Key Insights

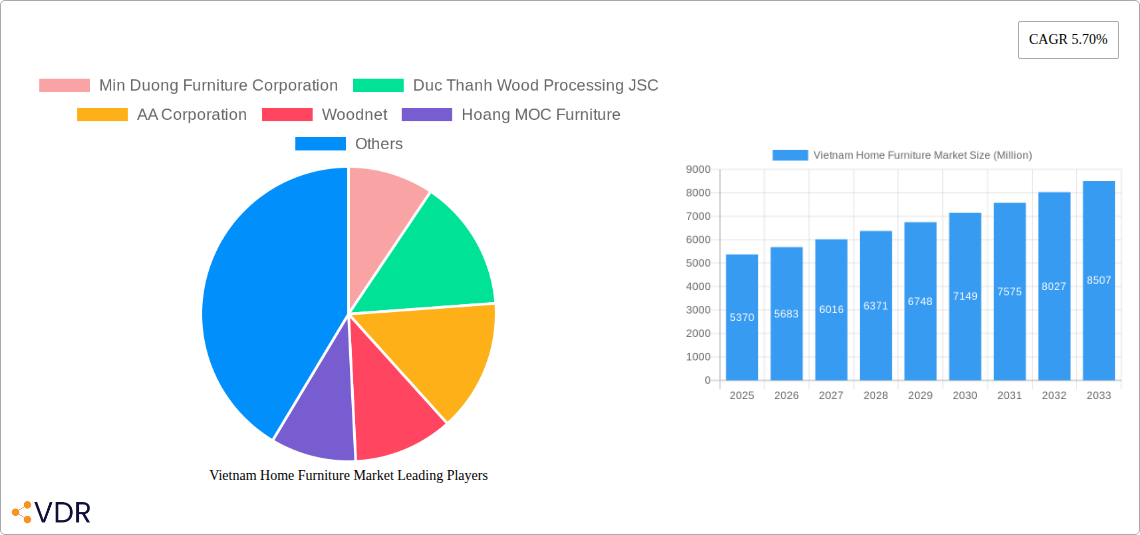

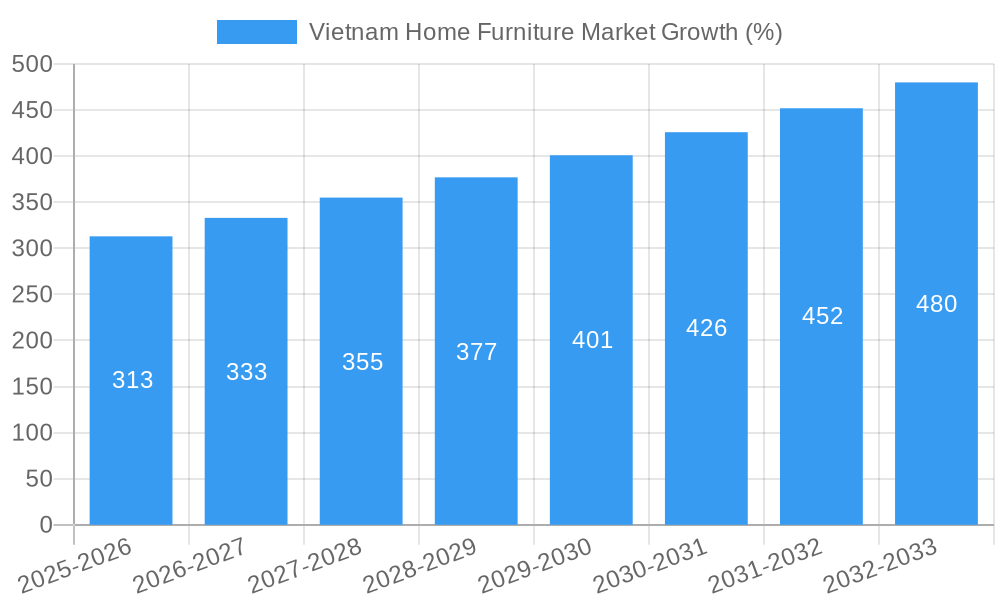

The Vietnam home furniture market, valued at $5.37 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.70% from 2025 to 2033. This growth is fueled by several key factors. A rising middle class with increased disposable incomes is driving demand for higher-quality and stylish furniture, particularly in urban centers. Furthermore, a burgeoning construction sector, including new residential developments and apartment complexes, creates significant demand for furniture across all segments. The increasing popularity of e-commerce platforms offers convenient access to a wider range of products and brands, further boosting market expansion. While the market is fragmented, comprising both domestic and international players, there's a noticeable shift towards modern designs and sustainable materials, influencing consumer preferences and manufacturer strategies. Growth in the online distribution channel is particularly notable, reflecting consumer preference shifts.

However, challenges remain. Fluctuations in raw material prices, particularly timber, can impact production costs and profitability. Competition from cheaper imports, particularly from neighboring countries, also poses a threat to domestic manufacturers. To mitigate these challenges, Vietnamese furniture companies are increasingly focusing on specialization, product differentiation through innovative designs, and strategic partnerships to enhance their supply chains and distribution networks. The growing emphasis on sustainability and eco-friendly production practices is likely to gain traction and create new market opportunities for companies that embrace these trends. The market segmentation by furniture type (kitchen, living room, bedroom, etc.) and distribution channels (online, home centers, specialty stores) highlights distinct opportunities for targeted marketing and product development strategies. The concentration of key players, including both local and international brands, further underscores the dynamic and competitive nature of the Vietnamese home furniture market.

Vietnam Home Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam home furniture market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. Market values are presented in million units.

Vietnam Home Furniture Market Market Dynamics & Structure

The Vietnam home furniture market, valued at xx million units in 2024, exhibits a moderately consolidated structure. Key factors shaping the market include technological innovations (e.g., smart furniture, 3D printing), evolving consumer preferences towards modern aesthetics and sustainable materials, and a supportive government regulatory framework promoting domestic manufacturing and foreign investment. Competitive pressures stem from both domestic and international players, with increasing presence of imported furniture. Furthermore, substitutes like modular furniture and ready-to-assemble (RTA) options are influencing market segmentation. Mergers and acquisitions (M&A) activity is moderate, with a projected xx deals per year for the forecast period, primarily driven by expansion strategies and market consolidation.

- Market Concentration: Moderately consolidated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Growing adoption of smart home technology integrated with furniture is driving innovation. Barriers include high R&D costs and limited access to advanced technologies for smaller players.

- Regulatory Framework: Supportive policies encouraging domestic manufacturing and FDI are facilitating market growth.

- Competitive Product Substitutes: Increasing availability of modular and RTA furniture poses a challenge to traditional furniture makers.

- End-User Demographics: Growing middle class and urbanization are major drivers of market demand, particularly in major cities like Ho Chi Minh City and Hanoi.

- M&A Trends: Moderate M&A activity is expected, driven by strategic acquisitions and expansion initiatives.

Vietnam Home Furniture Market Growth Trends & Insights

The Vietnam home furniture market demonstrates robust growth, driven by a burgeoning middle class, rising disposable incomes, and increasing urbanization. The market size is projected to reach xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements in furniture design and manufacturing, leading to improved durability, aesthetics, and functionality. Consumer behavior is shifting towards online purchasing and a preference for eco-friendly, customizable furniture. Market penetration of online sales channels is expected to increase significantly during the forecast period, reaching xx% by 2033.

Dominant Regions, Countries, or Segments in Vietnam Home Furniture Market

Urban centers like Ho Chi Minh City and Hanoi dominate the Vietnam home furniture market, driven by higher purchasing power and consumer awareness. Within product segments, bedroom furniture currently holds the largest market share (xx%), followed by living-room furniture (xx%) and kitchen furniture (xx%). The online distribution channel is rapidly expanding, projected to witness a CAGR of xx% from 2025 to 2033, driven by increasing internet penetration and e-commerce adoption.

Key Growth Drivers:

- Rapid urbanization and economic growth

- Rising disposable incomes and consumer spending

- Increasing preference for modern and stylish furniture

- Growing adoption of online shopping channels

Dominant Segments:

- Bedroom furniture (highest market share & growth potential)

- Online distribution channel (highest growth rate)

Vietnam Home Furniture Market Product Landscape

The Vietnam home furniture market showcases a diverse product landscape, ranging from traditional to modern designs. Innovations include the integration of smart technology (e.g., adjustable height desks, automated lighting systems), the use of sustainable materials (e.g., bamboo, recycled wood), and customizable furniture options catering to individual preferences. Performance metrics focus on durability, aesthetics, and functionality, aligning with evolving consumer preferences. Unique selling propositions often involve superior craftsmanship, locally sourced materials, and environmentally friendly manufacturing processes.

Key Drivers, Barriers & Challenges in Vietnam Home Furniture Market

Key Drivers:

- Rising disposable incomes: Fueling increased demand for higher-quality furniture.

- Urbanization: Creating a larger target market concentrated in urban areas.

- Government support: Promoting domestic manufacturing and attracting foreign investment.

Challenges:

- Supply chain disruptions: Global events can impact material availability and manufacturing timelines.

- Intense competition: Both domestic and international players compete for market share.

- Fluctuations in raw material prices: Affecting profitability and pricing strategies.

Emerging Opportunities in Vietnam Home Furniture Market

Untapped opportunities exist in the market for customized and personalized furniture, smart home integration, and sustainable and eco-friendly products. E-commerce expansion provides opportunities for smaller businesses to reach wider customer bases. Targeting specific niche markets, such as luxury furniture or minimalist designs, also presents significant growth potential.

Growth Accelerators in the Vietnam Home Furniture Market Industry

Technological advancements, such as 3D printing and advanced manufacturing techniques, are poised to accelerate market growth. Strategic partnerships between domestic and international players are facilitating technology transfer and market expansion. Government initiatives supporting the development of the furniture industry, through training programs and infrastructure investments, also contribute significantly.

Key Players Shaping the Vietnam Home Furniture Market Market

- Min Duong Furniture Corporation

- Duc Thanh Wood Processing JSC

- AA Corporation

- Woodnet

- Hoang MOC Furniture

- Nitori Furniture

- Truong Thanh Furniture Corporation

- BO Concept

- Kaiser Furniture

- Cam Ha Furniture

- Ashley Furniture Industries

Notable Milestones in Vietnam Home Furniture Market Sector

- October 2022: Wendelbo, a high-end interior brand, opened a five-story showroom in Saigon, marking a significant entry into the Vietnamese market.

- August 2023: JYSK, a Danish furniture brand, expanded to Hanoi, indicating growing international interest in the Vietnamese market.

In-Depth Vietnam Home Furniture Market Market Outlook

The Vietnam home furniture market is poised for sustained growth, driven by a confluence of factors, including a burgeoning middle class, increasing urbanization, and technological advancements. Strategic partnerships, investments in sustainable practices, and the adoption of innovative marketing strategies will be key to success in this dynamic market. The continued expansion of e-commerce and the entry of international brands present both opportunities and challenges for existing players. Companies that effectively leverage these trends will be well-positioned for future growth.

Vietnam Home Furniture Market Segmentation

-

1. Type

- 1.1. Kitchen Furniture

- 1.2. Living-room Furniture

- 1.3. Dining-room Furniture

- 1.4. Bedroom Furniture

- 1.5. Other Furnitures

-

2. Distribution Channel

- 2.1. Home Centers

- 2.2. Specialty Stores

- 2.3. Flagship Stores

- 2.4. Online

- 2.5. Other Distribution Channels

Vietnam Home Furniture Market Segmentation By Geography

- 1. Vietnam

Vietnam Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Vietnam has a young population with changing lifestyles and preferences. This demographic is more inclined towards modern

- 3.2.2 stylish

- 3.2.3 and functional furniture

- 3.2.4 driving demand for contemporary furniture designs.

- 3.3. Market Restrains

- 3.3.1 Despite rising incomes

- 3.3.2 a significant portion of the population remains price-sensitive. This can limit the market for premium or high-end furniture products and may drive consumers towards more affordable

- 3.3.3 lower-quality options

- 3.4. Market Trends

- 3.4.1. There is a growing demand for sustainable and eco-friendly furniture in Vietnam. Consumers are becoming more environmentally conscious and are seeking products made from sustainably sourced materials and using eco-friendly manufacturing processes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Home Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Kitchen Furniture

- 5.1.2. Living-room Furniture

- 5.1.3. Dining-room Furniture

- 5.1.4. Bedroom Furniture

- 5.1.5. Other Furnitures

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Home Centers

- 5.2.2. Specialty Stores

- 5.2.3. Flagship Stores

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Min Duong Furniture Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Duc Thanh Wood Processing JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AA Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Woodnet

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hoang MOC Furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nitori Furniture

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Truong Thanh Furniture Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BO Concept

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kaiser Furniture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cam Ha Furniture

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ashley Furniture Industries

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Min Duong Furniture Corporation

List of Figures

- Figure 1: Vietnam Home Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Home Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Home Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Home Furniture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam Home Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Vietnam Home Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Home Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Home Furniture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Vietnam Home Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Vietnam Home Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Home Furniture Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Vietnam Home Furniture Market?

Key companies in the market include Min Duong Furniture Corporation, Duc Thanh Wood Processing JSC, AA Corporation, Woodnet, Hoang MOC Furniture, Nitori Furniture, Truong Thanh Furniture Corporation, BO Concept, Kaiser Furniture, Cam Ha Furniture, Ashley Furniture Industries.

3. What are the main segments of the Vietnam Home Furniture Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Vietnam has a young population with changing lifestyles and preferences. This demographic is more inclined towards modern. stylish. and functional furniture. driving demand for contemporary furniture designs..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly furniture in Vietnam. Consumers are becoming more environmentally conscious and are seeking products made from sustainably sourced materials and using eco-friendly manufacturing processes..

7. Are there any restraints impacting market growth?

Despite rising incomes. a significant portion of the population remains price-sensitive. This can limit the market for premium or high-end furniture products and may drive consumers towards more affordable. lower-quality options.

8. Can you provide examples of recent developments in the market?

August 2023: Danish furniture brand JYSK expanded to Hanoi, Vietnam, and opened a new store in the Indochina Plaza Hanoi Residences in the capital city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Home Furniture Market?

To stay informed about further developments, trends, and reports in the Vietnam Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence