Key Insights

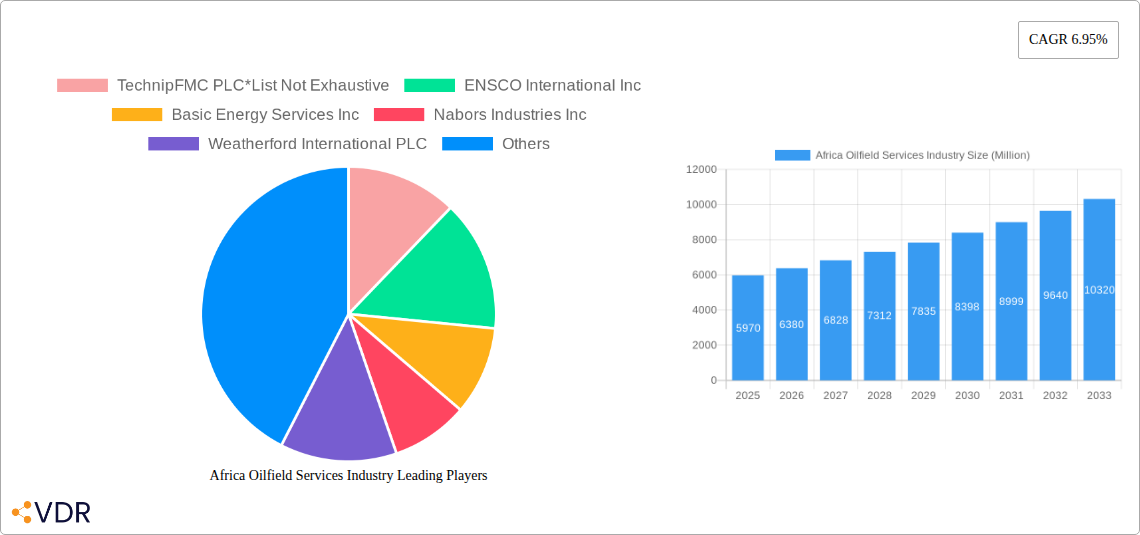

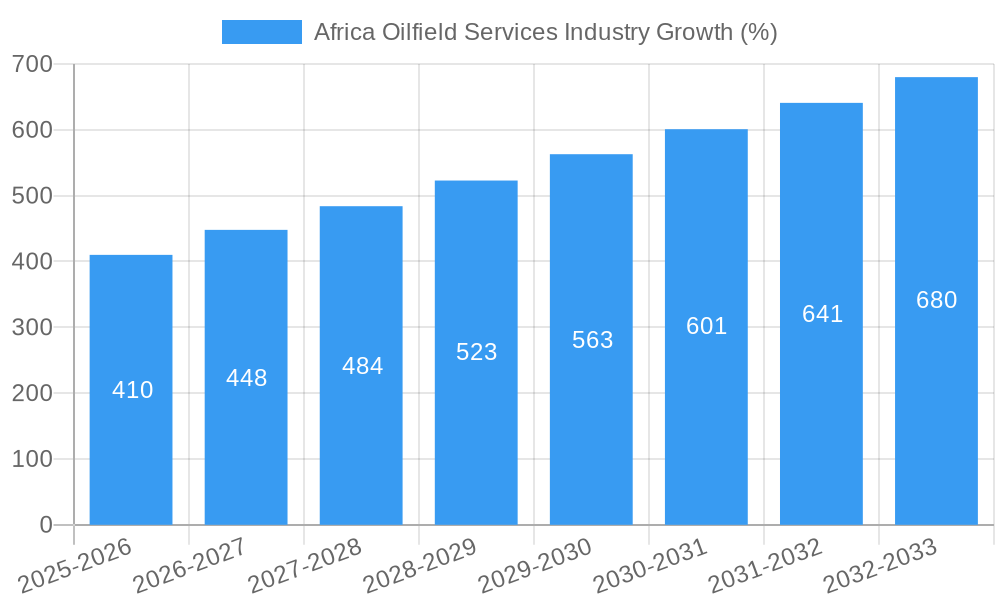

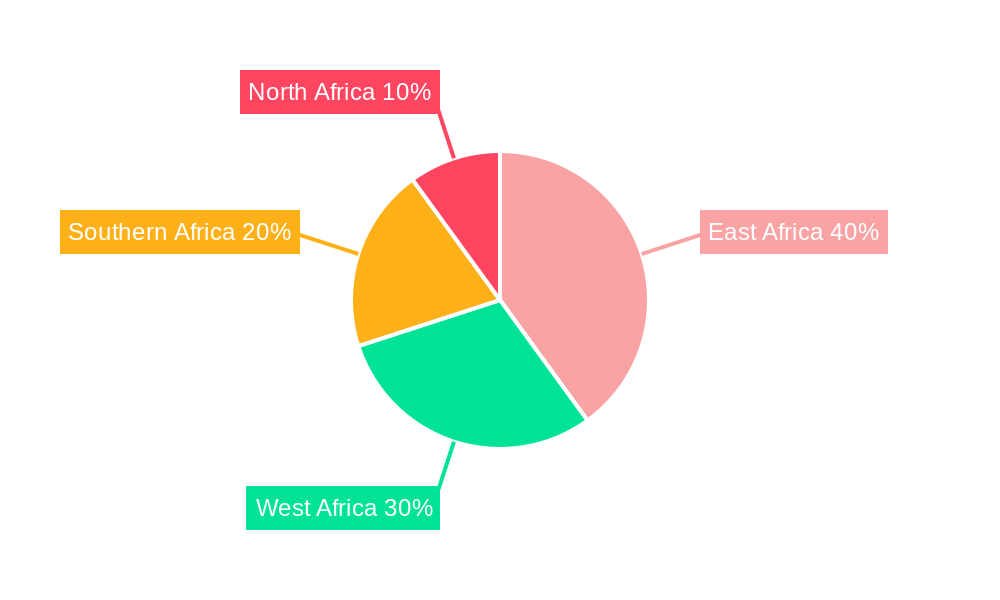

The Africa Oilfield Services market, valued at $5.97 billion in 2025, is projected to experience robust growth, driven by increasing exploration and production activities across the continent. A Compound Annual Growth Rate (CAGR) of 6.95% is anticipated from 2025 to 2033, indicating a significant expansion of the market to approximately $11.5 billion by 2033. This growth is fueled by several factors, including substantial investments in new oil and gas discoveries, particularly in East Africa (Kenya, Uganda, Tanzania), coupled with ongoing operations in established oil-producing nations such as South Africa and Sudan. The demand for drilling, completion, and production services is expected to rise consistently as companies strive to meet the growing global energy demand and capitalize on Africa's untapped hydrocarbon resources. However, challenges such as geopolitical instability in certain regions, infrastructure limitations, and regulatory hurdles could potentially moderate growth. The segment breakdown reveals a significant share for onshore services, reflecting the prevalence of onshore oil and gas fields. Major players, including Schlumberger, Halliburton, Baker Hughes, and TechnipFMC, are actively involved, leveraging their expertise and technological advancements to cater to the growing market demand. The competitive landscape is dynamic, with both international and local companies vying for market share. Future growth will likely hinge on effective risk management strategies, addressing logistical challenges, and continuous innovation in oilfield technologies.

The offshore segment, while currently smaller, presents substantial growth potential as deepwater exploration gains momentum. Technological advancements that enhance efficiency and safety in offshore operations are crucial for driving this segment's expansion. The "Other Services" category encompasses a broad range of ancillary services, expected to expand in line with the overall market growth. Regional disparities are expected, with East Africa exhibiting particularly high growth potential driven by new discoveries and expanding infrastructure. Sustained investment in both human capital development and advanced technological solutions will be critical in mitigating risks and unlocking the full potential of the African oilfield services market.

Africa Oilfield Services Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Africa oilfield services industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report segments the market by service type (Drilling Services, Completion Services, Production Services, Other Services) and location of deployment (Onshore, Offshore), offering granular insights into the dynamic African oil and gas landscape. The total market size in 2025 is estimated at XX Million.

Africa Oilfield Services Industry Market Dynamics & Structure

The African oilfield services market is characterized by a moderately concentrated structure, with a few multinational corporations holding significant market share alongside numerous smaller, regional players. Market concentration is higher in certain segments like offshore drilling compared to onshore production services. Technological innovation, driven by the need for enhanced efficiency and safety, is a key driver. However, barriers to innovation, such as limited access to capital and infrastructure, are present. Stringent regulatory frameworks and evolving environmental concerns influence operational practices. The market is susceptible to price fluctuations in crude oil and natural gas. M&A activity is moderate, with larger companies seeking to consolidate their presence and acquire niche technologies. The volume of M&A deals in the historical period (2019-2024) averaged approximately XX deals per year, with a total deal value of approximately XX Million.

- Market Concentration: Moderate, with multinational dominance in specific segments.

- Technological Innovation: Significant driver, challenged by access to capital and infrastructure.

- Regulatory Framework: Stringent, evolving to address environmental concerns.

- Competitive Substitutes: Limited, mostly focused on cost-effective solutions.

- M&A Trends: Moderate activity, focused on consolidation and technology acquisition.

Africa Oilfield Services Industry Growth Trends & Insights

The Africa oilfield services market exhibited a CAGR of XX% during the historical period (2019-2024), reaching an estimated size of XX Million in 2024. Growth is primarily fueled by increasing oil and gas exploration and production activities across the continent, driven by rising energy demand and significant reserves. The adoption of advanced technologies, such as digitalization and automation, is gradually increasing, improving efficiency and reducing operational costs. However, fluctuating oil prices and geopolitical instability remain significant challenges. Consumer behavior shifts are subtle, with a growing emphasis on sustainability and environmental responsibility. The market is expected to witness a CAGR of XX% during the forecast period (2025-2033), reaching XX Million by 2033. Market penetration of advanced technologies is expected to increase steadily, leading to improved efficiency gains.

Dominant Regions, Countries, or Segments in Africa Oilfield Services Industry

Nigeria, Angola, and Egypt are the dominant countries in the African oilfield services market, accounting for a combined XX% of the total market value in 2025. The offshore segment dominates due to extensive offshore oil and gas reserves. Drilling services comprise the largest segment, reflecting a significant focus on exploration and production activities.

- Key Drivers: Abundant oil and gas reserves, increasing exploration and production activities, favorable government policies in specific regions.

- Dominance Factors: Existing infrastructure in certain regions, expertise and experience of local players, and supportive regulatory environments.

- Growth Potential: High, particularly in less-explored regions with significant potential reserves.

Africa Oilfield Services Industry Product Landscape

The Africa oilfield services market showcases a diverse range of products and services, including advanced drilling rigs, completion equipment, and production optimization technologies. Innovations focus on enhancing efficiency, safety, and environmental performance. Unique selling propositions include improved fuel efficiency, reduced downtime, and advanced automation features. Technological advancements are focused on remote monitoring, data analytics, and automation to optimize operations and reduce costs.

Key Drivers, Barriers & Challenges in Africa Oilfield Services Industry

Key Drivers:

- Growing energy demand across Africa.

- Significant oil and gas reserves.

- Government initiatives supporting exploration and production.

- Investment in infrastructure development.

Challenges & Restraints:

- Volatility in crude oil prices.

- Geopolitical instability in some regions.

- Limited access to finance and technology in certain areas.

- Infrastructure gaps in several regions. This results in an estimated XX Million loss annually in potential revenue.

Emerging Opportunities in Africa Oilfield Services Industry

- Expansion into less-explored regions with high potential.

- Development of cost-effective and sustainable solutions.

- Adoption of digital technologies for improved efficiency.

- Focus on local content development and capacity building.

Growth Accelerators in the Africa Oilfield Services Industry

Long-term growth will be accelerated by continued investment in infrastructure development, technological advancements leading to greater efficiency and safety, and strategic partnerships to foster local capacity building. Furthermore, supportive government policies encouraging investment in the sector are crucial.

Key Players Shaping the Africa Oilfield Services Industry Market

- TechnipFMC PLC

- ENSCO International Inc

- Basic Energy Services Inc

- Nabors Industries Inc

- Weatherford International PLC

- Transocean Ltd

- Petrofac Ltd

- Baker Hughes Company

- China Oilfield Services Ltd

- Halliburton Company

- Schlumberger Limited

Notable Milestones in Africa Oilfield Services Industry Sector

- November 2022: TotalEnergies announced plans to explore oil and gas resources offshore South Africa, signifying renewed interest in the region's deepwater potential.

- October 2022: Eco (Atlantic) commenced drilling an exploration well offshore South Africa, highlighting ongoing exploration activities and the utilization of advanced drilling technologies.

In-Depth Africa Oilfield Services Industry Market Outlook

The Africa oilfield services market presents substantial long-term growth potential, driven by increasing energy demand, significant untapped reserves, and ongoing investments in infrastructure development. Strategic opportunities exist for companies offering technologically advanced, cost-effective, and environmentally responsible solutions. The focus on local content and capacity building offers additional growth prospects for local players and international collaborations.

Africa Oilfield Services Industry Segmentation

-

1. Service Type

- 1.1. Drilling Services

- 1.2. Completion Services

- 1.3. Production Services

- 1.4. Other Services

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. Nigeria

- 3.2. Angola

- 3.3. Algeria

- 3.4. Rest of Africa

Africa Oilfield Services Industry Segmentation By Geography

- 1. Nigeria

- 2. Angola

- 3. Algeria

- 4. Rest of Africa

Africa Oilfield Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Drilling Services to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Drilling Services

- 5.1.2. Completion Services

- 5.1.3. Production Services

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Nigeria

- 5.3.2. Angola

- 5.3.3. Algeria

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Nigeria

- 5.4.2. Angola

- 5.4.3. Algeria

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Nigeria Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Drilling Services

- 6.1.2. Completion Services

- 6.1.3. Production Services

- 6.1.4. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Nigeria

- 6.3.2. Angola

- 6.3.3. Algeria

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Angola Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Drilling Services

- 7.1.2. Completion Services

- 7.1.3. Production Services

- 7.1.4. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Nigeria

- 7.3.2. Angola

- 7.3.3. Algeria

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Algeria Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Drilling Services

- 8.1.2. Completion Services

- 8.1.3. Production Services

- 8.1.4. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Nigeria

- 8.3.2. Angola

- 8.3.3. Algeria

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Africa Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Drilling Services

- 9.1.2. Completion Services

- 9.1.3. Production Services

- 9.1.4. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Nigeria

- 9.3.2. Angola

- 9.3.3. Algeria

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. South Africa Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 TechnipFMC PLC*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ENSCO International Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Basic Energy Services Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nabors Industries Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Weatherford International PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Transocean Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Petrofac Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Baker Hughes Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 China Oilfield Services Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Halliburton Company

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Schlumberger Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 TechnipFMC PLC*List Not Exhaustive

List of Figures

- Figure 1: Africa Oilfield Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Oilfield Services Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Oilfield Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Africa Oilfield Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Africa Oilfield Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Africa Oilfield Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Oilfield Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Oilfield Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Oilfield Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Oilfield Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Oilfield Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Oilfield Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Africa Oilfield Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 15: Africa Oilfield Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Africa Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Africa Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 18: Africa Oilfield Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 19: Africa Oilfield Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Africa Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 22: Africa Oilfield Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 23: Africa Oilfield Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Africa Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Africa Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 26: Africa Oilfield Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 27: Africa Oilfield Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Africa Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Oilfield Services Industry?

The projected CAGR is approximately 6.95%.

2. Which companies are prominent players in the Africa Oilfield Services Industry?

Key companies in the market include TechnipFMC PLC*List Not Exhaustive, ENSCO International Inc, Basic Energy Services Inc, Nabors Industries Inc, Weatherford International PLC, Transocean Ltd, Petrofac Ltd, Baker Hughes Company, China Oilfield Services Ltd, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the Africa Oilfield Services Industry?

The market segments include Service Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.97 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Drilling Services to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

November 2022: TotalEnergies announced its plan to explore oil and gas resources in an area offshore South Africa. The company plans to drill one well in the Deep Water Orange Basin, off the west coast of South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Oilfield Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Oilfield Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Oilfield Services Industry?

To stay informed about further developments, trends, and reports in the Africa Oilfield Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence