Key Insights

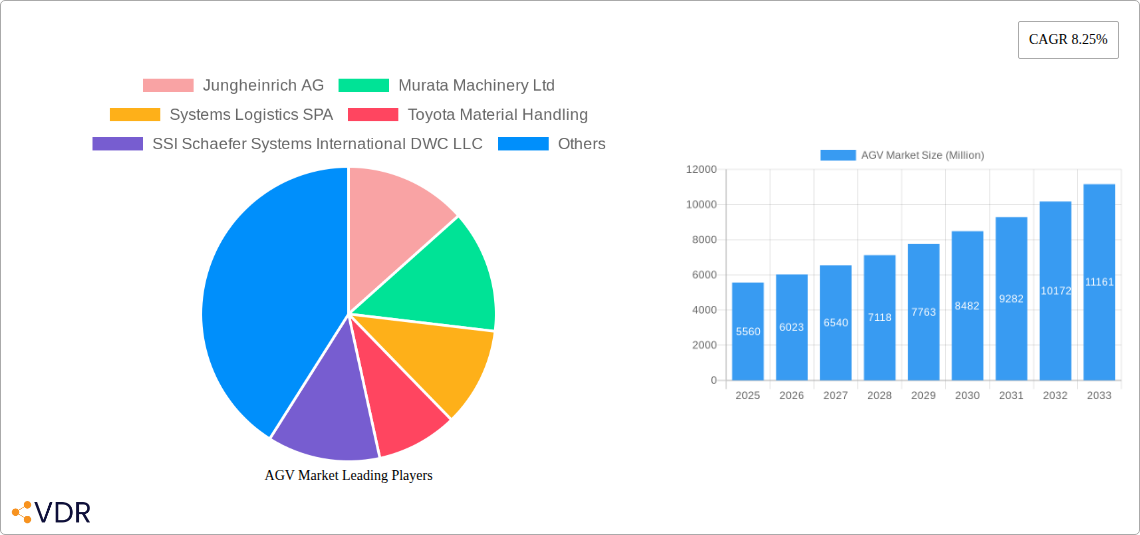

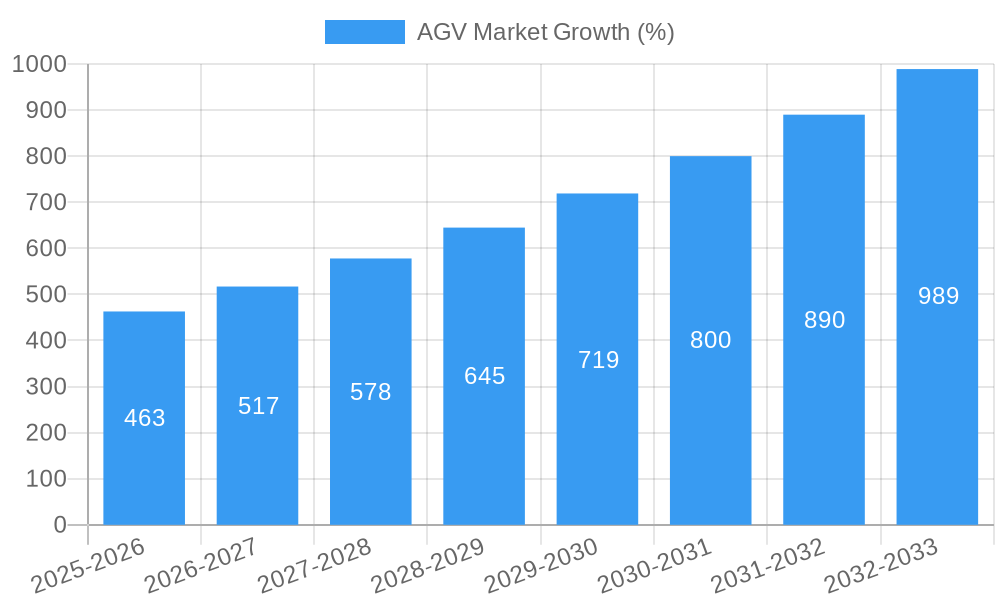

The global Automated Guided Vehicle (AGV) market is experiencing robust growth, projected to reach $5.56 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.25% from 2025 to 2033. This expansion is fueled by several key factors. Increasing adoption of automation across diverse industries like e-commerce (driving demand for warehouse automation), food and beverage (enhancing efficiency in logistics), and automotive (optimizing manufacturing processes) is a major driver. The rising need for improved warehouse efficiency, reduced labor costs, and enhanced safety standards further contribute to market growth. Technological advancements, such as the integration of Artificial Intelligence (AI) and improved navigation systems, are leading to more sophisticated and versatile AGVs, expanding their application possibilities across various sectors.

However, the market also faces certain restraints. High initial investment costs associated with AGV implementation can be a barrier for smaller businesses. The complexity of integrating AGVs into existing infrastructure and the need for skilled workforce for maintenance and operation can also pose challenges. Despite these limitations, the long-term benefits of improved productivity, reduced operational costs, and enhanced supply chain resilience are expected to outweigh these constraints, driving continued market expansion. The segmentation reveals that Automated Forklifts and Unit Load AGVs currently dominate the product type segment, while the Food & Beverage and Automotive sectors are leading adopters among end-user industries. Major players like Jungheinrich AG, Murata Machinery Ltd, and Dematic Corp are actively shaping market dynamics through innovation and expansion strategies, contributing to the overall market momentum.

AGV Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Automated Guided Vehicle (AGV) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report dives deep into both the parent market (Automated Material Handling Equipment) and the child market (AGV), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market size is presented in million units.

AGV Market Dynamics & Structure

The AGV market is characterized by a moderately concentrated landscape, with key players like Jungheinrich AG, Murata Machinery Ltd, and Daifuku Co Ltd holding significant market share. However, the market is also witnessing increasing participation from smaller, specialized firms focusing on niche applications. Technological innovation, particularly in AI, robotics, and sensor technology, is a primary growth driver, enabling the development of more sophisticated and efficient AGVs. Stringent safety regulations and industry standards influence design and implementation, while the availability of competitive substitute technologies (e.g., automated forklifts, conveyor systems) present challenges. The end-user demographic is broad, encompassing diverse industries, with a growing demand from e-commerce and logistics sectors. M&A activity in the AGV sector is relatively high, with xx major deals recorded between 2019 and 2024, reflecting a push for consolidation and technological integration.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AI, robotics, and sensor technologies are key drivers.

- Regulatory Framework: Stringent safety and operational standards influence market growth.

- Competitive Substitutes: Automated forklifts and conveyor systems pose competitive pressure.

- End-User Demographics: Diverse, with significant growth from e-commerce and logistics.

- M&A Trends: High level of M&A activity, xx major deals between 2019-2024.

AGV Market Growth Trends & Insights

The AGV market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to increasing automation needs across various industries, particularly e-commerce and logistics which are experiencing explosive demand and hence requiring more efficiency to sustain. Technological advancements, such as the integration of AI and improved navigation systems, have enhanced AGV capabilities, leading to wider adoption. Changing consumer behavior, favoring faster delivery times and improved supply chain efficiency, further fuels market expansion. The estimated market size in 2025 is xx million units, with a projected CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Market penetration in key industries like automotive and electronics remains relatively high, while emerging opportunities lie in expanding to sectors like pharmaceuticals and food & beverage.

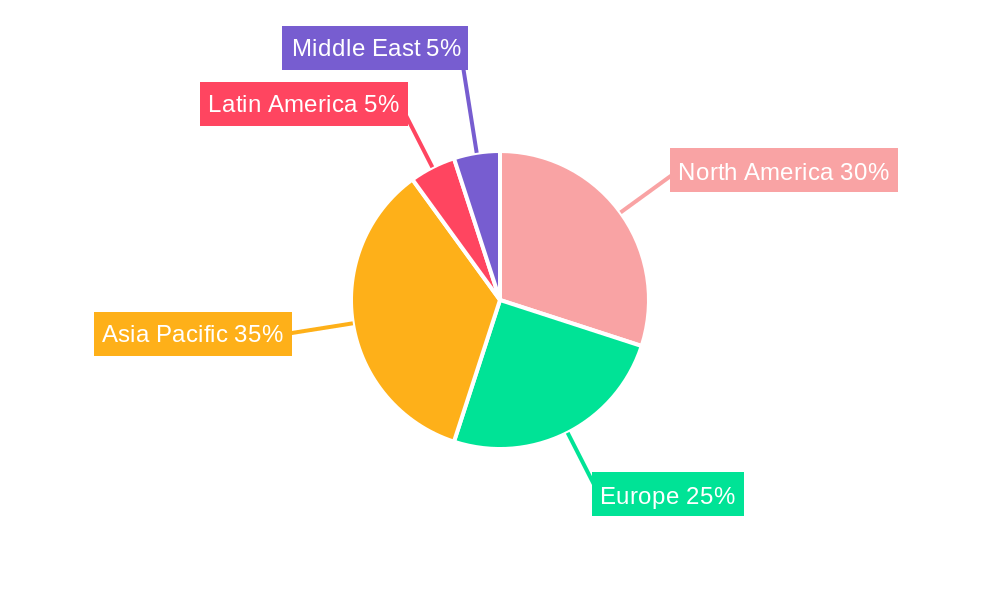

Dominant Regions, Countries, or Segments in AGV Market

North America and Europe currently dominate the AGV market, driven by strong technological advancements, high adoption rates, and well-established industrial automation infrastructure. Within product types, Automated Forklifts and Automated Tow/Tractor/Tugs hold the largest market share, accounting for approximately xx% combined in 2024. The Automotive and Electronics & Electrical industries are the key end-user segments, primarily due to their high levels of automation and stringent efficiency requirements. However, significant growth potential is anticipated in the Food & Beverage and Pharmaceuticals industries. Asia-Pacific is projected to exhibit rapid growth during the forecast period, driven by expanding manufacturing capacity and increasing investments in automation technologies.

- Key Drivers:

- North America: Strong automation adoption and technological innovation.

- Europe: Mature industrial automation infrastructure and regulatory support.

- Asia-Pacific: Rapidly expanding manufacturing sector and growing automation investments.

- Dominant Segments:

- Product Type: Automated Forklifts and Automated Tow/Tractor/Tugs.

- End-User Industry: Automotive and Electronics & Electrical.

AGV Market Product Landscape

The AGV market showcases continuous product innovations, encompassing enhanced navigation systems (e.g., SLAM, LiDAR), improved payload capacities, and increased operational efficiency. New applications are emerging in warehouse automation, manufacturing, and material handling, addressing diverse customer needs. Key performance indicators include payload capacity, speed, battery life, and safety features. Unique selling propositions focus on flexibility, scalability, and integration with existing warehouse management systems (WMS). Technological advancements emphasize AI-powered decision-making, predictive maintenance, and autonomous navigation.

Key Drivers, Barriers & Challenges in AGV Market

Key Drivers: The increasing demand for efficient logistics and warehouse operations, coupled with labor shortages and rising labor costs, are pushing the adoption of AGVs. Government initiatives promoting automation and technological advancements in navigation and control systems are accelerating market growth. The growing e-commerce sector and its need for rapid order fulfillment are major catalysts for market expansion.

Challenges and Restraints: High initial investment costs, integration complexities with existing systems, and concerns about job displacement pose significant challenges. Supply chain disruptions affecting component availability can hinder production and deployment. Safety regulations and cybersecurity risks must be addressed to ensure reliable and secure operations. The complexity of integrating AGVs into existing systems is a further barrier. These factors lead to xx% (projected) decrease in market growth within xx timeframe.

Emerging Opportunities in AGV Market

Emerging opportunities include the integration of AGVs with other automated systems (e.g., robotic arms), the development of AGVs for specialized environments (e.g., cold storage), and expansion into new industries (e.g., healthcare). Untapped markets exist in developing economies, where the need for improved efficiency and cost savings is high. Consumer preferences for faster delivery and seamless shopping experiences further drive demand for efficient automated solutions. The growth of last-mile delivery solutions is creating a vast opportunity for the deployment of smaller, more agile AGVs.

Growth Accelerators in the AGV Market Industry

Strategic partnerships between AGV manufacturers and technology providers, focused on the integration of advanced technologies (AI, IoT), are fostering innovation and accelerating market growth. Expansion into new geographical markets, particularly in developing economies, creates significant growth opportunities. Government incentives and supportive policies promoting automation are crucial catalysts. The increasing focus on sustainability and the development of energy-efficient AGVs are also driving market expansion.

Key Players Shaping the AGV Market Market

- Jungheinrich AG

- Murata Machinery Ltd

- Systems Logistics SPA

- Toyota Material Handling

- SSI Schaefer Systems International DWC LLC

- KUKA AG

- Dematic Corp

- Daifuku Co Ltd

- Scott Technology Limited

- John Bean Technologies (JBT) Corporation

- Swisslog Holding

- Seegrid Corporation

Notable Milestones in AGV Market Sector

- June 2023: Mitsubishi Logisnext Americas and Jungheinrich launched Rocrich AGV Solutions, expanding their partnership and broadening AGV offerings.

- August 2022: Swissport piloted an unmanned AGV for unit load devices at Frankfurt Airport, demonstrating potential for automated cargo handling.

- March 2022: Third Wave Automation and CLARK Material Handling partnered to launch the "TWA Reach," a new automated reach truck.

- March 2022: KNAPP and Covariant strengthened their collaboration to develop AI-powered robot solutions, enhancing warehouse efficiency.

In-Depth AGV Market Market Outlook

The AGV market is poised for sustained growth, driven by the continuous integration of advanced technologies, expansion into new applications, and increasing demand from various industries. Strategic partnerships and investments in research and development will further enhance market potential. The focus on improving efficiency, reducing costs, and enhancing safety will drive adoption across diverse sectors. The market's future success hinges on addressing ongoing challenges like high initial investment costs and integration complexities. Nevertheless, the long-term outlook for the AGV market remains highly positive, indicating substantial growth and opportunities for innovation.

AGV Market Segmentation

-

1. Product Type

- 1.1. Automated Fork Lift

- 1.2. Automated Tow/Tractor/Tugs

- 1.3. Unit Load

- 1.4. Assembly Line

- 1.5. Special Purpose

-

2. End-User Industry

- 2.1. Food & Beverage

- 2.2. Automotive

- 2.3. Retail

- 2.4. Electronics & Electrical

- 2.5. General Manufacturing

- 2.6. Pharmaceuticals

- 2.7. Other End User Industries

AGV Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

AGV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth of E-commerce Demanding Higher Efficiency; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. Limitation of Real-Time Wireless Control Due to Communication Delays

- 3.4. Market Trends

- 3.4.1. Rapid Growth of E-commerce Demanding Higher Efficency

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AGV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automated Fork Lift

- 5.1.2. Automated Tow/Tractor/Tugs

- 5.1.3. Unit Load

- 5.1.4. Assembly Line

- 5.1.5. Special Purpose

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food & Beverage

- 5.2.2. Automotive

- 5.2.3. Retail

- 5.2.4. Electronics & Electrical

- 5.2.5. General Manufacturing

- 5.2.6. Pharmaceuticals

- 5.2.7. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America AGV Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Automated Fork Lift

- 6.1.2. Automated Tow/Tractor/Tugs

- 6.1.3. Unit Load

- 6.1.4. Assembly Line

- 6.1.5. Special Purpose

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Food & Beverage

- 6.2.2. Automotive

- 6.2.3. Retail

- 6.2.4. Electronics & Electrical

- 6.2.5. General Manufacturing

- 6.2.6. Pharmaceuticals

- 6.2.7. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe AGV Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Automated Fork Lift

- 7.1.2. Automated Tow/Tractor/Tugs

- 7.1.3. Unit Load

- 7.1.4. Assembly Line

- 7.1.5. Special Purpose

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Food & Beverage

- 7.2.2. Automotive

- 7.2.3. Retail

- 7.2.4. Electronics & Electrical

- 7.2.5. General Manufacturing

- 7.2.6. Pharmaceuticals

- 7.2.7. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia AGV Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Automated Fork Lift

- 8.1.2. Automated Tow/Tractor/Tugs

- 8.1.3. Unit Load

- 8.1.4. Assembly Line

- 8.1.5. Special Purpose

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Food & Beverage

- 8.2.2. Automotive

- 8.2.3. Retail

- 8.2.4. Electronics & Electrical

- 8.2.5. General Manufacturing

- 8.2.6. Pharmaceuticals

- 8.2.7. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand AGV Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Automated Fork Lift

- 9.1.2. Automated Tow/Tractor/Tugs

- 9.1.3. Unit Load

- 9.1.4. Assembly Line

- 9.1.5. Special Purpose

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Food & Beverage

- 9.2.2. Automotive

- 9.2.3. Retail

- 9.2.4. Electronics & Electrical

- 9.2.5. General Manufacturing

- 9.2.6. Pharmaceuticals

- 9.2.7. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America AGV Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Automated Fork Lift

- 10.1.2. Automated Tow/Tractor/Tugs

- 10.1.3. Unit Load

- 10.1.4. Assembly Line

- 10.1.5. Special Purpose

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Food & Beverage

- 10.2.2. Automotive

- 10.2.3. Retail

- 10.2.4. Electronics & Electrical

- 10.2.5. General Manufacturing

- 10.2.6. Pharmaceuticals

- 10.2.7. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa AGV Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Automated Fork Lift

- 11.1.2. Automated Tow/Tractor/Tugs

- 11.1.3. Unit Load

- 11.1.4. Assembly Line

- 11.1.5. Special Purpose

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Food & Beverage

- 11.2.2. Automotive

- 11.2.3. Retail

- 11.2.4. Electronics & Electrical

- 11.2.5. General Manufacturing

- 11.2.6. Pharmaceuticals

- 11.2.7. Other End User Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. North America AGV Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe AGV Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific AGV Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America AGV Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East AGV Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Jungheinrich AG

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Murata Machinery Ltd

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Systems Logistics SPA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Toyota Material Handling

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 SSI Schaefer Systems International DWC LLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 KUKA AG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Dematic Corp

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Daifuku Co Ltd

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Scott Technology Limited

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 John Bean Technologies (JBT) Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Swisslog Holding

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Seegrid Corporation*List Not Exhaustive

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global AGV Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America AGV Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America AGV Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America AGV Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 15: North America AGV Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 16: North America AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe AGV Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe AGV Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe AGV Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 21: Europe AGV Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: Europe AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia AGV Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia AGV Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia AGV Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 27: Asia AGV Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 28: Asia AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Australia and New Zealand AGV Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Australia and New Zealand AGV Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Australia and New Zealand AGV Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 33: Australia and New Zealand AGV Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Australia and New Zealand AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Australia and New Zealand AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America AGV Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Latin America AGV Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Latin America AGV Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 39: Latin America AGV Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 40: Latin America AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America AGV Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa AGV Market Revenue (Million), by Product Type 2024 & 2032

- Figure 43: Middle East and Africa AGV Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 44: Middle East and Africa AGV Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 45: Middle East and Africa AGV Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 46: Middle East and Africa AGV Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Middle East and Africa AGV Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global AGV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global AGV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: AGV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: AGV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: AGV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: AGV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: AGV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 20: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 23: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 26: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 29: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global AGV Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global AGV Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 32: Global AGV Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AGV Market?

The projected CAGR is approximately 8.25%.

2. Which companies are prominent players in the AGV Market?

Key companies in the market include Jungheinrich AG, Murata Machinery Ltd, Systems Logistics SPA, Toyota Material Handling, SSI Schaefer Systems International DWC LLC, KUKA AG, Dematic Corp, Daifuku Co Ltd, Scott Technology Limited, John Bean Technologies (JBT) Corporation, Swisslog Holding, Seegrid Corporation*List Not Exhaustive.

3. What are the main segments of the AGV Market?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth of E-commerce Demanding Higher Efficiency; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

Rapid Growth of E-commerce Demanding Higher Efficency.

7. Are there any restraints impacting market growth?

Limitation of Real-Time Wireless Control Due to Communication Delays.

8. Can you provide examples of recent developments in the market?

June 2023: Mitsubishi Logisnext Americas and Jungheinrich announced an expansion of their partnership for mobile automation solutions in North America by launching a company called Rocrich AGV Solutions. The combined product and service portfolios of Jungheinrich and Rocla will likely enable Rocrich to cover all major customer use cases, from standard to special purpose AGVs and automated forklifts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AGV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AGV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AGV Market?

To stay informed about further developments, trends, and reports in the AGV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence