Continuous Glucose Monitoring Market?

The projected CAGR is approximately 12.03%.

2. Which companies are prominent players in the Canada Continuous Glucose Monitoring Market?

Key companies in the market include Other, Abbott Diabetes Care, GlySens, Dexcom Inc, Medtronic PLC, Ascensia Diabetes Care.

3. What are the main segments of the Canada Continuous Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 277.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Canada is anticipated to boost the market studied..

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2023: Dexcom launched its next-generation G7 continuous glucose monitor (CGM) in Canada for people with all types of diabetes aged two and older, including those who are pregnant, in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Canada Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence