Key Insights

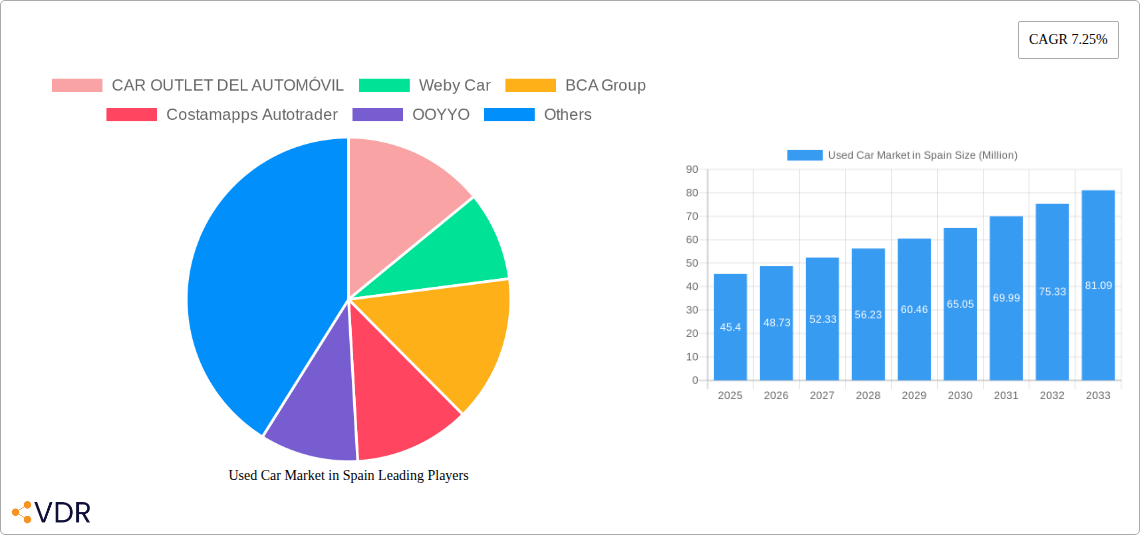

The Spanish used car market, valued at €45.40 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.25% from 2025 to 2033. This growth is fueled by several key factors. Increasing consumer preference for more affordable transportation options, coupled with the rising cost of new vehicles, is driving demand for used cars. Furthermore, the expanding online used car marketplaces, such as Weby Car and Autotrader, are enhancing transparency and convenience for buyers, facilitating market expansion. The shift towards online booking platforms further streamlines the purchasing process, attracting a wider range of consumers. While the unorganized sector still holds a significant market share, the organized sector is experiencing growth driven by improved quality control, financing options, and warranties offered by established players like CAR OUTLET DEL AUTOMÓVIL and Clicars Spain SL. The market segmentation reveals a diverse landscape, with SUVs and MPVs showing strong growth, reflecting evolving consumer preferences. The transition to electric vehicles is also influencing the market, although petrol and diesel cars remain dominant. However, potential restraints include fluctuating economic conditions impacting consumer spending and potential supply chain disruptions affecting the availability of used vehicles.

The competitive landscape is characterized by a mix of large international players like AUTO1 com GmbH and smaller, localized businesses. These businesses compete primarily on pricing, vehicle selection, and customer service. Regional variations exist within Spain, with larger metropolitan areas experiencing higher demand and potentially higher prices compared to rural regions. Future growth will likely be driven by continued technological advancements in online platforms, innovative financing options, and the increasing availability of certified pre-owned vehicles. The market's steady growth trajectory suggests attractive opportunities for both established players and new entrants focusing on meeting evolving consumer preferences and technological advancements. Sustainable practices, transparent pricing, and robust after-sales services will play a crucial role in shaping future success within this dynamic market.

Used Car Market in Spain: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the used car market in Spain, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an invaluable resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report utilizes data from the historical period (2019-2024) and includes detailed segmentation by vehicle body style, vendor type, booking type, and fuel type.

Used Car Market in Spain Market Dynamics & Structure

This section analyzes the competitive landscape of Spain's used car market, exploring market concentration, technological disruptions, regulatory influences, and market trends. The Spanish used car market, valued at xx million units in 2024, is characterized by a blend of organized and unorganized players. Market concentration is moderate, with several large players competing alongside numerous smaller dealerships.

- Market Concentration: The top five players hold an estimated xx% market share in 2024. This indicates a relatively fragmented market with opportunities for both expansion and consolidation.

- Technological Innovation: The increasing adoption of online platforms and digital tools is transforming the market, enhancing transparency and efficiency. However, challenges remain in bridging the digital divide and ensuring data security.

- Regulatory Framework: Spanish regulations concerning used car sales, including emissions standards and consumer protection laws, significantly influence market dynamics. Future regulatory changes could impact market growth and the competitive landscape.

- Competitive Product Substitutes: Public transport, ride-sharing services, and new car financing options pose competition to the used car market. However, the affordability of used cars remains a key advantage.

- End-User Demographics: The primary target demographic is price-sensitive consumers, including young adults and families. Changing consumer preferences are driving demand for specific vehicle types and fuel options.

- M&A Trends: The past five years have witnessed xx M&A deals in the Spanish used car market, indicating a growing trend of consolidation amongst larger players. This is predicted to increase to xx deals between 2025-2033.

Used Car Market in Spain Growth Trends & Insights

This section examines the evolution of the Spanish used car market size, adoption rates across different segments, and shifts in consumer behavior. The market experienced significant growth during the historical period, fueled by factors such as economic recovery and evolving consumer preferences. The compound annual growth rate (CAGR) from 2019 to 2024 was estimated at xx%, with the market size reaching xx million units in 2024. The forecast period (2025-2033) projects continued growth, driven by increasing demand for pre-owned electric vehicles and the expansion of online sales channels. Market penetration for online used car sales is predicted to grow from xx% in 2024 to xx% by 2033. Technological advancements, such as improved online marketplaces and vehicle inspection technologies, are further accelerating market expansion. Consumer behavior is shifting towards greater online engagement, preference for specific vehicle types (e.g., SUVs and EVs), and a growing emphasis on transparency and vehicle history information.

Dominant Regions, Countries, or Segments in Used Car Market in Spain

This section identifies the leading segments within the Spanish used car market, focusing on regional variations, vehicle types, vendor categories, and booking methods.

- By Vehicle Body Style: SUVs are anticipated to be the dominant segment, capturing approximately xx% of the market share in 2025, followed by Hatchbacks (xx%), Sedans (xx%), and MPVs (xx%). The growth of SUVs is attributed to consumer preferences for larger vehicles and increased popularity of family-oriented models.

- By Vendor Type: Organized vendors (dealerships and large online platforms) are expected to hold a larger market share (approximately xx%) compared to unorganized vendors (private sellers) in 2025. The dominance of organized vendors is driven by greater consumer trust, better inventory management, and access to financing options.

- By Booking Type: Online booking is growing rapidly, projected to reach xx% market share by 2025, driven by improved online platforms and increased digital literacy. However, Offline sales will still represent a significant portion (xx%) due to consumer preferences for in-person vehicle inspections.

- By Fuel Type: Petrol cars will still represent the largest segment (xx% in 2025), although the proportion of diesel and electric vehicles is expected to rise steadily, driven by government incentives and environmental concerns. The 'Others' category includes hybrid and alternative fuel vehicles which will have a combined market share of xx% by 2025.

Used Car Market in Spain Product Landscape

The Spanish used car market offers a diverse range of vehicles, catering to various consumer needs and budgets. Innovation is focused on enhancing the online car buying experience, including detailed vehicle history reports, virtual inspections, and streamlined financing options. The introduction of certified pre-owned vehicles with warranties is also gaining traction, building consumer trust. Technological advancements include the integration of telematics and data analytics to optimize pricing and risk management. Unique selling propositions include extended warranties, comprehensive inspection reports, and flexible financing plans.

Key Drivers, Barriers & Challenges in Used Car Market in Spain

Key Drivers: Increased affordability compared to new cars, economic recovery, government incentives for electric vehicles (Moves III), and the expansion of online sales platforms. The growth of the Spanish economy and resulting increased purchasing power will further boost the market.

Challenges: Fluctuations in the used car supply chain, particularly for specific models and fuel types, create challenges in meeting demand. Stringent emission standards and regulatory compliance requirements impose costs on sellers. Intense competition among organized and unorganized vendors can put downward pressure on prices. Lack of consumer trust in private sellers remains a significant barrier.

Emerging Opportunities in Used Car Market in Spain

Emerging opportunities include the growth of the pre-owned electric vehicle market, supported by government subsidies and improved charging infrastructure. The expansion of online marketplaces and financing options will also attract new customers. The development of specialized services, such as subscription models and vehicle maintenance packages, will enhance customer value proposition. Targeting niche segments, such as commercial vehicles or specific vehicle types, offers further growth potential.

Growth Accelerators in the Used Car Market in Spain Industry

Long-term growth will be driven by continuous technological advancements, including AI-powered pricing and condition assessment tools. Strategic partnerships between online platforms and traditional dealerships can enhance market reach. Government policies promoting sustainable transportation and support for the pre-owned electric vehicle market will play a key role. Expansion into underserved regions and tapping into new customer segments, such as younger demographics, will fuel further growth.

Key Players Shaping the Used Car Market in Spain Market

- CAR OUTLET DEL AUTOMÓVIL

- Weby Car

- BCA Group

- Costamapps Autotrader

- OOYYO

- Auto Fes

- VIVA AUTOS COSTA BLANCA SL

- Clicars Spain SL

- OcasionPlus

- Impormop Venta De Maquinaria SL

- AUTO1 com GmbH

- YAMOVIL

Notable Milestones in Used Car Market in Spain Sector

- January 2024: Norbolsa announced plans for a digital platform for selling used cars, partnering with eight dealers and Arval (BNP Paribas subsidiary). This initiative reflects the increasing trend towards digitalization in the used car market.

- January 2024: The Spanish government expanded the Moves III electric vehicle subsidy program to include pre-owned vehicles (less than one year old) and increased grant eligibility for fleet operators. This policy significantly boosts the market for used electric vehicles.

- January 2024: CaixaBank's initiative to provide pre-approved loans to low-risk customers will boost consumer credit accessibility, positively affecting used car purchases.

In-Depth Used Car Market in Spain Market Outlook

The future of the Spanish used car market is bright, driven by strong underlying growth factors. Continued technological innovation, government support for electric vehicles, and the expansion of online sales channels will propel market expansion. Strategic partnerships and consolidations among key players are expected to reshape the market structure, improving efficiency and transparency. The market presents significant opportunities for both established and new players seeking to capitalize on the growing demand for pre-owned vehicles.

Used Car Market in Spain Segmentation

-

1. Vehicle Body Style

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Fuel Type

- 4.1. Petrol

- 4.2. Diesel

- 4.3. Electric

- 4.4. Others

Used Car Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth

- 3.3. Market Restrains

- 3.3.1 Technology Advances

- 3.3.2 Older Used Cars May Lack the Latest Features

- 3.4. Market Trends

- 3.4.1. The Sport Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs) Segment Holds a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Fuel Type

- 5.4.1. Petrol

- 5.4.2. Diesel

- 5.4.3. Electric

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 6. North America Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports U

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Fuel Type

- 6.4.1. Petrol

- 6.4.2. Diesel

- 6.4.3. Electric

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 7. South America Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports U

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Fuel Type

- 7.4.1. Petrol

- 7.4.2. Diesel

- 7.4.3. Electric

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 8. Europe Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports U

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Fuel Type

- 8.4.1. Petrol

- 8.4.2. Diesel

- 8.4.3. Electric

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 9. Middle East & Africa Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports U

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Fuel Type

- 9.4.1. Petrol

- 9.4.2. Diesel

- 9.4.3. Electric

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 10. Asia Pacific Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports U

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Booking Type

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Fuel Type

- 10.4.1. Petrol

- 10.4.2. Diesel

- 10.4.3. Electric

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CAR OUTLET DEL AUTOMÓVIL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weby Car

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BCA Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Costamapps Autotrader

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OOYYO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Auto Fes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VIVA AUTOS COSTA BLANCA SL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clicars Spain SL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OcasionPlus

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Impormop Venta De Maquinaria SL

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AUTO1 com GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 YAMOVIL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 CAR OUTLET DEL AUTOMÓVIL

List of Figures

- Figure 1: Global Used Car Market in Spain Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Spain Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 3: Spain Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 5: North America Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 6: North America Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 7: North America Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 8: North America Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 9: North America Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 10: North America Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 11: North America Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 12: North America Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 15: South America Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 16: South America Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 17: South America Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 18: South America Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 19: South America Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 20: South America Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 21: South America Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 22: South America Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 25: Europe Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 26: Europe Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 27: Europe Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 28: Europe Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Europe Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Europe Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 31: Europe Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 32: Europe Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 35: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 36: Middle East & Africa Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 37: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 38: Middle East & Africa Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 39: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 40: Middle East & Africa Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 41: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 42: Middle East & Africa Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 45: Asia Pacific Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 46: Asia Pacific Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 47: Asia Pacific Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 48: Asia Pacific Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 49: Asia Pacific Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 50: Asia Pacific Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 51: Asia Pacific Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 52: Asia Pacific Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 3: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 5: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 6: Global Used Car Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 9: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 11: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 17: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 18: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 19: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 25: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 26: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 27: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 39: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 40: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 41: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 42: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 50: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 51: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 52: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 53: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in Spain?

The projected CAGR is approximately 7.25%.

2. Which companies are prominent players in the Used Car Market in Spain?

Key companies in the market include CAR OUTLET DEL AUTOMÓVIL, Weby Car, BCA Group, Costamapps Autotrader, OOYYO, Auto Fes, VIVA AUTOS COSTA BLANCA SL, Clicars Spain SL, OcasionPlus, Impormop Venta De Maquinaria SL, AUTO1 com GmbH, YAMOVIL.

3. What are the main segments of the Used Car Market in Spain?

The market segments include Vehicle Body Style, Vendor Type, Booking Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth.

6. What are the notable trends driving market growth?

The Sport Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs) Segment Holds a Significant Market Share.

7. Are there any restraints impacting market growth?

Technology Advances. Older Used Cars May Lack the Latest Features.

8. Can you provide examples of recent developments in the market?

January 2024: Norbolsa planned a digital platform for selling used cars in Spain with eight dealers and Arval, a BNP Paribas subsidiary. CaixaBank aims to boost consumer credit growth, offering pre-approved loans to low-risk customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in Spain?

To stay informed about further developments, trends, and reports in the Used Car Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence