Key Insights

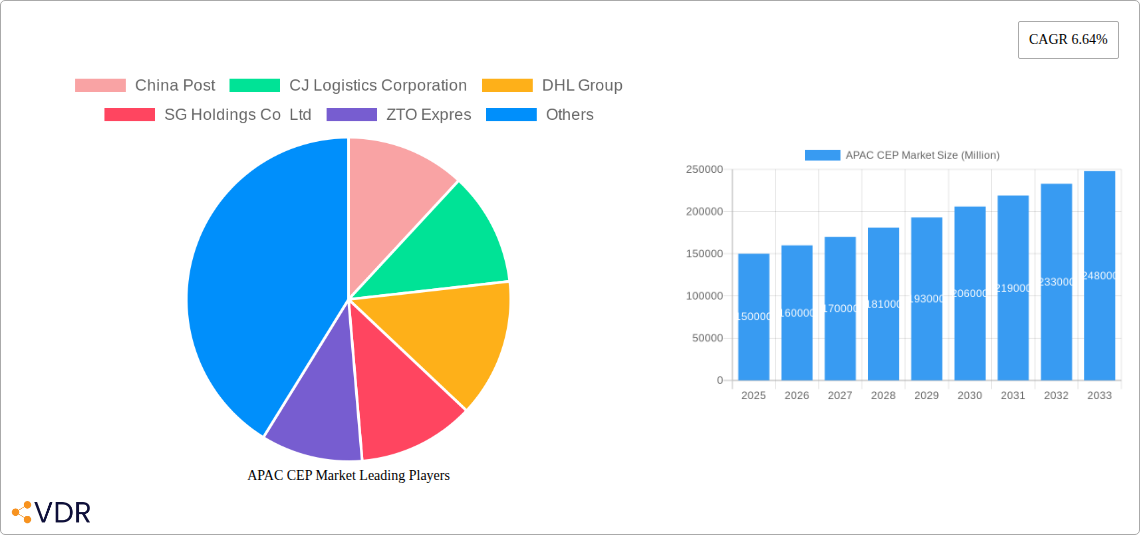

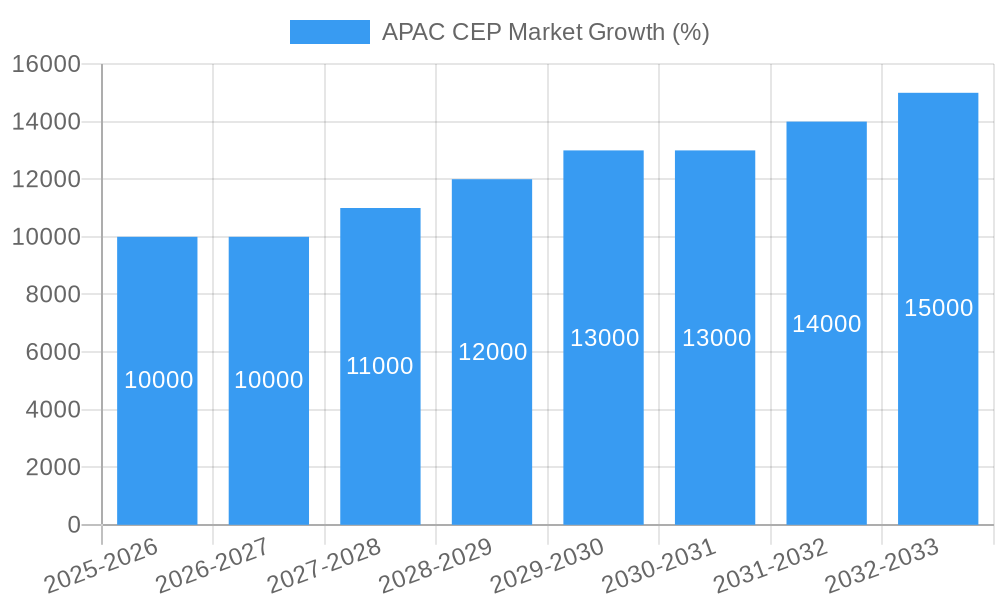

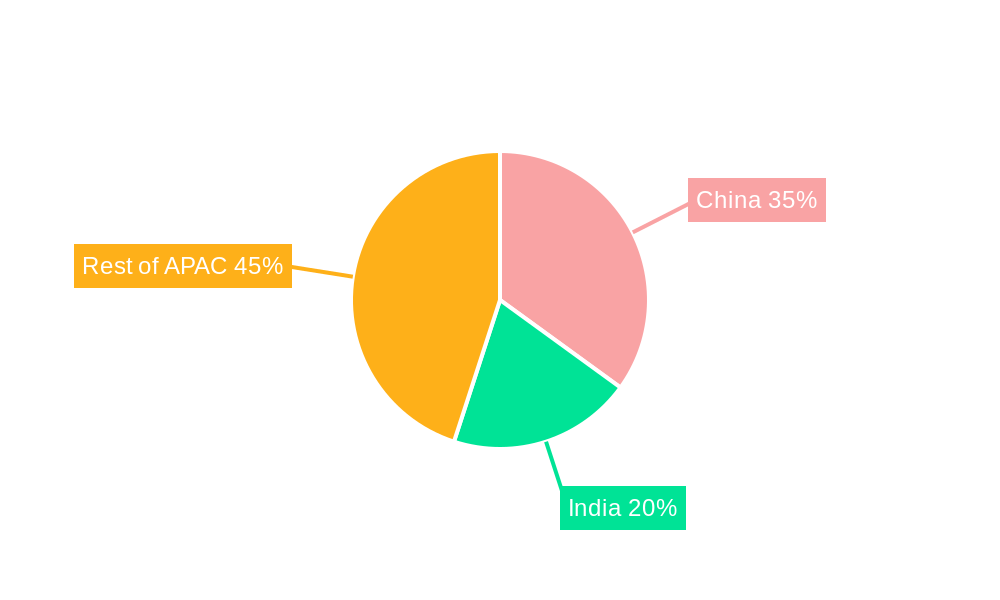

The Asia-Pacific (APAC) Courier, Express, and Parcel (CEP) market is experiencing robust growth, driven by the burgeoning e-commerce sector, rapid urbanization, and increasing cross-border trade. The market's 6.64% CAGR indicates a significant expansion, projected to reach a substantial value by 2033. Key growth drivers include the rising disposable incomes in several APAC countries fueling online shopping, the expansion of logistics infrastructure to support efficient delivery networks, and the increasing adoption of technological advancements such as automated sorting systems and delivery drones. The dominance of e-commerce as an end-user industry is further amplified by the growth of financial services, healthcare, and manufacturing sectors relying heavily on efficient CEP services. While the market faces challenges like fluctuating fuel prices and the complexities of navigating diverse regulatory landscapes across the region, the overall growth trajectory remains positive. Segmentation analysis reveals that express delivery services are significantly contributing to market growth, catering to the rising demand for speed and time-sensitive deliveries, especially in B2C segments. Within the APAC region, China and India are expected to be the largest contributors to market growth due to their massive populations and burgeoning economies. Competition is fierce, with established global players like DHL, FedEx, and UPS, along with strong regional players such as China Post and SF Express, vying for market share. The evolving landscape will likely see increased consolidation and strategic partnerships among CEP providers to enhance efficiency and expand reach.

The future of the APAC CEP market hinges on adapting to technological advancements and evolving customer expectations. Companies are increasingly investing in data analytics, artificial intelligence (AI), and machine learning (ML) to optimize delivery routes, predict demand, and enhance customer experience. Sustainable practices, including the use of electric vehicles and eco-friendly packaging, are gaining prominence due to growing environmental concerns. Furthermore, addressing regulatory hurdles and infrastructure gaps in certain regions remains crucial for sustained growth. The strategic focus will likely be on strengthening last-mile delivery capabilities, enhancing supply chain visibility through advanced tracking systems, and developing robust cross-border shipping solutions to meet the demands of expanding international trade within the APAC region. The continued rise in mobile commerce and the adoption of omnichannel strategies by businesses are expected to further fuel the demand for efficient and reliable CEP services in the coming years.

APAC CEP Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) Courier, Express, and Parcel (CEP) market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report dissects market dynamics, growth trends, dominant segments, and key players, ultimately forecasting market potential through 2033. The report leverages extensive data analysis to deliver actionable intelligence on the APAC CEP market, which is projected to reach xx Million units by 2033.

APAC CEP Market Dynamics & Structure

The APAC CEP market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is high, with a few dominant players holding significant market share. Technological innovation, driven by automation, AI, and data analytics, is a key growth driver, while stringent regulatory frameworks, particularly concerning data privacy and cross-border shipments, present both challenges and opportunities. The market witnesses substantial M&A activity as larger players consolidate their market position and expand their service portfolios. Competitive product substitutes, such as same-day delivery services and specialized niche players, continuously exert pressure on the market leaders.

- Market Concentration: Highly concentrated, with the top 5 players accounting for approximately xx% of the market share in 2024.

- Technological Innovation: Strong focus on automation (robotics, AI-powered sorting), real-time tracking, and improved delivery efficiency.

- Regulatory Landscape: Varying regulations across APAC countries impact operational costs and cross-border shipments. Increased focus on data security compliance.

- M&A Activity: Significant volume of mergers and acquisitions, with xx deals recorded between 2019 and 2024.

- Competitive Substitutes: Growth of e-commerce platforms with in-house logistics and specialized delivery services for specific industries.

- End-User Demographics: Rapidly expanding middle class and increasing e-commerce penetration drive demand across various segments.

APAC CEP Market Growth Trends & Insights

The APAC CEP market exhibits robust growth, fueled by the region's expanding e-commerce sector, rising disposable incomes, and supportive government policies promoting logistics infrastructure development. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a strong CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of drone delivery and autonomous vehicles, are further accelerating market growth and reshaping the industry landscape. Changing consumer behavior, including a preference for faster delivery options and increased reliance on online shopping, are driving the market's expansion. Market penetration rates for express delivery services are projected to increase significantly by xx% by 2033.

Dominant Regions, Countries, or Segments in APAC CEP Market

China remains the dominant market within APAC, accounting for approximately xx% of the total market value in 2024, primarily driven by its massive e-commerce sector and robust manufacturing base. India and Indonesia are exhibiting high growth potential, fueled by their burgeoning economies and expanding digital landscapes. The E-commerce segment is the largest end-user industry, accounting for xx% of the market, followed by Wholesale and Retail Trade (Offline). The B2C model holds a significant market share, reflecting the expansion of online shopping. Domestic shipments contribute a larger portion of the total volume, although International shipments demonstrate significant growth potential. Express delivery services capture a larger market share than non-express options.

- Key Growth Drivers:

- China's dominance in e-commerce and manufacturing.

- Rapid growth of e-commerce in India and Indonesia.

- Increasing government investment in logistics infrastructure.

- Expanding middle class and rising disposable incomes.

- Dominant Segments:

- Country: China (xx Million units), India (xx Million units), Indonesia (xx Million units)

- End-User Industry: E-commerce (xx Million units), Wholesale and Retail Trade (Offline) (xx Million units)

- Mode of Transport: Road (xx Million units), Air (xx Million units)

- Model: Business-to-Consumer (B2C) (xx Million units)

- Destination: Domestic (xx Million units)

- Speed of Delivery: Express (xx Million units)

APAC CEP Market Product Landscape

The APAC CEP market features a diverse range of products and services, including express delivery, freight forwarding, and specialized logistics solutions tailored to specific industry needs. Recent product innovations focus on enhanced tracking capabilities, improved delivery speed and reliability, and the integration of AI and machine learning to optimize delivery routes and improve efficiency. Key selling propositions include real-time visibility, flexible delivery options, and cost-effective solutions. Technological advancements in areas like drone delivery and autonomous vehicles are transforming the product landscape.

Key Drivers, Barriers & Challenges in APAC CEP Market

Key Drivers:

The APAC CEP market is propelled by factors like the rapid expansion of e-commerce, the rising middle class, and substantial investments in logistics infrastructure. Government initiatives aimed at improving the efficiency of supply chains and fostering digital trade further fuel market growth. Technological advancements, such as AI and automation, are transforming delivery efficiency and reducing costs.

Key Challenges & Restraints:

The market faces challenges such as infrastructure limitations in some regions, especially in last-mile delivery, increasing fuel costs, and stringent regulatory compliance requirements. Competition among existing players is fierce, posing pricing pressures. Supply chain disruptions caused by geopolitical events and natural disasters also impact market growth. The cost of implementing new technologies can act as a significant barrier for smaller companies.

Emerging Opportunities in APAC CEP Market

Emerging opportunities lie in untapped rural markets, the growing demand for specialized logistics solutions across sectors like healthcare and cold chain logistics, and the increasing adoption of sustainable and eco-friendly delivery methods. The rise of cross-border e-commerce creates growth avenues, while innovation in areas like drone delivery and autonomous vehicles presents exciting prospects. Personalized delivery services and enhanced customer experiences will be crucial for gaining a competitive edge.

Growth Accelerators in the APAC CEP Market Industry

Long-term growth in the APAC CEP market will be driven by continuous technological innovation, strategic partnerships between CEP providers and e-commerce platforms, and aggressive market expansion strategies into less-developed regions. Investments in advanced technologies like AI, robotics, and blockchain will significantly impact operational efficiency and customer experience. The development of robust last-mile delivery infrastructure will be crucial in maximizing market penetration.

Key Players Shaping the APAC CEP Market Market

- China Post

- CJ Logistics Corporation

- DHL Group

- SG Holdings Co Ltd

- ZTO Expres

- FedEx

- United Parcel Service of America Inc (UPS)

- YTO Express

- Yamato Holdings

- SF Express (KEX-SF)

- Blue Dart Express

- DTDC Express Limited

- Toll Group

- JWD Group

Notable Milestones in APAC CEP Market Sector

- June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution.

- April 2023: China Post and Ping An Bank launched an intelligent archives service center.

- March 2023: Colowide MD Co. Ltd and Yamato Transport Co. Ltd entered an agreement to optimize supply chains.

In-Depth APAC CEP Market Market Outlook

The future of the APAC CEP market is bright, fueled by the continuous growth of e-commerce, technological advancements, and strategic investments in infrastructure. Companies that embrace innovation, adapt to changing consumer preferences, and effectively navigate regulatory landscapes will be best positioned to capitalize on significant growth opportunities. The market is expected to witness further consolidation, with larger players acquiring smaller companies to expand their market reach and service portfolios. Focus on sustainable and efficient delivery solutions will gain importance.

APAC CEP Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

APAC CEP Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. North America APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6.2.1. Express

- 6.2.2. Non-Express

- 6.3. Market Analysis, Insights and Forecast - by Model

- 6.3.1. Business-to-Business (B2B)

- 6.3.2. Business-to-Consumer (B2C)

- 6.3.3. Consumer-to-Consumer (C2C)

- 6.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 6.4.1. Heavy Weight Shipments

- 6.4.2. Light Weight Shipments

- 6.4.3. Medium Weight Shipments

- 6.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.5.1. Air

- 6.5.2. Road

- 6.5.3. Others

- 6.6. Market Analysis, Insights and Forecast - by End User Industry

- 6.6.1. E-Commerce

- 6.6.2. Financial Services (BFSI)

- 6.6.3. Healthcare

- 6.6.4. Manufacturing

- 6.6.5. Primary Industry

- 6.6.6. Wholesale and Retail Trade (Offline)

- 6.6.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 7. South America APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7.2.1. Express

- 7.2.2. Non-Express

- 7.3. Market Analysis, Insights and Forecast - by Model

- 7.3.1. Business-to-Business (B2B)

- 7.3.2. Business-to-Consumer (B2C)

- 7.3.3. Consumer-to-Consumer (C2C)

- 7.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 7.4.1. Heavy Weight Shipments

- 7.4.2. Light Weight Shipments

- 7.4.3. Medium Weight Shipments

- 7.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.5.1. Air

- 7.5.2. Road

- 7.5.3. Others

- 7.6. Market Analysis, Insights and Forecast - by End User Industry

- 7.6.1. E-Commerce

- 7.6.2. Financial Services (BFSI)

- 7.6.3. Healthcare

- 7.6.4. Manufacturing

- 7.6.5. Primary Industry

- 7.6.6. Wholesale and Retail Trade (Offline)

- 7.6.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 8. Europe APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8.2.1. Express

- 8.2.2. Non-Express

- 8.3. Market Analysis, Insights and Forecast - by Model

- 8.3.1. Business-to-Business (B2B)

- 8.3.2. Business-to-Consumer (B2C)

- 8.3.3. Consumer-to-Consumer (C2C)

- 8.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 8.4.1. Heavy Weight Shipments

- 8.4.2. Light Weight Shipments

- 8.4.3. Medium Weight Shipments

- 8.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.5.1. Air

- 8.5.2. Road

- 8.5.3. Others

- 8.6. Market Analysis, Insights and Forecast - by End User Industry

- 8.6.1. E-Commerce

- 8.6.2. Financial Services (BFSI)

- 8.6.3. Healthcare

- 8.6.4. Manufacturing

- 8.6.5. Primary Industry

- 8.6.6. Wholesale and Retail Trade (Offline)

- 8.6.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 9. Middle East & Africa APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9.2.1. Express

- 9.2.2. Non-Express

- 9.3. Market Analysis, Insights and Forecast - by Model

- 9.3.1. Business-to-Business (B2B)

- 9.3.2. Business-to-Consumer (B2C)

- 9.3.3. Consumer-to-Consumer (C2C)

- 9.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 9.4.1. Heavy Weight Shipments

- 9.4.2. Light Weight Shipments

- 9.4.3. Medium Weight Shipments

- 9.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.5.1. Air

- 9.5.2. Road

- 9.5.3. Others

- 9.6. Market Analysis, Insights and Forecast - by End User Industry

- 9.6.1. E-Commerce

- 9.6.2. Financial Services (BFSI)

- 9.6.3. Healthcare

- 9.6.4. Manufacturing

- 9.6.5. Primary Industry

- 9.6.6. Wholesale and Retail Trade (Offline)

- 9.6.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 10. Asia Pacific APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10.2.1. Express

- 10.2.2. Non-Express

- 10.3. Market Analysis, Insights and Forecast - by Model

- 10.3.1. Business-to-Business (B2B)

- 10.3.2. Business-to-Consumer (B2C)

- 10.3.3. Consumer-to-Consumer (C2C)

- 10.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 10.4.1. Heavy Weight Shipments

- 10.4.2. Light Weight Shipments

- 10.4.3. Medium Weight Shipments

- 10.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.5.1. Air

- 10.5.2. Road

- 10.5.3. Others

- 10.6. Market Analysis, Insights and Forecast - by End User Industry

- 10.6.1. E-Commerce

- 10.6.2. Financial Services (BFSI)

- 10.6.3. Healthcare

- 10.6.4. Manufacturing

- 10.6.5. Primary Industry

- 10.6.6. Wholesale and Retail Trade (Offline)

- 10.6.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 11. Netherland APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Germany APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Begium APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. France APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Romania APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Bulgaria APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Rest of Europe APAC CEP Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 China Post

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 CJ Logistics Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 DHL Group

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 SG Holdings Co Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 ZTO Expres

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 FedEx

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 United Parcel Service of America Inc (UPS)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 YTO Express

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Yamato Holdings

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 SF Express (KEX-SF)

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Blue Dart Express

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 DTDC Express Limited

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Toll Group

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 JWD Group

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 China Post

List of Figures

- Figure 1: Global APAC CEP Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Netherland APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Netherland APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Germany APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Germany APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Begium APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Begium APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: France APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 9: France APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Romania APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Romania APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Bulgaria APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Bulgaria APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Rest of Europe APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Rest of Europe APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: North America APAC CEP Market Revenue (Million), by Destination 2024 & 2032

- Figure 17: North America APAC CEP Market Revenue Share (%), by Destination 2024 & 2032

- Figure 18: North America APAC CEP Market Revenue (Million), by Speed Of Delivery 2024 & 2032

- Figure 19: North America APAC CEP Market Revenue Share (%), by Speed Of Delivery 2024 & 2032

- Figure 20: North America APAC CEP Market Revenue (Million), by Model 2024 & 2032

- Figure 21: North America APAC CEP Market Revenue Share (%), by Model 2024 & 2032

- Figure 22: North America APAC CEP Market Revenue (Million), by Shipment Weight 2024 & 2032

- Figure 23: North America APAC CEP Market Revenue Share (%), by Shipment Weight 2024 & 2032

- Figure 24: North America APAC CEP Market Revenue (Million), by Mode Of Transport 2024 & 2032

- Figure 25: North America APAC CEP Market Revenue Share (%), by Mode Of Transport 2024 & 2032

- Figure 26: North America APAC CEP Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: North America APAC CEP Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: North America APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 29: North America APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America APAC CEP Market Revenue (Million), by Destination 2024 & 2032

- Figure 31: South America APAC CEP Market Revenue Share (%), by Destination 2024 & 2032

- Figure 32: South America APAC CEP Market Revenue (Million), by Speed Of Delivery 2024 & 2032

- Figure 33: South America APAC CEP Market Revenue Share (%), by Speed Of Delivery 2024 & 2032

- Figure 34: South America APAC CEP Market Revenue (Million), by Model 2024 & 2032

- Figure 35: South America APAC CEP Market Revenue Share (%), by Model 2024 & 2032

- Figure 36: South America APAC CEP Market Revenue (Million), by Shipment Weight 2024 & 2032

- Figure 37: South America APAC CEP Market Revenue Share (%), by Shipment Weight 2024 & 2032

- Figure 38: South America APAC CEP Market Revenue (Million), by Mode Of Transport 2024 & 2032

- Figure 39: South America APAC CEP Market Revenue Share (%), by Mode Of Transport 2024 & 2032

- Figure 40: South America APAC CEP Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 41: South America APAC CEP Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 42: South America APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 43: South America APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Europe APAC CEP Market Revenue (Million), by Destination 2024 & 2032

- Figure 45: Europe APAC CEP Market Revenue Share (%), by Destination 2024 & 2032

- Figure 46: Europe APAC CEP Market Revenue (Million), by Speed Of Delivery 2024 & 2032

- Figure 47: Europe APAC CEP Market Revenue Share (%), by Speed Of Delivery 2024 & 2032

- Figure 48: Europe APAC CEP Market Revenue (Million), by Model 2024 & 2032

- Figure 49: Europe APAC CEP Market Revenue Share (%), by Model 2024 & 2032

- Figure 50: Europe APAC CEP Market Revenue (Million), by Shipment Weight 2024 & 2032

- Figure 51: Europe APAC CEP Market Revenue Share (%), by Shipment Weight 2024 & 2032

- Figure 52: Europe APAC CEP Market Revenue (Million), by Mode Of Transport 2024 & 2032

- Figure 53: Europe APAC CEP Market Revenue Share (%), by Mode Of Transport 2024 & 2032

- Figure 54: Europe APAC CEP Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 55: Europe APAC CEP Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 56: Europe APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 57: Europe APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Middle East & Africa APAC CEP Market Revenue (Million), by Destination 2024 & 2032

- Figure 59: Middle East & Africa APAC CEP Market Revenue Share (%), by Destination 2024 & 2032

- Figure 60: Middle East & Africa APAC CEP Market Revenue (Million), by Speed Of Delivery 2024 & 2032

- Figure 61: Middle East & Africa APAC CEP Market Revenue Share (%), by Speed Of Delivery 2024 & 2032

- Figure 62: Middle East & Africa APAC CEP Market Revenue (Million), by Model 2024 & 2032

- Figure 63: Middle East & Africa APAC CEP Market Revenue Share (%), by Model 2024 & 2032

- Figure 64: Middle East & Africa APAC CEP Market Revenue (Million), by Shipment Weight 2024 & 2032

- Figure 65: Middle East & Africa APAC CEP Market Revenue Share (%), by Shipment Weight 2024 & 2032

- Figure 66: Middle East & Africa APAC CEP Market Revenue (Million), by Mode Of Transport 2024 & 2032

- Figure 67: Middle East & Africa APAC CEP Market Revenue Share (%), by Mode Of Transport 2024 & 2032

- Figure 68: Middle East & Africa APAC CEP Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 69: Middle East & Africa APAC CEP Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 70: Middle East & Africa APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 71: Middle East & Africa APAC CEP Market Revenue Share (%), by Country 2024 & 2032

- Figure 72: Asia Pacific APAC CEP Market Revenue (Million), by Destination 2024 & 2032

- Figure 73: Asia Pacific APAC CEP Market Revenue Share (%), by Destination 2024 & 2032

- Figure 74: Asia Pacific APAC CEP Market Revenue (Million), by Speed Of Delivery 2024 & 2032

- Figure 75: Asia Pacific APAC CEP Market Revenue Share (%), by Speed Of Delivery 2024 & 2032

- Figure 76: Asia Pacific APAC CEP Market Revenue (Million), by Model 2024 & 2032

- Figure 77: Asia Pacific APAC CEP Market Revenue Share (%), by Model 2024 & 2032

- Figure 78: Asia Pacific APAC CEP Market Revenue (Million), by Shipment Weight 2024 & 2032

- Figure 79: Asia Pacific APAC CEP Market Revenue Share (%), by Shipment Weight 2024 & 2032

- Figure 80: Asia Pacific APAC CEP Market Revenue (Million), by Mode Of Transport 2024 & 2032

- Figure 81: Asia Pacific APAC CEP Market Revenue Share (%), by Mode Of Transport 2024 & 2032

- Figure 82: Asia Pacific APAC CEP Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 83: Asia Pacific APAC CEP Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 84: Asia Pacific APAC CEP Market Revenue (Million), by Country 2024 & 2032

- Figure 85: Asia Pacific APAC CEP Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC CEP Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC CEP Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 3: Global APAC CEP Market Revenue Million Forecast, by Speed Of Delivery 2019 & 2032

- Table 4: Global APAC CEP Market Revenue Million Forecast, by Model 2019 & 2032

- Table 5: Global APAC CEP Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 6: Global APAC CEP Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 7: Global APAC CEP Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 8: Global APAC CEP Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global APAC CEP Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 24: Global APAC CEP Market Revenue Million Forecast, by Speed Of Delivery 2019 & 2032

- Table 25: Global APAC CEP Market Revenue Million Forecast, by Model 2019 & 2032

- Table 26: Global APAC CEP Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 27: Global APAC CEP Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 28: Global APAC CEP Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 29: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global APAC CEP Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 34: Global APAC CEP Market Revenue Million Forecast, by Speed Of Delivery 2019 & 2032

- Table 35: Global APAC CEP Market Revenue Million Forecast, by Model 2019 & 2032

- Table 36: Global APAC CEP Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 37: Global APAC CEP Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 38: Global APAC CEP Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 39: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Brazil APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Argentina APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of South America APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global APAC CEP Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 44: Global APAC CEP Market Revenue Million Forecast, by Speed Of Delivery 2019 & 2032

- Table 45: Global APAC CEP Market Revenue Million Forecast, by Model 2019 & 2032

- Table 46: Global APAC CEP Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 47: Global APAC CEP Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 48: Global APAC CEP Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 49: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United Kingdom APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Germany APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Russia APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Benelux APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Nordics APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global APAC CEP Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 60: Global APAC CEP Market Revenue Million Forecast, by Speed Of Delivery 2019 & 2032

- Table 61: Global APAC CEP Market Revenue Million Forecast, by Model 2019 & 2032

- Table 62: Global APAC CEP Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 63: Global APAC CEP Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 64: Global APAC CEP Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 65: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Turkey APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Israel APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: GCC APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: North Africa APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: South Africa APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Middle East & Africa APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Global APAC CEP Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 73: Global APAC CEP Market Revenue Million Forecast, by Speed Of Delivery 2019 & 2032

- Table 74: Global APAC CEP Market Revenue Million Forecast, by Model 2019 & 2032

- Table 75: Global APAC CEP Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 76: Global APAC CEP Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 77: Global APAC CEP Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 78: Global APAC CEP Market Revenue Million Forecast, by Country 2019 & 2032

- Table 79: China APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: India APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 81: Japan APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: South Korea APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 83: ASEAN APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Oceania APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 85: Rest of Asia Pacific APAC CEP Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC CEP Market?

The projected CAGR is approximately 6.64%.

2. Which companies are prominent players in the APAC CEP Market?

Key companies in the market include China Post, CJ Logistics Corporation, DHL Group, SG Holdings Co Ltd, ZTO Expres, FedEx, United Parcel Service of America Inc (UPS), YTO Express, Yamato Holdings, SF Express (KEX-SF), Blue Dart Express, DTDC Express Limited, Toll Group, JWD Group.

3. What are the main segments of the APAC CEP Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China. The intelligent delivery solution relies on a combination of unmanned vehicles outdoors and robots indoors, constructing an integrated indoor and outdoor unmanned distribution mode and developing a last-mile logistics network with AI transport capacity sharing.April 2023: China Post and the Automobile Consumption Financial Center of Ping An Bank Co. Ltd launched an intelligent archives service center in Guangdong to promote the service integration of auto finance and express and logistics businesses.March 2023: Colowide MD Co. Ltd, which oversees merchandising for the Colowide Group, and Yamato Transport Co. Ltd entered an agreement. The two companies will promote the visualization and optimization of the entire supply chain of Colowide Group, which operates multiple brands such as Gyu-Kaku, Kappa Sushi, and OOTOYA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC CEP Market?

To stay informed about further developments, trends, and reports in the APAC CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence