Key Insights

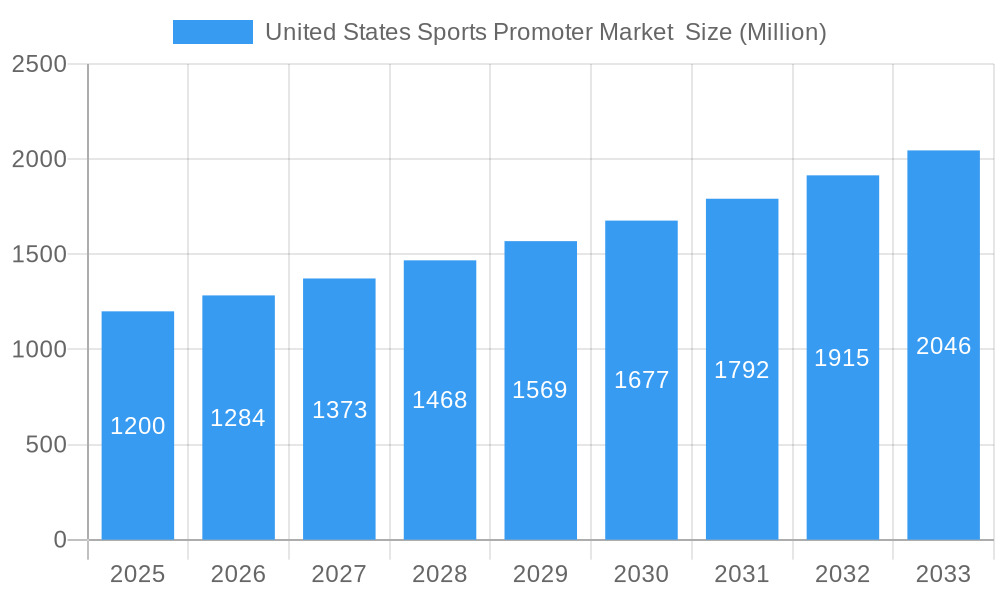

The United States sports promoter market is experiencing robust growth, fueled by increasing fan engagement, the rise of digital media platforms, and lucrative sponsorship opportunities. With a Compound Annual Growth Rate (CAGR) exceeding 7% from 2019 to 2033, the market is projected to reach significant value in the coming years. Major drivers include the escalating popularity of professional sports leagues like the NBA, NFL, MLB, and NHL, coupled with the expanding influence of social media and streaming services in reaching a broader audience. This has led to a surge in demand for sophisticated promotional strategies and specialized agencies capable of maximizing revenue streams through media rights, merchandise sales, ticket distribution, and strategic sponsorships. Segmentation analysis reveals significant revenue contributions from various sources, with media rights and sponsorship likely commanding substantial portions of the market share. The market is further diversified across various end-users, including individual athletes, teams, leagues, and events, reflecting the multifaceted nature of the sports promotion industry. The market's robust growth is also supported by the increasing investments by major sports promoter companies in data analytics and technology to enhance their marketing and promotional efforts.

United States Sports Promoter Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established global players and specialized niche agencies. Companies such as Endeavor, Wasserman Media Group, and Creative Artists Agency are leading the market, leveraging their extensive networks and expertise to secure lucrative deals and maximize the value of their athlete and league portfolios. However, the market is also dynamic, with smaller, specialized agencies emerging to capitalize on specific niche sports and innovative marketing approaches. While challenges such as economic downturns and shifts in consumer preferences could potentially restrain growth, the overall market outlook remains positive. The continued growth of professional sports and the ever-evolving landscape of digital marketing will continue to present substantial opportunities for sports promoters in the United States. The projected market size for 2025, considering the provided CAGR and assuming a reasonable 2019 base figure, is estimated (note: this is an estimation and requires further analysis based on the true 2019 market size to reach precision) within a billion-dollar range, demonstrating substantial growth potential over the forecast period.

United States Sports Promoter Market Company Market Share

United States Sports Promoter Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Sports Promoter Market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The parent market is the broader Sports and Entertainment Industry, while the child market focuses specifically on Sports Promotion and Management. The market size is projected to reach xx Million by 2033.

United States Sports Promoter Market Market Dynamics & Structure

The US Sports Promoter Market is a highly competitive landscape characterized by a mix of large, established agencies and smaller, specialized firms. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies compete for niche segments. Technological innovation, particularly in digital marketing and data analytics, is a key driver, enabling promoters to reach wider audiences and personalize marketing campaigns. However, regulatory frameworks concerning athlete representation and marketing practices influence operations. Competitive substitutes include in-house marketing departments of sports teams and leagues. End-user demographics are diverse, encompassing individual athletes, teams, leagues, and event organizers. The market has witnessed significant M&A activity in recent years, reflecting consolidation and the pursuit of synergies.

- Market Concentration: Moderate, with top 5 players holding approximately 60% market share in 2025.

- Technological Innovation: Rapid adoption of digital marketing, data analytics, and social media strategies driving efficiency and reach.

- Regulatory Framework: Compliance with athlete representation regulations and marketing guidelines crucial for operators.

- M&A Activity: Significant consolidation, with an average of 15-20 deals annually in the historical period (2019-2024). Deals are predominantly focused on acquiring agencies with specialized expertise or existing client portfolios.

- End-User Demographics: Individual athletes (35%), Teams (25%), Leagues (20%), Events (20%).

United States Sports Promoter Market Growth Trends & Insights

The US Sports Promoter Market has experienced consistent growth over the historical period (2019-2024), driven by rising popularity of sports, increased media rights revenue, and the growing influence of digital platforms. The market size grew from xx Million in 2019 to xx Million in 2024, reflecting a CAGR of xx%. This growth is anticipated to continue throughout the forecast period (2025-2033), albeit at a slightly moderated pace due to potential economic fluctuations and competitive intensity. Technological advancements, including the rise of esports and virtual reality experiences, are creating new opportunities, while changing consumer behavior (e.g., increased streaming consumption) is reshaping marketing strategies. Market penetration among smaller leagues and athletes remains significant growth potential.

Dominant Regions, Countries, or Segments in United States Sports Promoter Market

The largest segments within the US Sports Promoter Market are driven by high revenue potential and extensive audience engagement:

- By Revenue Source: Media Rights (40%), Sponsorship (30%), Tickets (20%), Merchandising (10%). Media Rights' dominance stems from the increasing value of broadcasting and streaming deals. Sponsorship is fueled by brand investment in sports.

- By End Users: Teams and leagues (45%) dominate due to their extensive sponsorship and marketing needs. Individual athletes (35%) represent a significant portion, especially in high-profile sports.

- By Type: Basketball and Football (60% combined) hold the largest market share due to their popularity and extensive commercial opportunities.

The Northeast and West Coast regions of the US (California, New York, Florida) dominate the market due to a high concentration of major sports teams, leagues, and entertainment companies. Key drivers include:

- High concentration of professional sports teams and leagues: Provides a large pool of potential clients for promotion and management services.

- Robust media markets: Facilitates extensive reach and engagement for marketing campaigns.

- Favorable economic conditions: Supports higher brand investment and sponsorship activity in the sports sector.

United States Sports Promoter Market Product Landscape

The US sports promoter market offers a range of services, including athlete representation, sponsorship sales, media rights negotiation, event management, and digital marketing. Product innovations focus on data-driven strategies, personalized marketing campaigns, and leveraging new technologies like virtual and augmented reality for fan engagement. Unique selling propositions often center on specialized expertise within specific sports or client segments and strong relationships with key stakeholders.

Key Drivers, Barriers & Challenges in United States Sports Promoter Market

Key Drivers: The increasing popularity of sports, growth of media rights revenue, technological advancements (data analytics, digital marketing), and rising brand investment in sports sponsorship all propel market growth.

Key Challenges: Intense competition among numerous agencies, regulatory scrutiny of athlete representation, economic downturns impacting sponsorship budgets, and maintaining athlete loyalty all pose challenges. The market is estimated to face a 5-7% reduction in growth rate during major economic downturns due to decreased sponsorships.

Emerging Opportunities in United States Sports Promoter Market

Emerging opportunities include the rise of esports, growth of niche sports, increasing demand for data-driven marketing, expansion of international partnerships, and focus on sustainability and social responsibility initiatives. The integration of virtual and augmented reality for enhanced fan engagement also represents significant potential.

Growth Accelerators in the United States Sports Promoter Market Industry

Long-term growth is fueled by technological advancements in digital marketing and data analytics, strategic partnerships between promoters and technology firms, expansion into new sports and markets (such as esports), and adoption of innovative marketing and engagement strategies such as influencer marketing and experiential events.

Key Players Shaping the United States Sports Promoter Market Market

- Viral Nation

- Excel Sports Management

- Endeavor

- Wasserman Media

- Newport Sports Management

- Prosport Management

- Octagon

- WME Agency

- Creative Artist Agency

- US Sports Management

Notable Milestones in United States Sports Promoter Market Sector

- March 2023: WME (William Morris Endeavor) acquired full ownership of BDA Sports Management, expanding its reach in NBA player representation and strengthening its media and entertainment portfolio.

- September 2022: Brand Velocity Group acquired SCORE Sports, broadening its product offerings and leveraging its existing networks to create new partnerships.

In-Depth United States Sports Promoter Market Market Outlook

The US Sports Promoter Market is poised for continued growth, driven by a confluence of factors including technological advancements, expanding digital audiences, and the enduring popularity of sports. Strategic partnerships, innovative marketing strategies, and expansion into new areas like esports will be crucial for long-term success. The market's potential is significant, with opportunities for both established players and new entrants to capitalize on evolving consumer preferences and emerging technological innovations.

United States Sports Promoter Market Segmentation

-

1. Type

- 1.1. Baseball

- 1.2. Basketball

- 1.3. Football

- 1.4. Hockey

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

-

3. End Users

- 3.1. Individual

- 3.2. Team

- 3.3. leagues

- 3.4. Events

United States Sports Promoter Market Segmentation By Geography

- 1. United States

United States Sports Promoter Market Regional Market Share

Geographic Coverage of United States Sports Promoter Market

United States Sports Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-sports and Rising digital sports viewership driving the market; Rising Sports Event In United States Driving The Market

- 3.3. Market Restrains

- 3.3.1. Increasing Web Streaming Sports affecting Television sports market; A Large number of sports fan engagement is limited to a few sports

- 3.4. Market Trends

- 3.4.1. Increasing Sports Sponsorships Driving Sports Promoter Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Sports Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Baseball

- 5.1.2. Basketball

- 5.1.3. Football

- 5.1.4. Hockey

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Individual

- 5.3.2. Team

- 5.3.3. leagues

- 5.3.4. Events

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Viral Nation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Excel Sports Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Endeavor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wasserman Media

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Newport Sports Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Prosport Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Octagon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WME Agency

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Creative Artist Agency

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 US Sports Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Viral Nation

List of Figures

- Figure 1: United States Sports Promoter Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Sports Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: United States Sports Promoter Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Sports Promoter Market Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 3: United States Sports Promoter Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 4: United States Sports Promoter Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Sports Promoter Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: United States Sports Promoter Market Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 7: United States Sports Promoter Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 8: United States Sports Promoter Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Sports Promoter Market ?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the United States Sports Promoter Market ?

Key companies in the market include Viral Nation, Excel Sports Management, Endeavor, Wasserman Media, Newport Sports Management, Prosport Management, Octagon, WME Agency, Creative Artist Agency, US Sports Management.

3. What are the main segments of the United States Sports Promoter Market ?

The market segments include Type, Revenue Source, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-sports and Rising digital sports viewership driving the market; Rising Sports Event In United States Driving The Market.

6. What are the notable trends driving market growth?

Increasing Sports Sponsorships Driving Sports Promoter Market.

7. Are there any restraints impacting market growth?

Increasing Web Streaming Sports affecting Television sports market; A Large number of sports fan engagement is limited to a few sports.

8. Can you provide examples of recent developments in the market?

March 2023: WME (William Morris Endeavor) acquired full ownership of BDA Sports Management, which has built up a formidable client list of NBA players during its business. The acquisition is part of WME Sports' strategy to build a bridge for sports stars in media and entertainment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Sports Promoter Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Sports Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Sports Promoter Market ?

To stay informed about further developments, trends, and reports in the United States Sports Promoter Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence